-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

MNI ASIA OPEN: Weekly Claims Decline, Rate Cuts Cool

- MNI: Fed's Harker Warns Great Risk To Cutting Rates Too Early

- MNI: Fed's Jefferson Sees Rate Cuts Likely Later This Year

- MNI: BOC Still Needs Patience As Inflation Slows- Ex Staffer

- MNI: Canada January Retail Sales Falter After Strong 2023

- MNI ECB: Likely Downward '24 Mar Inflation Projection- ECB

- MNI US DATA: Mixed PMI Data Overall Consistent With "Soft Landing" Narrative

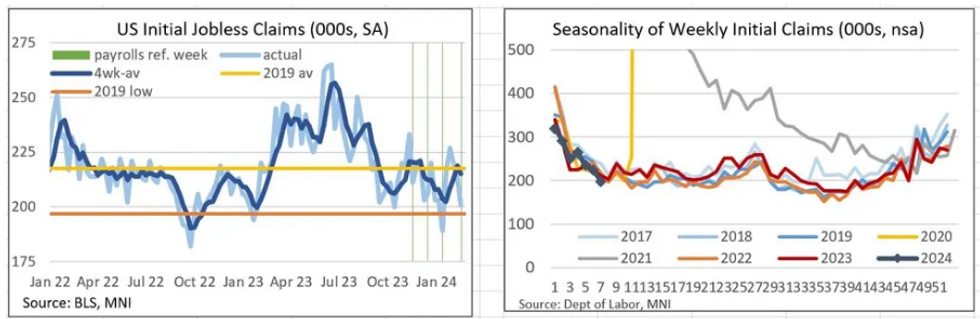

- MNI US DATA: Solid Jobless Claims Return To Stronger End Of Recent Range

US

FED (MNI): Fed's Jefferson Sees Rate Cuts Likely Later This Year. The Federal Reserve will likely begin lowering interest rates later this year but officials must beware of both the risk of excessive easing and of unexpected weakening in the economy, Fed Vice Chair Philip Jefferson said Thursday.

- "If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back our policy restraint later this year," Jefferson said in remarks prepared for the Peterson Institute for International Economics. There has been some welcome progress on inflation so far but policymakers must remain nimble and vigilant to fresh shocks, he said.

FED (MNI): Fed's Harker Warns Great Risk To Cutting Rates Too Early

Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday benchmark interest rates may well be lowered this year but warned that doing so too soon can lead to a resurgence of inflation that the Fed has fought so hard to contain over the past year.

- "I find our greatest economic risk comes from acting to lower the rate too early, lest we reignite inflation and see the work of the past two years unwind before our eyes," Harker said in remarks prepared for a University of Delaware event in Newark, Delaware.

NEWS

US (MNI): Biden Considers Executive Actions To Enhance Border Security

President Biden is reportedly considering a range of executive actions to enhance security at the US-Mexico border. Measures could include barring migrants from applying for asylum when crossings pass 5,000 a day, similar to a mechanism in bipartisan Senate border deal which was torpdedoed by Republicans earlier this month.

CANADA (MNI): BOC Still Needs Patience As Inflation Slows- Ex Staffer

The Bank of Canada is likely to remain patient before cutting rates despite headline inflation having slipped back within the official target band because there are too many potential flare-ups especially from real estate, a former central bank and finance department economist told MNI.

CANADA (MNI): January Retail Sales Falter After Strong 2023

Canadian retail sales fell for the first time since August according to Statistics Canada's flash estimate for January, with the 0.4% decline following a stronger-than-expected gain of 0.9% for December.

ECB MINUTES (MNI): Likely Downward '24 Mar Inflation Projection- ECB

The European Central Bank's Governing Council stressed that headline and underlying inflation figures “had recently been continuously below the predicted levels”, suggesting a faster disinflationary process and a likely downward inflation revision for 2024 in the March projections, accounts of the January policy meeting showed on Thursday.

US-RUSSIA (MNI): Putin-Ready To Work w/Any US Pres; Biden Better For Russia Than Trump

Wires carrying comments from Russian President Vladimir Putin claiming that "We are ready to work with any US president," and that he reiterates that he prefers incumbent Joe Biden to Donald Trump as US president.

MIDEAST (MNI): Houthi Leader Says Group Is Looking To 'Escalate' Red Sea Operations

Following earlier reports regarding an attack on a vessel in the Gulf of Aden (see 0814GMT and 0851GMT bullets), UK Maritime Trade Operations (UKMTO) state that the ship located 70NM southeast of the Yemeni city of Aden 'has sustained minor damage' but that the vessel and crew are safe and it is proceeding to its next port of call.

