-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Unexpected May Jobs Surge

- MNI INTERVIEW: US Dollar Leadership Eroding-Ex-IMF adviser

- MNI Large Payrolls Beat And With Rare Upward Revision To Boot

- MNI Household Survey Shows Much More Weakness Than Establishment

US

US: A combination of rising political risk, fear of economic sanctions and new financial technologies will gradually erode the U.S. dollar’s supremacy in global capital markets and trade in coming decades, ex-IMF adviser Josh Lipsky.

- Protracted debt ceiling negotiations, while ultimately successful at avoiding default, add to the impression that the U.S. is not as trustworthy a partner as it was in the past, said Lipsky, also a former State Department official and now senior director of the Atlantic Council's GeoEconomics Center.

- “Just because there’s no alternative doesn’t mean the rest of the world is not deeply frustrated. The world is increasingly exasperated by this,” he said in an interview.

- “For Biden to have to go the G7 and have to hear from the other leaders about the biggest threat to the global economy coming from inside the house – for the U.S. – is hugely problematic long term for U.S. leadership, maybe not short term because of the lack of viable alternatives.” (See MNI INTERVIEW: U.S. Fiscal Trajectory Deviating From AAA Peers-Fitch) For more see MNI Policy main wire at 1109ET.

US TSYS: Tsys Breach Support, Near Lows After Mixed Jobs/Unemployment Data

- Treasury futures remain under pressure, drifting near late session lows after this mornings mixed employment data: strong May jobs gains and up-revisions for prior two data sets, vs. a higher unemployment level - employment gains in Household were the weakest since April 2022, and the "beat" of Establishment employment (+339k) vs Household (-310k) of 649k was the widest since April 2020.

- Front month 10Y futures broke support on it's way to session low of 113-25 (-30.5), yield climbing to 3.6984% high, key support and the bear trigger is 112-29+, the May 26 / 30 low.

- In the short end, FOMC-dated OIS implied rates have faded from post-payrolls highs and haven’t meaningfully changed odds of a 25bp hike on Jun 14, whilst the July terminal doesn’t quite fully price in another hike with +22bps.

- It holds sizeable increases for subsequent meetings though, with 31bp of cuts from terminal to a year-end rate of 5.00% for an effective that is just 9bp lower than current levels - see table for full run.

- There haven’t been any Fed pop-up appearances since the data ahead of the start of the media blackout tonight, leaving markets continuing to weigh up Jefferson and Harker’s skip narrative after an inconclusive payrolls report whilst ultimately waiting on CPI on day one of the Jun 13-14 meeting. In WSJ Timiraos’ words: “A difficult one for the Fed, with many officials saying this report would be very important, because it has a "choose your narrative" element to it."

OVERNIGHT DATA

- US MAY NONFARM PAYROLLS +339K; PRIVATE +283K, GOVT +56K

- US PRIOR MONTHS PAYROLLS REVISED: APR +294K; MAR +217K

- US MAY UNEMPLOYMENT RATE 3.7%

- US MAY AVERAGE HOURLY EARNINGS +0.3% Vs APR +0.4%; +4.3% YOY

- US MAY AVERAGE WEEKLY HOURS 34.3 HRS

US DATA: Lots of client questions about why the unemployment rate jumped so much given the large upside surprise (and revisions) in the headline payrolls number: the answer is simply that they are taken from different surveys.

- The unemployment rate as noted above is taken from the Household survey (when employment fell 310k), and the overall payrolls number is taken from the Establishment survey. We're still going through the report but the household numbers were so weak (biggest increase in unemployed since Apr 2020) at first glance they should be taken easily as seriously as the headline payrolls figure.

- Employment gains in Household were the weakest since April 2022, and the "beat" of Establishment employment (+339k) vs Household (-310k) of 649k was the widest since April 2020.

