-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Steeper Ahead of JOLTS

MNI US OPEN - Censure Motion Against France Gov't Due Today

MNI EUROPEAN MARKETS ANALYSIS: Few Surprises Expected At Next Week's BoJ Meeting

- After the surprise hikes from the RBA and BoC this week, AU & CA STIR have firmed further with more than an additional 25bp of tightening priced into both markets. In contrast, expectations remain fairly benign heading into next week's BoJ meeting. Comments from BoJ Governor Ueda remain fairly balanced, recognizing some upside inflation risks, but the inflation goal has not been met yet.

- Most regional equity markets are tracking higher as we approach the end of the week. Japan stocks are leading the way, the Nikkei 225 up around 2.0% at this stage, the 9th straight week of gains. China stocks are around flat, with property sub indices giving back some recent gains. Weaker PPI inflation and benign CPI pressures is likely to keep easing talk as part of the market narrative.

- Brent crude has spent most the session on the back foot, albeit well within Thursday's volatile ranges. China's crude stockpiles reportedly hit a 2yr high in May, with expectations import demand will ease in June. This will heighten demand concerns, as Saudi's supply cut hasn't been able to materially lift sentiment so far.

- The data calendar is thin today, the latest Canadian employment report provides the highlight.

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-20+, -0-03, a 0-05 range has been observed on volume of ~63k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys cheapened in early dealing as local participants faded Thursday's richening, perhaps using the opportunity to close out longs/enter fresh shorts.

- Little meaningful macro news flow crossed through the session, and tsys dealt in a narrow range. The proximity to Tuesday's CPI print and Wednesday's FOMC meeting may be keeping participants on the sidelines.

- FOMC dated OIS price ~7bps of hikes into the June meeting with a terminal rate of ~5.30% in July. There are ~25bps of cuts priced for 2023.

- There is a thin calendar on Friday, the Canadian Labour Force survey provides the highlight.

JGBS: Futures Holding Gains, Narrow Range, Few Domestic Drivers

In the Tokyo afternoon session, JGB futures sit mid-range at 148.76, +14 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined comments from Governor Ueda in parliament re: seeing various uncertain elements over prices and fiscal management at the time of an exit from monetary easing. (link ICYMI)

- Cash JGBs are trading mixed in the Tokyo afternoon session with yield movements ranging from +0.8bp (1-year) to -0.8bp (20-year). The benchmark 10-year yield is 0.1bp lower at 0.437%.

- The swap curve has twist steepened with a 10-year pivot. Swap spreads are mixed, generally narrower out to the 5-year zone but wider beyond.

- The local calendar next week sees PPI (May) and Machine Tool Orders (May P) on Monday, BSI Large Manufacturing (Q2) on Tuesday, Trade Balance (May) and Core Machine Orders (Apr) on Wednesday and Weekly Investment Flows (June 9) on Thursday. The calendar highlights undoubtedly will be the BoJ Policy Decision on Friday.

AUSSIE BONDS: Richer, Narrow Range, Journalists Are In The Hawks Nest

In futures roll-impacted trading, ACGBs are richer (YM +4.8 & XM +6.7) after trading in a narrow range in the Sydney session. With the local calendar light today, local participants have likely been monitoring US tsys, which are 0.7-1.5bp cheaper in Asia-Pac trade.

- Cash ACGBs are 5-7bp richer with the AU-US 10-year yield differential +2bp at +22bp.

- Swap rates are 7-8bp lower with EFPs little changed.

- The bills strip is flatter with pricing +2 to +9.

- RBA dated OIS are 1-4bp softer across meetings with an expected terminal rate of 4.46%.

- James Glynn (Dow Jones) - It is looking more likely that the answer to Australia's stubborn inflation woes will be the onset of a recession. (link)

- Christopher Joye writes an AFR article titled “Why the cash rate could hit 5pc before the RBA is done”. (link)

- Note that Monday is a public holiday for most parts of Australia. The next key data is on Tuesday with the release of Westpac Consumer Confidence (June) and NAB Business Confidence (May). Next week’s highlight undoubtedly will be the May Employment Report on Thursday.

- The AOFM announced there will be no conventional bond tenders next week. They do plan to sell A$150mn of the 0.25% Nov-32 index-linked bond on Tuesday, 13 June.

