-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Mixed Fortunes For Equities

- China equities are trading on the back foot, amid a number of headwinds, although HK stocks have pared a good deal of early session losses. Sentiment is more positive elsewhere, aided by a firmer US futures backdrop (+0.50% for Eminis at this stage).

- US futures opened higher and have stayed in positive territory for the session, with reports from late last week of further Fed support for embattled bank First Republic likely helping at the margins. Surging deposits to large US banks had also slowed according to CNBC weekend reports. Still, we are off best levels for eminis.

- The latest German IFO survey headlines the data slate on Monday, while speakers from the Fed, ECB & BoE fill out the docket.

STIR: $-Bloc: Terminal Rate Seen In 3 Out Of 4

On Friday, U.S. STIR closed with 10bp of easing priced for June having briefly priced a full 25bp cut earlier in the session in the wake of another bout of European bank weakness. Moreover, 95bp of easing was priced for year-end.

- With the BoC on the tightening sidelines and the U.S. joining AU in pricing no further tightening, RBNZ-dated OIS remains the only market with tightening priced.

- At the close, NZ STIR had priced 40bp of tightening over meetings to July with 22bp priced for April.

Fig. 1: $-Bloc STIR: Terminal Rate Expectations & Year-End Pricing

Source: MNI - Market News / Bloomberg

US TSYS: Curve Flattens In Asia

TYM3 deals at 116-04+, +0-01, a touch off the top of the 0-10 range on volume of ~61k.

- Cash tsys sit 2bp cheaper to 2bp richer across the major benchmarks. The curve has twist flattened pivoting on 5s.

- Tsys were pressured in early dealing as local participants digested a Bloomberg source piece from Friday which suggested that US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet. CNBC also noted at the weekend that deposits moving from smaller regional banks to big institutions have slowed to a trickle in recent days.

- There was little follow through on the early downtick lower, tsys recovered from session lows as a lack of immediate offering of policymaker support for the US banking sector on Monday added a layer of support.

- Tsys respected narrow ranges for the remainder of the Asian session with little follow through on moves.

- Minneapolis Fed President Kashkari noted yesterday recent bank turmoil has increased the risk of a US recession but it was too soon to judge what that means for monetary policy.

- In Europe today we have a thin data calendar, IFO Business Climate Index from Germany provides the highlight. Further out Dallas Fed Manf. Activity headlines an otherwise thin docket. The latest 2 Year supply is also due.

JGBS: Futures Unwind Overnight Gains, Curve Twist Steepens

Early Monday trade saw JGB futures extend on the late overnight session pull away from best levels as Tokyo participants reacted to some hope surrounding further support for the U.S. banking sector, although worry re: the European banking and Chinese property sectors limited the move in general, with most of the cash curve remaining bid on the day.

- JGB futures sit at unchanged levels as we enter the last hour of Tokyo trade, with a recovery in the Hang Seng and bid in e-minis the more prominent moves in Asia-Pac trade, while cash JGBs are 2.5bp richer to 1bp cheaper across the curve as 10s outperform and only 40s trade cheaper on the day.

- Spill over from swap flows will have applied some pressure to the space, with that curve steepening as rates ticked higher, meaning that swap spreads ran wider all day.

- Marginally firmer than expected domestic services PPI data will have also aided the direction of travel for JGB futures in early Tokyo trade.

- Elsewhere, domestic catalysts were light. The weekend saw the junior party in the ruling coalition affirm previous guidance re: the rough spending outline for the impending round of fiscal stimulus.

- Note that the 10-/40-Year JGB curve is on course to steepen for a third consecutive session, with the presence of tomorrow’s 40-Year JGB supply likely aiding that dynamic.

AUSSIE BONDS: 10-Year Hits Lowest Yield Since August

ACGBs sit richer ahead of the bell (YM +5.0 & XM +2.0) but well off session bests as hope surrounding further support for the U.S. banking sector pressured U.S. Tsys in Asia-Pac trade, offsetting gains sparked by weakness in Chinese property developer names. Cash ACGBs were 2-4bp richer on the day with the 3/10 curve 2bp steeper and the AU-US 10-year yield differential -2bp at -18bp. After hitting its lowest level since August (3.14%), the benchmark 10-year yield sits at 3.20%.

- Swaps curve bull steepened with rates flat to 3bp stronger and EFPs 2bp wider.

- Bills strip pricing is +2 to +4bp.

- RBA dated OIS sits 4-7bp softer for meetings beyond May with 37bp of easing priced by year-end. No change remained priced for April.

- After a light calendar today, things heat up tomorrow with the release of Retail Sales for February. After a volatile couple of months related to Black Friday sales (-4.0% M/M in December followed by +1.6% in January), the market will be keen to get a read on whether household spending weakness seen in Q4 GDP data has carried over into early 2023.

