-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stimulus Deal Deadline Looms

EXECUTIVE SUMMARY:

- MNI POLICY: Fed's Evans-No Urgency to Ramp Up QE Now

- MNI POLICY: Fed Corporate Debt Buys, Flexible, Could Increase

- Quarles says more must be done to reduce risk at money market funds

- PELOSI SAYS SHE IS OPTIMISTIC FOR STIMULUS, ECONOMY NEEDS IT, Bbg

- GOOGLE ACCUSED BY U.S. OF ABUSING MARKET POWER IN LANDMARK CASE, Bbg

- BREXIT - UK PM JOHNSON TELLS GREEK PM: EU HAVE EFFECTIVELY ENDED NEGS, Rtrs

- ASTRAZENECA COVID-19 VACCINE US TRIAL EXPECTED TO RESUME AS EARLY AS THIS WEEK - RTRS

US

FED: Stepping up asset purchases will have a limited effect on already-low borrowing costs now, but the Fed could consider offering further accommodation later in the recovery, Federal Reserve Bank of Chicago President Charles Evans told reporters Tuesday. Monetary policy "could lower borrowing costs somewhat, but borrowing costs are already probably about as low as they're going to go for the moment," Evans said. "I don't see the same kind of necessity or opportunity like we saw in 2010 and 2012 when interest rates were higher and we were really activating the portfolio balance effect." For me see 10/20 main wire at 1453ET.

FED: The New York Fed's Daleep Singh says corporate bond purchases could be ramped up should market decisions demand it.

- * The pace of the central banks' secondary marker corporate credit facility "purchases is dependent on measures of market functioning and market volumes" and "if market stress were to return and our purchase pace were to increase, we would initially focus our support primarily through direct purchases of corporate bonds," he said, adding that, in a scenario of significant market stress, the Fed would buy bonds and ETFs. For me see 10/20 main wire at 1334ET.

OVERNIGHT DATA

US DATA: September Housing Starts +1.9%; Permits +5.2%

- U.S. housing starts rose 1.9% in September to a seasonally adjusted annual rate of 1.415M, according to figures released Tuesday by the Census Bureau. Financial markets had expected starts to climb to a saar of 1.465M.

- From a year earlier, starts were up 11.1% in September.

- August housing starts were revised down to a saar of 1.388M (prev 1.416M).

- Permits rose 5.2% to a saar of 1.553M, above forecasts of saar 1.520M.

- Permits were up 8.1% from a year earlier.

- Completions increased 15.3% in Sep to a saar of 1.413M from 1.226M in Aug

- Completions were up 25.8% year-over-year.

US REDBOOK: OCT STORE SALES +1.0% V SEP THROUGH OCT 17 WK

US REDBOOK: OCT STORE SALES +1.9% V YR AGO MO

US REDBOOK: STORE SALES +2.5% WK ENDED OCT 17 V YR AGO WK

US OCT PHILADELPHIA FED NONMFG INDEX 16

MARKET SNAPSHOT

- - DJIA up 110.33 points (0.39%) at 28436.04

- - S&P E-Mini Future up 12.75 points (0.37%) at 3453

- - Nasdaq up 39.6 points (0.3%) at 11581.31

- - US 10-Yr yield is up 2.2 bps at 0.7907%

- - US Dec 10Y are down 6/32 at 138-23.5

- - EURUSD up 0.0057 (0.48%) at 1.1827

- - USDJPY up 0.01 (0.01%) at 105.47

- - WTI Crude Oil (front-month) up $0.63 (1.54%) at $41.46

- - Gold is up $7.21 (0.38%) at $1910.67

- - EuroStoxx 50 down 14.64 points (-0.45%) at 3241.44

- - FTSE 100 up 4.57 points (0.08%) at 5900.51

- - German DAX down 117.71 points (-0.92%) at 12812.78

- - French CAC 40 up 0.01 points (0%) at 4948.86

US TSY SUMMARY: Leaning Towards No-Deal Today

Markets buffeted by deal/no-deal stimulus headlines during second half. White House Speaker Pelosi remained optimistic, Sen Shelby expressed no optimism of a deal, while Sen Mitt Romney flat-out opposing $1.8T deal (or more) adding to late sales in equities. Stanza: Sen majority leader McConnell said would hold vote for stimulus if deal reached, vote does not mean pass.

- Astrazeneca vaccine trial to resume in a few days likely contributed to the midday bid in equities. Other salient headlines:

- GOOGLE ACCUSED BY U.S. OF ABUSING MARKET POWER IN LANDMARK CASE, Bbg

- BREXIT - UK PM JOHNSON TELLS GREEK PM: EU HAVE EFFECTIVELY ENDED NEGS, Rtrs

- Little to no react to multiple Fed speakers, Chicago Fed Pres Evans said stepping up asset purchases would have limited effect on already-low borrowing costs now, but the Fed could consider offering further accommodation later in the recovery.

