-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD's RBA-Inspired Losses Tempered By Reports Of Thawing Sino-Aussie Tensions

- AUD struggled after the RBA held rates steady at 3.60%, in what was widely viewed as a line ball call (STIR markets were more certain when it came to the idea of no change, heavily favouring such an outcome ahead of the meeting). The RBA also watered down its forward guidance re: further tightening. An SCMP report suggesting that Beijing has extended an offer to Australian PM Albanese re: a visit then helped limit AUD weakness post-RBA.

- JGBs struggled, with a soft 10-Year auction adding to early pressure, while U.S. Tsy mimicked wider core global FI markets in the main.

- Tuesday's conventional data docket is headlined by U.S. JOLTS & Eurozone PPI. We will also get the ECB's consumer expectations survey, Fedspeak and communication from the ECB & BoE throughout the day.

MNI RBNZ Preview - April 2023: Another 25bp, Tightening Bias To Stay

EXECUTIVE SUMMARY:

- A step down to 25bp from February’s 50bp is widely expected at the April 5 meeting bringing the OCR to 5%, the highest since 2008. A pause and 50bp hike are also likely to be discussed. The February forecasts had rates peaking at 5.5%.

- Given that another 25bp rise is expected, the guidance part of the accompanying statement will be particularly important to the outlook for monetary policy. It will probably acknowledge the very weak Q4 GDP data while reiterating that inflation remains too high and the labour market too tight. The RBNZ is likely to keep its options open while maintaining its tightening bias.

- The Committee will have updated forecasts and Q1 CPI and wages/employment data at its May 24 meeting.

- Click to view full preview:MNI RBNZ Preview April 2023.pdf

US TSYS: Pare Losses After RBA Holds Cash Rate Steady

TYM3 deals at 115-18, +0-03+, with a 0-07+ range observed on volume of ~91k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys pared losses after the RBA held the cash rate steady at 3.6%. The RBA board watered down previously hawkish forward guidance as the bank noted in the final paragraph that some further tightening "may" be needed, at the previous meeting the board had noted further tightening will be needed. A subsequent rally in ACGB spilled over.

- Earlier in the session after an initial muted start tsys were marginally pressured as the USD came off session lows and US equity futures and regional equities softened.

- Spillover from a poorly received 10 Year JGB auction saw losses extended a touch, a block seller of TY (3,240 lots) also weighed.

- Early today Fedspeak from Governor Cook noted that the disinflationary process is underway, but there is more work to do. She also noted that continuing tightness in the labour market is still producing an inflationary impulse.

- Eurozone PPI data headlines an otherwise thin European session. Further out we have Factory Orders and JOLTS Job Opening. Fedspeak from Fed Governor Cook will cross.

JGBS: Soft 10-Year Auction Adds To Early Pressure, Futures More Than Unwind Overnight Gains

A soft round of 10-Year JGB supply added to some early Tokyo pressure (the latter was a product of Tokyo’s seemingly greater focus on the potential ramifications of higher oil prices, as opposed to Monday’s soft U.S. manufacturing data, as well as some cheapening in U.S. Tsys and the presence of the 10-Year JGB auction), leaving JGB futures comfortably below settlement levels as we work towards the Tokyo close, last -19, more than reversing overnight session gains.

- JGB futures hit session lows in the wake of the auction, before stabilising and working away from worst levels,

- Wider cash JGB trade sees the major benchmarks running little changed to ~4bp cheaper on the day, with the super-long end coming under the most pressure.

- The swap curve twist steepened.

- Local headline flow saw Finance Minister Suzuki point to a need for a permanent source of revenue for the government’s child-related spending policies, with an unveiling of the framework surrounding the matter scheduled for June. Suzuki was explicitly cautious re: additional bond issuance to finance the policy steps, but that did little to support the space.

- Looking ahead, BoJ Rinban operations covering 1- to 5- & 10- to 25+-Year paper (the first Rinban since the well-documented tweak to the purchase bands in the Q2 outline) headline tomorrow, with final services & composite PMIs also slated.

AUSSIE BONDS: Stronger Post-RBA, But Off Bests

After some initial volatility ACGBs sit 4-5bp richer post-RBA to be in the top of the session trading range at the time of writing (YM +9.0 & XM +6.5). While the RBA decision to leave the cash rate unchanged (for the first time since April 2022) was largely priced, the positive surprise for the market came via less hawkish guidance with the board stating that “some further tightening of policy may be needed”. The market will be tuned into the release of Q1 CPI on April 26 after the RBA board also signalled their belief that a range of data suggested inflation has peaked.

