-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Treasuries Rally as Distance" on COVID Deal Remains (test)

EXECUTIVE SUMMARY:

- MNI INTERVIEW: ECB Could Ease More This Year- De Guindos

- MNI INTERVIEW: Fiscal Block Threatens Factory Rebound-ISM

- Pelosi: Huge Differences Between Reps And Dems But "Still Important"

- Core PCE Inflation higher than expected in August, ISM Eases Slightly

- MNI REALITY CHECK: Cautious September Hiring by US Employers

- Fed Extends Measures To Ease Credit

- While fiscal policy should be "the first line of defence" for eurozone countries hardest hit by the economic effects of Covid-19, De Guindos said in a video interview that the ECB's Pandemic Emergency Purchasing Programme still had more than half its total EUR1.35 trillion envelope available.

- A Pelosi aide Tweets: "Speaker Pelosi and Secretary Mnuchin spoke by phone today at 1 p.m. The two discussed further clarifications on amounts and language but distance on key areas remain. Their conversation will continue this afternoon."

- Wires and social media reporting an EU official debunking comments made earlier by the FT's Seb Payne that indicated a 'landing zone' on certain sticking points in the UK-EU FTA negotiations was in sight.

- Reports state the EU official as saying there is 'no sign of landing zone' on these key issues.

- Continues the back-and-forth of sentiment and talks today, with stories andmcomments from UK officials significantly more upbeat than those from the EU

- "We are coming out of a manufacturing recession," he said. "But the problem is we are now entering into October and November and the political parties are deadlocked," he said, and manufacturers "lack optimism" about fiscal support for payrolls.

FED: Fed Extends Measures To Ease Credit

The Federal Reserve issues a notice that it has extended "temporary actions aimed at increasing the availability of intraday credit extended" by Fed banks, to Mar 31 2021 (they had been announced April 23, and had been set to expire yesterday, Sep 30). Per the Fed press release: "These temporary actions:

- Suspend uncollateralized intraday credit limits (net debit caps) and waive overdraft fees for institutions that are eligible for the primary credit program;

- Permit a streamlined procedure for secondary credit institutions to request collateralized intraday credit (max caps); and

- Suspend two collections of information that are used to calculate net debit caps.

DATA

US DATA: The ISM Mfg PMI eased in Sep by 0.6pt to 55.4 after four consecutive months of growth. Sep's downtick was driven by a sharp drop in New Orders, falling by 7.4pt and by Production which declined 2.3pt. Among the main five categories, Employment (49.6) saw the largest increase, followed by Inventories (47.1) and Supplier Deliveries (59.0). The Employment indicator has sat below the 50-mark since Jul 2019, despite Sep's uptick. Overall, Prices saw the largest uptick in Sep, up 3.3pt to 62.8, while Exports grew 1pt to 54.3 and Order Backlogs rose 0.6pt to 55.2. On the other hand, imports dropped 1.6pt to 54.0 and customer's inventory cooled 0.2pt to 37.9.

US DATA: US Core PCE Inflation Higher Than Expected- Initial jobless claims and continuing claims come in better-than-expected, with personal income a slight miss/personal spending a slight beat. But one of the standouts of the 0830ET releases is the continued uptick of the core PCE price deflator: at 1.59335 unrounded year-on-year, it's solidly above the 1.4% expected and the highest since March. As the Fed's preferred inflation metric, it's helping push short-end yields a little higher after the mixed data set.

- U.S. personal income fell 2.7% in August, below market expectations for a 2.5% drop, according to figures published Thursday by the Bureau of Economic Analysis. Personal income in July was up a revised 0.5% (prev 0.4%).

- August's decline mainly reflected a decrease in unemployment insurance benefits, driven by the expiration of an added USD600 in weekly benefits at the end of July, the BEA said. That was partially offset by an increase in compensation, driven primarily by rising government wage and salary disbursement as temporary Census hiring ramped up.

- July PCE rose 1.0%, above forecasts for a 0.8% gain. That reflected a USD87.9 billion increase in spending for services, which was partially offset by a USD10.3 billion decline in spending for goods.

