-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JGB Curve Flattens On Multiple Factors

- Cash JGBs bull flattened, with desks still pointing to super-long demand from life insurers and pension funds ahead of the turn of the Japanese FY. That added to the impulse derived from comfortably larger than average estimates of month-end index extensions in the space, a lack of shock & awe comments from BoJ leadership candidates and spill over from the light bid seen in U.S. Tsys on Monday.

- The USD has firmed at the margins in Asia-Pac dealing as U.S. Tsy yields have move incrementally higher, while U.S. e-mini futures and regional equities retreated from best levels.

- CPI & PPI data from France, as well as several BOE speakers & comments from ECB's Vujcic headline in Europe. Further out, we have U.S. consumer confidence data and the MNI Chicago PMI survey. Fedspeak from Chicago Fed President Goolsbee will also cross.

ECB: Lane: Need Lower Underlying Inflation For Rate Hikes To End

Reuters has published an interview with ECB Chief Economist Philip Lane and the initial headlines appear to be relatively balanced, but seem to point to rates being higher for longer. He says that the case for 50bp in March remains solid (the ECB has well telegraphed this) but these headlines in isolation would provide a broadly dovish tilt:

- POSITIVE SUPPLY SHOCKS SINCE DECEMBER, RATE HIKES, HAVE CURBED INFLATIONARY PRESSURES

- INTERMEDIATE STAGE PRICING PRESSURES BEGIN TO FADE

- FORWARD-LOOKING INDICATORS FOR FOOD, ENERGY, GOODS SUGGEST INFLATION SLOWDOWN

- In terms of initial market reaction, there is little movement in EURUSD while Bund futures are at their lows of the day (but have not really moved on the story).

ECB: What's Priced In?

- In terms of market pricing for the ECB, there is currently around 49bp priced for the March meeting, 85bp cumulatively by May, 110bp by June, 126bp by July and then a peak of 137bp by December.

- So effectively to get to the 126bp by July the ECB would need to deliver 50bp in March and then one 50bp and two 25bp in the May/June/July meetings.

- As we noted yesterday, two and a half weeks ago we were looking at a terminal rate around 100bp higher than now by September before the curve inverted. So we are effectively now pricing in 1.5 more 25bp hikes than previously this year, and with no curve inversion until 2024.

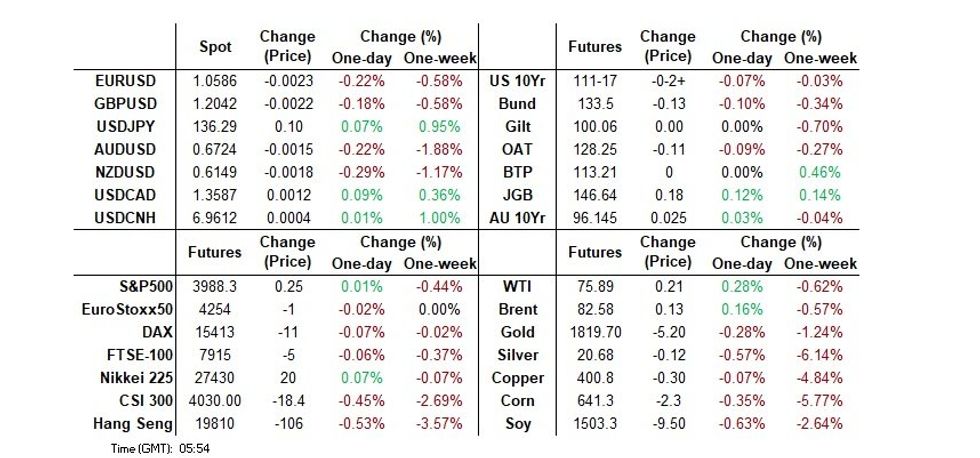

US TSYS: Marginally Cheaper In Asia

TYM3 deals at 111-17+, -0-02, a touch off the base of a narrow 0-04+ range on volume of ~56K.

- Cash Tsys sit 1-2bp cheaper across the major benchmarks, mild bear flattening has been observed.

- Tsys pulled back from best levels seen in early Asia cash dealing as a similar move in ACGBs spilled over. There was no headline driver for the move.

- Narrow ranges were observed for the remainder of the session as Tsys struggled to recover from session lows.

- Flow-wise a block seller (-3,812) in TU headlined.

- CPI and PPI data from France, and several BOE speakers headline in Europe. Further out we have Wholesale Inventories, and MNI Chicago PMI. Fedspeak from Chicago Fed President Goolsbee will also cross.

