-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: GBP Hit On COVID & Brexit Woes

- The deteriorating COVID-19 situation in the UK has dominated broader Asia-Pac trade, with GBP underperforming in the FX sphere, crude over $1.00 lower and general caution evident.

- Congress is set to vote on the U.S. fiscal support package on Monday, with passage now expected.

- Matters surrounding fisheries continue to block progress in Brexit talks.

BOND SUMMARY: Core FI Mostly Firmer On UK COVID Worry

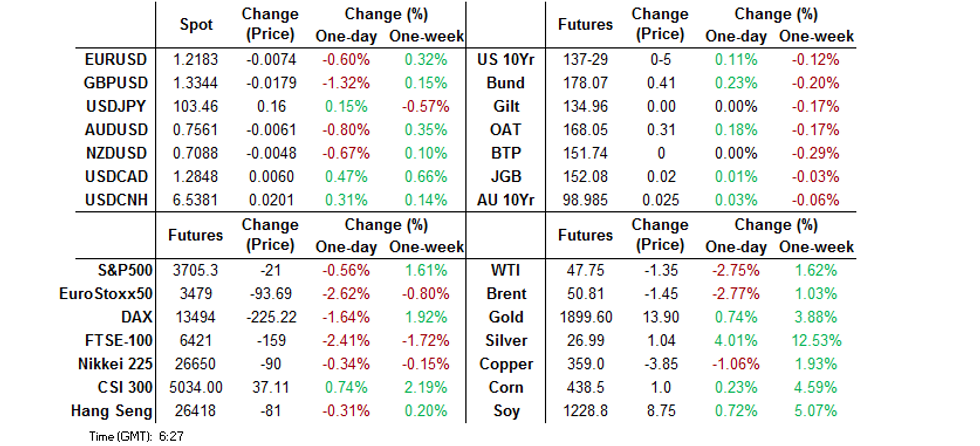

T-Notes ticked away from Friday's closing levels at the re-open, grinding higher as we worked our way through Asia trade, before edging off best levels. The impact of the COVID-19 situation in the UK/Brexit dynamics outweighed the progress on the domestic fiscal front (Congress is set to vote on the fiscal package on Monday), although e-minis initially ticked higher, paying more attention to the latter, before pulling back. The weekend also saw the approval of Moderna's COVID-19 vaccine for emergency use in the U.S. T-Notes last +0-05 at 137-29, with cash Tsys 0.6-2.2bp richer across the curve, as 10s see some mild outperformance. Eurodollar futures -0.5 to +1.0 thru the reds. With a 5.0K seller of EDZ1/H3 seen in Asia.

- JGB futures firmed in the Tokyo morning, hitting the lunch bell 7 ticks above Friday's settlement levels, aided by the broader defensive feel to the session. The move took place alongside some twist steepening of the curve, which was likely driven by speculation surrounding and official confirmation of last week's reports pointing to Y600bn worth of additional 40-Year JGB supply in the FY21/22 budget vs. the current FY, while the total amount of JGBs issued will fall. The strength in futures unwound as we moved through the afternoon, with the contract closing 2 ticks above settlement levels on light headline flow. Elsewhere, the BoJ left the size of its 1-10 Rinban operations unchanged, with the following offer/cover ratios seen: 1-3 Year: 2.09x (prev. 2.47x), 3-5 Year: 3.21x (prev. 3.29x), 5-10 Year: 3.05x (prev. 3.26x)

- Aussie bonds clung to the broader defensive dynamic during Monday trade, with YM closing +1.5 & XM +2.5, after the latter unwound its overnight session losses early on, drawing an extra layer of support from the COVID-19 situation in Sydney, with the city rolling out wider risk-mitigation measures over the weekend.

FOREX: Novel Virus Strain, Brexit Brinkmanship Weigh On Risk Despite U.S. Fiscal Progress

Risk assets started the week on the defensive after UK authorities placed London and areas across South East England under strict lockdown in a bid to prevent further spread of a new mutation of Covid-19, while a number of countries introduced restrictions on travel from the UK. Meanwhile, Brexit jitters lingered with negotiators from both sides of the English Channel struggling to break the current deadlock in their trade talks. GBP remained the worst G10 performer alongside NOK, with cable crossing below the $1.3400 mark (last -160 pips at $1.3364).

- Aforementioned developments outweighed the news that U.S. congressional leaders agreed on a $900bn economic relief package. The text of the bill is still being finalised and is expected to be put to the vote later today. USD outperformed its G10 peers amid demand for safe havens, which saw the likes of JPY and CHF pick up a bid.

