-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Tech Struggles Continue

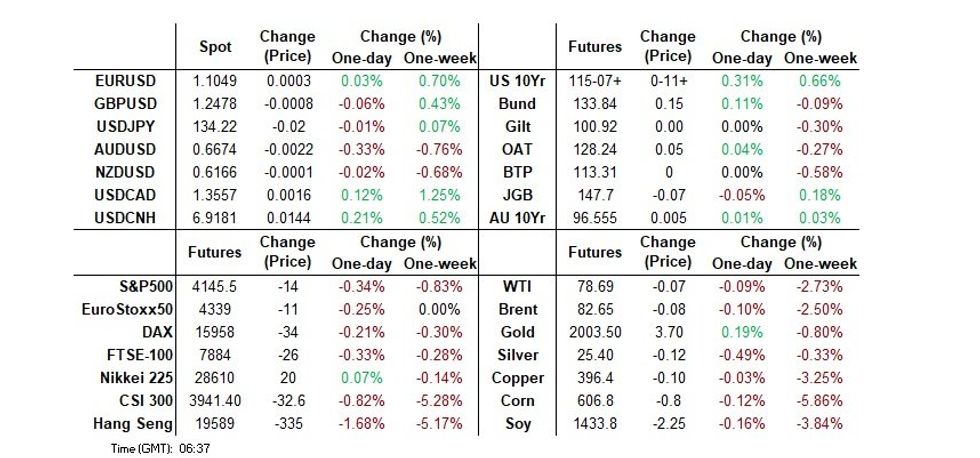

- Weakness in Chinese tech stocks, centred on continued worry re: potential fresh U.S. steps against the Chinese chip space, along with some questions surrounding the longevity of the Chinese consumption boom, supported Tsys overnight. That came after support from First Republic’s earnings, published after hours on Monday, faded. Warnings from Russia re: the potential for direct conflict with the U.S. also generated some alarm.

- Early USD weakness had little follow through, as weaker equity sentiment filtered through into dollar support. The BBDXY got close to 1221 early but we now sit back above 1223, not too far off session highs, but around NY closing levels.

- ECB & BoE speak will come under the microscope during the London morning. Further out, NY hours will see the release of U.S. new home sales data, a couple of the major home price metrics, consumer confidence. services activity indicators from the Philly & Dallas Feds and the Richmond Fed m’fing index.

US TSYS: Firmer On Weakness In Chinese Tech Stocks & Sharper Than Expect First Republic Deposit Flight

TYM3 re-tested its early Asia-Pac highs on a downtick in Chinese tech stocks, although failed to break that line. The contract is +0-10 into London hours, 0-01 off the peak of its 0-06 Asia-Pac range, on volume of ~68K. Monday’s break and close above 115-00 eases the bearish technical threat, with bulls now targeting the 14 Apr high (115-23).

- Cash Tsys are 0.5-2.5bp richer, with intermediates leading the bid.

- Weakness in Chinese tech stocks, centred on continued worry re: potential fresh U.S. steps against the Chinese chip space, along with some questions surrounding the longevity of the Chinese consumption boom, supported Tsys overnight.

- That came after support from First Republic’s earnings, published after hours on Monday, faded.

- Warnings from Russia re: the potential for direct conflict with the U.S. also generated some alarm.

- The most notable rounds of flow came via pockets of TY & FFK3 screen buying during the early rounds of Asia-Pac trade.

- ECB & BoE speak will come under the microscope during the London morning. Further out, NY hours will see the release of new home sales data, a couple of the major home price metrics, consumer confidence. services activity indicators from the Philly & Dallas Feds and the Richmond Fed m’fing index. We will also get 2-Year Tsy supply.

JGBS: Curve Twists Flatter, Futures Off Lows

JGB futures recovered from early session lows, alongside a stabilisation in U.S. Tsys, last -7, while cash JGBs are 1bp richer to 1bp cheaper, with 10s underperforming surrounding tenors and the curve twist flattening. The swap curve has twist flattened (20+-Year rates lower on the day), with swap spreads little changed to tighter across the curve, supporting JGBs.