JGBS: Super-Long End Drives The Bid As Curve Flattens

The morning bid in JGBs extends through the afternoon.

- Early gains were inspired by comfortably larger than average estimates of month-end index extensions and spill over from the light bid seen in U.S. Tsys on Monday.

- That leaves JGB futures +20 ahead of the close, just shy of best levels.

- Wider cash JGBs run 1-9bp richer as the curve bull flattens, with desks still pointing to super-long demand from life insurers and pension funds ahead of the turn of the Japanese FY.

- Swap spreads were mixed across the curve, with the most pronounced moves coming in the form of widening in the super-long end.

- Comments from BoJ Deputy Governors in waiting, Himino & Uchida, failed to move the needle as they took part in their nomination hearings in front of the upper house of parliament. Ultimately, they didn’t stray too far from what they delivered to the lower house last week. The comments are moderate to slightly dovish when compared to the pre-hearing expectations that were in place last week (pushing back against an imminent need for policy tweaks, while being cognisant of side effects of policy settings). Ultimately, the new stewards of the BoJ should be a little more pragmatic, tipping its hat to the need to alter policy again at some point (when the inflation goal is reached), while supporting the deployment of current policy settings.

- 2-Year JGB supply was delayed by technical issues but cleared smoothly.

- The latest round of BoJ pooled collateral funding operations generated a cover of just over 3.00x.

- The BoJ will release its March Rinban schedule after market.

- Final manufacturing PMI data and an address from BoJ’s Nakagawa will cross on Wednesday.

AUSSIE BONDS: Market Looks Through Upside Data Surprises To Slowing Trends

Despite stronger than expected prints for January retail sales, private sector credit and Q4 current account data (although a modest miss for net exports contribution to GDP), ACGBs deliver a post-data reversal to close nearer to Sydney session highs with YM +4.0 and XM +2.5. Cash benchmarks run 2-4bp richer with the 3/10 curve steepening 3bp.

- The AU/US cash 10-year yield differential closes -3bp at -8bp.

- 3s10s swaps curve bull steepens with rates 2-4bp lower.

- Bills were 1 cheaper to 4bp firmer through the reds, with only IRH3 finishing softer.

- RBA dated OIS gives back 2-5bp of yesterday’s +7-12bp firming for meetings beyond June, with terminal rate pricing back at 4.30% versus last week’s high of 4.35%.

- The market chose to look through today’s upside data surprises, instead focusing on the slowing underlying trends. Despite today’s beat, the volatile Nov-Jan period for retail sales leaves the average monthly change (+0.1% M/M) significantly slower than the average monthly change for the period Aug-Oct (+0.7% M/M). On the private credit front as well, today’s upside surprise did little to arrest the appreciable slowing in the monthly pace of credit growth from +0.9% in April last year to +0.4% in January.

- Tomorrow sees the release of Q4 GDP (BBG consensus forecast is +0.8% Q/Q) and the relatively new, but increasingly important, monthly read on the CPI. We will also hear from RBA's Jones.

AUSTRALIA: SEEK Advertised Salary Growth Elevated But Slowed In January

The SEEK Advertised Salary Index rose a modest 0.2% m/m in January and 4.4% y/y. This had eased from December’s 0.3% m/m and 4.6% y/y. It is too early to call a peak in advertised salaries but the monthly rate has slowed for two consecutive months now and SEEK notes that the labour market remains tight but not as tight as it was as job ads have eased. The slowing in the pace of advertised salaries along with the more moderate WPI should ease any wages concerns at the RBA.

- There is a broader range of sectors now showing more moderate salary growth. But as the advertised salaries continue to run ahead of the WPI, SEEK observes that there is still a “bidding war for talent” and so an effective way to get a pay rise is to change jobs.

- There are disparities across the country. Salary growth in NSW and Victoria are below the national average at 4.2% and 4.1% respectively but in Tasmania it is growing at 6.4% and 5.4% in Queensland.

- There are also signs that wages are picking up in the public sector with the gap between the ACT and others narrowing and government and other public areas, such as healthcare and education, have seen a pickup in advertised salary growth.

Source: MNI - Market News/SEEK/ABS

NZGBS: Outperform Vs. $-Bloc Peers

NZGBs stage an across the curve strengthening with yields down 6-7bp at the close. With the local news light and U.S. Tsys flat in Asian trading, the cumulative rise in NZGB yields over the past week (+35-40bp) and the narrowing in the gap between market pricing and the RBNZ’s projected OCR path appear to be likely drivers of today’s rally, along with the lead from Monday's light richening in Tsys. NZGBs outperformed across the curve versus its $-bloc peers with the NZ/US cash yield differential narrowing 3bp in the 2-year and 5bp in the 10-year. Cash NZGB 10-year outperformed Australia by 4bp.

