-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: Another Uptick In COVID Cases Weighs On Chinese Equities

- The BBDXY oscillated between gains and losses as most major FX crosses treaded water, with the greenback last sitting atop the G10 pile, virtually on a par with the yen in terms of today's performance. Key U.S. risk events drew nearer, with all eyes on the midterm elections and monthly CPI data.

- Asia Pac equities have been mixed today. Tech sensitive markets have outperformed, while China/HK stocks have faltered somewhat. US equity futures have traded tight ranges overall, currently close to flat across the major indices, ahead of mid-term elections in the US this evening.

- EZ retail sales and comments from ECB's Nagel & Wunsch, BoE's Pill & Riksbank's Breman will take focus after Asia-Pac hours.

US TSYS: Modest Downtick In Asia

Cash Tsys run 0.5-1.5bp cheaper at typing, with intermediates leading the weakness. TYZ2 is -0-02+ at 109-18, 0-04 off the base of its 0-09 range on solid volume of ~95K. TY futures failed to test initial technical support in the form of Friday’s low during Asia dealing.

- Screen-based sales in TY futures helped Tsys to cheapest levels of the session, with the move facilitated by news that Macau is to ease entrance rules for foreigners from Nov. 13.

- Some participants were leaning on the idea that this points towards an eventual loosening of ZCS restrictions in mainland China given recent speculation surrounding that matter. However, some caveats around the Macau headlines that were a little more restrictive than the initial headline suggested limited the move lower in Tsys.

- A fresh downtick in Chinese equities during early afternoon trade (that move was initially aided by another multi-month high for new Chinese COVID cases) allowed Tsys to stabilise off of lows into European hours.

- Antipodean FI dynamics had provided some cheapening pressure earlier in the session.

- Tuesday’s NY slate includes the release of NFIB small business optimism data, as well as 3-Year Tsy supply. Further out, the results from the mid-terms (with opinion polls pointing to the GOP taking the House, and maybe the Senate) and the CPI print provide this week’s key domestic risk events.

JGBS: Light Steepening Pressure, Prefecture Cancels Plans To Issue Long Bond

The major cash JGB benchmarks are mostly little changed on the day, with a slightly more pronounced round of cheapening observed in 20s, resulting in some light steepening of the curve. This came after some pressure for wider core global FI markets on Monday & during Tuesday’s Asia-Pac session. Futures have softened during the afternoon, but remain relatively contained, -10 ahead of the bell.

- BoJ Rinban operations covering 1- to 25-Year JGBs didn’t provide any tangible market impact.

- Fiscal speculation continued in Japan, with source reports doing the rounds re: adjustments to tax structures, alongside continued reports surrounding bond issuance to finance the government’s latest fiscal support package, although these headlines were not market moving.

- Participants also looked through the summary of opinions covering the latest BoJ monetary policy meeting.

- Shizuoka prefecture cancelled its plans to sell 20-Year paper owing to market conditions & the rise in super-long yields This comes after the prefecture cancelled plans to sell 30-Year paper back in September.

- Wednesday’s domestic docket consists of the release of the release of the latest economy watchers survey, BoP data and 30-Year JGB supply.

AUSSIE BONDS: Syndication & Global Forces Weigh

YM finished -14.0, with XM -13.0, as the contracts went out just off their respective late Sydney lows. Cash ACGBs saw 12.5-14.5bp of cheapening, with 5s leading the weakness.

- Futures extended on overnight weakness in early Sydney dealing as Asia-Pac participants reacted to Monday’s cheapening in core global FI markets and made room for today’s ACGB May-34 syndication.

- A$14.0bn of the new ACGB May-34 priced, which was probably a little smaller in size than many expected (there was plenty of demand apparent, with A$42.4bn of orders received at the final clearing price).

- Still, XM futures only saw a modest uptick from lows after hedging flows surrounding the syndication subsided.

- Another multi-month high for new COVID cases in China and a soft round of domestic business and consumer confidence data did little to support the space, with a move higher in NZ inflation expectations spilling over, adding a trans-Tasman dimension to the weakness in ACGBs.

