-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Asia-Pac Equities Firm Into Month-/Quarter End

- Cash Tsys sit 1.5bp richer to 1.5bp cheaper as the curve twist steepens, pivoting around 7s, unwinding some of Thursday’s light twist flattening.

- Asia-Pac equities are mostly tracking higher, albeit sitting off highs for some indices, mostly notably HK, with feedthrough from Chinese firmer than expected Chinese PMI & Thursday's broader bid for equities noted, as well as month-/quarter-end flows and some local idiosyncracies.

- Looking ahead, we get Q4 UK GDP revisions. French CPI is also due later, although most focus is likely to rest on the US PCE deflator. The ECB's Lagarde does a Q&A with students. Also note Fed's Williams and Cook are due to speak.

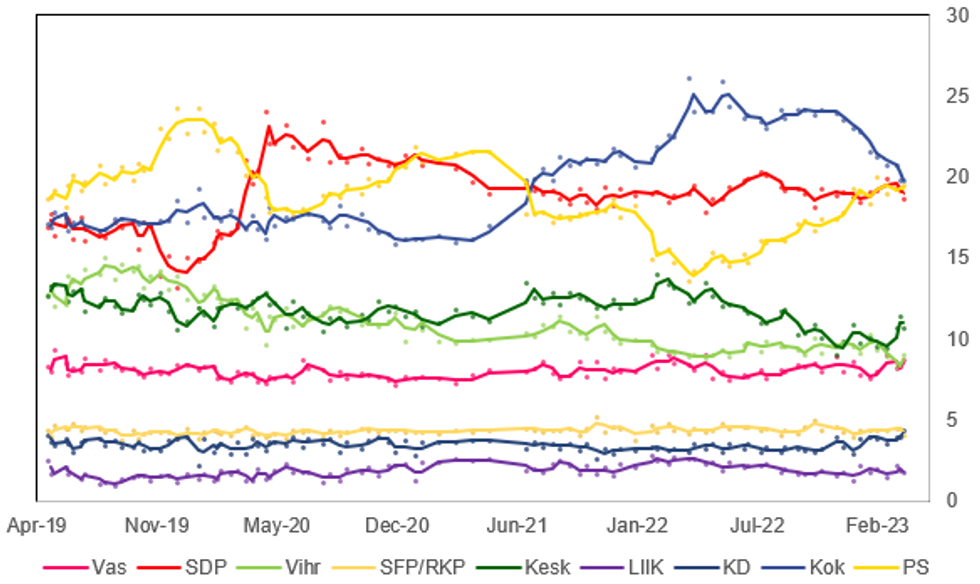

FINLAND: Election Too Close To Call; Finishing 1st Important For Coalition Talks

Some of the final opinion polling ahead of the 2 April legislative election shows a race that is too close to call, with PM Sanna Marin's centre-left Social Democrats (SDP), the centre-right National Coalition Party, and the right-wing nationalist Finns Party (PS) all within the margin of error of one another with around 18-20% support each. The party winning a plurality is set to be afforded the initial mandate to seek to form a governing coalition, making every vote count.

- The identity of the party leading initial negotiations could prove key for the future direction of Finnish gov't policy.

- If it is the National Coalition Party then the direction could swing either way, as the party could seek a right-leaning coalition with the Finns or a cross-spectrum 'grand coalition' with the SDP and Centre Party.

- If it is the Finns, the gov't will almost certainly shift sharply to the right as the only major party willing to work with it would be the National Coalition Party.

- If it is the Social Democrats than Marin could seek to re-form the incumbent 5-party left-leaning coalition.

- For more information please see ourFinland Election Preview.

Source: Taloustutkimus, Kantar Public, Kantar TNS, MNI. Vas-Left Alliance, SDP-Social Democrats, Vihr-Green League, SFP/RKP-Swedish People's Party, Kesk-Centre Party, Liik-Movement Now, KD-Christian Democrats, Kok-National Coalition Party, PS-Finns Party

Source: Taloustutkimus, Kantar Public, Kantar TNS, MNI. Vas-Left Alliance, SDP-Social Democrats, Vihr-Green League, SFP/RKP-Swedish People's Party, Kesk-Centre Party, Liik-Movement Now, KD-Christian Democrats, Kok-National Coalition Party, PS-Finns Party

US TSYS: Light Twist Steepening In Asia, Contained Ranges Observed

TYM3 is mid-range into London hours last dealing -0-02+ at 114-16 on light volume of ~51K. Meanwhile, cash Tsys sit 1.5bp richer to 1.5bp cheaper as the curve twist steepens, pivoting around 7s, unwinding some of Thursday’s light twist flattening.

