-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hang Seng Falters Even As China Returns

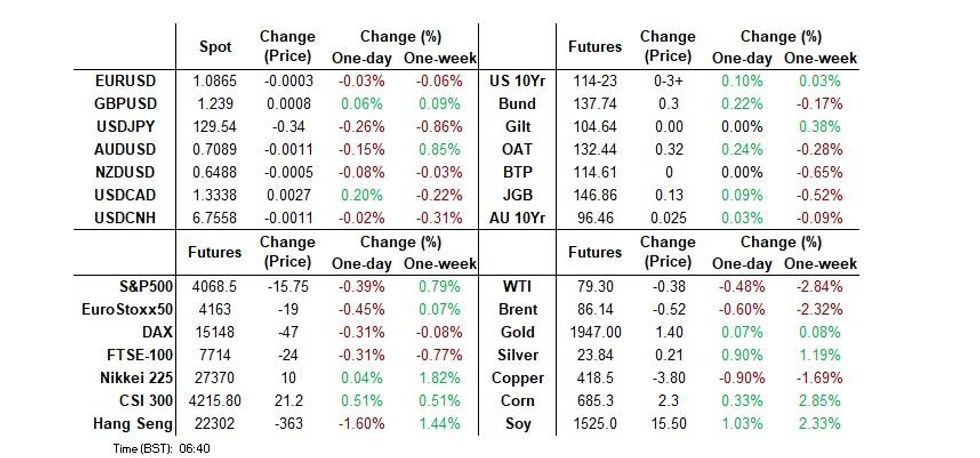

- Asia Pac equities are a mixed bag, with the return of China markets not proving to be as supportive as was hoped. The CSI 300 opened up above 2%, but is now back to +0.5%. Hong Kong and South Korea stocks are down noticeably. A generally negative tone to U.S. equity futures, hasn't helped either.

- USD indices are lower, largely in part to a firmer yen through the afternoon session. The BBDXY is back to the 1221.50 region, which is -0.06% sub NY closing levels from Friday. The JPY is the +0.20% higher at this stage, while other pairs are more subdued. AUD/USD is the weakest performer, down close 0.15% to 0.7090.

- Looking ahead, the calendar remains quiet in the northern hemisphere later with the highlight the EC sentiment surveys for January and only the Dallas Fed manufacturing index in the U.S.

US TSYS: Cross-Market Moves At The Fore, A Touch Richer Into London Trade

TYH3 heads into London trade 0-01 shy of the peak of its 0-07+ Asia-Pac range, dealing +0-03+ at 114-23, running on about average volume of ~89K. Cash Tsys are flat to 1bp richer, with the intermediate zone leading the modest richening.

- Cross-market gyrations seemed to aid the ultimate direction of travel in Asia, with oil more than reversing its early gains (after an early bid was seen on a seeming ratcheting up of Israeli-Iranian tensions, as Israel seemed to be the most likely perpetrator of drone strikes on Iranian facilities), a bid in JGBs and weakness in Hong Kong equities observed.

- Elsewhere, weekend news flow saw U.S. Tsy Sec. Yellen continue to highlight her worry re: fiscal matters and the threat of default, while WSJ Fed watcher Timiraos flagged a debate within the central bank re: whether wages or low unemployment will drive inflation.

- The Dallas Fed m’fing activity release headlines the domestic docket on Monday. Further out, a slew of global central bank decisions, headlined by the FOMC, present the major risk events this week, while the ISM surveys, NFPs, quarterly refunding announcement and ECI data will also filter out during the coming the days.

JGBS: Curve Twist Steepens, Comments From Potential BoJ Deputy Get Some Airtime

JGB futures are 25 ticks firmer on the day into the bell, a touch off highs, after closing the Tokyo CPI gap lower to the tick.

- Early afternoon trade saw some pressure on comments from Japan Research Institute Chair Yuri Okina, who noted that there needs to be a rethink of the BoJ-government accord, as she outlined her preference for the Bank’s inflation target to be shifted to a longer-term goal (as press reports have suggested will be the case). Okina also identified a desire to foster bond market normalisation and a recovery in the function of interest rates within the monetary policy framework. Note that there is speculation Okina could become a Deputy Governor at the Bank after the impending leadership reshuffle. She then stressed that wage growth and fiscal sustainability are pre-requisites for monetary policy normalisation (in line with the BoJ’s central tone).

