-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD Pares Retail Sales Gains

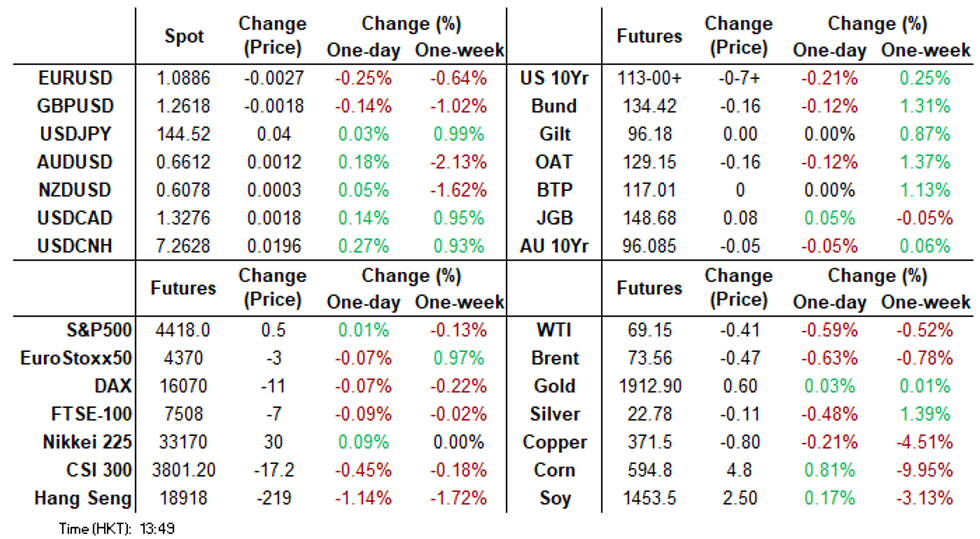

- AUD is the strongest performer in the G-10 space at the margins. Australia's Retail Sales rose 0.7% M/M in May more than the expected 0.1%. This saw the AUD extend gains seen after the PBOC fixed the Yuan firmer than expected. Resistance was seen above $0.6620 and gains were pared. AUD/USD sits ~0.1% firmer last printing at $0.6605/10.

- Oil prices are down around 0.5% during APAC trading after Wednesday’s 2% rally driven by the large US crude inventory drawdown. Oil rose earlier in the session but turned down once the dollar strengthened. It is now flat to slightly down on the week.

- Elsewhere the USD was marginally firmer, BBDXY up ~0.2%, and US Tsy Yields were marginally firmer.

MARKETS

US TSYS: Marginally Cheaper In Asia, Powell Due Shortly

TYU3 deals at 113-03, -0-05, a 0-05+ range has been observed on volume of ~45k.

- Cash tsys sit 1-2bps cheaper across the major benchmarks the curve has bear flattened.

- Tsys were pressured in early dealing as Asia participants digested Fed Chair Powell's comments that consecutive rate hikes were not off the table and news that major US banks passed the Feds stress tests.

- Losses marginally extended after pressure from ACGB's spilled over in lieu of firmer than forecast Retail Sales in Australia.

- Ranges remained narrow with little follow through on moves for the remainder of the session.

- Fed Chair Powell takes part in a discussion at the Bank of Spain, which crosses shortly. Further out US GDP and Initial Jobless Claims are due. Fedspeak from Atlanta Fed President Bostic will also cross.

JGBs: Futures Stronger, Narrow Range, Solid 2-Year Auction, Tokyo CPI Tomorrow

JGB futures sit in the middle of a relatively narrow range in Tokyo afternoon trade, +12 compared to the settlement levels.

- ICYMI, BoJ Governor Kazuo Ueda suggested it’s possible to start normalizing monetary policy if the BOJ becomes confident inflation will pick up next year. For now, underlying inflation remains below 2%, and the BOJ’s outlook is for price increases to slow toward the end of the year, Ueda said Wednesday. He didn’t specify whether he was talking about the fiscal year that ends next March. (See link)

- Cash JGBs are little changed across the curve beyond the 1-year zone (1.1bp cheaper) with the 10-year zone the best performer (1.0bp richer).

- The 2-year benchmark yield is 0.4bp lower on the day at -0.063%, after today’s supply takedown saw solid demand with the cover ratio jumping to its highest level observed at a 2-year auction since September with a reduced tail.

- The swap curve twist flattens, pivoting at the 7-year, with rates ranging from +0.5bp (2-year) to -1.3bp (30-year). Swap spreads are generally wider out to the 7-year and narrower beyond.

- The local calendar tomorrow sees the all-important Tokyo CPI data with BBG consensus expecting an uptick for the annual headline, core and core-core measures. Jobless rate is also due along with BoJ Rinban operations covering 3- to 25+ Year JGBs.

AUSSIE BONDS: Cheaper After Stronger-Than-Expected Retail Sales

ACGBs sit 4-5bp cheaper (YM -6.0 & XM -4.0) after retail sales for May printed significantly stronger than expected at +0.7% m/m versus expectations of +0.1%. The ABS noted that the solid rise was driven by higher food and restaurant spending as well as “a boost in spending on discretionary goods”, which is in contrast to consumer surveys. People took advantage of discounting in the month and seem prepared to spend at the right price.