- There wasn’t an overt driver re: the light richening away from cheapest levels of the day, so we would point to a move away from cheaps in JGBs as a likely driver.

- Note that e-minis have been better bid all session. Here we would point to the slight reduction in the Fed’s balance sheet size (and feedthrough into less worry re: the banking sector) and month- & quarter-end rebalancing flows (touted flows out of bonds into stocks) as potential drivers for the early Asia cross-market moves, as well as Asia-Pac reaction to Thursday’s wider market swings.

- Firmer than expected official PMI data out of China then applied further pressure, before the aforementioned light, JGB-derived bid became apparent.

- There wasn’t much in the way of market reaction to news that former President Trump is set to be indicted re: the well-documented ‘hush money payments’ he is alleged to have made.

- Eurozone CPI & U.S. PCE data are set to provide the focal points on Friday. Elsewhere, we will get the latest MNI Chicago PMI print and final UoM sentiment data, in addition to Fedspeak from Waller, Williams & Cook (Waller crosses a few hours after the market close).

MNI U.S. Commercial Banking Update: Deposit Drawdown Extends

With focus firmly on the US banking sector, we break down latest trends in weekly commercial bank balance sheet data.

- Small Banks See Big Deposit Withdrawals

- Loans & Leases Also Saw Broad-Based Sharp Increase Over The Same Period

- PLEASE FIND THE FULL NOTE: US Commercial Banking Update - Deposit Drawdown Extends.pdf

JGBS: Off Tokyo CPI-Inspired Cheaps

JGB futures ticked away from session lows after the lunch break, last printing -22, while cash JGBs edge away from session cheaps (trading flat to 2bp cheaper, with 7s providing the only point of meaningful weakness given the moves in futures since yesterday’s settlement).

- The bid may be tied to Japan’s plan to restrict exports of 23 types of semiconductor manufacturing equipment, as the country moves with some of its international allies in an apparent attempt to curb the technological might of China (which was outlined ahead of the Tokyo lunch break, although Japan played down the idea that it is targeting China).

- Receiver-side flows in swaps also helped the direction of travel, with swap rates now flat to lower across the curve.

- This came after firmer than expected Tokyo CPI data applied some pressure in early Tokyo trade.

- Elsewhere, the IMF once again pushed the idea of the BoJ adopting greater flexibility in the long end of JGB the curve under its YCC mechanism, while pointing to yields out to 5s as the most important zone of the yield curve re: real economic activity.

- The BoJ will release its quarterly Rinban plan after hours. Several sell-side names have suggested that the plan could reveal some tweaks to the purchase bands, with some outlining the potential for a reduction in lower limits of the purchases from the 5- to 10-Year bucket to further out the curve given the recent richening in the space and recent purchase tweaks from the Bank.

AUSSIE BONDS: Subdued, Awaiting U.S. PCE Deflator

ACGBs are at session bests (YM +4.0 & XM +5.5) ahead of the bell as U.S. Tsy tread water in Asia-Pac trade ahead of the release of the U.S. PCE deflator later today. Cash ACGBs are 4-6bp richer with the 3/10 curve 2bp flatter and the AU/US 10-year yield differential -2bp at -25bp.

- 3s10s swap curve bull flattens with rates 3-5bp lower and 3-year EFP 1bp wider.

- Bills strip pricing is 1-4bp richer.

- RBA dated OIS pricing is flat to 4bp softer across meetings with an 18% chance of a 25bp hike priced for April. Cumulative tightening over the April and May meetings remains around 10bp, its highest level since March 15th.

- On the local front, Private Sector Credit printed 0.3% M/M for February, displaying the slowest 3-month growth rate in two years.

