-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: BoJ Expected To Remain Last Dove Standing Tomorrow

- Outside of China and Japan, regional equities continued to track higher today. China's recovery has stalled somewhat, as industrial profits slid and on-going Covid cases (including a lock down in part of Wuhan) weighed on sentiment. Iron ore also continues to diverge from firmer metal trends elsewhere.

- The tone to regional yields was generally to the downside in the aftermath of the BoC's downstep in hiking pace. Although US yields stabilized around recent lows. A number of local backs also expect the RBA to hike by 50bps next week, but futures pricing is not moving much beyond 25bps. AUD and NZD were generally on the front foot though, outperforming other high beta FX.

- Coming up, the main focus will be the ECB decision (+75bps expected). In the US, advance Q3 GDP data will provide another key input to the ongoing debate on Fed tightening trajectory.

US TSYS: T-Notes Slip Amid Bid In E-Minis, Fed Musings Take Centre Stage

The debate on Fed tightening outlook dominated, after a surprise downshift in the BoC's rate-hike pace fuelled speculation that U.S. policymakers could follow suit sooner than had been expected. A slew of weak earnings reports from big U.S. tech names and unimpressive data outturns earlier this week helped this narrative gain some more traction. Another 75bp rate rise at the next FOMC meeting remains fully priced in, but hawkish bets for the subsequent meetings have moderated over the past week.

- A positive showing from U.S. e-minis kept a lid on core FI. Continued rally in the Hang Seng and resilience in South Korean stock indices lent further support to sentiment, even as equity indices in Japan and mainland China traded narrowly in the red.

- T-Notes ground higher but struggled to penetrate 111-05 on several attempts and eased off into negative territory. The contract last deals -0-02+ at 111-00+. Eurodollars trade 1.0-2.0 ticks lower through the reds.

- Cash Tsy curve runs marginally steeper at typing, with yields last seen 1.1-2.1bp cheaper. The spread on 5-Year/30-Year Tsys remained in inversion territory, despite moving towards the breakeven level through the session.

- Advance Q3 GDP data will provide another key input to the ongoing debate on Fed tightening trajectory. Other data highlights include durable goods and initial jobless claims. The Treasury will auction $35bnworth of 7-Year notes.

JGBS: Confidence In BoJ Dovish Resolve Supports JGBs, But Spillover From Offshore Bites Into Gains

Benchmark JGB futures went bid from the off after Wednesday's boost to the sizes of BoJ bond-purchase operations across the 10-25 & 25+ Year baskets reinforced expectations that the central bank will stick with its ultra-loose monetary policy settings tomorrow. The contract for December delivery climbed to a session high of 148.75, before easing off into the Tokyo lunch break and extending its pullback thereafter. It last operates at 148.59, up 27 ticks versus prior settlement.

- Fresh pressure to JGB futures likely came from other core FI markets, with U.S. Tsy yields pausing recent declines. Resilience in e-mini futures and several major equity markets (albeit not in Japan) may have helped sap strength from core FI.

- Cash JGB yields are lower across the curve, save for 10s, which remain in the vicinity of the BoJ's 0.25% ceiling. 20s comfortably outperform, while 2s are strongest in the short end, aided by an auction of Nov '24 Notes today.

- 2-Year JGBs advanced after an auction of that tenor. The tail remained unchanged from the previous offering and the bid/cover ratio fell to 4.16x (prev. 4.78x), but the low price was higher than forecast in a BBG dealer poll. The yield on 2-Year JGBs remains under scrutiny after if flirted with positive territory last Friday.

- The widely watched Japan 10-Year swap rates extended the retreat from cyclical highs printed a few days back, reducing their premium to 10-Year JGB yield.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.2704tn 2-Year JGBs:

- Average Yield -0.031% (prev. -0.046%)

- Average Price 100.074 (prev. 100.103)

- High Yield: -0.027% (prev. -0.042%)

- Low Price 100.065 (prev. 100.095)

- % Allotted At High Yield: 41.4205% (prev. 3.2510%)

- Bid/Cover: 4.155x (prev. 4.779x)

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.8643tn 3-Month Bills:

- Average Yield -0.1381% (prev. -0.1492%)

- Average Price 100.0371 (prev. 100.0401)

- High Yield: -0.1265% (prev. -0.1358%)

- Low Price 100.0340 (prev. 100.0365)

- % Allotted At High Yield: 53.2362% (prev. 33.2481%)

- Bid/Cover: 2.576x (prev. 3.036x)

BOJ: MNI BoJ Preview - October 2022: The Solitary Dove

EXECUTIVE SUMMARY

- The BoJ will likely leave its monetary policy settings and forward guidance as they currently stand come the end of its October policy meeting, as it looks to promote meaningful wage growth, while looking through the current round of cost-push driven inflation.