STIR: RBA & BoC Expected To Play Catch-Up To Fed & RBNZ

After the surprise hikes from the RBA and BoC this week, AU & CA STIR have firmed further with more than an additional 25bp of tightening priced into both markets.

- The lift in US jobless claims overnight softened projected Fed rate hike chances over the next three meetings. FOMC-dated OIS pricing attaches a 27% chance of a 25bp hike next week, with July and September receding to a cumulative chance of 80% and 68% respectively.

- Overnight, BoC Deputy Governor Beaudry raised several concerns. These included the potential reversal in core inflation, the durability of household spending, and the possibility that the neutral interest rate for CA has surpassed post-pandemic levels and could continue to rise further.

- The RBNZ is further along the global rate hiking journey, with the 5.50% OCR still well above the expected terminal rates elsewhere in the $-Bloc. Consequently, the RBNZ arguably faces a higher threshold for future rate hikes.

Figure 1: $-Bloc STIR: Terminal Rate Expectations & Year-End Pricing

Source: MNI – Market News / Bloomberg

NZGBS: Closed On A Low Note But Richer On the Day

NZGBs closed on a low note but with the benchmarks 2-5bp richer on the day. NZ/US 10-year yield differential is 1bp higher.

- NZGBs have shown stronger performance compared to ACGBs, with the NZ/AU 10-year yield differential -1bp. At +57bp, the NZ/AU differential is back near its tightest level since mid-February. The 10-year differential hit a 20-year+ high in March at around +100bp.

- Swap rates closed 5-6bp lower with the implied short-end swap spread tighter.

- RBNZ dated OIS are 1-3bp softer across meetings with the expected terminal rate at 5.63%.

- Not surprisingly given how much they've risen over the past 18 months or so, a growing number of New Zealanders are worried about interest rates, market research company Roy Morgan says.

- Next week sees Retail Card Spending (May) on Monday, Net Migration (Apr) on Tuesday, Balance of Payments (Q1) on Wednesday and GDP (Q1) on Thursday.

- The global calendar is light today. Accordingly, market participants will be keen to see if US tsys can hold yesterday’s gains sparked by the larger-than-expected jump in US initial jobless claims.

EQUITIES: Japan Stock Rally Extends To 9th Week, China Indices Close To Flat

Most regional equity markets are tracking higher as we approach the end of the week. Japan stocks are leading the way, the Nikkei 225 up around 1.80% at this stage. China stocks are around flat, while US futures are down slightly at this stage. Eminis last near 4293.

- The rebound in Japan stocks follows a ~2.6% correction in the Nikkei Wed/Thurs. The index is back above 32000 but we are below intra-session highs form earlier in the week. The index is tracking higher for the 9th straight week.

- Tech related names have led the move, while BoJ Governor Ueda appeared before parliament. Ueda's comments didn't suggest any surprises at next Friday's BoJ meeting.

- China stocks are around flat at the break, the CSI 300 sitting close to 3817.50. Inflation data for May suggests a weakish domestic demand backdrop, which should keep easing calls as part of the market narrative. The CSI 300 property sub index is down 2.27%, the first drop since Monday. News outlets reported US Secretary of State Blinken may visit China next week.

- The HSI is +0.20% higher at the break, with tech up 0.59%. The index tracking slightly higher for the week.

- The Taiex (+0.80%) and Kospi (+1.00%) are tracking higher in line with tech related gains in US trade on Thursday.

- In SEA trends are mixed, Thai equities are down around 0.50% at this stage, pulling back a degree after yesterday's 1.71% gain.

FOREX: Greenback Ticks Higher In Asia

The USD has pared some of Thursday's losses as US Treasury Yields tick higher, aiding a mild bid in the greenback.

- Yen is the weakest performer in the G10 space at the margins. USD/JPY has firmed above the ¥139 handle, last printing ¥139.25/35. On the wires early in the session M2 Money Supply rose 2.7% Y/Y in May and M3 Money Supply rose 2.1%.

- AUD/USD is also pressured, the pair is now dealing below the $0.67 handle. The pair was unable to break recent highs in early dealing and ticked away from session highs marginally extending losses as we approach the London session.

- Kiwi is a touch lower however ranges have been narrow with little follow through. NZD/USD has dealt in a narrow ~15pip range for the most part of today's Asian session.

- Elsewhere in G-10 EUR and GBP are both down ~0.1% reflecting the broader USD move.

