-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Strong Retail Sales, Brexit Talk Weighs

EXECUTIVE SUMMARY:

- MNI INSIGHT: More BOE QE Likely Even If Gains Slight

- MNI SOURCES: Boosts To APP, PEPP On ECB Radar; Need Disputed

- MNI REALITY CHECK: China Sales Seen Up As Restrictions Ease

- MNI POLICY: U.S. Treasury Says 2020 Deficit Hit Record USD3.1T

- MNI POLICY: U.S. Treasury Seeks Dealer Input on TIPS Demand

- BREXIT: UK PM JOHNSON SAYS EU ABANDONED IDEA OF FREE TRADE DEAL, Rtrs

- UK JOHNSON: HAS CONCLUDED WE SHOULD GET READY FOR AUSTRALIA STYLE DEAL, Rtrs

- NO POINT IN TRADE TALKS IF EU DOESN'T CHANGE POSITION: SLACK

EUROPE

BOE: Recent research has reassured the Bank of England it would be safe to boost its quantitative easing programme, which it is likely by the end of the year, without fear of risking market disruption when it is eventually withdrawn, MNI understands. With the Bank's consultation on negative interest rates only starting, the likely expansion of the GBP745 billion QE stock target in November or December would potentially relieve any upsurge in market stress in the event of a disruptive Brexit or a worsening Covid-19 pandemic. For more, see 10/16 main wire at 0813ET.

ECB: The European Central Bank could top up its pre-Covid quantitative easing plan as early as its next policy meeting and could also expand its Pandemic Emergency Purchase Programme in the coming months, but not all policymakers agree on the need for immediate additional easing or on the best mechanism to provide it, ECB sources said. For more, see 10/16 main wire at 0753ET.

BREXIT: Canada vs Australia deals

Just a reminder of some of the main differences on Canada vs Australia trade deals now that Boris Johnson has said an Australia-style deal is most likely.

- Canada deal eliminates 98% of tariffs on goods.

- Canada has "increased access" to services.

- There is also more harmonization of regulations between Canada and the EU to make it easier to sell goods/services in both markets.

- Australia is still negotiating a trade deal with the EU and is a likely to be a little better than WTO rules. Boris is most likely referring to the likely terms of an Australia deal rather than the current deal.

- In essence FTA>Canada>Australia>WTO

ASIA

CHINA: China retail sales recovery likely extended in September on buoyant auto sales. China's retail sales are expected to edge higher in September, helped by the ongoing pick up in auto, hospitality and traditional bricks and mortar spending as social distancing rules ease, industry insiders and analysts told MNI.

US

US TSY: The U.S. federal deficit hit a record USD3.1 trillion at the end of the fiscal year 2020, according to official estimates by the Treasury Department released Friday, with a USD125 billion deficit in September alone rounding out the year. The next largest deficit was in 2009 at USD1.4 trillion when the Obama administration fought the effects from the financial crisis. The current shortfall also represents the largest deficit relative to GDP since the end of World War II in 1945 at 15% of GDP. For more, see 10/16 main wire at 1400ET.

US TSY: The U.S. Treasury has asked primary dealers for their input on debt projections and whether the department should increase TIPS auction sizes. The Treasury on Friday said it also asked if dealers believe the Federal Reserve's new flexible form of average inflation targeting will have an impact on TIPS demand. The queries will be the focus of discussion between the Treasury and primary dealers ahead of their quarterly meeting later this month. For more, see 10/16 main wire at 1200ET.

CANADA

BOC: Bank of Canada holdings of federal government bonds climbed CAD6.5 billion this week according to figures published on Friday, taking the total past the quarter trillion dollar mark for the first time. Federal bond holdings of CAD252 billion come as part of a QE program to buy at least CAD5 billion a week of that debt until the economic recovery is well underway, with the overnight policy rate on hold at 0.25%. For more, see 10/16 main wire at 1401ET.

