-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: BOJ Tomorrow, No Major Changes Expected

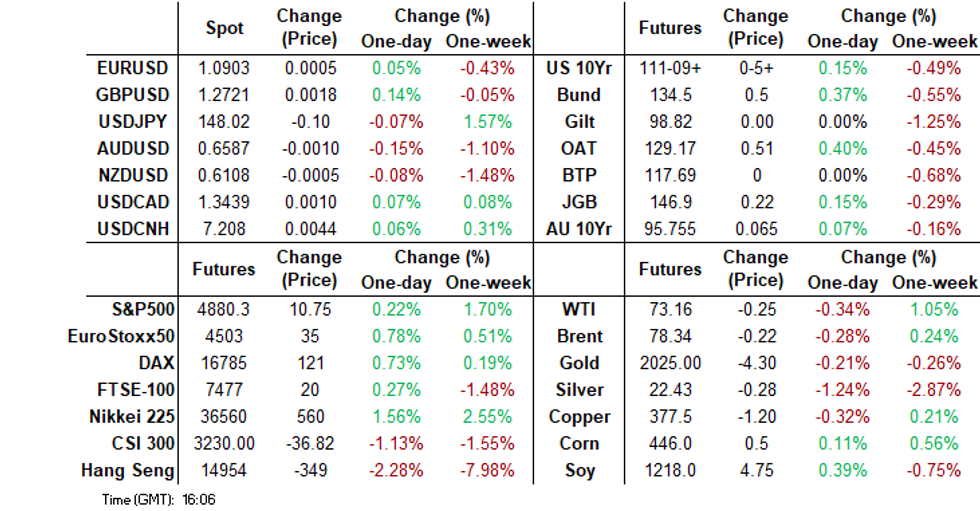

- The early risk on tone, led by higher US equity futures gave way to more caution as the Asia Pac session progressed. US futures remain comfortably in the green, but Cjina/HK equity losses have grown as the session progressed, with property headwinds continuing.

- This helped stabilize the USD against the majors and Asian currencies. Cash US Tsys continue to flatten in the cash bond space.

- JGB futures are holding richer and near session highs, +14 compared to the settlement levels, ahead of tomorrow’s BoJ Policy Decision.

- Looking ahead, the calendar for the rest of today is light with the Fed’s blackout period now in place and only the US leading index for December printing.

MARKETS

US TSYS: Cash Bonds Continue Flattening Theme

TYH4 is trading at 111-10, +06 from NY

closing levels, breaking above Fridays highs but has remained range bound since mid morning.

• Cash bonds have slowly continued the flattening theme throughout the day, with the 2yr now 1.5bps higher, while the 10yr is 1.3bps lower

• There hasn’t been anything meaningful on the newsflow front today.

• In the US session later today, we have the Leading Index (pr,-0.5%, est,-0.3%) data out, and US Tsy $77B 13W, $70B 26W Bill auctions.

JGBS: Futures Holding Richer, BoJ Policy Decision Tomorrow, No Change Expected

In Tokyo afternoon dealing, JGB futures are holding richer and near session highs, +14 compared to the settlement levels, ahead of tomorrow’s BoJ Policy Decision.

- Our analysis aligns with the prevailing consensus, anticipating the BoJ to continue normalising its policy in 2024, though such adjustments are not anticipated at this week's meeting.

- The delay in exiting the Negative Interest Rate Policy (NIRP) is grounded in several considerations: an evaluation of the impact of the earthquake, conclusion of the shunto wage negotiations, no incentive to surprise the market and the need to transition from an explicit easing bias to a tightening bias. (See MNI’s BoJ Preview here)

- There hasn’t been much in the way of domestic drivers to flag today.

- Bloomberg reported that trading of Japanese government bonds was the most active last month in more than a decade as investors bet on interest rate hikes and the central bank sought to reduce its presence in the debt market. (See link)

- Cash JGBs are dealing mixed, with yield movement ranging from -1.6bps (7-year) to +2.3bps (30-year). The benchmark 10-year yield is 0.2bp lower at 0.666% versus the Nov-Dec rally low of 0.555%.

- The swaps curve is slightly richer. Swap spreads are mixed.

