-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy 2s10s Curve Back to Early Volcker Lvls

EXECUTIVE SUMMARY

US

US: The rate of U.S. housing services inflation will likely settle higher than before the pandemic and potentially contribute 2.5 percentage points to core CPI for as long as the labor market stays tight, nearly twice as much as pre-Covid, Kansas City Fed economist A. Lee Smith told MNI.

- Rent inflation has been on a steady climb since 2021 and is already the largest contributor to elevated core inflation. While Fed officials are expecting a reversal in the second half of the year, citing falling market rates on new leases, new research by Smith and colleagues at the Kansas City Fed shows housing disinflation may be limited, because rents are sensitive to measures of labor market tightness, as are other core services components like health care and hospitality.

- "Our view is that the labor market will underpin demand for shelter. That was true pre-pandemic even as the acceleration in rents during the pandemic suggests other forces at play," such as a greater demand for space as people spent more time at home, Smith said in an interview. For more see MNI Policy main wire at 0859ET.

- "I'm a little worried the economy's stronger than expected and that is likely to mean they have to go a little bit higher above 6%," he said in an interview, adding his name to a list of outside advisers who've told MNI recently there's a risk rates will move above 6%.

- The drag on GDP growth from last year’s fiscal and monetary policy tightening is fading and that means that a key risk for the economy is a premature reacceleration, he said. "The Fed has to tighten substantially further, and secondly it has to stick to its guns. It can't make the mistake of pivoting just because a recession occurs." For more see MNI Policy main wire at 1115ET.

- He said the Cleveland Fed’s own surveys of individuals and businesses point to inflation expectations of around 6% over a one-year horizon.

- “They really suggest that people expect inflation to be pretty high over the next year. Not out of control but still pretty high,” Knotek, who as part of his role advises President Loretta Mester on monetary policy and attends FOMC meetings, told MNI’s FedSpeak podcast.

- These are “consumers and firms, who are the price setters and wage setters – the demand side. The fact that those inflation expectations are high is a cause for some concern.” For more see MNI Policy main wire at 1157ET.

- "If -- and I stress that no decision has been made on this -- but if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," he told lawmakers on Capitol Hill. "We have some potentially important data" coming including the February jobs, CPI and retail sales reports, he added when asked whether the Fed will reaccelerate the pace of its rate increases. "They're going to be important in our assessment."

- The St. Louis Fed's Coincident Employment Index predicts a seasonally adjusted 234,000 increase in the number of employed people last month, down from 580,000 in January. The unadjusted employment growth for February is around 1 million. These figures correspond to the Bureau of Labor Statistic's household survey.

- The CEI for January "pointed to an important increase in employment suggesting a positive surprise in employment growth relative to market expectations, which was ultimately reflected in the data," Dvorkin said. "For February, the coincident employment index shows a moderate increase once seasonality is taken into account," he said.

US TSYS: Fed Terminal Tops 5.685% In October

- Short end rate futures remain weak in late trade, but off early overnight lows as Federal Reserve Chairman Powell had a modicum of success in tempering Tuesday's hawkish tones at today's testimony to Congress.

- Chair Powell conceded earlier, the upcoming NFP Friday, CPI and PPI inflation metrics next week are "going to be important in our assessment," however, "we have not made any decision about the March meeting. We’re not on a preset path."

- Treasury bonds lead the initial rally (traded off highs after a weak Treasury 10Y note auction re-open tailed: 3.985% high yield vs. 3.955% WI) while short end rates still reflect higher expectations of 50Bp hike at next FOMC announcement on March 22.

- Fed funds implied hike for Mar'23 at 42.4bp, May'23 cumulative 77.9bp to 5.357%, Jun'23 99.5bp to 5.573%. The trajectory of hikes slows to 108.4bp in July'23 to 5.663%.

- Terminal rate via Fed Funds has climbed to 5.685% in Oct'23 vs. 5.695% high.

