-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: $2 Trillion?

- Chatter of Biden tabling a larger than expected COVID-19 support package weighs on U.S. Tsys & supports USD overnight.

- Fed Vice Chair Clarida raises eyebrows, with his comments resulting in some pointing to a low CPI hurdle re: rate hikes.

- Political tension in Italy still evident.

BOND SUMMARY: Talk Of A Larger Than Expected U.S. Fiscal Impulse

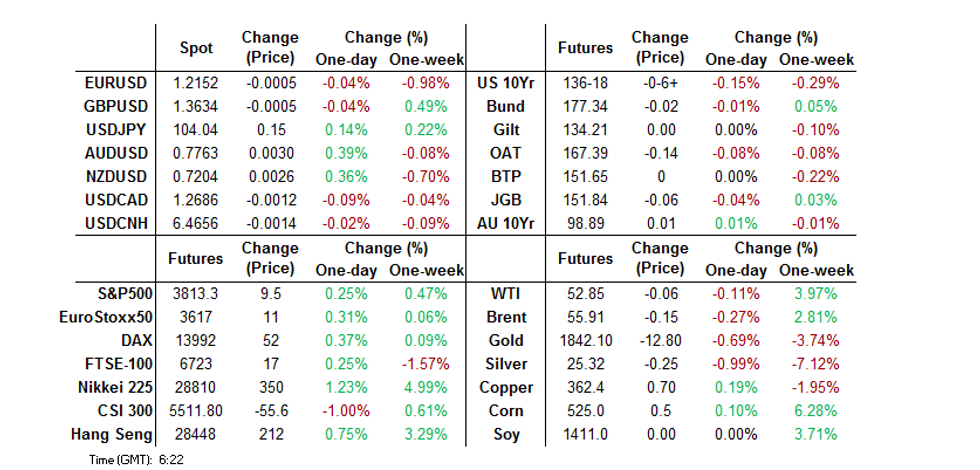

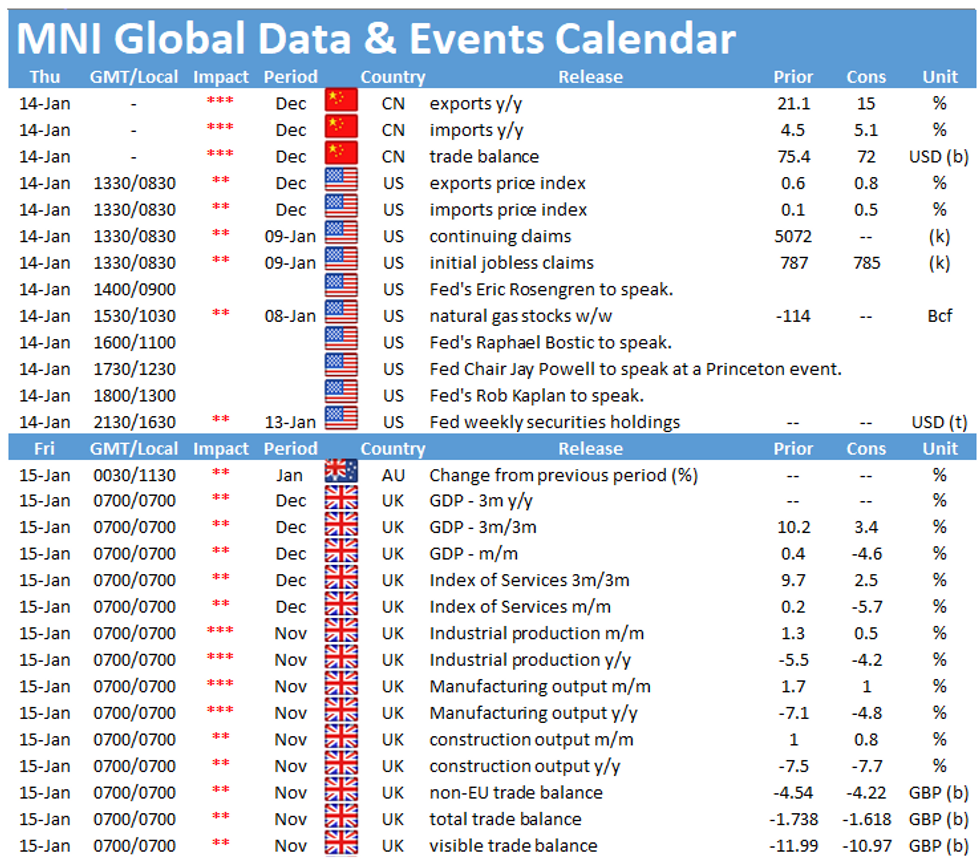

Asia-Pac hours saw T-Notes trade to fresh session lows on the back of a CNN source piece suggesting that U.S. President-elect Biden could table a $2tn COVID relief package later today, which would provide a larger than expected fiscal impulse for the U.S. The contract is last -0-06 at 136-18+. Biden will present his plan on Thursday evening, with the CNN piece noting that "the Biden team is taking a "shoot for the moon" approach with this package, one lawmaker in close contact with them told CNN, though they added that the price tag could still change." The curve bear steepened on the story, with 30s now sitting ~3.0bp cheaper vs. closing levels. We should note that Fed Vice Chair Clarida caught most off guard late on Wednesday as he noted that there will not be a rate hike until the U.S. sees inflation of at least 2.0% for a year, leading some pointing to a particularly low inflation hurdle for rate hikes. Weekly claims data, a raft of Fedspeak (including comments from Chair Powell) and Biden's aforementioned address headline the U.S. slate on Thursday.