- Before the RBA rates decision on Tuesday, the local calendar is light, with the Judo Bank PMIs and Melbourne Institute Inflation Gauge being the highlights. The RBNZ rates decision is on Wednesday.

- Until then, the market's focus will be on the release of Euro Area CPI for March and the U.S. PCE deflator for February, which are set to be released later today.

AUSSIE BONDS: AU Vs. US Curve Correlation Corrects

In early March, the shift in focus from data dependency to global banking concerns led to a steepening of 45bp in the U.S. Tsy 2/10 curve. It also caused a noticeable steepening in the AU 3/10 cash curve and an increase in global curve correlations.

- Before the recent credit issues, domestic developments were having a significant impact on the movement of the AU curve, consistent with the notion that global curve correlations decreased as the tightening cycle matured and policy rates followed their independent paths.

- As global banking concerns ease, it seems that the correlation between AU and US curves is decreasing. If this trend continues, the yield differential between the AU 3-year and the US 2-year is expected to become the main driver of relative curve movements.

- A simple regression of the AU 3/10 - US 2/10 curve box against the short-end yield differential during the current tightening cycle suggests that the AU curve is 15-20bp too flat relative to the US curve.

Fig. 1: Rolling 10-day Correlation – ACGB 3/10 Curve Vs. US Tsy 2/10 Curve

Source: MNI – Market News / Bloomberg

NZGBS: Steady Ahead of U.S. PCE Deflator

The NZGBs closed near session bests within a narrow range, with benchmark yields unchanged as U.S. Tsys marked time ahead of the release of the U.S. PCE deflator later in the day. NZGBs did however underperform their counterparts in the $-bloc, with the NZ/US and NZ/AU 10-year yield differentials widening by 1bp and 3bp respectively.

- Swaps were flat to 1bp cheaper on the day.

- The RBNZ dated OIS had a subdued session, with pricing little changed across meetings. The April meeting is priced for a 25bp hike, with terminal OCR expectations at 5.27%.

- According to a Reuters poll of economists, the RBNZ is expected to reduce the hike to 25bp next week. However, there is a split among economists on whether there will be another 25bp hike in May.

- On the local data front, the ANZ Consumer Confidence was weaker in March, with rising interest rates and higher cost of living being the reasons.

- The Antipodean calendar is light ahead of the RBA rates decision on Tuesday and the RBNZ decision on Wednesday.

- Until then, the market will be focused on the release of Euro Area CPI for March and the U.S. PCE deflator for February. The focus will be on core measures.

BONDS: AU/NZ 10-Year Yield Differential Off Lows

AU/NZ cash 10-year yield differential has pushed away from its multi-decade low of -100bp, which was reached after NZ's current account deficit deteriorated more than expected, to be currently -87bp, having been as high as -75bp earlier this week.

- While consistent with the relative price movement in AU and NZ STIR, the 10-year yield differential has started to unwind the mispricing evident at the multi-decade low.

- At its wides, a simple regression of the NZ/AU 10-year yield differential on the AU/NZ 1y1m OIS differential (over the current tightening cycle) suggested the 10-year yield differential was 20bp too negative, most likely reflecting the divergent current account situations in AU (record surpluses) and NZ (record deficits).

- The regression error is currently around -14bp.

Fig. 1: AU/NZ 10-Year Yield Differential (% Y-Axis) Vs. AU/NZ 1Y1M OIS Differential (% X-Axis)

Source: MNI – Market News / Bloomberg

FOREX: USD/JPY Volatile Ahead Of Fiscal Year End, NZD Outperforms

JPY volatility has been evident today ahead of fiscal year end for Japan. USD/JPY got to a high just above 133.50, which also came near the Tokyo fix. However, the pair has steadily drifted lower since. We are now back at 132.70/80, only slightly weaker in yen terms for the session.

- Japan data was generally better than expected, with the new Tokyo core CPI measure printing at 3.4% y/y versus 3.2% expected, for March, continuing the trend move higher. Retail sales and IP were also better than expected for Feb, but some offset came from weaker jobs data.

- Elsewhere, NZD has outperformed, the pair around 0.30% higher, last near 0.6285. We came close to testing above 0.6300 (high of 0.6298). The Kiwi continues to benefit from improved equity sentiment, although the market may also have one eye on next week's RBNZ meeting.

