-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Over To Powell

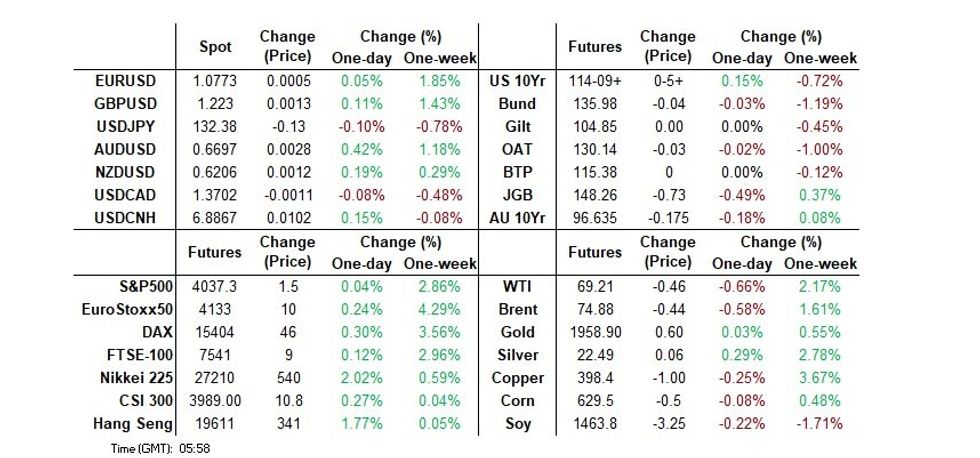

- Cash Tsys are a touch firmer across the curve, with one on the situation surrounding First Republic Bank.

- The AUD is the strongest performer in the G-10 FX sphere, benefiting from improved risk sentiment as regional equities firm and US Treasury Yields tick lower today.

- UK CPI provides the headline data release in London, with a plethroa of ECB speakers due to cross at the ECB Watchers conference. However, the latest Fed monetary policy decision and Chair Powell's post meeting press conference are today's highlight, our preview of that event is here.

MNI Fed Preview - Mar 2023: Balancing Evolving Risks

EXECUTIVE SUMMARY:

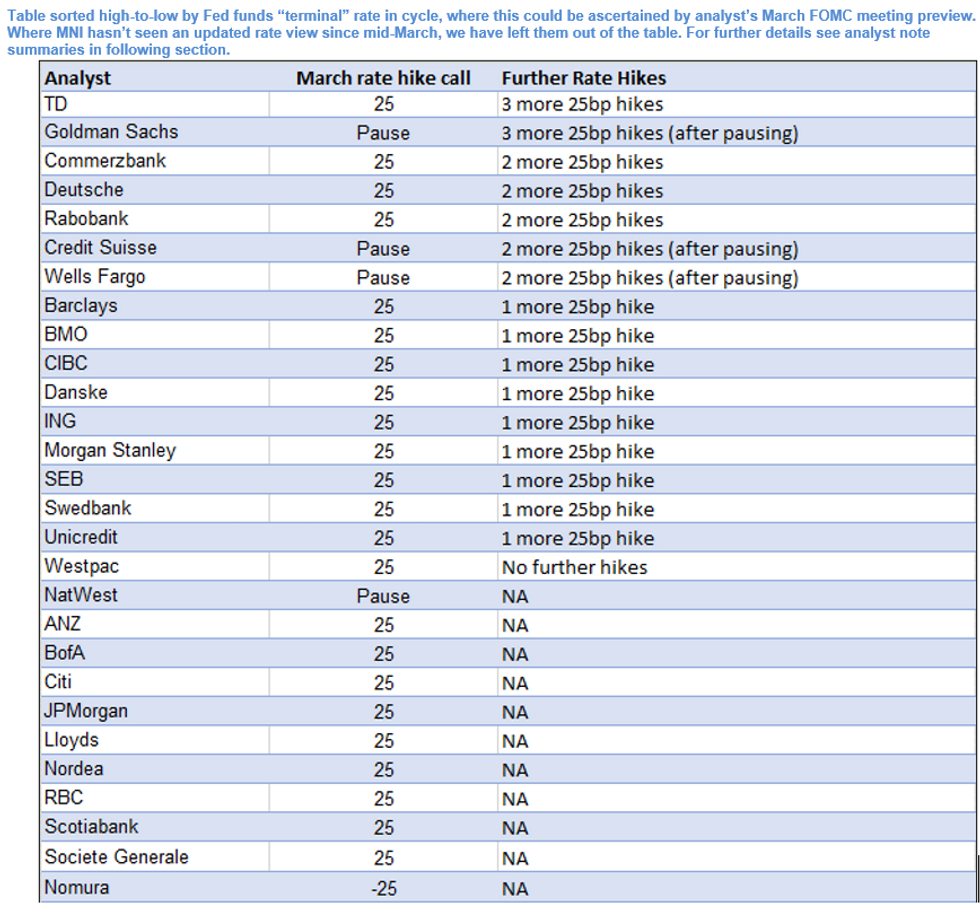

- MNI expects the FOMC to hike the Funds rate by 25bp to 4.75-5.00% at the March meeting, with markets implying a 60% chance of a quarter-point raise and 40% of a pause.

