-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Off Month-End Lows, Heavy Data Ahead

- MNI US FED: Powell's Initial Comments from Sintra Lean Slightly Dovish

- MNI US: First Sitting Democrat Lawmaker Calls On Biden To Withdraw

- MNI US: Biden To Meet With Democratic Party Governors Tomorrow

- MNI US DATA: A Major US Consumer Tailwind Is Fizzling Out

- MNI US DATA: JOLTS Openings Higher Than Expected But Doesn’t Change Rebalancing Trend

US

US FED (MNI): Powell's Initial Comments from Sintra Lean Slightly Dovish

Powell says that the last inflation reading (ie May), and the one before it (ie April) "to a lesser extent", do suggest that "we are getting back on a disinflationary path"...we want to be more confident that inflation is headed sustainably to 2% before loosening policy. "What we would like to see is more data like we've been seeing recently".

- On a 12-month basis, 2.6% PCE in May represents "really significant progress" on inflation. But "we have the ability to take our time and get it right".

- Asked about a cut in September, Powell laughs, saying he's not going to give any specific dates, reminding that there are risks of going too soon or too late.

The initial read on Powell is very slightly dovish if only because asked, point blank, whether the Fed was eyeing a cut in September, he didn't dismiss it out of hand. And in discussing the data, he has emphasized significant progress in inflation. But you have to squint pretty hard to get an unambiguously dovish take here: it's doubtful that he is intentionally changing the messaging in any way from the June FOMC meeting.

NEWS

US (MNI): First Sitting Democrat Lawmaker Calls On Biden To Withdraw

Rep. Lloyd Doggett (D-TX) has become the first sitting Democratic Party lawmaker to openly call for President Biden to withdraw from the presidential race, following his weak debate performance.

US (MNI): Biden To Meet With Democratic Party Governors Tomorrow

President Biden will meet with Democratic Party governors tomorrow. The meeting could offer a firmer indication of Biden's strategy in light of his underwhelming debate performance on Thursday.

US (MNI): Manhattan Prosecutors Agree w/Trump On Postponing Hush Money Sentencing

Manhattan prosecutors have issued a statement saying they will not oppose former President Donald Trump's request to postpone his criminal sentencing in light of yesterday's Supreme Court's ruling on presidential immunity.

FRANCE (MNI): RN Maj. Prospects Declining As Centrist & Leftist Candidates Withdraw:

Eligible candidates face a deadline of 1800CET (1200ET, 1700BST) to formally declare whether they intend to run in the 7 July second round legislative elections. This comes as the so-called 'republican front' of centrist and left-wing parties seek to minimise gains for the right-wing nationalist Rassemblement National (National Rally, RN) by reducing the number of tripartite run-offs that could split the vote and allow the RN to win a majority.

US TSYS Decent Short Covering Ahead Heavy Data, FOMC Minutes Wednesday

- Treasuries are firmer, off midmorning highs after the bell. Treasuries pared gains after higher than expected JOLTS job openings of 8.14M vs. 7.946M est, while prior was down-revised to 7.919M from 8.059M.

- Futures extended midmorning highs (TYU4 109-19.5) after Fed Chair Powell made mildly dovish comments from from central bank economics conference in Sintra, Portugal. Recent inflation data suggest that "we are getting back on a disinflationary path", Powell stated, with the caveat that more is needed to be more confident that inflation is headed sustainably to 2% before loosening policy.

- Tsy Sep'24 10Y futures currently trade 109-13.5 last (+8) -- still well off last Friday's post-Core PCE highs of 110-16. Decent volumes for typically muted summer trade, TYU4 over 1.4M contracts at the moment -- likely due to positioning ahead Thursday's 4th of July holiday closure.

- Technical resistance above at 110-00 20-day EMA. Curves reversed/pared early steepening are still near the least inverted levels since May 3: 2s10s currently -0.512 at -30.362 (-27.845 high), 5s30s +1,644 at 21.238 (+24.086 high).