- Financial markets continue to challenge the wider Japanese policymaking sphere via both the FX and fixed income channels.

- The BoJ faces a testing time in the months ahead, although it has proven that it stands ready to defend its current policy settings, via both words and actions.

- See the full preview here:

AUSSIE BONDS: ACGBs Pare Initial Gains, Tweak To Westpac RBA Call Provokes Knee-Jerk Reaction

Aussie bonds trimmed their initial gains, as the broader core FI space came under pressure, while hawkish RBA expectations sharpened at the margin.

- U.S. e-minis operated in the green, while Asia-Pac equity benchmarks outside of China and Japan firmed. The combination of the BoC's unexpected shift to a slower pace of rate hikes, weaker-than-forecast U.S. data outturns from earlier this week and underwhelming earnings reports from some U.S. tech giants lent credence to the narrative suggesting that the Fed could soon pivot to less aggressive tightening.

- ACGBs briefly ticked lower in a knee-jerk reaction to Westpac's updated RBA call. The bank now sees a 50bp cash rate target hike next week and a terminal rate of 3.85%. The tweak to his forecast came after a number of sell-side desks lifted their peak rate estimates in reaction to expectation-beating CPI report Wednesday, though the dominant view remains that we will see a 25bp move next week.

- Overhang impetus helped push Aussie bond futures to session highs in morning trade, before they slowly unwound gains; YM last sits +7.0 & XM +5.0. Bills run unch. to +11 ticks through the reds. Cash ACGB curve runs steeper and sits lower, albeit off early session lows.

RBA: MNI Insight: Economic Fundamentals Pointing To RBA Rate Hikes Into 2023

- The RBA began its first monetary policy tightening cycle in May this year, the first since October 2009. Given the pace at which rates have risen, 250bp in 5 months, and the expectations of more to come given elevated inflation, there continues to be a lot of focus on the RBA, what it is thinking and its decision-making process.

- Economic fundamentals are pointing to further monetary tightening ahead.

- We have estimated a simple policy reaction function and it is signalling 25bp rate hikes at the next six meetings to 4%, slightly above market pricing.

- For the full piece, see here: MNI Insight: Economics Pointing To Rate Hikes Into 2023

FOREX: USD Pullback Almost On Par With Previous 2022 Corrections

The USD was offered in early trade, particularly against both EUR and CNH. EUR/USD got close to 1.01, with the 100-day simple MA coming in at 1.0089, but we couldn't hold these levels, last back to 1.0070. USD/CNH got sub 7.1700, but has rebounded aggressively, back into a 7.2350/00 range, +0.70% above NY closing levels.

- This has helped the BBDXY stabilize, although we remain below the 50-day MA (1320.03), with the index last at 1318.45, see the chart below. Interestingly, the recent correction lower in this index, is getting close to the magnitude of other corrections, seen in recent months.

- In terms of cross-asset signals, equities have been mixed, with US futures higher, but the China equity rebound has stalled. US yields are slightly above NY closing levels (4.02% for the 10yr).

- AUD/USD has struggled to hold gains above 0.6500, even with calls from local banks for a 50bps move from the RBA next week. Futures pricing is slightly above 25bps priced in for next week.

- NZD has outperformed slightly, last near 0.5850, although unable to push above 0.5855 (50-day EMA). RBNZ Governor stated earlier that the RBNZ will fulfill its inflation mandate, even if the unemployment rate moves higher.

- Coming up, the main focus will be the ECB decision (+75bps expected). In the US, advance Q3 GDP data will provide another key input to the ongoing debate on Fed tightening trajectory.