- Ahead of the July 4 RBA meeting, labour market and retail data were stronger but headline inflation lower with stickier core. It is likely to be another “finely balanced” decision.

- Cash ACGBs are 4-6bp cheaper after the data with the AU-US 10-year yield differential +6bp on the day at +18bp.

- Swap rates are 4-6bp higher after the data to be 4-7bp higher on the day with the 3s10s curve flatter.

- The bills strip has bear flattened with pricing -8 to -4.

- RBA dated OIS pricing is 3-6bp firmer across meetings after the data with Dec’23/Feb-24 leading. The market now attaches a 45% chance of a 25bp hike in July versus 31% yesterday.

- The local calendar is scheduled to release May Private Sector Credit tomorrow.

NZGBS: Closed At Cheaps Despite Solid Supply Takedown

NZGBs ended the day 2bp cheaper after an initial strengthening during the local session. Despite a successful takedown of the weekly supply of the May-28 and May-34 bonds, the prices of NZGBs declined throughout the session. The cover ratios for the May-28 and May-34 bonds improved to 3.55x and 3.34x, respectively, compared to 2.47x and 3.31x previously. However, the cover ratio for the May-51 bond slightly decreased to 2.92 from 3.92.

- The session's weakness seems to be primarily influenced by the softness in US tsys during Asia-Pac trade and the sell-off of ACGBs following the release of stronger than expected retail sales data, notwithstanding the recent rise in business confidence and activity reported in the ANZBO survey.

- Swap rates closed 1-3bp higher with the 2s10s curve flatter.

- RBNZ dated OIS pricing flat to -3bp softer across meetings.

- Business confidence rose to -18 in June from -31.1. Business confidence is at its highest since November 2021. While the levels of many activity indicators are still subdued, firms appear to be cautiously optimistic that the worst may be over (ANZ).

- The local calendar tomorrow sees Consumer Sentiment, with the data expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

OIL: Crude Down As Dollar Strengthens

Oil prices are down around 0.5% during APAC trading after Wednesday’s 2% rally driven by the large US crude inventory drawdown. Oil rose earlier in the session but turned down once the dollar strengthened. It is now flat to slightly down on the week. The USD index is 0.1% higher.

- WTI is down 0.5% to $69.21/bbl, close to the intraday low of $69.12. It appears to have found support around $69. Earlier it reached a high of $69.58. Brent is 0.6% lower at $73.82, close to the low of $73.75 after a high of $74.23. They continue to trade well below resistance levels.

- US EIA crude stocks fell 9.6mn barrels, the largest drop in 2 months, as exports soared. The move may be a signal that the market is tightening as both the IEA and OPEC+ are forecasting. There were small rises in gasoline and distillate inventories. Gasoline and jet fuel demand should increase with the upcoming July 4 holiday weekend.

- Later today Fed Chair Powell takes part in a discussion at the Bank of Spain and Bostic speaks on the US economic outlook. On the data front revised Q1 US GDP, jobless claims, pending home sales and euro area economic sentiment print.

GOLD: Steady in Asia-Pac After Lowest Close Since Mid-March

Gold is little changed in the Asia-Pac session, after closing at its lowest level in more than three months, with investors weighing the latest hawkish commentary from the heads of the Fed, the ECB, and the BoE during the ECB's annual conference in Portugal. However, no new perspectives were shared as they echoed the recent policy updates, emphasising the importance of tightening policies to address inflationary concerns.

- Market confidence of a hike at the July 26 FOMC climbed to 78%. November is pricing a cumulative 29bp of tightening at 5.364%.

- However, the yield on 10-year US tsys declined and stocks experienced volatility in response to the comments, suggesting ongoing concerns that a hawkish stance by the Federal Reserve could potentially lead to an economic downturn. Such a scenario could provide some support for the precious metal as a safe haven asset.

FOREX: Greenback Marginally Firmer In Asia

The greenback is marginally firmer in Asia on Thursday however moves do remain modest with little follow through thus far.

- AUD is the strongest performer in the G-10 space at the margins. Australia's Retail Sales rose 0.7% M/M in May more than the expected 0.1%. This saw the AUD extend gains seen after the PBOC fixed the Yuan firmer than expected. Resistance was seen above $0.6620 and gains were pared. AUD/USD sits ~0.1% firmer last printing at $0.6605/10.

- NZD/USD prints at $0.6070/75, little changed from Wednesday's closing levels.The pair was up as much as 0.5% after the PBOC fix, however resistance was seen ahead of $0.61.

- Yen has observed narrow ranges with little follow through on moves. May Retail Sales were firmer than expected printing at 1.3% M/M vs 0.8% exp.

- Elsewhere in G-10 the EUR is down 0.2%, despite the absence of any specific headline driver. GBP and CAD are also down ~0.1%.

- Cross asset wise; BBDXY is up ~0.2% and US Tsy Yields are marginally firmer. E-minis have pared early gains and sit ~0.1% firmer.

- Fedspeak from Chair Powell crosses early in the European session, regional and national German CPI is also on the docket.

EQUITIES: Mixed Performance, Hawkish Central Bank Comments Unnerve Some Markets

Equities across the region were mixed with a number of markets closed. HK/China are down, Australia/Taiwan flat but Japan higher. The S&P e-mini is slightly higher around 4420 and Nasdaq futures up 0.1%.

- The Hang Seng is the underperformer today falling 1.6% with the CSI 300 performing better only down 0.4%. Comments from major central banks that rates need to go higher plus robust US data spooked these markets. Korea was also lower with the Kospi -0.2%.

- The Nikkei bucked the trend rising 0.4% to be 1.6% higher on the week. The weak yen is supportive of exports.

- The ASX was flat, despite better than expected May retail sales, but the NZX rose 0.4%.

- With most of ASEAN shut, SE Thai outperformed rising 1.3% and the Philippines PSEi +0.6%, performing a lot better than north Asia.

- Indonesia, India, Malaysia and Singapore are all closed today for the Eid-al-Adha holiday. Indonesia is closed again tomorrow.

GLOBAL MACRO – Growth Outlook Improved, Numerous Uncertainties

- 2023 growth expectations have been consistently revised up. This has been helped by the reopening of China, although projections have been revised down somewhat recently as data have disappointed.

- Global output and trade growth have been lacklustre but appear to have troughed in line with the bottoming out of the global manufacturing PMI, shipping rates and metal prices. But Asian PMIs have weakened recently and tech exports remain subdued signalling a renewed downturn in trade.

- Headline inflation has turned down significantly since it peaked late last year but core has proven stickier, especially in the OECD, which is likely to keep those central banks hawkish. Most Asian ones have paused.

- See full chartbook here.

AUSTRALIA: Retail Bounces As Consumers Spend In Sales & At Restaurants

Retail sales for May rose a stronger than expected 0.7% m/m after being flat the previous month. This was the highest monthly rise since August 2022, apart from the Christmas season, and stands 0.8% above October. Turnover values are now +4.2% y/y after 4.3% y/y in April, in line with stabilising CBA spending intentions. Given the May CPI was flat and ex volatile items up 0.5% m/m, sales volumes may have been positive. Ahead of the July 4 RBA meeting, labour market and retail data were stronger but headline inflation lower with stickier core. It is likely to be another “finely balanced” decision.

- The ABS noted that the solid rise was driven by higher food and restaurant spending as well as “a boost in spending on discretionary goods”, which is in contrast to consumer surveys. People took advantage of discounting in the month and seem prepared to spend at the right price.

- Household goods retailing rose 0.6% m/m, restaurants +1.4% and food retailing +0.3% (driven by higher prices +7.9% y/y). Restaurants are still able to pass on higher costs to diners. Other retailing rose a strong 2.2% driven by online sales and a variety of other businesses. Department store sales fell 0.5% and clothing -0.6%.

- 3-month sales momentum has improved since March and is positive, but with rates rising at the last two meetings and cost-of-living pressures remaining elevated and how consumers use savings buffers unknown, the consumer outlook remains clouded.

Source: MNI - Market News/ABS/CBA

NEW ZEALAND: ANZ Business Confidence Improves After RBNZ Moves To Neutral

The ANZ business confidence index rose to -18 in June from -31.1, the highest since November 2021, signalling that firms tentatively feel that the worst is behind them. This follows the RBNZ moving to a neutral stance. The activity outlook moved into positive territory at +2.7 from -4.5 the previous month, best result since April 2022.

- Inflation expectations eased further to 5.3% from 5.5%, which should reassure the RBNZ re its policy shift but the price/cost measures need to continue falling. Pricing intentions continued to moderate slowly falling to 49.3 from 52.4, but remained elevated, with a net 64% of retailers expecting to increase prices within 3 months. Costs are expected to rise more than prices though. Wage expectations eased to 80.2 from 84.

- But capacity pressures rose with employment improving to -3.5 from -5.7 and capacity utilisation to +4.3 from -1.2. Employment was higher versus a year ago. Investment intentions rose to their highest since October.

- Exports were weaker at -1.8 from +2.0, signalling a slowdown in global demand.

Source: MNI - Market News/Refinitiv

NZ ANZ business price/cost measures

Source: MNI - Market News/Refinitiv

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/06/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/06/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/06/2023 | 0630/0230 |  | US | Fed Chair Jerome Powell | |

| 29/06/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/06/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/06/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 29/06/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/06/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/06/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/06/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 29/06/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/06/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/06/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 29/06/2023 | 1230/0830 | *** |  | US | GDP |

| 29/06/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/06/2023 | 1600/1800 |  | EU | ECB Lagarde Closing Remarks at ECB Forum | |

| 29/06/2023 | 1630/1730 |  | UK | BOE Tenreyro Speech at SPE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.