-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: JGBs Steal The Show On BoJ Chatter, Liquidity Light

- A local press report suggesting the BoJ is considering widening the band that it allows 10-Year JGB yields to trade in pressured JGBs, although a fair chunk of the move unwound, with details surrounding the story proving light.

- WSJ sources suggested that Janet Yellen will affirm the U.S.'s "commitment to market-determined exchange rates" on Tuesday.

- Broader liquidity was sapped by the U.S. holiday, with U.S. markets set for early/full closures on Monday.

BOND SUMMARY: Mixed Performance, JGBS Lag On BoJ Story, Light Bid Elsewhere

Weakness in JGB futures probably helped T-Notes off of early Asia highs after the latter had a look through its Friday highs early on, before a modest bid came back in, although the range for T-Notes was limited to 0-03. Contract last +0-03 at 136-30+, with volume running at a sedate ~50K owing to the U.S. holiday, which in turn means that cash Tsys will be closed until Tuesday's Asia-Pac session. Weekend headline flow surrounding COVID-19 vaccine matters was a little negative, with Sino-U.S. tensions and DC political matters at the fore elsewhere. The space looked through stronger than expected Chinese GDP data. Eurodollar futures sit unchanged to +0.5 through the reds, with activity in the space calming after some buying activity in early Asia-Pac hours. A 10K lift of EDU3 provided the highlight of that particular round of flow.

- A JiJi source report pointing to the BoJ considering a suggestion re: the widening of the band that it allows 10-Year JGB yields to operate in is all that has mattered for JGBs on Monday, although the contract did recover some poise after the early pressure, finishing 16 ticks off the early Tokyo lows, -13 on the day. As we mentioned earlier, it was an unattributed report, with no indication re: the timing of any potential announcement, although most have chosen to focus on the BoJ's monetary policy review, set to be released in March, as a potential landing strip for any such move. The wings of the cash JGB curve were more robust than the belly on the news, although the latter unwound early Tokyo underperformance, leaving 20s as the weak point on the day ahead of tomorrow's 20-Year JGB supply.

- It was quite a narrow session for the Aussie bond space, which left YM +0.5 and XM +1.5 at the bell, with the latter sticking to the range established in early Sydney dealing and little attention paid to the latest round of Chinese macro data. Long end outperformance was at the fore in cash trade, with the curve bull flattening, while swaps lagged ACGBs from 5-Years to further out, resulting in some swap spread widening across most of the curve. Little in the way of market specific headline flow was seen, with JLMs mandated for TCV Nov '25 supply in the semi space after Friday's flagging, with record E/S surpluses looking for suitable deployment. Bill activity was dominated by IRM1/Z1 flattener flow during the Sydney morning. Weekly ABS payrolls data headlines locally on Tuesday.

