-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A$ & NZD Outperform JPY, Aided By Commodity Moves

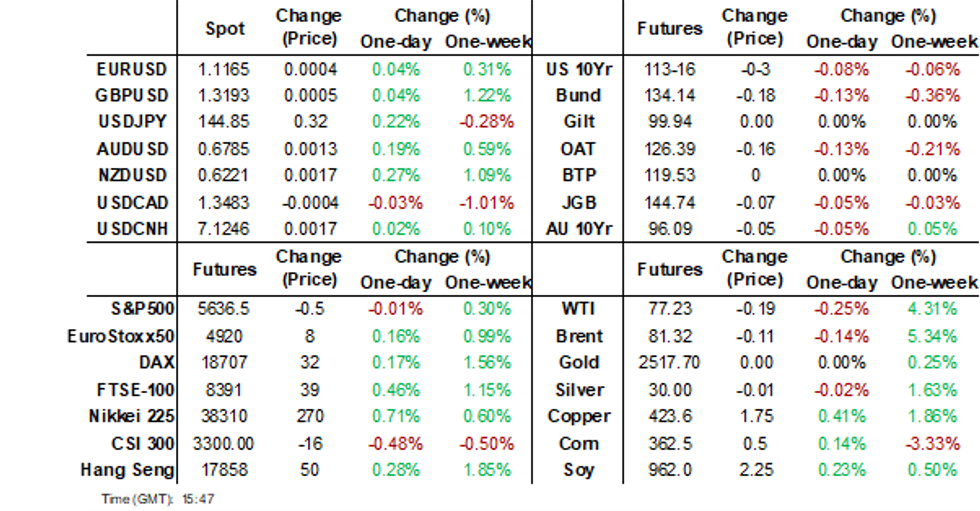

- Oil prices are moderately lower during APAC trading today after rallying strongly since Thursday on Fed cut optimism and geopolitical issues. US Treasury futures have edged slightly lower throughout today's session, although ranges have been tight while volumes have been largely roll based.

- The USD FX index sits little changed in the first part of Tuesday trade. There has been some cross G10 trends, with JPY underperforming the likes of AUD and NZD (aided by some commodity moves), but aggregate moves remain modest at this stage. RBNZ easing expectations have been pared further.

- China Industrial profit growth rose in July to 4.1% yoy, ahead of the prior release of 3.6%. In South Korea, expectations for a slowing economy are to be met via increased government spending in 2025 according to the Finance Ministry release today. Local Bond yields are sharply higher.

- Looking ahead, the second estimate of Q2 German GDP is out. Later there are US house price data and August consumer confidence and Richmond & Dallas activity indices.

MARKETS

US TSYS: Tsys Futures Edge Lower Ahead Of Tsys Auctions

- Treasury futures have edged slightly lower throughout the session, although ranges have been tight while volumes have been largely roll based. TUU4 is - 00+ at 103-10¼, while TYU4 is - 02+ at 113-16+

- Cash treasury yields are flat to 1bp higher, with the 2yr yield +0.1bp at 3.937, while the 10yr yield is trading near yearly lows at 3.824%.

- Fed funds futures are currently pricing in 32bps of cuts for the September meeting, pricing has softened 3-4bps into year-end with 99.5bps of cuts now priced for the December meeting.

- Treasury auction cycle begins later today with $69b 2-year note, while $70b 5-year and $44b 7-year following later in the week, at current levels all three auctions would be the lowest-yielding ones in more than a year.

- Today, we have housing Data, Consumer Confidence, regional Fed data from Dallas and Richmond Fed.

JGBS: Cash Bond Bull Flattener, Light Local Calendar Tomorrow

JGB futures are holding slightly negative, -9 compared to settlement levels, after dealing in a narrow range in today’s Tokyo session.

- Outside of the previously outlined PPI Services data, there hasn't been much in the way of domestic drivers to flag.

- The BoJ is likely to raise interest rates to 0.5% in December from 0.25% amid improvements in inflation-adjusted wages, Okasan Securities economist Ko Nakayama says in a research note. (as per DJ)

- "If the Bank of Japan is becoming more confident about the virtuous cycle of prices and wages, it is likely to raise policy interest rates by 25 basis points every six months, while paying attention to the impact on the markets."