- Short to mid-curve swaps outperformed, with rates 5-7bp lower and the curve 5bp steeper.

- RBNZ dated OIS is 2-6bp lower across meetings with August leading as terminal rate pricing re-coiled from a level just shy of the RBNZ’s projected OCR peak of 5.50% to close at 5.43% (after touching the RBNZ's 5.50% projection yesterday). April meeting pricing is 2bp lower at 38bp of tightening.

- On the local docket, the ANZ Business Outlook Survey delivered an improvement but the underlying story of an economy with subdued confidence and high inflationary pressures remained. Moreover, the results are unlikely to fully reflect the impact of the recent cyclone.

- The local calendar delivers CoreLogic House Prices (Feb) and Building Permits (Jan) tomorrow. While the market is keen to get an update on the impact of RBNZ tightening, the data pre-dates much of the recent severe weather. Recent permit data had shown increasing caution from developers and purchasers.

FOREX: USD Moderately Firmer In Asia

The USD has firmed through the Asian session as US Treasury Yields have marginally risen and US Equity futures and Regional Equities retreat from best levels.

- AUD/USD sits ~0.2% softer today, last printing at $0.6720/25. There was little follow through after the stronger than expected Jan Retail Sales print this morning, AUD initially firmed however couldn't hold its gains and deals a touch off session lows. There is a large option expiry, ~$800mn, at $0.6735 today.

- Kiwi is also pressured. NZD/USD prints at $0.6150/55, ~0.3% softer today. Feb ANZ Business Confidence continued to tick away from all time lows seen in December rising to -43.3 from -52.0. ANZ Activity Outlook rose to -9.2 from the prior read of-15.8.

- USD/JPY is a touch firmer, last printing at ¥136.30/40. The appearance of BoJ Deputy Governor-Nominees (Uchida & Himino) failed to move the needle as they reiterated comments given to the lower house last week. On the wires early in the session Jan Retail Sales printed 1.9% MoM vs 0.4% exp, preliminary read of Jan Industrial Production fell 4.6% vs exp -2.9%.

- EUR and GBP are moderately pressured as the Greenback advances. Both have given up some of the gains seen yesterday in the wake of the Brexit deal announcement.

- Cross asset flows are showing a mild risk-off tone. BBDXY is ~0.1% firmer and 10 Year US Treasury Yields are ~2bps higher. E-minis are flat, as they tick away from session highs, as is the Hang Seng.

- CPI and PPI data from France, and several BOE speakers headline in Europe. Further out we have Wholesale Inventories, and MNI Chicago PMI. Fedspeak from Chicago Fed President Goolsbee will also cross

FX OPTIONS: Expiries for Feb28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.3bln), $1.0520-30(E656mln), $1.0625-35(E559mln)

- USD/JPY: Y134.50-60($600mln), Y136.00($592mln), Y137.50($850mln)

- GBP/USD: $1.1850(Gbp854mln)

- AUD/USD: $0.7000-05(A$1.1bln)

- USD/CAD: C$1.3250($830mln), C$1.3415-25($650mln)

ASIA FX: Rebound Doesn't Have Much Follow Through

Follow through USD selling has been somewhat limited today. The more cautious tone to regional equities, coupled with USD gains against the majors, have emerged as headwinds as the session progressed. Indian Q4 GDP is due later. Tomorrow the focus is on China PMI prints and South Korean Feb trade figures. PMI prints will be out elsewhere in the region. Indonesia CPI is also due.

- USD/CNH got to a low close to 6.9450, but we have since rebounded, now back above 6.9600. The CNH is slightly weaker versus NY closing levels. The CNY fixing was again close to neutral, as we highlighted today, this is at odds with the recent round of yuan weakness, at least from an historical standpoint. Tomorrow, the market is forecasting improvement across the manufacturing and services PMI prints.

- 1 month USD/KRW tried to break towards 1310 in early trade but had little follow through. We are now through Monday session highs, approaching 1325. The authorities stated they would monitor FX supply and demand dynamics.

