-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: Still Dissecting Cooler CPI

EXECUTIVE SUMMARY

US

US: Higher interest rates and mounting fears of a downturn next year are biting into the morale of consumers, who are now expecting a worsening labor market, the head of the University of Michigan's Survey of Consumers, Joanne Hsu, told MNI.

- "It is pretty unambiguous that consumers expect a downturn going ahead and do by and large expect a recession," she said. "What's actually kind of interesting about this month is that labor market expectations have worsened in spite of the fact that labor markets continue to be very strong."

- "We have the highest share of consumers expecting unemployment to rise in the year ahead, since the very beginning of the pandemic, and is comparable to what we were seeing in the middle of the Great Recession. Consumers are absolutely expecting labor markets to worsen," Hsu said.

FED: An unexpectedly softer U.S. CPI report for October paints a rosier picture of moderating inflation than is likely the case, Atlanta Fed economist Brent Meyer told MNI.

- Roughly 60% of the CPI basket is still rising at rates above 5%, and alternative measures of underlying inflation remain "very elevated, reflecting broad-based price pressure," he said.

- The Median, 16% Trimmed-Mean and Sticky CPI measures all posted increases in the 5% to 7% range, well above core CPI reading of 0.3% for the month or 3.3% on an annualized basis.

- “This is a better report than we’ve seen over the past several months, but only slightly. The topline numbers are overstating the improvement in underlying inflation,” Meyer said. For more see MNI Policy main wire at 0514ET.

- It is however just a single print, carrying a risk of a reversal as was the case most recently in July.

- Markets see a 50bp hike at the Dec FOMC as locked in (57bp prior) - as do analysts included in the report - building on guidance from Powell and reinforced by subsequent FOMC comments, whilst the terminal closed some 15bps lower at circa 4.9%.

- We wouldn’t be surprised to see more hawkish FOMC commentary to limit the easing in financial conditions after equities also surged and the US dollar had its worst day since 2015.

EUROPE

EU: Agreement on a new package of economic sanctions on Russia is proving tricky as the bloc is running out of effective measures, Camilo Villarino, chef de cabinet for EU high representative for foreign affairs Josep Borrell, said on Friday.

- The bloc will make no "formal proposal" on sanctions until agreement has been reached, he said at an event in S'Agaro in Spain. "We can't afford public disagreements."

- Vilarino said the bloc has ways of overcoming the need for unanimity in foreign affairs decisions if necessary.

Tsys Weaker, But Near Highs, Dec Step-Down Still Alive

Still weaker, Tsys near top end of session (and overnight range, for that matter) amid two-way positioning ahead the weekend. Light volumes (TYZ2<650k) due to Veterans Day/bank holiday despite full session hours on screen.

- Tsys pared back a small portion of Thu's post-CPI rally, opening moderately lower Friday. Markets still digesting the Oct CPI data: An unexpectedly softer U.S. CPI report for October paints a rosier picture of moderating inflation than is likely the case, Atlanta Fed economist Brent Meyer told MNI.

- Roughly 60% of the CPI basket is still rising at rates above 5%, and alternative measures of underlying inflation remain "very elevated, reflecting broad-based price pressure," he said.

- Little react to preliminary November reading of consumer sentiment from the University of Michigan of 54.7 vs. 59.5 est. Rates and equities gradually pared losses (stocks posting gains in the second half) as participants square up ahead the weekend, slow start to next week.

- Fed Gov Waller kicks things off Sunday evening from Australia. PPI data on Tuesday. Tsy coupon supply starts Wednesday w/ $15B 20Y Bond, 10Y TIPS re-open on Thursday.

OVERNIGHT DATA

US: U Michigan 1/5-Year Inflation Expectations Edge Up

- UMICH NOV PRELIM CONS SENTIMENT 54.7 (59.5 EXP., 59.9 PRIOR)

- UMICH NOV PRELIM CURRENT CONDITIONS 57.8 (62.8 EXP., 65.6 PRIOR)

- UMICH NOV PRELIM EXPECTATIONS 52.7 (55.5 EXP., 56.2 PRIOR)

- UMICH NOV PRELIM 1Y INFL EXPECTATIONS 5.1% (5.1% EXP., 5.0% PRIOR)

- UMICH NOV PRELIM 5-10Y INFL EXPECTATIONS 3.0% (2.9% EXP., 2.9% PRIOR)

MARKETS SNAPSHOT

Key late session market levels:

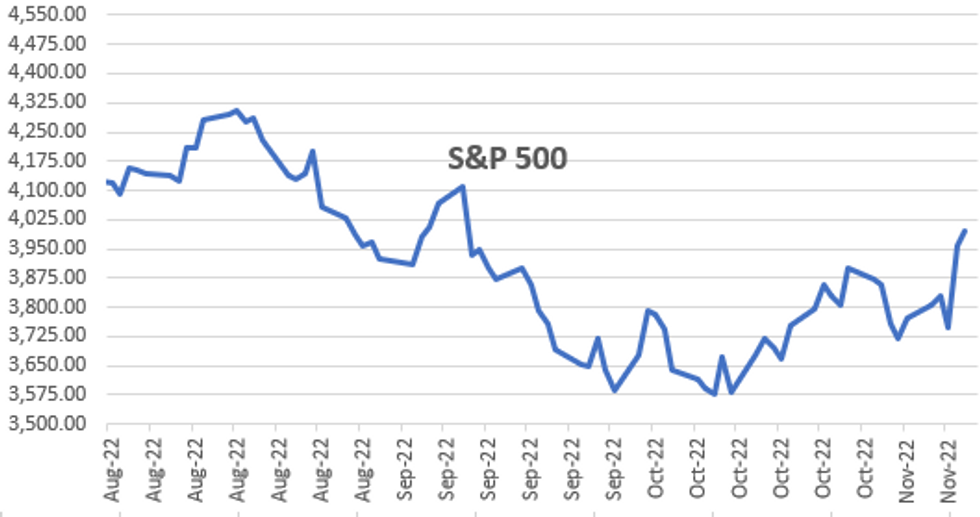

- DJIA up 54.61 points (0.16%) at 33774.82

- S&P E-Mini Future up 44.75 points (1.13%) at 4006.5

- Nasdaq up 226.8 points (2%) at 11341.99

- US 10-Yr yield is unchanged 0 bps at 3.8125%

- US Dec 10Y are down 6.5/32 at 112-10

- EURUSD up 0.0148 (1.45%) at 1.0357

- USDJPY down 2.41 (-1.71%) at 138.57

- WTI Crude Oil (front-month) up $2.55 (2.95%) at $89.01

- Gold is up $11.4 (0.65%) at $1767.00

- EuroStoxx 50 up 21.94 points (0.57%) at 3868.5

- FTSE 100 down 57.3 points (-0.78%) at 7318.04

- German DAX up 78.77 points (0.56%) at 14224.86

- French CAC 40 up 37.79 points (0.58%) at 6594.62

US TSY FUTURES CLOSE

- 3M10Y +0, -36.535 (L: -36.535 / H: -36.535)

- 2Y10Y +0, -52.381 (L: -52.381 / H: -52.381)

- 2Y30Y -3.552, -32.101 (L: -32.101 / H: -28.549)

- 5Y30Y -3.552, 7.602 (L: 7.602 / H: 11.154)

- Current futures levels:

- Dec 2Y down 1.625/32 at 102-13.875 (L: 102-11.125 / H: 102-15.875)

- Dec 5Y down 3.25/32 at 107-26 (L: 107-19.75 / H: 107-31)

- Dec 10Y down 6.5/32 at 112-10 (L: 112-00 / H: 112-18)

- Dec 30Y down 11/32 at 123-25 (L: 123-02 / H: 124-05)

- Dec Ultra 30Y steady at 130-27 (L: 129-26 / H: 131-12)

US 10YR FUTURE TECH: (Z2) Pierces The 50-Day EMA

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 112-19 High Oct 27 and a key resistance

- PRICE: 112-10.5 @ 1500ET Nov 10

- SUP 1: 110-28/109-10+ 20-day EMA / Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.05+ 3.0% 10-dma envelope

Treasuries traded sharply higher Thursday. This resulted in a break of resistance at 111-31, the Oct 27 high. The contract has also pierced the 50-day EMA, at 112-13. A clear break of the EMA would strengthen the case for short-term bulls and open 113-30, the Oct 4 high and a key resistance. On the downside, key support has been defined at 108-26+, the Oct 21 low. Initial support lies at 110-28, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.025 at 95.020

- Mar 23 +0.005 at 94.840

- Jun 23 -0.025 at 94.860

- Sep 23 -0.045 at 95.110

- Red Pack (Dec 23-Sep 24) -0.02 to +0.040

- Green Pack (Dec 24-Sep 25) +0.040 to +0.045

- Blue Pack (Dec 25-Sep 26) +0.025 to +0.035

- Gold Pack (Dec 26-Sep 27) +0.020 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 3.81486% (-0.00143/wk)

