-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: EU & US Inflation Prints Coming Up

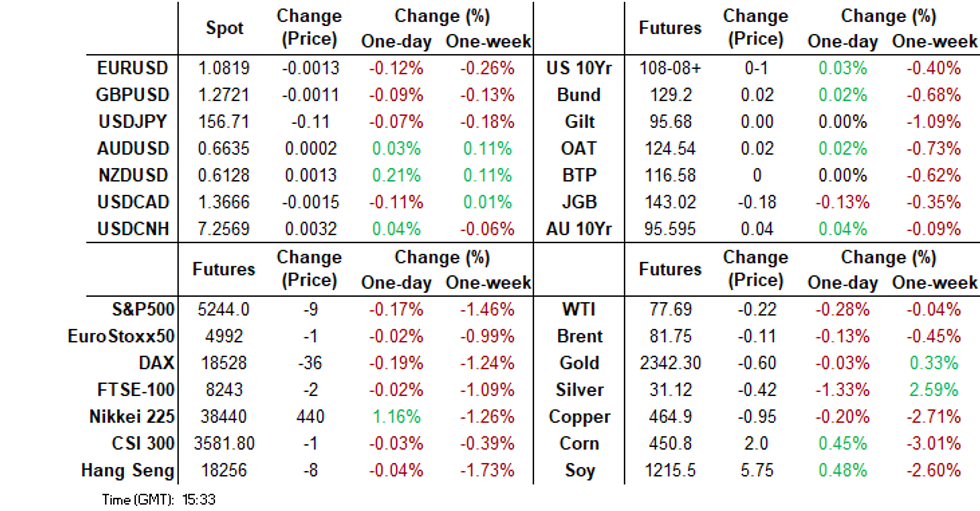

- US Treasury futures are little changed ahead of the US core PCE data later tonight. JGB futures have been faded on upticks, with the bear trend remaining intact. We had a number of Japan data prints earlier, with most focus on Tokyo CPI, which was close to expectations.

- The China PMIs were weaker than expected, with manufacturing dipping back into contraction territory. CNH is slightly weaker, while China equities are struggling to stay in positive territory.

- Looking ahead, we have Japan MoF intervention data (out early evening Tokyo time). Eurozone CPI figures will be the focus of the European session before US April PCE deflator and Canadian GDP round off the week’s calendar.

MARKETS

US TSYS: Treasuries Little Changed Ahead Of US PCE Later

- Treasury futures are little changed ahead of the US core PCE data later tonight. TU is -0.125 at 101-25.125, after hitting a session high of 101-25.75, while TY did briefly trade above Thursday's highs, however now trade little changed at 108-18.

- Volumes: TU 44.5k, FV 80.5k TY 110k

- Tsys flow: 2/5/10 Block, buyer FV on the fly in 636k DV01.

- Cash treasury curve is little change, yields are flat to 0.5bps lower. The 2Y unchanged at 4.925% while the 10Y -0.2bp at 4.544%.

- US overnight indexed swaps are now pricing more than 80% odds for a 25bps rate cut in November

- Local rates market: ACGB yield are 3-5bps lower, 5yr supply was well supported, NZGBs are 6-10bps lower as market digests the budget and following strong auction results across 7, 10 & 15yr tenors, while JGBs are 1-3bps higher, with the 10Y yield at 1.069% just off recent highs.

- Looking ahead; PCE, Personal Income/Spending and MNI's Chicago PMI, while Atlanta Fed Pres Bostic will speak.

JGBS: Weaker, As Bear Trend Remains Intact, Wages & BoJ Speak Next Week

JGB futures sit close to session lows in recent dealings. JBM4 was last at 143.02, -.18 versus settlement levels. This remains consistent with the broader technical backdrop, with a bear trend in place. Lows from yesterday rest sub 142.90.

- Post the earlier data flurry there hasn't been much in the way of major drivers. The BoJ bond ops were unchanged from the prior outcome, while the 3 month bill sale didn't impact sentiment.

- The data earlier showed close to expected Tokyo May CPI outcomes. Some of the core measures showed further deceleration versus the April y/y pace and services inflation looked to have cooled.

- Other data was mixed with retail sales better than expected (+1.2% m/m, versus 0.6% forecast), but IP fell 0.1% m/m (against a +1.5% forecast).

- In the cash JGB space, yields sit higher. The 10yr firming back towards 1.07%. The 30yr is up 2bps to 2.23%. In the swaps space, the 10yr is back above 1.09%.