- Cash US tsys are little changed in today’s Asia-Pac session after being slightly richer earlier.

- The cash JGB curve has bull-flattened, with yields flat to 2bps lower. The benchmark 10-year yield is 0.5bps lower at 0.887% versus the cycle high of 1.108%.

- Later today will see an Enhanced-Liquidity Auction for 15.5-39-year OTR JGBs.

- Swap rates are flat to 1bp higher. Swap spreads are wider.

- Tomorrow, the local calendar is empty apart from BoJ Rinban Operations covering 3-25-year+ and Inflation-Indexed JGBs.

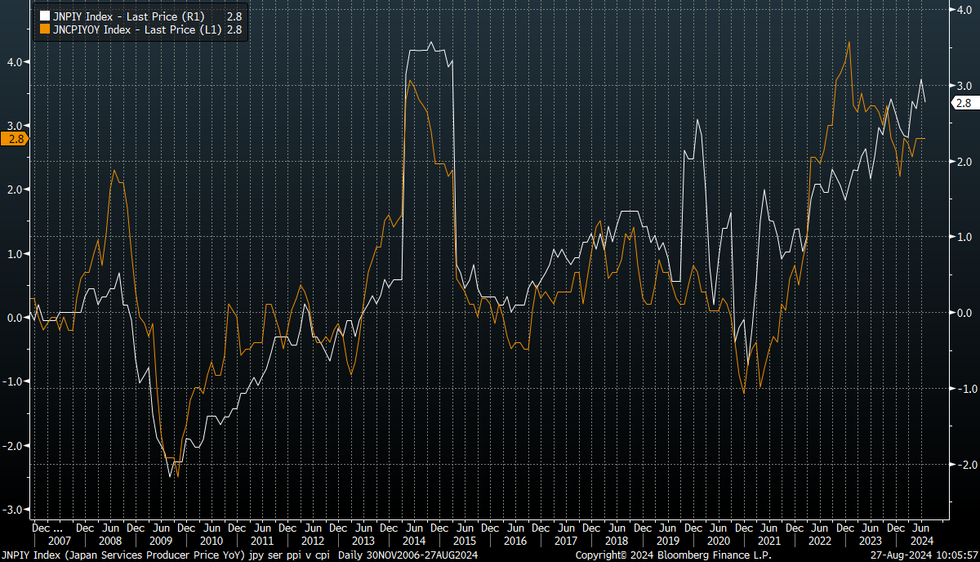

JAPAN DATA: Services PPI Slightly Below Forecasts But Still Elevated By Historical Standards

Japan's PPI for services printed slightly below forecasts for July. We came in at 2.8%y/y versus 2.9% projected by the consensus. The June rise was revised up to a 3.1% gain (originally reported as a 3.0% rise).

- Despite the loss of y/y momentum the m/m rise still accelerated to 0.3% from 0.1% in June. Given the y/y trajectory from last year though, base effects may still see y/y services PPI momentum wane as we progress through H2 of this year.

- The chart below plots the services PPI y/y versus national headline CPI in y/y terms. PPI services inflation remains elevated by historical standards, although the correlation with headline CPI is not as strong as it has been in the past.

- Note on Friday this week we get the August Tokyo CPI print.

Fig 1: Japan PPI Services & National CPI Y/Y

Source: MNI - Market News/Bloomberg

RBA: RBA Rate Cut Expectations Delayed Until Well Into 2025

In August RBA Governor Bullock clearly said that it is too early to discuss rate cuts and while the Board isn’t “ruling anything in or out”, current conditions do not warrant a “near-term” easing. Forecasters have shifted out their rate cut expectations with few now projecting one before year end and Bloomberg consensus has one 25bp in Q1 2025 with 85bp by end-2025. However, our policy reaction function, now with the core inflation gap, still estimates rates trending higher.

- Bloomberg consensus has only 5bp of easing in Q4 2024 followed by 20bp in Q1 2025 compared with the current rate of 4.35%. There’s a full 25bp in Q2 2025. Many analysts don’t expect the first cut until Q2 2025, while in contrast the market has 25bp of easing priced in by end-2024.

