-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: US PPI Downside Surprise

- CHICAGO FED GOOLSBEE SAYS SUBSTANTIAL DROP IN INFLATION IS THE TREND .. MARKET MAY HAVE PUT THE CART BEFORE THE HORSE ON CUTS, Bbg

- MNI US: Speaker Johnson: FY24 Spending Agreement Remains In Place

- MNI: Canada Seen As Resilient To Rate Hikes- Finance Memo

- MNI INTERVIEW: Fiscal Ratchet Puts UK Debt On Untenable Path

- MNI INTERVIEW: Bright Spots In UK Growth Outlook-ONS's Fitzner

- MNI US: PPI Details Pose No Apparent Upside Risk To Core PCE Estimates

US TSYS Projected Rate Cuts Gain Momentum After Soft PPI Inflation Metrics

- Treasury futures bounce off lows, trading steady to mildly higher after lower than expected PPI Final Demand MoM (-0.1 vs. 0.1% est), YoY (1.0% vs. 1.3% est, prior down-revised to 0.8% from 0.9%). Ex Food and Energy lower than expected as well.

- The most scrutinized areas though will be those that feed into the Fed's preferred measure of inflation: PCE. On this front there is no reason from this report to expect any upside revisions to those expectations than had been imputed by analysts after yesterday's CPI, and perhaps some bias toward downward revisions if anything - especially based on what was reported for the key healthcare services categories.

- March'24 10Y futures tested initial resistance of 112-19 (High Jan 4) to 112-26.5 high before settling back to 112-16.5 last (+5.5). Next technical level to watch 113-12 (High Dec 27 and the bull trigger). Curves bull steepening: 2Y10Y climbed above -20 to -17.936 high (late October 2023 level).

- Short end rates held strong into the close, indicative of higher projected rate cuts through mid-2024: January 2024 cumulative -1.6bp at 5.313%, March 2024 chance of rate cut -77% w/ cumulative of -20.9bp at 5.120%, May 2024 fully pricing in 25bp cut now, cumulative -50.1bp at 4.828%. June 2024 cumulative -80.4bp at 4.525%. Fed terminal at 5.3275% in Jan'24.

- Reminder: The U.S. will observe the Martin Luther King Day public holiday on Monday, January 15. For FI futures: Globex opens normal time Sunday evening at 1800ET but close at 1300ET Monday. Monday Globex re-open at 1800ET precedes normal session hours Tuesday.

NEWS

FED (BBG): CHICAGO FED'S AUSTAN GOOLSBEE SPEAKS IN FOX NEWS INTERVIEW

Federal Reserve Bank of Chicago President Austan Goolsbee said financial markets may have gotten ahead of policymakers in assuming an aggressive path of rate cuts this year. “They were getting the cart before the horse,” Goolsbee said Friday in an interview on Fox News. “What’s going to drive the decisions about rates is going to be the actual data.”

US (MNI): Speaker Johnson: FY24 Spending Agreement Remains In Place

House Speaker Mike Johnson (R-LA) has announced on the floor of the House of Representatives that he intends to honor the bipartisan topline spending agreement for Fiscal Year 2024 he announced with Senate Majority Leader Chuck Schumer (D-NY) earlier this week.

FREIGHT (MNI): US-Flagged Ships Should Restrict Transit Through Red Sea: Navcent

The US Naval Forces Central Command issued a note calling for US-flagged vessels to restrict transit in the Red Sea following the US strikes against the Houthis in Yemen.

CANADA (MNI): Canada Seen As Resilient To Rate Hikes- Finance Memo

Canadian finance department staff painted a picture of an economy resilient to the highest interest rates in decades according to a major briefing given to its top official as he moved into the job last fall and obtained by MNI through a freedom-of-information request.

UK INTERVIEW (MNI): Fiscal Ratchet Puts UK Debt On Untenable Path

The UK’s debt-to-GDP ratio is unlikely to improve in coming years due to the common government practice of giving away the proceeds of positive fiscal surprises with tax cuts or spending while compensating for negative outcomes with additional borrowing, former senior Treasury and Office for Budget Responsibility official Andy King told MNI.