- US DATA: AHE Unrounded - May'23

- Total AHE:

- M/M (SA): 0.330% in May from 0.392% in Apr

- Y/Y (SA): 4.304% in May from 4.352% in Apr

- AHE Non-Supervisory:

- M/M (SA): 0.454% in May from 0.351% in Apr

- Y/Y (SA): 4.965% in May from 4.95% in Apr

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 716.17 points (2.17%) at 33777.25

- S&P E-Mini Future up 64.75 points (1.53%) at 4292.75

- Nasdaq up 141.3 points (1.1%) at 13242.08

- US 10-Yr yield is up 9.2 bps at 3.6869%

- US Sep 10-Yr futures are down 27.5/32 at 113-28

- EURUSD down 0.0052 (-0.48%) at 1.071

- USDJPY up 1.16 (0.84%) at 139.96

- WTI Crude Oil (front-month) up $2.02 (2.88%) at $72.11

- Gold is down $28.19 (-1.43%) at $1949.51

- EuroStoxx 50 up 65.91 points (1.55%) at 4323.52

- FTSE 100 up 117.01 points (1.56%) at 7607.28

- German DAX up 197.57 points (1.25%) at 16051.23

- French CAC 40 up 133.26 points (1.87%) at 7270.69

US TREASURY FUTURES CLOSE

- 3M10Y +9.165, -170.096 (L: -186.092 / H: -169.259)

- 2Y10Y -6.221, -81.211 (L: -82.977 / H: -72.815)

- 2Y30Y -9.237, -62.232 (L: -64.51 / H: -51.073)

- 5Y30Y -7.925, 3.645 (L: 2.705 / H: 12.559)

- Current futures levels:

- Sep 2-Yr futures down 11/32 at 102-21.875 (L: 102-20.125 / H: 103-01.25)

- Sep 5-Yr futures down 21/32 at 108-20.25 (L: 108-17.75 / H: 109-09.5)

- Sep 10-Yr futures down 27.5/32 at 113-28 (L: 113-25 / H: 114-24.5)

- Sep 30-Yr futures down 28/32 at 127-31 (L: 127-26 / H: 129-03)

- Sep Ultra futures down 1-06/32 at 136-9 (L: 136-06 / H: 137-29)

(U3) Short-Term Bull Cycle Still In Play

- RES 4: 115-19 High May 18

- RES 3: 115-10 1.0% 10-dma Envelope

- RES 2: 115-06 50-day EMA

- RES 1: 115-00 High Jun 1

- PRICE: 114-02+ @ 16:36 BST Jun 2

- SUP 1: 114-00 Low May 31

- SUP 2: 112-29+ Low May 26 / 30 and key support

- SUP 3: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures faltered Friday on the better-than-expected NFP release. Nonetheless, the week’s lows remain in tact, keeping the short-term bull cycle in play. The short-term reversal was confirmed on Tuesday - the price pattern that day was a bullish engulfing candle and subsequent gains reinforce the pattern, suggesting scope for an extension to the 50-day EMA at 115-06. Clearance of the EMA would highlight a stronger reversal. On the downside, key support and the bear trigger is 112-29+, the May 26 / 30 low.

SOFR FUTURES CLOSE

- Jun 23 -0.033 at 94.725

- Sep 23 -0.095 at 94.780

- Dec 23 -0.160 at 95.050

- Mar 24 -0.205 at 95.490

- Red Pack (Jun 24-Mar 25) -0.23 to -0.19

- Green Pack (Jun 25-Mar 26) -0.175 to -0.145

- Blue Pack (Jun 26-Mar 27) -0.135 to -0.115

- Gold Pack (Jun 27-Mar 28) -0.11 to -0.105

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.03357 to 5.14067 (-.01277/wk)

- 3M -0.04604 to 5.23034 (-.03340/wk)

- 6M -0.03981 to 5.24547 (-.05289/wk)

- 12M -0.03573 to 5.02697 (-.13117/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06557%

- 1M +0.02557 to 5.18857%

- 3M -0.00228 to 5.49629 */**

- 6M -0.02400 to 5.62343%

- 12M -0.06814 to 5.65729%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $131B

- Daily Overnight Bank Funding Rate: 5.06% volume: $283B

- Secured Overnight Financing Rate (SOFR): 5.08%, $1.627T

- Broad General Collateral Rate (BGCR): 5.05%, $610B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $599B

- (rate, volume levels reflect prior session)