- JGB futures firmed to fresh session highs after a blip lower, while the super-long end of the curve cheapened, resulting in twist steepening of the curve. Swap rates out to 10s were lower, although swap spreads there widened, while 20+-Year swap spreads also widened, as moves higher in those rates outstripped yields.

- This came after BoJ Governor Kuroda reiterated well-trodden themes.

- The space also drew support from some light richening in U.S. Tsys and subdued offer to cover ratios at today’s BoJ Rinban operations.

- A reminder that the BoJ will issue its Rinban plan for the month of February after hours.

- Further out, flash industrial production, retail sales and labour market data headline the domestic docket on Tuesday.

AUSSIE BONDS: A Touch Richer On Wider Impetus

A move away from lows in U.S. Tsys and oil more than unwinding its early uptick supported ACGBs ahead of the close, allowing them to overturn their overnight/early Sydney cheapening.

- That left YM +2.0 & XM +2.5bp at the bell, after overnight session lows were respected on tests by both contracts. Cash ACGBs were 1.5-3.0bp richer, with the long end leading the bid.

- EFPs were essentially unchanged on the day.

- Bills finished 2-5bp richer through the reds, tracking gyrations in bonds, while RBA-dated OIS saw a steady 23-24bp of tightening priced into next month’s meeting, as terminal cash rate pricing edged back below 3.80% after showing above the level.

- Also note that S&P’s affirmation of Australia’s AAA rating, with a stable outlook, would not have harmed the (modest) rally.

- ACGB May-41 supply passed smoothly.

- Deutsche Bank updated their RBA call. They now look for a terminal cash rate of 4.10% by August, pointing to Q4 CPI and an apparent resilience in household spending as the primary drivers for the view change. Deutsche previously had a terminal rate of 3.35% pencilled in (which they expected to be registered next month).

- Looking ahead, private sector credit and retail sales data headline the domestic docket on Tuesday.

NZGBS: A Touch Cheaper, Impact Of Floods Eyed

Benchmark NZGB yields were ~2bp higher across the major benchmarks on Monday, as the space extended on Friday’s cheapening, even as JGBs firmed and U.S. Tsys ticked away from session cheaps.

- Swap rates were 2-5bp higher, leaving swap spreads flat to wider across the curve, suggesting that payside swap flow aided the cheapening in NZGBs, particularly given the timing of the moves.

- While it is easy to point to holiday-thinned markets (the Auckland area was closed), it is worth highlighting a domestic issue as a driver of the (still limited) price action. Heavy weekend rainfall and flooding in the Auckland region will no doubt exacerbate supply chain issues that are already well-documented, while creating some demand-pull price pressures as well. Could this impact the RBNZ’s Feb decision, even after Q4 CPI printed below the central bank’s assumptions? RBNZ dated OIS is currently showing ~60bp of tightening for the event, or just under a 50/50 chance of a 75bp step, little changed from late Friday levels, while terminal rate pricing continues to hover around 5.35%.

- The Q4 labour market report provides the domestic highlight of the week, with ANZ consumer confidence, building permits and CoreLogic house price data filling out the domestic docket at different points.

FOREX: Yen Firms, But With Little Follow Through, Tight Ranges Elsewhere

USD indices are lower, largely in part to a firmer yen through the afternoon session. The BBDXY is back to the 1221.50 region, which is -0.06% sub NY closing levels from Friday. The JPY is the +0.20% higher at this stage, while other pairs are more subdued. AUD/USD is the weakest performer, down close 0.15% to 0.7090.

- Yen has had a volatile session, getting close to 130.30 before comments from a potential future Deputy Governor (Yuri Okina) sparked a yen rebound. We got close to 129.20 before support emerged, the pair last at 129.60/65. Okina stated that there needs to be a rethink of BoJ and government cooperation, as she outlined her preference for the Bank’s inflation target to be shifted to a longer-term goal.