- AUD/USD also tracked higher, but couldn't get above 0.6740, we last sit near 0.6715, little changed for the session. As a result, the AUD/NZD cross is back sub 1.0700, last near 1.0680/85.

- EUR/USD is back close to 1.0900, unable to make much headway beyond 1.0925, which also coincides with Thursday session highs.

- The BBDXY is close to unchanged at 1227.50, while in the cross asset space, equities are firmer for the region and in terms of US futures (Eminis around +0.30%). US yields have mostly been range bound.

- Looking ahead, we get Q4 UK GDP revisions. French CPI is also due later, although most focus is likely to rest on the US PCE deflator. The ECB's Lagarde does a Q&A with students. Also note Fed's Williams and Cook are due to speak.

FX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.6bln), $1.0800(E1.7bln), $1.0850(E1.2bln), $1.0900(E648mln), $1.0950(E1.1bln), $1.1000(E532mln)

- USD/JPY: Y130.00($762mln), Y131.00($1.0bln), Y132.00($665mln), Y133.85-00($655mln), Y136.00-20($1.3bln)

- GBP/USD: $1.2000(Gbp515mln), $1.2100(Gbp693mln)

- AUD/USD: $0.6550(A$808mln)

- USD/CAD: C$1.3600($1.5bln), C$1.3900($1.2bln)

ASIA FX: USD/CNH Can't Sustain 50-Day MA Break To The Downside

USD/Asia pairs are mostly lower, although North East Asia pairs have seen limited downside from earlier moves, particularly USD/CNH and USD/KRW. Some South East Asia currencies, notably THB and IDR have done a better job of holding gains. Equity sentiment is positive throughout the region, but we are away from best levels post the China PMI beats. Note tomorrow March South Korean trade figures are due, while Monday next week sees March PMIs print, along with Indonesian CPI.

- USD/CNH got to a low of 6.8438 not long after the PMIs printed, but we have steadily recovered since. Th pair was last around 6.8660. This is back above the simple 50-day MA, which comes in around 6.8580. China equities are only modestly higher, showing a much more muted reaction to the better PMI prints compared to the start of the month.

- 1 month USD/KRW fell but found buying interest ahead of 1286 (which also coincides with the simple 100-day MA). We last track near 1295, little changed from NY closing levels on Thursday. Onshore equities are higher, +0.9% for the Kospi. Earlier Feb IP data was mixed, weaker than expected in m/m terms, buy showing some improvement in y/y terms (-8.1%, -13% for Jan).

- USD/TWD is a touch lower, last near 30.43. The manufacturing PMI eased for March to 48.6 from 49.0 in Feb. Note Taiwan markets are closed for the first 3 days of next week.

- Spot USD/IDR gapped lower in the first part of trade, getting under 14960. We sit slightly higher now at 14970 still around 0.50% firmer in IDR terms for the session. This is fresh lows in the pair back to early Feb. YTD lows come in at 14837. We are back sub all key EMAs and MAs, as IDR continues to ride the improved risk tone in global markets. 5yr CDS is back sub 100bps (we were around 120bps in terms of recent highs). Crude palm oil prices sit around recent highs, last at MYR4065, which is close to the 200-day MA (MYR4075). Offshore holdings of local bonds have also risen. This week has seen just over $500mn in fresh inflows so far. In level terms, foreign holdings of local bonds are close to recent early Feb highs (811.71 trillion IDR, versus 816.20 on Feb 7).

- USD/PHP spot sits around 54.30, close to recent lows. A fresh break sub 54.20 would likely have the market targeting a move below 54.00, which is where YTD lows came in. Local equities are the worst performer in the region today, down over 1%. This hasn't impacted PHP sentiment negatively so far today. One factor which may be weighing on equities is further tightening expectations. BSP Governor Medalla stating yesterday it was too early for a pause.

- USD/THB is lower, but hasn't been able to break through downside support at 34.00. The pair last close to 34.10, still 0.40% firmer for the session.

