MNI EUROPEAN MARKETS ANALYSIS: Aust Disinflation Progress Stalls, Prolonged RBA Hold Likely

- Treasury futures have continued to sell off as the Wednesday session has progressed. The 2yr yield has pushed towards 5.00%. The USD is firmer, building on Tuesday gains.

- The AUD couldn't sustain a bounce post stronger monthly CPI data. April CPI inflation came in higher-than-expected at 3.6% y/y after 3.5% in March, second straight monthly rise. This points to a prolonged RBA on hold.

- JGB futures are significantly weaker and hovering around session cheaps, -37 compared to settlement levels. Overnight weakness, influenced by US tsys, was exacerbated by a speech by BoJ Board member Seiji Adachi in Kumamoto. Yen didn't get any meaningful lift though.

- Looking ahead, the Fed’s Williams speaks and the Beige Book is published. In terms of data, US Richmond & Dallas Fed indices and German preliminary CPIs for May print.

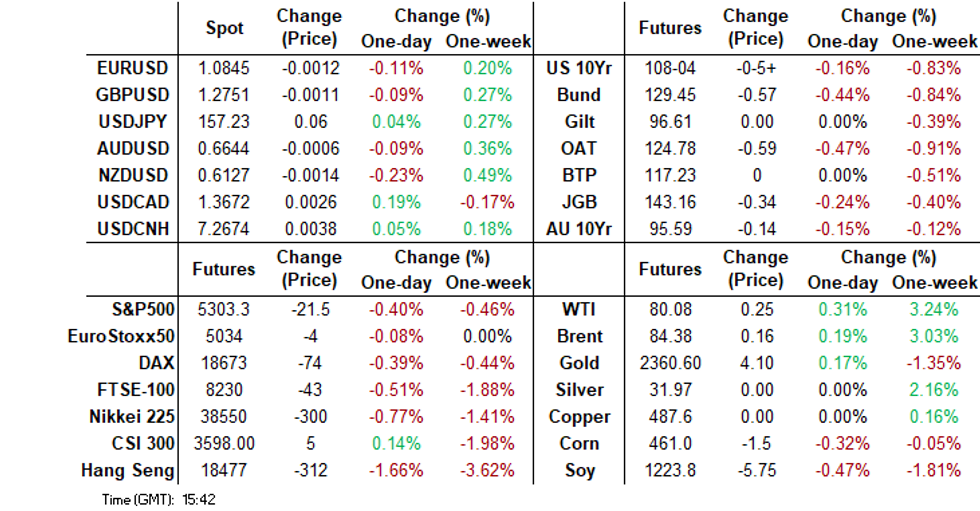

MARKETS

US TSYS: Tsys Futures Continue Sell-Off, AU CPI Beats,10Y JGB At 2011 Levels

- Treasury futures have continue to sell off as the Wednesday session has progressed, TU is ( - 01) at 101-12.625, support holds at 101-09.875, while TY is (- 05) at 108-04+ clearing support at 108-06, next support is may 2nd lows of 107-25.

- Volumes: TU 70k, FV 74k & TY 130k

- Cash treasury curve is flatter today, the 2Y +1.5bps to 4.992%, while the 10Y +1bp at 4.56%, the 2y10y is +1.805 at -41.267, we are now about 8bps off recent lows.

- Across Local Markets: ACGBs are 11-14bps higher, curve is steeper, NZGBs are 5-7.5bps higher, curve steeper, JGBs are 1-5bps higher curve is mixed, with the 10Y yield +4.8bps higher and now at 1.067%

- Fed Funds implied rates have lifted to show just 19bp of cumulative cuts priced for Nov and 32bp for Dec.

- Looking ahead; MBA Mortgage Applications, Richmond Fed Manufacturing Index & the Federal Reserve Releases Beige Book, while there will be continued supply with a $44b 7yr auction.