Source: MNI - Market News/Bloomberg

- In the FY25 budget the federal government announced cost-of-living measures, which temporarily reduces headline inflation for the year from July, especially the energy rebate. July CPI data is released August 28.

- The RBA has said that it will look through the transitory reduction in inflation and focus on the underlying trimmed mean. As a result, we have re-estimated our simple RBA policy reaction function with the core inflation gap.

- Economic fundamentals suggest that rates should be only around 5bp higher in Q3 than they currently are but then almost 40bp higher by end-2025. This is around 15bp more than the original equation, which continues to use the RBA’s May forecasts, as not only does the core inflation gap have a larger coefficient but it is forecast to be 0.1pp higher in Q4 2025.

Source: MNI - Market News/Refinitiv

AUSSIE BONDS: At Sydney Session Cheaps, CPI Monthly Data Due Tomorrow

ACGBs (YM -4.0 & XM -3.5) are weaker and near session cheaps on another data-light Sydney session.

- The highlight of the local calendar this week comes tomorrow in the form of July CPI Monthly data. July CPI data is expected to ease to 3.4% y/y from 3.8% but won’t include an update of most services components. This outcome requires the CPI to fall on the month. The moderation is expected to be driven by lower food inflation and an outright fall in petrol prices, as well as government cost-of-living measures.

- Q2 Construction Work Done is also due for release tomorrow.

- Cash US tsys are flat to 1bp cheaper in today’s Asia-Pac session after being slightly richer earlier.

- Cash ACGBs are 5-6bps cheaper, with the AU-US 10-year yield differential at +9bps.

- Swap rates are 3-4bps higher, with EFPs tighter.

- The bills strip is slightly cheaper, with pricing -2 to -4.

- RBA-dated OIS pricing is flat to 4bps firmer across meetings, with Aug-25 leading. A cumulative 25bps of easing is priced by year-end.

- Tomorrow, the AOFM plans to sell A$800mn of the 3.50% 21 December 2034 bond. There is a planned sale of A$700mn of the 2.75% 21 November 2029 bond on Friday.

NZGBS: Closed On A Weak Note, NZ-US 10Y Diff Too Wide

NZGBs closed on a weak note, with benchmark yields 4-5 bps higher. With the domestic calendar empty today, the move reflects the cheapening in US tsys over the past 24 hours.

- The NZ-US 10-year yield differential currently stands at +40 bps, up from its late July low of +14 bps, which was the narrowest level since late 2022. Before this, the differential had fluctuated between +20 and +80 bps since late 2022.

- The recent widening of the 10-year yield differential aligns with an increase in the NZ-US 1Y3M spread. However, a simple regression analysis over the current tightening cycle suggests that the 10-year yield differential is about 14 bps wider than fair value, which would be +26 bps instead of the current +40 bps.

- Swap rates closed 3-5 bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-7 bps firmer across meetings. A cumulative 73 bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Filled Jobs data ahead of ANZ Business Confidence on Thursday, and ANZ Consumer Confidence and Building Permits on Friday.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 4.50% May-30 bond, NZ$200mn of the 4.50% May-35 bond and NZ$50mn of the 2.75% May-51 bond.

NZGBS: NZ-US 10Y Differential Too Wide

The NZ-US 10-year yield differential currently stands at +36 bps, up from its late July low of +14 bps, which was the narrowest level since late 2022. Prior to this, the differential had fluctuated between +20 and +80 bps since late 2022.

- The recent widening of the 10-year yield differential aligns with an increase in the NZ-US 3-month swap rate 1-year forward (1Y3M) spread.

- However, a simple regression analysis over the current tightening cycle suggests that the 10-year yield differential is about 10 bps wider than fair value, which would be +26 bps instead of the current +36 bps.

- It's important to note that the regression error was approximately +20 bps in mid-August, indicating some variability in the relationship.

- The 1Y3M differential is a proxy for the expected relative policy path over the next 12 months.