- Trade volumes were about average, TYZ>1.1M after the bell, two-way flow from fast$, prop and bank portfolios in short end.

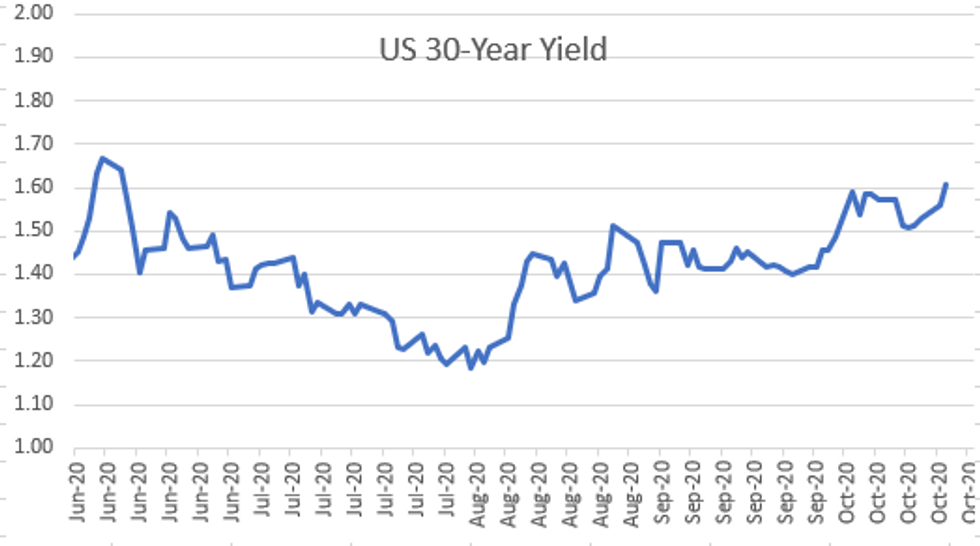

- The 2-Yr yield is down 0.2bps at 0.1431%, 5-Yr is up 0.2bps at 0.3361%, 10-Yr is up 2.2bps at 0.7907%, and 30-Yr is up 3.8bps at 1.5976%.

US TS FUTURES CLOSE: Deal/No-Deal Chop

Broadly weaker by the bell, just off late session lows on choppy trade. Markets buffeted by deal/no-deal stimulus headlines during second half. While House Sp Pelosi remains optimistic, Sen Shelby expressed no optimism of a deal, while Sen Mitt Romney flat-out opposing $1.8T deal (or more) adding to late sales in equities. Yld curves steeper, near highs, update:

- 3M10Y +1.58, 69.096 (L: 65.327 / H: 69.851)

- 2Y10Y +2.741, 64.723 (L: 61.316 / H: 65.19)

- 2Y30Y +4.269, 145.455 (L: 140.173 / H: 145.936)

- 5Y30Y +3.748, 126.104 (L: 121.595 / H: 126.398)

- Current futures levels:

- Dec 2Y up 0.12/32 at 110-13.75 (L: 110-13.25 / H: 110-13.8)

- Dec 5Y down 0.75/32 at 125-23.5 (L: 125-21.7 / H: 125-24.7)

- Dec 10Y down 6/32 at 138-23.5 (L: 138-21 / H: 138-28.5)

- Dec 30Y down 30/32 at 173-18 (L: 173-12 / H: 174-14)

- Dec Ultra 30Y down 2-9/32 at 215-31 (L: 215-21 / H: 218-03)

US EURODLR FUTURES CLOSE: Whites Hold Steady

Steady in the short end, Reds through Golds weaker -- moderate session lows. Lead quarterly back to steady after dipping briefly after 3M LIBOR rebounded +0.00712 from Mon's all-time low to 0.21575% (-0.00263/wk).

- Dec 20 steady at 99.765

- Mar 21 steady at 99.795

- Jun 21 steady at 99.805

- Sep 21 steady at 99.805

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.010 to -0.015

- Blue Pack (Dec 23-Sep 24) -0.015 to -0.035

- Gold Pack (Dec 24-Sep 25) -0.035 to -0.050

US DOLLAR LIBOR: Latest settles

- O/N -0.00050 at 0.08038% (-0.00075/wk)

- 1 Month +0.00237 to 0.14575% (-0.00563/wk)

- 3 Month +0.00712 to 0.21575% (-0.00263/wk)

- 6 Month -0.00237 to 0.25188% (-0.00562/wk)

- 1 Year -0.00262 to 0.33713% (+0.00213/wk)

US TSY STIR

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $54B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $155B

- Secured Overnight Financing Rate (SOFR): 0.09%, $903B

- Broad General Collateral Rate (BGCR): 0.06%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $324B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $18.032B submission