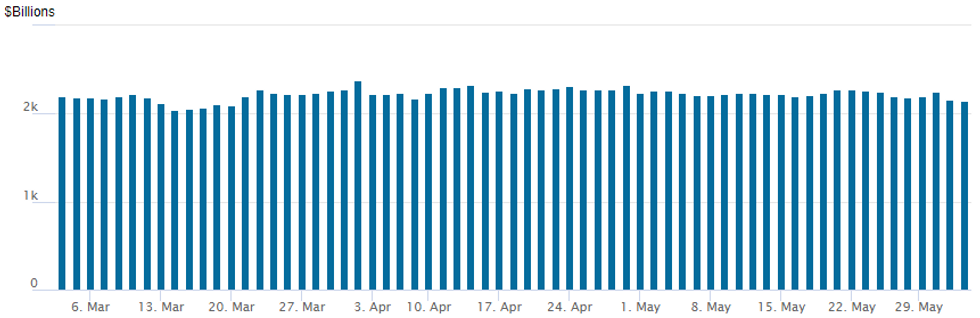

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,142.102B w/ 104 counterparties, compares to prior $2,160.055B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE

$4.25B Priced Thursday, no new issuance Friday. May finished with $168.22B total corporate bond issuance.

EGBs-GILTS CASH CLOSE: Bear Flatter In An Otherwise Bull Flattening Week

The German and UK curves bear flattened Friday to take the shine off an otherwise stronger week, with an above-expected headline US job gain accelerating yield rises in the afternoon.

- In an otherwise quiet session for headlines and data, ECB and BoE hike pricing finished marginally higher on the day, in a partial reversal of the recent pullback.

- Indeed, Friday's bear flattening came in the broader context of a soft-Eurozone CPI induced bull flattening this week. UK 2Y yields closed down 14bp on the week despite a 7bp rise today; 10Y Gilts finished the week down nearly 18bp, offset by a 4bp rise Friday.

- Similarly in Germany, Schatz rose by 9bp today but were down 14bp on the week; a 6bp yield rise in 10Y Bund today meant a weekly drop of "only" 23bp.

- A risk-on atmosphere following the US Congress's passage of a debt limit deal helped periphery EGB spreads tighten, with BTPs and GGBs outperforming.

- Friday's UK and France sovereign ratings reviews by Fitch and S&P respectively will garner attention after hours, though a 1.5bp drop in the 10Y OAT/Bund spread suggested little evident market concern for France.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.4bps at 2.802%, 5-Yr is up 9.2bps at 2.337%, 10-Yr is up 6.3bps at 2.312%, and 30-Yr is up 3.3bps at 2.489%.

- UK: The 2-Yr yield is up 7.2bps at 4.363%, 5-Yr is up 5.2bps at 4.102%, 10-Yr is up 4bps at 4.156%, and 30-Yr is up 2.1bps at 4.48%.

- Italian BTP spread down 8.1bps at 175.8bps / Greek down 10.4bps at 137.5bps

FOREX: Higher US Yields Prompts Renewed JPY Weakness, Greenback Firms

- While the mixed headlines within the US employment report prompted some initial two-way trade for the greenback, the higher-than-expected payrolls figures have kept the US dollar on the front foot on Friday with the USD index rising around 0.5% as we approach the week’s close.

- While the significant pressure on the front-end of the Treasury’s curve has underpinned the greenback strength, the more notable move in G10 currency markets has been the renewed JPY weakness which sees USDJPY breaking back above 140.00 in late session trade.

- With the bounce, bullish technical conditions remain intact and attention is re-focused on the top of a bull channel, drawn from the Jan 16 low which intersects at 140.96 and represents a key resistance. A clear break of it would reinforce trend conditions and open 141.61, the Nov 23, 2022 high.

- The clear outperformer on the day remains the Australian dollar, rising 0.5%. Despite paring around half the overnight gains following the US data, the powerful overnight rally cements AUD as one of the best performing majors on Friday. Price action remains underpinned by chances of another rate hike at the RBA's June 6 meeting having risen following a sharp jump in the country's minimum- and award-wage system and a persistently high monthly inflation print earlier in the week.

- The greenback strength was enough to unwind the initial USDCNH weakness following reports that China is weighing a property market support package as a means to boost the economy. The Chinese Yuan trades closed to unchanged for Friday’s close as of typing, having bounced off the 7.0670 lows.

- Monday sees Swiss CPI and final European services PMI readings before the release of US ISM Services PMI data for May. The RBA and BOC decisions highlight the central bank calendar.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/06/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/06/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/06/2023 | 0130/1130 |  | AU | Business Indicators | |

| 05/06/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/06/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/06/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/06/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/06/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/06/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/06/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/06/2023 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 05/06/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/06/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/06/2023 | 1400/1000 | ** |  | US | Factory New Orders |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.