- USD/SGD is trying to push above 1.3500, but is meeting some resistance so far. Bulls look to sustain a break of $1.35 to target the 200-Day EMA ($1.3637). Bears first look to break the 20-day EMA at $1.3359 to turn the tide. The SGD NEER is down a touch. Figures released by MAS today should that in January M2 Money Supply rose 1.8% YoY whilst M1 Money Supply Fell -12.8% YoY. The figures also showed total loans/advances continue to slow with the total falling 1.9% in the month. We were at +6.7% y/y in August last year.

- USD/IDR has backed away from the 15300 level, last tracking close to 15240, around 0.20% firmer in IDR terms versus yesterday's close. The pair remains wedged between the 50-day (15279) and 200-day (15158) MAs. Tomorrow the PMI and CPI data prints for Feb are due. The market expects an uptick in y/y CPI to 5.42% (form 5.28%), but core is expected to remain benign at 3.24% y/y (versus 3.27% prior). The BI reiterated that it doesn't expect to hike rates again and that it has been intervening to defend the rupiah.

- The BoT Governor stated the central bank is committed to the policy normalization path and is watching for stronger core inflation pressures (note the next CPI prints on March 7). The Finance Minister also added it was unlikely the BoT would be too aggressive in terms of the rate hike cycle. USD/THB tried to move towards 35.00 in early trade, but saw little follow through, the pair last at 35.15. Still to come is Jan trade figures.

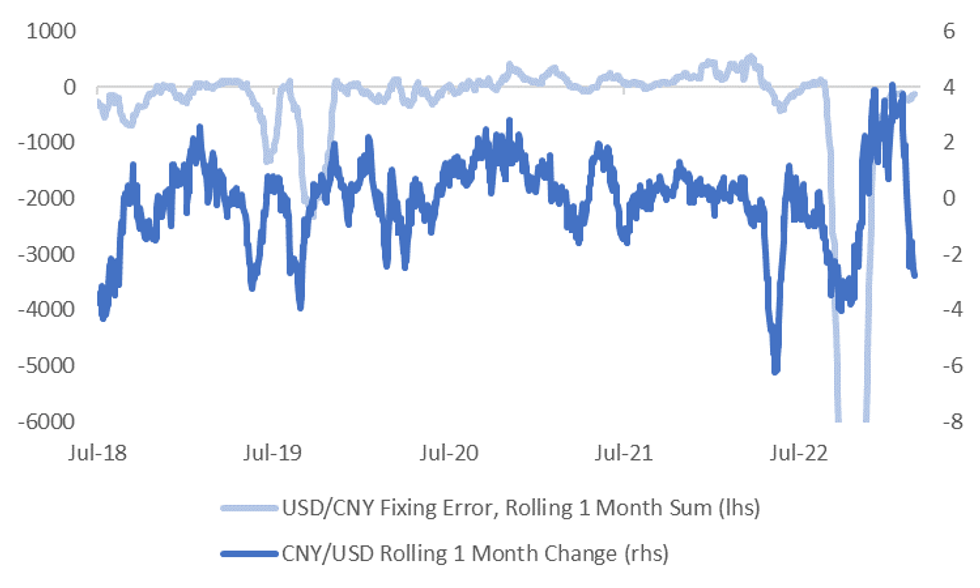

CNY: Benign CNY Fixing Trend Out of Line With Recent Yuan Weakness

The offshore yuan, CNH and onshore spot, CNY, have both lost close to 3% since the start of February. This is broadly in line with USD trends over the same period, with the DXY up 2.5% over this period, likewise for the BBDXY, up 2.40%. This translates into modest yuan underperformance, but only at the margins. The CFETS RMB index is down slightly off recent highs.

- This may explain why the USD/CNY fixing bias has remained close to neutral despite the recent run higher in USD/CNY.

- The rolling 5 day sum of the fixing error (the difference between the actual fix and the Bloomberg consensus) is close to flat at -13pips after today's fix. The two-week sum of this term is slightly wider at -45pips, and wider still for the past month -149pips.

- Still, this is relatively benign compared to the weakness seen in CNY versus the USD recently. The chart below overlays rolling 1 month changes in CNY/USD versus the rolling 1 month sum of the fixing error.

- We would normally expect to see a wider fixing error given the recent degree of CNY weakness, at least based the history of recent years.

- As noted above, this may reflect the relatively steady CFETS RMB levels. It may also reflect outright USD/CNY levels, i.e. a move 7.00 may see the bias shift back towards leaning against depreciation pressures. This may be a focus point, if we break above 7.00, in and around the upcoming People's Congress.

