-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Curves Bear Steepen Post-Data, BOJ Focus

- MNI Fed Review - July 2023: September’s Open

- MNI INTERVIEW: Fed Running Out Of Reasons To Hike- Williamson

- MNI US PRESIDENT BIDEN On GDP Report: "My Economic Plan Is Working"

- MNI BRIEF: U.S. Regulators Propose Tighter Bank Capital Rules

- MNI Jobless Claims Stronger Than Expected Across The Board

US

FED: The Fed’s July meeting emphasized a data-dependent, meeting-by meeting approach to future decisions.

- While the Statement retained the FOMC’s tightening bias and Chair Powell’s comments underscored the optionality to either hike again or hold in September, market implied rate expectations leaned slightly lower as the press conference was seen to lean dovish (or at least, not as hawkish as feared).

- There were several dovish-leaning elements to Powell’s commentary: he said current policy rates were restrictive, that past tightening and worsening credit conditions were yet to fully impact the economy, and hinted that some on the FOMC wanted to hold rates at this meeting.

FED: Jerome Powell's Federal Reserve is running short of reasons to lean towards tighter policy with evidence inflation is moving back to target, former St. Louis Fed vice president of research Stephen Williamson told MNI.

- “They have to think of reasons why they should bring rates down. And it’s a little puzzling why keep wanting to go up,” Williamson said. “Some of it’s inconsistent too, you’ll say oh it takes a long time for policy to work. But here they are at 3% (inflation),” Williamson said.

- The Fed raised its key rate a quarter point Wednesday to 5.25-5.5% and Powell later told reporters he could pause or hike again if the data didn't show enough progress cooling inflation. (See: MNI FED WATCH: Powell Withholds Guidance, Keeps September Live) Headline inflation was the slowest since March 2021 at 3.0% but core inflation was more than double the Fed’s 2% target at 4.8%. For more see MNI Policy main wire at 0940ET.

US: US President Joe Biden has released a statement on today's second quarter GDP report which saw the US economy grow at a seasonally and inflation adjusted annual rate of 2.4%, up from 2% in Q1.

- Biden: "The economy is growing... That's Bidenomics at work. Today's report shows that the economy grew at a 2.4 percent annual rate in the second quarter while inflation fell significantly."

- Biden: "The economy's continued growth builds on what was already the strongest pandemic recovery and lowest inflation of any G-7 country. This progress wasn't inevitable or accidental, it is Bidenomics in action..."

- Biden: "Our unemployment rate remains near record lows, inflation has fallen by two thirds, real wages are higher than they were before the pandemic, and we've seen more than half a trillion dollars in private sector investment commitments in clean energy and manufacturing. My economic plan is working, and we're just getting started."

- The statement comes as US voters continue to express scepticism about Biden's economic agenda and his handling of the economy remains the most persistent drag on his approval rating.

US BANKS: Large U.S. banks will be required to hold 16% more capital under proposed changes from the FDIC Thursday. "While the proposal would not generally change the minimum required capital ratios, the amount of required capital would change due to changes to the calculation of risk-weighted assets. As a result of the increases in risk-weighted assets, the agencies estimate that the proposal would increase the binding common equity tier 1 capital requirement, including minimums and buffers, of large holding companies by around 16%," the agency said. The rule changes apply to banks with USD100 billion in assets or more.

US TSYS: Late Session Focus on BOJ Rate Decision Tonight

- Treasury futures are extending session lows, curves bear steepening with the short end resisting the post-auction sell-off. While the 7Y note sale tailed 1.5bp, Treasury futures experienced a knee-jerk sell-off to new session lows after Nikkei report elevated yield curve control discussion by the BOJ at tonight's policy meeting (2200ET).

- "The Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting Friday to let long-term interest rates rise beyond its cap of 0.5% by a certain degree, Nikkei has learned, in what would be a shift toward a more flexible policy approach."

- Treasury 10Y futures have fallen to 110-30.5 low (-1-06), yield hitting 4.0142% high (July 10 levels), well through 1.0% 10-dma envelope support, and just above 110-28 (76.4% retracement of the Jul 7 - 18 rally). A breach of 110-28 puts focus on key support of 110-05 (Low Jul 6 and the bear trigger).

- Curves have bear steepened on the move, 3M10Y currently +16.191 at -142.759 (compared to -173.5 low on July 18), 2s10s +5.816 at -93.079.

- Reminder: heavy slate of corporate earning remain after today's close, include: Intel, Olin Corp, Weyerhaeuser, KLA, Roku, Juniper Networks, Mettler-Toledo, Mohawk Ind, US Steel Corp.

OVERNIGHT DATA

- US WEEKLY JOBLESS CLAIMS AT 221,000 LAST WEEK; EST. 235,00

- US DATA: Initial claims fell to a seasonally adjusted 221k (cons 235k) in the week to Jul 22 from an unrevised 228k.