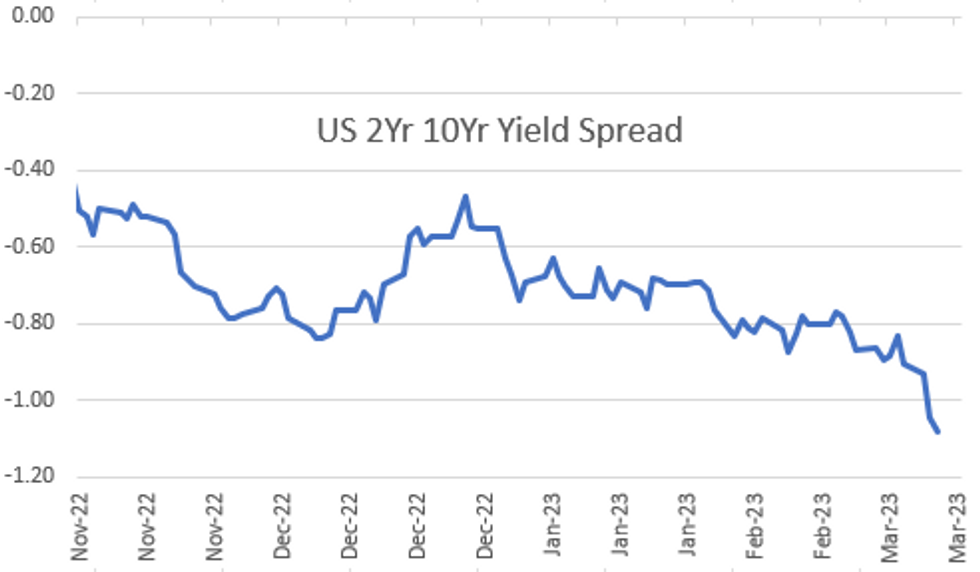

- Additional metrics: Treasury 2Y yield tapped new 16 year high of 5.0801% overnight, 2s10s yield curve fell to new inverted low of -105.513 last seen in 1981 when Volcker was Chairman of the Federal Reserve.

OVERNIGHT DATA

- US MBA: REFIS +9% SA; PURCH INDEX +7% SA THRU MARCH 3 WK

- US MBA: UNADJ PURCHASE INDEX -42% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.79% VS 6.71% PREV

- US MBA: MARKET COMPOSITE +7.4% SA THRU MAR 03 WK

- ADP US FEB. PRIVATE EMPLOYMENT RISES 242,000; EST. +200K

- US JAN. TRADE DEFICIT $68.3B; EST. -$68.7B

- US JAN. JOB OPENINGS 10.824M; Particularly Sticky Job Openings But Quits Rates Falling Faster

- The annual revisions broadly leave an even more elevated level of job openings in January at 10.82M (cons 10.55M) after 11.3M (initial 11.0M).

- As such the ratio to unemployed eased only from 1.96 to 1.90. It’s down from a high of 2.01 in March but up from 1.73 in Oct.

- Quits rates are however showing a greater degree of moderation though, the total from 2.65% to 2.50% and private from 2.92% to 2.76%, with both seeing the fastest single month declines since May.

- Single months can admittedly be noisy but they are both now within 0.2pps of 2019 averages.

- CANADIAN JAN TRADE BALANCE CAD +1.9 BILLION

- CANADA JAN EXPORTS CAD 67.0 BLN, IMPORTS CAD 65.1 BLN

- CANADA REVISED DEC MERCHANDISE TRADE BALANCE CAD +1.2 BLN

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 169.75 points (-0.52%) at 32683.35

- S&P E-Mini Future down 10.75 points (-0.27%) at 3978.5

- Nasdaq down 5.9 points (-0.1%) at 11524.02

- US 10-Yr yield is up 1.4 bps at 3.9775%

- US Jun 10-Yr futures are down 2/32 at 110-28.5

- EURUSD down 0.0006 (-0.06%) at 1.0543

- USDJPY up 0.12 (0.09%) at 137.28

- WTI Crude Oil (front-month) down $1.16 (-1.5%) at $76.42

- Gold is up $0.7 (0.04%) at $1814.15

- EuroStoxx 50 up 9.49 points (0.22%) at 4288.45

- FTSE 100 up 10.44 points (0.13%) at 7929.92

- German DAX up 72.34 points (0.46%) at 15631.87

- French CAC 40 down 14.51 points (-0.2%) at 7324.76

US TREASURY FUTURES CLOSE

- 3M10Y -1.99, -104.05 (L: -109.472 / H: -98.841)

- 2Y10Y -3.955, -108.851 (L: -110.917 / H: -104.846)

- 2Y30Y -4.895, -118.947 (L: -120.476 / H: -114.538)

- 5Y30Y -2.037, -46.146 (L: -47.981 / H: -41.912)

- Current futures levels:

- Jun 2-Yr futures down 3.5/32 at 101-10.375 (L: 101-09.25 / H: 101-16.125)