- Bills were 1-12bp softer through the reds, with the front end of the reds leading the weakness.

- Peak cash rate pricing in RBA dated OIS nudged a touch higher today, finishing just above 4.10%.

- Looking ahead to Wednesday, the local docket will be headlined by an address from RBA Deputy Governor Bullock, with the topic of “The Economic Outlook” being discussed in front of the ABE annual dinner.

AUSTRALIA: Solid Business Conditions Unlikely To Last, Costs Still Elevated

The October NAB business survey signalled that currently the economy is doing well but that businesses don’t expect that to last. Business conditions remained strong despite falling 1 point to 22 but confidence fell 4 points to 0.2.

- Cost measures for October were mixed and while elevated they were below the Q3 average. Labour costs moderated to 2.7% from 3.1% last month, as the impact of the minimum wage hike faded. Final product prices were stable at 2% but purchase costs rose to 4.1% from 3.7%. Retail prices also rose to 3% from 2.3%, but that is still below the readings seen over the middle part of the year. These figures may be suggesting a peak in CPI inflation ahead but are still consistent with further rate hikes, as signalled by the RBA.

- While business conditions were the second highest recorded this year, after September, business confidence was the lowest and below the long-run average, suggesting that global uncertainty and tightening monetary policy are weighing on the demand outlook. Forward orders fell to 7.3 from 14, which is still a solid level.

- The trading conditions and employment components moderated but remain elevated while profitability rose slightly. The retail sector also saw a deterioration in conditions but they remain robust.

Source: MNI - Market News/Refinitiv/NAB

NAB business confidence vs business conditions

Source: MNI - Market News/Refinitiv/NAB

AUSTRALIA: Very Depressed Consumer Sentiment, Watch Household Data Closely

Despite anecdotes and other consumer series, there was a lot of concerning information in Westpac’s November consumer confidence survey. The index fell 6.9% to 78.0 and -25.9% y/y, as news for consumers and their finances was almost all negative over the month (family finances -11.2% m/m). It is still above the low at the start of the pandemic but is now worse than the depths during the global financial crisis.

- This survey justifies the RBA’s more cautious approach. The details are concerning but other consumer information still points to robust spending and an element of consumers saying one thing and doing another. As such, spending developments warrant close attention.

- Households did not respond well to the October budget and 35% said that it worsened their financial outlook for the next year, above the 30% historical average. The projected 56% increase in energy prices over the next two years and limited cost-of-living relief spooked households.

- Confidence before the RBA announcement on November 1 was steady at 83.1 but fell to 75.6 post the meeting. This reaction was in response to the RBA being clear that hikes will continue as almost 60% surveyed expect rates to rise 1pp over the next year up from 54%.

- 40% of those surveyed said that they would spend less on Christmas this year compared with last. This was not only above the 33% average but also a series high (begins 2009).

- Prices also weighed on sentiment, as petrol price rose 6% last week, Q3 CPI was elevated, the RBA revised inflation higher and flood-related food price rises were widely reported.

- House price expectations fell 8% m/m to a new cyclical low but still above the pandemic and 2018/19 troughs. Responses were a lot lower after last week’s RBA hike falling 13.6%.

Source: MNI - Market News/Westpac

NZGBS: Global Forces & Firmer Inflation Exp. Weigh On NZGBs, RBNZ Pricing Shifts Higher

NZGBs finished 12-13bp cheaper on Tuesday, with Monday’s weakness in core global FI markets, a move higher in domestic inflation expectations and spill over from the presence of notable ACGB supply across the Tasman at the centre of today’s sell off.

- Swap rates mostly tracked the move in NZGBs leaving swap spreads little changed to a touch narrower on the day.

- 2-Year inflation expectations lodged a fresh cycle peak of 3.62%, as the labour market continuing to provide a key source of domestic inflation.

