-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Core FI Strengthen, Familiar Drivers In Play

- Bonds continue to rally amid persistent risk aversion as Asia digests tighten lockdowns in Europe and Fed Chair Powell's comments

- RBNZ misses its LSAP target and NZGB yields plummet as RBNZ rate-hike bets are further unwound

- Most equity benchmarks in Asia head lower, Hang Seng enters correction and completes head & shoulders pattern

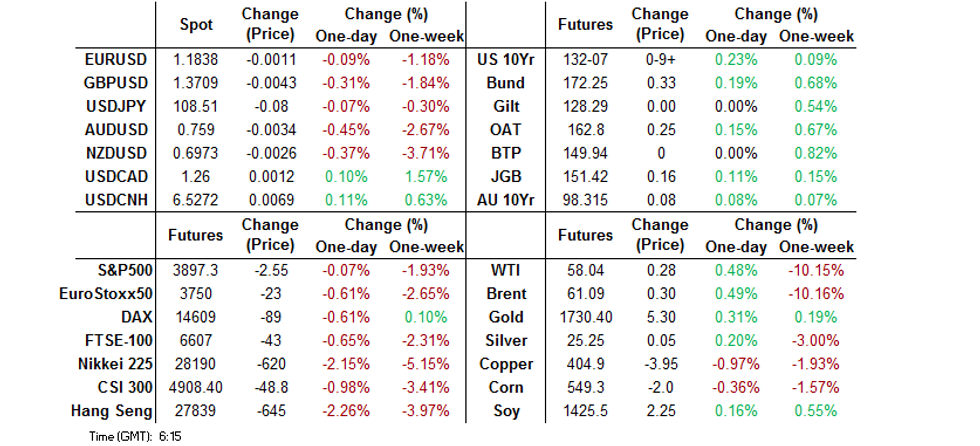

BOND SUMMARY: Lingering Caution Underpins Core FI, NZGB Dynamics Still In Focus

Lingering risk aversion continued to fuel a rally in T-Notes, as Asia-Pac players digested Fed Chair Powell's attempt to downplay unwanted inflation risk & tighter lockdown measures imposed in several European countries. Hong Kong's and Macau's move to suspend vaccinations with a faulty batch of BioNTech Covid-19 jabs & North Korea's latest missile test added to existing worries. Meanwhile, NZGB dynamics continued to lend support to broader core FI space, to a degree. T-Notes last sit +0-10+ at 132-08, testing session highs. Cash Tsy curve bull flattened, with yields last seen 0.2-3.2bp lower. Eurodollar futures run 0.5-2.0 ticks higher through the reds. 5-Year Note supply, Powell/Yellen Senate testimony, flash durable goods orders & Markit PMIs as well as more Fedspeak are the main points of note in the U.S. today.

- Fluctuations in JGB futures were directionless, the contract last trades at 151.43, 17 ticks above prior settlement. Cash JGB yields trade lower across the marginally flatter curve, with 40s outperforming ahead of tomorrow's auction of 40-Year JGBs. The slightly outdated minutes from the BoJ's Jan MonPol meeting provided little in the way of market-moving insight.

- Bull flattening evident also in cash ACGB space, with yields last seen 0.3-8.5bp lower. YM trades +3.0 & XM +8.0, both just a touch below their respective highs. Bills are unch. to +2 ticks through the reds. The downsized (A$1.2bn) offering of ACGB 1.25% 21 May '32 was smoothly digested, as was the RBA's proposal to buy semi-gov't bonds. There is some more RBA speak from Debelle & Bullock coming up today, after their colleague Harper said that the economic recovery is faster than expected. NZ bond market remained in focus, as the RBNZ missed the purchase target in today's LSAP ops, while the collapse in NZGB yields/paring of RBNZ rate-hike wagers continued.

FOREX: Risk Aversion Carries Over Into Asia

FX price action in the Asia-Pac session was largely driven by familiar factors, as the region absorbed a risk-off impetus from NY trade. The impact of tighter lockdown measures imposed across Europe & the latest address from Fed Chair Powell remained in play. The Antipodeans lagged the G10 pack as lingering risk aversion coincided with the continued unwinding of RBNZ tightening bets. NZD/USD ground through yesterday's trough to levels not seen since Nov 25 as NZ 5-Year IRS printed fresh multi-month lows.