- Cross asset wise; 10 Year US Treasury Yields are up ~1bp and e-minis are ~0.1% softer. BBDXY is ~0.1% firmer.

- The data calendar is thin today, the latest Canadian employment report provides the highlight.

OIL: Tracking Lower, China Crude Oil Inventories Hit 2yr High

Brent crude has spent most the session on the back foot, albeit well within Thursday's volatile ranges. Dips sub $75.40/bbl have been supported, with latest moves just above this level. This puts us down 0.70% from Thursday closing levels in NY. We are also tracking lower for the week (-0.92% at this stage). WTI is tracking a similar trajectory, last around the $70.75/bbl level and slightly worst week to date, -1.37%.

- Both Brent (low of ~$73.60 from Thursday) and WTI (low of ~$69) benchmarks remain well above intra-session lows from Thursday, when Middle East news reports of a possible US/Iran deal (which would bring fresh oil supply to the global market) sent prices sharply lower. We rebounded though as the US denied the reports.

- Elsewhere, China's crude stockpiles reportedly hit a 2yr high in May, with expectations import demand will ease in June (see this link for more details). This will heighten demand concerns, as Saudi's supply cut hasn't been able to materially lift sentiment so far.

GOLD: Bounces With The Lift In US Initial Jobless Claims

Gold in the Asia-Pac session is experiencing a slight decline after bouncing back from its lowest closing level since mid-March. The surge in US unemployment claims dampened expectations of further Fed tightening, leading to increased interest in gold. The precious metal closed 1.3% higher at 1965.46.

- According to a report from the US Labor Department released on Thursday, initial jobless claims climbed to 261,000 last week. This figure marked the highest level since October 2021 and significantly surpassed the median economist forecast.

- The rise in US jobless claims resulted in reduced expectations for upcoming Federal Reserve rate hikes over the next three meetings. FOMC-dated OIS pricing attaches a 27% chance of a 25bp hike next week, with July and September receding to a cumulative chance of 80% and 68% respectively.

- The dollar extended a drop following the data print, boosting gold.

- In recent weeks, the price of the precious metal has remained relatively stable in a range centred on $1,950 per ounce, as investors eagerly await clearer signals regarding the future direction of US monetary policy.

FX OPTIONS: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0695-00(E1.1bln), $1.0720-25(E759mln), $1.0750-60(E697mln), $1.0800(E622mln)

- USD/JPY: Y139.00($996mln), Y140.00($972mln)

- USD/CAD: C$1.3350-65($837mln), C$1.3390-00($1.0bln), C$1.3450($1.7bln), C$1.3500($2.1bln)

- USD/CNY: Cny7.10($990mln), Cny7.20($644mln)