- Heavy data drop on Wednesday's shortened session (floor closes at 1300ET, cash at 1300ET while Globex closes at normal time of 1700ET): Challenger Job Cuts, ADP Employment, Weekly Jobless claims, ISM Services, Factory/Durables Orders and June FOMC Minutes. Friday's full session sees June Non-Farm Payroll data.

OVERNIGHT DATA

US DATA (MNI): JOLTS Openings Higher Than Expected But Doesn’t Change Rebalancing Trend

JOLTS job openings surprisingly increased in May to 8.14m (cons 7.95m) after a downward revised 7.919m (initial 8.059m) in April.

- However, combined with the already known increase in the level of unemployment, the ratio of openings to the unemployed was unchanged at 1.22 (April revised down from an initial 1.24), in what is still the lowest since Jun 2021.

- That’s essentially back to the 1.19 averaged through 2019 even if somewhat high historically and vs the 1.0 through 2017-18.

- Quit rates unchanged at 2.18% after a downward revised 2.18 (initial 2.22) in April. Quits have stabilized at a rounded 2.2% since Nov’23, already below the 2.33 averaged in 2019 and in line with the 2.2 through 2017-18 having shown greater rebalancing than the openings to unemployed trend.

US REDBOOK: JUN STORE SALES +5.6% V YR AGO MO

US REDBOOK: STORE SALES +5.8% WK ENDED JUN 29 V YR AGO WK

US DATA (MNI): A Major US Consumer Tailwind Is Fizzling Out

Latest personal incomes and spending data saw the household savings ratio unexpectedly rise to a 4-month high in May at 3.9%, up from 3.7% prior (revised up from 3.6%), hinting at American households becoming slightly more cautious in mid-Q2.

- Latest personal incomes and spending data saw the household savings ratio unexpectedly rise to a 4-month high in May at 3.9%, up from 3.7% prior (revised up from 3.6%), hinting at American households becoming slightly more cautious in mid-Q2.

- In trend terms it marks a broad stabilization in the savings rate and, for now, an end to the tailwind to consumption seen through 2H23 when consumers reversed the prior uplift in their savings behavior.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 104.62 points (0.27%) at 39273.38

- S&P E-Mini Future up 22.5 points (0.41%) at 5556.75

- Nasdaq up 118.4 points (0.7%) at 17998.48

- US 10-Yr yield is down 2.4 bps at 4.4375%

- US Sep 10-Yr futures are up 8.5/32 at 109-14

- EURUSD up 0.0004 (0.04%) at 1.0744

- USDJPY up 0.01 (0.01%) at 161.47

- WTI Crude Oil (front-month) down $0.47 (-0.56%) at $82.91

- Gold is down $2.79 (-0.12%) at $2329.13

- European bourses closing levels:

- EuroStoxx 50 down 23.66 points (-0.48%) at 4906.33

- FTSE 100 down 45.56 points (-0.56%) at 8121.2

- German DAX down 126.6 points (-0.69%) at 18164.06

US TREASURY FUTURES CLOSE

- 3M10Y -4.059, -94.383 (L: -97.41 / H: -91.178)

- 2Y10Y -0.72, -30.57 (L: -31.631 / H: -27.845)

- 2Y30Y +0.203, -13.405 (L: -15.62 / H: -9.331)

- 5Y30Y +1.37, 20.964 (L: 19.115 / H: 24.086)

- Current futures levels:

- Sep 2-Yr futures up 1.625/32 at 102-1.625 (L: 102-00.375 / H: 102-03.625)

- Sep 5-Yr futures up 5.25/32 at 106-9 (L: 106-05.25 / H: 106-13)

- Sep 10-Yr futures up 8.5/32 at 109-14 (L: 109-07 / H: 109-19.5)

- Sep 30-Yr futures up 18/32 at 116-21 (L: 116-09 / H: 117-01)