- The yen outperformed at the margin amid demand for safe havens. USD/JPY shed a handful of pips ahead of today's expiry of $1.3bn of USD puts with strikes at Y108.00.

- The PBOC fixed its USD/CNY mid-point at CNY6.5228, 13 pips below sell side estimates. USD/CNH climbed to two-week highs as the greenback edged higher.

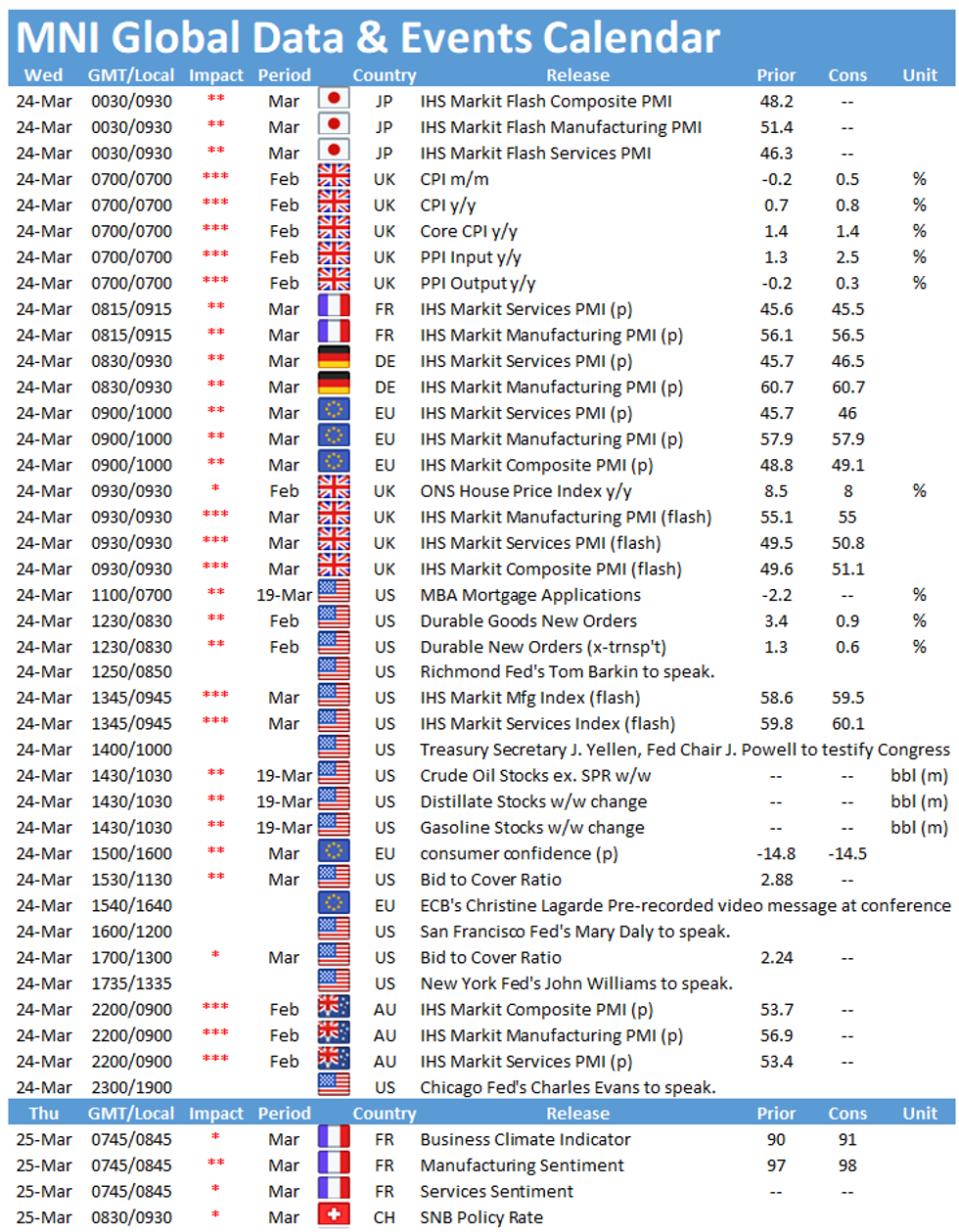

- Focus turns to the Senate testimony from Fed Chair Powell & Tsy Sec Yellen, a flurry of PMI readings from across the world, UK inflation data, U.S. flash durable goods orders and comments from ECB's Lagarde, RBA's Debelle & Bullock, Fed's Barkin, Williams, Daly & Evans.

FOREX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E320mln), $1.1960-75(E732mln), $1.2000-10(E615mln)

- USD/JPY: Y108.00($1.4bln-USD puts), Y108.45-50($586mln)

- EUR/NOK: Nok10.20(E844mln-EUR puts)

- AUD/USD: $0.7710-12(A$533mln)

- USD/CNY: Cny6.50($631mln-USD puts)

- USD/MXN: Mxn20.50($1.1bln-USD puts), Mxn21.25($583mln), Mxn21.48($675mln)

ASIA FX: Doubts Over Global Recovery Spurs Risk Off

A general risk off tone and gains in USD saw most USD/Asia crosses gain again.

- CNH: Yuan is weaker after hovering around neutral levels for most of the session, there are reports doing the rounds that China will speed up coronavirus vaccination to offer free shots for its entire population having already dished out around 80m doses.

- SGD: Singapore dollar has weakened further in Asia. Resistance is seen at 1.3480 which was challenged several times last week. Data yesterday showed CPI rose above estimates, the MAS said much of the increase was driven by a hike in petrol duty, while the increase in core prices was due to an increase in services costs as well as higher food inflation

- TWD: Taiwan dollar is weaker, USD/TWD above the 28.50 handle for the first time since December 3. Following earlier reports that Intel was to invest around $20bn on two new chip plants in Arizona, Taiwan's EconMin Wang has said Taiwan is not threatened by Intel's massive investment in new chip plants.