UK INTERVIEW (MNI): Bright Spots In UK Growth Outlook-ONS's Fitzner

The UK economy continued to flatline late in 2023, but there are bright spots on the horizon for the coming year, Office for National Statistics chief economist Grant Fitzner told MNI Friday. "The conditions to help demand recover will likely be stronger in 2024 that they were last year," Fitzner said.

UK (MNI): PM-Aim Of Strikes To De-Escalate Red Sea Tensions

Speaking on a visit to the Ukrainian capital, Kyiv, UK Prime Minister Rishi Sunak states that the gov't "believes strikes with the US on Yemen will degrade and disrupt Houthi capabilities in the Red Sea", adding that, "Our aim is to de-escalate the tensions and restore stability."

SECURITY (MNI): WH NSC Kirby: "We're Not Interested In A War With Yemen"

White House National Security Council Spokesperson John Kirby has told reporters that President Biden is not interested in a war with Yemen, but restates Biden comments from yesterday that the US, "will not hesitate to take further actions," if Houthi attacks on US troops and commercial shipping in the Red Sea continue.

SECURITY (MNI): WH Spox Talks On Strikes As UKMTO Warns Of Incident In Gulf Of Aden

Speaking to MSNBC, White House National Security Council spox John Kirby, stating that the joint US/UK airstrikes on targets in Yemen on 11 Jan "Went right at the Houthi's ability to store, launch and guide its missiles or drones."

NATO (MNI): Turkey's Erdogan Criticises US/UK Strikes On Houthi Targets

Turkish President Recep Tayyip Erodgan has voiced scathing criticism of the US/UK air strikes on Houthi targets in Yemen on 11 Jan. Erdogan claims that the strikes are "not proportional", and that the US and UK are trying to turn the Red Sea into "as sea of blood".

BRIEF (MNI): China Dec New Loans, TSF Rise Less Than Expected

China’s new yuan loans and aggregate finance both grew less than expected in November, while money supply also slowed more than foreseen, the People's Bank of China data released showed Friday.

OVERNIGHT DATA

US DEC FINAL DEMAND PPI -0.1%, EX FOOD, ENERGY +0.0%

US DEC FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.2%

US DEC FINAL DEMAND PPI Y/Y +1.0%, EX FOOD, ENERGY Y/Y +1.8%

US DEC PPI: FOOD -0.9%; ENERGY -1.2%

US DEC PPI: GOODS -0.4%; SERVICES +0.0%; TRADE SERVICES -0.8%

Unrounded Dec final demand PPI: -0.132% M/M (-0.088% prior)

Unrounded Dec final demand ex-food/energy: -0.010% M/M (0.021% prior)

Unrounded Dec ex-food/energy/trade: 0.219% M/M (0.061% prior)

US PPI: December's PPI report produced a downside surprise in terms of headline (-0.1% M/M vs +0.1% expected, and vs a -0.1% Nov figure that includes a downward 0.1pp revision), with ex-food/energy also soft (0.0% vs 0.2% expected, 0.0% prior).

- The ex-food/energy/trade metric was in line though, accelerating to a 3-month high 0.2% from 0.1% prior as expected.

- The most scrutinized areas though will be those that feed into the Fed's preferred measure of inflation: PCE.

- On this front there is no reason from this report to expect any upside revisions to those expectations than had been imputed by analysts after yesterday's CPI, and perhaps some bias toward downward revisions if anything - especially based on what was reported for the key healthcare services categories.

- Recall that sell-side analyst expectations for core PCE ranged from 0.12-0.15% M/M (BofA) to as high as 0.28 (Citi)-0.3% (unrounded, Wrightson ICAP) post-CPI yesterday.