- With the global calendar relatively light until later in the week when Euro Area CPI (Mar) and US PCE deflator (Feb) are released, the market will likely find itself guided by banking headlines.

AUSTRALIA: Advertised Salary Growth Elevated But Stabilised

The SEEK advertised salary index rose 0.3% m/m in February to be up 4.5% y/y. This is in line with January’s 0.2% m/m and 4.4% y/y but indicates that offered wages remain robust in the current environment of persisting skills shortages. Advertised salary growth has stabilised, thus suggesting the absence of a wage-price spiral, but it remains elevated. Q1 WPI is released on May 17.

Fig. 1: Australia wages y/y%

Source: MNI - Market News/ABS/SEEK

NZGBS: Closed At Bests, Outperforming $-Bloc

NZGBs closed at session bests with the 2-year and 10-year benchmarks 9bp richer on the day following the firmer lead from U.S. Tsys ahead of the weekend. U.S Tsys were little changed in Asia-Pac trade with the market eyeing e-minis and weakness in Chinese property developer names. NZGBs outperformed their $-bloc peers with the NZ/US 10-year yield differential 6bp narrower and the NZ/AU differential -4bp.

- Swaps closed 5-6bp stronger, implying wider swap spreads, with the 2s10s curve 1bp flatter.

- RBNZ dated OIS closed flat to 5bp softer across meetings with 22bp of tightening priced for April. Terminal OCR expectations were unchanged at 5.14%.

- With the NZ calendar light until ANZ Business Confidence and Building consents on Thursday, the market attention, other than banking headlines, will be on tomorrow’s release of Australian Retail Sales for February. After a volatile couple of months related to Black Friday sales (-4.0% M/M in December followed by +1.6% in January), the market will be keen to see if household spending weakness seen in Q4 GDP data has carried over into early 2023.

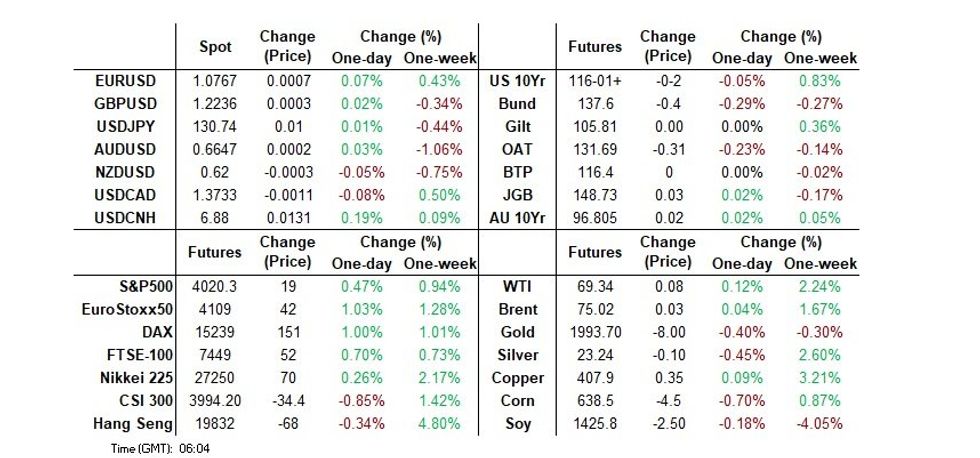

FOREX: USD Mildly Pressured In Asia

The greenback is mildly pressured in Asia today, the Hang Seng paring early losses and a bid in US Equity futures has weighed. BBDXY sits ~0.1% softer.

- AUD/USD is ~0.2% firmer, the AUD is the strongest performer in G-10 space at the margins today. The trend condition remains bearish, however the bull cycle that started Mar 10 remains in play for now. Resistance is at $0.6769, 50-Day EMA and support is seen at $0.6625 the low from Mar 24.

- Kiwi is also a touch firmer today. NZD/USD prints at $0.6205/10, the pair has observed a narrow range thus far with support seen below $0.62 and resistance about the 20-Day EMA ($0.6216).

- USD/JPY is ~0.1% softer, the pair was firmer in early dealing however resistance was seen at ¥131.00 and gains were pared. This morning Japan's Feb Services PPI printed at 1.8% rising from the Jan print of 1.6%.

- Elsewhere in G-10 the mild USD weakness we've seen is evident. EUR and GBP are ~0.1% higher.

- Cross asset wise; the Hang Seng erased losses of as much as 2% to sit little changed. E-minis are ~0.5% firmer. 10 Year US Treasury Yields are little changed.