- It’s the lowest single week since Feb’23 but we prefer to focus on the four-week average which dipped 4k to 234k for a still decent downward trend to its lowest since late May as it declines from 257k a month ago.

- The non-seasonally adjusted data show a sizeable drop after Jul 4 distortions after remaining elevated the prior week (214k from 258k), with no particular standout moves in the states that have recently been in focus.

- Continuing claims meanwhile saw a particularly strong beat as they declined to a seasonally adjusted 1690k (cons 1750k) from 1749k (initial 1754k) to fall below their 2019 average for the first time since January.

- There does however look to be a more favorable seasonal adjustment here, with the outright level of continuing claims still high relative to non-pandemic years, in contrast to initial claims being more in line.

- US 2Q GDP PRICE INDEX RISES AT A 2.2% ANNUAL RATE; EST. 3.0%

- US 2Q ECONOMY GROWS AT 2.4% ANNUAL RATE; EST. 1.8%

- US DATA: Real GDP Beats in Q2, In Line With GDPNow

- Real GDP increased 2.4% annualized (cons 1.8%, Atlanta Fed GDPNow 2.4%) in the first Q2 reading after +2.0% in Q1.

- The beat is helped by Personal consumption rising 1.6% (cons 1.2%) after 4.2% in Q1 but with implied stronger than expected components elsewhere. “Compared to the Q1, the acceleration in GDP in the Q2 primarily reflected an upturn in private inventory investment and an acceleration in nonresidential fixed investment. These movements were partly offset by a downturn in exports, and decelerations in consumer spending, federal government spending, and state and local government spending. Imports turned down.”

- US 2Q CORE PCE PRICE INDEX RISES AT A 3.8% ANNUAL RATE (vs. Exp. 4.0%)

- US DATA: Q2 Core PCE Misses, Skews Tomorrow’s June Reading Lower

- Core PCE prices were notably softer than expected at 3.83% annualized (cons 4.0) in Q2 after 4.88% in Q1.

- On the perhaps unlikely assumption that prior monthly figures are unrevised, it would leave June core PCE rising just 0.07/0.08% M/M vs prior expectations in the low 0.2s for tomorrow’s release (lowest since the then one-off 0.076% in Jul’22 and before that Nov’20). Any potential revisions will however be important to see where latest momentum lies.

- US NAR JUN PENDING HOME SALES INDEX 76.8 V 76.6 IN MAY

- US NAR JUN PENDING HOME SALES +0.3% MOM; -15.6% YOY

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 186.39 points (-0.52%) at 35333.11

- S&P E-Mini Future down 23.75 points (-0.52%) at 4571.25

- Nasdaq down 58 points (-0.4%) at 14068.45

- US 10-Yr yield is up 13.7 bps at 4.0042%

- US Sep 10-Yr futures are down 35/32 at 111-1.5

- EURUSD down 0.0112 (-1.01%) at 1.0974

- USDJPY down 0.81 (-0.58%) at 139.45

- WTI Crude Oil (front-month) up $1.01 (1.28%) at $79.78

- Gold is down $26.11 (-1.32%) at $1945.90

- EuroStoxx 50 up 101.29 points (2.33%) at 4447.44

- FTSE 100 up 15.87 points (0.21%) at 7692.76

- German DAX up 274.57 points (1.7%) at 16406.03

- French CAC 40 up 150.17 points (2.05%) at 7465.24

US TREASURY FUTURES CLOSE

- 3M10Y +15.85, -143.1 (L: -166.773 / H: -141.757)

- 2Y10Y +5.839, -93.056 (L: -99.782 / H: -92.061)

- 2Y30Y +3.88, -88.25 (L: -94.852 / H: -87.031)

- 5Y30Y -0.97, -19.329 (L: -21.942 / H: -14.115)

- Current futures levels:

- Sep 2-Yr futures down 7.125/32 at 101-13.5 (L: 101-12.5 / H: 101-21.5)

- Sep 5-Yr futures down 21.75/32 at 106-17.5 (L: 106-15.75 / H: 107-09.25)

- Sep 10-Yr futures down 35.5/32 at 111-1 (L: 110-30.5 / H: 112-07)

- Sep 30-Yr futures down 74/32 at 123-28 (L: 123-21 / H: 126-10)

- Sep Ultra futures down 94/32 at 131-12 (L: 131-02 / H: 134-14)

US 10Y FUTURE TECHS: (U3) Correction Lower

- RES 4: 114-06+ High Jun 6

- RES 3: 114-00 High Jun 13

- RES 2: 113-08 High Jul 18 and the short-term bull trigger

- RES 1: 112-17+/113-01+ High Jul 24 / 50-day EMA

- PRICE: 111-05 @ 16:42 BST Jul 27

- SUP 1: 111-04+ 1.0% 10-dma envelope

- SUP 2: 111-02 Low Jul 25

- SUP 3: 110-28 76.4% retracement of the Jul 7 - 18 rally

- SUP 4: 110-05 Low Jul 6 and the bear trigger

The recent pullback in Treasuries appears to be a correction, rather than a full reversal. However, price has pierced 111-22+ as well as 111-11, the 50.0% and 61.8% retracement levels for the Jul 7 - 18 rally. This highlights scope for a deeper retracement and opens envelope support at 111-04+ for direction. For bulls, a reversal higher and a clearance of last week’s 113-08 high (Jul 18), would resume the recent bull cycle and this would expose 114-00, the Jun 13 high.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.580