- Sep Ultra futures up 22/32 at 123-2 (L: 122-16 / H: 123-18)

US 10Y FUTURE TECHS: (U4) Remains Vulnerable

- RES 4: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-13 High Mar 25

- RES 2: 110-16/111-01 High Jun 28 / 14 and the bull trigger

- RES 1: 110-00 20-day EMA

- PRICE: 109-08 @ 11:08 BST Jul 2

- SUP 1: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-17+ Trendline drawn from the Apr 25 low

- SUP 4: 107-31 Low May 29 and a key support

Treasuries remain vulnerable following yesterday’s move lower, marking an extension of the bear leg that stated Jun 14. It is still possible that the move down is a correction, however the steep sell-off does suggest scope for an extension - price has breached both the 20- and 50-day EMAs. Sights are on 109-00+, the Jun 10 low. A break would open 108-17+, a trendline drawn from the Apr 25 low. Initial firm resistance to watch is 110-16, the Jun 28 high.

SOFR FUTURES CLOSE

- Sep 24 +0.005 at 94.850

- Dec 24 +0.010 at 95.135

- Mar 25 +0.020 at 95.415

- Jun 25 +0.030 at 95.650

- Red Pack (Sep 25-Jun 26) +0.040 to +0.050

- Green Pack (Sep 26-Jun 27) +0.050 to +0.055

- Blue Pack (Sep 27-Jun 28) +0.050 to +0.055

- Gold Pack (Sep 28-Jun 29) +0.045 to +0.050

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00228 to 5.33192 (-0.00525/wk)

- 3M -0.00272 to 5.31817 (-0.00643/wk)

- 6M +0.00469 to 5.25274 (-0.00197/wk)

- 12M +0.02454 to 5.05029 (+0.01025/wk)

- Secured Overnight Financing Rate (SOFR): 5.40% (+0.07), volume: $1.967T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $752B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $733B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $239B

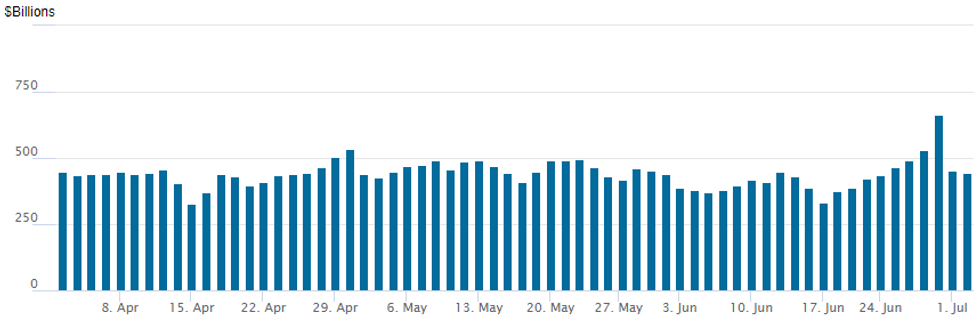

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage continues to wane with latest read at $443.369B. Usage gapped below $500M to $451.783B yesterday vs. $664.570B last Friday when moth/quarter end usage pushed figure to highest level since January 10. Number of counterparties rises to 78 from 67 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

$4.5B Sumitomo Mitsui Bank (SMBC) 5Pt Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 7/2 $4.5B #Sumitomo Mitsui Bank (SMBC) $750M 5Y +93, $500M 5Y SOFR+117, $900M 7Y +103, $1.35B 10Y +113, $1B 20Y +113

- 7/2 $4B *EIB 7Y SOFR+46

- 7/5 $500M *ANZ Bank WNG 10NC5 +150

EGBs-GILTS CASH CLOSE: OAT Spreads Continue To Tighten

Bund and Gilt yields fell modestly Tuesday, with semi-core/periphery EGB spreads tightening

- A flat-to-weaker morning for core FI in European trade - with June Eurozone flash inflation data coming in line with expectations - was followed by a decent rally in the afternoon with little discernable trigger.

