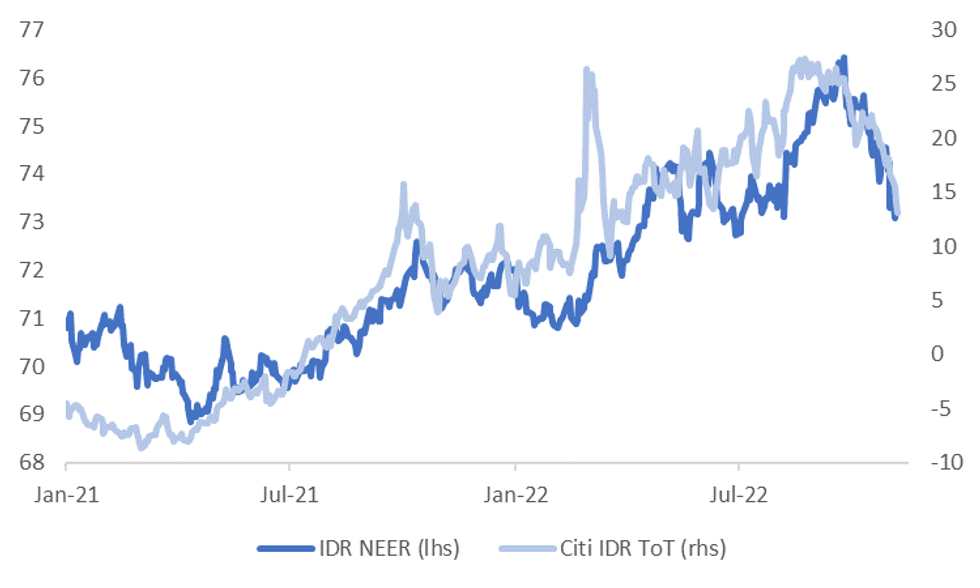

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN MARKETS ANALYSIS: China Tweaks ZCS, Risk-Positive Flows Ensue

- News of China’s freshly optimised COVID restrictions (which include a rollback of the country’s international travel restrictions and reduced quarantine time for international travelers) has resulted in a fresh round of risk-positive flows ahead of London dealing, building on the theme witnessed in early Asia-Pac dealing. A reminder that such adjustments had been flagged via news wire source reports in recent days.

- Gains in the Hang Seng (+8%) are particularly impressive, with a surge in Chinese property developer stocks noted. E-minis are through Thursday’s post-CPI highs, while USD/CNH has broken comfortably below yesterday’s base .Commodities trade sees SGX iron ore print 6% higher on the day, while WTI futures are over $2 better off.

- On tap today are UK GDP & activity indicators, final German CPI & flash U.S. Uni. of Mich. Sentiment. Central bank speaker slate features ECB's Holzmann, Panetta, de Guindos, Lane, de Cos & Centeno, as well as BoE's Haskel & Tenreyro.

US TSYS: Futures Lower, China’s Refinement Of COVID Restrictions Applies Light Pressure Into London

Tsy futures operate around session lows as we move into London hours, with news re: the implementation of China’s optimised COVID restrictions (which include a rollback of the country’s international travel restrictions and reduced quarantine time for international travellers) applying some light pressure late in Asia-Pac dealing. A reminder that such adjustments had been flagged via news wire source reports in recent days.

- E-minis have extended to fresh session highs, breaching their respective Thursday peaks, in the wake of the news, while USD/CNH has pulled lower.

- The rally in Asia-Pac equities had already knocked U.S. Tsy futures away from best levels before the news out of China crossed.

- Previous headline flow flagging a multi-month high for new COVID cases in China had little impact on the day.

- TYZ2 is -0-07+ at 112-09, 0-01 off the base of its 0-10 range on volume of ~94K.

- Cash Tsys are closed on Friday owing to the observance of the Veterans Day holiday.

- Looking ahead, Friday’s docket will be headlined by the latest UoM sentiment survey, with the inflation expectations components generating the most interest when it comes to that release.

JGBS: Curve Flattens Post-U.S. CPI, Long End Looks Better For Domestic Investors

JGB futures have ticked back towards session lows ahead of the Tokyo close, last printing +32 on the day (after surging in the overnight session in lieu of the softer than expected U.S. CPI reading), with news of China’s freshly-deployed optimised COVID prevention settings (an unwind of international travel bans and reduced quarantine time for international travellers) applying some modest pressure.