- Dec 23 -0.025 at 94.595

- Mar 24 -0.090 at 94.790

- Jun 24 -0.145 at 95.095

- Red Pack (Sep 24-Jun 25) -0.18 to -0.17

- Green Pack (Sep 25-Jun 26) -0.19 to -0.18

- Blue Pack (Sep 26-Jun 27) -0.185 to -0.17

- Gold Pack (Sep 27-Jun 28) -0.17 to -0.16

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00128 to 5.31865 (+.02066/wk)

- 3M +0.00353 to 5.36912 (+.01791/wk)

- 6M +0.00757 to 5.45283 (+.02440/wk)

- 12M +0.00466 to 5.40252 (+.04102/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $98B

- Daily Overnight Bank Funding Rate: 5.07% volume: $265B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.452T

- Broad General Collateral Rate (BGCR): 5.04%, $589B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $582B

- (rate, volume levels reflect prior session)

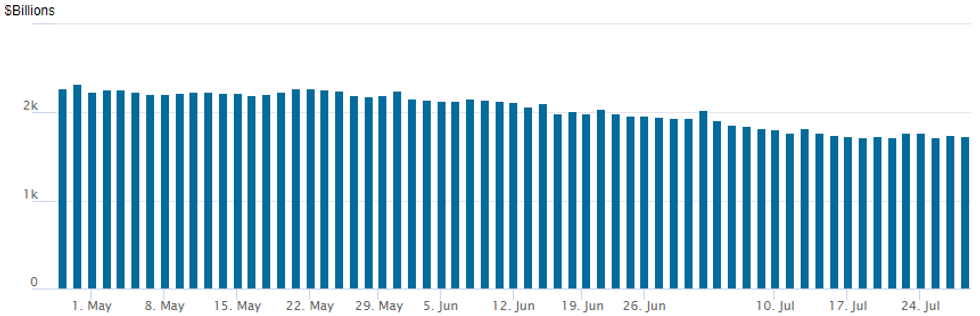

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation recedes to $1,735.783B, w/103 counterparties, compared to $1,749.733B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $3.25B L3Harris 3Pt Priced

- Date $MM Issuer (Priced *, Launch #)

- 07/27 $1.1B *Penske Trucking 5Y +187.5

- 07/27 $2B #WM $750M +5Y +75, $1.25B +10Y +105

- 07/27 $3.25B *L3Harris $1.25B +3Y +85, $1.5B 10Y +140, $500M 3Y +155

FOREX: USD Index Boosted By Strong US GDP, Late JPY Surge Before BOJ Decision

- Stronger than expected GDP data on Thursday provided a strong boost to the greenback with the USD index showing gains of around 0.85% as we approach the APAC crossover. A more cautious ECB also weighed on the Euro, which has prompted EURUSD to shed around 170 pips and significantly reverse an early morning rally.

- Second quarter data from the US showed the economy grew 2.4% Q/q, well ahead of the 1.8% estimate. Combined with a lower GDP price index, the soft landing theory gained traction which initially provided a firm bid for both the US dollar and major equity indices.

- The USD bid has prevailed and while sitting slightly off session highs, the DXY has resumed its recovery and approaches the June lows around the 102 mark.

- The greenback shift is most notable against EUR, GBP and CHF which have all declined around 1%. USD gains had been entirely broad based before a late report from the Nikkei regarding the Bank of Japan prompted a punchy surge for the Japanese Yen.

- USDJPY fell aggressively from around 141.00 to 139.21 lows following reports that the Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting Friday. This would apparently allow “long-term interest rates to rise beyond its cap of 0.5% by a certain degree”, Nikkei is said to have learned.

- While the piece only mentions potential discussions and shows no attribution, the substantial JPY bounce places Friday’s BOJ meeting/decision at the top of the event risk agenda. 139.11, the July 20 low and 138.77 the July 19 low are the immediate reference points on the downside for USDJPY before key support at 137.25.

- As well as the BOJ, European preliminary CPI data is due Friday, as well as US Core PCE, US Employment Cost index and Canadian GDP.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/07/2023 | 0200/1100 | *** |  | JP | BOJ policy announcement |

| 28/07/2023 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/07/2023 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/07/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 28/07/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 28/07/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/07/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/07/2023 | 0645/0845 | ** |  | FR | PPI |

| 28/07/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/07/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/07/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/07/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/07/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/07/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/07/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/07/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 28/07/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.