-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD & Iron Ore Move Off Recent Highs

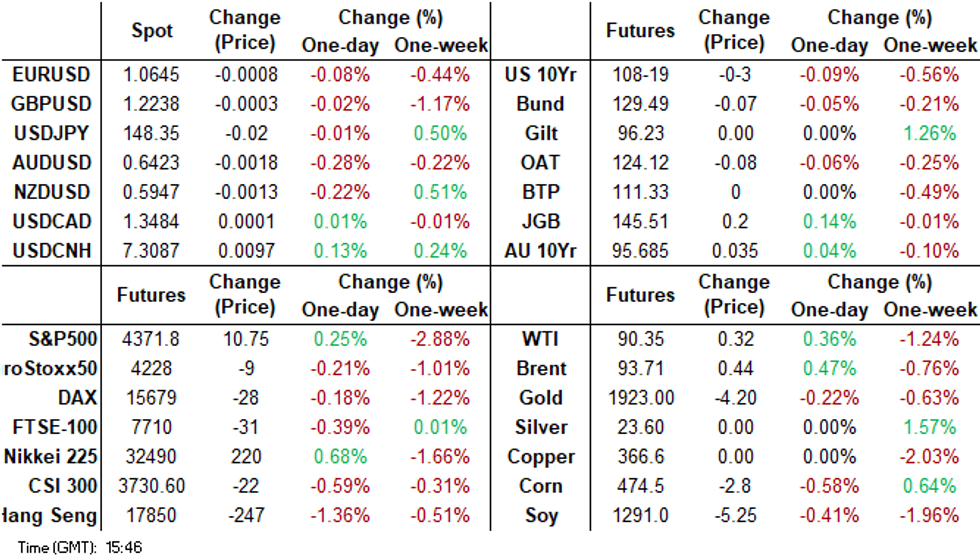

- The main macro focus today has been weakness in Hong Kong and China equities, which have unwound some of the strong gains we saw at the end of last week. Renewed concerns in the property developer segment have weighed heavily on real estate equity sub-indices. This has crimped risk appetite in the FX space and kept USD dips supported. Iron ore is lower, while AUD and NZD FX have been the weakest performers. Overall moves haven't been large though.

- In the bond space, Cash tsys are dealing flat to 2bp cheaper across major benchmarks beyond the 1-year. In the Tokyo afternoon session, JGB futures are sitting at a session high, +20 compared to settlement levels.

- Looking ahead, the German IFO is tap, while Lagarde also speaks. In the US the Dallas Fed survey is due, while we also here from the Fed's Kashkari.

MARKETS

US TSYS: Slightly Weaker In Asia-Pac Dealings, Narrow Ranges, Light News flow

TYZ3 is currently trading at 108-19+, -0-02+ from NY closing levels in early Asia-Pac dealings.

- Cash tsys are dealing flat to 2bp cheaper across major benchmarks beyond the 1-year. Newsflow has been light, with narrow ranges observed.

- Later today sees Chicago Fed Nat and Dallas Fed Manf. Activity Indices, along with Fedspeak from Kashkari.

JGBS: Futures At Tokyo Session Highs In the Afternoon Session, 40Y Supply Tomorrow

In the Tokyo afternoon session, JGB futures are sitting at a session high, +20 compared to settlement levels.

- Today the local calendar has been light, with Department Sales data due later. However, BOJ’s Governor Ueda will give a speech in Osaka at about 0830 BST, and Uchida will speak around an hour earlier.

- Local participants have ignored the slight cheapening in US tsys in the Asia-Pac session today, possibly focusing on the message contained in the BOJ’s ‘dovish hold’ on Friday ahead of today’s BOJ-speak. Cash US tsys are dealing flat to 3bps cheaper across major benchmarks.

- Cash JGBs are mixed, with yields 1.1bps lower (7-year) to 1.0bps higher (40-year). The benchmark 10-year yield is 1.1bps lower at 0.735% versus the cycle high of 0.756% set ahead of the BOJ policy decision on Friday. 40-year supply is due tomorrow.

- The swaps curve is richer out to the 20-year, with rates 0.7bp to 1.1bp lower. Swap spreads are generally tighter.

- Tomorrow the local calendar sees PPI Services data.

AUSSIE BONDS: Slightly Richer, Narrow Ranges, Light Local Calendar Until CPI Monthly On Wednesday

ACGBs (YM +2.0 & XM +2.5) are slightly richer, after dealing in relatively narrow ranges in the Sydney session. With the local calendar light today, local participants have likely sought direction from US tsys. Cash US tsys are dealing flat to 2bps cheaper across major benchmarks in Asia-Pac trade.

- Cash ACGBs are 3bps richer, with the AU-US 10-year yield differential unchanged at -15bps.

