-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI BI Preview - July 2022: On The Cusp Of Hike

EXECUTIVE SUMMARY:

- A majority of 22 sell-side analysts in a Bloomberg survey expect Bank Indonesia to keep the 7-Day Reverse Repo Rate unchanged this week, while the remaining 14 economists call for a 25bp hike. We cautiously side with the stand-pat camp but cannot rule out a rate rise.

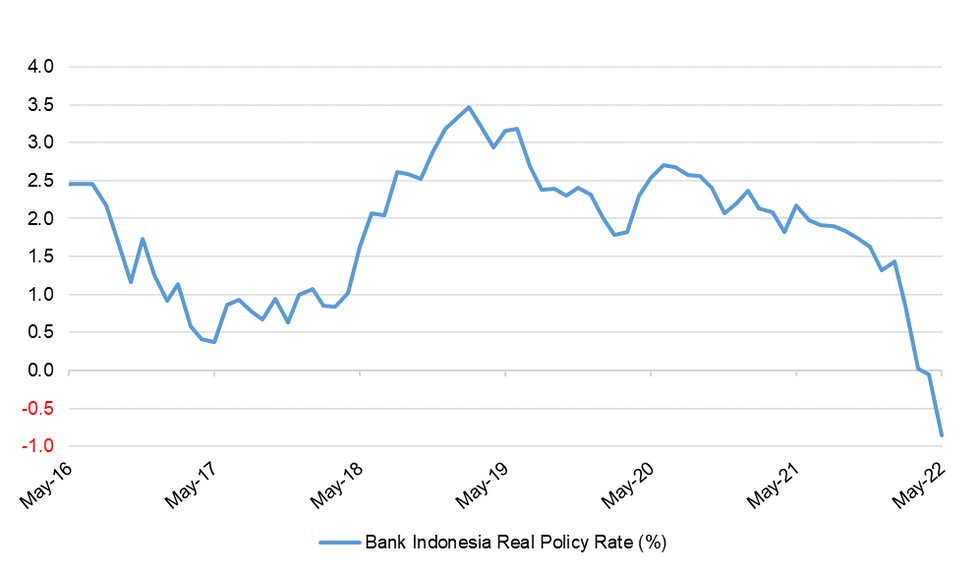

- Pressure keeps mounting on Bank Indonesia to fire the starting pistol on its rate-hike cycle. Rupiah stability indicators are sending warning signals, while narrowing yield differentials reduce the attractiveness of local assets. Furthermore, accelerating inflation is pushing the real policy rate deeper into negative territory.

- Nonetheless, Bank Indonesia has been vocal about focusing on core inflation as the key indicator of price pressures. The main metric of underlying inflation remains below the mid-point of the target range, with the Bank still "comfortable" with current levels of inflation.

- The global commodity boom has allowed Indonesia to fund subsidies and keep inflation in check. It has also underpinned Indonesia's trade surplus, lending support to the rupiah. Resultant price stability has put Bank Indonesia in a comfortable position to hold off on raising the key policy rate longer than most of its peers.

- We are looking at a live meeting, with Bank Indonesia on the cusp of interest-rate action. If its opts to stand pat, which is our base-case scenario, focus will turn to the imminent budget speech from President Widodo, in which he may provide some clarity on the outlook for fiscal efforts to cushion inflation.

Fig. 1: Bank Indonesia Real Policy Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Click here to access the full preview: MNI BI Preview July 2022.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.