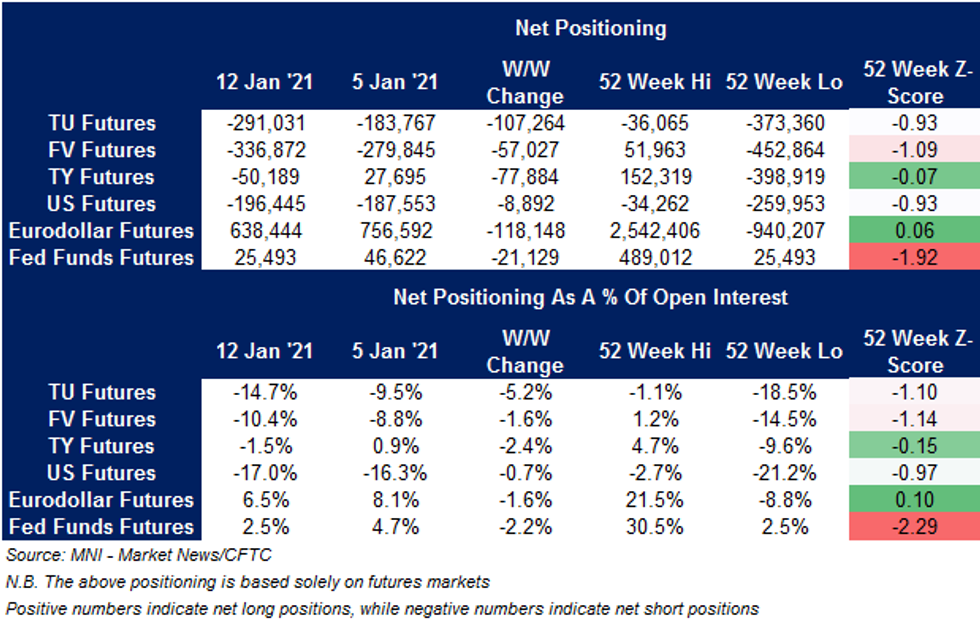

US TSYS: CFTC CoT Points To Larger Net Short Exposure

The latest CFTC CoT report saw an extension of net short exposure in TU, FV and US futures, while net exposure to TY futures moved into net short territory for the first time since early November, hitting the shortest levels seen since June in the process.

FOREX: Yellen To Defend Market-Based FX Rate, Biden Could Withdraw Keystone Pipeline Permit

Participants shied away from riskier currencies in a slow start to the week caused by a market holiday in the U.S., with markets awaiting the this week's congressional testimony from Janet Yellen, the inauguration of Joe Biden as the new U.S. President and a number of central bank decisions. The WSJ circulated a piece noting that Yellen is expected "to affirm the U.S.'s commitment to market-determined exchange rates when she testifies on Capitol Hill Tuesday, and she will make clear the U.S. doesn't seek a weaker dollar for competitive advantage." The article lent support to the greenback, allowing it to outperform all of its G10 peers save for the yen, which gained on the back of broader sense of caution.

- CAD landed at the bottom of the G10 pile after a CBC News report suggested that Joe Biden would rescind presidential permission for the Keystone XL pipeline as soon as on his first day in office. USD/CAD rose past Friday's high.

- The Antipodeans struggled alongside CAD & NOK as crude oil traded on a softer footing. AUD/NZD seems poised to snap its seven-week winning streak.

- Chinese data dump provoked little in the way of immediate reaction in the yuan. China's economy grew 2.3% in 2020, coming in better than expected. Monthly economic activity data saw a beat in industrial output counterbalanced by a miss in retail sales.

- GBP was weaker at the start to the week as the UK closed its travel corridors with other countries, while Foreign Sec Raab refused to rule out the prospect of forcing inbound travellers to quarantine in dedicated hotels upon arrival.

- EUR was happy to look past the election of the new CDU leader over the weekend & continued political uncertainty in Italy.

- Final Italian CPI, Canadian housing starts and comments from BoE Gov Bailey & Riksbank's Jansson take focus from here.

FOREX OPTIONS: Expiries for Jan18 NY cut 1000ET(Source DTCC)

- EUR/USD: $1.2080(E522mln-EUR puts), $1.2100-05(E627mln-EUR puts)

- USD/JPY: Y103.50-60($551mln), Y104.15-25($549mln)

- EUR/GBP: Gbp0.8840-50(E780mln-EUR puts)

- AUD/USD: $0.7345(A$836mln-AUD calls)

ASIA FX: Greenback Strength Inspires EM Weakness

EM Asia currencies suffered amid risk off sentiment and some upside in the greenback. The US dollar caught a bid following WSJ reports suggesting that Yellen is expected "to affirm the U.S.'s commitment to market-determined exchange rates when she testifies on Capitol Hill Tuesday, and she will make clear the U.S. doesn't seek a weaker dollar for competitive advantage."

- The yuan saw limited reaction to stronger GDP and Industrial Production data. The PBOC fixed USD/CNY at 6.4845, around 212 pips higher than the previous fix on USD strength. USD/CNH moved higher through the session, last up 101 pips at 6.4949.

- USD/IDR operates +45 at 14,065 after rising in tandem with most of the other USD/Asia crosses.

- USD/THB firmed up at the re-open, as greenback appreciation drove a move higher in USD/Asia. The baht also under some pressure from headlined on Friday where the BoT warn that it may need to revise its 2021 GDP estimate lower, as the latest Covid-19 outbreak weighs on economic recovery. Last trades up 88 pips at 30.115.

- USD/SGD trades 28 pips higher at 1.3325 having reclaimed the 1.33 level. Weakness in SGD limited by strong exports data in the session.

- In South Korea the won is the worst performer in Asia, impacted by the latest Trump pledge to restrict licences to several Huawei suppliers which impacted sentiment South Korea as markets assessed the impact on chip component makers. USD/KRW last up 6.25 at 1105.50.