- The PCE price index was up 0.3% in July, in line with market expectations. Excluding food and energy, the PCE price index was also up 0.3%.

- From a year earlier, the PCE price index was up 1.4%. The core PCE price index increased 1.6% year-over-year.

- US PREV JOBLESS CLAIMS REVISED TO 873K IN SEP 19 WK

US DATA: US CHALLENGER: SEP LAYOFF INTENTIONS 118,804 V AUG 115,762

CANADA DATA: CANADIAN AUG BUILDING PERMITS +1.7% MOM- CANADA RESIDENTIAL BUILDING PERMITS +7.1%; NON-RESIDENTIAL -8.6%

MARKETS

US TSYS SUMMARY: Rally On Reassessment Of Fiscal Progress

Treasuries bounced off lows as traders reassessed the likelihood of a fiscal breakthrough in Washington.

- ith expectations of a White House - House of Reps agreement over further COVID stimulus reaching fever pitch, Speaker Pelosi dashed expectations, characterizing both sides as being "way off" on some issues (though "closer" on others). Talks between Pelosi and Sec Mnuchin at 1300ET seen as potentially the last chance for a deal.

- Against this backdrop, front Tsys rallied 12 ticks from session lows, having weakened earlier following decent jobless claims data /higher-than-expected core PCE inflation / rallying equities. Lower-than-expected Sep ISM did help fuel the rally, despite signs of incipient supply-push inflation.

- As we await further news from D.C., attention closely paid to Friday's payroll figures.

- Curve trades mixed, with the long end underperforming. The 2-Yr yield is unchanged at 0.127%, 5-Yr is down 0.6bps at 0.2705%, 10-Yr is down 0.2bps at 0.6824%, and 30-Yr is up 0.9bps at 1.4637%.

- Dec 10-Yr futures (TY) up 0.5/32 at 139-17.5 (L: 139-06.5 / H: 139-19)

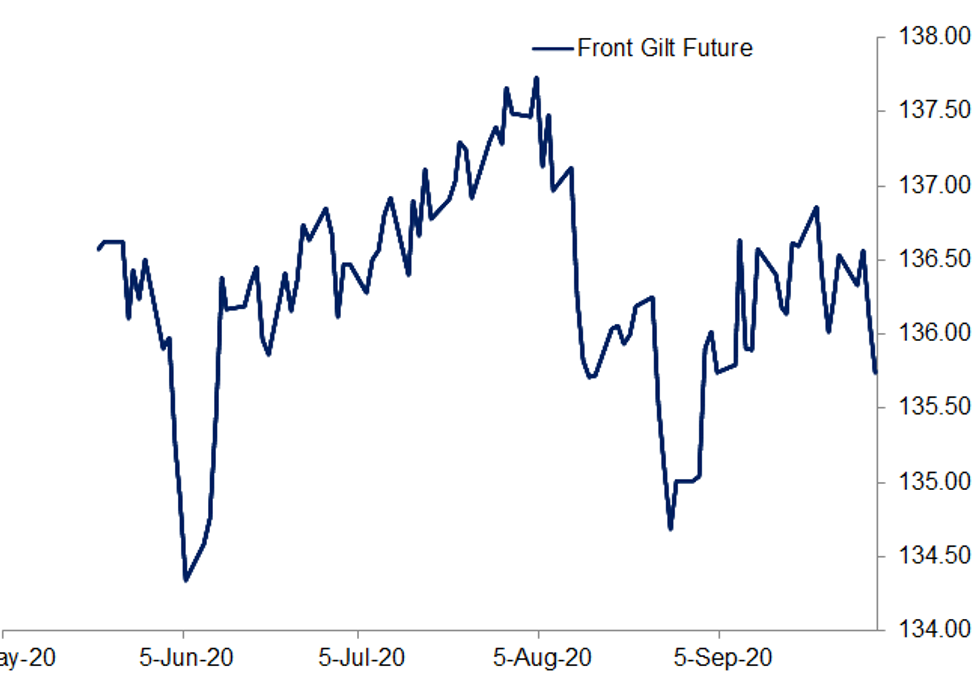

Bunds gained and Gilt yields came off highs on a day buffeted by political developments: mainly back-and-forth headlines on progress (or lack thereof) on UK-EU trade negotiations. In the end, we saw the UK curve steepen once again, and BTP spreads tighten sharply.