Figure 1: NZ-US Cash 10-Year Yield Differential (%) Vs. Regression Fair Value (%)

Source: MNI – Market News / Bloomberg

NZD STIR: RBNZ Dated OIS Continues To Pare Expected Easing

RBNZ dated OIS pricing closed 1-7 bps firmer across meetings today.

- The market is now anticipating 32 bps of easing at the next meeting, with a total of 73 bps expected by November.

- This is a shift from August 16, when the market was pricing in 39 bps of easing by October and 82 bps cumulatively by November.

- Looking further ahead, mid-2025 meetings still price in around 175 bps of easing, though this is about 20 bps less than in mid-August.

Figure 1: RBNZ Dated OIS Post-RBNZ Versus Pre-RBNZ Levels (%)

Source: MNI – Market News / Bloomberg

FOREX: Yen Lags A$, NZD Amid Higher Commodities, But Aggregate Moves Modest

The USD BBDXY index sits little changed in the first part of Tuesday trade, last near 1226.6. There has been some cross G10 trends, with JPY underperforming the likes of AUD and NZD, but aggregate moves remain modest at this stage.

- USD/JPY was weaker in the first part of trade, but support was seen at lows in the 144.20/25 region. We last tracked near 144.70. On the topside we have been unable to break above 145.00.

- Cross asset wise, US yields are closed to unchanged, with US equity futures displaying a similar backdrop. Regional equities have been mixed, with HK/China slightly softer.

- A firmer commodity backdrop, with oil retaining most of its Monday gain, and firmer metals may be lending some support to the likes of AUD/ AUD/USD is up 0.15%, last 0.6780/85. This leaves us close to key resistance near 0.6800.

- NZD/USD is slightly firmer, last near 0.6220, but short of recent highs close to 0.6240.

- On the data front Japan services PPI was a touch weaker than projected, but market reaction at the time was minimal. China profits data was above the June outcome in y/y terms, but again market impact was negligible.

- Looking ahead, the second estimate of Q2 German GDP is out. Later there are US house price data and August consumer confidence and Richmond & Dallas activity indices.

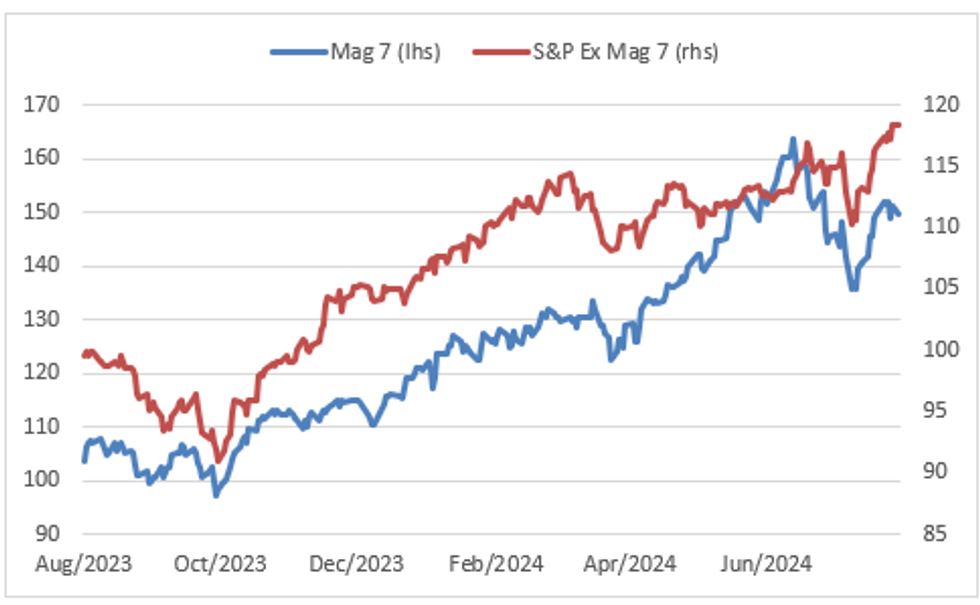

ASIA STOCKS: Asian Equities Weigh Down By Weaker Tech Prices

Asian equities fell today, driven by weakness in major tech stocks ahead of Nvidia's earnings report, with concerns over artificial intelligence demand and disappointing results from Chinese e-commerce firm PDD weighing on sentiment. The MSCI Asia Pacific Index declined, led by losses in Hong Kong, mainland China, Taiwan, and South Korea. Meanwhile, the growing chances of an upcoming US rate cuts and a weaker dollar provided some support, especially for Japanese equities, which benefited from a firmer yen with small-cap stocks performing the best. Overall, markets are in consolidation mode after recent gains, with attention focused on upcoming corporate earnings and central bank actions.