JGBS: Bear-Steepener, BoJ Adachi Links FX Weakness To Another Hike, 2Y Supply Tomorrow

JGB futures are significantly weaker and hovering around session cheaps, -37 compared to settlement levels. Overnight weakness, influenced by US tsys, was exacerbated by a speech by BoJ Board member Seiji Adachi in Kumamoto.

- Although Adachi emphasised that the central bank's decision to end easing measures does not signify a shift towards monetary tightening, he acknowledged it’s possible that yen weakness could spur price gains and prompt authorities to consider another rate hike earlier than expected. (See BBG link)

- Japan’s May Consumer Confidence Index falls to 36.2 (39.5 est).

- Cash US tsys are dealing 1-2bps cheaper in today’s Asia-Pac session after yesterday’s bear-steepening.

- The cash JGB curve has bear-steepened, with yields flat to 4bps higher. The benchmark 10-year yield is 4.4bps higher at 1.073% after making a fresh cycle high of 1.079%, the highest level since 2011.

- The swaps curve has also bear-steepened, with rates 1-3bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see Weekly International Investment Flow data alongside 2-year supply.

AUSSIE BONDS: Yields Shunt Higher After CPI Data, RBA Hunter Fireside Chat Tomorrow

ACGBs (YM -13.0 & XM -15.0) are 3-4bps cheaper after the release of hotter-than-expected CPI Monthly data for April. However, futures have managed to ebb away from the session’s worst levels.

- April CPI inflation came in at 3.6% y/y after 3.5% in March, the second straight monthly rise. This is particularly noteworthy given that many services components were not updated given it is the first month of the quarter. The underlying trimmed mean picked up to 4.1% from 4.0%. Inflation remains sticky and heading towards the RBA’s upwardly revised 3.8% forecast for Q2 keeping it on hold.

- Cash ACGBs are 12-15bps cheaper on the day with the AU-US 10-year yield differential at -15bps versus -20bps before the data.

- Swap rates are 10-13bps higher on the day, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -2 to -13.

- RBA-dated OIS pricing is 4-12bps firmer on the day for meetings beyond August. Only 2bps of easing is priced by year-end from an expected terminal rate of 4.38%.

- Tomorrow, the local calendar will see Private Capital Expenditure and Building Approvals data. Also, Assistant Governor (Economic) Sarah Hunter will also partake in a Fireside Chat at the Australasian Investor Relations Association (AIRA) annual conference.

AUSTRALIAN DATA: Disinflation Progress Stalls, Prolonged RBA Hold Likely

April CPI inflation came in higher-than-expected at 3.6% y/y after 3.5% in March, second straight monthly rise. This is particularly noteworthy given that many services components were not updated given it is the first month of the quarter. The underlying trimmed mean picked up to 4.1% from 4.0%. Inflation remains sticky and heading towards the RBA’s upwardly revised 3.8% forecast for Q2 keeping it on hold.

- Seasonally-adjusted headline CPI rose 0.2% m/m after 0.5% in March. CPI ex volatile items and holiday travel also rose 0.2% m/m to be steady at 4.1% y/y, still well above headline inflation and signalling that the April pick up was not just driven by volatile food and fuel.

Source: MNI - Market News/ABS

- Domestically–driven services prices picked up to 4% y/y from 3.9% while non-tradeables eased to 5% y/y from 5.2%, but still elevated and above the Q1 average.

- Goods inflation was steady at 3.3% y/y while tradeables rose 1.1% y/y up from 0.5%. The RBA has said that the best of the disinflationary impact from goods prices is behind us and this data is consistent with that.

Source: MNI - Market News/ABS

- Housing, food & beverages, transport and alcohol & tobacco continued to be the main contributors to annual headline inflation. Rents rose 7.5% y/y. Food was impacted by bad weather.

- Electricity prices rose 4.2% y/y in April but the ABS calculates that without government rebates they would have been 13.9% y/y. The budget included further relief which is expected to temporarily reduce inflation over FY25.

- Automotive fuel rose 7.4% y/y after 8.1% in March. They rose 2.2% m/m, the third straight monthly increase.

