-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

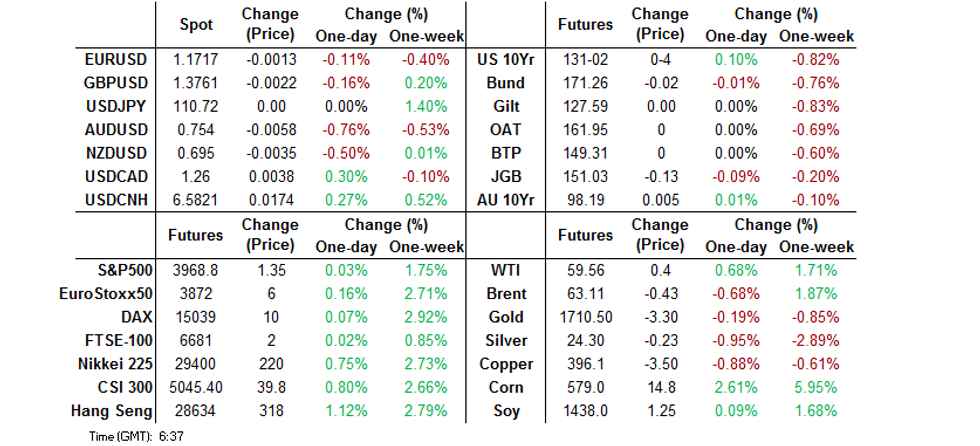

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD Leads High Beta G10 FX Lower

- Biden's infrastructure plan provides no notable surprises.

- Chinese Caixin manufacturing PMI misses.

- AUD/USD dips to fresh YtD low.

BOND SUMMARY: Core FI Mixed In Asia, BoJ Related Matters Steal The Headlines

Cash Tsys sit unchanged to a touch firmer as we move into European hours, with the curve seeing some light bull flattening (30s print ~2.5bp richer on the day). There has been very little of note on the headline front in Asia, outside of a softer than expected Chinese Caixin m'fing PMI print and some production issues for the J&J COVID vaccine at one plant, although the company has noted that it doesn't expect any interruptions to its delivery schedule. T-Notes in a narrow 0-05 range, last +0-03+ at 132-01+. As a reminder, the space was subjected to some end of month/quarter chop towards the end of Wednesday's NY trade, with a fresh COVID lockdown in France providing some support during that timeframe, alongside a couple of WNM1 block buys (5.5K lifted over the 2 blocks). T-Notes held to the confines of Tuesday's range and softened back towards lows into the close. 7s provided the weak point on the curve, cheapening by ~5bp on the day, as yields ticked higher across the board. Elsewhere, the first part of U.S. President Biden's infrastructure plan provided nothing in the way of notable surprises given the leaks ahead of his address, while the monthly ADP employment print didn't quite meet median expectations, but still topped +500K. The ISM m'fing survey headlines the local economic docket on Thursday, with challenger job cuts and the weekly jobless claims data also due.

- The JGB space played catch up to the BoJ's April Rinban plan in early Tokyo trade, after the Bank noted that it will remove Y550bn of conventional JGB purchases in April vs. March, with some pre-auction concession also built in. There was some respite in the wake of the latest 10-Year JGB auction, which saw the low price top dealer estimates, with the tail narrowing and cover ratio moving higher, although the latter continues to operate within the lower end of its recent range (the metric observed at last month's auction provided a low bar to hurdle given the fact that it represented a multi-year low). JGB futures -12 on the day at typing, with the cash curve a little steeper (30s provide the weak point, cheapening by 2.0bp on the day). The Q1 BoJ Tankan survey generally revealed inline to stronger than exp. metrics, which were more favourable than Q4's offering.

- The Aussie bond space reversed its overnight losses, aided by the light firming in the longer end of the Tsy curve. YM +1.0, XM +1.0 at typing, while cash ACGBs sit unchanged to 1.0bp firmer on the day. There has been nothing in the way of a meaningful reaction to a relatively packed local data docket and vanilla weekly issuance slate from the AOFM. Focus now moves to next Tuesday's RBA decision, as participants look forward to the elongated Easter weekend, although it is seen as a placeholder event.

US: Easter Holiday Exchange Schedules

Major U.S. exchange holiday schedules covering the Easter weekend period can be found below:

JAPAN: Foreign Investors Shed Japanese Assets Last Week

Net foreign selling of Japanese bonds and equities dominated within the latest round of weekly international security flow data, with foreign investors shedding exposure to Japanese assets in the wake of the well-documented tweaks to BoJ monetary policy (and also ahead of the end of the Japanese FY). The metrics both experienced multi-month highs in terms of net sales.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 200.7 | 554.4 | 440.5 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -368.0 | -274.7 | -773.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -2393.1 | -943.1 | -1816.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -852.4 | -79.0 | -1118.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Antipodeans Sag Ahead Of Easter

The Antipodeans led high-beta currencies lower, with liquidity in Australia and New Zealand likely thinned ahead of the Easter holidays. AUD faltered amid chatter about the liquidation of AUD longs during the release of Australian retail sales data and accelerated losses as AUD/USD slid through its YtD lows into the London morning. The latest round of AUD sales coincided with a spell of broader demand for the greenback and spilled over into the NZD to a degree, helping the Antipodeans cement their position as worst G10 performers.