CHINA DATA: CPI As Expected, But Details Soft, PPI Deflation Deepens

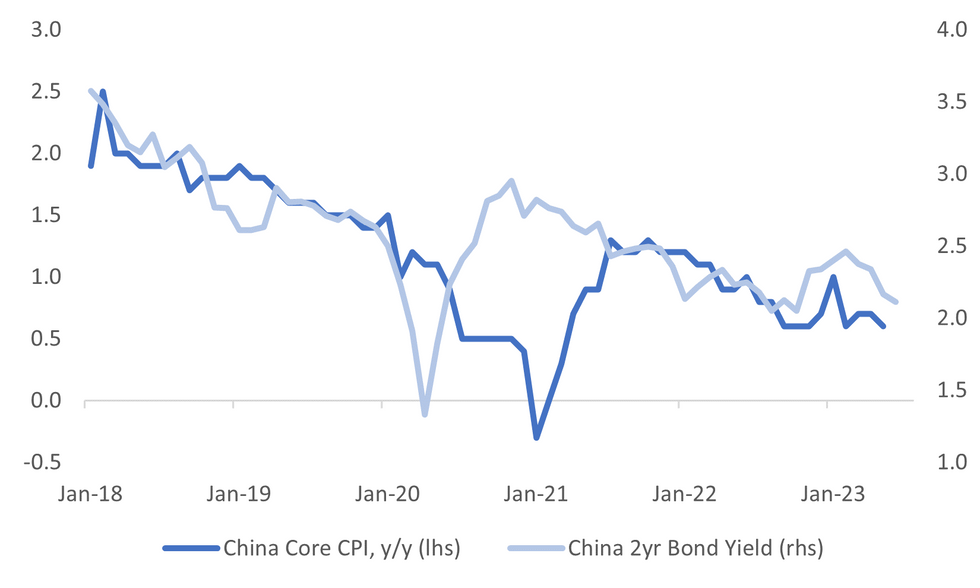

China headline inflation printed as expected at 0.2% y/y. We were down -0.2% in m/m terms, the fourth straight m/m fall. Consumer goods fell -0.3%, (-0.4% prior), while services inflation eased to 0.9% (1.0% prior). Non-food inflation was flat, while the ex food and energy core measure was 0.6% y/y, versus 0.7% prior.

- Looking at the sub-categories, only food and medical care recorded firmer y/y momentum versus Apr. The 6 other sub-categories saw either the same y/y pace or a deceleration.

- The first chart below overlays the core CPI and 2yr government bond yield. Core inflation is back to recent cyclical lows, which coupled with weaker m/m headline momentum is likely to keep easing calls still part of the market narrative.

Fig 1: China Core Inflation & 2yr Government Bond Yield

Source: MNI - Market News/Bloomberg

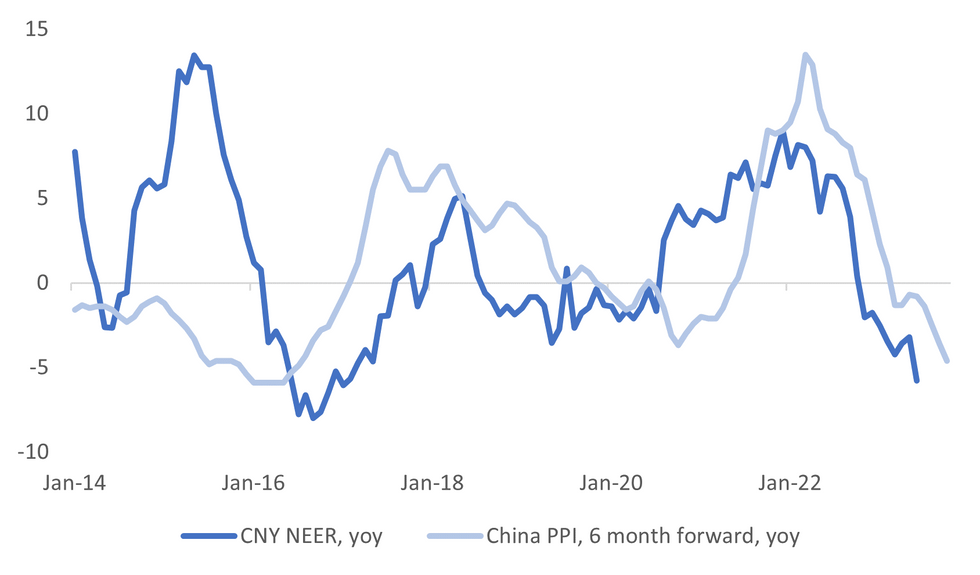

- On the PPI side, the headline -4.6% was the weakest y/y print since 2016. Mining was -11.5%y/y, raw materials -7.7% y/y, with both in line softer global commodity prices in recent months.

- Manufacturing PPI slipped further into contraction though, -4.6% y/y (from -3.6%), while consumer goods were -0.1%y/y, led by consumer durables at -1.1% y/y. Both measures are back to 2021 Q2 lows.

- The second chart overlays the headline PPI y/y against the J.P. Morgan CNY NEER y/y. NEER weakness looks to be running a little ahead of PPI trend, but it is hard to argue there were positives for the CNY FX in today's data.

Fig 2: China PPI Y/Y & CNY NEER Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: Weaker PPI Inflation Curbs CNH Rebound, KRW Still Outperforming

Weaker, on balance, China inflation data has weighed on the CNH, although we remain within recent ranges. This week's property equity rebound has lost some momentum as well today. KRW continues to outperform, while INR, PHP and MYR are also stronger against the USD. SGD has lagged somewhat. Next Monday the main focus will be May CPI out for India (Apr IP also prints), while we are still waiting for China May aggregate/new loans data.