AUSTRALIAN DATA: Q1 Construction Contraction Broad-Based

Q1 construction work volumes contracted 2.9% q/q with the weakness broad-based across states/territories, public/private sectors, engineering and residential/non-residential building. It was the first quarter total public work done fell since Q3 2021. The RBA has previously pointed out weak dwelling investment.

- Residential building fell 1.2% q/q to be down 2.8% y/y while non-residential sank 7% q/q to be 0.9% y/y lower.

- Private construction work done fell 2.4% q/q to be up 1% y/y with private building down 2.8% q/q and 1.2% y/y and engineering -1.7% q/q but is still up 5% y/y.

- Public construction fell 4.3% q/q, the largest quarterly drop since Q4 2018, to be up 3.9% y/y. The weakness was driven by building (-9.2% q/q -7.1% y/y) but engineering also fell (-2.7% q/q +7.8% y/y).

Source: MNI - Market News/ABS

NZGBS: Cheaper, Outperforms ACGBs, Budget Tomorrow

NZGBs closed 6-7bps cheaper after dealing in relatively narrow ranges in today’s session. NZGBs did however outperform their antipodean counterpart after higher than expected Australian CPI monthly data for April. NZ-AU 10-year differential closed 7bps tighter at +48bps.

- Business Confidence fell 4 points to +11 in May while expected Own Activity fell 2 points to +12 and past own activity rose 2 points to -18, according to ANZ's Business Outlook Report.

- Swap rates closed 4-8bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 2-6bps firmer for meetings beyond October. A cumulative 16bps of easing is priced by year-end.

- NZ’s government will present its first budget tomorrow. It promised tax cuts in the election but has been clear that it has found spending reductions to maintain fiscal responsibility. The timing of both will be important to the RBNZ.

- Building Permits data for April will be released ahead of the Budget tomorrow.

- Thursday’s usual weekly supply has been delayed until Friday, with the NZ Treasury planning to sell NZ$275mn of the 1.5% May-31 bond, NZ$175mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: Dollar Recovery Continues, US 2yr Yield Near 5.0%

The firmer USD backdrop has extended. The BBDXY index last around 1250.35, up a further 0.10% in the first part of Wednesday dealings.

- We remain within recent ranges for the index, although USD strength has been evident against all of the G10 currencies and Asia FX.

- US equity futures sit lower, while regional equities are mostly lower, another USD support point. In the yield space, US cash Tsys are higher, with marginal outperformance at the front end, the 2yr yield back close to 5.0%.

- AUD/USD spiked to session highs of 0.6666 post stronger than expected monthly April CPI, but follow through was limited. We were last back near 0.6650, little changed for the session, although outperforming the likes of NZD and JPY.

- NZD/USD is off nearly 0.20%, last near 0.6130.

- USD/JPY has been supported on dips back to 157.20. The pair was last near 157.30 (earlier highs were at 157.40).

- Comments from BoJ board member Adachi hinted at a possible faster adjustment pace in policy settings if the weaker yen drives a quicker rebound in y/y inflation momentum. Still, Adachi stated policy settings needed to remain accommodative and that further policy adjustments were likely to be gradual.

- Looking ahead, the Fed’s Williams speaks and the Beige Book is published. In terms of data, US Richmond & Dallas Fed indices and German preliminary CPIs for May print.

ASIA STOCKS: HK Equities Head Lower, China Equities Higher On Property Easing

Hong Kong & Chinese equities are mixed today, Chinese property stocks are performing well after Shenzhen, Guangzhou & Shenyang follow Shanghai in easing requirements for home down payments and mortgages. Tech stocks are lower after Lenovo fell on news they sold a $2b convertible bond to Saudi Arabia's sovereign wealth fund, while the CNY has hit a 6-month lows. There has been little else in the way of headlines or economic data today.