- AUD/USD was firmer early doors, but ran out of steam around the 0.7120 level. Not much follow through to the China equity rebound at the open, may have seen some profit taking flows emerge. In the commodity space, copper slipped to $421.25 (CMX basis), but iron ore firmed to $128.25/ton, +1.50%.

- NZD/USD couldn't sustain moves above 0.6500, last around 0.6495/00, close to flat for the session.

- Looking ahead, the calendar remains quiet in the northern hemisphere later with the highlight the EC survey for January and only the Dallas Fed manufacturing index in the US.

FX OPTIONS: Expiries for Jan30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E581mln), $1.0950(E783mln), $1.1315(E529mln)

- USD/JPY: Y130.00($785mln), Y131.40($1.3bln), Y133.50($801mln)

- USD/CAD: C$1.3400($841mln)

ASIA FX: USD/Asia Pairs Struggle For Fresh Downside

The USD/Asia picture is mixed today. Outside of baht, and onshore CNY and TWD, there hasn't been a great deal of momentum against the USD. China markets returning from the LNY break haven't delivered the equity move that might have been hoped for, with tech sentiment softer. Tomorrow, Jan China official PMIs print, while South Korean IP figures are also due. Taiwan export orders are also out, along with Singapore unemployment and Thailand trade figures.

- USD/CNH hasn't been able to break sub 6.7400, while moves towards 6.7600 have drawn selling interest. The equity rebound has run of momentum as the session progressed, particularly in the tech space, which has likely helped keep the pair within recent ranges. The CNY fixing remained on the firm side of expectations.

- 1 month USD/KRW has traded with a softer bias, but found support sub 1226. Onshore equities are weaker (-1.1%), while offshore investors have been small sellers of local equities. An offset has come from the stronger yen, which has outperformed in the G10 space.

- Spot USD/TWD has gapped lower in the first day of trading since 19th of Jan. We hit a low of 30.13, but now sit slightly higher near 30.17. Still, this is +0.65% firmer in TWD terms since the last close. This is lows back to mid-August last year. The 1 month NDF sits under 30.00, although moves sub this level haven't been sustained in recent months. TWD continues to follow the improved equity tone. The Taiex is up around 3.8% today, playing catch up to the improved mood global equities, particularly the tech space since markets were last open.

- USD/INR is trading with a firmer bias since the open, with the pair last at 81.70/75. The pair hasn't been above 82.00 since the 10th of Jan, so there might be some selling interest ahead of this level. There is also the 20-day EMA at 81.80, the 50 days at 81.95. On the downside the 100-day EMA comes in at 81.49. INR continues to lag the firmer ADXY backdrop. Equity market wobbles following the Adani saga are not helping, although local bourses are away from worst levels, after opening down 1%.

- USD/THB has tracked lower, last around 32.74, +0.40% in baht terms versus Friday's close. We did see some support ahead of the 32.70 level. For now, the pair remains within recent ranges.