Fig 1: CNY Fixing Error Trend Benign Despite Recent Yuan Weakness

Source: MNI - Market News/Bloomberg

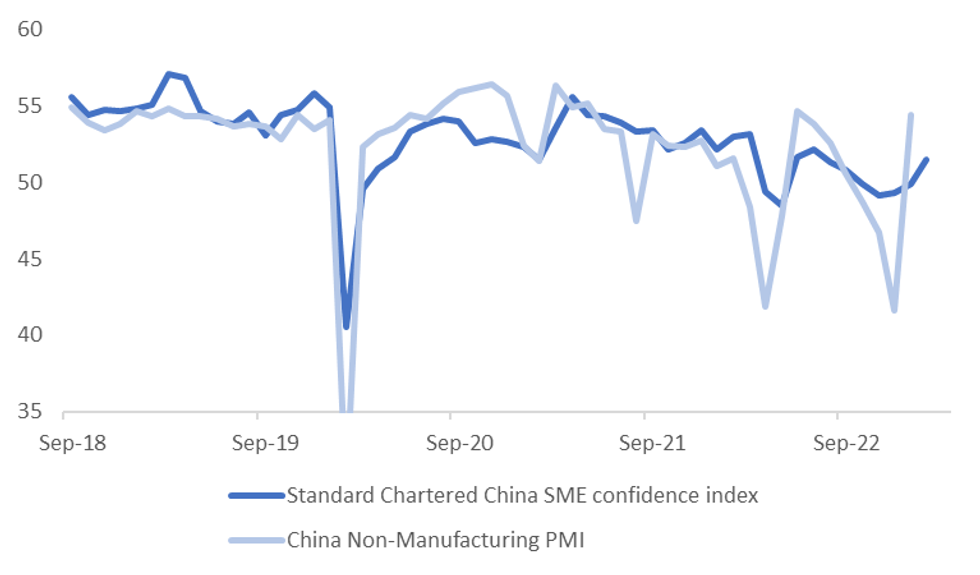

CHINA: Further Improvement Expected From Tomorrow's PMI Prints

A reminder that tomorrow delivers the official PMI prints for Feb, along with the Caixin manufacturing PMI. The market consensus if for improvement across all 3 prints.

- The consensus for the official manufacturing PMI is at 50.6 (range is 50.1-53.0), with the prior at 50.1. The non-manufacturing PMI is forecast at 54.9 (range 53.0-56.0), prior was at 54.4. The Caixin manufacturing PMI is forecast to move back into expansion territory, 50.7 (range is 49.5-52.0), prior was 49.2.

- The prints will help the market form the near-term outlook. Mobility indicators were particularly firm through February, which could benefit the services related PMI, although it is already at elevated levels.

- The chart below plots the services China PMI against the Standard Chartered China SME survey. This measure moved back into expansion territory in Feb, although the rate of improvement has been outpaced by the official measures.

- The services wedge over manufacturing is expected to be maintained. For the manufacturing PMI the weaker external backdrop (judging by weaker trends of South Korea exports to China) may be a factor.

- Better outcomes tomorrow may give the market greater confidence around the China re-opening theme, which has wavered through February and vice versa for weaker than expected outcomes. Of course, tomorrow's outcomes could also be overshadowed by the upcoming People's Congress.

Fig 1: China Non-Manufacturing PMI & Standard Chartered SME China Index

Source: Standard Chartered/MNI - Market News/Bloomberg

GLOBAL: Global CPB Data Show Trade And Output Slowing Into End Of 2022

The Netherlands Centraal Planbureau (CPB) reported that global trade volumes continue to deteriorate. In December they fell 0.9% m/m, the third consecutive decline, driven by weak emerging market exports. With the full extent of global tightening not yet felt, there is likely to be a further deterioration in trade flows and output over H1 2023. Metals prices and the Baltic Freight Index are signalling further global trade and IP weakness at the start of 2023.

- Global trade momentum is now -8.1% on a 3-month annualised basis, signalling further weakness ahead. Exports fell 1.2% m/m, the third consecutive monthly fall and down 2.8% y/y, with emerging market exports underperforming at -3.6% m/m and -7.2% y/y compared with +0.2% m/m and -0.4% y/y for OECD countries. EM export growth should improve into 2023 with the reopening of China but there will continue to be headwinds from slower global demand.

- Global IP also recorded its third consecutive monthly fall declining 0.2% m/m to be up only 0.2% y/y. It is also showing negative and deteriorating momentum.