- This print allowed RBNZ dated OIS to move higher, adding to the earlier uptick, with 73bp of tightening priced for this month’s meeting. Pricing for the terminal OCR has moved up to 5.45%, ~20bp above levels seen late on Monday.

- We also saw the reappointment of RBNZ Governor Orr for a second 5-year term, which will start in March ’23. The opposition National Party presented a clear source of dissent, stressing that it was appalled by the fact that the decision was made before the review of the RBNZ was completed.

- Wednesday’s domestic docket will see the release of card spending data, the publication of the RBNZ’s review of monetary policy implementation and an address from RBNZ Assistant Governor Silk (although this comes at the Payments NZ "The Point" conference, with the subject topic limiting the scope for meaningful comments re: monetary policy).

NEW ZEALAND: Rising Inflation Expectations Point To Unchanged RBNZ Stance

The RBNZ’s survey of expectations for Q4 showed a further step up in inflation expectations, especially further out, signalling that they are becoming deanchored. As a result, the RBNZ is likely to maintain its hawkish stance for now.

- Expected annual CPI growth 1-year out rose to 5.1% from 4.9% in Q3 and 2-years out increased to 3.6% from 3.1%. The NZ 2-year swap rate is roughly in line with the move in 2-year ahead expectations (see Figure 1 below).

- The 1-year out measures often leads CPI inflation and suggests that it is unlikely to moderate over the coming quarters (see Figure 2 below).

- While monetary conditions are perceived to tighten this quarter and next, some slight easing is expected in 12-months.

Figure 1: NZ 2-year ahead inflation expectations vs 2-yr swap rate

Source: MNI - Market News/Bloomberg/RBNZ

Figure 2: NZ 1-year ahead inflation expectations vs CPI y/y%

Source: MNI - Market News/Refinitiv/RBNZ

FOREX: G10 FX Space Sees Little Action With Key U.S. Risk Events Ahead Stealing Limelight

The BBDXY oscillated between gains and losses as most major FX crosses treaded water, with the greenback last sitting atop the G10 pile, virtually on a par with the yen in terms of today's performance. Key U.S. risk events drew nearer, with all eyes on the midterm elections and monthly CPI data.

- The Aussie dollar showed a muted reaction to weak domestic outturns for consumer and business confidence. Westpac Consumer Confidence fell to 78.0 (prev. 83.7), while NAB Business Confidence slipped to 22 (prev. 25) amid higher interest rates and elevated inflation.

- New Zealand's inflation expectations rose across the board in the RBNZ's Q4 Survey of Expectations, cementing the case for continued aggressive monetary tightening. The data saw participants add hawkish central bank bets, with ~71bp worth of OCR hikes priced for this month's monetary policy review. The reaction in NZD/USD was limited to a brief knee-jerk higher.

- AUD/NZD trades slightly below neutral levels, having clawed back the bulk of losses registered on the back of New Zealand's inflation expectations data. AU/NZ 2-Year swap spread was heavy, weighing on spot AUD/NZD.

- Spot USD/CNH is poised for a bullish inside day, as a 6-month high in China's COVID-19 case count applying some pressure to the yuan. The PBOC fix returned to a stronger bias after a pause yesterday.

- EZ retail sales and comments from ECB's Nagel & Wunsch, BoE's Pill & Riksbank's Breman will take focus after Asia-Pac hours.

FX OPTIONS: Expiries for Nov08 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E1.1bln), $0.9950(E603mln), $0.9970-85(E1.3bln), $1.0000(E922mln)

- AUD/USD: $0.6275(A$714mln), $0.6450(A$1.5bln)