US TSYS Roundup: Weekly Jobless Claims Lower Than Expected

- Treasury futures holding mixed after the bell, short end to intermediates moderately weaker vs. Bonds. Treasury futures extended early lows after lower than expected Initial Jobless Claims (201k vs. 216k est) and Continuing Claims (1.862M vs. 1.885M est), Chicago Fed Nat Activity Index is lower (-0.30 vs. -0.22 est).

- Rates rebounded briefly following February flash PMI readings were mixed though on balance weaker than expected, signaling still-solid but slowing growth and potentially softer price pressures. Meanwhile, January existing home sales were roughly as expected, at 4.00mln (SAAR), vs 3.97mln expected and a 3.1% gain vs 3.88mln in December

- Well through technical support, Mar'24 10Y futures traded -10 at 109-10, technical support level at 109-05+ (Low Nov 28) to finish near 109-16.5 Thursday. Heavy volumes with TYH4 over 4.1M after the bell tied to surge in Mar'24/Jun'24 quarterly roll efforts. Curves bear flatten: 2s10s -3.329 at -38.281, 10Y yield +0.0080 at 4.3266%.

- Handful of Fed speakers still ahead: At separate events scheduled at 1700ET: Fed Gov Cook speaks at a macro-finance conference, MN Fed President Kashkari panel discussion on outlook, (Q&A, livestreamed). Later this evening, Fed Gov Waller Speaks on Economic Outlook (text, Q&A and livestreamed) at 1935ET.

OVERNIGHT DATA

US DATA (MNI): Jobless claims data pointed to a still-resilient labor market in mid-February, made more impactful as the reference week for February's nonfarm payrolls report.

- Initial claims unexpectedly fell to 201k in the week to Feb 16 (216k expected vs 213k prior, upwardly revised by 1k), marking. Continuing claims in the week to Feb 10 also came in lower than expected at 1,862k (1,884k expected vs 1,889k prior, downwardly revised by 6k). This was the 3rd consecutive decline in initial claims since the 11-week high of 227k hit in late January, and brings the 4-week moving average back down to 215k.

US DATA (MNI): Mixed PMI Data Overall Consistent With "Soft Landing" Narrative: The US February flash PMI readings were mixed though on balance weaker than expected, signaling still-solid but slowing growth and potentially softer price pressures.

- Manufacturing was stronger than expected at 51.5 (50.7 expected, 50.7 prior), but Services disappointed by the most vs survey median since March 2023 at 51.3 (52.3 expected, 52.5 prior). This left the Composite reading at 51.4 (51.8 expected, 52.0 prior).

US DATA (MNI) Existing Home Sales Set To Stay Stagnant As Mortgage Rates Tick Back Up. January existing home sales were roughly as expected, at 4.00mln (SAAR), vs 3.97mln expected and a 3.1% gain vs 3.88mln in December (upwardly revised from 3.78mln, with each of the preceding 3 months also revised up).

- The uptick in January meant the highest sales volume since August 2023, but to put this into context, it is just months after briefly hitting the lowest reading post-2010 (3.85mln in Oct 2023). From a regional perspective, sales increased in each of the Midwest, South, and West regions, but were flat in the Northeast.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 412.57 points (1.07%) at 39023.6

- S&P E-Mini Future up 100.5 points (2.01%) at 5097

- Nasdaq up 456.3 points (2.9%) at 16039.61

- US 10-Yr yield is up 0.4 bps at 4.3227%

- US Mar 10-Yr futures are down 3.5/32 at 109-16.5

- EURUSD up 0.0002 (0.02%) at 1.0821

- USDJPY up 0.24 (0.16%) at 150.54

- WTI Crude Oil (front-month) up $0.61 (0.78%) at $78.52

- Gold is down $3 (-0.15%) at $2022.82

- European bourses closing levels:

- EuroStoxx 50 up 80.05 points (1.68%) at 4855.36

- FTSE 100 up 21.98 points (0.29%) at 7684.49

- German DAX up 252.33 points (1.47%) at 17370.45

- French CAC 40 up 99.51 points (1.27%) at 7911.6

US TREASURY FUTURES CLOSE

- 3M10Y +0.022, -108.779 (L: -113.814 / H: -105.489)

- 2Y10Y -4.136, -39.088 (L: -39.105 / H: -33.915)

- 2Y30Y -6.29, -25.361 (L: -25.576 / H: -17.114)

- 5Y30Y -4.29, 12.841 (L: 12.662 / H: 19.1)