- In Europe today we have a thin data calendar, IFO Business Climate Index from Germany provides the highlight. Further out Dallas Fed Manf. Activity headlines an otherwise thin docket.

FX OPTIONS: Expiries for Mar27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0785(E700mln), $1.0800(E1.0bln)

- USD/JPY: Y130.00-10($606mln), Y130.50-60($1.1bln)

- GBP/USD: $1.2300(Gbp636mln)

- USD/CAD: C$1.3660($500mln)

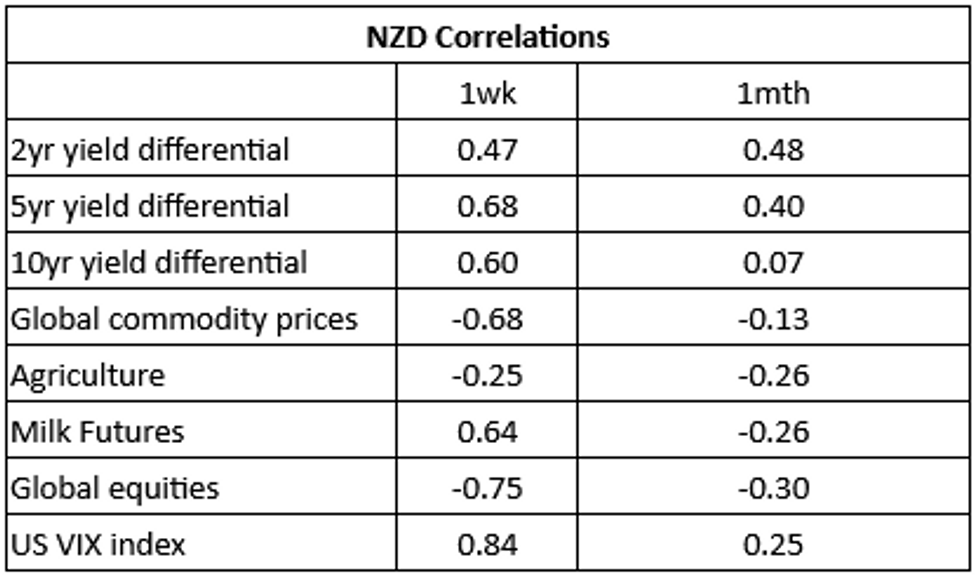

NZD: VIX, Milk Futures and Yield Differentials Main Macro Drivers Last Week

NZD/USD finished last week's trade down ~1% for the week, dealing in a 2% range. The table below presents levels correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- The VIX, Milk Futures and 5- and 10-Year Yield Differentials were the main macro drivers in the NZD last week.

- Conversely, a recovery in global commodity and equity prices did not filter through to the Kiwi in a meaningful way.

- Over the longer time frame there is no standout macro driver, the 2-Year Yield Differential does show the strongest correlation to the NZD.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

ASIA FX: INR Outperforms Higher USD/Asia Levels Elsewhere

USD/Asia pairs have risen for the most part today, but are away from session highs. Some improvement in the regional equity space aided by higher US futures has helped. USD indices are down though, so the likes of CNH and KRW have underperformed this soft dollar backdrop (albeit at the margins). Tomorrow, the data calendar remains light, with South Korean retail/department store sales due. Thai customs trade figures for Feb may also print.

- USD/CNH got to a high of 6.8840/45, before moderating in later trade. We are now back at just under 6.800. This is still around 0.20% weaker versus NY closing levels last week, but we remain within recent ranges for the pair. Industrial profits data was disappointing, which along with earnings headwinds and on-going housing concerns, weighed on China equities. At this stage the CSI 300 is off close to 1%.

- 1 month USD/KRW got dragged higher, but found selling interest above 1300. The pair last tracks near 1297. Local equity markets are down, but only modestly at -0.3%. Offshore investors have sold -$268.2mn of local equities so far today.

- USD/INR is ~0.2% softer on Monday, printing at 82.30/40. INR is the standout performer in USD/Asia on Monday. Barclays expect the current account gap to be 1.9% of GDP in FY24 and Citi slashed its forecast to 1.4% from 2.2% previously. USD/INR has opened below its 20-Day EMA (82.44). From a technical perspective if bears close below the 20-Day EMA they can target the 200-Day EMA (80.95). Bulls look to test the 83 handle.

- At the other end of the spectrum, baht has underperformed. The USD/THB pair last around 34.30/35, +0.55% above closing levels from the end of last week. The 20 and 50-day EMAs sit slightly higher, in the 34.35/34.40 region. On the data front, Feb customs trade figures are due between now and the end of the month. Tourism arrivals were slightly down in Feb (2.11mln) versus Jan (2.14mln). Most focus will rest on Wednesday's BoT outcome though. The consensus looks for a +25bps hike, but a few forecasters expect no change.