OVERNIGHT DATA

US DATA: Sep Retail Sales Gains Surprise 1.9%, Ex-Motor Vehicles 1.5%

- September retail sales beat expectations handily, rising by 1.9% vs 0.8% expected, and August sales were unrevised at 0.6%. YOY sales up 5.4%

- Excluding motor vehicles, sales rose 1.5% vs 0.7% expected

- Control group -1.3% vs -0.5% in Aug

- Motor vehicles rose 3.6%; Food and beverage were flat after rising 10.5% in Aug; Non-store retailers rose 0.5% after a 23.8% gain in Aug.

US DATA: Sept Industrial Production Below Expected -0.6%; CapU 71.5%

Industrial production in September fell 0.6% vs +0.5% expected, the first decline after four consecutive months of gains, while August's gain went unrevised at +0.4%. September capacity utilization -0.5pp to 71.5%, below expectations of 71.8%, while August capacity utilization was revised up to 72.0% from 71.4%

- September IP reading was still 7.1% below its pre-pandemic February level

- Manufacturing output declined (-0.3%) in September and was 6.4% below February's level; motor vehicles and parts +1.4%

- Mining +1.7%

- Utilities -5.6%

MICHIGAN PRELIM. OCT. CONSUMER SENTIMENT AT 81.2; EST. 80.5

NY FED Staff Nowcast stands at 13.8% for 2020:Q3 and 3.6% for 2020:Q4

Atlanta Fed GDPNow: Third-Quarter GDP Growth Estimate Is 35.2 Percent

US AUG BUSINESS INVENTORIES +0.3%; SALES +0.6%

US AUG RETAIL INVENTORIES +0.4%

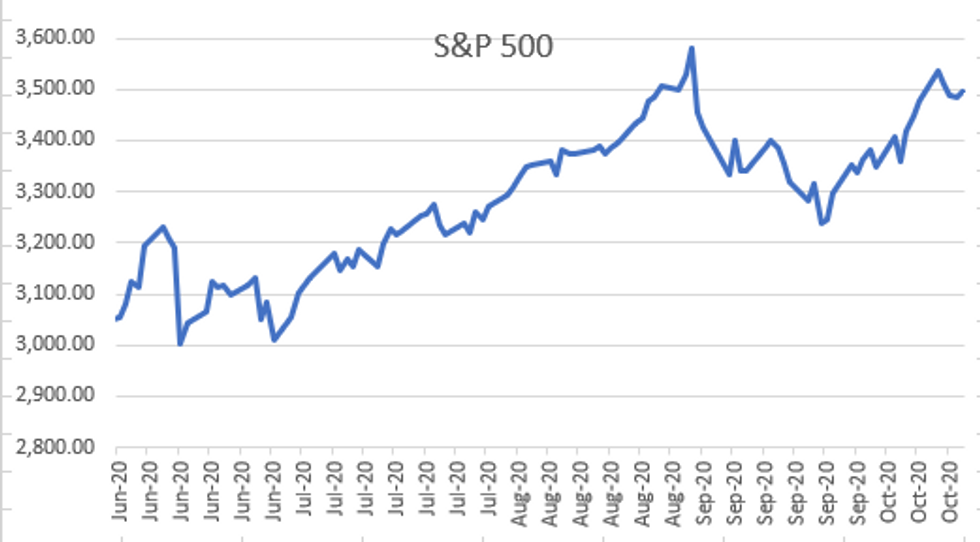

- DJIA up 269.38 points (0.95%) at 28494.2

- S&P E-Mini Future up 22.25 points (0.64%) at 3481.5

- Nasdaq up 55.8 points (0.5%) at 11713.87

- US 10-Yr yield is up 0.5 bps at 0.7373%

- US Dec 10Y are down 1.5/32 at 139-2.5

- EURUSD up 0.0013 (0.11%) at 1.172

- USDJPY down 0.05 (-0.05%) at 105.25

- WTI Crude Oil (front-month) down $0.16 (-0.39%) at $40.56

- Gold is down $5.52 (-0.29%) at $1909.36

- European bourses closing levels:

- EuroStoxx 50 up 52.78 points (1.65%) at 3222.63

- FTSE 100 up 87.06 points (1.49%) at 5888.79

- German DAX up 205.24 points (1.62%) at 12805.12

- French CAC 40 up 98.44 points (2.04%) at 4904.08

US TSY SUMMARY

Rates traded weaker by the bell but off early session lows to near middle session range amid modest overall volumes (TYZ w/ 825k -- a tepid pace with volumes in the 10Y futures at 290k on the open). Brexit headline and data related risk drove session vol: Retail sales beating expectation while US IP missed the survey. Salient factors spurring trade today:

- Drug maker Pfizer hopes of vaccine provided mild risk-on tone;

- UK PM Johnson Brexit comments spurred decent 2-way, rates quickly reversed gains after Australia-style deal intimated

- Better than expected retail sales weighed on rates (support for equities) Tsys bounced on UK PM spokesman Slack comment:

- NO POINT IN TRADE TALKS IF EU DOESN'T CHANGE POSITION, Bbg, and "`TRADE TALKS ARE OVER' BECAUSE EU EFFECTIVELY ENDED THEM", Bbg. More Brexit Headline Induced Vol Midday bounce in Tsys w/below exp IP data and recent comments from UK PM spokesman Slack intimating Brexit negotiations are over purred quick round of short covering, long end back to narrow overnight range.

- The 2-Yr yield is up 0.2bps at 0.1411%, 5-Yr is up 0.3bps at 0.3169%, 10-Yr is up 0.8bps at 0.7406%, and 30-Yr is up 1.1bps at 1.5247%.

- 3M10Y +1.355, 63.931 (L: 61.169 / H: 65.419)

- 2Y10Y +0.133, 59.257 (L: 58.2 / H: 61.453)

- 2Y30Y +0.328, 137.565 (L: 135.776 / H: 140.511)

- 5Y30Y +0.525, 120.344 (L: 119.014 / H: 122.45); Current futures levels:

- Dec 2Y down 0.12/32 at 110-13.875 (L: 110-13.62 / H: 110-14.5)

- Dec 5Y down 0.25/32 at 125-26.75 (L: 125-25.7 / H: 125-28.7)

- Dec 10Y down 1/32 at 139-3 (L: 138-31 / H: 139-07.5)

- Dec 30Y down 6/32 at 175-2 (L: 174-16 / H: 175-18)

- Dec Ultra 30Y down 17/32 at 219-10 (L: 218-03 / H: 220-12)

- DATE TIME AMOUNT SECURITY (CUSIP)/ANNC

- 19-Oct 1130ET $54B 13W-Bill (9127963V9)

- 19-Oct 1130ET $51B 26W-Bill (9127962Q1)

- 20-Oct 1130ET $30B 42D-Bill CMB (912796TU3)

- 20-Oct 1130ET $30B 119D-Bill CMB (9127964D8)

- 21-Oct 1130ET TBA 105D Bill CMB 20-Oct

- 21-Oct 1130ET TBA 154D Bill CMB 20-Oct

- 21-Oct 1300ET $22B 20Y-bond/R/O (912810SQ2)

- 22-Oct 1130ET TBA 4W-Bill 20-Oct

- 22-Oct 1130ET TBA 8W-Bill 20-Oct

- 22-Oct 1300ET $17B 5Y-TIPS (91282CAQ4)

US EURODOLLAR FUTURES CLOSE

Mostly steady in the short end to marginally mixed by the bell. Lead quarterly holds steady since 3M LIBOR climbed +0.00063 off Thu's all-time lo to 0.21838% (-0.00575/wk). Latest lvls:

- Dec 20 +0.000 at 99.760

- Mar 21 +0.005 at 99.795

- Jun 21 +0.005 at 99.805

- Sep 21 +0.010 at 99.810

- Red Pack (Dec 21-Sep 22) steady to +0.005

- Green Pack (Dec 22-Sep 23) steady

- Blue Pack (Dec 23-Sep 24) steady

- Gold Pack (Dec 24-Sep 25) -0.01 to -0.005

- O/N -0.00012 at 0.08113% (-0.00062/wk)

- 1 Month +0.00413 to 0.15138% (+0.00613/wk)

- 3 Month +0.00063 to 0.21838% (-0.00575/wk)

- 6 Month +0.00425 to 0.25750% (+0.01175/wk)