- Japanese equities traded mixed today, with modest gains in small-cap and domestic-oriented firms driven by a stronger yen, which shifted investor focus towards local companies like retailers and information-system vendors. While the broader Topix Index outperformed, blue-chip stocks in the Nikkei 225 faced some pressure, reflecting a rotational trade within the market. Investor sentiment was cautious overall, as the broader Asian market struggled due to weakness in technology stocks and concerns over slowing demand in the artificial intelligence sector ahead of Nvidia's earnings report. Despite these concerns, Japan’s market showed relative resilience, supported by expectations of U.S. Federal Reserve rate cuts, which could benefit Japanese companies with a stronger yen and more stable economic outlook.

- Taiwanese equities declined, led by losses in technology stocks as concerns over the sustainability of artificial intelligence demand weighed on the market. Companies like TSMC were among the biggest drags (-0.75%), reflecting broader caution in the tech sector ahead of Nvidia’s highly anticipated earnings report. Investors are also cautious due to mixed signals from global markets, with the potential for U.S. rate cuts providing some support but not enough to offset worries about slowing growth in key sectors. The Taiex is currently down 0.46%.

- South Korean stocks fell, driven by weakness in semiconductor and technology shares, mirroring declines in global tech markets. Concerns about the future demand for AI-related products, coupled with a broader tech sell-off, pressured key companies like Samsung (-0.26%) and SK Hynix (-3.10%). the KOSPI is 0.35% lower, while the KOSDAQ is down 0.50%

- Australian equities are slightly lower today with strong performances in the mining and energy sectors in particular BHP and Woodside Energy leading the gains. Woodside advanced over 4% after reporting first-half net income that exceeded analyst expectations while BHP shares also rose by as much as 2.7%, buoyed by better-than-expected underlying profit and a robust dividend, gains have been offset by losses in financials. New Zealand equities are down 1% with healthcare contributing the most to the loses.

- In Asia EM, Indonesia's JCI is down 0.60%, Thailand's SET is down 0.05%, Singapore Straits Times is down 0.30%, while Malaysia's KLCI is 0.70% higher and Philippines PSEi is 0.30% higher.

ASIA TECH STOCKS: Asia Tech Stocks Lower As PDD's Growth Slows, Nvidia Earnings

- Asian tech stocks have fallen today with weak expected sales from Temu's owner PDD weighing on the market, although there has been a small bounce over the past 30 mins. While investors have also been looking to book profits ahead of Nvidia's earnings due out later this week, if we look South Korea's intraday equity flows, investors have been selling tech stocks although the speed of which has slowed over the past few hours, there has currently been about $80m of outflows in tech stocks today from the region.

- CSI 300 Tech Index is down 1.46%, HSTech Index is down 0.60% while BBG APAC DM Tech Index is down 0.55%, all just off session lows.

- If Nvidia's supplier TSMC earnings are anything to go by, we should see some positive positive numbers after TSMC's revenue beat estimates by 2.34%, EPS beat estimates by 5% while EBITDA beat estimates by 3.45%.

- Overnight PDD Holdings the owner of Temu fell almost 30% following weaker-than-expected sales, which also hurt the likes of Alibaba & JD.com

- The S&P minus the magnificent 7 hit continues to hit new records highs, while the Magnificent 7 are still trading 8.4% off all time highs.

ASIAN EQUITY FLOWS: Asian Tech Stocks See Selling Ahead Of Nvidia's Earnings

- South Korea: South Korea experienced an outflow of $430m on Monday, leading to a net outflow of $473m over the past five trading days. Year-to-date, however, the country has accumulated substantial inflows totaling $17.38b. The recent 5-day average shows a small outflow of $95m, while the 20-day average shows an outflow of $39m, and the 100-day average inflow is $52m.

- Taiwan: Taiwan recorded an outflow of $286m on Monday, contributing to a net inflow of $110m over the past five trading days. Despite the recent inflows, year-to-date, Taiwan has seen outflows totaling $8.08b. The 5-day average shows a modest inflow of $22m, while the 20-day average indicates an outflow of $117m, and the 100-day average shows an outflow of $128m.

- India: India saw a significant inflow of $463m on Friday, leading to a net inflow of $904m over the past five trading days. Year-to-date, India has accumulated inflows totaling $2.56b. The 5-day average inflow is $181m, while the 20-day average shows an outflow of $82m, and the 100-day average remains slightly negative at $10m.

- Indonesia: Indonesian equities recorded an inflow of $60m on Monday, contributing to a net inflow of $554m over the past five trading days. Year-to-date, Indonesia has accumulated inflows totaling $918m. The 5-day average inflow is $111m, with a 20-day average inflow of $50m, although the 100-day average shows a small outflow of $8m.

- Thailand: Thailand experienced an inflow of $16m on Monday, contributing to a net inflow of $150m over the past five trading days. Year-to-date, Thailand has seen outflows amounting to $3.47b. The 5-day average shows an inflow of $30m, while the 20-day and 100-day averages reflect outflows of $9m and $15m, respectively.

- Malaysia: Malaysia recorded a small inflow of $1m on Monday, contributing to a net inflow of $190m over the past five trading days. Year-to-date, Malaysia has seen inflows totaling $350m. The 5-day average inflow is $38m, while the 20-day average shows a modest inflow of $14m, and the 100-day average reflects a small inflow of $5m.

- Philippines: The Philippines market has been closed for the past two sessions for public holidays, the past five trading sessions have seen a net inflow of $124m. Year-to-date, the Philippines has experienced outflows totaling $362m. The 5-day average inflow is $25m, aligning with the 20-day average inflow of $4m, but the 100-day average still reflects an outflow of $6m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -430 | -473 | 17382 |

| Taiwan (USDmn) | -286 | 110 | -8078 |

| India (USDmn)* | 463 | 904 | 2557 |

| Indonesia (USDmn) | 60 | 554 | 918 |

| Thailand (USDmn) | 16 | 150 | -3467 |

| Malaysia (USDmn) | 1 | 190 | 350 |

| Philippines (USDmn)** | 41 | 124 | -362 |

| Total | -136 | 1559 | 9300 |

| * Up to Date 23-Aug-24 | |||

| ** Up to 22nd Aug (Public Holidays) |

OIL: Crude Retains Most Of Recent Gains As Supply Uncertainty At The Fore

Oil prices are moderately lower during APAC trading today after rallying strongly since Thursday on Fed cut optimism and geopolitical issues. WTI is down 0.3% to $77.17/bbl off the intraday low of $76.85, and Brent is 0.2% lower at $81.25 following a trough of $80.92. The USD index is flat.

- Focus has now shifted to the supply side with developments in Libya, tensions between Iran and Israel, a tanker adrift in the Red Sea after Houthi strikes and low US inventories. Industry data is out later today with official EIA numbers on Wednesday. A Reuters’ poll is forecasting another drop in US EIA stocks.

- Libya’s eastern government in Benghazi closed its oil fields and halted exports to protest the government in Tripoli’s control of the central bank, which manages the country’s oil revenues. If there is another civil war, Libyan oil output could fall to zero. It is currently 1mbd down from 1.18mbd in July. All but one of the major fields are in eastern Libya.

- Later there are US house price data and August consumer confidence and Richmond & Dallas activity indices. There is also the second estimate of Q2 German GDP.

GOLD: Choppy Start To Week

Gold is 0.4% lower in today’s Asia-Pac session. This comes after both spot gold and silver largely ignored the moderate uptick for the US dollar yesterday. Bullion traded 0.2% higher, extending Friday’s rally.

- Gold’s underlying bullish trend saw the yellow metal print fresh all-time highs last week.

- Yesterday US Treasuries largely consolidated their move richer following Chair Powell’s Jackson Hole speech ahead of the weekend. With little on the data docket until Thursday's claims data, the market took a breather.

- SF Fed Daly sounded a little more cautious over the pace/size of rate cuts while generally echoing Chairman Powell's "the time is now" opinion from Jackson Hole.

- Lower rates are typically positive for gold, which doesn’t pay interest.

IRON ORE: Rebound Close To Late June/July Bounce In Percentage Terms, Broader Metal Gains Helping

The active iron ore contract has continued to recover in the first part of Tuesday trade. We were last at $101.65/ton just off session highs ($101.85/ton). This puts the correction from recent lows beyond 10%. Interestingly, the late June to early July correction was of similar magnitude (albeit based at higher levels). This bounce ran out of steam with a +11% gain.

- The current episode looks to reflect positive spill over from gains elsewhere in the metals space, which are also up strongly from recent lows.

- Receding global recession fears are a positive in this context. Onshore positives are from further rises in local steel futures, while carry over from lower inventory levels at China ports (from the end of last week) may also be helping sentiment.

- China profits data was firmer earlier, although onshore equities remain weak. Property sub-indices are threatening fresh multi month lows.

- The next local data focus will Saturday's official PMI prints for August.

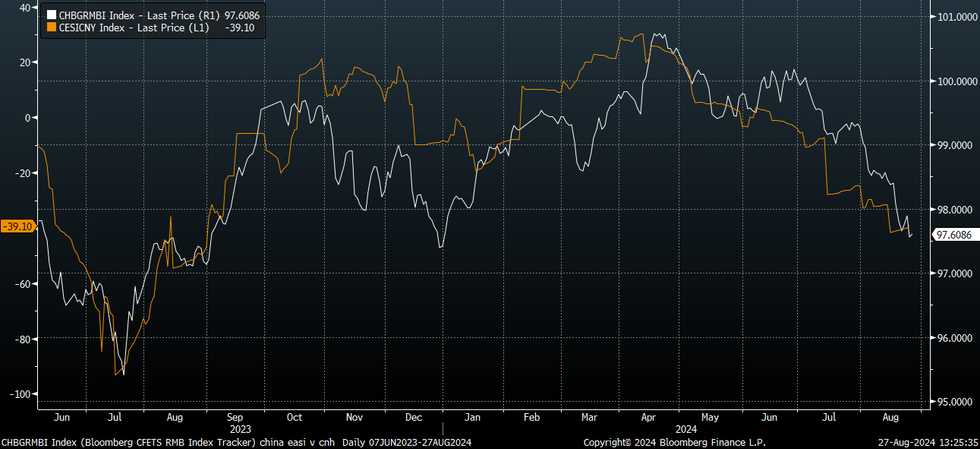

CNH: USD/CNH Edges Higher, But Basket May Remain The Preferred Play For Yuan Underperformance

USD/CNH sits slightly firmer for the session, last near 7.1270. We saw an earlier move above 7.1300, post the higher than forecast USD/CNY fixing, but that move had no follow through. USD/CNY spot is a little higher as well, but there is little basis between onshore and offshore spot at this stage.

- Earlier data showed July industrial profits at 4.1% y/y, versus 3.6% prior. Profit growth is holding up reasonably well, albeit down from H2 2023 levels.

- This goes against the grain of generally softer data outcomes. The Citi China economic surprise index is close to lows going back to September last year.

- The chart below overlays this index against the CNY CFETS basket tracker. Downside data surprises have generally led to CNY basket underperformance in recent months. The latest Bloomberg consensus survey for China showed a slight downtick in 2024 growth expectations to 4.8%, sub the government's 5% target.

- The still challenging growth backdrop suggests yuan weakness on crosses or in basket terms may be the preferred way to play yuan underperformance. Broader USD/CNH trends may be dictated by the Fed outlook.

- Next up on the data front will be official PMI prints for August, out this Saturday.

Fig 1: China Citi Economic Surprise Index Versus CNY CFETS Tracker (BBG)

Source: CITI/MNI - Market News/Bloomberg

CHINA DATA: Industrial Profits Surprise

- Industrial profit growth rose in July to 4.1% yoy, ahead of the prior release of 3.6%.