USD: USD Weakening Despite Resilient Yield Backdrop

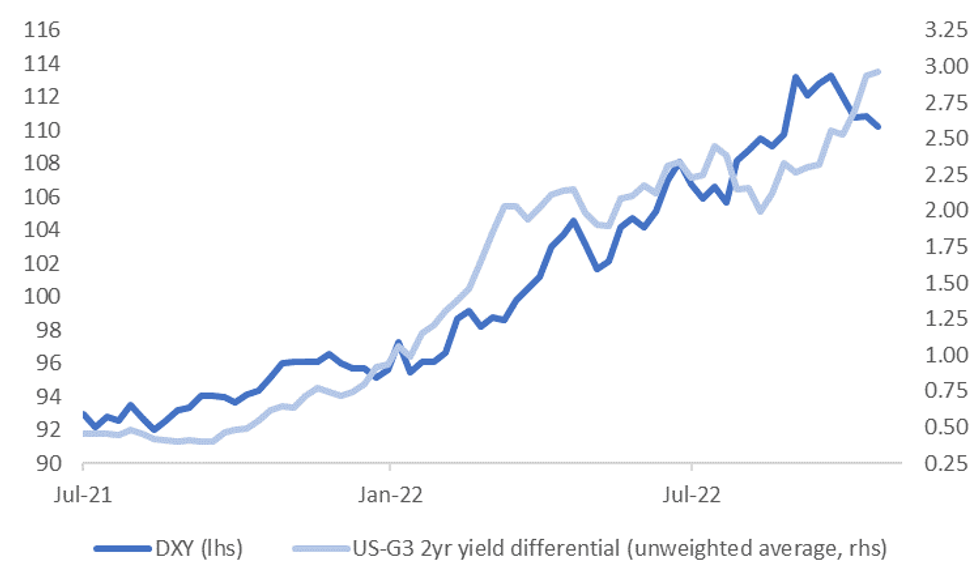

The USD is close to recent lows if the DXY and BBDXY indices are used as gauges. Both indices are below their respective 20 & 50-day EMAs. At face value this weakness is at odds with still decent yield premium over the G3 economies. The first chart below plots the DXY index against the unweighted yield differential between the US and G3 economies (for the 2yr tenor).

- The correlation between the two series has been high the past year, but is lower for the past 3 months (+20%).

- Currency markets may be positioning for a reduced pace of Fed tightening, although this is yet to show meaningfully in terms of yield differentials.

- There is also a sense that a Republican controlled Congress (if that's how results unfold) will be more fiscally conservative and therefore less inflationary, but again this be expected to be showing up more in relative yield differentials.

- Correlations between these USD indices and global equities is much stronger at the moment (in an inverse fashion), with the USD suffering as global equities rebound. Optimism around China shifting away from covid-zero is part of this rebound story, although the authorities are pushing back against a quick-reopening theme.