- Next week Q1 Capex is out along with April wages. We also have BoJ speak, along with 10y and 30y debt auctions.

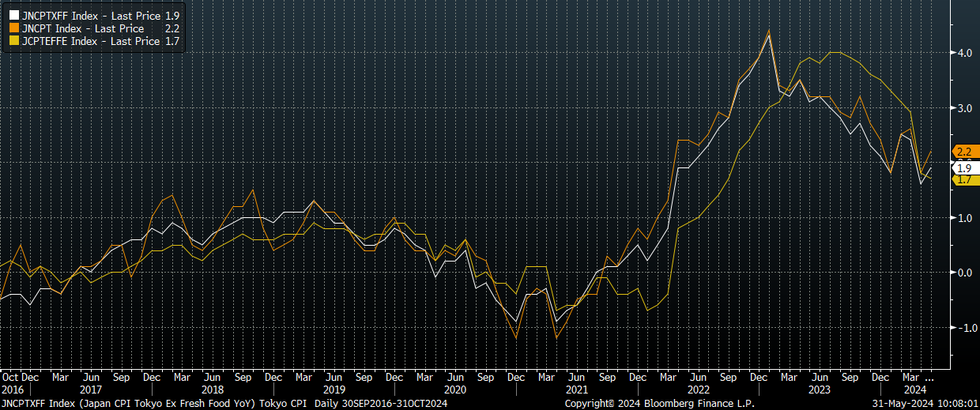

JAPAN DATA: Y/Y Tokyo CPI Rebounds, But Not Much Inflation Pick Up Outside Of Utilities Rise

May Tokyo CPI was close to expectations, both the headline and ex fresh food y/y outcomes, at 2.2%y/y and 1.9%y/y respectively, were in line with market expectations. The showed sequential improvement on the April outcomes as well. The core measure which excludes fresh food and energy was 1.7%y/y down from April's 1.8% outcome. The measure which excludes all food and energy was 1.2% y/y, versus 1.4% in April.

- In terms of m/m outcomes, the headline measures also saw a pick up compared to April's drop. This was led by goods prices rising 0.9% m/m, versus April's +0.4%. Services prices were -0.1%m/m, paring April's -0.9% drop.

- By sub-categories, education fell 0.4%m/m, compared to April's -9.4%, which was impacted by subsidies. transport was -0.2%m/m, while entertainment fell -0.4%. On the plus side utilities rose 3.5% m/m, after a +0.6% rise in April.

- Outside of the utilities rise there wasn't much sign of firmer inflation pressures, particularly in the services sector. At the margin this shouldn't add any hawkishness to the BoJ outlook.

Fig 1: Tokyo CPI Y/Y Trends

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: ACGBS Richer, Curve Slightly Flatter Post 5yr Auction

ACGBs (YM +5.0 & XM +4.0) are richer and trade near session's best. Earlier, we had Private Sector Credit come in just above consensus at 0.5%m/m vs 0.4% est, while we also had the Nov-29 Bond auction, which was well received with a bid/cover ratio of 3.2286%

- Cash US tsys are are about 0.5bp richer today, the curve is unchanged. Tsys futures have traded in very tight ranges, will the only notable flow a 2/5/10 Block, buyer FV on the fly in 636k DV01.

- Cash ACGBs are 3-4.5bps richer, the curve is slightly flatter with the AU-US 10-year yield differential 1bps higher at -15bps.

- Swap rates are 1-3bps lower

- The bills strip is flat to 3bps higher, curve has bear-steepened

- RBA-dated OIS pricing is 2-5bps softer at the Sept & Nov meetings today, with a17% cut into year end.

- Looking ahead; MI Inflation on Monday, and GDP on Wednesday

NZGBS: Richer Post The Budget, FinMin Says Budget To Assist RBNZ

NZGBs closed 5-9.5bps richer, the curve bear-steepened, the calendar was empty today although we did have a 7, 10 & 15yr bond auction, bid/cover across all lines increased from prior auction, although total successful bids were well done.

- NZGB curve is tighter today, the 2y is -6.2bps at 4.877%, while the 10yr is -7.5bps at 4.800%.

- NZ FinMin Nicola Willis has received a letter alleging RBNZ Governor Orr breached the bank’s code of conduct, prompting discussions about the central bank's independence and its handling of employment matters, following Orr's response to criticism from the NZ Initiative regarding prudential regulation and banking competition.