- Cash JGBs have held on to the bulk of their early richening, running 1-8bp richer across the curve, with the super-long end leading, resulting in bull flattening. This comes as the wider international FX-hedged yield picture for Japanese investors indicates the potential for further onshore-based JGB long end demand.

- Local headline flow was muted, with familiar overtures re: the FX market dominating.

- The latest liquidity enhancement auction for off-the-run 5- to 15.5-Year JGB went well, as was expected, with firm spread dynamics providing a light post-auction bid for the space.

- Looking ahead, the latest batch of BoJ Rinban operations headline Monday’s limited domestic docket.

AUSSIE BONDS: Back From Best Levels On Wider Bid For Risk

ACGBs pulled back from best levels as the Sydney day wore on, with the post-U.S. CPI bid waning as risk-positive flows came to the fore.

- China’s move to outline its “optimised” COVID controls saw a wind back of international flight restrictions and reduced post-travel quarantine periods for travellers, as had been flagged in recent news wire source reports.

- Still, this failed to impact Aussie bond futures, with the news crossing around the Sydney close. That left YM +9.0 and XM +6.5 come the close. The wider ACGB curve bull steepened, but the pullback from best levels saw the curve work away from session steeps, leaving the major benchmarks 3-9bp richer late in the day.

- Bills were 5-9bp richer through the reds at the bell, comfortably off of best levels, bull flattening. RBA dated OIS was softer on the day, in lieu of yesterday’s U.S. CPI print, with ~19bp of tightening now priced for next month’s RBA meeting & a terminal cash rate of ~3.75% observed on the strip.

- Next week’s AOFM issuance slate is somewhat vanilla, while semi-issuance saw NSWTC mandate banks for a benchmark round of Feb-35 supply, which would have applied some marginal pressure.

- Next week’s domestic docket is headline by the minutes from the latest RBA meeting, the monthly labour market report and quarterly WPI data.

NZGBS: Off Best Levels, Bull Steepening

NZGBs followed the global pullback from their U.S. CPI-inspired richest levels of the session, with the major benchmarks going out 16-22bp richer as the curve bull steepened. Swap spreads were little changed to a touch narrower across the curve.

- RBNZ dated OIS was little changed after the early adjustment lower, which was also inspired by Thursday’s U.S. CPI readings. Just over 60bp of tightening is priced for this month’s RBNZ meeting, with terminal rate pricing now sitting at ~5.05%.

- Local data saw an uptick in the M/M rise in food prices (+0.8% M/M in Oct vs. +0.4% in Sep), while the BusinessNZ manufacturing PMI moved into contractionary territory for the first time in over a year. The collators of the PMI noted that “new orders are falling while the PMI stocks index remains expansionary and firmly above its long-term norms. A low orders-to-inventory ratio typically bodes ill for production ahead.”

- Local news flow saw the Government announce that Kainga Ora’s future financing requirements will be met by loans from New Zealand Debt Management (NZDM), rather than private markets. Spreads of the entities bonds narrowed vs. NZGBs on the news.

- REINZ property market data, the quarterly PPI reading and non-resident bond holding data headline next week’s local docket.

FOREX: China COVID Rules Adjustment Triggers Risk-On Flows, USD/JPY Trims Early Gains

USD/JPY gained in a relief rally as Tokyo participants went online following the pair's 3.75% sell-off Thursday in reaction to below-forecast U.S. CPI figures. Buying momentum ran out of steam at Y142.48 and the rate halved its initial gains, albeit the yen remains the worst performer in G10 FX space.

- The partial unwinding of USD/JPY gains was driven by a pullback in broader greenback strength, with the BBDXY index refreshing its 2-month lows. The USD came under further pressure as risk sentiment picked up late doors, which allowed the BBDXY to fall below 1,290. Note that cash Tsys did not trade because of a public holiday in the U.S.

- Reports of China loosening some COVID-19 controls triggered a round of risk-on flows, with USD/CNH staging a clean breach of yesterday's low and moving below its 50-DMA for the first time since mid-Aug. Health authorities scrapped COVID flight suspensions and reduced quarantine times.

