-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Chile Central Bank Preview - Mar 2022: Potential For 200BP Hike

MNI Chile Central Bank Preview

Executive Summary

- The BCCh are widely expected to continue their aggressive pace of tightening at the March meeting with at least another 150bp hike to the overnight rate.

- However, worsening price dynamics both globally and on the domestic front, have prompted several analysts to forecast even bolder action of up to a 200 basis point interest rate increase at this week’s meeting, potentially bringing the overnight rate to 7.5%.

- Aside from the actual decision, the updated forward guidance will be provided in the quarterly monetary policy report (IPOM), scheduled to be published the day after the committee’s decision and analysts will look for details relating to the short-term trajectory for the policy rate.

Click to view the full preview: MNI BCCH Preview - March 2022.pdf

Rosanna Costa Takes Charge As President

Tuesday’s BCCh meeting will be the first at which Rosanna Costa will chair as newly appointed President. Given the fact she has been a committee member since January 2017, analysts do not expect any notable policy divergences from the committee’s approach under now Finance Minister, Mario Marcel. Additionally, Luis Felipe Céspedes and Stephany Griffith-Jones have also been appointed to the BCCh board, both having been selected by President Pinera in February.

Since the January meeting, speculation had mounted as to whether the BCCh may convene mid-schedule to act on surging inflation. The new central bank head ruled out an emergency meeting to address the high January prints, but warned of higher interest rates at the next policy meeting in March. Costa stated that the committee are “concerned about the evolution of inflation and this is going to require adjustments in monetary policy”. The new president added that “achieving convergence to the target will require a different monetary policy”, emboldening calls for bolder action this week.

Inflation Continues To Spike Amid Soaring Expectations

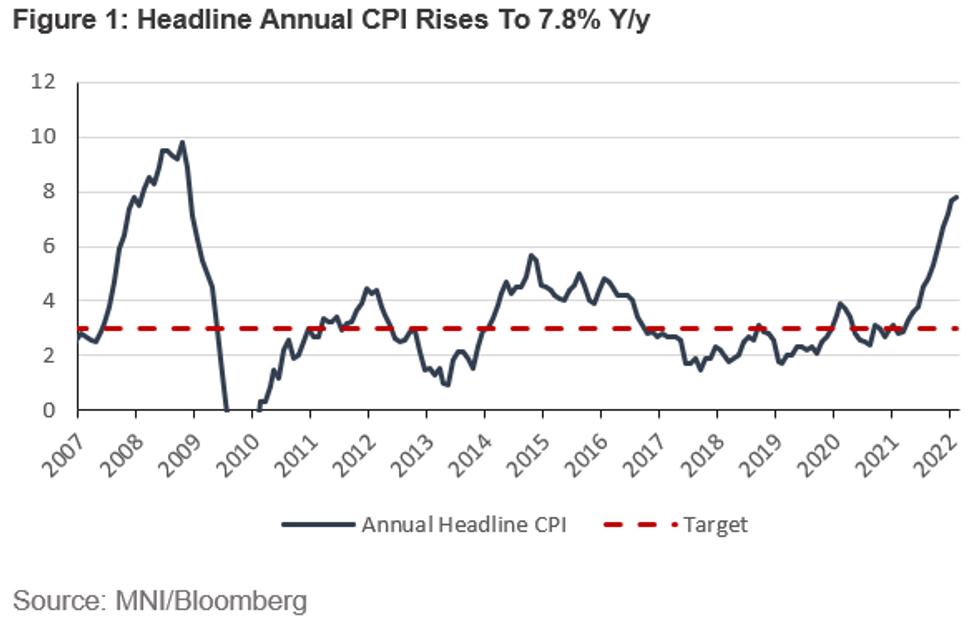

Annual headline inflation rose to 7.8% in February and while this figure was below surveyed estimates of an 8.2% rise, the numbers are significantly above the 7.2% level seen prior to the January meeting and continues to be significantly higher than the central bank’s target of 3%. In the latest BCCh economist survey, 2023 year-end inflation expectations rose to 4.0% from 3.7%, further indicating the contamination of medium-term expectations. Additionally, and highlighting the growing pressures, the latest central bank trader’s survey indicated one-year ahead expectations have increased to 7.4% from a 5.0% reading prior to the January meeting. They also foresee rates being hiked by 200bps to 7.5% at the March meeting.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.