-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Small Beat for July NY Fed Mfg Survey

- MNI INTERVIEW: FOMO Trumps BOC In Housing Market- Royal LePage

- MNI: A Small Beat For A Noisy Empire Series

US TSYS Markets Roundup: Narrow Inside Range to Start New Week

- Typical summer session, muted action after last last week's full docket of CPI, PPI and Retail Sales. Light volumes with Japan out for one day holiday, Treasury futures traded inside narrow session range, 5s-10s outperforming mildly lower intermediates by the close. Curves a touch flatter.

- Limited reaction to small beat for July Empire Fed manufacturing index as it dipped to +1.1 (cons -3.5) after +6.6, close compared to some recent surprises.

- Remember this is a particularly volatile measure, with a standard deviation for its monthly change since 2021 at a very wide 23pts (and 28pts since 2022), but two months at broadly similar levels has been unusual compared to its typical pattern of lurching lower again.

- The Federal Reserve is in media blackout in regards to policy, through July 27, the day after the next FOMC.

- Projected rate hike expectations holding steady: July 26 FOMC is 93.6% w/ implied rate of +23.4bp to 5.313%. September cumulative of +26.6bp at 5.345%, November cumulative of 32.1bp at 5.399%, and December cumulative of 25.8bp at 5.337%. Fed terminal holding at 5.40% in Nov'23.

CANADA

BOC: “Fear of missing out” and a low supply of homes is likely to fuel continued strong demand in Canada’s housing market even as the central bank raises interest rates further to fight inflation, a leading real estate executive told MNI.

- Buyers are facing "an absolute supply crisis" and sellers have been outwaiting buyers through the Bank of Canada's interest-rate hikes, Royal LePage Real Estate Services COO Karen Yolevski said in an interview Friday. The central bank raised rates last week for a second straight meeting after signaling a pause early this year, an ntermission that rekindled what the IMF says is about the world's most stretched housing market.

- “They said we are going to stop raising rates and see what’s going to happen. That was the ignition that people needed, buy side, to come off the sidelines,” she said. “You’ve got buyers back in competition, competition is spurring prices to go back up and up, despite the fact that interest rates were higher.” For more see MNI Policy main wire at 1144ET.

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX 1.1 JUL

- US NY FED EMPIRE MFG NEW ORDERS 3.3 JUL

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 4.7 JUL

- US NY FED EMPIRE MFG PRICES PAID INDEX 16.7 JUL

US: The Empire Fed manufacturing index for July saw a small beat as it dipped to +1.1 (cons -3.5) after +6.6, close compared to some recent surprises.

- Remember this is a particularly volatile measure, with a standard deviation for its monthly change since 2021 at a very wide 23pts (and 28pts since 2022), but two months at broadly similar levels has been unusual compared to its typical pattern of lurching lower again.

- Some further progress in price components: “the prices paid index fell 5pts to 16.7, and the prices received index fell 5pts to 3.9. The prices paid index has now fallen nearly fifty points over the past year, and the prices received index has fallen a cumulative twenty-seven points.”

- The 6-month ahead general conditions measure dipped from 18.9 to 14.3 having last held higher levels back in early 2022.

- FOREIGN HOLDINGS OF CANADA SECURITIES +11.2B CAD IN MAY

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -2.8B CAD IN MAY

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 86.53 points (0.25%) at 34591.48

- S&P E-Mini Future up 19.5 points (0.43%) at 4555.75

- Nasdaq up 123.9 points (0.9%) at 14236.61

- US 10-Yr yield is down 3.5 bps at 3.797%

- US Sep 10-Yr futures are up 5/32 at 112-23

- EURUSD up 0.0016 (0.14%) at 1.1244

- USDJPY down 0.15 (-0.11%) at 138.66

- WTI Crude Oil (front-month) down $1.34 (-1.78%) at $74.08

- Gold is up $0.7 (0.04%) at $1955.79

- EuroStoxx 50 down 43.32 points (-0.98%) at 4356.79

- FTSE 100 down 28.15 points (-0.38%) at 7406.42

- German DAX down 36.42 points (-0.23%) at 16068.65

- French CAC 40 down 82.88 points (-1.12%) at 7291.66

US TREASURY FUTURES CLOSE

3M10Y -1.878, -160.31 (L: -168.459 / H: -156.842)