- This will come alongside a new Dot Plot that raises the 2023 median rate expectation by 25bp to 5.4%, and tweak of the Statement's forward guidance to indicate that the terminal rate is nearing.

- Of the 28 analyst previews of the March FOMC decision whose previews MNI have seen, 23 expect a 25bp hike at the February FOMC. 4 see a pause, and 1 sees a cut.

- Recent banking sector volatility will probably result in a tightening of financial conditions that warrants a lower terminal Fed funds rate than may have been foreseen just a couple of weeks ago.

- That said, Powell’s task in the press conference will be to acknowledge risks stemming from banking sector uncertainty while emphasizing that the Fed’s primary focus is the fight against well-above-target inflation.

- FOR THE FULL PUBLICATION PLEASE USE THE FOLLOWING LINK: FedPrevMar2023-1.pdf

US TSYS: Marginally Richer In Asia, Fed In View

TYM3 deals at 114-09, +0-05, with a 0-08 range observed today on volume of ~91k.

- Cash tsys sit 1-4bps richer across the major benchmarks, the curve has steepened

- In early dealing, Asia-Pac participants faded yesterday's cheapening, perhaps using the opportunity to square short positions ahead of today's FOMC rate decision.

- The bid marginally extended on reports that US bank First Republic may need government support to encourage buyers for the troubled bank.

- Further support was seen as USD/JPY was offered after testing resistance level at ¥132.65, the high from 20 March, which spilled over into mild USD weakness. However there was little follow through in the move and tsys ticked away from session highs.

- FOMC dated OIS currently price a 20bps hike for today's meeting, with a terminal rate of ~4.95% seen in May. There are ~65bps of cuts priced for 2023.

- In Europe today UK CPI and ECB speak from Lagarde headlines. However the Fed rate decision and Powells post meeting press conference are today's highlights; our preview is here.

US SWAPTIONS: Implied Vol. Back From Extremes Pre-FOMC But Still Notably Elevated

Implied swaption vol. has edged back from cycle highs ahead of the impending FOMC meeting after both the 3-month/1-year and 3-month/10-year measures surged to the highest levels witnessed since the GFC in the wake of the well-documented tumult in the banking sector.

- Questions surrounding the health of banks has resulted in elevated uncertainty surrounding the immediate future of the Fed hiking cycle, although recent policymaker rhetoric & source reports pointing to U.S. support for the regional banking space has taken the edge off of things, just about.

- The OIS strip is currently pricing in ~20bp of tightening for the impending FOMC decision, a little over 20bp shy of levels seen before the meltdown of SVB (and just over 10bp off the recent lows). Meanwhile, terminal pricing sits around 4.90% after breaching 5.70% pre-SVB, with ~65bp of cuts currently priced in by year end vs. existing terminal rate expectations. Assuming the widely expected 25bp rate hike is delivered on Wednesday focus will quickly move to the guidance deployed by Powell & co. (see our full preview of the event here)

Fig. 1: 3-Month/1-Year and 3-Month/10-Year Swaption Implied Vol.

JGBS: Futures Lead Weakness After Tokyo Holiday, Swap Spread Widening Adds Further Pressure

The early Tokyo cheapening impetus held through Wednesday’s session after Japanese participants returned from Tuesday’s holiday and reacted to a moderation in systemic fears surrounding the global banking sphere.

- That leaves JGB futures the best part of 80 ticks lower into the close, with bears unable to force a test of early session lows despite various rounds of selling pressure becoming evident as the session wore on.

- Cash JGBs sit 1-8bp cheaper with 7s leading the weakness given the move in futures.

- Meanwhile, swap rates are 3-10bp higher as that curve steepens, with swap spreads wider across the term structure, meaning that payside swap flows exerted some pressure on JGBs at different stages of the day.

- Some light richening in U.S. Tsys and the proximity to the impending FOMC decision probably provided some light counter to the broader weakness in JGBS.

- Local news flow was dominated by the loose outlining of a Y2tn fiscal package (drawn up from reserve funds) that will aim to lessen the inflationary burden in Japan (handouts for low-income households and support for those using LNG as an energy source). This comes ahead of next month’s local elections.

- Looking ahead, global matters are set to continue to dominate on Thursday, with a liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs the only point of note on tomorrow’s local docket.

AUSSIE BONDS: Closes At Cheaps Ahead of FOMC

ACGBs closed at session cheaps (YM -18.0 & XM -17.5) as U.S. Tsys give back early Asia-Pac strength ahead of the FOMC decision tonight. ACGBs however underperformed U.S. Tsys highlighting a continuation of yesterday’s post-RBA Minutes selling. While the RBA Minutes for March confirmed that the Board was set to evaluate the case for a pause at the April meeting it failed to provide a fresh local impetus for ACGBs.

- Cash benchmark yields closed at their highs +17-18bp with the AU-US 10-year yield differential +6bp at -22bp.

- Swaps shunt 15-16bp cheaper with EFPs 2-3bp tighter.

- Bills strip closed 12-18bp cheaper with back-end whites leading.

