-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Offered At End Of Japanese FY, Biden Speech Eyed

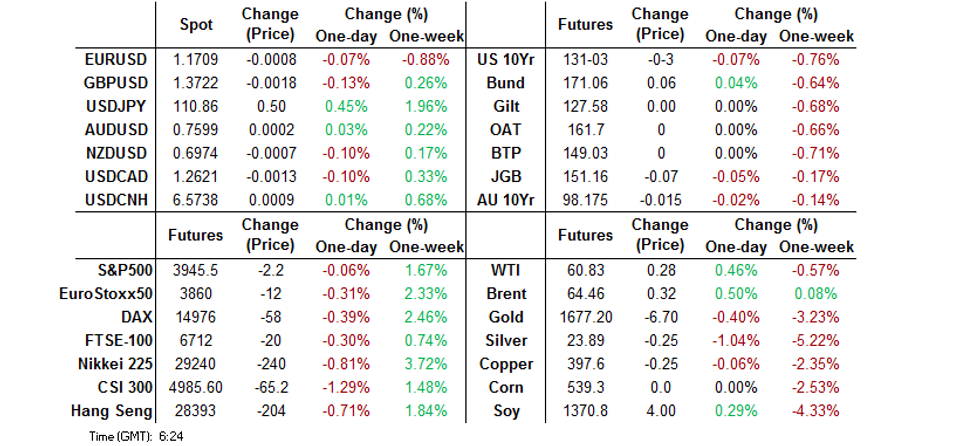

- USD/JPY threatened to break above Y111.00 as Japanese FY end triggered JPY selling.

- Nothing In the way of meaningful support for core FI markets in Asia, with Tsy yields a touch higher on the JPY weakness and firmer than expected official Chinese PMI data.

- U.S. President Biden will make his infrastructure address at 16:20 Eastern time.

BOND SUMMARY: Core FI A Touch Lower In Asia

Weakness in T-Notes allowed the 7- to 10-Year zone of the cash Tsy curve to underperform overnight, cheapening by ~3.0bp on the day, with T-Notes last printing -0-02+ at 131-03+, off of worst level. The move was aided by JPY weakness (much of the JPY movement surrounded the end of FY flows in Japan around the Tokyo fix) and firmer than expected official PMI readings out of China. Elsewhere, participants continue to look ahead to today's infrastructure related address from U.S. President Biden. That address (scheduled for 16:20 Eastern), the ADP employment reading & Chicago PMI print headline locally on Wednesday.

- Some modest pressure crept into the JGB space on the back of the same drivers flagged elsewhere, although the space is off cheaps as we move towards the bell in Tokyo. Cash trade sees 20+-Year paper a touch cheaper (aided by flows in swaps, which have resulted in a slight widening of longer dated swap spreads), with the remainder of the curve trading either side of unchanged, resulting in twist flattening, while futures sit 3 ticks softer on the day. The BoJ left the size of its 3- to 5- & 10- to 25+-Year JGB purchases at unchanged levels, with little to note on the offer/cover front. As we noted earlier, the BoJ's April Rinban plan is due to hit after hours and this is the first time that we will see the outright purchase amounts given in the Rinban plan (ranges were given in the past). Some have suggested that the BoJ could cut the size of its super-long JGB purchases, while others have suggested that any such move would come too soon after the BoJ's March decision and may risk muddying the message of a need for low yields across the entirety of the curve.

- Aussie bonds drifted lower in the wake of the firmer than expected official PMI readings out of China and stronger than expected local building approvals data, with the pressure applied to U.S. Tsys also noted. Futures have corrected from worst levels, although there is little in way of support seen from the previously flagged "modest" month-end extension for local bond market indices. A reminder that today's ACGB Nov '31 supply wasn't the firmest in pricing terms, with the weighted average yield 'only' 0.19bp through prevailing mids at the time of supply, but was still smoothly absorbed (especially when you adjust the bid/cover ratio for increased auction size vs. the prev. offering). YM -0.5, XM -2.0. The 10- to 12-Year zone of the curve underperforms in cash ACGB trade. There is plenty of note on Thursday's local docket, which of course comes ahead of the elongated Easter weekend. M'fing PMIs, retail sales, job vacancies, CoreLogic house prices, trade balance & housing finance data are all due to hit.