- USD/MYR is around 115 pips higher on the session at 4.0470, PM Muhyiddin announced that he will form a Covid-19 advisory group, which will help the gov't draft policies to contain the virus.

EQUITIES: Risk Off And Thin Volumes

Asian equity indices and European/US futures have declined to kick off the week in Asia, under some pressure as broad risk off sentiment prevails, volumes are thin with US markets away for Martin Luther King Jr. day.

- Tensions between the Trump administration and China continue to keep pressure on equity markets. The latest spat has seen Trump pledge to restrict licences to several Huawei suppliers which impacted shares in South Korea and Taiwan as markets assessed the impact on chip component makers.

- Indices in China and Hong Kong have bucked the trend, gaining slightly after positive GDP and Industrial Production data from the region.

GOLD: Dip In Early Asia Unwound

Spot gold saw a sharp move lower in early Asia-Pac trade, with little in the way of headline flow behind the price action. This left most to point to thinner liquidity conditions around Monday's U.S. holiday as a major component of the move, exacerbating downward pressure on a technical break below the recent lows. This train of thought was given further credence by the subsequent recovery, with spot last dealing the best part of $10/oz higher, just shy of $1,840/oz, after printing as low as $1,804.7/oz early on. A move through today's early low would open the way to round number support at $1,800/oz, with any sustained breach there set to shift bearish focus to the Dec 1 low, located at $1,775.9/oz. To the upside, bulls need to reclaim the 50-EMA before looking higher.

OIL: Extends Friday's Losses

Oil is lower to kick off the week, holding declines seen on Friday, with WTI & Brent $0.30-0.40 softer at typing. The declines come amid general risk off sentiment with most equity indices in the region negative and global futures also under some pressure.

- A stronger US dollar is also a headwind for oil, the greenback has seen upside after reports in the WSJ that Yellen will not pursue a weak US dollar policy.

- Extra pressure comes from Friday's Baker Hughes US Rig Count data which showed oil rigs rose to 363 from 360, the eighth consecutive week of gains for the metric.

- Oil did come off session lows of $51.76 after strong GDP and Industrial Production data from China.

- Elsewhere, oil output from Libya has fallen around 200k BPD after the closure leaking pipelines for maintenance. Total oil output is now around 1m BPD as Waha Oil carries out maintenance across the pipeline linking the Samah and Dahra fields to the Es Sider crude oil terminal. The maintenance works are scheduled to start today, for an estimated two weeks, according to state-controlled parent company NOC, which hopes to reduce that to a seven to 10-day period.

- There were headlines earlier in the session the US President elect Biden will cancel presidential permission for the Keystone XL pipeline as one of his first acts in office.

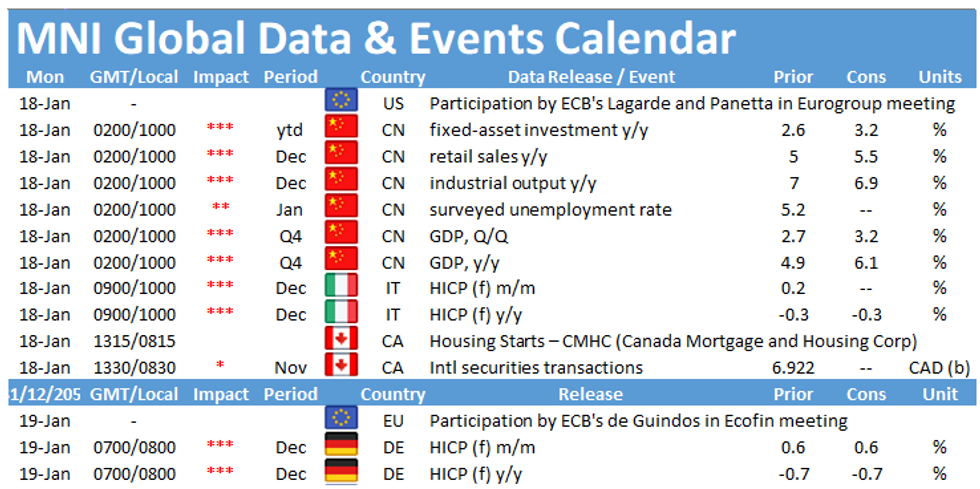

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.