- Next scheduled purchase:

- Wed 10/21 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

PIPELINE: Kingdom of Denmark Priced

- Date $MM Issuer (Priced *, Launch #)

- 10/20 $2B *Denmark 2Y +1

- 10/20 $3B United Airlines 4.1Y EETC deal (enhanced equipment trust certificates, corporate debt securities)

- Expected Wednesday

- 10/21 $Benchmark World Bank (IRBD) 5Y +11a

FOREX: Signs of Deal Progression Ahead of Pelosi's Deadline

US equities got a late bid as House Speaker Pelosi talked up the chances of a COVID-19 aid package by the end of play Tuesday, with markets particularly enjoying her statement that the administration has "come a long way" toward an agreement. This helped keep the greenback under pressure across the board, which fell most notably against the CAD, EUR and Scandi currencies.

- GBP remains volatile in a range, with some late support emerging in GBP/USD as Telegraph sources reported that EU negotiator Barnier could be making a surprise visit to London as soon as Thursday. GBP/USD failed to cement the gains, however, returning lower just after the London close.

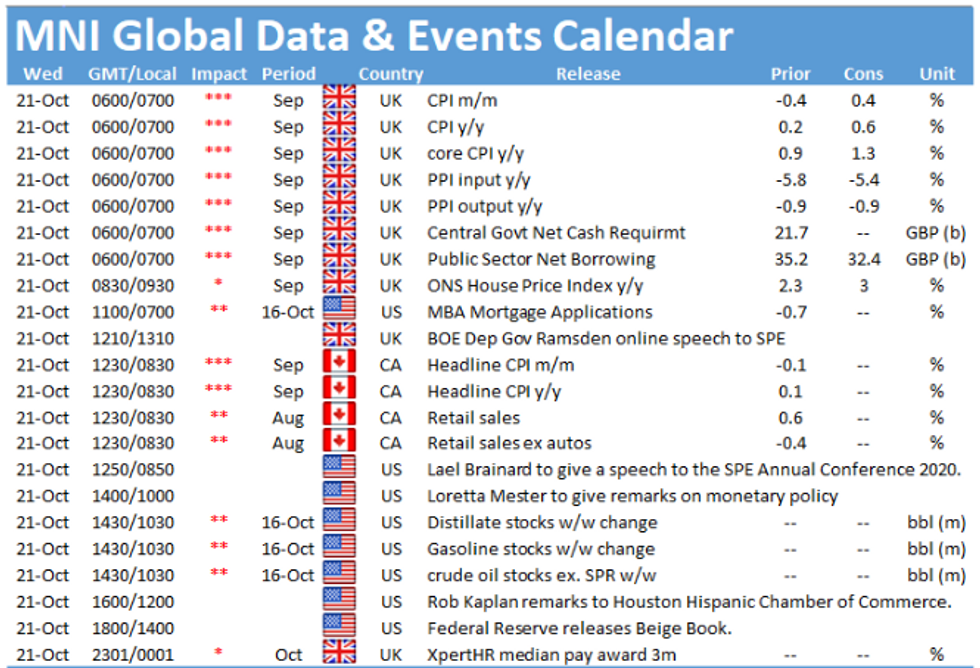

- UK inflation, Canadian retail sales and the Westpac Leading Index for Australia are the calendar highlights Wednesday, which may leave more focus on the central bank speaker slate - ECB's Lagarde & Lane, BoE's Ramsden, RBA's Debelle and Fed's Mester, Kaplan, Kashkari and Bullard are all due.

EGBs-GILTS CASH CLOSE: Issuance Takes The Spotlight

Brexit and COVID news got some attention Thursday but were largely on the back burner compared with remarkable Eurozone supply headlines.

- These included: E17bln EU SURE dual-tranche syndication saw E233bln in books; BTPs gained temporarily on official confirmation that Italy funding for the remainder of 2020 would be 30% lower vs last year; BBG reporting that Europe's primary bond market has surpassed E1.5trn in annual sales, a record.

- Gilt and EGB curves a little steeper on the day, periphery spreads wider.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.4bps at -0.783%, 5-Yr is up 0.8bps at -0.806%, 10-Yr is up 1.3bps at -0.615%, and 30-Yr is up 1.3bps at -0.199%.

- UK: The 2-Yr yield is up 1bps at -0.063%, 5-Yr is up 1bps at -0.078%, 10-Yr is up 1.1bps at 0.18%, and 30-Yr is up 1.2bps at 0.722%.

- Italian BTP spread up 2.6bps at 137.4bps

- Spanish bond spread up 2.2bps at 80.9bps

- Portuguese PGB spread up 1.8bps at 78.6bps

- Greek bond spread up 4.5bps at 149.4bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.