Fig 1: USD DXY Index Versus 2yr Yield Differentials

Source: MNI - Market News/Bloomberg

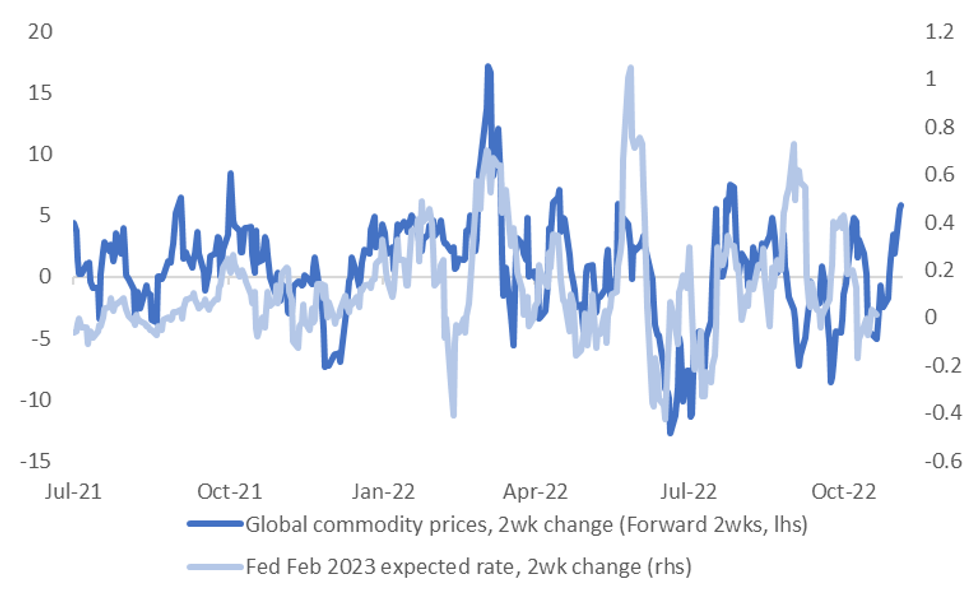

- Fed expectations for early next year are holding around recent highs. The recent rebound in commodity prices suggests some upside risks to pricing, although a lot is likely to depend on how the October inflation print unfolds later this week.

- In any case, further USD downside may need support from a weaker US yield backdrop at some stage.

Fig 2: Fed Expectations For Early 2023 & Global Spot Commodity Prices

Source: MNI - Market News/Bloomberg

ASIA FX: CNH Weakens, KRW & PHP Outperform

Asian FX trends have been mixed again. USD/CNH has mostly traded higher, as rising covid case numbers weigh on risk appetite. KRW, THB and PHP have performed better though. Still to come is Taiwan trade and inflation figures. Tomorrow, China inflation figures are out, along with the South Korean unemployment rate.

- USD/CNH is higher but has found selling resistance above 7.2500. The pair was last close to 7.2460, around +0.20% above NY closing levels. Onshore spot is also up, but is down from earlier session highs, last close to 7.2400. China equities have fallen, while domestic daily covid case numbers have hit a fresh 6 month high. This is likely to dampen sentiment around the re-opening trade, at least from a near term standpoint.

- The won has outperformed. 1 month USD/KRW is down a further 0.40% from NY closing levels, last at 1386/87, although nearly touched 1384 in early trade. Local equities continue to power on, up a further 1% today. This puts the Kospi above its 100-day EMA, which has been a resistance point going back to September 2021.

- Spot USD/TWD is trying to break back below 32.00, but hasn't made a convincing move yet. Onshore equities are also firmer for the Taiex, in line with tech outperformance since the start of the week. Coming up is Taiwan trade and inflation figures. Export growth is expected to slow further (-6% y/y).

- Spot USD/IDR trades -30 figs at 15,678 as we type, with bears looking for a fall through Oct 28 low of 15,523 and bulls keeping an eye on the 16,000 mark. Indonesia's CDS premium has tumbled since approaching cyclical highs in late-Sep/mid-Oct and last sits at 122.4bp. Foreign investors were net buyers of $41.07mn in local equities. The Jakarta Comp posted gains but has already halved yesterday's gains this morning.

- Spot USD/THB is above early session lows, but still down for the session, last at 37.355 (against 37.225). The simple 50-day MA comes in at 37.3765. Foreign investors snapped up a net $63.34mn in Thai stocks Monday, extending the streak of daily inflows going back to Oct 20. The SET index gave back its initial gains after re-testing its 200-DMA.

- Spot USD/PHP has declined and last operates -0.41 at 58.188, with bears looking for a retreat towards the 50-DMA, which intersects at 58.040. Philippine foreign reserves expanded to $94.1bn last month from the revised $93.0bn. ANZ estimated that Bangko Sentral ng Pilipinas spent less than $1bn on interventions in the FX spot market during that month, the smallest amount since April, but there may have been more intervention through forwards.

SOUTH KOREA: Improved Current A/C Likely To Prove Short Lived, But Medium Term Trends Can Improve