- Global trade prices continued to rise in December, increasing 1.6% m/m to be +3.2% y/y. Non-energy raw material prices rose 1.4% m/m but are down 9.6% y/y while energy prices are off of their recent peaks, they rose 2.8% m/m in December after declining 1.5% m/m the previous month and are still up 21.6% y/y. But both series have negative 3-month momentum.

Source: MNI - Market News/Refinitiv/CPB

EQUITIES: Early HK/China Strength Runs Out Of Steam

The early positive impulse to regional equities has given way to a more cautious stance as the session has progressed. The HSI is back to flat after being up by over 1% at one stage. Mainland indices are also back to slightly in the red. Trends are mixed elsewhere, although most indices are away from best levels. US futures are modestly positive, but only just.

- The early impetus was higher for China/HK stocks. An end to the mask mandate in HK aided sentiment early (although this was expected). Politico also reported that US President Biden won't ramp up investment restrictions into China, but instead focus on increased transparency. This is a positive, albeit at the margins.

- Gains ebbed as the session progressed. Tomorrow, we have important China PMI data for Feb, while this weekend the People's Congress begins. Hence this may be keeping some funds on the sidelines until we have greater clarity on the outlook.

- Elsewhere, the Kospi is +0.50% firmer, in line with better tech tone from Monday's session, but we are down from earlier session highs. The Nikkei is +0.12% higher at his stage.

- The ASX 200 is +0.46%, led by materials stocks, while better retail sales data, also helped staple stocks at the margin.

GOLD: Bullion Stabilising After A Weak Month Driven By Fed Hawkishness

Gold prices have stabilised this week rising 0.3% on Monday and are down 0.1% so far during APAC trading. Bullion has been in a narrow range and is currently around $1815.00/oz, close to the intraday low, after a reaching a high of $1819.43 earlier. The USD index is up 0.1% and US yields are marginally lower.

- Trend conditions for gold remain bearish and close to the 2023 lows as Fed talk remains hawkish. Bullion had been trending higher since November. Prices are now approaching the 100-day moving average after breaking through the 50-day earlier in February.

- Bloomberg is reporting that there were net outflows from gold-backed ETFs on every day in February except for three and that holdings are close to their lowest since April 2020.

- A number of second tier data releases are out in the US later today. There are the January trade balance and wholesale inventories, February consumer confidence, Chicago and Richmond indices, and December house prices. The Fed’s Goolsbee also speaks.

OIL: Another Disappointing Month As Fed Stays Hawkish & Russian Output Resilient

Oil has been trading in a very tight range today. WTI is currently up 0.3% after falling 0.7% on Monday. It is now around $75.90/bbl, close to its intraday high of $75.94 which followed a low of $75.55 earlier. Brent is trading around $82.60 and the USD index is up about 0.1%.

- Oil has been broadly range trading since December and that continued in February, although it is likely to be down again this month. The continued hawkish tone from the Fed and signs of persistent inflation pressures have weighed on crude, as the market remains concerned about the demand implications of further US tightening despite China’s reopening.

- Crude broke through both the 50-day and 100-day simple moving averages in February and it remains below them. The outlook is currently neutral.

- Bank of America is the latest to revise down its 2023 crude forecasts following a disappointing start to the year and resilient Russian output. It now expects Brent to reach $88 down from $100. (Bloomberg)

- A number of second tier data releases are out in the US later today. There are the January trade balance and wholesale inventories, February consumer confidence, Chicago and Richmond indices, and December house prices. The API data on US crude stocks also print. The Fed’s Goolsbee speaks and a number of BoE members later.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2023 | 0700/0800 | ** |  | SE | PPI |

| 28/02/2023 | 0700/0800 | *** |  | SE | GDP |

| 28/02/2023 | 0745/0845 | ** |  | FR | Consumer Spending |

| 28/02/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 28/02/2023 | 0745/0845 | ** |  | FR | PPI |

| 28/02/2023 | 0745/0845 | *** |  | FR | GDP (f) |

| 28/02/2023 | 0800/0900 | *** |  | CH | GDP |

| 28/02/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 28/02/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 28/02/2023 | 1015/1015 |  | UK | BOE Treasury Select Committee hearing: The crypto-asset industry | |

| 28/02/2023 | 1215/1215 |  | UK | BOE Pill Closes BEAR Research Conference | |

| 28/02/2023 | 1230/1230 |  | UK | BOE Mann Panellist at EIB Forum | |

| 28/02/2023 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 28/02/2023 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 28/02/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/02/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/02/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/02/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/02/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/02/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 28/02/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/02/2023 | 1930/1430 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/03/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.