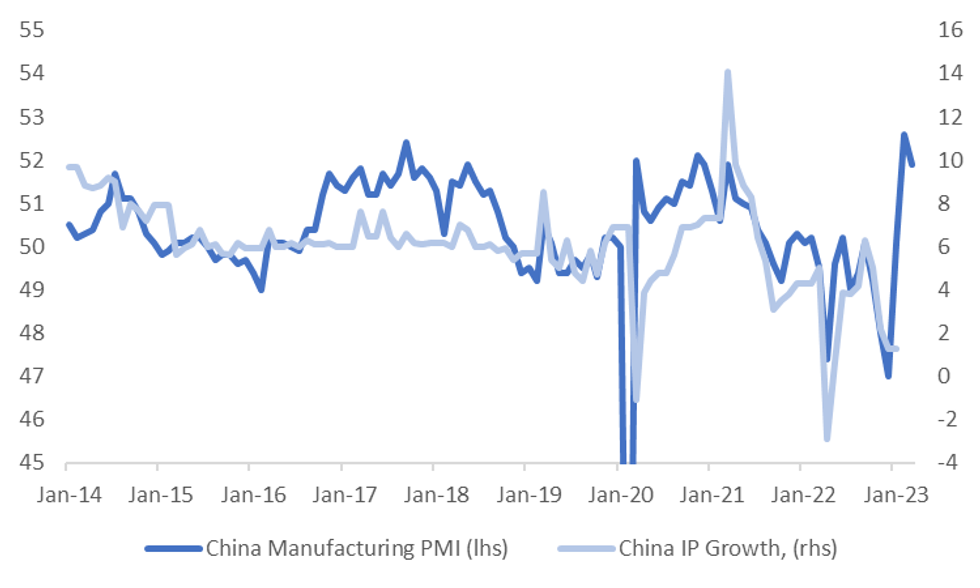

CHINA: PMIs Paint Positive Activity Backdrop, But Jobs Less Upbeat & Price Pressures Muted

The headline prints for the official PMIs continue to paint a near term positive backdrop for activity, albeit with a less positive employment picture and muted price pressures.

- The first chart below is the manufacturing PMI against IP growth and even with the pull back in the March PMI, it still suggests better IP momentum. The next IP print is out on April 18, the Jan-Feb data (which was out in mid March) coming in a touch below expectations (2.4% v 2.6% actual).

- The detail showed some easing conditions across components, with employment dipping back below the 50 expansion/contraction point (to 49.7, was 50.2 in Feb). New orders eased to 53.6 form 54.1, as did new export orders to 50.4 from 52.4.

- Still, the new export order reading is comfortably above levels that prevailed this time last year. Note March trade figures are due on April 13.

- On the price front, output prices eased to 48.6, from 51.2.

Fig. 1: China IP Versus Manufacturing PMI

Source: MNI - Market News/Bloomberg

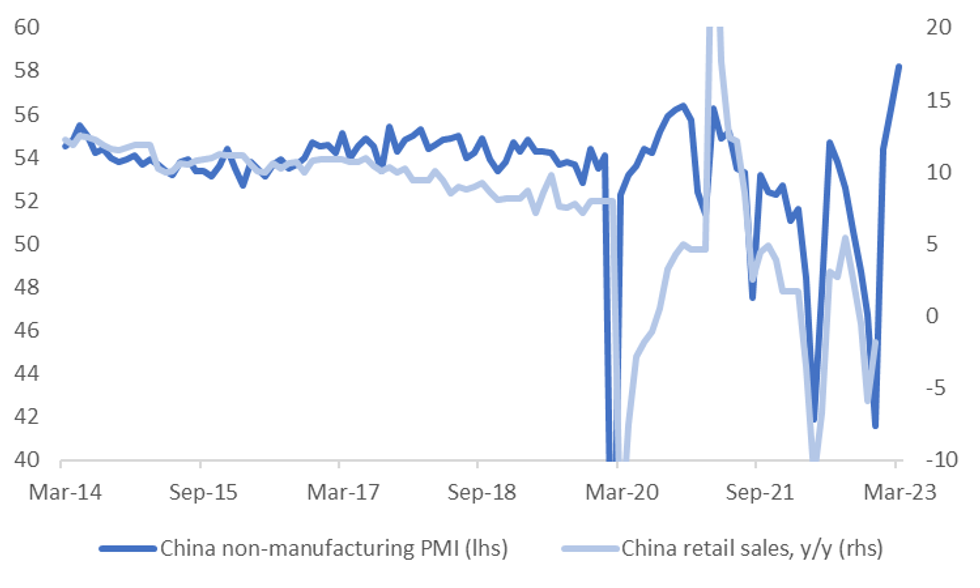

- The services side delivered a more impressive result. The second chart below plots this PMI against retail sales growth. This is fresh highs in this PMI back to 2011. The next retail sales print is also out on April 18.