- JGB futures also softened on the chatter surrounding the U.S. fiscal impulse, with futures closing -6 on the day, virtually at lows. Yields were mixed in the cash space, with the long end experiencing some light outperformance in the main, as the curve saw modest twist flattening. A quick look at the latest round of 1-3 & 25+ Year BoJ Rinban ops (which saw the purchase sizes left unchanged) revealed little movement in the offer to cover ratios vs. prev. Japanese Economy Minister & COVID chief Nishimura noted that it's possible that the country may further extend the area covered by its emergency declaration, depending on the infection situation.

- The Aussie curve looked to matters abroad, unwinding its early flattening to sit near unchanged vs. yesterday's settlement levels on the back of the previously flagged Biden stimulus plan chatter, with YM +0.5 & XM +1.0 come the bell. This comes after the latter firstly consolidated and then marginally extended on overnight gains in early Sydney trade. Swaps were wider vs. cash ACGBs across most of the curve, with cash ACGBs showing some light twist steepening. There has been nothing in the way of notable local news. The AOFM's funding update/next week's issuance task provide the highlights on Friday.

FOREX: Greenback Gains On Fiscal Chatter

The greenback shook off its initial weakness and popped higher as a CNN piece suggested that U.S. Pres-elect Biden is set to propose a $2.0tn economic relief plan, with more details coming up later in the day. The DXY swung into positive territory, yet the U.S. dollar struggled to gain much traction against its G10 peers.

- Stimulus chatter helped generate light risk-on flows across G10 FX space, pushing the Antipodeans to the top of the G10 pile. JPY underperformed in the basket as hopes for U.S. fiscal package reduced demand for safe haven assets. The yen shrugged off uninspiring comments from BoJ Gov Kuroda.

- EUR/USD briefly ticked higher as a contact flagged demand from a macro account, but the shared currency failed to cling onto gains and faltered, with political risks in the Eurozone eyed.

- The PBOC fixed USD/CNY at CNY6.4746, weakening the yuan by 141 pips. Sell side estimates predicted a fixing some 22 pips weaker for the yuan, but it was much more in line than the 95 pip discrepancy yesterday which markets interpreted as a signal the PBOC were uncomfortable with too much strength in the yuan.

- KRW was comfortably the worst performer in Asia. USD/KRW rallied past its 50-DMA for the first time since Jun 2020 after rejecting that moving average on Tuesday.

- Today's data highlights include U.S. initial jobless claims, Swedish unemployment & German 2020 GDP. Central bank speaker slate features Fed's Powell, Kaplan, Bostic & Rosengren, ECB's de Cos & Riksbank's Ingves. The ECB will publish the minutes from its Dec MonPol meeting.

FOREX OPTIONS: Expiries for Jan14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E909mln-EUR puts), $1.2200-05(E527mln), $1.2250-70(E739mln)

- USD/JPY: Y102.00($506mln), Y103.90-104.00($694mln-USD puts),

Y104.25-40($1.3bln-USD puts) - AUD/USD: $0.7355(A$606mln)

EQUITIES: Mostly Bid In Asia, But There Are Some Exceptions

Chatter of a larger than expected U.S. fiscal impulse generally provided support for equities in Asia-Pac hours, although the space was mainly higher before the headlines hit as participants looked to the positive lead from Wall St.

- NASDAQ 100 e-minis dipped on sensitivity to higher U.S. yields, while the major Chinese indices lost ground as U.S. President Trump tweaked his previous executive order to force the U.S. divestment of shareholdings of companies linked to Chinese military matters (chances of such a move were outlined via press reports in recent days). Note that the deadline for this divestment falls in November and President-elect Biden may choose to roll back the order before the deadline is reached (although, there are lots of unknowns surrounding the issue). Still, the matter outweighed a more positive WSJ report, which noted that "the U.S. government is expected to let Americans continue to invest in Chinese technology giants Alibaba Group Holding Ltd. , Tencent Holdings Ltd. and Baidu Inc."

- Nikkei 225 +0.9%, Hang Seng +0.6%, CSI 300 -1.2%, ASX 200 +0.4%.

- S&P 500 futures +9, DJIA futures +106, NASDAQ 100 futures -3.

GOLD: Blip Lower On U.S. Fiscal Matters, But Little Changed Now

An uptick in the USD and U.S. Tsy yields pressured bullion in Asia-Pac hours, with the move linked to the Biden stimulus chatter that we have flagged elsewhere. Gold has recovered from worst levels and didn't manage to threaten the recent low on the move. Spot last deals ~$5/oz softer on the day at $1,840/oz, with initial support located at the Jan 11 low of $1,817.5/oz. The U.S. fiscal impetus and its impact on U.S. real yields will likely drive bullion in the coming days.

OIL: Tight In Asia

WTI & Brent sit $0.10-0.20 below their respective settlement levels, adding to Wednesday's modest losses. Crude failed to benefit from talk of a larger than expected U.S. fiscal impulse during Asia-Pac hours, with the resultant uptick in the USD and a relatively muted reaction in equities doing little for the space.

- This comes after Wednesday's DoE crude inventory release revealed a sharper than expected headline drawdown, although the dip wasn't as sharp as the API equivalent.

- Wednesday also saw comments from OPEC Secretary General Barkindo as he noted that the worst is now over for the oil market, although he is still focused on stubbornly high crude stocks.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.