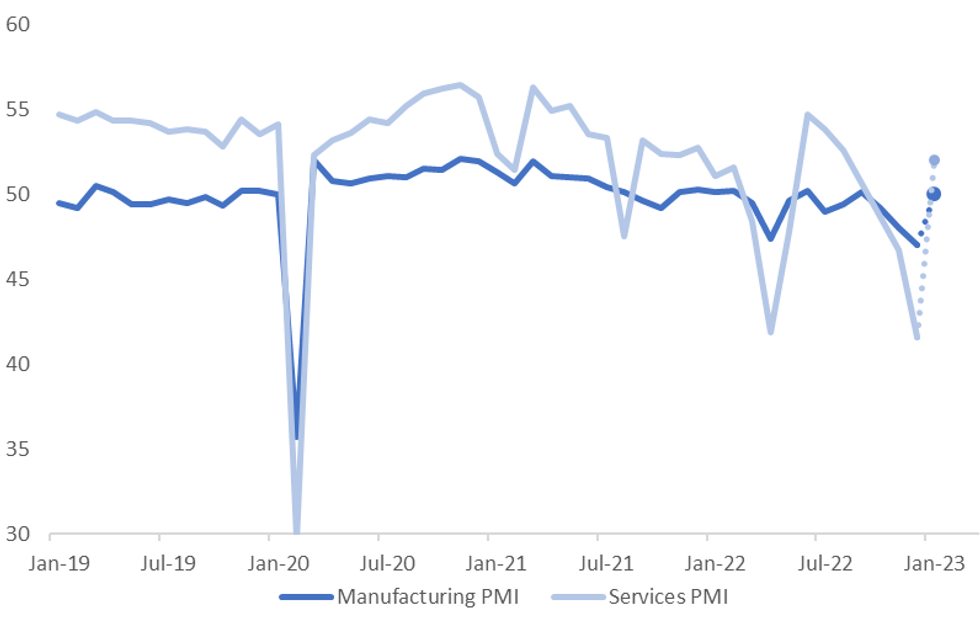

CHINA DATA: Both Manufacturing & Services PMIs Expected Back In Expansion Territory

A reminder that tomorrow delivers the official manufacturing and non-manufacturing PMIs for Jan. The market is looking for a steep improvement, particularly in the non-manufacturing/services index, see the chart below. The consensus sits at 52.0, versus 41.6 in Dec. For manufacturing the consensus is 50.0 versus 47.0 in Dec.

- The range of expectations is quite wide, 45.0 to 53.3 for services, 48.5 to 52 for manufacturing.

- The anecdotes pointed to a noticeable improvement in activity through January as Covid cases subsided. Mobility indicators picked up, while spending and travel activity picked up through the LNY period, albeit not quite to pre Covid levels of 2019 (see this link for more details).

- How this translates into the PMIs remains to be seen, with an improvement obviously expected, but the risk of supply related disruptions something that can't be discounted.

- It's likely that China data will start to have more of impact now that we are clear of the Covid wave, and the market starts to assess how growth momentum is shaping up in the first part of 2023.

- China markets largely ignored disappointing data through Nov/Dec as it focused on the 2023 outlook following the pivot away from CZS.

Fig 1: China PMIs Expected To Rebound Sharply For January

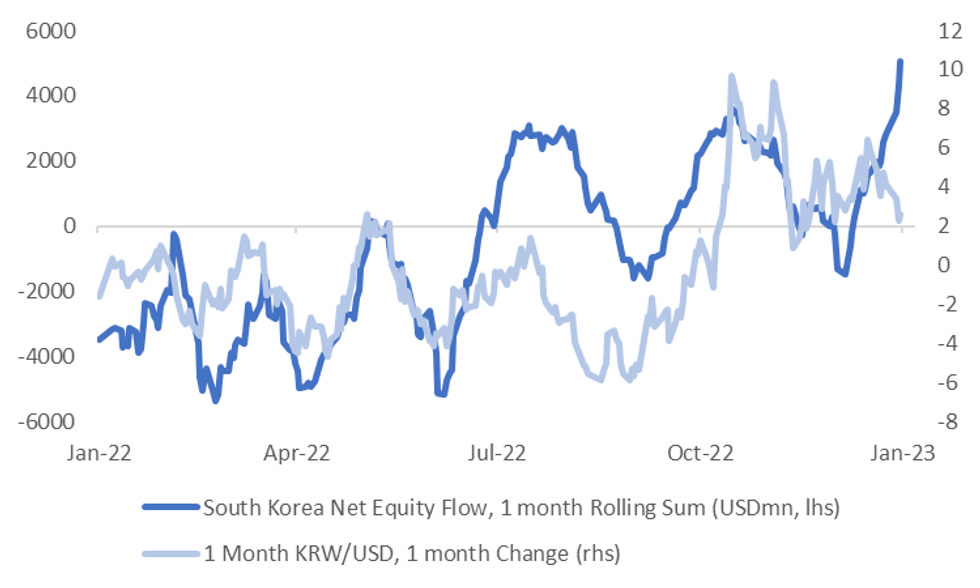

KRW: Won Lagging Robust Equity Inflows

1 month USD/KRW tracked familiar ranges late last week, with a 1227/1235 range for Friday's session. We ended NY trading close to 1229. Note onshore spot ended Friday's onshore session at 1231.30.