- 1 Year -0.01275 to 0.33500% (-0.01263/wk)

US TSYS/STIR

STIR: FRBNY EFFR for prior session:

Daily Effective Fed Funds Rate: 0.09% volume: $54B

Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

US TSYS: Repo Reference Rates

Secured Overnight Financing Rate (SOFR): 0.10%, $952B

Broad General Collateral Rate (BGCR): 0.07%, $359B

Tri-Party General Collateral Rate (TGCR): 0.07%, $331B

(rate, volume levels reflect prior session)

FED: NY Fed Operational Purchase:

Tsy 0Y-2.25Y, $12.801B accepted vs. whopping $45.582B submission

Next week's scheduled purchases:

Mon 10/19 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

Tue 10/20 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

Wed 10/21 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

Thu 10/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

Fri 10/23 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE

US$ High-Grade Credit Supply; $8B BoA 5pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/16 $8B #Bank of America $2B 4NC3 +63, $500M 4NC3 SOFR+73, $2.5B 6NC5 +88, $2.5B 11NC10 +118, $1B 31NC30 +130

- 10/16 $1B *Morgan Stanley WNG 5NC4 fix/FRN, +55

- 10/16 $500M *China Minsheng Banking 3Y FRN, L+90

- 10/?? $Benchmark Denmark short duration bond

- -

- $2.55B Priced Thursday

- 10/15 $900M *Bank of China Group Inv $400M 5Y +125, $500M 10Y +160

- 10/15 $850M *Ag Bank of China, $500M 3Y +90, $350M 5Y +100

- 10/15 $300M *Union Bank of Philippines 5Y +195

- 10/15 $500M *COFCO (HK) 10Y +150

FOREX

Most FX pairs have remained stable Fri aside from USD vs. British Pound as the street awaited the EU Summit and the state of play on Brexit.

- Cable plummeted 90 pips to 1.2865, when UK Johnson said that UK should be ready for an Australian style deal. GBP recovered to around 1.2925 in late trade despite continued uncertainty.

- Although the UK government have told EU Chief Brexit negotiator Michel Barnier that there is 'no basis' for trade talks to continue next week, Barnier and UK lead Lord Frost will talk on Monday, BBC political correspondent Johnathan Blake says.

- US Data mixed with US Retail sales beating expectation while US IP missed the survey. US Michigan came above expectations.

- Rand is the best performing currency, up 0.66% versus the Greenback.

EGB: Brexit Headlines Focus

UK Prime Minister Boris Johnson's statement that the UK is preparing for an Australia-style deal (which is little more than WTO rules) pushed core fixed income higher, but much of the knee jerk move was retraced as the market took the view that the talk was little move than posturing and hard talk.

- Macron later continued the hard talk saying that the UK needed a deal more than the EU but Merkel struck a more conciliatory tone stating that compromises would be needed from both sides.

- Johnson later said that unless the EU was willing to compromise talks would stop now, despite EU diplomats already on their way to the UK to continue talks and EU sources stating that talks would continue next week.

- Elsewhere, a better than expected US retail sales print pushed fixed income lower globally.

- Bund futures are up 0.24 today at 176.14 with 10y Bund yields down -1.8bp at -0.630% and Schatz yields down -0.8bp at -0.781%.

- BTP futures are up 0.67 today at 150.27 with 10y yields down -5.2bp at 0.644% and 2y yields down -4.6bp at -0.367%.

- OAT futures are up 0.29 today at 170.21 with 10y yields down -2.3bp at -0.355% and 2y yields down -1.1bp at -0.716%.

UP TODAY

- 19-Oct 0800 Fed Chair Powell, panel remarks IMF event "Cross-Border Payment, A Vision for the Future", IMF Mng Dir Kristalina Georgieva moderating

- 19-Oct 1000 Oct NAHB home builder index (83, 83)

- 19-Oct 1130 US Tsy $54B 13W-Bill auction (9127963V9)

- 19-Oct 1130 US Tsy $51B 26W-Bill auction (9127962Q1)

- 19-Oct 1420 Atl Fed Bostic, economic diversity

- 19-Oct 1500 Philly Fed Harker, Covid-19 recovery

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.