- Current futures levels:

- Mar 2-Yr futures down 3.5/32 at 101-27.25 (L: 101-26.25 / H: 101-31.25)

- Mar 5-Yr futures down 4.75/32 at 106-10 (L: 106-06.25 / H: 106-17)

- Mar 10-Yr futures down 3.5/32 at 109-16.5 (L: 109-10 / H: 109-24)

- Mar 30-Yr futures up 13/32 at 118-4 (L: 117-11 / H: 118-09)

- Mar Ultra futures up 23/32 at 124-4 (L: 123-03 / H: 124-11)

US 10Y FUTURE TECHS: Bear Cycle Resumes With Fresh YTD Lows

- RES 4: 112-00 Round number resistance

- RES 3: 111-21+ High Feb 5

- RES 2: 110-31+ 20-day EMA

- RES 1: 110-17+ High Feb 15

- PRICE: 109-16+ @ 16:57 GMT Feb 21

- SUP 1: 109-10 Low Feb 22

- SUP 2: 109-05+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 108-14 Low Nov 15

Solid PMI data and a surge in US equities worked against Treasury prices Thursday, pressing Treasuries to 109-10, a new YTD low. The latest downleg affirms a resumption of the downtrend posted off the early February high, opening losses toward the late November lows of 109-05+. The 110-00 handle has been solidly cleared, with 109-17 support giving way into the close. Initial firm resistance is at 110-25+, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 -0.005 at 94.698

- Jun 24 -0.035 at 94.905

- Sep 24 -0.060 at 95.190

- Dec 24 -0.070 at 95.50

- Red Pack (Mar 25-Dec 25) -0.08 to -0.045

- Green Pack (Mar 26-Dec 26) -0.035 to -0.015

- Blue Pack (Mar 27-Dec 27) -0.01 to +0.005

- Gold Pack (Mar 28-Dec 28) +0.015 to +0.030

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00010 to 5.32093 (+0.00508/wk)

- 3M +0.00190 to 5.32383 (+0.00981/Wk)

- 6M +0.00924 to 5.25273 (+0.02157/wk)

- 12M +0.02614 to 5.02505 (+0.04715/wk)

- Secured Overnight Financing Rate (SOFR): 5.30% (+0.00), volume: $1.607T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $669B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $660B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $101B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $272B

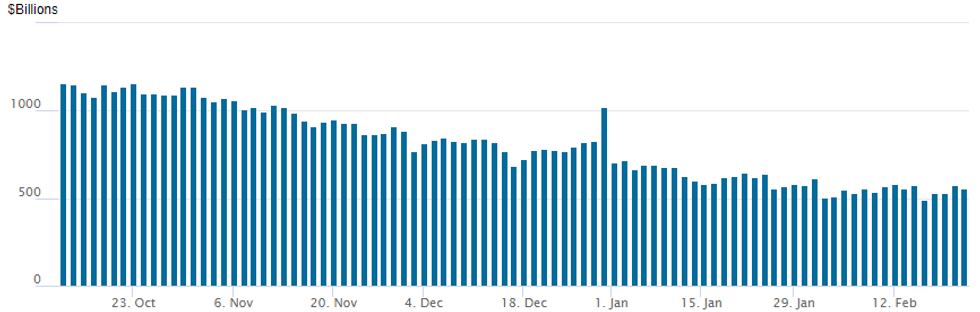

FED REVERSE REPO OPERATION

- RRP usage recedes to $553.245B vs. 574.882B Wednesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties falls back to 86 from 96 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $15B Abbvie 7Pt Jumbo Launched, $5B Larger Than Immunogen Deal

Abbvie's $15B 7-tranche issuance is appr $5B larger than the amount paid for Immunogen: according to Abbvie, the transaction was "valued at $31.26 per share in cash, for a total equity value of approximately $10.1B." Needless to say, market eager to provide the capital with the order book growing over $80B before the launch.