- The SGD NEER (per Goldman Sachs estimates) continues to tick away from cycle highs printed last week, we are a touch softer this morning. We sit ~0.7% below the upper end of the band. USD/SGD is ~0.1% firmer on Monday, last printing at $1.3330/40. The pair is following the broader USD/Asia trend thus far.

EQUITIES: China Stocks Underperform, HSI Pares Losses, US Futures Higher

China equities are trading on the back foot, amid a number of headwinds, although HK stocks have pared a good deal of early session losses. Sentiment is more positive elsewhere, aided by a firmer US futures backdrop (+0.50% for Eminis at this stage).

- US futures opened higher and have stayed in positive territory for the session, with reports from late last week of further Fed support for embattled bank First Republic likely helping at the margins. Surging deposits to large US banks had also slowed according to CNBC weekend reports. Still, we are off best levels for eminis.

- A headwind from China stocks has been evident, with the CSI 300 off 0.95% at this stage. Weaker industrial profits for Feb (-22.9% y/y ytd) didn't help, while Sinopec posted disappointing earnings. Housing related stocks were also under pressure after weekend reports from a major developer that the housing slump may drag on.

- Hong Kong shares were weaker, but the HSI pared losses of as much as 2% to be back near flat. So, this may help China stocks stabilize as the session continues.

- Sentiment has been less volatile elsewhere, Japan stocks +0.45% in terms of the Topix. The Kospi and Taiex sit slightly lower.

- Trends in SEA are mostly positive, led by Singapore stocks (+1%), but Indonesian and Philippine stocks have lagged.

GOLD: Stronger US Equities Holding Back Bullion, Market Watching Fed Closely

Gold broke through $2000 to a high of $2003.05/oz on Friday on continued banking concerns but it struggled to hold these gains once US equities began to rally. It ended the session down 0.75%. During today’s APAC trading bullion has been range trading and is down 0.1% to $1975.45 following a low of $1970.96, as the S&P e-mini is 0.5% higher. The USD index is down 0.1%.

- Increased recession risks in the wake of recent banking troubles and the implication that there will be less Fed tightening have driven increased positioning in gold. The outlook on these factors remains unclear and so any developments are likely to drive bullion going forward.

- On the weekend, the Minneapolis Fed’s Kashkari said that it was too early to gauge the impact of the banking crisis, while others have said that the Fed’s focus remains inflation, which could mean more tightening.

- The Fed’s Jefferson speaks later on monetary policy (2200 BST). ECB’s Elderson and BoE’s Bailey are also scheduled to speak. US Dallas Fed Index for March prints as well as the German IFO.

OIL: Prices Volatile As Waiting For Clarity

Oil prices have stabilised during the APAC session after falling over 1 percent on Friday. They are off highs reached earlier today but have been in a narrow range. WTI is 0.1% higher to $69.30/bbl, close to the intraday low of $69.13, while Brent is flat at $74.98, close to the $74.80 low. The USD index is down 0.1%. Positive US equity sentiment has failed to boost oil so far today.

- Crude markets are still concerned that central bank tightening and banking troubles will result in recession and reduced energy demand. Fed officials’ recent comments suggest that while it is too soon to gauge the fallout from banking events, for many members the focus remains on inflation and further hikes may be needed. There is still a lot of uncertainty around the growth/inflation and thus the Fed outlook and while that remains the case, oil markets are likely to remain volatile.

- JP Morgan is forecasting that Brent could fall below $60/bbl in the short-term.

- Due to strikes, Exxon Mobil has said that it will begin closing down its Gravenchon refinery in France, which accounts for 20% of the country’s refining capacity. The strikes have also impacted Nigeria, half of its April oil shipments are yet to be sold.

- The Fed’s Jefferson speaks later on monetary policy (2200 BST). ECB’s Elderson and BoE’s Bailey are also scheduled to speak. US Dallas Fed Index for March prints as well as the German IFO.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/03/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 27/03/2023 | 0800/1000 | ** |  | EU | M3 |

| 27/03/2023 | 0845/0945 |  | UK | BOE Treasury Select Committee Hearing on Silicon Valley Bank | |

| 27/03/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/03/2023 | 1340/1540 |  | EU | ECB Elderson Speech at Foreign Bankers' Association | |

| 27/03/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/03/2023 | 1500/1700 |  | EU | ECB Schnabel in Conversation at Columbia University | |

| 27/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/03/2023 | 1700/1800 |  | UK | BOE Bailey Speech at LSE | |

| 27/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/03/2023 | 2100/1700 |  | US | Fed Governor Philip Jefferson |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.