- The detail showed new orders rise further to 57.3 (from 55.8), but employment slipped to 49.2 from 50.2. Selling prices also corrected back lower to 47.8 (from 50.8).

Fig. 2: China Retail Sales Versus Non-Manufacturing PMI

Source: MNI - Market News/Bloomberg

EQUITIES: Ending March With Positive Momentum

Regional equities are mostly tracking higher, albeit sitting off highs for some indices, mostly notably HK. US futures are higher for the session, but just below highs currently. Eminis (around 4093/94) and Nasdaq futures are around 0.30/0.40% higher respectively at this point.

- Hong Kong shares surged higher at the open, the HSI up over 20700, as optimism around JD.com listing two units in HK spurred gains. Plans for Alibaba's first spin off IPO are also underway. Better China PMIs gave another leg higher, but we now sit back at 20480, still +0.84% up for the session.

- China shares also tracked higher in early trade, but now sit only 0.16% up for the CSI 300, +0.22% for the Shanghai Composite. Market sentiment was more positive at the start of March following the Feb PMI beats compared to today's reaction.

- Japan's Topix is nearly 1.3% higher, with bank stocks around 1.75% higher. Semi conductor stocks have given back earlier gains, as Japan announced curbs on chip exports. This will cover 23 types of chipmaking gear.

- Taiwan's Taiex is +0.25%, while the Kospi is around +1%, with offshore flows close to flat.

- The ASX 200 is up 0.76%, while in SEA, Philippines stocks are the main underperformers, off by over 1%. Hawkish BSP rhetoric may be weighing at the margins.

GOLD: Tracking +8.5% Higher For March

Gold is a touch above NY closing levels at this stage, last near $1982. The range for the session so far has been $1977.74 to $1983.71. The precious metal is slightly higher for the week (near +0.2%), but for March is up around 8.5%.

- Gold continues to follow broader USD gyrations, although has outperformed USD weakness through March.

- A further improvement in equity sentiment hasn't dented gold from a reduced safe have haven standpoint. Gold ETF holdings continue to track higher.

- Technically, recent highs come in above $1984, but the focus is likely to rest on the $2000 level from a trend standpoint.

OIL: Just Shy Of Weekly Highs, Better China Data Doesn't Impact Sentiment

Brent crude is slightly lower, off 0.25% from NY closing levels, last just under $79.10/bbl. This follows Thursday's +1.25% gain. Brent is tracking +5.45% firmer for the week, although still looks likely to post a sharp lost for March (nearly 5.75% at the time of writing). WTI is around $74.35/bbl currently.

- From a technical standpoint, Brent is struggling near term for a break above $80/bbl. if seen, this would open up a test of the 50-day EMA ($80.71/bbl). As we noted earlier in the week, a breach of the 100-day EMA (just above $83.70/bbl), is likely to be needed to entrench more bullish sentiment.

- Focus remains on the supply side, with Iraq’s Kurdistan region remaining offline as talks between the Iraqi and Kurdish governments aren’t scheduled to resume before next week.

- Today's better than expected China PMI prints hasn't produced a positive impact on oil sentiment.

- Looking ahead French CPI is due later, although most focus is likely to rest on the US PCE deflator, which prints later on. The ECB's Lagarde does a Q&A with students. Also note Fed's Williams and Cook are due to speak.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/03/2023 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/03/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/03/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/03/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 31/03/2023 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students | |

| 31/03/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/03/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2023 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 31/03/2023 | 1900/1500 |  | US | New York Fed's John Williams | |

| 31/03/2023 | 2145/1745 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.