Fig 1: BBDXY Correction Approach Previous 2022 Pullbacks In Terms Of Magnitude

Source: MNI - Market News/Bloomberg

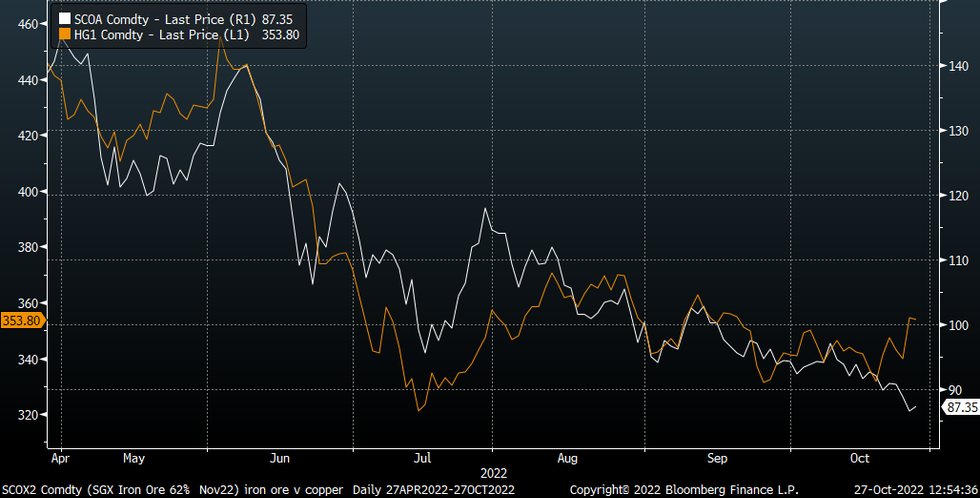

AUD: A$ Correlation With Iron Ore Dips Sharply

AUD/USD correlations with global equities/risk measures remain firm, as well as with global commodities, ex iron ore. Correlations are negative with yield spreads on a short term basis.

- The table below presents correlations (levels terms) for AUD/USD with key macro drivers over the past week and month.

- The weaker correlations with government bond yield spreads are not surprising, given yield momentum has generally moved against the AUD over the past week, as the A$ has bounced. The AU-US 2yr spread is back close to -110bps, down from recent highs near -95bps.

- This comes despite yesterday's decent Q3 CPI beat, and speculation around a reduced pace of Fed tightening. Next week delivers the RBA meeting, which historically has seen higher short term correlations between spreads and the A$.

- Elsewhere, correlations remain firm with global commodities, including base metals. The correlation is strongly negative though with iron ore. Iron ore continues to drift down, despite the firmer backdrop for other metals, see the chart below. It is finding some support in the past 24 hours, last at $87.40/tonne for the active Singapore contract.

- As correlation with global equities also remains firm, although sits slightly higher with the VIX (inversely) for the past week.

Table 1: AUD/USD Correlations

| 1wk | 1mth | |

| 2yr yield differential | -0.47 | 0.52 |

| 5yr yield differential | -0.42 | 0.48 |

| 10yr yield differential | -0.44 | 0.25 |

| Global commodity prices | 0.86 | 0.22 |

| Base metals | 0.81 | 0.27 |

| Iron ore | -0.93 | -0.25 |

| Global equities | 0.73 | 0.44 |

| US VIX index | -0.93 | -0.58 |

Source: MNI - Market News/Bloomberg

Fig 1: Iron Ore & Copper Trends Somewhat Divergent At The Moment

Source: MNI - Market News/Bloomberg

ASIA FX: USD/CNH Rebounds 1% From Intra-Day Lows

A sharp recovery in USD/CNH from early session lows has defined the Asian FX session. This has spilled over to the rest of the region, with only INR outperforming, although this largely reflects catch up after onshore markets were closed yesterday. In terms of focus tomorrow we get Q3 GDP for Taiwan, along with Singapore unemployment data.

- USD/CNH sunk to sub 7.1700 in early trade, but has spent much of the session rebounding, trading above 7.2400, a +1% turn around. Onshore spot has pushed back towards 7.2200 as well. Sentiment has now stabilized somewhat. The CNY fixing error was much lower today, but this is likely to reflect yesterday's sharp USD sell-off. China industrial profits continued to slow for September, while President Xi stated China was willing to find ways to get along with the US.

