-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A Tame Start To The Year Of The Ox, Tsys Stabilise, DXY Marginally Higher

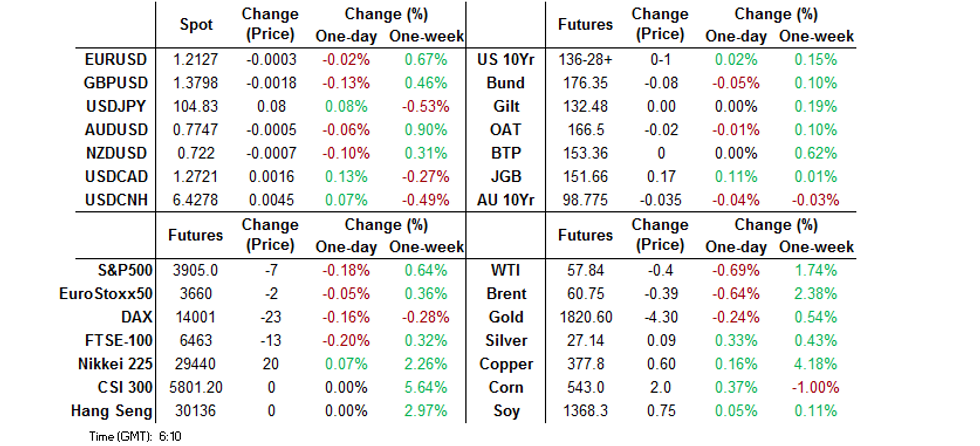

- Thin LNY trade in Asia saw U.S. Tsys stabilise after Thursday's cheapening, while FX trade saw the DXY marginally higher.

- Continued positive political developments witnessed in Italy.

- Sino-U.S. Tensions & consistent Fed messaging also noted.

BOND SUMMARY: Mixed Core FI Trade In Asia

Little to flag for the U.S. Tsy space in Asia-Pac hours given the ongoing LNY holidays, with a very light bid creeping in as e-minis ticked lower. T-Notes last +0-00+ at 136-28, within a 0-03+ range, aided by a couple of 1.5-2.0K lifts in TYH1 (as we have flagged). Light bull flattening has been seen in the cash space, with 30s sitting ~1.0bp richer on the day. There has been little in the way of notable headline flow, although the Australian state of Victoria has gone into a 5-day circuit breaker lockdown after < 20 COVID cases became apparent in the state, while there are questions re: the appropriateness of planning surrounding the next stage of the UK's COVID vaccine drive. Domestically, the latest U.S. daily new COVID case count rose back above 100K for the first time this week. None of these headlines are deemed to be gamechangers, but are incrementally negative. UoM sentiment data headlines a slim local docket ahead of the elongated U.S. holiday weekend.

- JGB futures oscillated around the closing levels posted at the end of the pre-holiday overnight session, finishing +17, with the 5-10 Year zone of the curve outperforming, firming by ~2.0bp, while the super-long end lagged. Economy Minister Nishimura stressed that it is necessary for the state of emergency to be maintained across 10 areas of Japan, as was flagged in recent days. Elsewhere, Finance Minister Aso reiterated the broader policymaker view re: the Japanese economy. The broader firming was also aided by several recent press reports which suggested that the BoJ's monetary policy review will note that the Bank has space to cut interest rates further into negative territory, if required. This message is not new, although there may be a slight tweak in the language employed, which could be part of a balancing act as the BoJ looks set to promote broader flexibility re: monetary policy matters to elongate the sustainability of ultra-loose monetary conditions.

- YM -0.5, XM -3.5 at the close, while cash ACGBs were steeper and swaps narrowed vs. ACGBs across most of the curve, with the impetus from Thursday's NY U.S. Tsy trade spilling over and holding. Elsewhere, some SSA issuance pricing was seen (A$200mn tap of KfW's Sep '26 A$ line). The AOFM's weekly issuance schedule provided another atypical round of issuance, with a wider spread of maturities set to be offered over 3 auctions next week (see earlier bullet for details). Today's ACGB supply was easily digested. Looking to next week, outside of the aforementioned AOFM supply and usual RBA ACGB purchases, markets will focus on the local labour market report and meeting minutes from the RBA's Feb decision, although a deluge of post-decision RBA rhetoric has limited the potential for any notable surprises.