FOREX: JPY Falters Into Japanese FY-End, G10 FX In Risk-On Mood

Optimism surrounding the upcoming fiscal announcement from U.S. Pres Biden and a round of strong official Chinese PMI readings resulted in risk-on flows across G10 FX space. The yen went offered into the final Tokyo fix of the Japanese fiscal year, extending losses thereafter as wider sentiment remained buoyant. Demand for the greenback helped push USD/JPY towards the psychological Y111.00 barrier, but the round figure proved resilient.

- The usual talk of quarter-/month-end flows lending support to the greenback did the rounds. The DXY extended its recent rally to a fresh five-month high as U.S. Tsy yields firmed ahead of Biden's speech.

- Commodity-tied currencies & growth proxies benefitted from appetite for riskier assets and sighed with relief as crude oil bounced off yesterday's low. The Aussie led the way, with AUD/USD consolidating above $0.7600 as BBG trader sources flagged morning purchases by Aussie exporters.

- The PBOC set its central USD/CNY mid-point at CNY6.5713, in line with sell-side estimates. USD/CNH traded sideways, looking through upbeat Chinese data.

- U.S. MNI Chicago PMI, UK & Canadian GDPs, flash EZ, French & Italian CPIs, German unemployment and comments from ECB's Villeroy, Rehn & Visco take focus from here.

FOREX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E714mln), $1.1725-30(E648mln-EUR puts), $1.1750(E1.2bln), $1.1770-75(E1.2bln), $1.1785-90(E818mln), $1.1800(E1.2bln), $1.1850(E1.36bln-EUR puts), $1.1880(E606mln), $1.1900(E1.8bln), $1.1920-25(E1.7bln), $1.1945-56(E1.3bln), $1.2000(E1.0bln)

- USD/JPY: Y108.50($725mln), Y109.50($630mln), Y110.00($2.6bln-$2.48bln of USD puts), Y110.15-20($1.25mln-USD puts), Y110.50($685mln-USD puts), Y110.80($475mln-USD puts)

- GBP/USD: $1.3650-70(Gbp686mln), $1.3800(Gbp921mln-GBP puts), $1.3825(Gbp432mln-GBP puts), $1.3945-50(Gbp537mln), $1.3960-75(Gbp720mln), $1.4000(Gbp751mln)

- EUR/GBP: Gbp0.8515-25(E1.2bln-EUR puts), Gbp0.8540-50(E1.3bln-EUR puts), Gbp0.8600(E1.3bln-E1.2bln of EUR puts), Gbp0.8645-50(E664mln)

- USD/CHF: Chf0.9250($660mln)

- AUD/USD: $0.7450(A$864mln), $0.7500(A$1.3bln), $0.7600-05(A$732mln), $0.7650(A$774mln), $0.7675-90(A$917mln), $0.7700(A$1.0bln), $0.7750-60(A$1.8bln), $0.7770-80(A$1.3bln), $0.7790-0.7800(A$1.1bln), $0.7825-30(A$615mln)

- AUD/JPY: Y84.45(A$782mln)

- EUR/AUD: A$1.5450-60(E696mln-EUR puts)

- USD/CAD: C$1.2500($837mln), C$1.2600-05($690mln), C$1.2645-50($1.1bln-USD puts)

- USD/CNY: Cny6.50($660mln), Cny6.5600-20($1.1bln), Cny6.62($1.0bln)

- USD/MXN: Mxn19.95($890mln), Mxn20.25($516mln), Mxn20.30($631mln), Mxn20.56($680mln), Mxn20.90($540mln)

- USD/ZAR: Zar14.75($511mln)

ASIA FX: Mixed At Month-End

After a brief dip at the start of trade the greenback resumed its rally, most Asia EM FX remained resilient heading into month and quarter end though.

- CNH: Offshore yuan is stronger, moving out of negative territory following strong PMI data, USD/CNH last trades at 6.5723, still within yesterday's range.

- SGD: Singapore dollar is stronger, SGD supported by higher domestic yields, the benchmark 10-year yield is over 90bps higher since the start of 2021.

- TWD: Taiwan dollar has gained slightly, oscillating around the 28.50 level. Markets look ahead to PMI data tomorrow, after China reported strong activity.

- KRW: The won is stronger, data earlier saw confidence in South Korean manufacturers rise to 91, the highest since 2011. Encouragingly, exporters and domestic focused firms both saw confidence increase and shows optimism around the economic recovery.