- Early lows in USD/CNH sub 7.1170 were supported. We eventually got back close to 7.1380, as inflation data showed weaker than expected factory gate inflation, while CPI was as expected but the detail remained fairly soft. China onshore equities are around flat, with property sub indices giving back some gains from recent sessions. 2yr government bond yields have ticked down slightly, while the 10yr remains close to 2.70%.

- 1 month USD/KRW has tracked to fresh lows, hitting 1292, before some support emerged. The pair last tracked just above 1293. A rebound in USD/CNH has weighed on won at the margins, still the won is the second best performer in Asian FX over the past week, slightly shaded by IDR. Onshore equities have rebounded today, the Kospi to fresh highs near 2640. Offshore investors have bought $278.1mn of local equities today, but we are still down slightly for the week in terms of net flows.

- In Malaysia April Industrial Production printed at -3.3%, well below the estimated +2.0% gain, this was the lowest print for the measure since July 2021. We are well off the heady levels of Q3 last year, above 13% y/y. Weakness was broad based, with manufacturing IP m/m slumping -11.4%. Manufacturing Sales Value fell 2.0% in Apr down from the prior read of 8.0%. There has been little reaction in USD/MYR prints at 4.6110/30 unchanged from prior to the print.

- The Rupee has open dealing ~0.1% firmer, the pair last prints at 82.45/48. The lingering impact of yesterday's RBI meeting where the bank maintained its pause on rate and stance but stressed that the 4% inflation target needs to be met sees the INR outperform in the USD/Asia space. Local banks stepped up government bond purchases yesterday buying a net $1.03bn which was the largest single day purchase since May 4 2022. Looking ahead, May CPI print on Monday headlines next week's data calendar, inflation is expected to tick lower to 4.40% from 4.70% prior.

- USD/PHP currently tracks close to 56.00/05, down -0.15% from yesterday's closing levels (56.12). This is line with a softer tone more broadly, although PHP's beta is fairly low to such moves. Moves above the 200-day MA, around 56.13, continue to draw selling interest. Recent lows came in around 55.85, earlier in June. We haven't seen any adverse FX reaction to the RRR cut announced late yesterday. BSP stressed the move didn't shift the monetary stance. Apr trade figures showed much weaker than expected export and import growth. Export growth fell to -20.2% y/y (-9.0% forecast), lows back mid 2020. Import growth was -17.7% y/y, also back to H2 2020 lows. The trade deficit was slightly better than expected, printing at -$4.531bn. We are up from 2022 lows on this metric, but the improvement is stop-start, as weaker export growth offsets a lower energy bill.

- The SGD NEER (per Goldman Sachs estimates) is firmer this morning, the measure printed its highest level since 22 March yesterday and we remain just below the top of recent ranges. We now sit ~0.6% below the upper end of the band. USD/SGD is a touch higher in early trade today paring some of yesterday's losses. Broader greenback trends saw USD/SGD fall ~0.5% on Friday. Looking ahead, the local data calendar is empty until next Friday when May Export data crosses.

- USD/THB is tracking lower, last near 34.60/35, around 0.60% firmer in baht terms versus yesterday's close. We remain broadly within recent ranges though. Onshore equities have given back part of yesterday's strong bounce.

SOUTH KOREA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of South Korean Newspapers and some other major news outlets from the past day or so.

ECONOMY: Resurging household loans pose challenge for BOK's rate policy (link)

ECONOMY: OECD Slashes Korea's Growth Forecast to 1.5% (link)

BOK: BOK to maintain restrictive policy amid uncertainties: report (link)

TRADE: Finance minister predicts trade surplus in Q4 on chip rebound, China reopening (link)

TRADE: Korean exporters struggle as China’s reopening slower than expected (link)

WAGES: Rising minimum wage burdens small biz owners: survey (link)

EMPLOYMENT: Yoon's labor reform drive sputters as umbrella union exits talks (link)

TECH: Yoon declares ‘all-out war’ on chips to support chip industry (link)

TECH: South Korea Strategizes amid US-China Tech Cold War (link)

MARKETS: Korea to open derivative market 15 minutes earlier from end-July (link)

SOUTH KOREA/JAPAN: S.Korea to discuss bilateral currency swap with Japan (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 09/06/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 09/06/2023 | 0800/1000 |  | EU | ECB de Guindos in Capital Requirements Seminar at EU Parliament | |

| 09/06/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/06/2023 | 1400/1000 | * |  | US | Services Revenues |

| 09/06/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/06/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.