-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Banxico Preview - December 2021: Tightening Pace On A Knife-Edge

Banxico Preview - December 2021

Executive Summary

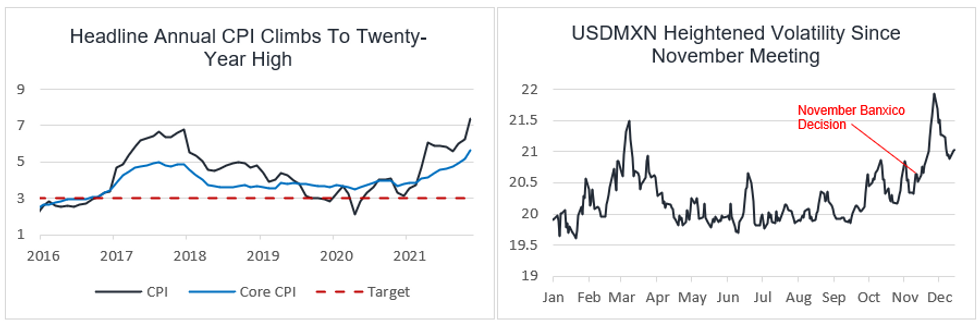

- Analysts are divided on whether Banxico will continue their gradual tightening cycle or whether they will accelerate the hiking pace to 50bps at the December meeting.

- Given the persistent upward trajectory of inflation readings and the associated pressure on inflation expectations, the likelihood of some board members voting for bolder action has certainly increased.

- In Governor Díaz de León’s final meeting before Ms. Victoria Rodriguez takes the helm in January, his vote may prove pivotal in the decision.

Click to view the full preview: MNI Banxico Preview - December 2021.pdf

Rodriguez Named As New Governor, Unknown Policy Stance

The most significant piece of news since the November meeting was the announcement that ex-finance minister, Arturo Herrera, would no longer be taking over as Banxico governor in 2022. Instead, President AMLO chose Victoria Rodriguez Ceja, who is set to become Mexico’s first female central bank governor after the senate confirmed her to its board roughly two weeks ago.

The appointment was originally met with caution among market participants as they questioned whether she has the relevant experience for the role, prompting heightened volatility in the Mexican peso. Additionally, given her roles at the finance ministry and close ties with President AMLO and Deputy Governor Esquivel, markets are currently leaning towards the appointment being a marginally dovish development. However, in her first remarks to Senators, she emphasised the autonomy of the central bank and the bank’s role in avoiding unintended effects from inflation.

Inflation Data May Be Enough To Persuade The Hawks

November CPI printed 1.14% M/m, boosting the annual headline rate to 7.37% Y/y, ahead of expectations of 7.24%. Furthermore, as measured through the two-week series of the INPC, the annual reading currently stands at 7.70%. This was highlighted by Deputy Governor Heath who described the data as “bad news” and called the individual reading as “even worse”. Additionally, Deputy Governor Espinosa, while taking part on a podcast hosted by Banorte, said “monetary policy should respond in an overwhelming manner to inflation levels”.

Before the November decision, a handful of analysts had discussed the potential for either a larger hike or at least some individual votes for a 50bp hike. Although the majority of the board stuck to their gradualist approach, the minutes from the November meeting highlighted that this was discussed and may even be warranted at that juncture, although there were risks of unsettling markets. The likelihood of a 50bp hike manifesting, or at least some induvial votes for said action, has certainly increased and indeed has prompted several analysts to revise their forecasts for this meeting.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.