- MNI's interview with ECB's de Guindos published today pointed to the potential for further easing to be considered this year (contact sales@marketnews.com for full story).

- Supply this morning (Spain and France), and Sep PMI data, passed uneventfully.

- Closing levels: Germany: The 2-Yr yield is down 0.6bps at -0.707%, 5-Yr is down 1.1bps at-0.721%, 10-Yr is down 1.4bps at -0.536%, and 30-Yr is down 1.2bps at -0.106%.

- UK: The 2-Yr yield is down 2.1bps at -0.044%, 5-Yr is down 0.9bps at -0.065%,10-Yr is up 0.5bps at 0.234%, and 30-Yr is up 1.8bps at 0.8%.

- 10-Yr Periphery EGB Spreads:

- Italian BTP spread down 3.1bps at 135.7bps

- Spanish bond spread down 0.2bps at 76.8bps

- Portuguese PGB spread down 0.2bps at 78.3bps* Greek bond spread up 0.7bps at 155.5bps

- Sterling traded in a highly volatile fashion inside a range Thursday, as duelling Brexit headlines prompted a 150 pip range in GBP/USD. Hopes ran high for a post-transition period Brexit deal, as the FT reported that EU-UK negotiators were within sight of a 'landing zone' on state aid and the level playing field, with fisheries the only outstanding issue. This prompted a rally up to 1.2978, the highest since mid-September. These hopes were quickly dashed, however, as Reuters cited an EU official in saying there was "no sign" of a landing zone just yet. As a result, GBP is easily the poorest performer in G10 at the US close.

- Elsewhere, markets were disappointed with Pelosi's pessimism over the prospects for a renewed bipartisan push for the HEROES act. The pain was most clearly felt in industrial metals and oil, both of which fell sharply during US hours, with both copper and oil down as much 5% on the day.

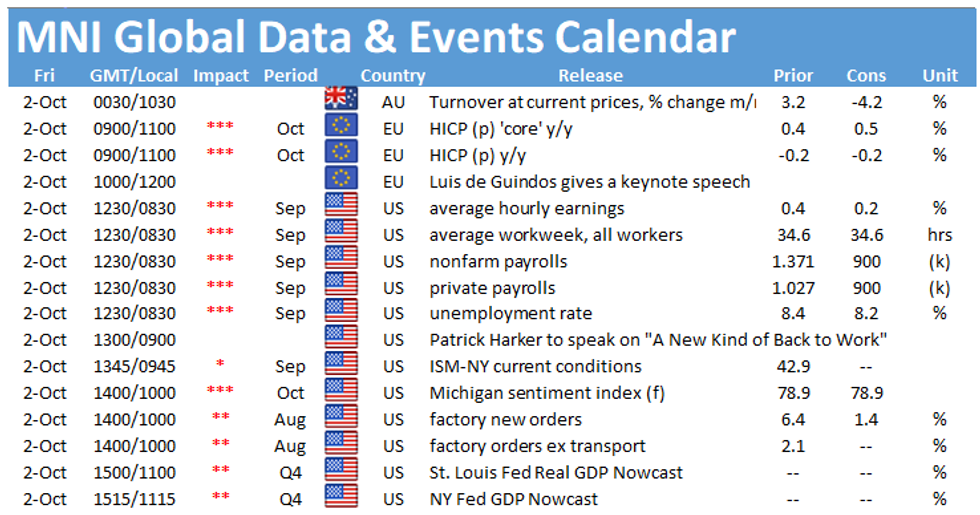

- Focus Friday turns to the September Nonfarm Payrolls report, with the US seen adding 875k jobs over the month, dropping the unemployment rate by 0.2ppts. Australian retail sales and speeches from Fed's Kashkari & Harker and ECB's Holzmann, de Guindos and de Cos are also due.

CALENDAR:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.