- Swap rates are 2-3bps lower.

- Bills pricing is +1 to +4 across the strip.

- RBA-dated OIS pricing is 2-4bbps softer for ’24 meetings.

- (Bloomberg) Australia is considering a “broader definition” of full employment. Monday’s white paper follows an independent review of the Reserve Bank that recommended the central bank give equal consideration to price stability and full employment in its decision-making. (See link)

- (AFR) Chris Richardson believes tax cuts will keep RBA on interest rate sidelines for longer. Noting that in less than 10 months’ time there is A$21 billion of personal tax cuts coming due. (See link)

- Today sees panel participation by RBA Assistant Governor Jones at a Conference on Financial Technology and Climate Change (0700 BST).

- The local calendar is light until the release of the CPI Monthly for August on Wednesday.

NZGBS: Closed On Session Bests, NZ-US 10Y Spread Unchanged

NZGBs closed at session bests, with benchmark yields 5bps lower. With the domestic calendar empty until ANZ Business Confidence on Thursday, the local market has tracked the performance of US tsys and ACGBs. NZ-US and NZ-AU 10-year yield differentials are unchanged versus the NZ close on Friday.

- Swap rates are 3-4bps lower, with the short-end implied swap spread wider.

- RBNZ dated OIS pricing is little changed, with terminal OCR expectations at 5.76%.

- Stronger-than-expected employment or CPI data in October alongside Thursday’s solid GDP and elevated levels of government spending could force the RBNZ to raise its Official Cash Rate from 5.5% as soon as November, former Reserve officials told MNI. John McDermott, executive director at Motu Economic and Public Policy Research and former RBNZ assistant governor, said the central bank had failed to contain non-tradable inflation, while oil price spikes could again cause tradable and goods prices to rise. (See link)

- Tomorrow the local calendar is empty.

- Later today sees Chicago Fed Nat and Dallas Fed Manf. Activity Indices, along with Fedspeak from Kashkari

EQUITIES: HK Shares Lower On Renewed China Property Woes, US Futures Tracking Higher

Regional Asia Pacific equity markets are mixed to start the week. Downside has been evident in terms of Hong Kong and China shares, amid renewed China property woes. This unwinds some of Friday's positive momentum in these markets. Some positive trends are evident elsewhere, most notably for Japan stocks. US equity futures are tracking higher at this stage, with Eminis +0.27% to 4373. With lows from late last week, sub 4360 intact. Nasdaq futures are slightly outperforming, +0.35%.

- A tentative agreement to end the Hollywood strike may be aiding US equity sentiment, although the auto strike continues, while US yields have recouped some of Friday's losses.

- Hong Kong equities opened flat, but this quickly gave way to renewed weakness. The HSI down 1.24%. A Bloomberg property sector gauge is down 6%, the most since Dec last year. Among the headwinds have been property developer Evergrande scraping a creditors meeting and revisiting its restructuring plan. China Oceanwide, which also has operations in real estate, will reportedly be wound up.

- China's CSI 300 is also lower, down -0.51% at the break. The real estate sub index down 2.13%. It is back close to July lows in index terms.

- Japan stocks are outperforming, the Nikkei +0.80% at this stage. The positive US futures backdrop little helping. The Taiex is +0.80%, likely helped by a better SOX trend from Friday US trade.

- South Korean shares are weaker though, the Kospi off by 0.55% at this stage.

- The ASX 200 is down slightly, while Malaysia and Thailand shares are weaker in SEA. Indonesia is around flat.

FOREX: USD Dips Supported, AUD and NZD Down On Weaker HK/China Equities

The BBDXY ranges have been relatively tight to start the week. We got to lows of 1257.21, but we now sit slightly higher for the session, last near 1258.33. AUD and NZD have underperformers, as Hong Kong and China equities have seen renewed weakness on property developer concerns.

- Helping the USD at the margin has been a slightly offered tone to USTs, with yields recouping some of Friday's losses. The 10yr sits +2bps higher to 4.455%, while the 2yr is down a touch.

- US equity futures have firmed as well, +0.28% for Eminis.

- This hasn't helped AUD or NZD a great deal though, with the weaker HK/China equity performance outweighing. Iron ore is also down. AUD/USD last tracked near 0.6425, -0.25% versus NY closing levels from Friday. NZD/USD is down to 0.5950, off by a similar amount.

- USD/JPY got to fresh highs near 148.50 in early trade, but had no follow through. We are back at 148.40 now. BoJ Governor Ueda will reportedly talk soon, followed by Deputy Governor Uchida. Ueda will be speaking in Osaka.

- Looking further ahead, the German IFO is tap, while Lagarde also speaks. In the US the Dallas Fed survey is due, while we also here from the Fed's Kashkari.

