-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

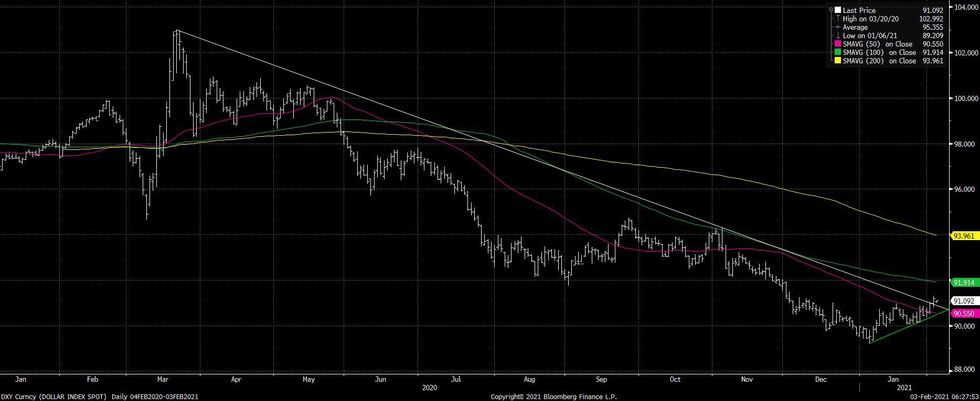

MNI EUROPEAN MARKETS ANALYSIS: Break Or Fake For The DXY?

- DXY closes above trendline drawn off the Mar '20 high.

- NZ labour market report stronger than expected, adding further fuel to AU/NZ monetary policy divergence trades.

- Amazon & Alphabet report blockbuster headline figures in quarterly earnings.

BOND SUMMARY: Narrow Ranges For Core FI, Mostly Lower In Asia

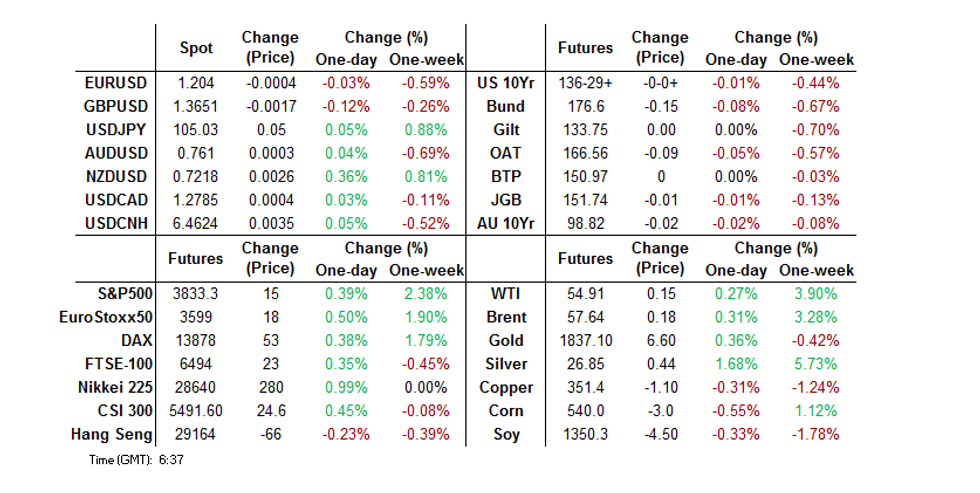

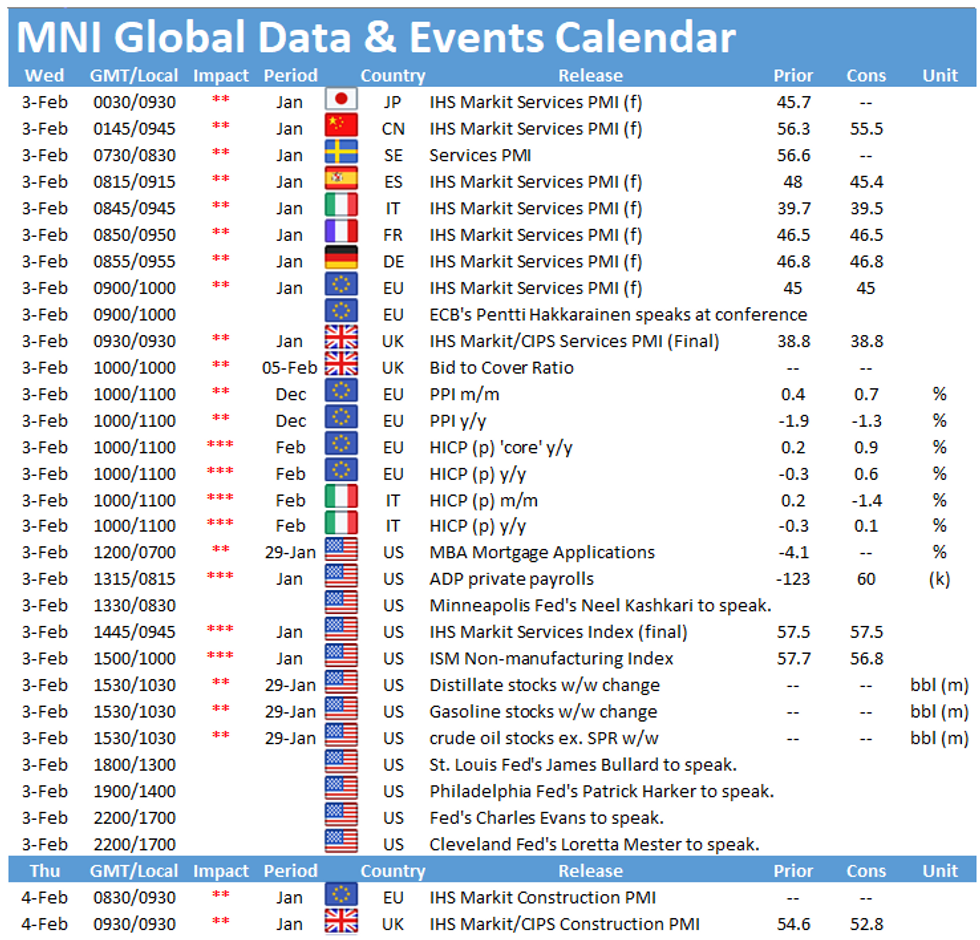

T-Notes have edged away from their early Asia-Pac lows, but have held to a 0-05+ range, to last trade -0-00+ on the day at 136-29+, 0-02+ off worst levels. Light bear steepening remains in play in the cash space, with 30s 1.0bp or so cheaper, while e-minis are higher on the day in the wake of earnings from tech giants Amazon & Alphabet. The space looked through a softer than expected Caixin services PMI print out of China, given the softer than expected Chinese PMI readings already seen in recent days. On the flow side, a 5,625 block buy of the TYJ1 134.00 puts was posted into European hours. Eurodollar futures are little changed on the day. Overnight screen trade in the EDU1 99.8125/99.7500 put spread saw paper pay 1.5 on 5.0K. Locally, Wednesday will bring the latest quarterly refunding announcement from the U.S. Treasury, while the ADP employment and ISM services readings are due. We will also see Fedspeak from Kashkari, Bullard, Harker, Mester & Evans.

- JGB futures finished -1, holding a tight range, with the belly seeing some marginal underperformance in cash trade. The BoJ delivered the expected Y50bn cuts to the purchase sizes of both of the 1-3 & 3-5 Year Rinban buckets, which was in line with broader expectations after the adjustments to the relevant purchase bands in the Bank's February Rinban outline. There was little in the way of meaningful movement in the offer/cover ratios, even against lower purchase volumes. 30-Year JGB supply headlines locally on Thursday.

- Aussie bond futures have operated in the ranges established in early Sydney dealing, with RBA Governor Lowe's address largely reaffirming knowns. The major point of note saw Lowe state that "later in the year, the Board will need to consider whether to shift the focus of the yield target from the April 2024 bond to November 2024 bond. In considering this issue the Board will be giving close attention to the flow of economic data and the outlooks for inflation and jobs. It has made no decision yet." The idea that the RBA's 3-Year yield target may roll forwards at some point in 2021 had been discussed by several analysts in recent days/weeks and gained further traction after the RBA's inclusion of explicit calendar guidance in yesterday's statement. The space ultimately showed little reaction to Lowe's comments, YM +0.5 and XM -2.0 at the close of Sydney trade, with the weakness in the longer end largely stemming from the trans-Tasman impetus in the wake of a stronger than expected NZ labour market report. On the semi front, NSW TCorp launched a benchmark tap of its Mar '33 line, which should price on or before tomorrow. RBA ACGB purchases and monthly trade balance data headline the local docket on Friday.

FOREX: NZ Jobs Report Sends Kiwi Flying, Gets 2021 OCR Cuts Priced Out

NZD caught a bid in Asia after a strong local Q4 jobs report inspired further unwinding of RBNZ easing bets, with money markets pricing out chances for any OCR reductions this year. The unemployment rate unexpectedly dropped to 4.9% from 5.3%, on the back of a decent beat in employment growth & a marginally slower than projected uptick in the participation rate. Evidence that GDT prices are still on a tear (BNZ & Fonterra raised their respective milk price forecasts for 2020/21) & fresh data reinforcing the belief that NZ housing market remains hot helped the kiwi to build on the impetus provided by the stellar jobs report and the Antipodean currency easily outperformed all of its peers from the G10 basket. NZD/USD extended its rally off the 50-DMA tested yesterday, while NZD/JPY rose to its best levels since Apr 2019.

- NZD gains spilled over into its Antipodean cousin, to a degree, albeit BBG trader sources pointed to AUD/NZD sales by macro & leveraged funds after RBA Gov Lowe signalled potential for the RBA shifting its YCC target from Apr '24 to Nov '24. The pair sank for the fourth day in a row as commodity price dynamics (dairy vs. iron ore prices) combined with QE dynamic differential between the RBA/RBNZ & NZ jobs data rendered AUD/NZD heavy.

- Safe haven currencies traded on a softer note as risk sentiment remained positive, with e-minis ticking higher in the wake of blockbuster earnings reports from Alphabet & Amazon.

- The PBOC fixed USD/CNY at CNY6.4669, a 10 pip miss against sell side estimates, which brings misses to +42 pips so far in February. The bank drained a net CNY 80bn of liquidity via OMO's after three days of injections.

- Preliminary inflation data from the EZ & Italy, U.S. ADP employment report, a number of services PMI readings from across the globe and comments from Norges Bank's Bech-Moen as well as Fed's Kashkari, Bullard, Harker, Mester & Evans.

USD: Break Or Fake For The DXY?

We have already flagged some risks to the USD downtrend in recent days, and note that Tuesday saw the DXY close above the trendline drawn off its March high.

- U.S. Tsy yield dynamics, worries around European growth prospects as the continent's COVID-19 vaccine rollout falters and the widely discussed USD short positioning/consensus calls for a softer USD in '21 present the main risks to the bearish USD view, at least in the immediate term.

Source: MNI - Market News/Bloomberg

FOREX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1995-15(E526mln), $1.2070-80(E1.2bln-EUR puts), $1.2100-15(E1.0bln)

- USD/JPY: Y103.75-80($610mln)

ASIA FX: Stock Sentiment Seeps Into Asia

Sentiment was lifted by back to back gains in US stocks, regional equities gained and most USD/Asia FX crosses declined.

- CNH: Yuan weakened, dropping from positive territory following a drop in Caixin services PMI which followed weaker official and Caixin manufacturing PMI. The PBOC drained a net CNY 80bn of liquidity.

- SGD: Singapore dollar is stronger in Asia trade, USD/SGD down 8 pips at 1.3312, off session lows at 1.3306 with resistance seen at the 1.33 handle which formed a double bottom yesterday. PMI rose to 52.9 in January from 50.5 in December, hitting the highest since April 2019.

- TWD: USD/TWD declined through the session, heading into European hours at 27.944. The intraday rate continues its downward trend and probes new lows, but a close below 28.00 seems out of reach due to swings into the close on touted intervention.

- KRW: The won adds to strength from yesterday, hitting the highest since the middle of last week. South Korea reported January FX reserves of $442.73bn, down from $443.10bn. This is the first decline in 10 months, the won weakened 3% in the period.

- IDR: Rupiah gained, a number of prominent speakers including BI Gov Warjiyo, FinMin Indrawati, Econ Affairs Min Hartarto & Health Min Sadikin will appear at the Annual Mandiri Investment Forum (MIF) 2021 today.

- MYR: Ringgitt weakened following the extension of Malaysia's Covid-19 restrictions yesterday.

- PHP: USD/PHP trades at PHP48.024, a touch lower on the day, narrowing in on the key PHP48.000 figure. The Bank of Investment set a target of PHP1.25tn of project approvals to boost economic growth.

- THB: Baht weakened through the session, Bank of Thailand holds its first monetary policy meeting of 2021 and most analyst expect the Monetary Policy Committee to leave the main policy rate unchanged.

ASIA RATES: Bond Space Mixed In Asia

Back to back gains in US equity markets inspired risk on sentiment in Asia which saw regional equities gain for the third day and put pressure on the bond space, but some local dynamics also in play.

- CHINA: Yields are higher across the curve in China, the move exacerbated by sales of 1-,3-,7-year paper. The supply was digested smoothly, with demand particularly strong in the 7-year sector. Curve bear flattens 10-year yield up 1.8bps.

- KOREA: Yields slightly lower across the curve in South Korea, some bull steepening, 10-year yield down 0.4bps. Some caution around a pick-up in COVID-19 cases cited as rationale. Bank of Korea sold KRW 2.4tn 2-year paper, markets look ahead to 50-year supply on Friday.

- INDIA: Cash yields were lower ahead of the RBI meeting on Feb 6. Having already cut rates five times in 2020 and with inflation well above the central bank's target, there's limited scope for further cuts. Some bull steepening seen, 10-year yield down 3.4bps.

- INDONESIA: Mixed performance on the curve, 10-year yield last down 1.5bps. The government sold IDR 35tn of bills and bonds yesterday, with cover far exceeding the previous auctions.

EQUITIES: Third Day Of Gains For Asia-Pac Bourses

Another day of gains for Asia-Pac equities, most indices gaining for a third day. Bourses rose almost across the board in Asia, the Hang Seng is the underperformer, printing flat as Alibaba weighs post earnings.

- Markets took a positive lead from the US where indices posted back to back rallies as headlines around the Reddit/GME frenzy subside.

- In Japan the Nikkei rose by 1%, boosted by automakers as Mitsubishi beat earnings with better guidance, while Toyota enjoyed analyst upgrades.

- E-mini S&P advanced and Nasdaq futures contracts climbed after Alphabet and Amazon reported revenue that topped estimates, while Amazon also noted that CEO Jeff Bezos will step down from his post, but would stay with the company.

GOLD: Off Tuesday's Lows

The stronger USD has outweighed the impetus from softer U.S. real yields over the last 24 hours, leaving gold a little softer over that timeframe, with spot last dealing around the $1,840/oz mark. Bears managed to have a brief and very shallow look below $1,830/oz on Tuesday, before retracing to current levels during Asia-Pac hours.

OIL: Crude Futures Build On Gains

Crude futures are higher on Wednesday as they extend Tuesday's gains, benchmarks have hit the highest in over a year on tightening global supplies and indications of strength in physical markets. WTI and Brent sit $0.15 better off on the day.

- Data after market yesterday helped support crude; API inventory figures showed a sizable 4.26m bbl draw in headline inventories, while there was also a marginal improvement in fundamentals for downstream markets, reporting 240k bbl and 1.62m bbl draws in US gasoline and distillate inventories, respectively. Data from China showed stockpiles fell to a one year low, declining for the seventh straight week. The market will now look ahead to more comprehensive US DOE data at 1530GMT today.

- OPEC headlines from yesterday continue to offer support. The group said they expect that inventories will fall back below their 5-year averages in June.

- Also supporting prices is robust corporate buying with Shell active in the market again after it engaged in the heaviest buying by a single company since at least 2008.

- The market now focuses on the OPEC+ JMMC meeting scheduled for today, which will provide a preview for the OPEC+ meeting on March 4 when the latest production figures will be announced.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.