- The won couldn't build on yesterday's gains. The 1-month USD/KRW NDF is back to a 1420, +0.50% above NY closing levels, in line with CNH weakness. Earlier, Q3 GDP showed slowing q/q growth, but a resilient domestic demand backdrop. The BoK also stepped-up efforts to stabilize local credit markets by widening the collateral that it accepts.

- USD/SGD is above early session lows as well, last at 1.4050/55. The MAS expects inflation to stay high in 2023, even with growth forecast to slow further. Core inflation is forecast to average 3.5-4.5% next year (against a 4% avg for this year), while growth dips below trend.

- USD/INR is lower, after onshore markets re-opened today. The pair dipped towards 82.10 but is back at 82.30 now. Onshore equities are +0.50% in the first part of trading, while the 10yr yield has moved away from recent highs, back sub 7.60%, -6bps for the session.

- USD/IDR spot is slightly above yesterday's levels, last at 15573, + figs for the session. The USD/UST yield pullback should be favorable for IDR, but today's USD/CNH rebound may be offsetting. In the absence of notable data releases during the remainder of this week, focus turns to the latest batch of CPI figures, due next Tuesday.

- USD/PHP moves further away from the line in the sand, last at 58.33, -13 figs for the session. BSP Gov Medalla sought to water down messaging from his predecessor and current FinSec Diokno, who drew a line in the sand at PHP60, vowing that officials would defend that level. Medalla said that he saw "very little" difference between USD/PHP hitting PHP60.00 and PHP60.50, but the round figure "became a magic number" politically, which "can complicate central banking."

EQUITIES: China Rebound Stalls, Mixed Performances Elsewhere

Asia Pac equities have been mixed, with the onshore China market rebound stalling, while HK stocks continue to recover. US futures have stayed in positive territory for much of the session (0.30-0.60% ranges), following cash losses overnight, particularly in the tech sector.

- Mainland China indices are modestly lower at this stage, the CSI 300 off 0.1%. September industrial profits fell YTD y/y by 2.3%, with weakness fairly broad based. Wuhan has also locked down parts of the city amid fresh covid cases. It's expected the lockdown will last until Sunday. President Xi did state that China is willing to find ways to get along with the US.

- In contrast, the HSI is up around 1.7%, with tech related companies gaining 3.00%. Note the China Golden Dragon index gained a further 7.19% overnight, recouping more of Monday's 14.43% dip.

- The Kospi is up a further 1.40%, despite an earnings miss from Samsung Electronics. BoK stepped up efforts to stabilise credit markets, by expanding the type of bonds it will accept as collateral. The Taiex is also higher, +1.3%. The government is planning to work with industry to support chip sector development amid US-China tensions in the sector.

- The Nikkei 225 has underperformed, -0.25%, with the banking sector weighing. Tomorrow's BoJ decision looms as the next major risk event for these markets.

GOLD: Holding Overnight Gains

Gold is largely holding onto to gains from the overnight session. The precious metal was last close to $1665, near NY closing levels, after yesterday's +0.69% gain. This comes despite a slight recovery in USD sentiment, although mvoes amongst the majors have been modest

- An early attempt to push above $1670 met with resistance. Overnight, gains above this level couldn't be sustained either (highs were near $1675). On the downside, dips to the low $1660 level are being supported. Beyond that is earlier lows this week between $1638/$1643.

- More broadly, a sustained break above $1670 could pave the way for a test of the 50-day simple MA ($1687.26). ETF gold holdings rose for the first time in 5 sessions yesterday as well.

- Gold bulls may wish to see a further pull back in US real yields though before turning more constructive.

OIL: Refined Product Shortages Provide Crude Price Support

Oil prices held onto their overnight gains from a lower USD and product market shortages. They have traded slightly higher today with WTI now just over $88 and Brent just under $96.

- While the EIA weekly data showed a build in inventories of crude, the details continued to report distillate stocks at record lows in the US and a drawdown of gasoline. Demand for crude is expected to rise globally to increase refined product supplies, especially of diesel, thus providing price support.

- Along the same theme, China increased export quotas to encourage more shipments of refined fuel products and to provide a boost to the struggling economy. Given excess capacity in the sector, refiners are likely to increase output and purchases of crude oil.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/10/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 27/10/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 27/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/10/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/10/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 27/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/10/2022 | 1245/1445 |  | EU | ECB post-policy decision press conference | |

| 27/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.