- Jun 5-Yr futures down 4.25/32 at 106-7.75 (L: 106-02.5 / H: 106-20.75)

- Jun 10-Yr futures down 2/32 at 110-28.5 (L: 110-20.5 / H: 111-14.5)

- Jun 30-Yr futures up 6/32 at 125-8 (L: 124-22 / H: 126-13)

- Jun Ultra futures up 9/32 at 135-31 (L: 135-05 / H: 137-16)

US 10YR FUTURE TECHS: (M3) Bearish But Remains Above Its Recent Lows

- RES 4: 113-04 50-day EMA

- RES 3: 112-18 High Feb 17

- RES 2: 112-03 High Feb 24 / 20-day EMA

- RES 1: 111-23+ High Feb 28

- PRICE: 111-01 @ 17:05 GMT Mar 8

- SUP 1: 110-12+ Low Mar 02 and the bear trigger

- SUP 2: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 110-02+ Lower 2.0% Bollinger Band

- SUP 4: 109-22 3.236 proj of the Jan 19 - Jan 30 - Feb 2 price swing

Treasury futures have recovered from today’s earlier lows and price remains above 110-12+, the Mar 2 low. Recent gains appear to be a correction and note that a move higher is allowing an oversold trend condition to unwind. Key short-term resistance is seen at 112-03, the 20-day EMA. The bear trigger lies at 110-12+, the Mar 2 low. A break would confirm a resumption of the downtrend and open 110-06, a Fibonacci projection.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.020 at 94.780

- Jun 23 -0.040 at 94.210

- Sep 23 -0.055 at 94.040

- Dec 23 -0.050 at 94.20

- Red Pack (Mar 24-Dec 24) -0.05 to +0.005

- Green Pack (Mar 25-Dec 25) -0.01 to +0.010

- Blue Pack (Mar 26-Dec 26) -0.01 to -0.01

- Gold Pack (Mar 27-Dec 27) -0.005 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00415 to 4.55814% (-0.00143/wk)

- 1M +0.04071 to 4.75971% (+0.05057/wk)

- 3M +0.09900 to 5.12471% (+0.14071/wk)*/**

- 6M +0.12800 to 5.47414% (+0.15743/wk)

- 12M +0.16400 to 5.88071% (+0.18628/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.02571% on 3/7/23

- Daily Effective Fed Funds Rate: 4.57% volume: $118B

- Daily Overnight Bank Funding Rate: 4.57% volume: $308B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.151T

- Broad General Collateral Rate (BGCR): 4.51%, $474B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $463B

- (rate, volume levels reflect prior session)

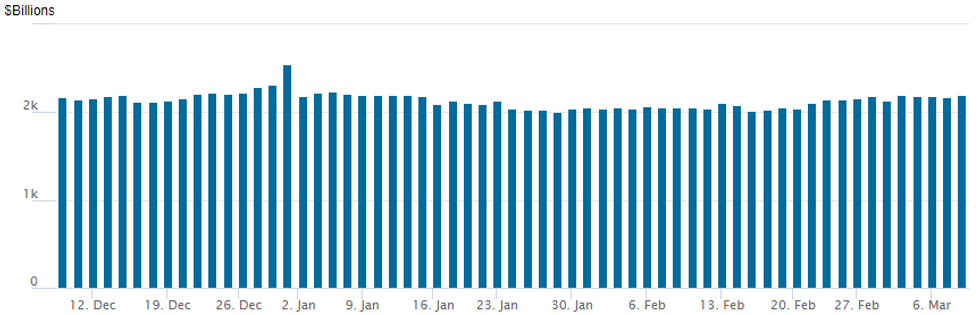

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,193.237B w/ 102 counterparties vs. prior session's $2,170.195B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $7.75B Kenvue 8-Tranche Bond Issuance Launched

Note, Treasury futures bounced slightly off session lows as speculative accounts unwind hedges after Kenvue jumbo debt launched, poorly received Treasury 10Y note auction re-open a boon for early rate locks.

- Date $MM Issuer (Priced *, Launch #)

- 03/08 $7.75B #Kenvue

- $750M 2Y +45,

- $750M 3Y +60,

- $1B 5Y +75,

- $1B 7Y +85,

- $1.25B 10Y +95,

- $750M 20Y +100,

- $1.5B 30Y +120,

- $750N 40Y +135

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/03/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/03/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/03/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/03/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 09/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/03/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/03/2023 | 1840/1340 |  | CA | BOC's Rogers "Economic Progress Report" speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.