2Y10Y +0.498, -93.695 (L: -95.016 / H: -92.142)

2Y30Y +3.557, -81.076 (L: -83.849 / H: -80.4)

5Y30Y +3.93, -8.171 (L: -11.694 / H: -7.707)

Current futures levels:

Sep 2-Yr futures up 1/32 at 101-29.875 (L: 101-27.125 / H: 101-31.375)

Sep 5-Yr futures up 3.75/32 at 107-22 (L: 107-14.75 / H: 107-25.25)

Sep 10-Yr futures up 5/32 at 112-23 (L: 112-13 / H: 112-29.5)

Sep 30-Yr futures up 3/32 at 126-17 (L: 126-01 / H: 127-04)

Sep Ultra futures down 1/32 at 134-18 (L: 133-30 / H: 135-16)

US 10Y FUTURE TECHS: (U3) Watching Resistance At The 50-Day EMA

- RES 4: 114-06+ High Jun 6

- RES 3: 114-00 High Jun 13

- RES 2: 113-11+ 50-day EMA and a key resistance point

- RES 1: 113-03 High Jul 13

- PRICE: 112-22 @ 1505 ET Jul 17

- SUP 1: 112-07+ Low Jul 13

- SUP 2: 111-03+/110-05 Low Jul 11 / 6 and the bear trigger

- SUP 3: 110-00 Low Nov 9 2022 (cont)

- SUP 4: 109-14 Low Nov 8 2022 (cont)

Treasury futures rallied last week and are holding on to their recent gains. The medium-term trend remains down and the latest recovery is likely part of a short-term corrective cycle. The contract has cleared the 20-day EMA and attention turns to a key resistance area at the 50-day EMA, at 113-11+. A clear break of this average would strengthen a bullish theme. Key support and the bear trigger has been defined at 110-05, the Jul 6 low.

SOFR FUTURES CLOSE

- Sep 23 -0.005 at 94.60

- Dec 23 +0.015 at 94.695

- Mar 24 +0.025 at 95.035

- Jun 24 +0.010 at 95.435

- Red Pack (Sep 24-Jun 25) +0.010 to +0.035

- Green Pack (Sep 25-Jun 26) +0.040 to +0.045

- Blue Pack (Sep 26-Jun 27) +0.045 to +0.050

- Gold Pack (Sep 27-Jun 28) +0.035 to +0.045

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01617 to 5.24611 (+.05293 total last wk)

- 3M +0.01023 to 5.32012 (+.01451 total last wk)

- 6M +0.02081 to 5.39635 (-.03946 total last wk)

- 12M +0.03891 to 5.29292 (-.20041 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $115B

- Daily Overnight Bank Funding Rate: 5.07% volume: $270B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.448T

- Broad General Collateral Rate (BGCR): 5.03%, $598B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $590B

- (rate, volume levels reflect prior session)

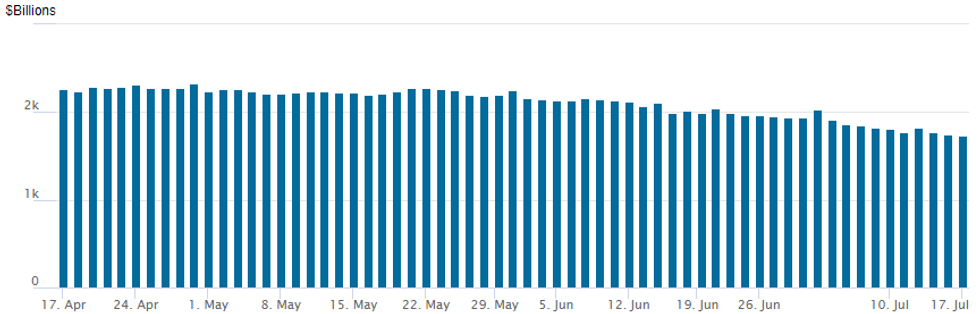

FED Reverse Repo Operation

NY Federal REserve/MNI

The latest operation falls to $1,728.322B (lowest since early May'22), w/ 98 counterparties, compared to $1,740.777B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $4.5B JP Morgan 2Pt Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/17 $4.5B #JP Morgan $2.5B 6NC5 +128, $2B 2034 Tap +150