- Date $MM Issuer (Priced *, Launch #)

- 2/22 $15B #Abbvie** $2.25B 3Y +35, $2.5B 5Y +50, $2B 7Y +60, $3B 10Y +75, $750M 20Y +75, $3B 30Y +95, $1.5B 40Y +105

- 2/22 $3.1B #Panama $1.1B 7Y 7.5%, $1.25B 13Y 8%, $750M 33Y 8.25%

- 2/22 $2B *Federal Rep of Germany (KFW) 10Y +51

- 2/22 $2B #BNG Bank 3Y SOFR +32

- 2/22 $1.7B #Exelon $650M 5Y +87.5, $650M 10Y +115, $400M 29Y +130

- 2/22 $1.25B #Royal Caribbean 8NC3 6.25%

- 2/22 $700M *Northern States WNG 30Y +97

- 2/22 $2B *Caterpillar $800M 2Y +35, $600M 2Y SOFR+46, $600M 5Y +55

- **Abbvie held investor calls yesterday after filing funding offer to fund Immunogen deal. For historical context, back on November 12, 2019, Abbvie issued $30B debt over 10 tranches

EGBs-GILTS CASH CLOSE: Flattening Resumes As Short End Sinks

The German and UK curves resumed Thursday where they left off late Wednesday by flattening further, led by a short-end selloff.

- Downside in the session was initially seen following French PMI beats on both the Services and Manufacturing measures, though the German readings were more mixed with Manufacturing weaker than expected. UK PMIs were better than expected but unintuitively, Gilts rallied in the aftermath. The UK and Eurozone composites were both above expectations.

- Otherwise developments were limited: the accounts of the January ECB meeting brought no surprises, while the US PMIs were weak on balance they showed relatively steady growth.

- The short-end weakness was again led by central bank cut repricing. After 8bp of 2024 ECB cuts were priced out Wednesday, another 8bp was priced out Thursday, with 92bp of reductions now seen. For the BoE, 4bp was priced out today, bringing the 2-day retracement to 13bp at 63bp.

- The UK and German curves twist flattened on the day, with Bunds modestly underperforming Gilts. Periphery spreads tightened, led by BTPs, with elevated risk appetite evidenced by ongoing strength in equities.

- German data features early Friday, including the IFO survey; we also get ECB inflation expectations and multiple speakers including de Cos and Schnabel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.1bps at 2.905%, 5-Yr is up 2.2bps at 2.448%, 10-Yr is down 1bps at 2.44%, and 30-Yr is down 3.3bps at 2.557%.

- UK: The 2-Yr yield is down 3.2bps at 4.602%, 5-Yr is up 1bps at 4.153%, 10-Yr is up 0.2bps at 4.105%, and 30-Yr is down 0.5bps at 4.63%.

- Italian BTP spread down 2.5bps at 147.5bps / Spanish down 1.3bps at 90.5bps

FOREX: Greenback On Firmer Footing As US Yields Move Higher

- The USD index trades closed to unchanged on Thursday, having recovered from an initial 0.5% sell-off earlier in the session. The more optimistic backdrop for equities had initially placed pressure on the greenback, however, the move higher for US yields supported the greenback bounce.

- The most notable reversal has been seen in EURUSD, following some mixed PMI data in early European hours. Generally, the data fared better than expected, with the Eurozone and French figures topping forecast, and countering modest weakness in Germany manufacturing. EURUSD traded as highs as 1.0888 before a consistent grind back towards the 1.08 handle ensued.

- G10 FX implied vols extend recent lows, with EUR/JPY 6m implied nearing on 8 vol points and the lowest level since Feb'22. With lower vols tied to JPY weakness over the past 12 months, EUR/JPY has extended the YTD rally, putting the cross within range of key resistance at the bull trigger of the cycle high from late 2023 at 164.30.

- Indeed, USDJPY remained buoyant on Thursday and likely was supported by the higher core yields. Highs of 150.69 bring the pair ever closer to resistance at 1.5089, the Feb 13 high, before 151.43, the November 16 high.

- Higher equities continue to keep NZD as one of the best performing majors, extending its impressive run in recent days. NZDUSD now stands 2.5% above the Feb 14 lows, breaching the 50-day moving average in the process and breaching 0.6200 for the first time since Jan 16.

- New Zealand retail sales kick off the Friday docket, while Japan will be out for a national holiday. German final GDP and IFO sentiment data will cross in Europe, in an otherwise quiet data day to end the week.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2024 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/02/2024 | 0035/1935 |  | US | Fed Governor Christopher Waller | |

| 23/02/2024 | 0700/0800 | *** |  | DE | GDP (f) |

| 23/02/2024 | 0800/0900 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 23/02/2024 | 0800/0900 |  | EU | ECB's Lagarde, de Guindos, and Cipollone in ECONFIN meeting | |

| 23/02/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 23/02/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 23/02/2024 | 0920/1020 |  | EU | ECB's Schnabel lecture on Inflation fight at Bocconi | |

| 23/02/2024 | 1300/1400 |  | EU | ECB's Schnabel speech at Forum Analysis | |

| 23/02/2024 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/02/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/02/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 23/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.