-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Large Moves In U.S. Short End Continue

- Swings in the short end of the U.S. FI curve continue to dominate matters in Asia.

- Headlines surrounding Credit Suisse financial statements create some vol. into London hours.

- In Europe today the UK Labour Market survey headlines, however the focus will continue to be on the SVB-inspired volatility. Further out February's CPI print headlines the docket, our preview of that event is here.

MNI US CPI Preview: Core CPI Seen Holding Jan Pace After Historical Rally

EXECUTIVE SUMMARY:

- Core CPI inflation is seen holding a 0.4% M/M clip for the third month running in February.

- It is however expected to have been boosted by a bounce in used car prices rather than more broad-based pressure, especially in light of a sizeable easing in supply chain pressures.

- Core non-housing services will again be in focus after moderating to a mixed extent in January, whilst OER and primary rents inflation are seen slowing slightly further.

- Powell had last week opened the door to a 50bp hike at the March FOMC, arguably dented after Friday’s payrolls report showed softer wage pressures despite continued surprise strength for payrolls growth. That already seems like a long time ago: a historical fixed income rally on regional bank contagion fears now sees only one more 25bp hike for the cycle priced, after a 100bp drop in 2Y Tsy yields in three days.

- PLEASE FIND THE FULL REPORT HERE: USCPIPrevMar2023.pdf

US TSYS: 2-Year Yield Rises In Asia, CPI In Focus

TYM3 deals at 114-04+, -0-16+, a touch off the base of the 0-13 range on elevated volume of ~223k.

- Cash tsys sit 16bps cheaper to 2bps richer across the major benchmarks. The curve has twist flattening pivoting on 10s.

- The front end of the curve continued to lead swings in Asia as local participants faded yesterday's historic move in the short end of the curve.

- 2-Year Yields had moved ~115bps from peak to trough from Wednesday to Monday, with Monday’s fall the largest since the early 1980s.

- With an eye on this evening's CPI print, movements in FOMC dated OIS have been seen in Asia today. There is ~25bps of tightening priced into the next two Fed meetings with the terminal rate seen in May at 4.83%, with ~70bps of cuts now priced in for 2023. There was over 90 bps of cuts priced in early in the Asian session

- In Europe today the UK Labour Market survey headlines. Further out February's CPI print headlines the docket, our preview is here. Fed Governor Bowman will also cross today.

JGBS: Curve Flattens, Futures Finish Off Best Levels

JGB futures finished away from best levels of the session, after an early Tokyo rally failed to breach the overnight session high, although the contract was comfortably firmer on the day, +138 at the close.

- JGBs in the intermediate zone of the curve pulled away from best levels after 10-Year swap rates found an intraday base just above the BoJ’s YCC cap (where a low of 0.516% was registered this morning). This probably isn’t a coincidence, as 10-Year swaps are viewed as a fair value play re: JGBs given the relative lack of BoJ control over that market.

- This combination saw 10-Year JGB yields pull away from multi-month lows, after showing below the BoJ’s prior YCC cap (0.25%) for a large chunk of the session. A reduction in short positioning seems to be a clear factor in the recent round of richening in the 7- to 10-Year sector, but does leave the space susceptible to pressure if fresh BoJ YCC speculation is triggered by a hawkish repricing of the path of global central banks.

- Cash JGBs sit 1-16bp richer across the curve, with bull flattening in play after the early outperformance of 7s and 10s gave way. Swaps spreads are tighter out to 5s, but mixed beyond that.

- Local headline flow was limited.

- 5-Year JGB supply saw tepid reception, with outright richness countering relative and carry & roll appeal.

- BoJ Rinban operations headline domestically tomorrow.