- Cash ACGBs are 3-5bp richer after the RBA decision to be 7-10bp stronger on the day.

- Swaps rates are 3-6bp lower post-RBA with the 3s10s curve steeper.

- Bills strip strengthens 5-8bp after the RBA decision with pricing +3 to +13 on the day with the whites leading.

- RBA-dated OIS pricing is 5-7bp softer across meetings after the RBA decision. The market had priced an 81% chance of a pause today ahead of the decision. May meeting pricing softened 5bp post-RBA, while year-end easing expectations remained unchanged at 23bp.

NZGBS: Stronger But off Bests, Eyeing US Tsys

NZGBs closed 2-4bp richer but off session bests as US Tsys come under modest pressure in Asia-Pac trade as local participants faded Monday’s ISM-induced rally. Without any meaningful macro news flow, a shift in focus to the inflationary impact of higher oil prices is one possible explanation. NZGBs underperformed US Tsys with the NZ/US 10-year yield differentials +5bp.

- Swap rates closed flat to 1bp lower, implying a wider long-end swap spread.

- Ahead of the RBNZ policy decision tomorrow, RBNZ dated OIS pricing closed 1-2bp softer across meetings. 27bp of tightening is priced for tomorrow’s meeting with terminal OCR expectations at 5.29%.

- On the local data front, the NZIER Quarterly Survey of Business Opinion showed a slight improvement in confidence (66% of firms expect the economy to deteriorate versus 70% previously). A net 69% of firms raised prices in Q1 with a net 61% expecting to raise prices in Q2. Market pricing was little changed after the data.

- Given that the local market has closed ahead of the RBA rates decision, tomorrow's opening is expected to reflect not only the Australian market's response to the announcement but also any fluctuations in the US Tsys overnight.

FOREX: AUD Pressured After RBA Holds Rates At 3.6%

AUD is pressured in Asia today, falling after the RBA held rates at 3.6%. The RBA board watered down previously hawkish forward guidance as the bank noted in the final paragraph that some further tightening "may" be needed, at the previous meeting the board had noted further tightening will be needed.

- AUD/USD prints at $0.6760/65 ~0.3% softer today. The pair fell from $0.6785/90 pre decision. AUD/NZD is also ~0.4% softer, the cross has fallen below its 20-Day EMA ($1.0754) as bears target 2023 lows ($1.0667).

- Yen is also pressured. USD/JPY briefly dealt below Monday's lows before firming as US Treasury Yields ticked marginally higher. The pair prints at ¥132.70/80 ~0.2% firmer.

- Kiwi is little changed today, NZD/USD firmed through $0.63 meeting resistance at $0.6310 and paring gains to sit at current levels. A narrow 20 pip range has been respected for the session thus far.

- Elsewhere in G-10 EUR and GBP are both little change, there has been little follow through on moves thus far.

- Cross asset wise; 10 Year US Treasury Yields are little changed having been ~2bps higher earlier in the session. BBDXY is ~0.1% firmer and e-minis are little changed.

- Eurozone PPI data headlines an otherwise thin European session. Further out we have Factory Orders and JOLTS Job Opening.

ASIA FX: Commodity Related FX Still Outperforming NEA

USD/Asia pairs have traded in a mixed fashion today, albeit with some commodity related FX outperforming relative to North East Asia FX. IDR remains somewhat of a standout in terms of recent performance. YTD lows for USD/IDR aren't too far away. In contrast USD/CNH and USD/KRW dips were generally supported. Tomorrow is headlined by Philippines and Thailand CPI prints. Singapore retail sales (and PMI) are on tap. India services PMI is also out, along with South Korean FX reserves.

- USD/CNH dipped in early trade but was supported ahead of the 6.8700 level. We got above 6.8900 before offers capped the move. We were last around 6.8860/70. Higher USD/JPY levels and a firmer US yield backdrop weighing on CNH at the margins. Onshore equities are also struggling to maintain positive momentum.

- 1 month USD/KRW has also been supported on dips, albeit holding within recent ranges. Lows were close to 1302.50, but we are back to session highs now, around 1312/13. Earlier March CPI data showed slightly softer headline CPI pressures, but core remained sticky.