- Hong Kong equities are lower today, HK listed property names are lagging their Chinese listed peers, although outperforming the rest of the market, with the Mainland Property Index down 1.55%, the HS Property Index down 1.16%, HSTech Index is down 1.95%, while the HSI is down 1.55%. China onshore markets are higher today, the CSI300 Real Estate Index is up 0.66% although well off opening highs, small-cap indices are down about 0.30%, while the CSI 300 is up 0.27%.

- (MNI): China Press Digest May 29: Yuan, Housing, Consumption - (See link)

- (MNI): IMF China 2024 GDP Growth Revised Up - (see link)

- In the property space, Major cities in China, including Shanghai, Shenzhen, and Guangzhou, have reduced downpayment requirements and mortgage rates to stimulate the property market, following government initiatives aimed at aiding the struggling sector. This move is anticipated to improve market sentiment and sales, although concerns persist over falling property values and incomplete developments. Some Country Garden Creditors Got 4.8% Yuan Bond Payment.

- Money managers increased investments in exchange-traded funds tracking Chinese stocks for the second consecutive week, with China recording the largest inflows across emerging markets, amounting to $610.3 million. This surge follows government measures to bolster market confidence, particularly in the property sector, and signals renewed investor interest in Chinese assets amid broader emerging market inflows.

- Looking ahead: China PMI and Hong Kong Retail Sales of Friday

ASIA PAC STOCKS: Asian Equities Head Lower As Yields Creep Higher, AU CPI Beats

Asia markets are lower today, with mixed economic data, comments from the Fed's Kashkari and US treasury supply pushing yields higher. Elsewhere, Oil extended gains as another attack in the red sea heightened geopolitical tensions ahead of the OPEC meeting on the weekend. MSCI Asia Pacific has fallen for the second straight day, ACGBs bonds sold-off after CPI came in stronger-than-expected while JGB yields continue to make new highs with the 10Y now trading at 1.068% the highest since 2011 while the yen continues to slip.

- Japanese equities are lower today, tech shares are the best performing sector while autos are lower. The yen continues to slid and now trades at 157.25, while JGB yields continue to move higher with the 10Y now 1.068%, the highest since 2011. May Consumer Confidence was 36.2 vs 39.5 est. The Topix is down 0.60%, Topix Auto & Transportation down 1%, while Nikkei 225 is down 0.48%

- Taiwan equities have opened a touch higher this morning but have since pared gains and now trade lower for the day. The Taiex still trades up 13.55% from recent lows, with TSMC now up almost 27% over the same period. Thursday we have GDP data, with consensus at 6.5%. The Taiex is of 0.70%.

- South Korean equities are lower today, with the Kospi now trading back below the 20-day EMA, the Kosdaq has underperformed recently and trades below all major moving averages. South Korea was the only market in the region to see an inflow on Tuesday, although short-term flow momentum still remains subdued and below longer term averages. Later this week we have Industrial Production. The Kospi is down 1.30%, while the Kosdaq is down 1.10%

- Australian equities are lower today, CPI beat estimates coming in at 3.6% y/y vs 3.4% est, while total construction falls 2.9% q/q vs +0.5% est. Financials are the largest contributor to the fall today, while only energy stocks higher. The ASX200 is down 1.05%.

- Elsewhere in SEA, New Zealand equities are up 0.25%, Singapore equities are 0.11% lower, Malaysian equities are down 0.43%, Indonesian equities are down 1.70% while Philippines equities are 1% lower.

ASIA EQUITY FLOWS: Asian Equity Flows Mixed, Markets Lower

- South Korean equity markets were unchanged on Tuesday, the Kospi hold just above the 20-day EMA, while inflows were above the short-term average with a $104m inflow taking the past 5 sessions to a net inflow of $330. Later this week we have Industrial Production. The 5-day average is now just $65.8m, below the 20-day average of $110.5m, and well down on the longer term 100-day average at $160m.

- Taiwan equities continue their rally higher, they closed up another 0.25% on Tuesday, and now trade up 13% since their recent lows on Apr 19th. There was a $21m outflow on Tuesday taking the past 5 trading sessions to a net inflow of $2.03b. Focus this week will be on GDP on Thursday. The 5-day average now sits at $407m, below the 20-day average at $314m however both are well above the longer term 100-day average at $89m.