- The Aussie cemented its position as the best G10 performer on reports from China. AUD/USD broke above yesterday's high as a result, while NZD/USD tested yesterday's peak. Antipodean cross AUD/NZD attacked resistance from its 200-DMA.

- On tap today are UK GDP & activity indicators, final German CPI & flash U.S. Uni. of Mich. Sentiment. Central bank speaker slate features ECB's Holzmann, Panetta, de Guindos, Lane, de Cos & Centeno, as well as BoE's Haskel & Tenreyro.

FX OPTIONS: Expiries for Nov11 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9955-65(E1.3bln), $1.0000(E1.8bln), $1.0050-65(E1.4bln), $1.0240(E2.2bln)

- USD/JPY: Y144.40-50($560mln)

- GBP/USD: $1.1600(Gbp503mln)

- AUD/USD: $0.6475(A$624mln), $0.6575(A$680mln)

- USD/CAD: C$1.3605-20($1.2ln)

- USD/CNY: Cny7.20($1.1bln)

CHINA: China's CZS To Remain A Strong Focus Point For Markets

Focus on China's ZCS continues following yesterday's meeting of the new Standing committee on the issue and comments that followed afterwards. There is optimism current lockdown measures in various districts will be less disruptive to economic activity, given comments around ensuring normal life and production can resume as soon as possible, as reported by Xinhua News Agency.

- This comes despite a continued move higher in onshore covid case numbers. Indeed, the China Health Commission stated late yesterday that optimizing CZS is not loosening retractions.

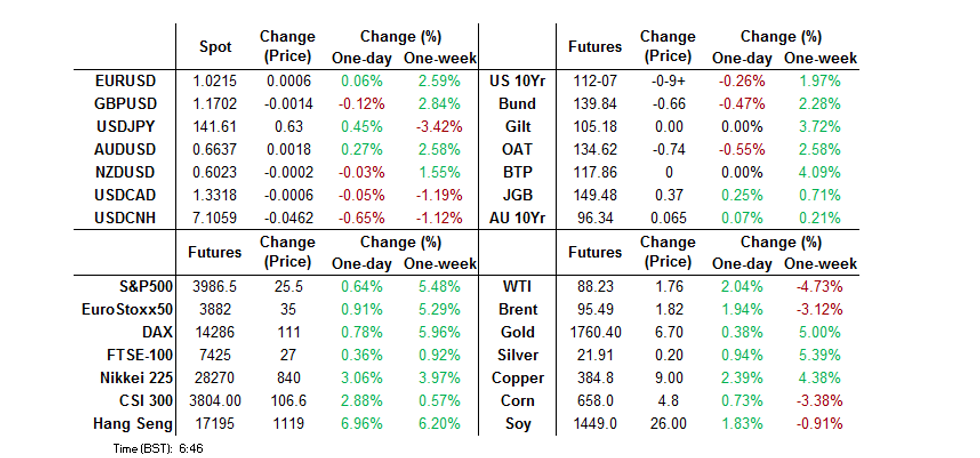

- The chart below plots daily case numbers against the China Oxford Stringency Index. Interestingly, the stringency index, which lockdowns form a part of, hasn't moved higher despite the recent pick up in cases.

- Note though, the latest observation for the stringency index is the end of last week, so it may tick higher once this week's observations are updated. The stringency index has spent little time sub-50 since the measure was first introduced in 2020.

- In any event, China's CZS is likely to remain a strong focus point for markets as we progress into year-end and through Q1 2023.

Fig 1: China Daily Covid Case Numbers & The China Oxford Stringency Index

Source: Oxford/MNI - Market News/Bloomberg

IDR: Rupiah Gains Post-CPI But Commodity Backdrop Remain Unfavourable

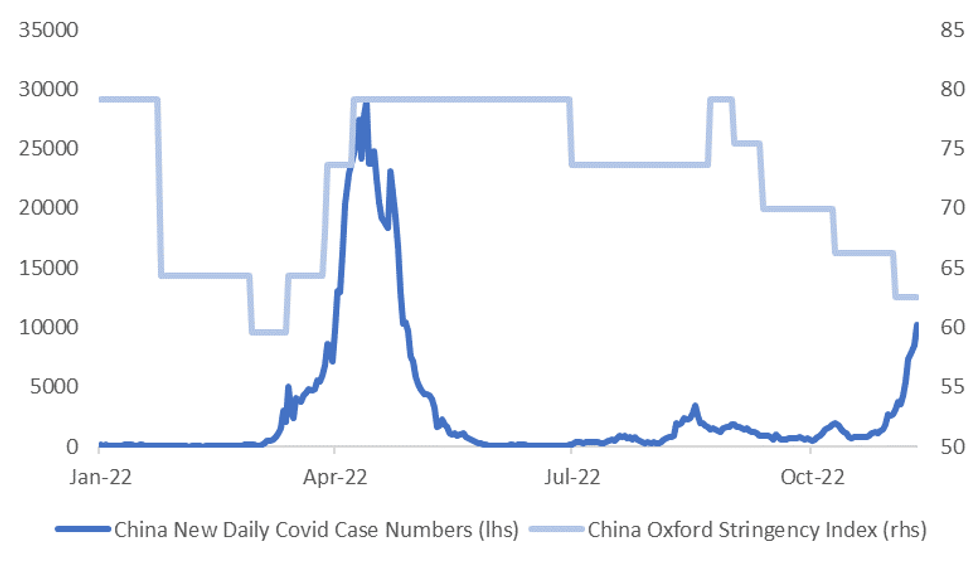

Spot USD/IDR is down nearly 1.30% from yesterday's closing levels, last tracking just above 15,500. The IDR is playing some catch up with overnight moves in the USD and the sharp pull back in US real yields following the CPI miss. The first chart below plots USD/IDR against the UST real 10yr yield.

- Post-CPI reaction allowed Indonesia's 5-Year CDS premium (one of the measures of rupiah stability watched by Bank Indonesia) to tighten to a fresh cyclical low near its 200-day MA.

- Of course, it remains to been seen how much further US yield momentum pulls back. Further downside should benefit the IDR based off current correlations.

- It's also noteworthy USD/IDR is still some distance above its simple 50-day MA (15,300), even with today's correction lower. A number of other USD/Asia pairs have already comfortably breached this support level.

Fig 1: USD/IDR and US 10yr Real Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

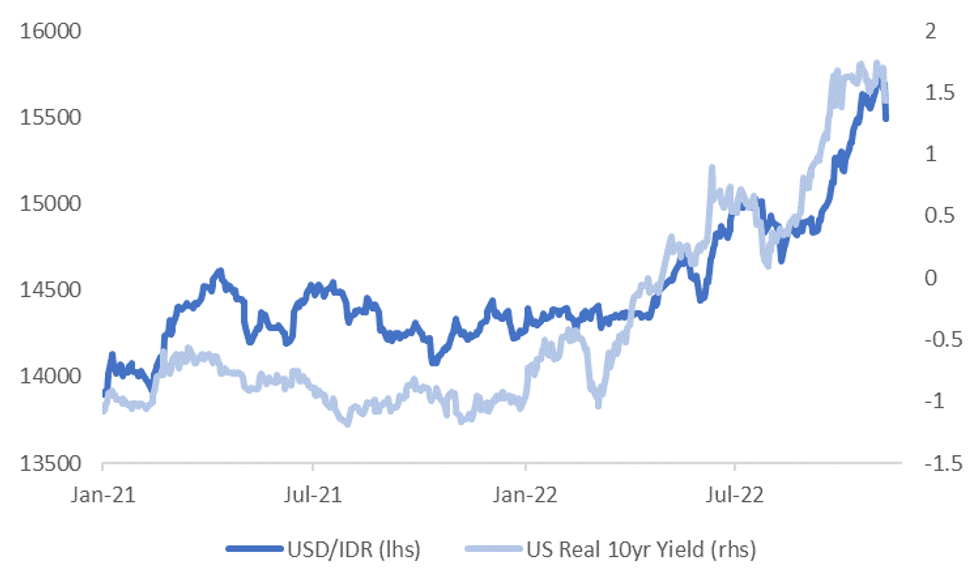

- Commodity price dynamics are still presenting a less favorable backdrop for IDR though. The second chart below overlays the J.P. Morgan IDR NEER versus the Citi IDR ToT proxy. Indonesia's status as a major commodity exporter has become a liability as the pass-through from deteriorating global growth prospects to the commodity markets became evident.