- IDR: Rupiah is weaker, the worst performer in EM. Indonesian CPI & Markit M'fing PMI are due tomorrow, while Danareksa Consumer Confidence is expected to hit the wires at some point during the remainder of this week. On the IDR losses, BI said it was intervening in the FC market so smooth volatility.

- MYR: Ringgit is weaker, in the annual Economic and Monetary Review, BNM revised its 2021 GDP forecast to +6.0-7.5% Y/Y from +6.5-7.5%. Growth will be anchored by private consumption, but lifted by manufacturing & commodities, it said.

- PHP: Peso is marginally stronger, data earlier showed Philippines bank net loans fell 2.7% Y/Y in February.

- THB: Baht hit fresh five-month lows, the baht has been the worst performer in the Asian EM basket in the first quarter, with analysts pointing to the impact of the collapse of the tourism industry which used to be the backbone of Thailand's economy, as well as current-account deficit, USD strength and the repatriation of dividends by Japanese investors.

ASIA RATES: Yields Gain

A mixed bag heading in to month-end, yields higher in general as data from the region paints a positive picture.

- INDIA: Yields are mixed across the curve, markets await the announcement of the April – September borrowing plan said to be released today. At the release of the budget on February 1 the government announced plans to issue INR 12.1t on government debt.

- INDONESIA: Yields higher, moves mixed across the curve. The government said it received IDR 15t of bids at greenshoe option on Wednesday, after a disappointing sale yesterday. The government sold KRW 4.75t against a target of IDR 30t, with incoming bids of IDR 33.95t. This was the smallest sale amount since 2016 with the government reluctant to lock in higher yields.

- CHINA: The PBOC matched maturities with injections again today, the eighteenth straight day of matching maturities, while the bank hasn't injected funds since February 25. Repo rates have risen heading into month and quarter end. Overnight repo rate up 51bps at 2.1097%, while the 7-day repo rate has come off highs and is last at 2.2285%, above the 2.20% offered by the PBOC. The PBOC earlier said it would ensure adequate liquidity through April. Bond futures are essentially flat, still buoyed by the news yesterday of inclusion on the FTSE Russel WGBI, supported by the prospect of $3.6bn inflows a month.

- SOUTH KOREA: Futures in South Korea are higher but have declined through the session after gapping higher at the open. Data earlier saw confidence in South Korean manufacturers rise to 91, the highest since 2011. Encouragingly, exporters and domestic focused firms both saw confidence increase and shows optimism around the economic recovery.

EQUITIES: Negative Note For Quarter-End

Asia-Pac markets are mostly in the red, taking a negative lead from the US. Markets await clarity on the latest fiscal stimulus package from the US. In Japan the financial sector is the laggard, hampered by reports that Mitsubishi UFJ will also take a hit from Archegos Capital Management fire sale. Markets in mainland China are lower despite strong PMI data, repo rates have risen heading into month and quarter end. Australia and India are the outperformers, gaining after declining for the previous two sessions. Most major indices in Asia are on track for their first monthly loss since last October. Futures in the US are virtually unchanged.

GOLD: Probing Tuesday's Low

U.S. Tsy yields have nudged higher in Asia-Pac hours after their pullback during Tuesday's NY session, with the broader DXY a touch firmer (although that is mainly due to JPY weakness vs. the USD, with the moves vs. G10 FX a little more nuanced on a case by case basis), building on Tuesday's bid. Spot gold is lower as a result, last -$5/oz at $1,680/oz, but hasn't yet managed to force a sustained, meaningful break below Tuesday's trough. Bears currently eye the bear trigger in the form of the Mar 8 low (located at $1,676.9/oz) as their next technical target.

OIL: OPEC+ Meeting Eyed

WTI & Brent print $0.30 above yesterday's settlement levels.

- Markets look ahead to the OPEC+ meeting on Thursday, the group are expected to maintain output cuts given signs in the last few weeks of the fragility of the oil rally. There are reports that Saudi Arabia has not yet decided its position on oil production quotas. The OPEC+ JMMC met ahead of the meetings and revised down oil demand, they now forecast that global demand will expand by 5.6m bpd this year, a 300k bpd reduction. The downward revision came after OPEC SecGen Barkindo warned the group must remain cautious.

- Elsewhere, data from API yesterday showed headline crude inventories rose again, adding 3.91m bbls. Downstream stockpile figures were more bullish, gasoline stocks fell 6.01m bbls while distillate stocks rose 2.6m bbls.

- There are positives though, in China PMI figures were strong while the IMF will upgrade growth forecasts next week.

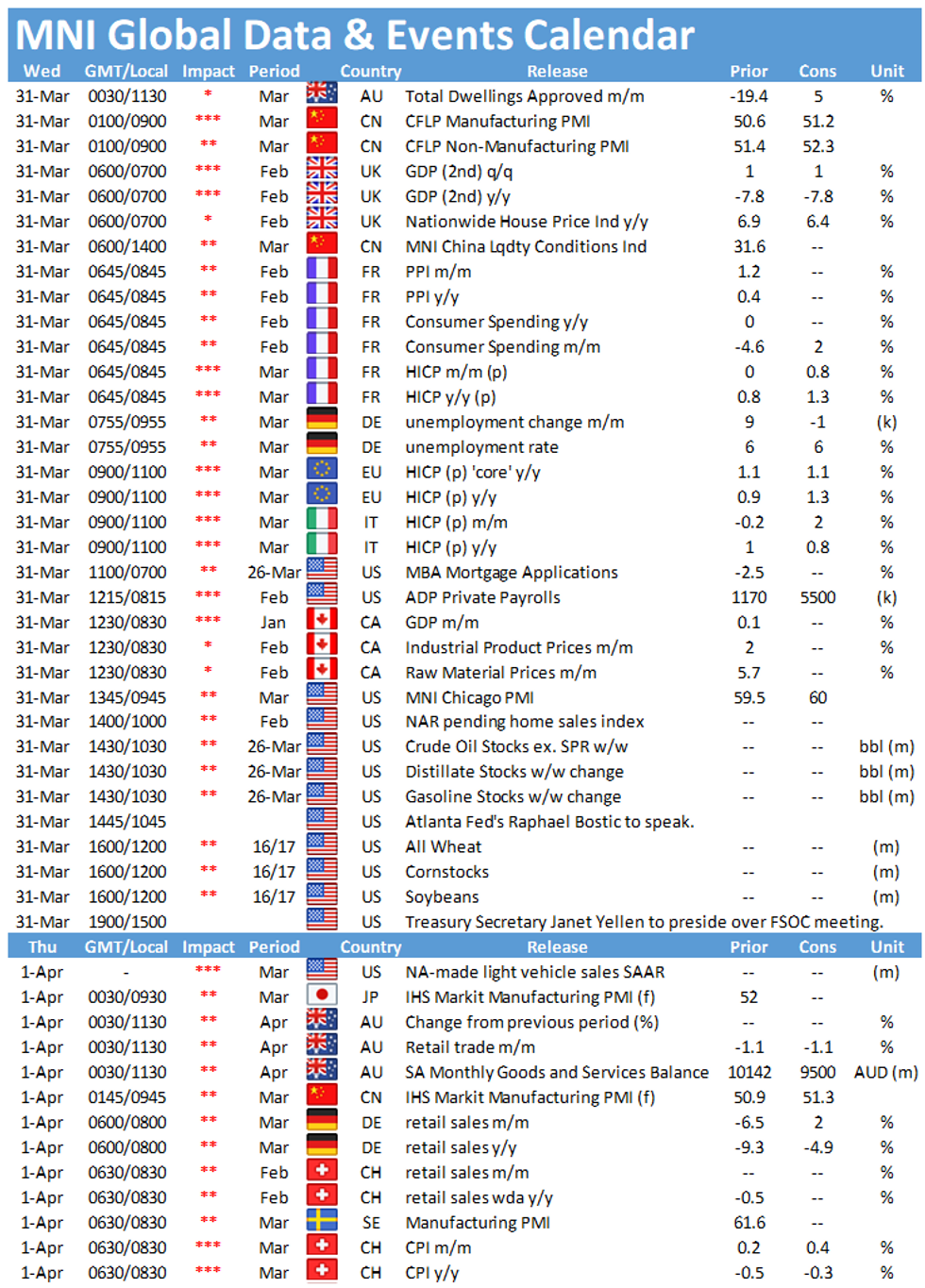

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.