- KRW: The won is weaker, posting the worst losses in Asia, USD/KRW hitting the highest since March 15. Coronavirus cases have risen above 400 again. BoK Gov Lee was positive on the economy but reiterated the accommodative stance.

- INR: Rupee has weakened, there are some concerns over a pickup in the number of coronavirus cases in India; active infections in have continued to climb, there were over 40,000 fresh cases in 24 hours. New infections have been exceeding single-day recoveries since March 11.

- IDR: Rupiah is lower, declining for the first time in five days. FinMin Indrawati told parliament that pandemic will further delay Indonesia's turnaround with GDP figures expected to show the economy has shrunk.

- MYR: Ringgit is weaker, USD/MYR stopping short of attacking the nearby 200-DMA. Malaysia and Singapore confirmed that they are working on reciprocal vaccination certification in a bid to reopen travel between the two countries.

- PHP: Peso is weaker, stock outflows have continued for the 25th day, markets look ahead to the BSP rate announcement tomorrow.

- THB: Baht is lower, hitting the lowest since November. Markets look ahead to BoT rate announcement after market today. The bank are expected to leave their key interest rate unchanged at the record low after holding fire for six straight meetings.

ASIA RATES: Rising Tide Lifts All Safe Havens

Broad risk off themes saw equity markets hit and bonds supported.

- INDIA: Yields lower across the curve in India, the space supported by broad risk off themes and the decision to cancel this week's bond auctions. There are some concerns over a pickup in the number of coronavirus cases in India; active infections in have continued to climb, there were over 40,000 fresh cases in 24 hours. New infections have been exceeding single-day recoveries since March 11.

- SOUTH KOREA: Bonds are higher in South Korea as equity markets come under. BoK Gov Lee gave a positive assessment of the economy. He also touched on bond purchases, he noted the amount of purchases from the market depends on how quickly yields rise, as well as the reasons behind the rise. He said managing liquidty after the purchases was important, and that the bank could buy bonds without any difficulties.