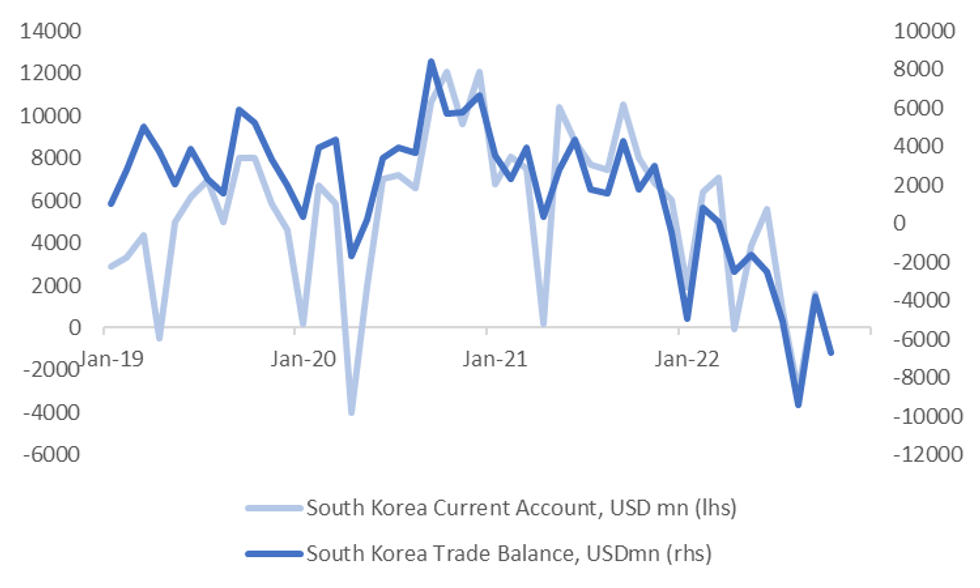

South Korea's current account moved back into surplus in September, to $1.61bn, up from the -$3.05bn deficit recorded in August. The goods balance also improved, back to +494mn, versus the -4.45bn deficit prior. This improvement is likely to be short lived though, given the October trade deficit showed a re-widening to -6.7bn, from -3.78bn in September.

- The chart below plots the current account balance against the trade position (the orange line). While there is a clear levels difference between the two series, the directional correlation is fairly firm.

Fig 1: South Korea Trade Balance & Current Account Trends

Source: MNI - Market News/Bloomberg

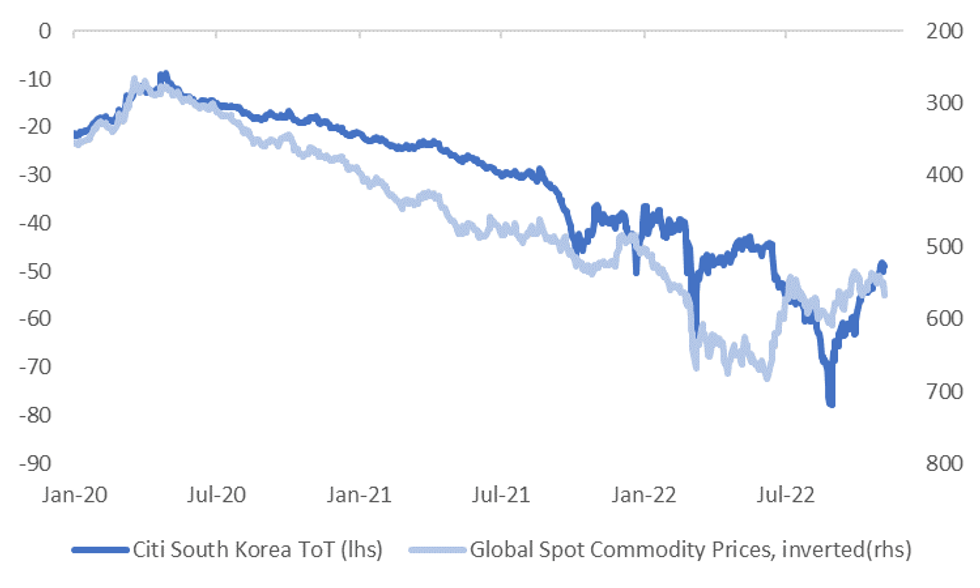

- There is still scope for improved trade balance outcomes in coming months, given a better terms of trade (ToT) backdrop relative to earlier in the year. The rate of improvement though in the Citi South Korean ToT proxy has slowed somewhat. Not surprisingly, this index shares a strong inverse relationship with global commodity prices, see the second chart below.