- The FinMin has also defended her budget, stating that despite tax cuts, its overall effect is disinflationary, aiming to assist the RBNZ rather than hinder it. Economists raised concerns that the budget's less contractionary fiscal stance may complicate the central bank's efforts to tackle inflation and could make it more nervous about potential growth.

- Swap rates are flat to 1.5bps, the curve has bear-flattened

- RBNZ dated OIS pricing is 2-4bps lower heading into Nov meeting with A cumulative 23.5bps of easing is priced by year-end.

- Looking ahead: ANZ Commodity Price on Thursday

FOREX: USD Marginally Higher, Japan MoF Intervention Figures Out Later

The BBDXY index sits marginally higher, last just above the 1253.25 level. Overall FX moves have been fairly contained though in the first part of Friday trade.

- The BBDXY sits higher for the week, albeit away from Thursday highs (near 1256.6). Today, cross asset signals have been mixed. US equity futures sit lower, but regional Asia Pac markets are higher. US yields are close to unchanged.

- USD/JPY got just under 156.60 earlier, but sits back at 156.80 in latest dealings, unchanged for the session. FinMin Suzuki reiterated familiar FX verbal jawboning, which provided some yen support but there was no follow through.

- Japan had a number of data releases, with most focus on the Tokyo CPI print. IT was close to expectations, albeit with some further loss of momentum for y/y core prints.

- AUD/USD is around 0.6630, down a touch for the session. We had softer than forecast China PMI prints. This didn't impact sentiment greatly. NZD/USD is a touch higher but at 0.6120 remains comfortably within recent ranges.

- EUR/USD sits lower last near 1.0815, aiding the broader recovery in USD indices.

- Looking ahead, we have Japan MoF intervention data (out early evening Tokyo time). Eurozone CPI figures will be the focus of the European session before US April PCE deflator and Canadian GDP round off the week’s calendar.

ASIA STOCKS: Hong Kong & China Equities Higher, China To Target Property Supply

Hong Kong & Chinese equities are higher today, largely tracking global markets. Earlier China Manufacturing PMI was below consensus coming in at 49.5 vs 50.5 and non-manufacturing was 51.1 vs 51.5 composite PMI was 51 in May down from 51.7 in Apr, later today we have Hong Kong Retail Sales, with consensus at -6.3%, up from -7% in March. China Vanke is in talks with banks to secure a $6.9b loan.

- Hong Kong equities are higher today, with property indices are again the worst performing, the Mainland Property Index is down 0.10%, while the HS Property Index is up just 0.20%, elsewhere HSTech Index is faring better up 1%, while the wider HSI is up 0.95%. In China onshore markets, the CSI300 is 0.20% higher, the CSI 300 Real Estate Index is up 1.67%, small cap indices the CSI1000 & CSI2000 are up 0.67% and 0.90% respectively, while the ChiNext is up 0.54%

- (MNI): China May Mfg. PMI Contracts To Three-Month Low - (See link)

- In the property space, Chinese policymakers are targeting the reduction of a massive housing inventory, with over 60 million unsold apartments, to address the nation's property slump. Despite recent government initiatives, including a 300 billion yuan initiative to purchase unsold homes, challenges remain in reviving home sales and alleviating oversupply issues, particularly in larger cities. China Vanke is in advanced talks with major banks for a record-breaking loan of about 50 billion yuan ($6.9 billion), aimed at alleviating liquidity concerns and avoiding potential defaults, with the facility backed by real estate assets totaling around 80 billion to 90 billion yuan, part of an asset package for collateralization.

- Looking ahead: Caixin China PMI Mfg on Monday

ASIA PAC STOCKS: Asian Equities Higher, Japanese Banks Benefit From Higher Yields

Asian equities have climbed Friday as the latest round of US economic data signaled momentum is slowing, boosting the case for the Federal Reserve to start cutting interest rates this year. The MSCI Asia Pacific is trading up over 0.60% led by gains in Japan and Australia. Earlier we had Japanese Jobs, Tokyo CPI, Industrial Production and Retail Sales, South Korean Industrial Production and Australian Private Sector Credit. Elsewhere local rates have found some support, although JGBs yields are a touch higher this morning however off highs made on Thursday.