OIL: Little Changed in Asia-Pac After A Small Gain On Friday

Oil is little changed in the Asia-Pac session, after closing 0.4% higher on Friday. However, crude did relinquish some of the gains seen earlier in the day. The Baker Hughes’ rig count data showed rig numbers fall for the first time in three weeks to offer some upside (630, -11, of which oil 507, -8). Despite a mid-week spike, crude was down compared to the previous Friday, with WTI falling by around 80 cents/bbl.

- The US Coordinator for MENA Brett McGurk and Senior Advisor to the President for Energy and Investment Amos Hochstein emphasised the urgency of reopening the Iraq-Turkey pipeline as soon as possible, according to a White House e-mailed statement.

- Onshore crude inventories in China have been drawn down over the past three weeks to the lowest since mid-June according to data tracked by satellite firm Ursa Space Systems.

- Russia’s government expects the average price of its crude grades to average $71.30/bbl in 2024, up from an average of $63.40/bbl so far in 2023.

GOLD: Bullion Proved Resilient Despite A Higher USD, US Yields Lower

Gold is slightly weaker in the Asia-Pac session, after closing +0.25% at $1925.23 on Friday. Bullion proved resilient despite the climb in the USD, with the precious metal supported by a rally in US Treasuries.

- Traders slightly unwound bets on another rate hike this year on Friday, with key US inflation data due this week (PCE deflator on Thursday) set to show a deceleration.

- US Treasuries closed the week with a relief rally. Cash US Treasuries finished 3-6bps richer, with the belly outperforming. The 10-year yield touched a new 16-year high of 4.5064% before finishing 6ps lower at 4.43%. Friday's better close came despite ‘higher for longer’ messaging from Fedspeak, which reinforced the Fed’s "hawkish hold" earlier in the week. US Treasuries drew support after Flash PMI data came out mixed.

- Hedge funds boosted their bullish bets on gold to a six-week high, the latest CFTC data on futures and options show, further underscoring bets on a rate hike pause.

- According to MNI’s technicals team, resistance remains a way off at $1947.5 (Sep 20 high), the high shortly before the FOMC decision.

ASIA FX: USD/CNH Rebounds, As HK/China Equities Weaken

USD/Asia pairs are mixed to start the week. For the most part dollar dips have been supported. This has been notable in USD/CNH, amid renewed equity pressures in HK and China. USD/INR and USD/IDR have also tracked higher. KRW is outperforming modestly, while most other pairs are close to flat. Tomorrow, South Korea consumer confidence is on tap.

- USD/CNH tracked lower in early trade, but couldn't sustain the move. After hitting lows of just under 7.2950, we rebounded back towards 7.3100, before finding selling interest. The main source of weakness coming from lower HK and China equities, with renewed property developer concerns weighing on the major bourses (with Evergrande's debt restructuring under a cloud). The CNY fixing was steady, with the fixing error staying near recent record wides.

- 1 month USD/KRW has tracked lower for most of the session. However, the pair has been unable to break meaningfully sub the 1330 level. We last tracked near 1330.50. Onshore equities are weaker, amid on-going outflows but this hasn't dented sentiment so far today. Neither has higher USD/CNH levels.

- USD/IDR spot is drifting higher, last near 15400. Recent highs at 15411 aren't too far away. On the downside, a move back sub 15333 (the 20-day EMA) is potentially needed to shift the trend more positively for IDR. Elevated US real yields, with the 10yr sitting at 2.07%, down slightly from cyclical highs, will be weighing, or at least limiting IDR rebounds. Equally, the market will be mindful of BI intervention with the 15400 potentially acting as a near term resistance point.

- USD/INR is back above 83.10, unwinding all of Friday's rupee gains post the J.P. Morgan index inclusion decision. The pair closed last Friday near 82.90. Local bond yields are lower, but the sell-side is mixed on whether strong bond inflows will lead to meaningful rupee appreciation.

- USD/THB opened on a softer tone, getting close to 35.90, before support emerged. We now sit back near 36.05, a touch higher for the session. Recent highs sit just above 36.30 from last week, while on the downside, recent lows are near 35.63, while the 20-day EMA is ~35.67. The local data calendar is busy this week, headlined by the BoT decision on Wednesday. The consensus is expecting a +25bps to take the policy rate to 2.50%.

- USD/SGD was relatively steady near 1.3660 currently (range today of 1.3652-1.3667) August CPI was close to expectations. Core at 3.4% y/y (3.5% forecast (3.8% prior). Headline was 4.0% y/y, in line with the consensus (prior was 4.1%). The m/m print rose 0.9% (prior -0.2%).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/09/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/09/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/09/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/09/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Lagarde speaks at ECON Hearing | |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Schnabel speaks at JHvT Lecture | |

| 25/09/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/09/2023 | 2200/1800 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.