US DATA (MNI): Medical Prices Key To Soft Core PCE-Related Categories

We already know that methodological differences (housing especially) almost certainly meant a lower core PCE rate than the CPI equivalent of 0.31% M/M, and today's PPI figures should reinforce the downside.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 163.85 points (-0.43%) at 37548.03

- S&P E-Mini Future down 4 points (-0.08%) at 4811.25

- Nasdaq down 21.1 points (-0.1%) at 14949.18

- US 10-Yr yield is down 1.4 bps at 3.9521%

- US Mar 10-Yr futures are up 7.5/32 at 112-18.5

- EURUSD down 0.0017 (-0.15%) at 1.0955

- USDJPY down 0.45 (-0.31%) at 144.85

- WTI Crude Oil (front-month) up $0.66 (0.92%) at $72.67

- Gold is up $18.13 (0.89%) at $2047.03

- European bourses closing levels:

- EuroStoxx 50 up 37.74 points (0.85%) at 4480.02

- FTSE 100 up 48.34 points (0.64%) at 7624.93

- German DAX up 157.53 points (0.95%) at 16704.56

- French CAC 40 up 77.52 points (1.05%) at 7465.14

US TREASURY FUTURES CLOSE

- 3M10Y +0.771, -141.145 (L: -148.471 / H: -137.419)

- 2Y10Y +9.988, -18.146 (L: -30.704 / H: -17.936)

- 2Y30Y +14.233, 6.569 (L: -10.998 / H: 6.779)

- 5Y30Y +7.378, 36.581 (L: 26.816 / H: 36.669)

- Current futures levels:

- Mar 2-Yr futures up 7/32 at 103-3.875 (L: 102-26.625 / H: 103-05)

- Mar 5-Yr futures up 9/32 at 108-24.75 (L: 108-10.75 / H: 108-29)

- Mar 10-Yr futures up 8/32 at 112-19 (L: 112-03 / H: 112-26.5)

- Mar 30-Yr futures up 4/32 at 122-27 (L: 122-09 / H: 123-13)

- Mar Ultra futures down 12/32 at 129-15 (L: 129-00 / H: 130-16)

US 10Y FUTURE TECHS: (H4) Short-Term Bear Threat Remains Present

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-26+ High Jan 12

- PRICE: 112-15+ @ 16:53 GMT Jan 12

- SUP 1: 111-06+ Low Jan 05

- SUP 2: 110-31+ 50-day EMA

- SUP 3: 110-16 Low Dec 13

- SUP 4: 109-31+ Low Dec 11 and a key short-term support

Treasuries traded sharply higher on the soft PPI release, as the contract extends the recovery from 111-06+, Jan 5 low. The extension does suggest that the recent correction lower may be over. If correct, this signals scope for a climb towards the key resistance and bull trigger at 113-12, the Dec 27 high. A break of this level would resume the uptrend and open the 114-00 handle. Key pivot support lies at 110-31+, the 50-day EMA.

SOFR FUTURES CLOSE

- Mar 24 +0.045 at 95.005

- Jun 24 +0.135 at 95.575

- Sep 24 +0.155 at 96.025

- Dec 24 +0.150 at 96.375

- Red Pack (Mar 25-Dec 25) +0.070 to +0.135

- Green Pack (Mar 26-Dec 26) +0.010 to +0.050

- Blue Pack (Mar 27-Dec 27) -0.005 to +0.010

- Gold Pack (Mar 28-Dec 28) -0.015 to -0.01

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00482 to 5.33798 (-0.00126/wk)

- 3M +0.00254 to 5.31653 (-0.01273/wk)

- 6M -0.00218 to 5.15347 (-0.03937/wk)

- 12M -0.01317 to 4.78978 (-0.06472/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.648T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $668B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