- USD/JPY popped higher at the re-open before trimming gains. Sunday was a Gotobi day while the weekend saw the Nikkei run a source report noting that PM Suga asked MOF officials to defend the Y100 level in USD/JPY, which may have provided some mild support to the pair.

- The Antipodeans faltered on the back of a jump in Covid-19 cases in NSW/Sydney. The state has imposed fresh restrictions on home gatherings and travel from Sunday night, while the resurgence of virus put the smooth implementation of the trans-Tasman travel bubble at risk. AUD/USD gapped lower at the re-open and generally held below the $0.7600 figure, while NZD/USD slid under the $0.7100 level.

- NOK took a hit as crude oil retreated, taking UK lockdown measures/restrictions on inbound travel from the UK as a bad omen. The Nokkie landed at the bottom of G10 scoreboard, as tight liquidity conditions in the Asia-Pac session amplified volatility.

- PBOC fixed USD/CNY at 6.5507, around 192 pips weaker than Friday's fix of 6.5315, but slightly stronger than sell side estimates of 6.5523. The PBOC injected a net CNY 90bln of liquidity. Elsewhere, China's central bank left its monthly LPR fixings unchanged, as expected.

- USD/Asia crosses generally moved higher, with KRW shedding a modicum of strength seen after strong export data and reports that new Covid cases drop under 1,000, as South Korea moved to tighten its Covid-19 restrictions. THB was the main laggard in the region after Thai authorities suggested they might expand lockdown measures implemented in the Samut Sahkon province after the detection of a new Covid-19 outbreak.

- A BBG source report noted that Joe Biden's Tsy Sec pick Yellen might put an Obama administration alumnus Brad Setser in charge of overseeing FX policy, which would include the compilation of the Tsy's widely watched semi-annual FX report. Setser is known from his hawkish comments on FX interventions by foreign governments.

- Focus turns to advance EZ consumer confidence and a speech from Norges Bank Gov Olsen.

FOREX OPTIONS: Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1880-90(E1.4bln), $1.2000(E665mln), $1.2050(E556mln), $1.2100-05(E534mln), $1.2150-60(E2.4bln), $1.2195-1.2205(E1.1bln), $1.2225(E677mln), $1.2250(E514mln)

- USD/JPY: Y102.90-00($581mln-USD puts), Y103.10-25($840mln-USD puts), Y103.90-00($732mln-USD puts)

- GBP/USD: $1.3300-10(Gbp695mln mixed, Gbp655mln GBP puts), $1.3600-05(Gbp1.0bln)

- AUD/NZD: N$1.0650(A$1.1bln-AUD puts)

- AUD/JPY: Y75.70(A$517mln-AUD calls)

- USD/CAD: C$1.2675($515mln-USD puts),

C$1.2690-1.2700($525mln-USD puts), C$1.2725($555mln),

C$1.2750-55($1.1bln-USD puts), C$1.2925($530mln-USD puts), C$1.2945-55($565mln-USD puts)

EQUITIES: COVID Worry Outweighs DC Positives

Worry surrounding the latest COVID-19 developments in the UK and the subsequent short-term (at least for now) UK travel bans put into place by many nations overshadowed positive fiscal developments in DC in most instances, with e-minis pulling back from their early Asia-Pac highs, while FTSE 100 futures shed over 1.0% at one point.

- Chinese mainland equities managed to look through the broader defensive feel to the session and latest ratcheting up of Sino-U.S. tensions, given the telegraphed nature of the latter, benefitting from a PBoC liquidity injection that looked to alleviate any strains over the calendar new year.

- Nikkei 225 -0.2%, Hang Seng -0.3%, CSI 300 +0.8%, ASX 200 -0.1%.

- S&P 500 futures -1, DJIA futures +48, NASDAQ 100 futures +48.

GOLD: Through $1,900/oz

The yellow metal has drawn support from the latest round of COVID-19 related worry, this time centred on the situation in the UK, although the broader round of USD strength witnessed during Asia-Pac hours perhaps limited the gains, with spot failing to break through $1,900/oz at the first time of asking. Still, that threshold has now been breached, with spot last trading ~$25/oz higher, around the $1,905/oz mark. Bulls now look to the 76.4% retracement of the Nov 9-30 dip, located at $1,918.2/oz.

OIL: Oil Struggling On UK COVID Situation

WTI & Brent have shed well over $1.00 apiece in Asia-Pac trade. The UK COVID situation is the big pressure point there, with resulting border closures in Europe re: travellers from the UK set to impact fuel demand. While these measures are set to be short-term, at least initially, there is clear worry evident re: regional mobility.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.