- Japanese equities are higher today, banking stocks are the top performing sector today they are being well supported by higher yields as the 10Y trades just off multi year highs. Further moves higher may be limited as the market now awaits the Fed Reverse's favorite price gauge due out later today. Earlier, we had had a flurry of local data - Jobless rate was in line at 2.6%, Job-To-Applicate Ratio was 1.26 vs 1.28 est, Tokyo CPI was 2.2% vs 2.2% est, Industrial Production was -0.1% vs 1.5% est, while Retail Sales was 2.4% vs 1.7% est. The Topix is up 1.50%, with the Topix Bank Index up 2.02%, while the Nikkei 225 lags, trading up just 0.95%.

- Taiwan equities are slightly lower today, foreign investors have been selling local stocks recently with a total outflow of just over $2b. Late on Thursday, GDP came in slightly above estimates at 6.56% vs 6.50% est and saw the economy grow at the fastest pace since 2021, while the bureau of statistics now expected GDP to hit 3.94% this year up from their most recent forecast of 3.43%. The Taiex is down 0.13% today and trades off 1.10% for the week. The index still trades above all major moving averages, although the 14-day RSI has fallen about 15pts to 60 and the MACD indictor is showing decreasing green bars.

- South Korean equities are higher today. Earlier today we had industrial production come in well above consensus at 6.1% vs 4.4%, and SK chip stockpiles shrank at the fastest pace in 10 year showing just how much demand there currently is for especially for customers developing AI technologies. Samsung has contributed the most to the gains in the Kospi, although we are off morning highs and now trade just 0.50% higher for the session, the small-cap Kosdaq is up 0.35%.

- Australian equities are higher today, although we are on track to close the week lower. Earlier, we had Private Sector Credit, which beat estimates coming in at 0.5% vs 0.4% and up from a revised 0.4% in March we also had a bond auction which was well recovered with a bid/cover ratio of 3.22x up from 2.57x from the last auction in March. Most sectors are in the green today, other than Material and Tech stocks. Currently the ASX200 is up 0.43%.

- Elsewhere in SEA, New Zealand equities closed up 1.75% following the release of the budget on Thursday, Indonesian equities are 0.65% lower and have broken below Thursday and the YTD lows, Singapore equities are 0.30% higher, Indian Equities are 0.30% higher while Philippines & Malaysian equities are little changed.

ASIA EQUITY FLOWS: Asian Equity Flows Turn Negative As Tech Stocks Weaken

- South Korean equity markets were lower on Thursday, with both the Kospi & Kosdaq both down around 1.50% for the second straight session. Tech and Semiconductor names were the worst performing and saw the largest outflow and we saw an total outflow of $537 for the day which takes the 5 day net outflow of $1.5b. The 5-day average is now -$303m, well below the 20-day average of $12m, and w longer term 100-day average at $138m.

- Taiwan equities were lower on Thursday and we saw a $930m outflow marking the largest outflow since Apr 19th, the past 5 sessions has seen an outflow of $2.1b. GDP was released late Thursday which came in above estimates at 6.56%. The 5-day average is now -$416m, well below both the 20-day average at $212m and the 100-day average is $60m.

- Thailand equities were lower on Thursday, the SET briefly traded below support at 1,350, before closing at 1,351.5. Equity flows have been negative over the short-term, we have marked 8 straight days of selling, with the past 5 trading sessions netting a total outflow of $231m. The 5-day average is now -$46m, below both the 20-day average at -$15m and the 100-day average at -$21m

- Indonesian equities have seen 6 straight sessions of selling from foreign investors, with the past 5 session seeing a net outflow of $328m. The JCI briefly made new ytd lows after breaching the 7,000 mark, before recovering to close just above there. The 5-day average is now -$65m, below both the 20-day average at -$49m and the 100-day average at $2m.

- Philippines equities also continue to see selling from foreign investors, we have now marked 4 straight days of selling and the past 5 trading sessions have seen a total outflow of $45m. The PSEi broke below YTD and the 6,400 level we had been above since late December and unlike Indonesian equities were unable to close back above. The 5-day average is -$9m, below the 20-day average at -$4m and the 100-day average at -$3.5m.

- Indian equities were down almost 1% on Thursday. Equity flows have been negative over the past couple of weeks, although the past 5 trading sessions saw an net inflow of $18m. The 5-day average is $83m,below the 20-day average at -$146m, although above the longer term 100-day average of $18m.