- CHINA: The PBOC matched liquidity injections with maturities, the thirteenth straight day of matching maturities, while the bank hasn't injected funds since February 25. The overnight repo rate is 9.3bps higher, but below last week's peak, last at 1.793%. 7-day repo rate has declined 13.5bps to 1.8655% after jumping as high at 2.75% on Monday. Bond futures are higher with equity markets rapidly losing ground, 10-year yield fell to lowest since early Feb.

- INDONESIA: Yields lower across the curve. The government announced today its decision to cancel tomorrow's auction after taking into account the latest financial market conditions, yesterday's auction was poorly received with around 50% of the target filled. FinMin Indrawati told parliament that pandemic will further delay Indonesia's turnaround with GDP figures expected to show the economy has shrunk.

EQUITIES: Further Losses

Another day of declines in Asia, most major bourses losing over 1% as bond yields decline. Hong Kong leads the way lower as the risk-off tone of Tuesday's NY session spilled over into Asia, while Hong Kong authorities suspended vaccinations with the BioNTech Covid-19 jab, citing packaging defects in a single batch of doses. Japanese stocks lost ground for a third day, while markets in China are on track for a fourth daily loss. In Taiwan TSMC weighs after Intel announced plans for two new factories. Markets in New Zealand and Australia were supported by lower domestic currencies.

- Futures in Europe are lower as markets contemplate fresh lockdowns, while in the US e-mini Dow and S&P are flat, but Nasdaq futures are higher as QQQ, the Invesco QQQ Trust Series 1 ETF which tracks the Nasdaq 100, saw inflows of almost $5bn earlier this week.

HONG KONG STOCKS: Hang Seng Enters Correction, Charts Head & Shoulders Pattern

The Hang Seng Index has has tumbled in tandem with most of its regional peers today, as the risk-off tone of Tuesday's NY session spilled over into Asia, while Hong Kong authorities suspended vaccinations with the BioNTech Covid-19 jab, citing packaging defects in a single batch of doses. The index last sits just above the 28,000 mark.

- Today's move has allowed the index to enter technical correction, as Hang Seng has now weakened by more than 10% since its Feb 18 peak.

- With today's downswing, the index has completed a head and shoulders pattern, signalling scope for a deeper sell-off.

- The slide off the Feb 18 peak was heralded by a bearish divergence in the RSI, which is still some way off from oversold territory as we type.

- Mind that price action over the last two weeks or so was underpinned by a below-average and generally declining volume.

- The rate has attacked its 100-DMA (27,889), which was intact since early Nov. A clean break below there would confirm that bears are taking control, bringing the 200-DMA at 26,321 & key support from Dec 22 low of 25,999 into view.

- Bulls look for a rebound above the 28,260 neckline of the head and shoulders formation, before taking aim at the 50-DMA/Mar 18 high at 29,330/29,597.

Fig. 1: Hang Seng Index

Source: MNI - Market News/Bloomberg

GOLD: Higher As Yields Drop

The yellow metal has gained in Asia on Wednesday, the rate bottomed out at $1723.94 before bouncing to session highs just below $1735, last trades up $4.69 at $1731.81.

- Broad risk off trade has seen bonds bid, pressuring yields lower and allowing gold to rally, even as the greenback consolidates its recent gains. Markets are still digesting comments from Fed Governor Powell yesterday where he played down the risk of inflation overshoots. Markets await further comments from Powell and US Treasury Secretary Yellen at the Senate Banking Committee.

OIL: Holding Losses

Crude prices are essentially flat in Asia, holding yesterday's declines. WTI is last $0.07 higher at $57.83/bbl, while Brent is $0.06 lower at $60.85/bbl.

- Markets are digesting reports that a large shipping container has run aground the Suez Canal, blocking off traffic in both directions. Ever Given, a 400m long container ship wedged itself lengthways and caused a build up of around 100 ships. Still, worries over the global recovery amid fresh lockdowns in Europe have tempered any upside for crude. API inventory data yesterday was bearish, headline crude stocks rose 2.93m bbls, though stocks at Cushing, OK fell 2.28m bbls and gasoline stocks fell 3.73m bbls. Markets now look to DoE figures later today.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.