- JGBs looked through comments from BoJ Governor Ueda. RTRS noted that (in answer to a question in his parliamentary address) Ueda said that the “central bank will respond appropriately, such as by raising interest rates, if faster-than-expected growth in inflation and wages warrant tightening monetary policy. At present, however, the BOJ considers it appropriate to maintain its ultra-easy monetary policy, including yield curve control, to sustainably and stably achieve its 2% inflation target.” The initial lines were situational, as opposed to a likelihood, with Ueda also reaffirming the Bank’s well-known views on inflation. Ueda stressed that tightening now could result in a “grave” situation.

- Elsewhere, Finance Minister Suzuki noted that there may be some movements in BoJ policy in the future, which would pose challenges re: maintaining current debt issuance levels. On that front, we also saw a senior MoF official note that Japan will strive to keep debt issuance costs at low levels, reacting to any future BoJ policy moves via maturity alteration and the tweaks to the distribution of JGB issuance.

- 2-Year JGB supply headlines tomorrow.

FOREX: USD Finds Support From Equity Weakness

Early USD weakness had little follow through, as weaker equity sentiment filtered through into dollar support. The BBDXY got close to 1221 early but we now sit back above 1223, not too far off session highs, but around NY closing levels from Monday.

- Carry over from First Republics earning's result boosted US Tsy futures, and this aided a early move in USD/JPY sub 134.00, but this dip was supported. USD/JPY climbed higher into the Tokyo fix and has stayed in a rough 134.20/134.40 range since.

- Comments from BoJ Governor Ueda in parliament were mixed, discussing what conditions would warrant a shift in policy, while also noting tightening now would lower inflation. Overall, these comments didn't shift sentiment a great deal.

- USD/JPY still looks too high relative to the lower US yield backdrop, but prominent sell-side name stated that EUR/JPY demand may be evident from a month end rebalancing standpoint.

- EUR/USD pushed higher today but ran out of steam near 1.1070, but is back to 1.1055 now.

- AUD and NZD ran out of momentum, although AUD saw more downside, moving back to 0.6675/80 in holiday impacted markets, with both AU and NZ markets closed for ANZAC day. NZD/USD is back to 0.6165/70. A$ likely saw great headwinds from weakness in China related equities. The AUD/NZD cross continued to correct, back down to 1.0825/30. Q1 AU CPI prints tomorrow.

- Looking ahead, ECB & BoE speak will then come under the microscope during the London morning. Further out, NY hours will see the release of new home sales data, a couple of the major home price metrics, consumer confidence. Services activity indicators from the Philly & Dallas Feds and the Richmond Fed m’fing index.

FX OPTIONS: Expiries for Apr25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0923-25(E602mln), $1.0937-50(E947mln), $1.1000(E1.2bln), $1.1020-25(E539mln), $1.1050(E1.4bln), $1.1080(E568mln), $1.1100(E2.2bln)

- USD/JPY: Y133.35($724mln)

- GBP/USD: $1.2300(Gbp628mln)

- AUD/USD: $0.6665(A$510mln), $0.6720-35(A$774mln), $0.6750-65(A$519mln), $0.6800(A$616mln)

- NZD/USD: $0.6150(N$817mln)

- USD/CNY: Cny7.00($1.8bln)