- The SGD NEER (per Goldman Sachs estimates) little changed from yesterday's closing this morning, we remain well within recent ranges and below cycle highs seen in March. We sit ~0.6% off the upper end of the band. USD/SGD met resistance at the 20-Day EMA yesterday before falling ~0.6% from peak to trough as US Treasury Yields softened on Monday. The pair is marginally firmer this morning but moves have been limited with little follow through and last prints $1.3270/80.

- USD/IDR spot is down a further 0.35% so far today, last in the 14915/20 region. Earlier lows were close to 14900. A fresh break below this level will have the market targeting a move towards 14837, which is the YTD low for 2023. Recent highs (towards the end of March and earlier in April), come in around the 15000 level. The IDR remains a comfortable outperformer against the rest of Asia FX over the past week (+1.15%). Cross asset signals remain positive, with 5yr CDS back to 92bps. while global equities generally remain on the front foot. Palm oil also looks to be breaking above its simple 200-day MA. The Citi ToT proxy has bounced for Indonesia, albeit from depressed levels.

- USD/INR firmed yesterday finishing the session up ~0.2%. Rising oil prices weighed on the pair however gains were pared into the close as US Treasury Yields softened.• A reminder that onshore markets are closed today for the observance of a national holiday.• The pair closed below its 20-Day EMA (82.38), bears now target 200-Day EMA (80.95). Bulls look to target the 83 handle.

- USD/THB is lower in large part due to USD weakness post yesterday's close. The pair is back to 34.25/30, +0.35% firmer in baht terms. We remain above recent lows close to 34.00 though.

CNH: History Suggests CNH May Struggle To Benefit From Wide PMI Gap With The US

USD/CNH hasn't seen much follow on the downside today post the US ISM miss from Monday's session, which weighed on the dollar and US yields during NY trade. US yields have firmed modestly during the first part of Tuesday trade in Asia Pac, which has aided dollar sentiment.

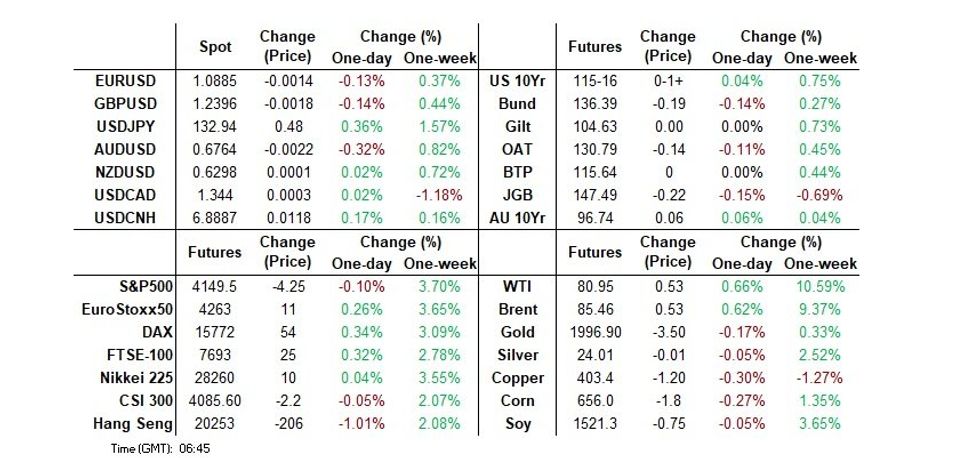

- More broadly though USD/CNH tends to have an inverse relationship with the US-China PMI differential. The chart below plots USD/CNH against this differential (for manufacturing PMIs, the official one for China versus ISM for the US).

- That is, periods where the US ISM is sharply lower than the China manufacturing PMI don't often coincide with weaker USD/CNH levels. Indeed, the correlation between the two series is -70% for the past 5 years. This comes down a bit when we look at service PMI differentials, but only to -40%.

- One factor may be what happens to China export growth when the US ISM falls sharply. Such episodes may leave the China authorities reluctant see local FX appreciation.