- Malaysian equities were little changed on Thursday and hover just above the 20-day EMA. Equity flow momentum has negative recently except for a single day on the 23rd where we saw a large $100m inflow, the past 5 session have saw a net outflow of $57m. The 5-day average now -$11m, below the 20-day average at $23m but in line with the longer term 100-day average at -$0.50m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -537 | -1518 | 14089 |

| Taiwan (USDmn) | -1550 | -2095 | 3678 |

| India (USDmn)* | -517 | 418 | -2889 |

| Indonesia (USDmn) | -73 | -329 | -331 |

| Thailand (USDmn) | -37 | -232 | -2169 |

| Malaysia (USDmn) * | -67 | -57 | -38 |

| Philippines (USDmn) | -14 | -45.1 | -334 |

| Total | -2795 | -3857 | 12006 |

| * Data Up To Apr 29th |

COMMODITIES: Oil Tracking Lower Ahead Of OPEC Meeting, Gold Steady

Oil prices have continued to track lower, following sharp losses in Thursday trade. The front month WTI contract is off a further 0.45%, last tracking near $77.60/bbl. For Brent, front month is just under $81.60/bbl. Both benchmarks are tracking slightly lower for the week.

- Markets are looking ahead to the OPEC+ meeting June 2 where the group are widely expected to rollover current cuts into the second half of the year. OPEC+ members who have agreed to voluntary cuts totalling 2.2m b/d are discussing extending them until year-end, Reuters said, citing sources within the bloc.

- Thursday's dip also came even despite a larger than expected draw in US stocks. Broader risk off/concerns around the Fed outlook weighed in the space.

- Brent prompt time spreads are also painting a more amply supply backdrop.

- For WTI, the trend direction remains down, and the recovery from earlier in the week appears to be a correction - for now. A resumption of weakness would signal scope for a move towards $75.64, the Mar 11 low. Initial firm resistance to watch is at $83.63, the Apr 26 high.

- Gold hasn't shown a strong directional trend in the first part of trade. We were last near $2343, little changed for the session. We are still tracking higher for the week. Recent lows came in at $2322.8, which is close to the 50-day MA.

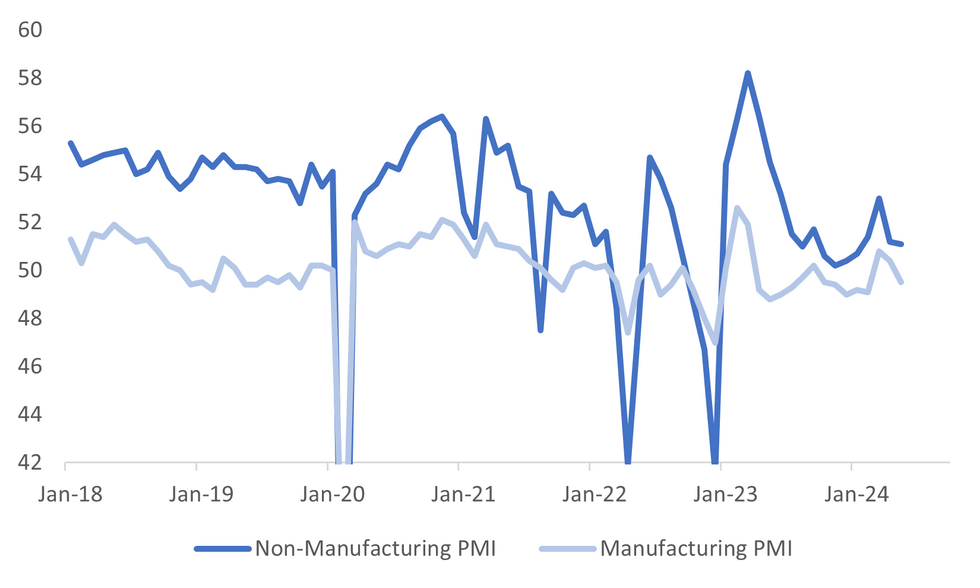

CHINA DATA: May PMIs Weaker Than Forecast, Manufacturing Back Sub 50

The official PMIs were weaker than expected. Manufacturing slipped back into contraction territory, printing at 49.5, versus 50.5 forecast. This ends the 2 month run of above 50.0 prints. The services or non-manufacturing PMI printed at 51.1, against a forecast of 51.5 and a prior outcome of 51.2. The composite PMI printed at 51.0, versus 51.7 in April.