- The tone from equities was more mixed, although trends remained positive. The SOX down on Friday, while the MSCI IT rose. Both indices recorded strong weekly gains (SOX +5.39%, MSCI IT +4.22%). To recap, the Kospi rose 0.88% on Friday, leaving it at +4% for the week and the fourth straight week of gains.

- This is propelling firmer net equity inflows, although the won is lagging these moves, see the chart below. The past month has seen over $5bn of net equity inflows, with nearly $3bn coming in the past 5 trading sessions. The rate of won gains has slowed over this period though.

- One factor may be that the won ran ahead of the equity story through December, so has entered more of a consolidation phase in recent weeks. last week was also the LNY period, which may have impacted liquidity.

- On the data front, Dec retail sales are due between now and the end of the month, while IP figures print tomorrow.

- Elsewhere Japan is reportedly considering putting South Korea back on its trusted export list in a sign of improving relations. South Korea was removed from this list back in 2019.

Fig 1: South Korea Net Equity Flows KRW/USD 1 Month Change

Source: MNI - Market News/Bloomberg

EQUITIES: China Re-Opening Not As Positive As Hoped

Asia Pac equities are a mixed bag, with the return of China markets not proving to be as supportive as was hoped. The CSI 300 opened up above 2%, but is now back to +1.15%. Hong Kong and South Korea stocks are down noticeably. A generally negative tone to US equity futures, -0.20%/-0.34% across the major indices, hasn't helped either.

- Despite economic optimism around the China outlook, with strong anecdotes positive post the LNY break (in terms of travel and leisure spending), housing remains a source of weakness. Sales were down over the LNY break, while the Shanghai Property sub index is down 0.60% at this stage (the main index is +0.72%).

- The HSI is off by 1.62% so far, with the tech sector down 2.73%. Curbs on technology exports to China may be a factor, after Japan and the Netherlands agreed to join the US, although this was likely known on Friday.

- The Kospi is off by 1.30%, with Samsung profit results due tomorrow. Offshore investors has sold -$40.3mn so far in the session. In contrast, the Taiex has rallied by 3.2%, largely playing catch up as the markets return from the LNY break.

- Indian shares opened sharply lower, but have recovered back to flat. Fallout from the Adani saga remains a focus point.

GOLD: Bullion Trading Sideways As Major US Events Due Later In The Week

Gold prices ended last week slightly higher supported by easing US inflation pressures but is flat during the APAC session at around $1927.80/oz. It reached a high of $1931.07 earlier followed by a low of $1924.53. The USD DXY index is flat.

- Gold remains in a bullish trend and any pullback is considered corrective. Moving average studies reflect the uptrend. $1963 is the next level to watch and $1893.70, the 20-day EMA, should provide support.

OIL: Prices Range Trading Ahead Of Key Events This Week

Oil prices ended last week down around 1.5% but are trading down slightly and in a range of around a dollar today, as the market awaits signs of increased Chinese demand, the impact of sanctions on Russian exports and Wednesday’s Fed & OPEC decisions. The USD is down slightly.

- WTI is below $80/bbl again at $79.52 around the intraday low and in line with the 100-day simple moving average. Brent is $86.45, also at its low. Resistance remains at $82.66 for WTI; it approached it on Friday but couldn’t break through. Initial support is $78.45, the January 19 low.

- In China, Sinopec said that petrol sales were up 20% y/y over the Lunar New Year holiday week. (bbg) Some analysts believe that crude markets are yet to price in the impact of China’s reopening on oil demand.

- Troubles in the Middle East over the weekend have provided some support to crude.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/01/2023 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2023 | 1000/1100 | ** |  | IT | PPI |

| 30/01/2023 | 1000/1100 |  | EU | Consumer / Economic Confidence Indicators | |

| 30/01/2023 | 1500/1000 |  | US | Treasury Quarterly Financing Estimates | |

| 30/01/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.