Fig 1: USD/CNH Versus US ISM - China Manufacturing PMI

Source: MNI - Market News/Bloomberg

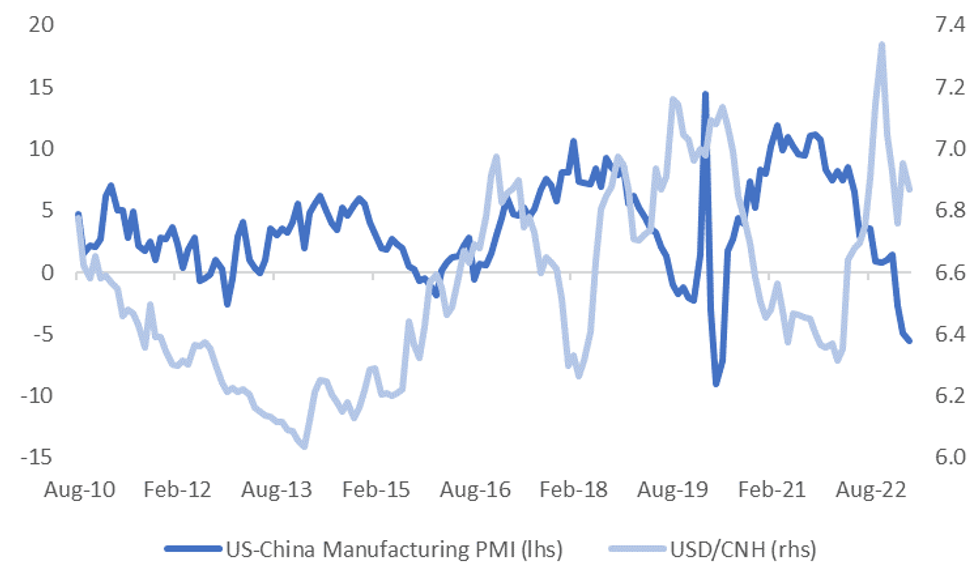

- The USD may also benefit from flight to safety flows during ISM slumps, which often coincide with US recessions. The second chart below plots the USD NEER (J.P. Morgan Index) against the US ISM level, which is inverted on the chart.

- Other factors in the context of the current cycle are lingering fears of higher inflation still driving Fed support for the USD in the near term.

- The China authorities have also been highlighting the weaker external backdrop in recent months, so again may be reluctant to encourage FX strength. Indeed, the CNY NEER has slipped to the bottom end of its recent range for 2023 over the past few weeks.

- The final point would be around scope for a further easing in monetary policy settings in China, which could be to aid the recovery, but all else equal, may act as a FX headwind.

Fig 2: USD NEER And US ISM (Inverted)

Source: J.P. Morgan/MNI - Market News/Bloomberg

SOUTH KOREA: CPI Headline Y/Y Momentum Continues To Moderate, But Core Remains Sticky

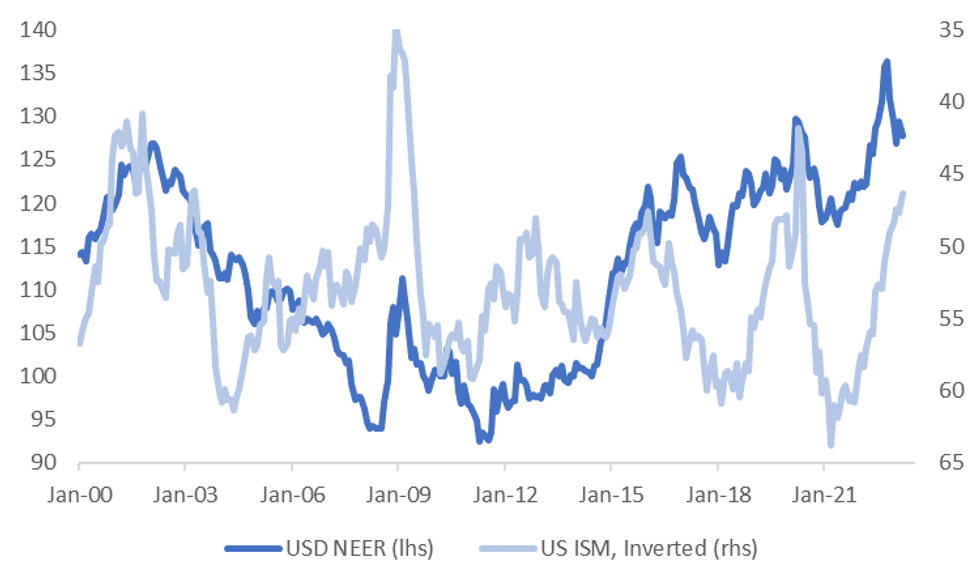

South Korea CPI headline y/y was a touch below expectations. We printed at 4.2%, versus the 4.3% consensus. The m/m was as expected (+0.2%), while core held steady at 4.8% y/y.