- CAD was hurt by a CBC source report noting that Ontario will be placed under a 28-day lockdown from Saturday.

- JPY led gains in the G10 basket despite a round of sales into the Tokyo fix. USD/JPY jumped to its session high of Y110.82 around that time, but gave up all earlier gains thereafter.

- The PBOC set its USD/CNY mid-point at CNY6.5584, just 3 pips shy of sell-side estimates. USD/CNH rallied past yesterday's high on a surprise deterioration in China's Caixin M'fing PMI, which printed at 50.6.

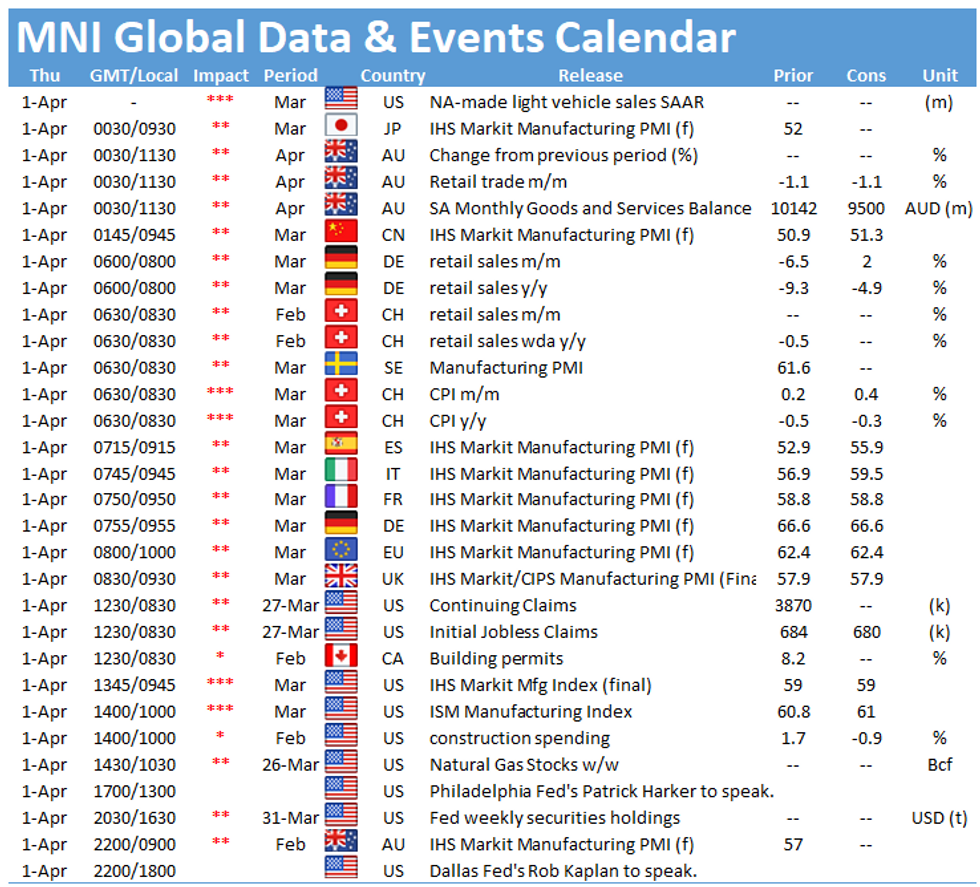

- Global PMI data, U.S. construction spending & initial jobless claims, Canadian building permits & German retail sales take focus on the data front. Fed's Harker will speak at a fintech symposium.

FOREX OPTIONS: Expiries for Apr01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E468mln-EUR puts), $1.1850(E1.1bln-EUR puts)

- USD/JPY: Y108.00($969mln), Y108.50($655mln), Y108.90-109.00($660mln), Y109.35($585mln), Y110.00($532mln), Y111.00($790mln-USD puts)

- GBP/USD: $1.3800(Gbp399mln)

- AUD/JPY: Y85.85(A$664mln)

- USD/CAD: C$1.2350-55($750mln), C$1.2450($1.5bln), C$1.2600-10($1.5bln-USD puts), C$1.2630-45($1.2bln-USD puts), C$1.2660-75($1.3bln), C$1.2875($502mln)

- USD/CNY: Cny6.5475($750mln)

ASIA FX: Mixed Start To The Month

The greenback was steady as markets reaction to the US's latest stimulus plan was muted, volumes were thin ahead of Easter holiday's with some markets already closed.

- CNH: Offshore yuan is weaker, giving back after two days of gains. USD/CNH last up 93 pips at 6.5740, it reversed course after a miss in Caixin PMI data, jumping from session lows of 6.5583.