- For the manufacturing PMI, we saw weakness in new orders, the headline falling to 49.6 (51.1 prior). New orders to orders eased slightly but remains elevated by recent standards. New export orders fell to 48.3 form 50.6. Output was 50.8 from 52.9 in April, while imports fell to 46.8 from 48.1.

- The employment sub index was steady near 48.0, while input and output price measures both rose. Input prices to 56.9 from 54.0, output prices to 50.4 (49.1 prior).

- On the services side, the detail was mostly softer. New orders rose but only to 46.9. Input and selling prices both eased. Both these measures are back sub the 50.0 expansion/contraction point. Employment also fell further to 46.2 (from 47.2).

- The data is disappointing in the sense the manufacturing/industrial side had been showing more positive trends compared to other parts of the China economy. It will see on-going calls for policy support maintained.

Fig 1: China PMIs Soften In May

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Mixed, USD/CNH Dips Supported Post Weaker PMIs

USD/Asia pairs are mixed as we approach month end. The weaker China PMIs didn't impact sentiment much, although USD/CNH dips have been supported. Regional equities are mostly higher, albeit away from best levels for the session. Tomorrow, South Korea full month trade figures for May print. Next week we more China PMI data on Monday, then trade figures later in the week. The RBI decision is due next Friday as well.

- USD/CNH got close to Thursday lows (just under 7.2480) in early trade, but we sit back above 7.2550 now. The 20-day EMA is near recent lows. Spot USD/CNY has also crept higher, back above 7.2400. China PMIs showed manufacturing moving back into contraction territory, a fresh worry from a growth standpoint. Local equities are marginally higher though.

- 1 month USD/KRW got to fresh highs near 1383, levels last seen on the first day of May. We have pared gains back to 1380, but this is still 0.4% weaker in won terms, continuing a recent run of underperformance. Regional equity sentiment is better today, although the Kospi is only recovering part of its recent losses. Offshore investors have sold nearly $1.3bn of local equities this week. earlier IP data for April was stronger than forecast but didn't impact sentiment. The BoK and National Pension fund are reportedly in discussions to expand their FX swap program (per RTRS).

- USD/PHP spot sits off recent last under 58.50. Recent highs rest at 58.75. PHP is comfortably the worst performer in EM Asia FX for the month of May (with the dovish BSP a factor). BSP stated earlier that the May inflation print (due next week) is likely 3.7 to 4.5%. They added that the weaker PHP is a key source of pressure.

- Spot USD/IDR is holding just below recent highs, last near 16245 as month end approaches. Local equity weakness continues, with the JCI off a further 0.6% and sub the 7000 level.

- USD/THB is also away from recent highs, last near 36.75, but dips have been supported.

CREDIT: APAC Credit Tighter On Month End Buying, QBE Outlook Revised

- Regional Asian equities are higher today, Chinese listed property names are higher today, while Hong Kong listed trade down a touch, with Chinese policy makers looking to reduce the massive amount of housing inventory, while China Vanke is in advanced talks to get a $6.9b loan.

- Aus Corps 2-3bp tighter, better buying in high beta names. Aus Snr Fins 1bps tighter, while are Subs are 1-2bp tighter. China & Korea credit are unch to 1bp tighter. In the EM space, Indonesian quasis are 1-2bps tighter and EM sovs are are unchanged

- Aus iTraxx CDS unchanged at 65bps & Asia Ex-J iTraxx is up 0.5bp at 97bps

- Headlines: S&P revises QBE Outlook to Positive (BBG)

- Rates: Local rates are richer today, US Treasury yields are unchanged ahead of PCE later tonight.

- Data: Japan - Jobless rate was in line at 2.6%, Job-To-Applicate Ratio was 1.26 vs 1.28 est, Tokyo CPI was 2.2% vs 2.2% est, Industrial Production was -0.1% vs 1.5% est, while Retail Sales was 2.4% vs 1.7% est. Aus - Private Sector Credit 0.5% m/m vs 0.4% est. China - Composite PMI 51 vs 51.7 prev, Manufacturing PMI 49.5 vs 50.5 est & Non-Manufacturing PMI 51.1 vs51.5 est.

- Primary Deals: Moneyme announced an AUD Personal Loan ABS.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/05/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/05/2024 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 31/05/2024 | 0630/0730 |  | UK | DMO to release FQ2 (Jul-Sep) gilt operations calendar | |

| 31/05/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2024 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2024 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2024 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2024 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/05/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/05/2024 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2024 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/05/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 31/05/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/05/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 31/05/2024 | 2215/1815 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.