-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA OPEN: Yield Curves March Steeper

US TSYS: Covid Curbs Back On

Tsys finishing well off early session highs, near midday lows on light holiday volumes (TYH3 appr 675k by the close - had started the session around 300k).

Markets see-sawed lower following mixed midmorning data:

- Pending Home Sales much weaker than expected at -4.0% MoM vs. -1.0% est (YoY -38.6% vs -36.7% prior); Richmond Fed Index much stronger than expected at +1 vs -10 est.

- Mkt optimism over China reopening faded as covid infections surged (MILAN REPORTS 50% PASSENGERS WITH COVID IN FLIGHTS FROM CHINA, Bbg; US TO REQUIRE NEGATIVE COVID TEST FOR TRAVELERS FROM CHINA, Bbg).

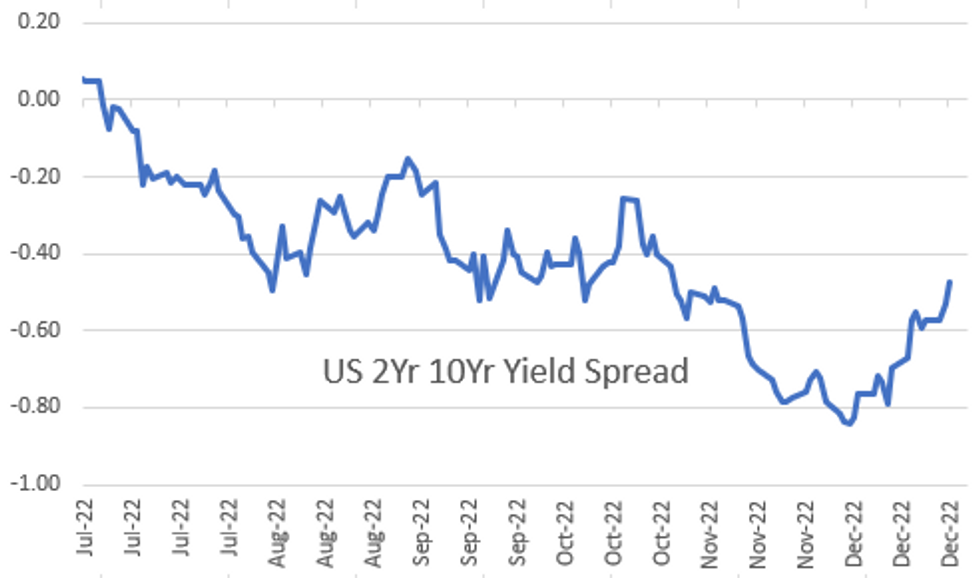

- Carry-over curve steepening through the session: 2s10s +6.476 at -47.469, least inverted lvl since mid-November amid fair amount of unwinds in crowded flattener positions going into year end.

- Fed funds futures have the policy rate peaking at under 5% by mid-'23 and then receding to around 4.5% by year-end - expectation of rate cuts in late 2023 potentially overpriced.

- Tsy futures dip slightly after $43B 5Y note auction (91282CGC9) tail: 3.973% high yield vs. 3.970% WI; 2.46x bid-to-cover vs. 2.39x the prior month. US Tsy $35B 7Y Note auction Thu (91282CGB1).

OVERNIGHT DATA

- US NAR NOV PENDING HOME SALES INDEX 73.9 V 77 IN OCT

- US NAR NOV PENDING HOME SALES -4.0% MOM; -37.8% YOY

- Richmond Fed: Dec Mfg Shipments Index 5 Vs Nov -8

- Richmond Fed: Dec Manufacturing Index 1 Vs Nov -9

- US REDBOOK: DEC STORE SALES +7.2% V YR AGO MO

- US REDBOOK: STORE SALES +9.6% WK ENDED DEC 24 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 211.99 points (-0.64%) at 33030

- S&P E-Mini Future down 31.5 points (-0.82%) at 3823.5

- Nasdaq down 110.4 points (-1.1%) at 10243.1

- US 10-Yr yield is up 4.5 bps at 3.8865%

- US Mar 10-Yr futures are down 5.5/32 at 112-5

- EURUSD down 0.0024 (-0.23%) at 1.0616

- USDJPY up 0.88 (0.66%) at 134.38

- WTI Crude Oil (front-month) down $0.72 (-0.91%) at $78.81

- Gold is down $8.2 (-0.45%) at $1805.55

- EuroStoxx 50 down 24.07 points (-0.63%) at 3808.82

- FTSE 100 up 24.18 points (0.32%) at 7497.19

- German DAX down 69.5 points (-0.5%) at 13925.6

- French CAC 40 down 40.17 points (-0.61%) at 6510.49

US TSY FUTURES CLOSE

- 3M10Y -10.207, -58.264 (L: -68.018 / H: -52.354)

- 2Y10Y +6.044, -47.901 (L: -55.466 / H: -47.434)

- 2Y30Y +6.324, -38.985 (L: -48.534 / H: -36.991)

- 5Y30Y +0.916, -0.652 (L: -4.834 / H: 1.574)

- Current futures levels:

- Mar 2-Yr futures up 0.125/32 at 102-20.125 (L: 102-20 / H: 102-22.75)

- Mar 5-Yr futures down 2.5/32 at 107-29 (L: 107-29 / H: 108-06.75)

- Mar 10-Yr futures down 5.5/32 at 112-5 (L: 112-05 / H: 112-22)

- Mar 30-Yr futures down 15/32 at 124-27 (L: 124-22 / H: 125-31)

- Mar Ultra futures down 27/32 at 133-20 (L: 133-13 / H: 135-21)

US 10YR FUTURE TECHS: (H3) Bear Cycle Extends

- RES 4: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 3: 115-14 50% Aug - Oct Downleg

- RES 2: 114-23/115-11+ High Dec 19 / 13 and the bull trigger

- RES 1: 113-20+ 20-day EMA

- PRICE: 112-07+ @ 19:00 GMT Dec 28

- SUP 1: 112-05+ Low Nov 14 and intraday low

- SUP 2: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 3: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 110-22 Low Nov 10

Treasury futures remain soft and the contract traded lower Wednesday, extending the pullback from 115-11+, the Dec 13 high and key resistance. The move lower has resulted in a print below support at 112-11+, the Nov 21 low. A clear break of this level would open 111-27+, a Fibonacci retracement level. On the upside, the 20-day EMA, at 113-20+, marks a firm resistance. A break is required to ease the current bearish pressure.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.045 at 94.940

- Jun 23 +0.040 at 94.870

- Sep 23 +0.015 at 94.965

- Dec 23 steady at 95.250

- Red Pack (Mar 24-Dec 24) -0.015 to -0.015

- Green Pack (Mar 25-Dec 25) -0.04 to -0.02

- Blue Pack (Mar 26-Dec 26) -0.07 to -0.05

- Gold Pack (Mar 27-Dec 27) -0.075 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume with London back from extended Christmas holiday:

- O/N -0.00028 to 4.31643% (-0.00029 total last wk)

- 1M -0.00329 to 4.38357% (+0.03400 total last wk)

- 3M +0.00343 to 4.72986% (-0.01943 total last wk)*/**

- 6M -0.00200 to 5.15114% (-0.03372 total last wk)

- 12M +0.02643 to 5.47029% (-0.03500 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $109B

- Daily Overnight Bank Funding Rate: 4.32% volume: $277B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.048T

- Broad General Collateral Rate (BGCR): 4.27%, $389B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $361B

- (rate, volume levels reflect prior session)

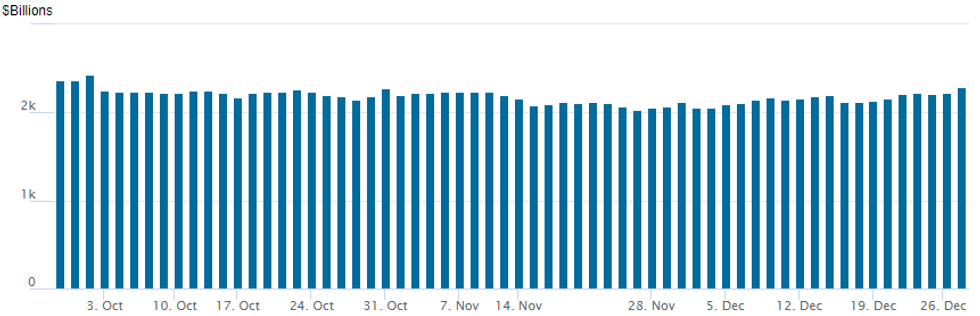

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,293.003B w/ 104 counterparties vs. $2,221.259B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGB/Gilts: Bunds Retrace Half Earlier Gains; Gilts Steady

- Bunds ground higher through the European morning session, with futures moving from a low of 133.29 in the Asian session to a high of 134.11 around when the US came in. However, more than 50% of the intraday move was retraced in early afternoon trading. 10-year Bund yields now stand 2.8bp lower on the day but 9.7bp higher than the pre-Christmas closing level. This is not a million miles from the 9.1bp increase in 10-year UST yields seen this week but the German curve has steepened much more with Schatz yields up just 1.9bp in 2-days versus 5.4bp for 2-year USTs.

- Peripheral spreads have widened with 10-year BTP-Bund spreads around 6.5bp wider on the day at writing.

- Gilts had been the big movers on their open, catching up with some of the moves seen yesterday in Bunds and Treasuries. Yields across the curve were over 10bp higher on the day at one point with a parallel curve shift, but 10-year yields are now up around 3.3bp on the day with a steeper curve (2-year gilt yields up 2.2bp).

- There has been very little in the way of domestic European drivers, and with little liquidity in the holiday period some of the moves have been exaggerated.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/12/2022 | 0800/0900 |  | ES | Retail Sales | |

| 29/12/2022 | 0900/1000 | ** |  | EU | M3 |

| 29/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 29/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/12/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 29/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.