- SGD: Singapore dollar weaker, there were reports in The Straits Times that China and Singapore could allow travel to resume if there is a system that mutually recognises health certification and personal information exchange

- TWD: Taiwan dollar is weaker, losing ground for a second day and consolidating over 28.50. March saw TWD post its first monthly decline since for 8 months. USD/TWD came off session highs after decent PMI data.

- KRW: The won is higher, the trade surplus widened slightly less than expected, but printed a robust $4.175bn, exports rose 16.6%, in line with estimates, South Korea Markit PMI Manufacturing was also released, the print was in line with the previous at 55.3.

- IDR: Rupiah is weaker, PMI headline index improved to 53.2 from 50.9. IHS Markit pointed to "firms ramping up production in response to the strongest influx of new orders in the decade-long survey so far." Market awaits CPI data.

- MYR: Ringgit has strengthened, FinMin Zafrul said that Malaysia's economy is expected to rebound strongly this year, boosted by various stimulus measures.

- PHP: Market closed for Maundy Thursday.

- THB: Baht is lower, Thailand's industrial output shrank 1.08% Y/Y in Feb, missing consensus forecast of a 0.60% increase. Declines in oil, refinery, clothing and beer productions weighed on the composite index. Thailand's Markit M'fing PMI came in at 48.8 in Mar after printing at 47.2 in Feb.

ASIA RATES: Supply Dynamics

Yields mostly higher amid positive sentiment and strong data from the region. Supply dynamics continue to be a focus.

- INDIA: Yields mostly higher, it was announced yesterday that India would issue INR 7.24tn of government debt in the first half of FY 2021, that equates to around 60% of the full-year target. Auctions are likely remain under pressure looking forward, price action will be dictated by the type and frequency of OMOs.

- INDONESIA: Yields mixed across the curve, Indonesian bonds are expected to come under pressure as auctions continue to be poorly received, yesterday Indonesia sold IDR 15.02tn of debt under the greenshoe option, missing the maximum target of IDR25.25tn. It was reported earlier that Indonesia targets sales of IDR 230tn of sukuk bonds, assuming weekly sales that equates to approximately IDR 17tn per week. CPI was slightly below estimates.

- CHINA: The PBOC matched maturities with injections again today, the nineteenth straight day of matching maturities, while the bank hasn't injected funds since February 25. Repo rates have risen again after moving higher heading into month/quarter end yesterday. Futures are broadly flat, moving out of negative territory following the weak PMI print. Caixin China PMI Manufacturing fell to 50.6 in March from 50.9, below estimates of 51.4. The figure denotes an 11-month low point, the findings contrast with those in an official survey which showed manufacturing activity grew at a stronger pace

- SOUTH KOREA: Bond futures are lower amid positive sentiment in the region. Data was positive, the trade surplus widened slightly less than expected, but printed a robust $4.175bn, exports rose 16.6%, in line with estimates, while imports rose 18.8% against expectations of a 19.1% rise. The jump in exports is the most since 2018, chips and automobiles continue to lead the export rally. South Korea Markit PMI Manufacturing was also released, the print was in line with the previous at 55.3 and firmly in expansionary territory. Markets await the April issuance plan.

EQUITIES: April Off To A Green Start

The new quarter kicks off with gains in Asia-Pac equity markets, taking a positive lead from the US and boosted by robust data in the region. US President Biden unveiled the latest spending plan late yesterday, which also helped engender a positive tone. Markets in Hong Kong rose, despite reports of around 50 companies suspended from trading on the Hang Seng, with speculation among traders that the restriction is due to a failure by the companies to report earnings on time. Chip makers were buoyed by TSMC's announcement to spend $100bn expanding capacity over the next three years, while Micron and Western Digital are said to be each exploring a potential $30bn deal for Kioxia. Futures in the US are mixed, S&P and Dow Jones in negative territory, while the Nasdaq ekes out some small gains.

GOLD: Key Support Holds

A pullback in the DXY and stable U.S. real yields (on net) allowed gold to move away from its recent trough on Wednesday. Bullion has stuck to a tight range in Asia-Pac hours, with spot last dealing +$7/oz at $1,715/oz. From a technical perspective bears failed to force their way through key support in the form of the Mar 8 low on Wednesday, with the subsequent rebound allowing bulls to refocus on the 20-Day EMA.

OIL: Halts Decline, OPEC+ Eyed

Crude futures are marginally higher in Asia, recouping some of yesterday's losses. WTI & Brent sit ~$0.30 above settlement levels. Data yesterday showed a draw in crude and gasoline inventories, with the market gleaning further support from expectations that OPEC+ will roll over its production quotas into May. US DOE inventory data showed headline stockpiles fell 880k bbls, while refinery utilisation reached 83.9% of total capacity, up 2.3 percentage points from the week prior. There are lingering demand concerns though, with France the latest European country to declare a 4-week lockdown while Italy extended restrictions, Ontario in Canada will also impost a lockdown. Markets look ahead to the conclusion of the OPEC+ meeting after a panel meeting finished on Wednesday without reaching a recommendation.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.