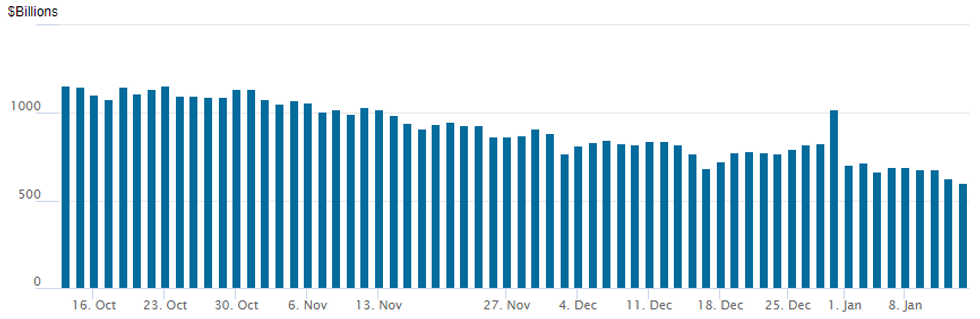

FED REVERSE REPO OPERATION: New Low Includes Counterparty Number

NY Federal Reserve/MNI

- RRP usage falls to $603.116B vs. $626.370B Thursday, today's usage marks the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties declines to 70 -- the lowest since January 5, 2022.

EGBs-GILTS CASH CLOSE: Rally Led By Short-End/Belly

Gilts and EGBs rallied Friday, led by gains in the short-end and belly after US producer price data came in softer than expected.

- Core FI rallied at the open, with some apparent focus on soft 3M/3M UK GDP and services data within a mixed report. The main event of the day though was US PPI which pointed to a softer core PCE inflation reading for December than Thursday's CPI alone implied.

- This boosted rate cut expectations in the US which spilled over into Europe: implied ECB cuts this year ramped up 14bp on the session to 155bp, with BoE up 15bp to 136bp.

- Periphery spreads tightened once again, with 10Y BTP/Bund at the tightest closing level since April 2022.

- The German and UK curves bull steepened. 10Y German yields finished the week 2.5bp higher; Gilts were flat.

- After hours, we get potential ratings decisions for the EFSF/ESM/Latvia/Austria; Monday's session will likely be quieter than usual given a US holiday, with attention next week on UK labour market/inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10.9bps at 2.517%, 5-Yr is down 7.5bps at 2.078%, 10-Yr is down 5.2bps at 2.184%, and 30-Yr is down 3.1bps at 2.395%.

- UK: The 2-Yr yield is down 9.5bps at 4.16%, 5-Yr is down 9.6bps at 3.661%, 10-Yr is down 4.9bps at 3.793%, and 30-Yr is down 1.6bps at 4.424%.

- Italian BTP spread down 2.1bps at 155bps / Spanish down 1bps at 90.8bps

FOREX USD Index Close To Unchanged On Week Amid Mixed US Inflation Figures

- Despite March Fed cut pricing building back up to a cumulative 21.5bps, broad volatility for the greenback this week remained relatively low, with the USD index’s weekly range unable to breach last Friday’s extremes. Mixed inflation data in the US prompted two-way flows for the DXY, but culminated in the index remaining close to unchanged levels from a week prior.

- USDJPY continues to register the most impressive daily ranges, with another 12- pip swing on Friday. Initial gains to 145.50 evaporated in the aftermath of the data and stale post-CPI longs were further challenged throughout the final session of the week. Despite trading as low as 144.37 the pair has stabilised around 144.80 as we approach the close.

- A key short-term support has been defined at 143.42, the Jan 9 low. A break of this level is required to instead signal a top and highlight a resumption of bearish activity.

- GBP/USD briefly made a round-trip back to the week’s best levels as the greenback initially extended upon the post-PPI pullback. Sustained cable gains through 1.2785 would open YTD highs and the bull trigger of 1.2827. Above here, the pair clears the best levels since August of last year.

- Stable equity markets continue to provide a relatively solid backdrop for emerging market fx, with Latin American currencies performing well on Friday. USDMXN hovers close to year-to-date lows at 16.80 and will eye a move towards support at 16.6262, the Jul 28 low.

- Swedish CPI and Eurozone IP & trade balance data highlight the docket on Monday. US banks will be closed in observance of Martin Luther King Jr. Day.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/01/2024 | 0700/0800 | *** |  | SE | Inflation Report |

| 15/01/2024 | 0900/1000 |  | DE | German Annual 2023 GDP First Estimate | |

| 15/01/2024 | 0900/1000 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 15/01/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/01/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 15/01/2024 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/01/2024 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 15/01/2024 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/01/2024 | 1530/1030 | ** |  | CA | BOC Business Outlook Survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.