AUSSIE BONDS: Stronger But Well Off Bests Going Into U.S. CPI

In the penultimate session of futures roll ACGBs close at or near Asia-Pac lows (YMM3 +16.6 & XMM3 +7.0) as cash Tsys twist flatten with 2-year yields 18bp higher and the 10-year -1bp. Cash ACGBs strengthen 7-15bp, but well off bets, with 3/10 curve +9bp. The AU-US 10-year yield differential widens 6bp to -12bp. For reference, this differential made a cycle low of -32bp last week.

- Swaps close firmer with rates 2-11bp lower (but 18-20bp off bests) and EFPs 5-6bp wider.

- Bills closed -1 to +39bp with whites leading.

- On the data front, consumer sentiment remained depressed, but business conditions remained robust with broad-based strength (business confidence was soft). In isolation the data would have lent support to a hike in April given it was explicitly cited by RBA Governor Lowe as important for upcoming policy discussions.

- In a significant development however, RBA dated OIS priced, at least temporarily, the end to the tightening cycle. April meeting pricing softened to 2bp of easing with 10bp of easing priced by end-22. At one stage in proceedings more than a full 25bp of easing had been priced.

- Elsewhere, Bloomberg reported today that China will allow all domestic companies to import Australian coal, signaling an end to trade restrictions imposed inn late 2020.

- US CPI for February tonight.

AUSTRALIA: Confidence Weak & Volatile, Components & Costs Robust

After two months in positive territory, NAB business confidence fell to -4 in February from +6, driven by services and finance & property. The series has been volatile since June 2022. Business conditions were stable at a robust 17 after 18 in January with the strength broad based. While confidence was soft, the other components of the survey remained robust pointing to a further RBA hike in April if considered in isolation.

- Conditions in consumer-related sectors remained strong around +20, in contrast to depressed Westpac consumer confidence, while the business ones were around +10. Trading remained robust at 27, profitability eased to 14 from 18 and employment rose to 12 from 11, indicating labour demand remains strong.

- In terms of the forward-looking components, forward orders were down to 3 from 6 driven by wholesale but capacity utilisation remained high above 85%.

- Cost indicators in the survey remained elevated in February with labour costs rising for the second consecutive month to 2.8%, the highest since November 2022. However, prices were subdued with prices of final products stable at 1.6% and retail prices down to 1.9% from 2.5%, indicating that it is becoming harder to pass costs onto customers.

- Cost pressures in services remained elevated and showed less moderation than in retail. Labour costs have eased from their peaks in both sectors.

Source: MNI - Market News/Refinitiv/NAB

Fig. 2: Australia NAB employment vs labour costs

Source: MNI - Market News/Refinitiv/NAB

NZGBS: Strong Gains Hold Ahead Of U.S. CPI

NZGBs close 10-21bp richer, but well off session bests, as U.S Tsys given back some of yesterday’s Silicon Valley Bank induced gains in Asia-Pac trade (U.S. Tsy 2-year yield +17bp). The 2/10 curve closes +11bp.

- Swaps curve bull steepens with rates 12-27bp lower, implying tighter swap spreads.

- RBNZ dated OIS collapses 16-31bp across meetings. April meeting pricing softens to 20bp of tightening with terminal OCR expectations tumbling to 5.19%, well above RBNZ’s projected OCR peak of 5.50%. For reference, RBA dated OIS went further and priced the end of the tightening cycle.

- Locally, REINZ house sales data notched up another large decline (-31.1% Y/Y), albeit with severe weather distortions. Net migration (Jan) was also released with the result robust. Migration and tourism provide one of the few bright spots for the local economy.

- The local calendar is scheduled to release tomorrow the first of this week’s quarterly data, Q4 Current Account. If a widening deficit is a sign of an overheated economy, then look no further than tomorrow’s data with BBG consensus expecting a -8.6% of GDP print.

- Until then, tracking U.S. Tsys and monitoring SVB developments is likely to remain the main game, at least until the release of US CPI tonight.

FOREX: Yen Pressured, USD Firms As 2-Year Treasury Yield Rises In Asia

The USD is firmer in Asia today, 2-Year US Treasury Yield has risen 18bps as it pares some of the losses it saw yesterday. The fall on Monday in the 2-Year Yield was the largest since 1982.