- 07/17 $1.725B #Wells Fargo PerpNC5 Pfd 7.625%

- 07/17 $500M #Conagra WNG 3Y +100

- 07/17 $Benchmark World Bank 7Y SOFR+44a

- 07/17 $Benchmark Caisse de dépôt et placement du Québec (CDP) 5Y SOFR+65a

EGBs-GILTS CASH CLOSE: UK Curve Bull Steepens With Weds CPI Eyed

The UK curve bull steepened modestly Monday as BoE hike pricing pulled back, with the belly outperforming on the German curve.

- There was little in the way of impactful newsflow or data in the session, with Italian final inflation data in line. Overnight, soft Chinese GDP data spurred some risk-off moves, though a solid US Empire Manufacturing reading lent a slightly hawkish tone to afternoon trade.

- A quiet session kept Wednesday's crucial UK CPI reading in focus (MNI's Gilt Week Ahead is titled "Inflation, inflation, inflation".

- BoE terminal rate pricing reversed Friday's rise, dropping 9bp on the day, though high odds of an August 50bp hike vs 25bp raise remained steady at 75%.

- Periphery spreads widened slightly, with Greece a modest outperformer following solid primary budget figures for H1.

- Tuesday's docket is light, with ECB's Villeroy speaking, along with German Schatz and 2053 Gilt supply.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.1bps at 3.189%, 5-Yr is down 3.2bps at 2.579%, 10-Yr is down 3.2bps at 2.48%, and 30-Yr is down 2.7bps at 2.506%.

- UK: The 2-Yr yield is down 3.8bps at 5.168%, 5-Yr is down 3.1bps at 4.556%, 10-Yr is down 1.3bps at 4.431%, and 30-Yr is unchanged at 4.556%.

- Italian BTP spread up 1.5bps at 167.4bps / Greek up 0.7bps at 145.9bps

FOREX: Antipodean FX Remain Underperformers Despite Buoyant Equities

- CNH, AUD and NZD are the poorest performers across G10 on Monday following a softer-than-expected Chinese GDP release. While the data showed an acceleration from the Q1 print, it has prompted a number of sell-side firms to trim their growth expectation for this calendar year, with most trimming around 0.5ppts to forecast 5.0% annual growth this year.

- A moderate risk-off tone prevailed in early trade following the data, helping JPY and CHF screen among the strongest initial performers in G10, eventually filtering through to a stronger greenback as the US session kicked off.

- The greenback was then bolstered by a firmer-than-expected Empire State Manufacturing Index figure (+1.1 vs -3.5 estimate), prompting the USD index to trade to session highs back above the 100.00 mark. USDJPY had a notable recovery from the 138.00 overnight lows to reach as high 139.41. Despite the bounce, the bear cycle that started Jun 30 is still underway for the pair. The recent sell-off has resulted in a break of both the 20- and 50-day EMAs and price is back inside the bull channel drawn from the Jan 16 low. A continuation lower would open 136.57, the lower band of a moving average envelope.

- As the dust settled on a quiet Monday, equities resumed their strengthening trend and the USD slowly edged lower throughout the session and the DXY remains close to unchanged as we approach Tuesday’s APAC crossover.

- RBA minutes are due overnight before Tuesday’s release of Canadian CPI and US retail sales. The other notable release this week will be Wednesday’s release of UK CPI.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 18/07/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/07/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/07/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 18/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/07/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 18/07/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2023 | 1400/1000 | * |  | US | Business Inventories |

| 18/07/2023 | 1400/1000 |  | US | Fed's Michael Barr | |

| 18/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 18/07/2023 | 2000/1600 | ** |  | US | TICS |

| 19/07/2023 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.