-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Yields Climb Higher Ahead Feb FOMC Minutes

EXECUTIVE SUMMARY

US

FED: The February FOMC meeting minutes (released 1400ET/1900GMT on Feb 22) could be the most interesting edition in a while.

- Data and Fed commentary since the February 1 decision have put focus on whether participants thought the Fed could go "higher for longer" than they thought at the December meeting / eyed a potential return to a 50bp hike pace in future if needed / and/or supported a 50bp hike at the February meeting.

- It's unlikely the Fed was very close to hiking 50bp three weeks ago (they instead dropped the hike pace to 25bp in a unanimous vote). But we now know that at least two non-voting participants (Mester and Bullard) were proponents of continuing 50bp hikes, and it's possible there were more.

- In addition to tightening prospects, criteria for a pause in the hiking cycle will also be a major focus: when asked in the post-meeting press conference whether the FOMC discussed the conditions for a pause, Chair Powell said "the minutes will come out in three weeks, and we'll give you a lot of detail...really talking quite a bit about the path forward".

- With the updated March Dot Plot revisions coming up, it could be interesting to see how FOMC members saw developments since the December meeting. Any assessment of evolving financial conditions in this regard will be especially worth noting.

US Data: Existing Home Sales Likely Bottoming Out At 4.0M Pace: U.S. existing home sales fell in January by 0.7%, more than analysts expected, to a seasonally adjusted annual rate of 4.00 million, though sales are bottoming out, the National Association of Realtors said Tuesday. It marks the twelfth straight month of declines and is the weakest sales pace since October 2010.

- The median existing-home sales price increased 1.3% from one year ago to USD359,000, the slowest month of price gain since February 2012, the NAR said, but there are signs that buyers are gaining some negotiating power. Homes that have sat on the market for more than 60 days are generally selling for 10% less than list price, NAR chief economist Lawrence Yun said.

- "Half the country is experiencing price declines, but I think it will be modest," Yun said, adding he would not be surprised if sales reaccelerate to a 5 million pace by the end of the year due to pent-up demand.

US Tsys Finish Heavy

Tsys traded heavy Tuesday, hugging lows in second half on subdued trade following whipsaw action in the first half.- Tsy futures gap lower post PMI, rebounds on 2-way trade, USH3 124-17 low, 124-23 last, 30YY 3.9513 high

- Inching off lows after Existing Home Sales came out weaker than forecasted, USH3 12409 vs. 124-04 low pre-data (30YY taps 3.9774% high). Yield curves extend steeper, 2s10s tapping -76.749 highs. Heavy volumes more associated to Mar/Jun quarterly rolls, pre-auction short sets in 2s.

- Tsy futures inch lower, modest selling after weak $42B 2Y note auction (91282CGN5) tails: 4.673% high yield vs. 4.667% WI; 2.61x bid-to-cover vs. 2.94x prior. Indirect take-up slips to 62.04% vs. 64.99% prior month, direct take-up 22.99% vs. 18.73% prior, primary dealer take-up 14.97% vs. 16.28%.

- Equity earnings continue after the close: FANG ($5.23 est), PSA ($3.97 est), TOL ($1.38 est), CHK ($2.86 est)..

- Focus turns to Wednesday's Feb FOMC minutes release at 1400ET.