- From a headline standpoint we are now comfortably off the July 2022 peak of 6.30% y/y. Still, the detail showed 7 out of 12 sub categories with a firmer y/y pace compared to February.

- Much of the downside in headline appeared to reflect a sharp fall in transport costs, -5.2% y/y, from 0.4% last month.

- So, while the authorities will welcome the continued correction lower in headline y/y momentum, they are likely to be mindful of still sticky underlying inflation pressures. The chart below plots headline and core CPI in y/y terms.

- Note the next BoK meeting is next week on April 11.

Source: MNI - Market News/ Bloomberg

EQUITIES: Regional Equity Sentiment Mixed

Regional equities are mixed today. In line with an indifferent lead from US/EU markets through Monday's session and local drivers haven't been strong today. US futures are modestly in the red at this stage, while EU futures are positive, although only by ~0.35%. The APAC large/mid-cap index is close to flat for the session, which arguably best sums up sentiment.

- The HSI is off by 0.64% at this stage, with tech off by 1.61%. We are away from session lows for both indices, although headwinds were evident from Monday's NY session with the Golden Dragon index weaker. Major tech related indices also underperformed.

- The CSI 300 is close to flat in mainland China, while the Shanghai Composite is faring a bit better (+0.25%).

- Japan stocks are modestly positive, Topix +0.1%, while the Kospi is higher at +0.50%, although offshore investors continue to sell local shares (-$231.2mn).

- The ASX 200 is marginally firmer after the RBA left rates on hold and watered down the prospect of further hikes.

- Most SEA bourses are lower today, but losses are under 0.50%.

GOLD: Bullion Eases Slightly After Monday’s Rally

Gold prices rose 0.8% on Monday as the OPEC-related rally in oil prices increased recession risks and the US ISM data disappointed. Today it has eased 0.2% to around $1980.40/oz. The USD index is up slightly.

- Gold reached a high of $1990.55 on Monday and is heading towards the bull trigger of $2009.70, the March 20 high. Today the intraday high was $1985.59 followed by a low of $1977.95.

- The manufacturing ISM showed that prices paid had fallen in March with the index down to 49.2 from 51.3, thus easing inflation and rate hike concerns. The services ISM prints on Wednesday and price pressures in this sector are a lot higher with analysts only expecting a slight moderation from February’s elevated 65.6.

- Later the Fed’s Cook, Collins and Mester speak. Bank of England’s Pill is also due to talk. There is little on the data calendar with February US JOLTS job openings the main release. The focus of the week is Friday’s US non-farm payrolls for March.

OIL: Crude Continues To Rally On Back Of OPEC+ Output Cut

Crude has continued to rise during APAC trading today. After rising over 6% on Monday it is up a further 0.5%, as the impact of OPEC+’s output cut announcement continued to be felt in markets. The USD index is up 0.1%.

- Brent is now about $85.34/bbl, close to the intraday high of $85.41. WTI is trading around $80.82 after reaching a high of $80.91. Prices are their highest since late January 2023.

- While there are concerns that the cut in crude production and the subsequent increase in prices will be inflationary. US President Biden said today that the impact is unlikely to be “as bad as you think”.

- According to Bloomberg, OPEC+ began to discuss the need to change the output quota on March 20 when Brent fell to a 15-month low.

- While Goldman Sachs has increased its oil price forecasts, Morgan Stanley reduced its projections on the back of disappointing demand from China and Citigroup doesn’t believe that prices will return to $100 quickly.

- Later the Fed’s Cook, Collins and Mester speak. Bank of England’s Pill is also due to talk. There is little on the data calendar with February US JOLTS job openings the main release.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/04/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 04/04/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Keynote Speech at RES Conference | |

| 04/04/2023 | 1230/0830 | * |  | CA | Building Permits |

| 04/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/04/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 04/04/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/04/2023 | 1630/1730 |  | UK | BOE Pill Speech at ICMB | |

| 04/04/2023 | 1730/1330 |  | US | Fed Governor Lisa Cook | |

| 04/04/2023 | 2245/1845 |  | US | Cleveland Fed's Loretta Mester | |

| 05/04/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.