- The bounce faded quickly after data showed surprisingly high US job openings.

- A panel appearance by ECB's Lagarde at the Sintra forum brought little new and had little impact on rate markets.

- The German curve twist steepened on the day, with the UK's bull flattening.

- EGB Periphery spreads tightened in a continuation of Monday's post-French election relief.

- Notably, French spreads continued compressing, with 10Y OAT in 2.7bp vs Bunds to a fresh post-June 13 low. Some desks cited reports of hundreds of candidates withdrawing from their runoff races ahead of the 2nd election round, in an effort to block far right gains.

- Wednesday sees final Services PMIs and Eurozone PPI, with multiple ECB speakers at Sintra.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 2.906%, 5-Yr is down 0.8bps at 2.58%, 10-Yr is down 0.4bps at 2.603%, and 30-Yr is up 0.4bps at 2.799%.

- UK: The 2-Yr yield is down 0.9bps at 4.189%, 5-Yr is down 2.9bps at 4.081%, 10-Yr is down 3.3bps at 4.248%, and 30-Yr is down 2.8bps at 4.747%.

- Italian BTP spread down 4.6bps at 145.2bps / Greek down 5.5bps at 112bps

FOREX: EURGBP Respects 0.8500 Resistance, BRL Under Significant Pressure

- US yields moderately reversed lower on Tuesday and with an associated bounce in US equities, the greenback pulled back from earlier session highs, with the USD index tracking close to unchanged as we approach the APAC crossover. JOLTS job openings surprisingly increased in May to 8.14m (cons 7.95m) but the data did little to jolt the market with the focus on Friday’s NFP report.

- As such G10 currency adjustments remain limited, with tomorrow’s FOMC minutes, the US July 04 holiday & UK election Thursday keeping any conviction in check.

- However, USDJPY continues to edge higher, looking to close above 161.50, having printed another multi-decade high of 161.74. Sights are on 162.21, a Fibonacci projection.

- EURUSD’s trend outlook remains bearish and price action following the French first-round indicates that rallies remain good selling opportunities. Resistance at the 50-day EMA (intersecting today at 1.0771), has capped the latest correction well and should keep the market’s focus on the bear trigger at 1.0666, Jun 26 low.

- It is also worth noting, EURGBP (-0.21%) failed to recover back above 0.8500 (also 50-day EMA), the key technical pivot for the cross, and while remaining below this level on a closing basis the outlook remains bearish.

- In emerging markets, local pressures added weight to both the South African Rand and the Brazilian real. Brazil’s domestic situation continues to sour and USDBRL’s 0.65% climb today brings YTD gains for the pair to an impressive 17.3%. The moves could raise the risk of the central bank intervening to stabilise the currency.

- Australia retail sales and European final services PMIs cross Wednesday. ADP and jobless claims from the US will play second fiddle to ISM services data for June and the FOMC minutes.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/07/2024 | 0130/1130 | ** |  | AU | Retail Trade |

| 03/07/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/07/2024 | 0800/1000 |  | EU | ECB's De Guindos chairing MonPol Cycles session | |

| 03/07/2024 | 0900/1100 | ** |  | EU | PPI |

| 03/07/2024 | 0900/1100 |  | EU | ECB's Cipollone chairing Productivty session | |

| 03/07/2024 | 1030/1230 |  | EU | ECB's Lane chairing panel on equilibirum interest rates | |

| 03/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/07/2024 | 1100/0700 |  | US | New York Fed's John Williams | |

| 03/07/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 03/07/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 03/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 03/07/2024 | 1330/1530 |  | EU | ECB's Lagarde closing remarks at ECB Forum | |

| 03/07/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/07/2024 | 1600/1200 | ** |  | US | Natural Gas Stocks |

| 03/07/2024 | 1800/1400 | *** |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.