-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN MARKETS ANALYSIS: Indian Markets Rally On Strong Exiting Polling For PM Modi

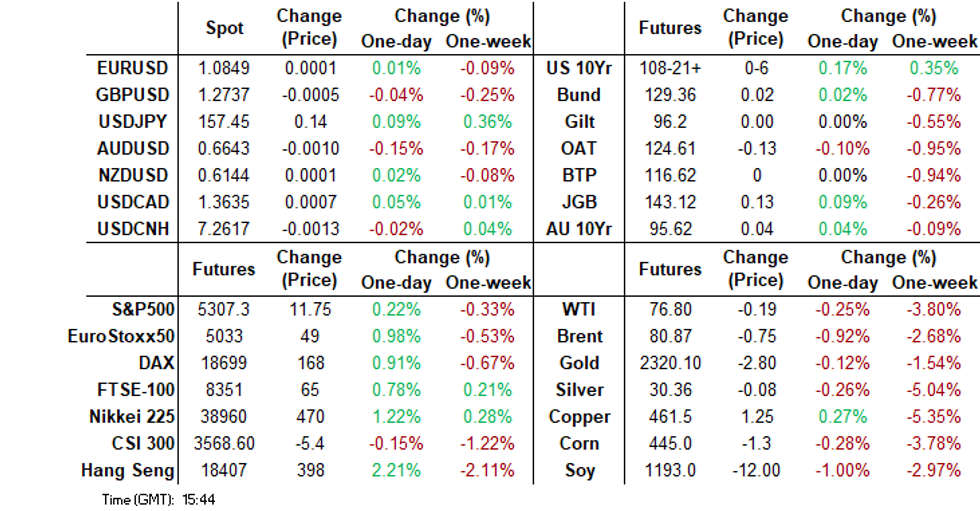

- The risk mood remained positive for most Asia equity markets, although China indices continued to lag. PMIs in North East Asia pointed to an improved global trade outlook. Indian markets rallied strongly as exit polls pointed to a strong result for PM incumbent Modi. In Mexico, exit polls show that Mexicans have overwhelmingly voted for Claudia Sheinbaum to replace Obrador has the country’s President.

- Japan Q1 capex was weaker than forecast, suggesting downside risks to Q1 GDP revisions. In Australia, the Fair Work Commission has decided to increase the minimum wage 3.75% from July 1, 2pp lower than in 2023 but above the Q1 CPI at 3.6% and in line with the RBA’s CPI forecast for Q2 and Q4 2024.

- US Treasury futures are higher today, the long-end is outperforming. The USD has been supported on dips against the G10, but has lost ground against some Asia currencies amid the positive equity backdrop.

- Later US May manufacturing ISM/PMIs and European manufacturing PMIs print.

MARKETS

US TSYS: Treasury Futures Edge Higher Ahead Of ISM Later Today

- Treasury futures are higher today, the long-end is outperforming. TU opened the session at intraday highs of 101-29.25, we have edged lower since but still trade + 01 for the day at 101-28.25, while TY is trading near session's best and is up 05+ at 108-31.

- Volumes: TU40.5k, FV 78k TY 115k

- Tsys flows: Likely Block Seller 1.8k FV at 105-29.25

- Cash treasury curve has bull-flattened today, the 2Y is +0.4bp at 4.877%, the 10Y -1.4bps at 4.485% while the 2y10y was -1.799 at -39.420.

- APAC Rates: ACGB yields are 2-4bps lower, while JGB yields are +/- 1bp, the 10y trading at 1.054%, New Zealand markets are closed.

- Rate cut projections have gained slightly post data: June 2024 at -0% w/ cumulative rate cut 0.0bp at 5.328%, July'24 at -12% w/ cumulative at -3.5bp at 5.293%, Sep'24 cumulative -14.7bp (-13.9bp pre-data), Nov'24 cumulative -21.7bp (-20bp pre-data), Dec'24 -35.5bp (-32.9bp pre-data).

- Looking ahead; S&P Global US Manufacturing PMI, while the Fed is in blackout period until June 13

JGBS: Futures Richer But Off Best Levels, 10Y Supply Tomorrow

JGB futures are stronger but off session highs, +16 compared to the settlement levels.

- Outside of the previously outlined Capex, Company Profits and Jibun Bank PMI data, there hasn't been much in the way of domestic drivers to flag.

- BoJ Executive Director Takashi Kato said on Monday that “BoJ has no plan to immediately unload its exchange traded funds (ETF) holdings.” He added, “I hope to spend time examining how to unload BoJ’s ETF holdings in the future.”

- Cash US tsys have bull-flattened in today’s Asia-Pac session, with yield flat to 2bps lower, after Friday’s post-PCE-Deflator rally.

- Cash JGBs are dealing mixed, with yield movements bounded by +/- 1.5bp. The benchmark 10-year yield is 0.4bp lower at 1.065% versus the cycle high of 1.101% set late last week.

- Swaps are dealing slightly mixed, with the 3-20-year zone seeing slightly lower rates. Swap spreads are mixed.

- Tomorrow, the local calendar sees Monetary Base data alongside 10-year supply.

AUSSIE BONDS: Richer, Session Highs, Q1 GDP On Wednesday

ACGBs (YM +2.0 & XM +4.5) are holding stronger and at Sydney session highs.

- Outside of the previously outlined Fair Work Commission’s Minimum Wage Decision, Judo Bank PMI Mfg and MI Inflation Gauge, there hasn't been much in the way of domestic drivers to flag.

- (AFR) Monday’s minimum wage decision by the Fair Work Commission – an increase of 3.75 per cent – isn’t going to trigger a wage-price spiral. But with productivity going backwards, it’s another meaningful factor in keeping inflation stuck higher for longer. (See link)

- Cash US tsys have bull-flattened in today’s Asia-Pac session, with yield flat to 2bps lower, after Friday’s post-PCE-Deflator rally.

- Swap rates are 2-4bps lower, with the 3s10s curve flatter

- The bills strip has bull-flattened, with pricing flat to +4.

- RBA-dated OIS pricing is 1-6bps softer across meetings. This comes after no upside surprise in the much-awaited US PCE deflator data on Friday prevented further erosion in the Fed outlook. The US market is still priced for at least one rate cut this year, though it is not fully priced until December. In Australia, 4bps of easing is priced by year-end from an expected terminal rate of 4.36%.

- Tomorrow, the local calendar will see Q1’s Current Account Balance, Company Operating Profit and Inventories ahead of Q1 GDP on Wednesday.

AUSTRALIA: 2024 Minimum Wage Rise In Line With RBA’s 2024 CPI Forecasts

The Fair Work Commission has decided to increase the minimum wage 3.75% from July 1, 2pp lower than in 2023 but above the Q1 CPI at 3.6% and in line with the RBA’s CPI forecast for Q2 and Q4 2024. It is also lower than Q1 WPI at 4.1%. It will impact around 2.6mn workers. The decision is unlikely to alter the RBA’s stance and we continue to expect a prolonged hold.

- Concerns that this could be the new benchmark for wage increases generally are unlikely, in contrast to last year’s 5.75%.

- Unions were hoping the increase would be at least 4% and employers a maximum of 2.8%. The FWC has deferred the ACTU’s application for a 4% increase for female-dominated sectors.

- The FWC said that it took into account upcoming tax cuts and increased superannuation contributions in its decision. They will also take place on July 1.

AUST STIR: RBA Dated OIS Softer After Friday's US PCE Deflator Data Prints In-Line

RBA-dated OIS pricing is 1-6bps softer across meetings.

- This comes after no upside surprise in the much-awaited US PCE deflator data on Friday prevented further erosion in the Fed outlook. The market is still priced for at least one rate cut this year, though it is not fully priced until December.

- In Australia, 4bps of easing is priced by year-end from an expected terminal rate of 4.36%.

Figure 1: RBA-Dated OIS – Today Vs. Friday

Source: Bloomberg / MNI - Market News

FOREX: USD Supported On Dips, But Tight Ranges Overall

The USD BBDXY index sits up from session lows sub 1250, last near 1250.50 (still down modestly for the session) but has traded tight ranges overall.

- In the G10 space, the A$ and JPY are the underperformers, although all majors are away from best levels against the USD.

- USD/JPY has nudged up to 157.40/45, currently around session highs. Earlier lows were at 157.00. We had weaker than expected Q1 capex figures earlier, but the yen didn't react to the print. Equity sentiment is mostly positive through the region, while US equity futures are also higher. US yields are slightly lower at the back end of the curve.

- AUD/USD probed above 0.6660, but sits back under 0.6650 in recent dealings. Some offset to the positive equity tone has come from further weakness in iron ore prices, down nearly 4% to the low $111/ton region. Higher iron ore inventories weighing on sentiment.

- May inflation expectations eased back to 3.1% y/y for Australia from 3.7%, although the m/m outcome was still higher than April's read. The better Caixin China manufacturing PMI hasn't shifted sentiment.

- NZD/USD is a touch higher, last near 0.6150 but away from session best levels.

- Looking ahead, US May manufacturing ISM/PMIs and European manufacturing PMIs print.

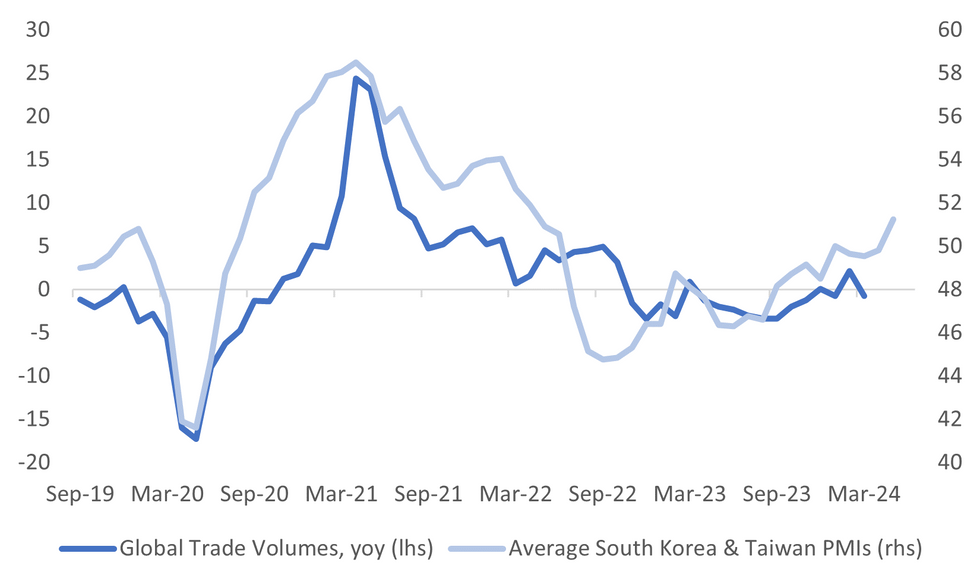

ASIA DATA: South Korea/Taiwan PMIs Point To Improved Global Trade Backdrop

The South Korean and Taiwan PMI's showed sequential improvement in May. This bodes well for the global trade backdrop, all else equal. The chart below plots the average of the PMI readings for these two trade sensitive economies against global trade volumes in y/y terms.

- South Korea's PMI rose to 51.6 (from 49.4 prior), which is back to around mid 2022 levels. Output surged to 53.3 from 50.1 in April, while new orders were also up versus the April print. This helps offset, at the margins, weaker than forecast export growth for May (data released over the weekend) with softness evident in exports outside of the tech space.

- The Taiwan PMI continued a steady recovery, up to 50.9 from 50.2 in April. This is the highest read for the headline index since April 2022. Output rose to 52.6 from 51.4 prior and new orders were also up from the April outcome.

Fig 1: South Korea/Taiwan PMIs Point To Improving Global trade

Source: MNI - Market News/Bloomberg

ASIA STOCKS: Hong Kong Equities Surge Higher, Property & Tech Lead The Way

Hong Kong & Chinese equities are mixed today, property names are the top performing sector after new home sales slump eased in in may and beat expectations, leading to belief that the recent government policies may be starting to have some positive effect. Hong Kong Markets are also benefitting from a softer reading of the Federal Reserve’s preferred inflation measure bolstered hopes for rate cuts. Earlier, we had Caixin China PMI Mfg which best estimates slightly.

- Hong Kong equities are higher today, with property names are the top performers today with the Mainland Property Index up 2.55%, the HS Property Index up 2.25%, elsewhere HSTech Index is up 2.70%, while the wider HSI is up 2.32%. In China onshore markets, the CSI300 is down 0.14%, the CSI 300 Real Estate Index is down 0.66%, small cap indices are the worst performing today with the CSI1000 & CSI2000 are down 01.35% and 1.90% respectively, while the ChiNext is up 0.25%

- (MNI): China Press Digest June 03: New Loans, CPI, Bonds (See link)

- In the property space, The Shanghai property market has become more active following the easing of home purchase rules, with increased on-site viewings and a boost in second-hand house sales, which in turn positively impacts the new home market, especially for houses priced below 3 million yuan. The PBoC is actively supporting the housing market by providing 300 billion yuan ($41 billion) in cheap credit to fund local-government purchases of unsold homes, alongside other lending programs aimed at easing cash flow for developers and revitalizing the market, though economists believe more central-bank credit is needed to achieve significant impact. The PBOC's scalable approach contrasts with slower fiscal spending methods, but the IMF suggests additional fiscal tools may be necessary to fully stabilize the market, per BBG.

- Looking ahead: China Caixin China PMI Composite & S&P Global Hong Kong PMI on Wednesday, while on Thursday we have China Trade Balance data.

ASIA PAC STOCKS: Equities Rally On US Data, China Prop & Indian Election Results

Asian stocks are higher today, after softer reading of the Federal Reserve’s preferred inflation measure bolstered hopes for rate cuts. Equities in Australia, Japan, and Hong Kong advanced. Indian equities surged following election results indicating a victory for Prime Minister Narendra Modi’s party in a landslide while positive property numbers out of China have also helped boost stocks today. The recent decline of the US dollar, down 1.1% in May, also supported gains. On the data front we have had regional PMIs, AU MI Inflation and Indonesian CPI.

- Japanese equities are higher today. Japan's Topix is 0.95% higher and is now trading near a two-month highs, driven by renewed expectations for US interest-rate cuts, which boosted investor appetite for riskier assets. Sony Group has contributed the most to the Topix gain, with high domestic bond yields particularly benefited banking stocks such as Mitsubishi UFJ and Sumitomo Mitsui, the Topix Bank Index is up 1.46% while the Nikkei also advanced 1.15%. Earlier Capital spending for 1Q was 6.8% vs 11% est, while Jibun Bank PMI was 50.4 vs 50.5 prior.

- Taiwan equities have surged higher today, TSMC has contributed the most the index gain up 3.41% after Nvidia announced plans for new chips. Earlier, S&P PMI manufacturing was up in May to 50.9 from 50.2. The Taiex is up 1.76%.

- South Korean equities have surged higher today as chip and auto names lead the way. Earlier, S&P Manufacturing PMI increased in May to 51.6 vs 49.4 in Apr. The Kospi is up 1.87% and is now testing the 50-day EMA, while the Kosdaq lags moves however still trades up 0.51%.

- Australian equities are on track for their 2nd straight day of gains, led by Utilities and energy stocks. Earlier, we had Judo Bank PMI coming in at 49.7 vs 49.6 prior and MI Inflation for May was 0.3% vs 0.1% in April. The ASX200 is 0.79% higher.

- Elsewhere in SEA, Indian equities have surged on the back of the election results with the Nifity 50 up 2.90%, Indonesian equities are 1.36% higher, Singapore equities are 0.42% and Philippines equities are 0.60% higher.

ASIA EQUITY FLOWS: Asian Equity Flows Turn Negative

- South Korean equity markets were mixed on Friday with both the Kospi unchanged and the Kosdaq up almost 1%. Equity flow momentum has turned negative over the short term, the past 5 trading sessions have seen a total outflow of $2.07b. The Kospi closed the week below the 100-day EMA, while the Kosdaq trades below all moving averages. The 5-day average is now -$414m, well below the 20-day average of -$33m, while the longer term 100-day average at $131m.

- Taiwan equities were lower on Friday and we saw a another day of more than $1b in selling from foreign investors, the past 5 sessions has seen an outflow of $3.48b. The 5-day average is now -$695m, well below both the 20-day average at $139m and the 100-day average is $37m.

- Thailand equities were lower on Thursday, the SET has closed below 1.350 and now eyes lows from Apr 19th, outflows were also the largest since Apr 19th. Equity flows have been negative over the short-term, we have marked 8 straight days of selling, with the past 5 trading sessions netting a total outflow of $320m. The 5-day average is now -$64m, below both the 20-day average at -$22m and the 100-day average at -$23m

- Indonesian equities have seen 7 straight sessions of selling from foreign investors, with the past 5 session seeing a net outflow of $297m. The JCI closed the week below the 7,000 level and made new ytd lows. The 5-day average is now -$59m, below both the 20-day average at -$43m and the 100-day average at -$0.5m.

- Philippines equities also continue to see selling from foreign investors, we have now marked 5 straight days of selling for a total outflow of $137m. The PSEi did however trade higher on Friday, after Thursday closed below 6,400 a level that had acted as support. The 5-day average is -$27.6m, below the 20-day average at -$7.5m and the 100-day average at -$4.4m.

- Indian equities were a touch higher of Friday, bouncing off the 50-day EMA. Equity flows have been negative over the past couple of weeks, with the past 5 session seeing an outflow of $424m. The 5-day average is -$84m, slightly above the 20-day average at -$153m, although below the longer term 100-day average of $15m.

- Malaysian equities were slightly lower on Friday, and closed the week below the 20-day EMA. The past 5 trading sessions have seen consistent selling from foreign investors for a total outflow of $176m. The 5-day average now -$35m, below both the 20-day average at $21m and longer term 100-day average at -$0.56m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -782 | -2069 | 13307 |

| Taiwan (USDmn) | -1069 | -3480 | 2609 |

| India (USDmn)* | -135 | -424 | -3023 |

| Indonesia (USDmn) | -4 | -298 | -335 |

| Thailand (USDmn) | -111 | -320 | -2281 |

| Malaysia (USDmn) * | -18 | -176 | -56 |

| Philippines (USDmn) | -89 | -138.0 | -423 |

| Total | -2208 | -6905 | 9798 |

| * Data Up To Apr 30th |

OIL: Crude Has Recovered From Early Losses Following OPEC Decision

Oil prices started the APAC session lower following OPEC’s decision to reduce the amount output is cut from October. They then rose but are now off those highs to be moderately lower on the day. Brent is down 0.1% to $81.03/bbl after rising to $81.65 and a low of $80.55 early in trading. WTI is around $76.93/bbl after a high of $77.52 and a low of $76.39. The USD index is down 0.1%.

- OPEC cuts will be extended into 2025 but will then be reduced over the year from October, which was earlier than many expected. The June agreement seems a compromise as Saudi Arabia wants higher prices to fund its economic plans while other producers want to pump more as many have increased capacity. Bloomberg estimates that there could be an additional 750kbd by January.

- There has been a mixed response to the group’s decision with Goldman Sachs seeing an increase in stocks putting pressure on prices but RBC and UBS continuing to believe that OPEC will direct the market, according to Bloomberg. June’s deal is likely structured to keep the group united.

- Later US May manufacturing ISM/PMIs and European manufacturing PMIs print. US May payrolls on Friday are the next focus for oil markets.

GOLD: Lower Despite Friday’s Benign US PCE Deflator

Gold is 0.2% lower in the Asia-Pac session, after closing 0.7% lower at $2327.33 on Friday. The yellow metal was marginally lower on the week.

- In terms of fundamental drivers, the market has embraced the idea that the Federal Reserve will stick to recent signalling that it needs more evidence that inflation is cooling before it can pivot to rate cuts.

- On Friday, no upside surprise in the much-awaited PCE price data prevented further erosion in the Fed outlook. The market is still priced for at least one rate cut this year, though it is not fully priced until December.

- According to MNI’s technicals team, a short-term bear cycle in gold remains in play, for now, although the recent move down appears to be a correction that is allowing an overbought condition to unwind.

- A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2307.8, represents a key support.

ASEAN DATA: Manufacturing Activity Positive, Indonesia Slowing

Indonesia’s manufacturing sector showed moderating growth in May but is likely to have remained the most robust in the region according to the S&P Global PMIs but unlike the Philippines and Korea it showed soft foreign orders. Asian PMIs released today were all in expansionary territory. The ASEAN aggregate prints on Tuesday with the Thai and Malaysian PMIs.

- Indonesia’s S&P Global PMI moderated to 52.1 from 52.9, still signalling manufacturing activity continues to grow but at the slowest pace since November 2023. There has been a slowdown from Q1 when the PMI averaged 53.3 and also the outlook is lacklustre with business confidence at its lowest in more than four years.

- Manufacturing growth is being driven by new orders and output but domestically driven as export orders fell for the third straight month. Employment was little changed.

- Cost inflation remains high partly due to the weak rupiah but it can only be partially passed on due to softer demand and greater price sensitivity from customers. Output inflation was its lowest since October 2023.

- The Philippines also saw a slight moderation in manufacturing to 51.9 from 52.2 but the Q2 average of around 52 is higher than Q1’s 50.9. Unlike Indonesia, producers are positive about the outlook with sentiment rising to its highest in nine months.

- Manufacturing activity is being driven by new orders, including from overseas, and production. But employment levels dropped as voluntary leavers weren’t replaced. S&P Global noted that the pickup in foreign orders was due to “improved demand trends in key export markets and new client wins”.

- There was a drop in cost inflation for the first time in four years as producers shopped around but output inflation rose at a faster rate as businesses increased profit margins.

Source: MNI - Market News/Bloomberg

INDONESIA DATA: Inflation Contained But Weak Rupiah Adding To Imported Price Risks

Indonesia’s May CPI rose a slightly less than expected 2.8% y/y after 3.0%. The drop on the month was driven by food and transport prices. Whereas core inflation rose 1.9% y/y up from 1.8%, highest since September 2023, due to higher rents and gold/jewellery and sugar prices. Inflation remains well within Bank Indonesia’s (BI) 1.5-3.5% target band but the central bank remains alert to the impact of the weaker currency on import prices.

Indonesia CPI y/y%

- Volatile food prices moderated to 8.1% y/y from 10.3% in April due to lower rice and chicken inflation. Administered prices remained low rising only 1.5% y/y up from 1.4%.

- Import prices were disinflationary from November 2022 until February this year but in March they turned positive rising 0.5% y/y. In the May S&P Global manufacturing PMI respondents reported that cost pressures were higher due to the soft rupiah.

- USDIDR has risen again since mid-May and the pair is up 1.6% since then. It has started this week slightly lower at 16223. With the pair stubbornly elevated BI will continue to monitor inflationary risks closely.

Source: MNI - Market News/Refinitiv

INDONESIA: INDON Sov Curve Flattens, CPI Comes In Below Consensus

The INDON sov curve has twist-flatten today pivoting at the 7yr. S&P PMI declined from the month prior, while CPI missed consensus.

- The INDON curve has twist-flattened today, yields are 1-8bps lower, the 2Y yield is -1bps at 5.290%, 5Y yield is -4.5bps at 5.130%, the 10Y yield is -5bps at 5.220%, while the 5-year CDS is 1bp at 71.5bps.

- The INDON to UST spread diff the 2Y is now 40bps (+2bp), 5yr is 63bps (+2bps), while the 10yr is 74bps (+1.5bps).

- In cross-asset moves, USD/IDR is 0.17% lower at 16,222, the JCI is up 1.55%, while US tsys curve has flattened today, with yields flat to 2bps lower.

- Earlier, S&P Global Indonesia PMI Mfg for May came in at 52.1 vs 52.9 in April, while CPI rose 2.84% y/y less than the 3.00% increase in April, this was below the consensus forecast of 2.97%.

- Indonesia aims to finalize three key trade agreements by year-end to address potential balance of payments and fiscal deficits, expanding trade partnerships with 43 countries. These agreements, including the IEU-CEPA, the Indonesia-Eurasian Economic Union FTA, and the CPTPP, are expected to boost economic growth, increase state revenue, and enhance exports, particularly to the European Union and Latin America.

- Looking ahead, it is a quiet week with just Foreign Reserves for May on Friday.

ASIA FX: INR Rallies On Election Exit Polls, KRW & TWD Buoyed By Equities

USD/Asia pairs are mostly lower, albeit to varying degrees. KRW, INR and TWD are the strongest performers, with generally steadier trends elsewhere. The rupee has been buoyed by strong exit polls for PM incumbent Modi, but the RBI is unlikely to allow sharp spot gains. Tomorrow, we have South Korea CPI for May. Thailand's PMI is out as well, along with Malaysia's.

- USD/CNH has tracked within recent ranges, the pair seeing support on a dip sub 7.2550. We last tracked near 7.2625, little changed for the session. Onshore equities are slightly in the red underperforming the better tone seen elsewhere, particularly in Hong Kong. The Caixin manufacturing PMI held up well, particularly compared to last Friday's official result, but hasn't aided FX sentiment meaningfully.

- 1 month USD/KRW sits away from late May highs (near 1385). We were last near 1374 around 0.50% stronger in won terms, slightly up from session lows. Sentiment is being aided by a better regional equity tone, along with strong local gains (the Kospi is up nearly 1.9%). Onshore sentiment has been boosted after President Yoon stated an offshore oil and gas discovery would be developed. PMI prints for North East Asia rose, with South Korea seeing the biggest improvement relative to the April outcome.

- USD/TWD has followed a similar trajectory, albeit with a lower beta compared to KRW moves. Spot was last back to 32.30/35, around 0.25% stronger in TWD terms. The Taiex is up around 1.8%.

- USD/INR gapped under 83.00 not long after the onshore open, as sentiment was buoyed by strong exit polls for PM incumbent Modi from the recent general election. We found support around the 200-day EMA though and sit back near 83.05 in recent dealings. Modi is seen as a positive for the growth backdrop from a policy continuity/reform perspective. Still, the rough sell-side consensus is that we are unlikely to see any meaningful run of spot INR gains, as the RBI is likely to maintain broader stability in FX.

- USD/IDR is lower, but remains within recent ranges. The pair around 16225/30 in latest dealings. The May CPI was mixed, with headline softer than expected, but core ticking up to 1.93% y/y (from 1.82%).

MEXICO: Incumbent Morena Party Candidate Sheinbaum On Track For Large Majority

Exit polls show that Mexicans have overwhelmingly voted for Claudia Sheinbaum to replace Obrador has the country’s President. She will not only be Mexico’s first female president but is Obrador’s chosen successor from the leftwing, nationalist ruling Morena party. Sheinbaum is projected to win 55-63% of the vote while her competitor pro-business Galvez representing a coalition of older parties is on track for 27-33%. Thus, the Morena coalition looks headed for a majority in congress.

- USDMXN is down 0.4% in APAC trading to 16.944 off the intraday trough of 16.918, as the market sees this result as providing stability.

- Despite rampant crime, a weak economy and a large budget deficit, Sheinbaum has benefitted from Obrador’s popularity and has promised broad policy continuity. He increased minimum wages to try and reduce inequality. There is some speculation that she may be friendlier towards the private sector particularly because she seems more pragmatic and will likely need finance.

- She is the former mayor of Mexico City and has said she will improve information sharing between police and the judiciary to combat crime.

- Sheinbaum is expected to remain supportive of central bank independence but will have to tackle deteriorating public finances.

- The election result is also important for the US, as it had been working with Obrador to reduce illegal migration.

- Sheinbaum is a former climate scientist and so spending to improve Mexico’s green credentials is expected to rise. She plans to not only restructure the debt of state-owned energy company Pemex but also plans to make it greener. She is hoping that its 2025 bond refinancing will provide funding for renewable energy investment.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/06/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/06/2024 | 0715/0915 | ** |  | ES | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0750/0950 | ** |  | FR | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0755/0955 | ** |  | DE | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/06/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/06/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (final) |

| 03/06/2024 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/06/2024 | 1400/1000 | * |  | US | Construction Spending |

| 03/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.