- Thailand equities were slightly lower on Tuesday with the SET continuing it's directionless trading since mid October. Equity flow momentum has been negative in the short-term as we mark 5 straight session of net selling by foreign investors for a net outflow of $211m. Focus this week will be on BoP Current Account Balance on Friday. The 5-day average is now -$42m, below the 20-day average at -$9.5m and the 100-day average at -$19.5m.

- Indian equities were a touch lower on Tuesday, and just off recent all time highs. Equity flows have been mixed recently, although we are positive for the past 5 trading sessions for a total inflow at $714m. This week we have GDP on Friday. The 5-day average is now $142m, below both the 20-day average at -$147m and the 100-day average at $18m.

- Philippines equities were down 1% Tuesday, the PSEi broke back below the 200-day EMA with next support 6,400 and the lows from Apr 19th. Equity flow momentum has been mixed recently we have seen a net outflow of $25m over the past 5 sessions. The 5-day average is -$5.05m, above the 20-day average at -$17.23m, while slightly below the 100-day average of -$3.1m

- Malaysian equities were slightly lower on Tuesday, and just of recent all time highs, equity flows have been positive recently with the past 5 trading sessions netting an inflow $63m, It's a quiet week for economic data in the region. The 5-day average now $12m, now above the 20-day average at $35m and well above the longer term 100-day average at $1.1m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 105 | 329 | 15424 |

| Taiwan (USDmn) | -21 | 2038 | 6159 |

| India (USDmn)* | 84 | 715 | -2628 |

| Indonesia (USDmn) | -37 | -205 | -156 |

| Thailand (USDmn) | -45 | -212 | -2035 |

| Malaysia (USDmn) * | -37 | 64 | 67 |

| Philippines (USDmn) | -14 | -25.2 | -307 |

| Total | 35 | 2704 | 16523 |

| * Data Up To Apr 27th |

OIL: Crude Off Highs But Still Up On The Day

Oil prices are off their intraday highs but still up on the day supported by a deterioration in the geopolitical situation in the Middle East. WTI has held above $80 and is up 0.4% to $80.11/bbl after a high of $80.32. Brent is 0.2% higher at $84.40 after a high of $84.64. The USD index is up 0.1%.

- Oil’s geopolitical risk premium rose after an altercation at the Rafah border crossing between Israel and Egypt killed an Egyptian soldier and Israeli armed forces moved into central Rafah. Houthi rebels also attacked a bulk carrier off Yemen.

- Industry inventory data from the API are released today with the official EIA numbers on Thursday. The data will be monitored closely for the supply/demand situation in the US last week ahead of the start of the US driving season.

- On the supply side, this weekend’s online OPEC+ meeting is widely anticipated with its 2mbd output cuts expected to be extended into H2. But compliance with quotas has been patchy and will continue to be monitored.

- Later the Fed’s Williams speaks and the Beige Book is published. In terms of data, US Richmond & Dallas Fed indices and German preliminary CPIs for May print.

GOLD: Third Straight Day Of Gains Ahead Of Key US Data

Gold is 0.2% lower in the Asia-Pac session, after closing 0.4% higher at $2361.31 on Tuesday.

- Tuesday’s move was the third straight day of gains ahead of batch of key US economic indicators including Q1 GDP and Weekly Jobless Claims on Thursday and April’s PCE Deflator, the Fed’s preferred inflation gauge, on Friday.

- According to MNI’s technicals team, the trend structure remains bullish and the move down from last week’s highs appears to be a correction. A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2,304.0, represents a key support.

- Silver outperformed, bringing the precious metal close to last week’s 11-year high of $32.5. A break of this level would open $33.887 next, a Fibonacci projection.