OVERNIGHT DATA

- US FEB PHILADELPHIA FED NONMFG INDEX 3.2

- US S&P GLOBAL FEB. MANUFACTURING PMI AT 47.8 VS 46.9 PRIOR

- US S&P GLOBAL FEB. SERVICES PMI AT 50.5 VS 46.8 LAST MONTH

- US NAR: JAN EXISTING HOME SALES -0.7% TO 4.00M SAAR

- NAR: JAN EXISTING HOME SALES PACE WEAKEST SINCE OCT 2010

- NAR'S YUN: HOME SALES DECLINE 'MODEST,' LIKELY BOTTOMING OUT

- CANADA JAN CPI 5.9% YOY VS FORECAST 6.1%, PRIOR 6.3%

- STATSCAN SAYS INFLATION SLOWED MAINLY ON BASE EFFECT

- CANADA JAN CPI +0.5% MOM VS FORECAST +0.7%, PRIOR -0.6%

- CANADA JAN CPI EX FOOD & ENERGY +0.2% MOM; 4.9% YOY

- CANADA CORE TRIM CPI 5.1% YOY, MEDIAN 5.0%

- CANADA DEC RETAIL SALES +0.5%, MATCHING FORECAST

- CANADA JAN CPI INFLATION +0.5% M/M, +5.9% YY

- CANADA DEC RETAIL SALES +0.5%; SALES EX-AUTOS/PARTS -0.6%

- CANADA DEC RETAIL SALES EX-AUTOS/PARTS-GASOLINE +0.4%

MARKETS SNAPSHOT

Key late session market levels:

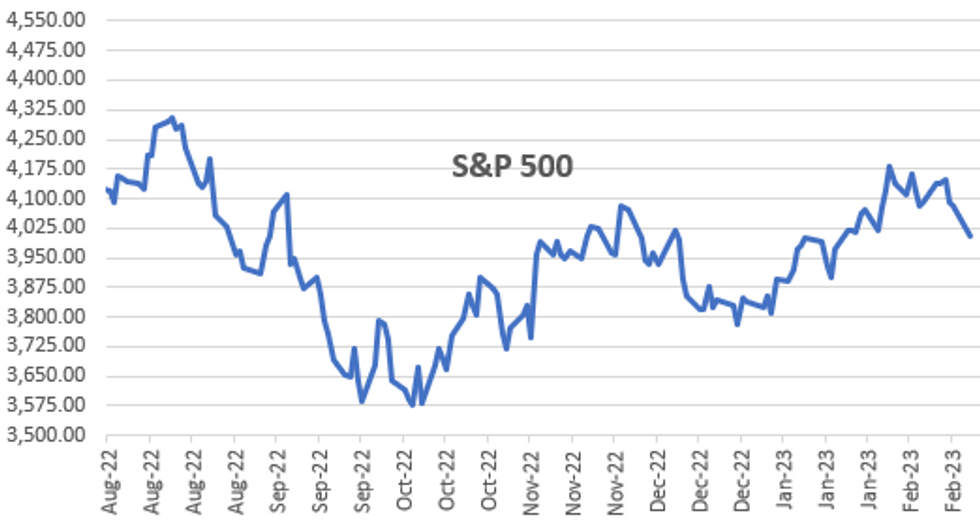

- DJIA down 626.32 points (-1.85%) at 33144.92

- S&P E-Mini Future down 74.5 points (-1.82%) at 4006.25

- Nasdaq down 261.7 points (-2.2%) at 11513.23

- US 10-Yr yield is up 13.8 bps at 3.9525%

- US Mar 10-Yr futures are down 30/32 at 111-2

- EURUSD down 0.0037 (-0.35%) at 1.0645

- USDJPY up 0.67 (0.5%) at 134.87

- WTI Crude Oil (front-month) down $0.18 (-0.24%) at $75.98

- Gold is down $6.22 (-0.34%) at $1833.57

- EuroStoxx 50 down 20.78 points (-0.49%) at 4250.4

- FTSE 100 down 36.56 points (-0.46%) at 7977.75

- German DAX down 79.93 points (-0.52%) at 15397.62

- French CAC 40 down 26.96 points (-0.37%) at 7308.65

US TREASURY FUTURES CLOSE

- 3M10Y +13.58, -87.139 (L: -100.678 / H: -86.944)

- 2Y10Y +2.779, -77.864 (L: -82.285 / H: -76.849)

- 2Y30Y -0.647, -75.844 (L: -78.931 / H: -73.007)

- 5Y30Y -3.828, -20.173 (L: -21.461 / H: -16.616)

- Current futures levels:

- Mar 2-Yr futures down 6.125/32 at 101-25.625 (L: 101-25 / H: 101-31.875)

- Mar 5-Yr futures down 19/32 at 106-24.25 (L: 106-22.75 / H: 107-11.25)

- Mar 10-Yr futures down 30/32 at 111-02 (L: 110-31.5 / H: 112-00.5)

- Mar 30-Yr futures down 1-21/32 at 124-04 (L: 124-02 / H: 125-30)

- Mar Ultra futures down 2-06/32 at 133-23 (L: 133-18 / H: 136-08)

US 10YR FUTURE TECHS: (H3) Near-Term Weakness Extends

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 113-18 50-day EMA

- RES 1: 113-05 20-day EMA

- PRICE: 111-17 @ 13:15 GMT Feb 21

- SUP 1: 111-08+ Low Feb 17

- SUP 2: 111-02+ Lower 2.0% Bollinger Band

- SUP 3: 110-08 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Near-term weakness extends across Treasury futures, putting prices at new pullback lows of 111-08+. This puts the contract through the early January lows, opening medium-term losses toward levels not seen since November. The strengthening bearish theme exposes 109-22 over the medium-term, the Nov 3 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-18. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.028 at 94.895

- Jun 23 -0.070 at 94.490

- Sep 23 -0.090 at 94.390

- Dec 23 -0.110 at 94.610

- Red Pack (Mar 24-Dec 24) -0.145 to -0.135

- Green Pack (Mar 25-Dec 25) -0.155 to -0.135

- Blue Pack (Mar 26-Dec 26) -0.16 to -0.155

- Gold Pack (Mar 27-Dec 27) -0.155 to -0.15

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00300 to 4.55986% (+0.00300/wk)

- 1M -0.00071 to 4.59200% (+0.00071/wk)

- 3M +0.01271 to 4.92214% (+0.00685/wk)*/**

- 6M +0.01672 to 5.25743% (+0.01443/wk)

- 12M +0.01929 to 5.63943% (-0.00343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.92214% on 2/21/23

- Daily Effective Fed Funds Rate: 4.58% volume: $107B

- Daily Overnight Bank Funding Rate: 4.57% volume: $292B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.209T

- Broad General Collateral Rate (BGCR): 4.52%, $461B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $450B

- (rate, volume levels reflect prior session)

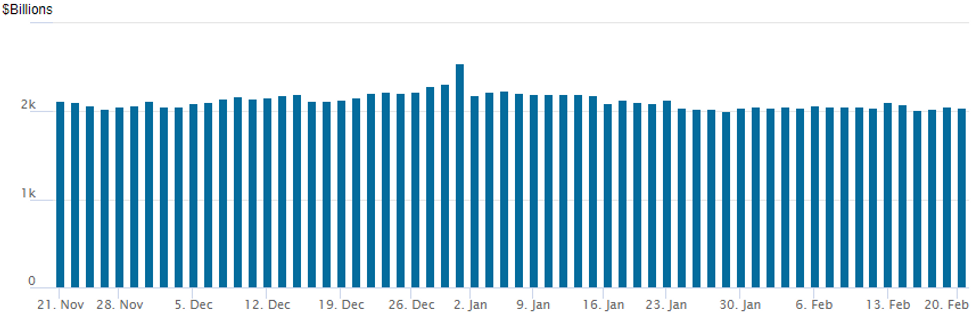

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,046.064B w/ 100 counterparties vs. prior session's $2,059.662B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.6B Mizuho 3Pt Launched

- $8.65B To price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 02/21 $2.6B #Mizuho $1B 6.25NC5.25 +150, $700M 8.25NC7.25 +165, $900M 11.25NC10.25 +180

- 02/21 $1.5B #Egypt 3Y Sukuk 11.0%

- 02/21 $1.35B #Constellation Energy $750M 5Y +143, $600M 10Y +185

- 02/21 $1.2B #Centerpoint $600M 5Y +115, $600M 10Y +145

- 02/21 $1B #Rabobank 6NC5 +140

- 02/21 $500M #Consolidated Edison WNG 10Y +125

- 02/21 $500M #Mitsubishi HC Finance AM 10Y +170

- Expected Wednesday

- 02/22 $1B OKB 5Y SOFR+39a

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 22/02/2023 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 22/02/2023 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 22/02/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 22/02/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 22/02/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 22/02/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2023 | 0900/1000 | *** |  | DE | Hesse CPI |

| 22/02/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 22/02/2023 | 0900/1000 |  | DE | Destatis Press Conference on Updated CPI Weights | |

| 22/02/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 22/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 22/02/2023 | 2230/1730 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.