BOJ: MNI BoJ Preview - January 2024: Policy Normalisation Is Coming But Not Yet

EXECUTIVE SUMMARY

- Our analysis aligns with the prevailing consensus, anticipating the BoJ to continue normalising its policy in 2024, though such adjustments are not anticipated at this week's meeting.

- Instead, both our perspective and the consensus majority anticipate the BoJ to implement a policy rate increase during the meeting scheduled for April 26, coinciding with the release of the next Quarterly Outlook Report.

- This delay in exiting the Negative Interest Rate Policy (NIRP) is grounded in several considerations: an evaluation of the impact of the earthquake, conclusion of the shunto wage negotiations, no incentive to surprise the market and the need to transition from an explicit easing bias to a tightening bias.

- Full review here:

AUSSIE BONDS: Richer With US Tsys, Light Local Calendar, PM To Consider COL Support

ACGBs (YM +3.0 & XM +6.5) sit richer and at or near the Sydney session’s best levels. This comes despite the domestic data calendar being empty. Tomorrow, the local calendar sees NAB Business Confidence.

- With domestic catalysts light on the ground, local participants appear to have been content to tie the local market's performance to developments in US tsys in today’s Asia-Pac session. Cash US tsys are currently 1bp cheaper to 2bps richer, with a flattening bias. There has been little by way of meaningful newsflow today.

- (AFR) PM Anthony Albanese has called ruling-party lawmakers to Canberra for an unscheduled meeting on cost-of-living pressures, as part of a renewed drive to combat inflation that the government hopes will reverse its slide in opinion polls. On Thursday, the PM will address the National Press Club, where he is expected to make policy announcements to help ease cost-of-living pressures. (See link)

- Cash ACGBs are 3-6bps richer, with the AU-US 10-year yield differential unchanged at +12bps after being at +15bps earlier in the session.

- Swap rates are 3-6bps lower, with the 3s10s curve flatter.

- Bills are slightly richer, with pricing flat to +2.

- RBA-dated OIS pricing is little changed. A cumulative 35bps of easing is priced by year-end.

NZGBS: Richer & At Best Levels, 10Y Outperformed $-Bloc, Q4 CPI On Wednesday

NZGBs closed 5-6bps richer and close to the session’s best levels. Without data to provide a domestic catalyst, the local market has traded in line with US tsys during today’s Asia-Pac Session. Cash US tsys are currently flat to 2bps richer, with a flattening bias.

- The NZGB 10-year has slightly outperformed the $-bloc today, with the NZ-US and NZ-AU yield differentials both 1bp tighter.

- The release of the Performance Services Index is due tomorrow, ahead of Q4 CPI data on Wednesday. Market consensus is expecting an increase of 0.5% q/q from 1.8%. That would see annual inflation dropping to 4.7%, down from 5.6% in the year to September.

- Swap rates closed 1-5bps lower, with implied swap spreads 3-5bps wider.

- RBNZ dated OIS pricing closed little changed. A cumulative 88bps of easing is priced by year-end.

- Trade Minister Todd McClay to meet key leaders in the World Trade Organization, including the director general. McClay will depart New Zealand on January 23.

EQUITIES: US Futures Higher, China Related Markets Down On Property Concern

Regional equities are mostly higher, with HK and Mainland

China the exception. US futures have continued their trend up from last week, led by Nasdaq futures, up 0.64%, Eminis were last near +0.262% higher.

- Japan has led the move higher in Asia as investors wait for the BOJ decision on Tuesday, the market expecting the BOJ to leave rates unchanged, however expect normalization to continue in the coming months. The Nikkei 225 up 1.31%, while the Topix is up 1.08% at this stage.

- The Taiex is up 0.68% currently, lead by strong performance in renewable names the sector is up 2.00%, while tech names follow the US tech strength, up 1% for the day.

- Hong Kong and Mainland China indices continue to lag the wider Asian markets today after the nations banks kept their benchmark lending rates unchanged, currently the Hang Seng is down 2.00%.

- The Hang Seng mainland properties index is off by over 5% to fresh record lows. A number of China developers have seen wind-up petitions filled in Hong Kong courts. At the same time, analysts at J.P. Morgan have a presented a cautious outlook for the China property sector in 2024, with sales projected to fall a further 10% (BBG).

- In Australia, the ASX 200 is up around 0.65%, with materials names underperforming. In SEA markets, Philippines are trading 0.75% higher, while most other regions are trading in the -0.5% to +0.5% range.

FOREX: USD Modestly Lower As Equity Futures Rally Further

The BBDXY sits down a touch from end levels last week (last near 1234.60), but up from earlier session lows of 1233.7.

- The early risk on impetus in US equity futures biased both NZD and AUD higher. However, after getting to 0.6614, AUD/USD sits back near 0.6590/95 in latest dealings. Higher USD/CNH levels and weaker HK/China equities likely weighing at the margin.

- NZD/USD is also off highs, last near 0.6115, up marginally for the session so far.

- US equity futures have largely held close to session highs, led by Nasdaq futures (up 0.65%). US yields have been mixed, but a curve flattening theme remains evident.

- USD/JPY got to lows of 147.74, but sits higher now, last close to 147.90, still modestly firmer in yen terms (+0.15%). Highs for the session came in at 148.33.

- The calendar for the rest of today is light with the Fed’s blackout period now in place and only the US leading index for December printing.

Crude In Narrow Range As Libyan Output To Recover

Oil prices are little changed during APAC trading today as continued geopolitical tensions in the Middle East are offset by expected strong 2024 supply with demand uncertain. Brent and WTI are down slightly to $78.46/bbl, off the intraday high of $78.89, and $73.19 after a high of $73.68 respectively. The benchmarks continue to range trade. The USD index is moderately lower.

- The resumption of production at Libya’s largest oil field after protesters caused prolonged disruptions pushed crude off its intraday lows earlier today. The National Oil Corp has said that it will take 3 weeks to bring output back to the usual 270kbd, according to Bloomberg.

- Attacks on merchant shipping in the Red Sea by the Iran-backed Houthis look likely to continue for now with the US expecting the effects of its hits on the rebels to take some time to be felt.

- The calendar for the rest of today is light with the Fed’s blackout period now in place and only the US leading index for December printing. Thursday’s advance Q4 US GDP is likely to be the focus of the week.

GOLD: Steady After A Weekly Decline, Fedspeak Weighs

Gold is little changed in the Asia-Pac session, after closing 0.3% higher at $2029.49 on Friday.

- Today’s price action follows a weekly decline as markets continued to scale back easing expectations for the Federal Reserve.

- San Francisco Fed’s Daly (’24 voter) used a Fox interview on Friday to push back on near-term cut expectations. "There's a lot of work left to do. We're not there yet, and it's far too early to declare victory” … "It's really premature to think (rate cuts) are around the corner."

- The market is currently assigning around a 50% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a week ago.

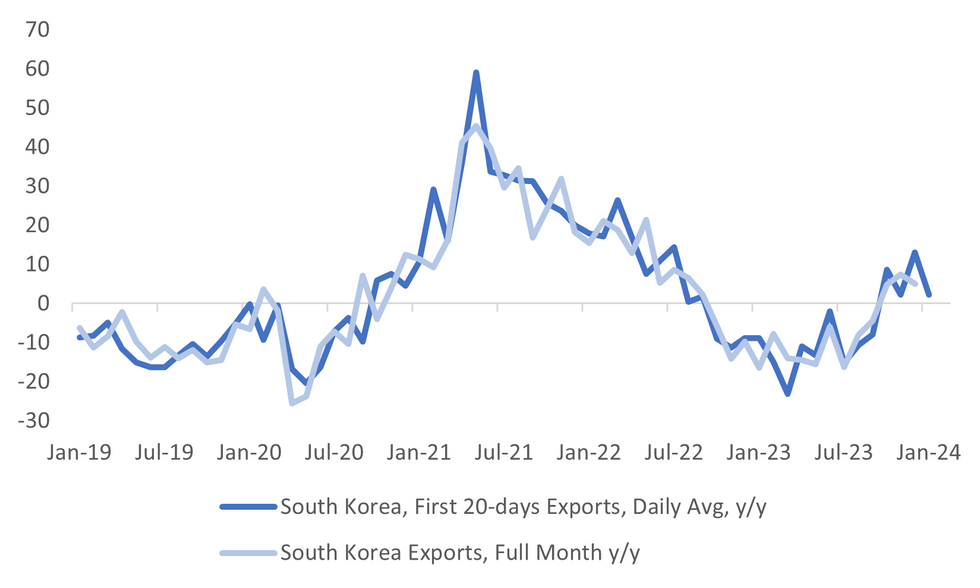

SOUTH KOREA DATA: Jan Export Growth Eased, Shipments To The US Slowed

The first 20-days of trade data for Jan, showed a less positive picture compared to the start of the month and the full month of Dec. Exports fell -1.0% (the prior first 20-day read for Dec was +13%y/y). On the import side we fell -18.2% y/y (versus -9.2% y/y for Dec). The trade deficit was at -$2.61bn, although this does tend to improve for the full month.

- The detail was better than the headlines suggested though, with daily average exports at +2.2% y/y, suggesting day count effects impacted the headline drop.

- This still suggests weaker full month momentum for January exports, see the chart below.

- Chip exports were +19.7% y/y as well, so a slight improvement on the prior rise of 19.3%.

- Exports to China were +0.1%y/y (the first 20-days of Dec recorded a -0.4% y/y fall). We did see a pull back in the US though, with growth slowing to +3.6% y/y for the first 20-days of Jan, versus +30.2% prior.

Fig 1: South Korean First 20-days Exports & Full Month Trend Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Up From Earlier Lows, PHP Underperforming

The early offered tone in USD/Asia pairs has given way to more a cautious backdrop as the Monday session has progressed. USD/CNH dipped sub 7.2000 in early trade, but is back above this level on further local equity weakness. PHP has lost ground and is back close to earlier YTD lows. KRW and TWD are also off earlier highs, although TWD is still outperforming. Still to come today is Taiwan export orders and the unemployment rate. Tomorrow, Singapore CPI is out along with South Korean PPI.

- USD/CNH lows were close to Friday session lows near 7.1960. This proved temporary as the pair rebounded back above 7.2000, last near 7.2080. Onshore equities have struggled, amid further property led weakness, which has also been evident for Hong Kong's bourse. The Hang Seng mainland properties index is off by over 5% to fresh record lows. A number of China developers have seen wind-up petitions filled in Hong Kong courts. At the same time, analysts at J.P. Morgan have a presented a cautious outlook for the China property sector in 2024, with sales projected to fall a further 10%.

- 1 month USD/KRW tried to go lower in early trade, but found support ahead of 1328. The pair last near 1336, around 0.3% weaker versus NY closing levels on Friday (in won terms). The Kospi is only marginally higher, while the first 20-days of trade data for January saw some colling in export growth momentum.

- 1 month USD/TWD got to lows of 31.09, but we sit higher now, last near 31.21, little changed for the session. The pair is sub nearly all of the key EMAS, with the 20-day (around 31.10), the next potential test point. The 100-day sits back at 31.38. Local equities are off earlier highs, but still up around 0.80% on tech optimism. Higher USD/CNH levels are likely to have weighed on TWD as the session progressed.

- USD/PHP spot has surged, the pair last at 56.31, 0.60% weaker in spot PHP terms. This puts us to fresh highs for the past week, although earlier Jan highs rest higher at the 56.40 level for spot. There doesn't appear to be a direct catalyst for fresh PHP weakness. Correlations with broader USD moves aren't usually strong at the best of times for PHP. Local equity sentiment has been weaker in the past week but has stabilized today (PCOMP up 0.80%). Offshore investors were net sellers of local equities late last week as well. The BSP said earlier this year, there would likely be less FX intervention, so this again could be a factor. Still, 1 month implied USD/PHP vol is still range bound, last at 6.15%, up from recent lows.

- Elsewhere, USD/THB has been supported on dips, the pair last at 35.61 against earlier lows of 35.44. We aren't too away from recent YTD highs. USD/MYR has also drifted higher, the pair last near 4.7260, the Dec CPI print coming in as expected at 1.5% y/y.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2024 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 23/01/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 23/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/01/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 23/01/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 23/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/01/2024 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

| 24/01/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/01/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.