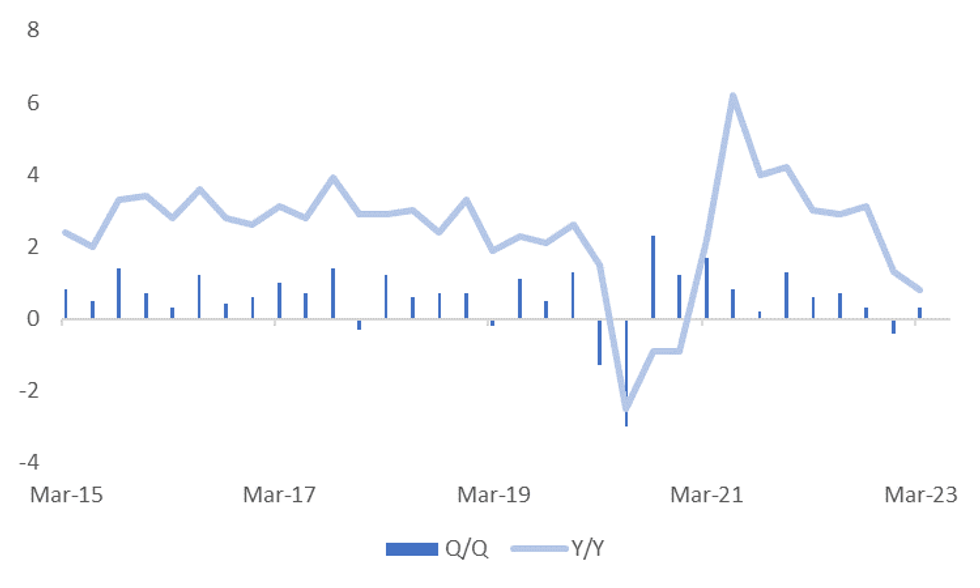

SOUTH KOREA: Recession Avoided, But Growth Momentum Still Eases

Q1 GDP printed a touch above market expectations, coming in at +0.3% q/q (+0.2%q/q expected). This allowed South Korea to avoid two-consecutive quarters of negative growth (Q4 was -0.4% q/q). Still, y/y momentum eased to +0.8% (slightly below +0.9% expected and versus 1.3% prior).

- This is the softest pace of y/y growth since the end of 2020, see the chart below.

- Looking at the detail, consumer spending rose 0.5% q/q, while exports rose in q/q terms, but slowed further in y/y terms. Construction spending was positive but momentum slowed. Business investment was a big drag, -4.0% q/q.

- Weaker sentiment in housing and the lagged impact of higher rates may still constrain consumption going forward.

- By industry we had 8 out of 14 record negative q/q growth. Manufacturing rebounded +2.6%, but is still down -3.3% in y/y terms.

- All in all, the data is unlikely to shift the narrative of a still challenging growth backdrop for South Korea. The central bank recently noting that growth may be below its 1.6% 2023 forecast.

Fig 1: South Korea GDP Growth

Source: MNI - Market News/Bloomberg

ASIA FX: Fresh Multi-Week Highs In USD/CNH Amid On-going Equity/Recovery Concerns

USD/Asia pairs are mostly higher, particularly in terms of USD/CNH and USD/KRW, with both currencies weighed by on-going equity market weakness. USD/CNH is not too far off the 6.9200 level. PHP has been the only notable outperformer. Tomorrow's data calendar delivers South Korean consumer confidence, Thai customs trade data and Singapore IP. Indonesian markets also return from a 5-day break.

- USD/CNH's early down move ran out of steam around 6.8950. From there it was a steady climb higher to 6.9200 and we sit just below this level currently. Onshore equities continue to weaken amid on-going geopolitical concerns with the US and fears over further fresh tech curbs. A report also noted the authorities were urgently looking at ways to boost consumption, according to a CSJ report. For USD/CNH focus is likely to rest on whether we can test the 200-day MA, which comes in just above 6.9500.

- Much like USD/CNH, USD/KRW couldn't sustain early weakness. The pair is back to recent highs. The 1 month NDF did see some resistance ahead of the 1335 level. We sit just below this level currently. Onshore equities slumped as the FSS Chair warned of overheating risks for the Kosdaq and too much borrowing. Q1 GDP was a touch above expectations but still showed y/y momentum slowing.

- The Philippine currency is outperforming the rest of the region today. USD/PHP currently sits at 55.55/60 currently, around 0.30% firmer in PHP terms versus yesterday's closing levels. The pair now sits ~1.40% off highs from early last Thursday (56.385). Mid-April lows between 55.07/55.37 could now be targeted by the market. Comments from BSP Deputy Governor Dakila from late on Monday that the central bank sees PHP as broadly stable over the medium term have helped stabilize sentiment. The Deputy Governor added that economic managers see USD/PHP in a 53-57 range this year, which is down from 55-59 seen in December.

- Malaysia markets have returned after a 4 day break. USD/MYR has pushed back towards 4.4500, after opening lower (sub 4.4200). USD/MYR bulls will target a break above this level, which would open a move towards the 200-day MA (around 4.4780), while bears need to see a break of the 100-day MA (4.4060/65) on the downside to turn the tide. Lower oil prices, relative to recent highs, and weaker CNH levels are weighing.

EQUITIES: China/HK Weakness Continues, South Korean Stocks Down Sharply On Regulator Warning

On-going weakness in China/HK equities remains the main focus in Asia Pac. US futures have been weighed down by these developments, with Eminis and Nasdaq futures last off by a little over 0.3%. South Korean stocks have also sold off sharply following a regulatory warning. Positive Japan sentiment has only provided a modest offset.

- For the US, there wasn’t much reaction in e-minis to First Republic’s earnings, published after hours on Monday. A quick reminder that the bank revealed a sharper than expected round of deposit outflows during the well-documented tumult that got underway in March, although it noted the situation has stabilised in recent weeks. It also removed previous guidance, chose not to answer any questions on its earnings call and disclosed that it is pursuing “strategic options” re: the shape of the firm going forwards. Weakness in China/HK markets weighed more heavily on US trends.

- Geopolitical worry re: potential fresh U.S. action against the Chinese chip sphere have been a key headline driver of the weakness observed over the last couple of sessions. The CSI 300 has continued to correct lower, off a further 0.50% to 3962, well below the index's 200-day MA. Adding pressure was a report that China is 'urgently' studying ways to boost consumption.

- In HK, the HSI is down 1.62% at the break, with the tech index losing close to 3.5% at this stage.

- The Kosdaq, in South Korea is off by 2.4%, the Kospi 1.6%. The FSS chair stated concerns over the Kosdaq overheating and excessive leverage for investments, which weighed heavily on sentiment. Offshore investors have sold $160.3mn of local shares today.

- Japan shares are modestly higher, the Topix +0.25%, with the tech sector higher following a chip subsidy boost.

GOLD: Rebound Stalls Above $2000, As USD Sentiment Stabilizes

Gold was firmer in the first part of trading, but ran out of steam above the $2000 level. This also coincided with USD indices finding some support and recovering from session lows. The precious metal was last near $1992, which is only a touch firmer for the session. We were +0.31% for Monday's session.

- Gold is still broadly following inverse dollar trends, although bullion has lagged somewhat in terms of the recent correction lower in the DXY.

- Fresh equity market headwinds in the region/lower US futures and a slightly weaker US cash Tsy yield backdrop haven't done much to aid gold sentiment today either.

OIL: Holding Monday Gains

Brent crude sits around $82.75/bbl currently, little changed for the session. Earlier highs came in just above $83/bbl, which was right around highs from the NY session on Monday. This move also coincided with USD weakness. Still, as the dollar has stabilized somewhat, downside in oil has been fairly limited. Sessions lows were just under $82.60/bbl. WTI was last around $78.80, having followed a similar trajectory.

- Modest supply concerns may have crept back into the market, with disruptions continuing from Iraqi Kurdistan. There are also concerns over fighting in Sudan, although there is hope of a short term cease fire. API's weekly report on inventories will be eyed later in the US.

- For Brent, a clean break above $83/bbl is needed before higher levels can be eyed. Note the April 19 high came in at $85.15/bbl. Recent lows come in around the $80.50/bbl level.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 25/04/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2023 | 0800/1000 |  | EU | ECB Supervisory Board Chair Andrea Enria and MNI event | |

| 25/04/2023 | 0900/1000 |  | UK | BOE Broadbent Speech at NIESR | |

| 25/04/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/04/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/04/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/04/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/04/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/04/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/04/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.