- The terms of trade outlook and how that flows into the current account position for South Korea, will be an important KRW driver over the medium term.

- Short-term gyrations are likely to be guided by broader risk appetite though, particularly in the equity space, which is looking firmer at the moment, as we highlighted earlier.

Fig 2: Citi South Korea ToT Proxy & Global Commodity Prices

Source: MNI - Market News/Bloomberg

EQUITIES: Mixed Trends, Rising Covid Cases Dampen China/HK Sentiment

Asia Pac equities have been mixed today. Tech sensitive markets have outperformed, while China/HK stocks have faltered somewhat. US equity futures have traded tight ranges overall, currently close to flat across the major indices, ahead of mid-term elections in the US this evening.

- The HSI has tracked sideways for the most part today, struggling to stay in positive territory. Still, we aren't too far from multi-week highs. The tech sub-index is also around flat, just below the 2100.

- The surge in domestic Covid cases onshore in China is likely to push back any dramatic shift in Covid-zero policies in the near term. Today case numbers were above 7.3k, the highest in 6 months.

- The CSI 300 is off by 0.75%, the Shanghai Composite by 0.50% at this stage.

- Tech plays have done better elsewhere in the region. The Nikkei 225 is up close to 1.5%, the Kospi +1.0%. Interestingly, the Kospi is above its 100-day EMA (2383.1, versus 2396 last). This has been a resistance point going back to late September 2021. The Taiex is also higher, adding 1%. These gains are consistent with tech outperformance during the US session overnight.

- The ASX has lagged somewhat, up just under 0.40% at this stage.

GOLD: Modest Drift Lower Ahead Of Key Event Risks

Gold is currently around the $1673 level, drifting modestly lower through the course of the session, off 0.15% versus NY closing levels. This fits with a slightly firmer tone to the USD through the course of the session.

- The precious metal has stuck to recent ranges since the start of the week. Overnight gains above $1680 couldn't be sustained, but we haven't tested sub $1670 yet.

- We might have seen a break higher if not for the resilient US yield backdrop. Current levels of gold continue to look too high relative to the real 10yr yield.

- ETF gold holdings continue to drift lower.

- The focus will also be upcoming risk event, with the US Mid-Term elections happening tonight, then US CPI prints later in the week.

OIL: Range Trading As Supply And Demand Forces Offset Each Other

Prices range traded again today as the market continued to be driven by the offsetting forces of tight supply conditions and fears regarding the impact of a global slowdown on oil demand.

- WTI is down about 0.7% from its intraday high and is trading just about $91.50/bbl. It continues to hold above its 10-, 20- and 50-day moving averages. Brent is 0.6% off its high and is now just under $97.70/bbl.

- The market is still working out what the likely impact of the OPEC+ output cuts this month and the upcoming EU sanctions on Russian oil will be in reality. Given the tightness of the market, the latter may be enough to push prices back above $100/bbl. (Bloomberg)

- Given supply concerns, there is likely to be some focus on the US API data out tonight, which last week reported a 6.53mn draw on crude stocks.

- The China National Petroleum Corp. said that the country’s crude demand fell 2.8% y/y in the year to September which has resulted in an inventory build of gasoline and diesel. (Bloomberg) Even a cautious reopening would put further pressure on global oil supplies pushing up prices.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/11/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/11/2022 | 0745/0845 | * |  | FR | Current Account |

| 08/11/2022 | 0900/1000 |  | IT | Retail Sales | |

| 08/11/2022 | 0900/0900 |  | UK | BOE Pill Panels UBS European Conference | |

| 08/11/2022 | 1000/1100 | ** |  | EU | retail sales |

| 08/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/11/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/11/2022 | - |  | US | Legislative Elections / Midterms | |

| 08/11/2022 | - |  | EU | ECB de Guindos at ECOFIN meeting | |

| 08/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/11/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/11/2022 | 1800/1300 | *** |  | US |

US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.