- Yen is pressured, USD/JPY is ~0.5% firmer. USD/JPY prints at ¥133.75/85, resistance is seen at the 50-Day EMA (¥134.27). Japan's 10-Year Yield has fallen below 0.25% the previous BOJ ceiling.

- AUD/USD is also softer, down ~0.2% today. The pair last prints at $0.6650/55 having found support at $0.6635. A Bloomberg source piece, linked here, noted that China will end trade restrictions on Australian coal which were imposed in late 2020.

- AUD/NZD printed a fresh YTD low at $1.0691, however losses have moderated in recent trade and the cross sits at $1.0700/10.

- NOK is down ~0.4%, last printing at 10.55/60. The next upside target for bulls is the high from 10 March at 10.7512.

- Cross asset wise; BBDXY is up ~0.2%. Regional equities are softer weighing on risk appetite, the Hang Seng is down ~2%. US Equity Futures are firmer, S&P500 eminis are up ~0.6%.

- In Europe today the UK Labour Market survey headlines, however the focus will continue to be on the SVB-inspired volatility. Further out February's CPI print headlines the docket, our preview is here.

AUD: A$ Correlations - All About Yield Spreads

AUD/USD correlations with yield differentials have shot higher, particularly relative to other traditional macro drivers. The table below presents the 1 week and past month levels correlations for AUD/USD against a host of macro drivers (note for yield spreads this reflects government bond yield spreads).

- The past week has seen a strong rebound in short term AUD/USD correlations with yield spreads. We sit slightly higher at the 2yr point, but are elevated across the 5 and 10yr space as well. Longer term correlations are also holding up.

- The sharp repricing in Fed expectations post the SVB collapse is weighing on broader USD sentiment, which the A$ is benefiting from. Still, we are mindful of how far US yields have come in such a short period. Any sharp rebound in US yields could cap the A$ rebound to a degree.

- Other correlations are much lower for global commodities, although are higher with iron ore in the past week, less so for the past month. The global equity correlation is also much weaker than historical norms.

Table 1: AUD/USD Correlations (Levels)

| 1wk | 1mth | |

| AU-US 2yr Spread | 0.87 | 0.48 |

| AU-US 5yr Spread | 0.74 | 0.70 |

| AU-US 10yr Spread | 0.72 | 0.71 |

| Global Commodities | 0.27 | 0.83 |

| Global Base Metals | 0.00 | 0.79 |

| Iron ore | 0.88 | -0.48 |

| Global equities | -0.64 | 0.77 |

| US VIX index | 0.65 | -0.64 |

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Mar14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E931mln), $1.0695-00(E724mln), $1.0740-50(E1.5bln), $1.0780-00(E1.4bln)

- USD/JPY: Y130.00($720mln), Y131.00($562mln)

- EUR/GBP: Gbp0.8830-50(E752mln)

- AUD/USD: $0.6781-00($694mln)

ASIA FX: CNH & KRW Weaken, Mixed Trends Elsewhere

USD/Asia pairs have been more mixed today, with a number rebounding from recent lows, most notably USD/CNH. USD/KRW has also bounced higher, but this trend is less evident for other pairs. The recovery in US yields, coupled with weakness in regional equities, is aiding the USD. Still to come today is India wholesale prices. Tomorrow the focus will be the China 1yr MLF rate outcome (no change expected) and Jan-Feb activity prints. Indonesian trade data is also due.

- USD/CNH has spent most the session on the front foot, although there appears some resistance ahead of the 6.8800 level. The CNY fixing was neutral, while onshore equities are weaker, but outperforming regional weakness elsewhere. Support for USD/CNH still appears evident around simple 50-day MA, ~6.8360.

- 1 month USD/KRW is back above 1300, last near 1304. Onshore equities are off by over 2%, while offshore investors have sold -$635.3mn in local shares. Dips below 1300 have been supported this month, while the equity backdrop looks poor from a technical standpoint. President Yoon will visit Japan later this week and hold a summit/dinner on Thursday.

- INR outperformance is being further unwound. USD/INR is back to 82.25/30, slightly below highs for the session. Still, the rupee has seen little benefit from the recent USD pullback. Yesterday's CPI print points to another RBI hike in April. We have wholesale price data due later today. The INR NEER is comfortably off early march higher.

- USD/PHP is off session highs, back near 55.00. Trade figures were weaker than expected, the trade deficit printing at -$5.74bn, versus -$4.381bn forecast. This puts the trade deficit just above record lows from mid 2022. This, along with a weaker equity tone is weighing PHP. Local stocks are off by around 1.1%. This puts the index back under 6500, which is also sub the simple 200-day MA. Yesterday saw -$384.7mn in net equity outflows, the largest single day of outflows since Sep 2015.

- The story is better for THB, with USD/THB not too far off recent lows at 34.50/55. The Thai parliament may be dissolved on March 20th, paving the wave for the general election. USD/MYR has also remained sub 4.5000, last near 4.4820/30, despite higher USD/CNH levels.

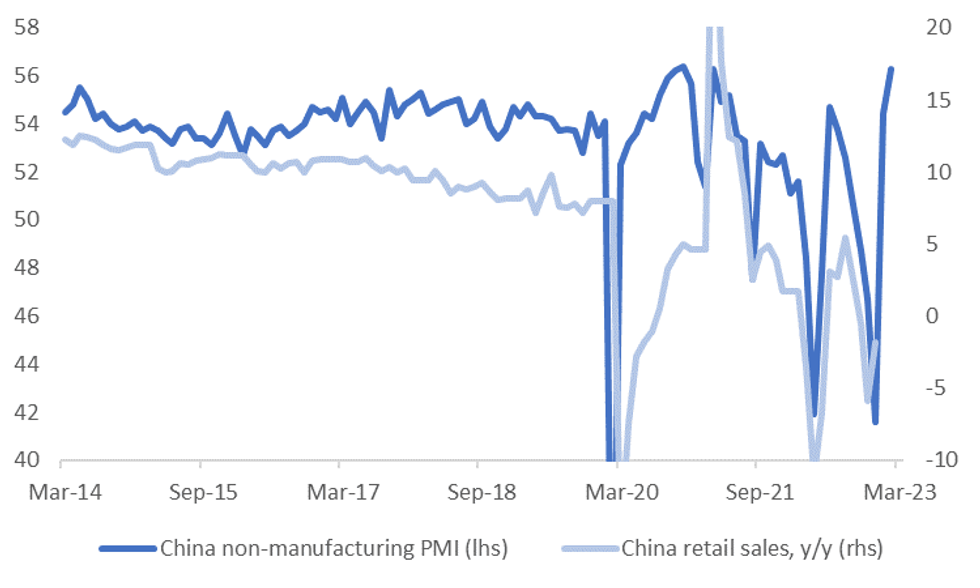

CHINA: Activity Data Expected To Improve, MLF Rate Likely To Be Held Steady

A reminder that China data prints tomorrow. First up is the 1yr MLF rate outcome. No change is expected from the current rate of 2.75%, with 1 forecaster, out of 18 surveyed by Bloomberg, looking for a 5bps cut. For MLF volumes the consensus sits at 325bn yuan (range is quite wide at 200-700bn yuan).

- Jan-Feb activity data is out a short term after these prints. The data is expected to firm as the re-opening theme gains traction. PMIs released at the start of the month point to an improved IP backdrop and better retail sales, see the charts below.

- The anecdotes also point this way, particularly in terms of consumer and services related activities. China export demand from places like South Korea and Taiwan has remained quite weak though, but this may reflect specific headwinds in the tech space as opposed to a much weaker China backdrop.

- Below we outline the data release, consensus expectation and forecast range.

- IP is forecast at 2.6% YTD Y/Y (the range is 1.8% to 5.5%).

- Retail sales is forecast at 3.5% YTD Y/Y (the range is -1.0% to 13.0%)

- Fixed asset investment is forecast at 4.5% YTD Y/Y (the range is range 2.0% to 6.0%).

- Property investment is expected at -8.5% YTD Y/Y (the range is -12.7% to 5.0%).

- The jobless rate is expected at 5.3% (range is 5.2% to 5.5%).

Fig 1: China IP & Manufacturing PMI

Source: MNI - Market News/Bloomberg

Fig 2: China Retail Sales & Non-manufacturing PMI

Source: MNI - Market News/Bloomberg

EQUITIES: Weakness Across The Board, Led By Financials

All the major indices are down across the board, led by financial stocks. The MSCI Asia Pac financials index was off by 2.7% at one stage. The focus of investors was very much on the sector, following US/EU weakness in the space through Monday's session. US futures are positive at this stage, +0.55% for eminis and Nasdaq futures, but this hasn't provided much of a positive offset for the region.

- Japan's Nikkei 225 is off by 2.25%, with bank names weighing. Bloomberg notes Japan finance companies are prominent in terms of unrealized losses to equity ratios, which could remain a focus point in the wake of the SVB collapse.

- Elsewhere, the HSI is down by around 1.60% at this stage, with banking names also weighing on the headline index. China stocks have fared better, with the CSI 300 down by ~0.70% in the first half of the session.

- The Kospi has sunk over 2%, with offshore investors unloading over $600mn in local shares so far today. The Taiex is down by 1%.

- In SEA, Singapore stocks have outperformed, with REITS drawing safe haven related flows, but all other markets are down. The Philippines index is down around 1%, after yesterday saw the biggest daily equity outflow from offshore investors since 2015.

GOLD: Prices Down As USD And Yields Begin Recovery

Gold prices are down 0.5% to $1903.25/oz as US yields firmed. They are holding above $1900 after reaching an intraday high of $1914.12 earlier, above Monday’s close of $1913.70. Bullion has been boosted by flight to quality flows, the drop in the USD and US Treasury yields following the collapse of Silicon Valley Bank. A less hawkish Fed has also been priced in by markets. The USD index is up around 0.1% today.

- Gold rose through its 50-day simple moving average on Friday and has remained there. Resistance is at $1923.20 and on the downside support is $1871.60.

- Later US CPI for February is released and is likely to be watched closely. It is expected to post similar monthly increases to January but see the annual rates moderate. The Fed’s Bowman speaks at a Community Bankers Event in Hawaii.

OIL: Crude Weakens Further, Waiting For Upcoming US CPI For Clarification On Fed

Oil prices slumped on Monday in the wake of the collapse of Silicon Valley Bank, as the market’s demand fears grew and risk sentiment deteriorated. Today crude is down another percent following yesterday’s -2.5%. WTI is down 1.1% to around $73.98/bbl, close to its intraday low of $73.74, and Brent is 1% lower at around $79.95, also close to the intraday low of $79.67. The USD index is up around 0.2% today.

- Oil has traded during the APAC session above support levels of $72.30 for WTI and $78.41 for Brent. Prices are likely to remain volatile until there is clarification on any economic impact from SVB and on the Fed outlook.

- Later US CPI for February is released and is likely to be watched closely. It is expected to post similar monthly increases to January but see the annual rates moderate. The Fed’s Bowman speaks at a Community Bankers Event in Hawaii. There is also US API inventory data today and OPEC’s monthly report.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/03/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/03/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 14/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/03/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/03/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/03/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/03/2023 | 1230/0830 | *** |  | US | CPI |

| 14/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/03/2023 | 1400/1000 | * |  | US | Services Revenues |

| 14/03/2023 | 2120/1720 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.