- From January to July this year, profits increased 3.6% to CNY4.09tn.

- Whilst export data for July showed they were moderating; overseas orders continue to support industrial profits.

- With protectionism from the US and elsewhere continuing to hang over the Chinese economy (note tariffs on EV from EU and Canada), this release going forward will provide valuable insight as to the financial performance of companies in China.

- The challenges for industrial profits domestically remain the same the malaise in the property market continues to be an overhang for the Chinese economy.

SOUTH KOREA: Government Spending Up in 2025 to support the consumer

- Expectations for a slowing economy are to be met via increased government spending in 2025 according to the Finance Ministry release today.

- Spending to reach KRW677.4tn – a 3.2% increase from 2024’s budget.

- 6.2 trillion won in low-interest loans to companies developing semiconductors, batteries and biotechnology, the Finance Ministry release said.

- The Bank of Korea forecasts GDP growth to moderate to 2.1% next year from 2.4% this year.

- South Korea’s debt-to-gross domestic product ratio would edge up to 48.3% next year from 47.4% this year if the budget proposal is approved, according to the Finance Ministry. The government projects this ratio at 50.5% by 2028.

- South Korea’s benchmark 10-year government bond jumped 6bps in yield this morning to trade at 3.044%

SOUTH KOREA BONDS: Bond Wrap

- Retail sales decline to 6.3% from 11.1% prior.

- South Korea Seeks KRW201.3tn bond sales in 2025 vs KRW158.4tn in 2024 to fund fiscal expansion.

- Bonds reacting immediately to selling off across intermediate and longer maturities.

- 10-year the underperformer on the curve.

2yr 3.109% (+2bp) 5yr 3.207% (+4bp) 10yr 3.079% (+8.5bp) 30yr 2.982% (+7.5bp)

ASIA FX: USD/Asia Pairs Firmer But Away From Session Highs

USD/Asia pairs are mostly higher in the first part of Tuesday trade, albeit away from session highs. Yen losses and a mixed regional equity backdrop have been headwinds. Still, aggregate moves have been fairly modest. At this stage the largest losses are in the 0.20-0.30% range. Also note, Thailand customs trade data prints in a little while.

- USD/CNH remains within recent ranges. The pair got above 7.1300 briefly post another stronger than expected USD/CNY fixing, but this proved to be fleeting. The pair last near 7.1225, little changed for the session. July profits data was better than the June outcome, but his hasn't lifted local equity market sentiment. Poor tech earnings has weighed, the CSI 300 off last 0.60%.

- Spot USD/KRW remains close to the mid point of recent ranges, last near 1330. Local equities have struggled to gain traction above the 2700 level, while outflows from offshore investors continue. Weaker spending data points to BoK easing risks, but comments this afternoon from the BoK Governor (*BOK RHEE: AUG. 22 DECISION MEANT AS WARNING ON HOUSEHOLD DEBT" - BBG), suggest a near term rate cut may not materialize. The government is ramping up 2025 fiscal spending to support the economy.

- USD/IDR has firmed with a less supportive global equity/risk backdrop. We were above 15500 in the first part of trade, but now sit back at 15470, still around 0.25% weaker in IDR terms. Finance Minister and Bank Indonesia Governor to speak at parliament meeting on 2025 state budget planning today.

- USD/PHP sits slightly lower for the session, last near 56.26. Earlier lows were just under 56.20, levels last seen in early April of this year. PHP is the only Asia FX currency up in spot terms today, although this largely reflects catch up as yesterday onshore markets were closed. The technical backdrop for USD/PHP remains skewed to the downside. The cautionary point is that the pair is oversold based off RSI (14), which has been the case for a number of weeks now. PHP has been a laggard within South East Asia FX, as we noted last week, so come catch up may be aiding local FX sentiment.

- USD/MYR firmed to 4.3550 in early trade, versus the Monday close of 4.3488. We have since drifted a little lower, but remain above 4.3500.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/08/2024 | 0600/0800 | *** |  | DE | GDP (f) |

| 27/08/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/08/2024 | 0600/0800 | ** |  | SE | PPI |

| 27/08/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/08/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/08/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/08/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/08/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/08/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.