ASIA FX: USD/PHP Rallies To Fresh Highs Back To 2022, Firmer USD Elsewhere

USD/Asia pairs are higher across the board, as the broader USD recovery continues. US yields have firmed further, while regional equity markets are mostly weaker, except for onshore China markets, although this hasn't benefited the yuan. USD/PHP has risen to fresh highs back to 2022, up 0.70%. Tomorrow, we get Thailand Industrial production, along with Taiwan GDP revisions for Q1.

- USD/CNY spot moved to fresh highs for the year above 7.2480, albeit just. The USD/CNY fix was set above 7.1100, but only 5pips above yesterday's outcome. The pace of yuan depreciation still looks very modest. USD/CNH is around 7.2660, marginally higher for the session. Onshore equities are firmer today, but an offset is coming from yields which are still wedged at low levels.

- 1 month USD/KRW is off earlier highs near 1365. The pair last close to 1362, little changed for the session, despite generally firmer USD tones (spot is 0.40% weaker, but this largely reflects catch up from Tuesday USD gains). Onshore equities are off more than 1.3% as a strike by workers at Samsung Electronics weighs.

- USD/PHP downside has proven to be short lived. The pair has rebounded firmly today and is back to 58.38/40, around 0.70% weaker in PHP terms. We are above earlier May highs in the pair (58.28) and at fresh highs back to 2022. As we noted yesterday recent dovish rhetoric from the BSP/local rates outlook may have lent the market towards buying dips in the pair. Post the Tuesday rise in US yields has also aided broader USD sentiment. The recovery in oil prices is another headwind for PHP, although correlations don't appear that strong through May (in terms of higher oil prices driving USD/PHP higher). Month end may also be playing a role given continued trade deficits, while local equities are also weaker, back sub the 200-day MA.

- Since onshore markets returned at the start of the week (after being close Thurs/Fri last week), spot USD/IDR has tracked higher. Spot is back towards earlier May highs, last 16160/65, down a further 0.45% in IDR terms so far today. Like elsewhere in the region, cross asset moves are a headwind for the currency, particularly in terms of US yields. Recent peak and troughs in USD/IDR have lined up with shifts in US yield momentum.• Local equities are also softening into month end, while offshore investors have net sellers of local equities in May to date (-$700.9mn). Net bond inflows have been in excess of $900mn, but momentum has slowed through the second half of May.

CREDIT: APAC Credit 1-2bps Tighter, AU Rates Sell-Off on Higher CPI

- Rates: Local rates are cheaper today, following moves by US treasuries overnight, ACGB yields are 11-15bps higher underperforming after CPI beat estimates at 3.6% vs 3.4%, NZGB yields are 5-7.5bps higher, JGBs are 2-5bps higher, the 10Y yield is +4.8bps at 1.067% and the highest since 2011.

- Regional Asian equities are mostly lower today, Chinese equities the only market in the green on positive property news, SK equities are the worst performing as foreign investors flows slow.

- Aus Corps 1-2bps tighter & Snr Fins 1bp tighter, Subs 1-2bps tighter, China Credit is little changed today

- Aus iTraxx CDS unchanged at 63bps & Asia Ex-J iTraxx is up 1bp at 92.50bps

- Data: NZ Activity Outlook for May was 11.8 vs 14.3 prior and Business Confidence was 11.2 vs 14.9 prior, AU Apr Leading Index was -0.03% vs -0.05% prior, Construction work -2.9% vs 0.5% est & Apr CPI was 3.6% vs 3.4% est,

- Primary Deals: Airport Authority launched a Fixed CNY 10Y at 3.4% area

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/05/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/05/2024 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/05/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 29/05/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/05/2024 | 0800/1000 | ** |  | EU | M3 |

| 29/05/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 29/05/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 29/05/2024 | 0800/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 29/05/2024 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/05/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 29/05/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/05/2024 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/05/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/05/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 29/05/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 29/05/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 29/05/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/05/2024 | 1745/1345 |  | US | New York Fed's John Williams | |

| 29/05/2024 | 1800/1400 |  | US | Fed Beige Book | |

| 29/05/2024 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic |