-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Inflation Dynamic Reverberates Through Asia, Even With Holidays In Play

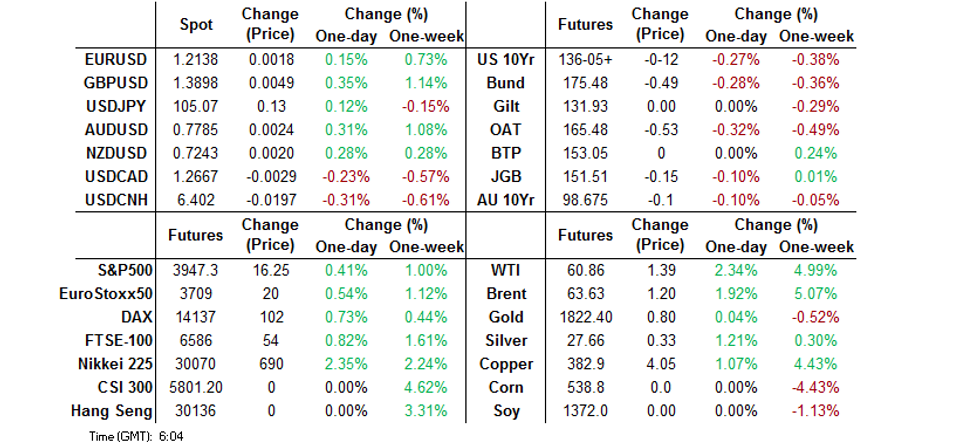

- Reflation narrative in full swing with oil higher, e-minis printing new all-time highs and the Nikkei closing above 30K.

- Market activity busy enough despite holidays in Asia/the U.S., as the region plays catch up to Friday's NY trade.

BOND SUMMARY: Reflation Narrative Reverberates Around Asia

Monday's Asia-Pac trade was all about the continuation of the reflation narrative, with sizeable enough core FI market movements seen in the timezone, especially when you consider the lower liquidity backdrop owing to the Lunar New Year & U.S. Presidents Day holidays. The Nikkei 225 moved above 30,000 for the first time in decades, while the 3 major e-mini contracts tagged new all-time highs and oil was well bid. T-Notes ran through Friday's late lows, with the contract last printing -0-11+ at 136-06 on healthy volume of ~170K. A reminder that cash Tsys will not be open until Tuesday's Asia-Pac session, with the aforementioned Presidents Day holiday in play.

- JGBs struggled on Monday as futures extended on the weakness seen in the final overnight session of last week, closing -15, with the curve marginally steeper, aided by long end payside flow in the swap space, with swap spreads comfortably wider on the day as a result. The sizes of BoJ Rinban operations covering 1-10 Year JGBs were left unchanged, with little of any real note in terms of offer/cover ratios witnessed within the details. The Nikkei 225's rally added further fuel to the fire. Elsewhere, Japan's preliminary Q4 GDP print was firmer than expected, with the private consumption, net exports and business spending components all topping expectations (business spending the standout of the three). The broader dynamic saw participants look through some negative local news, with the weekend seeing a strong earthquake (7.1 magnitude) hit off the coast of Fukushima prefecture. While there was no tsunami threat from the earthquake it has injured several hundred and resulted in damage/widespread power outages across the region.

- Aussie bonds were no exception to the broader reflation theme witnessed during Asia-Pac hours, YM finished -0.5, XM -10.0. The latest round of ACGB '41 supply from the AOFM saw a sub 3.00x cover ratio, as the average yield only printed ~0.1bp through mids, while the supply saw a wider tail vs. the last time the bond was tapped via auction (which was back in '19). It would seem that the COVID situation in Victoria remains under control, in the grander scheme of things, with the state lockdown ongoing there. Tomorrow's local docket is headlined by the minutes from the most recent RBA monetary policy decision, although the subsequent deluge of rhetoric from RBA Governor Lowe has limited the chances of any meaningful surprise. Elsewhere, the latest round of ABS payrolls data is due.

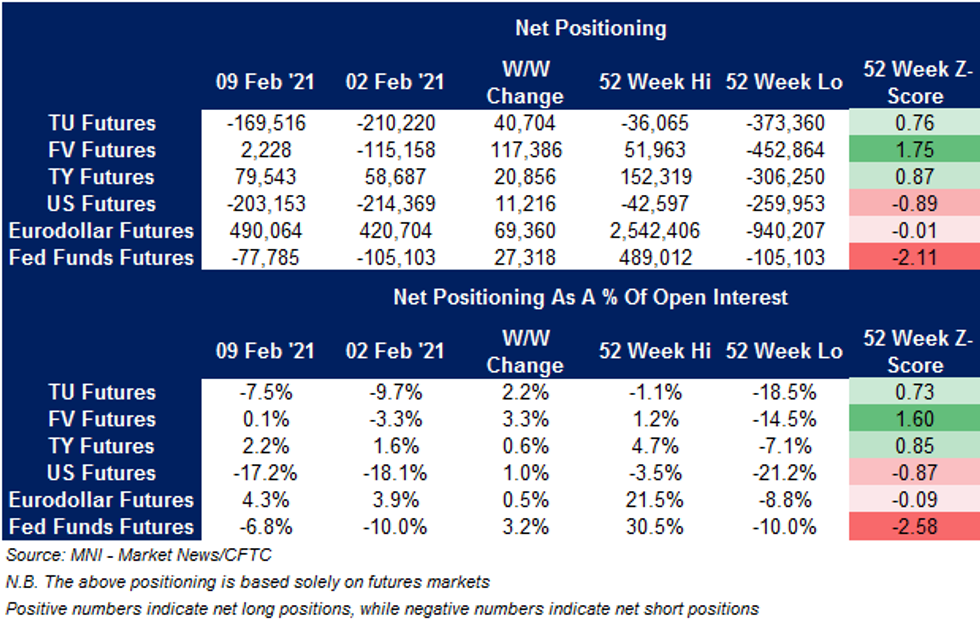

US TSY FUTURES: 1-Way Positioning Swing In CFTC CoT, Doesn't Catch Latest Steepening

A one-way reduction in net shorts/extension of net longs across the U.S. Tsy and STIR futures space in the week to 9 February, per the latest CFTC CoT report, released on Friday.

- Non-commercial positioning in FV futures turned net long for the first time since July.

- The cut-off date means that the release doesn't capture the latest round of steepening, which was seen at the backend of last week.

FOREX: Optimism Dominates

Reflation trade dynamics drove risk-on flows seen at the start to the week, bolstering high-beta currencies against their safe haven peers. Activity across the region was limited by market closures in China, Taiwan & HK as well as today's public holiday in the U.S. JPY lagged all of its G10 peers as the Nikkei 225 crossed above 30,000 for the first time since 1990 & all three U.S. e-mini contracts printed fresh all-time highs. The yen faced additional headwinds from above-forecast preliminary Q4 GDP data released out of Japan & the potential impact of Gotobi day flows.

- With the risk switch flicked to "on," the kiwi managed to shake off its initial weakness. The Antipodean currency started on a slightly softer footing after NZ gov't imposed a three-day lockdown in Auckland & raised the alert level in the rest of the country to 2 after finding three Covid-19 cases in the community over the weekend.

- Sterling advanced after PM Johnson announced that England met its target for offering the Covid-19 vaccines to 15mn people from four priority groups by mid-Feb, reaching an important milestone in its inoculation campaign. GBP registered fresh cycle highs vs. the likes of USD, EUR & JPY, with cable showing at levels not seen since mid-2018.

- USD/CNH went offered in holiday-thinned trade, printing a new 32-month low.

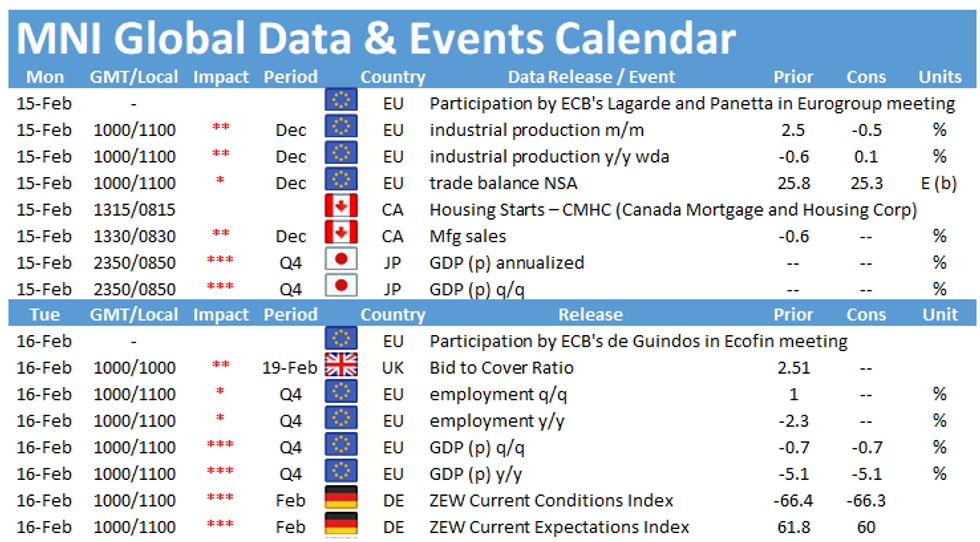

- Focus moves to EZ industrial output & trade balance, Canadian housing starts & m'fing sales as well as Norwegian trade balance.

FOREX OPTIONS: Expiries for Feb15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2045-55(E528mln), $1.2300(E931mln)

- EUR/GBP: Gbp0.8725(E520mln), Gbp0.8800-10(E1.0bln-EUR puts)

- AUD/USD: $0.7730(A$648mln), $0.7850(A$609mln)

ASIA FX: Reflation Trade Drags Greenback Lower, Boosts Risk Assets

The reflation trade exerted its effects through the Asia-Pac session. Oil, equities and other risk assets have rallied while the greenback has slipped.

- CNH: Offshore yuan rallied amid broad USD weakness as the reflation trade continued. USD/CNH hit the lowest level in 32 months.

- SGD: Singapore dollar strengthened, GDP data showed the economy grew faster than expected at 3.8%, the MAS maintained its growth forecasts of 4%-6% and said the its stance remained accommodative which limited SGD strength

- KRW: The won strengthened after robust export data which also helped push regional equity bourses to record highs.

- INR: The rupee strengthened, releases on Friday showed that CPI dipped, the rate is now basically on the mid-point of the RBI's target range of 2%-6%, the data release also showed industrial production rebounded to post growth of 1% after a 1.9% decline the previous month.

- IDR: Rupiah is higher, Indonesia's Tourism and Creative Econ Min said that the gov't considers opening an international travel corridor to Bali from low-risk countries, which have started Covid-19 vaccination campaigns.

- MYR: Ringgitt moved higher. Science, Technology & Innovation Min Khairy pushed back against conspiracy theories surrounding the Covid-19 jab and called on Malaysians to support the national vaccination programme, expected to kick off at the start of this month.

- PHP: The peso strengthened after the central bank kept rates on hold and said a rate cut was not forthcoming. The rate slipped under the PHP48.000 mark for the first time since Oct 2016, with increased volatility seen upon the breach of that round figure

- THB: Baht strengthened as GDP fell less than expected. Q4 GDP fell 4.2% Y/Y against expectations of a 5.4% decline.

ASIA RATES: Positive Sentiment Weighs On Fixed Income

A resurgent reflation trade saw risk assets bid and weighed on safe havens in Asia on Monday, volumes still fairly muted as some markets in the region are still away for LNY.

- INDIA: Bond futures are lower, data on Friday showed inflation slipped from the previous month, but at 4.1% is almost bang on the mid-point of the RBI's range. This will likely curb calls of a rate hike from the RBI, but could serve to increase calls of a rate cut with 5 analysts predicting a cut at the previous meeting.

- SOUTH KOREA: Bond futures slipped, export data was positive while reports that the government is pushing to pass extra budget bill by March and that the budget would result in further issuance.

- INDONESIA: There has been selling across the curve, focused in the belly ahead of a raft of supply due tomorrow.

GOLD: Sticking Within The Lines

Bullion is leaning on a weaker USD for support at the start of the week, sitting marginally higher on the day, printing at $1,826/oz, with cash Tsys closed owing to the observance of the Presidents Day holiday in the U.S. This comes after Friday trade saw spot stick to the recently established range, leaving the previously flagged technical picture intact.

OIL: WTI Above $60/bbl

Crude futures have posted robust gains to kick off the week, with both Brent & WTI printing comfortably above $1.00 better off.

- WTI, having conquered the $60/bbl handle, is at its highest level in 13-months, driven by fear disruption to shale supply due to cold weather in Texas.

- Hopes for demand are helping to support the move higher, a marked decline in daily new infections globally has painted a brighter outlook of economic recovery. A better-handled pandemic situation, alongside an impending fiscal stimulus package in the US, have buoyed reflation hopes and led risk assets higher.

EQUITIES: Reflation Trade Helps Bourses Higher

- A marked decline in daily new infections globally, alongside an impending fiscal stimulus package in the US, have buoyed reflation hopes and led risk assets higher.

- Several equity markets in the Asia time zone have returned from LNY holiday's and posted robust gains. Markets in South Korea and Japan lead the way higher with gains of over 1.5%; South Korea posted strong export data for the first 10 days of February, while Japan posted Q4 GDP data above estimates which saw the Nikkei 225 trade over 30,000 for the first time in 31 years.

- Futures are higher in the US, e-mini S&P up around 16 points as the major indices touch record highs. Volumes and news flow are expected to thin today with US participants observing President's Day.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.