- 1M +0.00215 to 3.87529% (+0.01715/wk)

- 3M -0.04357 to 4.60614% (+0.05585/wk) * / **

- 6M -0.04957 to 5.08400% (+0.07271/wk)

- 12M -0.18000 to 5.45129% (-0.21514/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.64971% on 11/10/22

US STOCKS: Q3 Earnings Roundup: Winding Down

Salient companies yet to announce Q3 earnings next week.- Monday ahead the open:

- Tyson Foods Inc (TSN) $1.711 est,

- Tuesday ahead the open:

- Home Depot (HD) $4.141 est

- Walmart (WMT) $1.323 est

- Wednesday:

- Lowe's Cos Inc (LOW) $3.089 est

- Target Corp (TGT) $2.191 est

- Twitter Inc (TWTR) -$0.013 est

- TJX Cos Inc (TJX) $0.804 est

- Cisco Systems (CSCO) $0.834 est after close

- Bath & Body Works (BBWI) $0.219 est after close

- NVIDIA (NVDA) $0.707 est after close

- Thursday:

- Kohl's Corp (KSS) $0.7445 est

- Applied Materials (AMAT) $1.679 est

EGBs-GILTS CASH CLOSE: Bunds Give Up Thursday's Gains

German yields rose sharply to close the week as ECB dovishness was reconsidered, reversing most of Thursday's fall, with Gilts also weakening but outperforming Bunds. Trading was thinner than usual, with several US markets on holiday.

- ECB and BoE terminal rate hike pricing bounced from Thursday's lows, returning to pre-US CPI release levels.

- UK Sept GDP came in weaker than expected, but the reading was distorted by the impact of an additional bank holiday. No real surprises for the BoE.

- ECB's de Cos said the QT start date could be announced in December.

- Periphery spreads were mixed: BTPs gave back some of Thursday's spread tightening, while GGBs outperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 12.7bps at 2.207%, 5-Yr is up 16bps at 2.087%, 10-Yr is up 15.1bps at 2.16%, and 30-Yr is up 11.4bps at 2.112%.

- UK: The 2-Yr yield is up 6.2bps at 3.165%, 5-Yr is up 5.8bps at 3.367%, 10-Yr is up 6.6bps at 3.358%, and 30-Yr is up 8.5bps at 3.491%.

- Italian BTP spread up 5.3bps at 204.5bps / Greek down 6.1bps at 237.5bps

FOREX: USD Index Extends Two-Day Decline To 3.2%

- Despite several comments from both Fed members and treasury Secretary Yellen highlighting that it is too early to declare victory over inflation, the greenback continues to slide following the lower US CPI figures on Thursday.

- Furthermore, overnight news of China’s freshly optimised COVID restrictions (which include a rollback of the country’s international travel restrictions and reduced quarantine time for international travellers) has resulted in a fresh round of risk-positive flows as we approach the end of the trading week.

- The extension of USD weakness has been broad based, with EUR, JPY, AUD and NZD all rising over 1% and extending the impressive rallies from Thursday. EURUSD looks set to retest the significant resistance zone between 10350-68, with the latter level representing the Aug 10, high.

- USDJPY also maintained high levels of volatility, briefly printing 138.78 during the European session, an impressive 769 pips below yesterday’s opening price. Price action stabilised somewhat during the US (Veteran’s Day Holiday) session but remains within 50 pips of the lows approaching the close.

- The Swiss Franc (+1.82%) is among the strongest performers in G10, receiving an additional tailwind from forceful SNB rhetoric, confirming the bank will use "all measures necessary" which could include currency intervention. USDCHF is rapidly approaching key resistance at 0.9371, the August lows.

- A much quieter week for data next week, with UK and Canadian CPI the highlights on Wednesday.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/11/2022 | 2130/1630 |  | US | Fed Governor Christopher Waller | |

| 14/11/2022 | 0001/0001 |  | UK | Rightmove House Prices | |

| 14/11/2022 | 1000/1100 |  | EU | ECB Panetta Speech at CEPR-EABCN Conference | |

| 14/11/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/11/2022 | - |  | UK | House of Commons Returns | |

| 14/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 14/11/2022 | 1345/0845 |  | CA | BOC's Macklem opening remarks at diversity conference | |

| 14/11/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/11/2022 | 1615/1715 |  | EU | ECB de Guindos Speech at Euro Finance Week | |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/11/2022 | 1630/1130 |  | US | Fed Vice Chair Lael Brainard | |

| 14/11/2022 | 2330/1830 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.