Fig 2: J.P. Morgan IDR NEER Versus Citi Terms Of Trade Proxy

Source: J.P. Morgan/Citi/MNI - Market News/Bloomberg

Source: J.P. Morgan/Citi/MNI - Market News/Bloomberg

- On a daily basis, however, the aggregate BBG Commodity Index is sligtly higher, consolidating yesterday's 1.25% advance. Palm oil futures trade MYR79/MT higher, albeit Indonesia's decision to lift its CPO reference price may undermine the attractiveness of Indonesian crude.

- With spot USD/IDR trading -176 figs at IDR15,516, bears set their sights on the 50-DMA, while bulls look to a rebound towards Nov 4 high of IDR15,750. USD/IDR 1-month NDF last -23 figs at IDR15,501, with bears keeping an eye on the 50-DMA at IDR15,320 and bulls targeting Nov 3 high of IDR15,838.

EQUITIES: Tech Sensitive Indices Dominate The Rebound

All the major Asia Pac indices are higher, with tech sensitive bourses leading the rebound, in line with overnight moves and the sharp pullback in US yields post the CPI print. US futures have had a relatively quiet session. S&P and Nasdaq futures have largely moved sideways, albeit with a slight downside bias.

- The HSI is among the best performers, up around 5.5% at this stage. The tech sub-index is +7.80% firmer, although we are away from opening highs by around 2.25%. Note overnight the China Dragon Index rose 7.50%, snapping a 3-day losing streak.

- For mainland shares, the CSI 300 last printed +2.10%, the Shanghai Composite Index +1.50%. The underlying property sub-index is +4.19%. There is hope that current lockdown measures will be less impactful on economic activity, although covid case numbers continue to climb, now above 10k. The health authorities continue to emphasize that optimizing covid control policies is not a loosening in restrictions.

- The other focus point will be Monday's meeting between President Xi and US President Biden, particularly from a tech outlook perspective (if this sector is raised).

- The Taiex is +3.5%, with TSMC leading the way. The Nikkei 225 is +2.75%. Kospi gains are +3.15%, with offshore investors adding +$375.8mn to local shares.

- South East Asian markets are also higher, but gains are under 2%.

GOLD: Edges Lower, But Tracking +4% Higher For The Week

Gold is slightly down from overnight highs, last tracking close to $1750, -0.30% for the session so far. This follows the 2.85% gain for Thursday's session, amid a sharp pullback in the USD and lower UST yields.

- Dips today towards $1747 have been supported today, which also coincides with pullbacks seen in the NY trading session after the post CPI induced bounce subsided.

- For the week, the precious metal is currently up over 4%, building on last week's gain of 2.25%.

- From a technical standpoint, resistance is evident around the 200-day EMA ($1756.65). Note on the downside the 100-day EMA comes in at $1718.21.

OIL: Lags Broader Risk Rally

Brent crude last tracked just below $94/bbl, still broadly stuck between its simple 50-day MA ($92.60/bbl) and the 100-day MA ($97.35/bbl). We are slightly above NY closing levels, +0.30%, which is building on Thursday's +1.10% gain. WTI is around $86.70, tracing out a similar trajectory.

- Still, oil has lagged the broader risk rally over the past 24 hours, post the US CPI miss, particularly relative to the equity space and some base metals like copper. Brent crude is currently tracking -4.7% down for the week.

- There is concern around the demand backdrop, with oil not receiving much benefit this week from on-going speculation around a potential shift in China's CZS.

- Earlier next week also has a number of important event risks for crude. On Monday the OPEC monthly report will be published, this is followed by the IEA monthly report on Tuesday.

- The G20 meeting also kicks off in Bali on Tuesday, while we also get an update on monthly economic activity in China, with industrial production, among other indicators due.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/11/2022 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 11/11/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 11/11/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/11/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/11/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/11/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/11/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/11/2022 | 1200/1300 |  | EU | ECB Panetta Speaks at ISPI | |

| 11/11/2022 | 1200/1300 |  | EU | ECB de Guindos Q&A at Encuentro de Economia en S'Agaro | |

| 11/11/2022 | 1310/1310 |  | UK | BOE Tenreyro Speech at Society of Professional Economists | |

| 11/11/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/11/2022 | 1600/1700 |  | EU | ECB Lane Panels Jacques Polak Conference | |

| 11/11/2022 | 1600/1600 |  | UK | BOE Haskel Seminar at Bank of Israel |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.