FOREX: Caution Creeps In, Asia Celebrates LNY

A sense of caution crept into G10 FX space in holiday-thinned trade, with macro flow subdued owing to a number of market closures across Asia. Crude oil prices softened a tad, applying a modicum of pressure to commodity-tied FX & pushing NOK to the bottom of the pile. AUD slipped as Victoria entered a five-day snap lockdown.

- GBP traded on a weaker footing amid resurfacing concerns over the ramifications of Brexit and a broader risk-off feel.

- DXY edged higher as the greenback outperformed its peers from the G10 basket. USD/JPY held a tight range and last trades at Y104.79, with $3.6bn worth of options with strikes at Y104.85-105.00 due to expire at the NY cut.

- Today's economic docket features flash quarterly GDP report & monthly economic indicators out of the UK, flash U.S. U. of Mich. Survey and Norwegian GDP.

FOREX OPTIONS: Expiries for Feb12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-05(E1.0bln), $1.2040-50(E550mln), $1.2060-70(E751mln), $1.2095-00(E573mln), $1.2110-25(E1.3bln), $1.2165-80(E1.8bln), $1.2195-10(E899mln), $1.2250-55(E538mln)

- USD/JPY: Y103.00-05($737mln), Y103.50-60($1.3bln), Y103.85-90($768mln), Y104.00-20($1.6bln), Y104.50($512mln), Y104.85-105.00($3.7bln), Y105.25-35($840mln), Y105.40-50($655mln), Y106.00-10($2.1bln), Y106.30-35($1.0bln)

- GBP/USD: $1.3850(Gbp1.0bln-GBP puts)

- EUR/GBP: Gbp0.8700(E607mln-EUR puts)

- AUD/USD: $0.7620-30(A$1.1bln), $0.7700-10(A$1.1bln), $0.7720-35(A$1.4bln), $0.7750-70(A$955mln)

- USD/CAD: C$1.2675-80($672mln), C$1.2715-25($625mln)

- USD/MXN: Mxn20.00($1.1bln-USD puts), Mxn20.30($510mln)

ASIA: Lunar New Year Holiday Regional Exchange Schedules

Selected Asia-Pac exchange Lunar New Year holiday schedules can be viewed below:

EQUITIES: Negative Day

Volumes remain thin in the Asia time zone with many participants observing LNY, those markets that are open trade in the red. Japan return after a holiday yesterday, the Nikkei 225 opened higher but has lost ground as the session wore on. The ASX 200 is also lower, weighed on by the announcement of a five-day lockdown in Victoria after a cluster of cases and losses across the commodity complex.

- In the US the S&P 500 closed in minor positive territory yesterday, futures are slightly lower in Asia today as negative sentiment prevails, US markets are closed on Monday for President's Day.

GOLD: Softer, But Rangebound

Gold has moved lower over the last 24 hours or so, with a modest uptick in the DXY and nudge higher in longer dated U.S. real yields seen, but remains confined to the recent range after the 50-day EMA capped on Wednesday. Spot last deals just above $1,820/oz.

OIL: Profit Taking Seen After Rally

Crude futures are heading into Europe on a negative note on Friday; WTI & Brent sit ~$0.40 lower on the day. If the benchmarks end on in the red, it will be the second consecutive day of losses after eight sessions of gains.

- Uncertainty over future demand is putting downward pressure on oil, the IEA reduced its 2021 global demand forecast by 200k bpd. This is the fourth straight month the IEA has lowered its demand outlook, citing the challenges the world is having in reining in COVID-19. It also increased estimates for non-OPEC supply by 400k bpd.

- OPEC's outlook, released shortly after the IEA's, painted a different picture. The group raised its estimate of 2021 global oil demand from last month, saying growth in the second half of 2021 will be supported by massive stimulus programs.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.