- RBA dated OIS closed 16-24bp firmer for meetings beyond May. April meeting pricing remained at flat.

- On the local data front, Westpac's leading Index signalled below-trend growth with a -0.06% M/M print in February after -0.12% M/M in January.

- The local calendar is light until next week when February retail sales (Tue) and monthly CPI (Wed) are scheduled for release. These two releases were highlighted in the RBA Minutes as important inputs to the April policy decision.

- Attention now turns to tonight’s FOMC policy decision. BBG consensus expects a 25bp hike. The market is pricing an 82% chance of a 25bp hike.

STIR: Canada Could Guide AU

Yesterday the RBA Minutes for the March meeting highlighted that, unlike recent meetings when several options were on the table, only the case for a 25bp increase – the resulting decision - was considered. The Minutes did however show that the Board agreed to evaluate the case for a pause at the April meeting.

- Given the BoC’s decision to pause earlier this month for the first time in this tightening cycle, tonight’s release (30 minutes before the FOMC decision) of the BoC Minutes for the March meeting may be worth a read given that it is likely to provide useful details on the deliberations.

- Also, of interest was Canada’s release of its inflation report for February yesterday. The report showed a further cooling in inflationary pressures with headline CPI rising a lower-than-expected 0.4% M/M and 5.2% Y/Y (0.5% & 5.4% expected).

- While core CPI printed just below 5.0% Y/Y (well above the BoC’s 1-3% target band), the inflation report suggested little urgency for the BoC to move off its pause.

- With RBA-dated OIS pricing no change from the RBA at the April meeting and more than 25bp of easing by year-end, all eyes will focus on February’s monthly CPI release next Wednesday once tonight’s FOMC policy decision is digested.

Fig. 1: AU and CA STIR

Source: MNI – Market News / Bloomberg

AUSTRALIA: Westpac Leading Index Signals Below Trend Growth In 2023

The Westpac leading index for February fell 0.06% m/m after -0.12%. This brought the 6-month annualised rate to -0.9% up slightly from -1.0%, the seventh consecutive negative result. It leads economic activity compared to trend by 3 to 9 months, thus it is signalling below trend growth over 2023. It may have reached a tentative base though, which if the signal is correct could indicate a trough in growth in H2 2023.

- Westpac expects the index to post more negative results, especially given recent overseas banking troubles.

- The index was weighed down by hours worked, less confidence in the labour market, lower commodity prices and falling US IP.

- See Westpac’s press release here.

Source: MNI - Market News/Refinitiv/Westpac

NZGBS: Off Bests Awaiting The FOMC Decision

NZGBs closed off best levels despite stronger U.S. Tsys in Asia-Pac trade. ACGB's underperformance versus U.S. Tsys likely assisted the move away from yield lows. At the close, the 2-year and 10-year benchmarks were respectively 11bp and 9bp higher in yield. NZGBs however outperformed ACGBs with the cash AU/NZ 10-year yield differential +4bp at -89bp. This differential hit a multi-decade low of around -100bp last week after the worse-than-expected Q4 current account deficit.

- Swaps closed at session cheaps with rates 11-14bp higher, implying wider swap spreads, with the 2s10s curve 3bp flatter.

- RBNZ dated OIS pricing closed 4-10bp firmer for meetings beyond April. April meeting pricing remained around 25bp of tightening. Terminal OCR expectations firmed 5bp to 5.22%.

- On the local data front, Q1 NZ Consumer Confidence showed a modest rise in sentiment to 77.7 from 75.6 but remained on the pessimistic side of the ledger.

- The local calendar is light for the remainder of the week with RBNZ Chief Economist Conway’s speech, “The path back to low inflation in NZ”, at the KangaNews DCM forum tomorrow the highlight.

- Attention now turns to tonight’s FOMC policy decision. BBG consensus expects a 25bp hike, although some analysts expect no move. The market is pricing an 82% chance of a 25bp hike.

STIR: NZ Is An Outlier In The $-Bloc

Extending the previous analysis of post-banking crisis developments in $-Bloc STIR to NZ highlights it as a clear outlier.

- Next Meeting: Unlike its Antipodean neighbour, RBNZ dated OIS has basically maintained pricing of a 25bp hike at the April meeting through the eye of the banking crisis storm. Moreover, it has done it despite news that the NZ economy wasn’t running as strongly as the RBNZ was expecting at the end of 2022. Indeed, with Q4 GDP printing -0.6% Q/Q the NZ economy is on recession watch.

- Terminal Rate Expectations: When it comes to terminal rate expectations NZ STIR’s willingness to run its own race is even more noticeable. Whereas AU and US STIR delivered terminal rate expectations declines of 77bp and 75bp respectively, RBNZ dated OIS has only declined 42bp.

- Once again, while NZ pricing may simply reflect pessimism with respect to the inflation outlook, it also likely reflects RBNZ’s reputation as an overshooter of OIS expectations this cycle. Accordingly, the market appears priced on the basis that the RBNZ is likely to want clearer signals that it has done enough in its fight against capacity constraints and inflation before halting tightening.

Figure 1: Terminal Rate Expectations: US, AU & NZ

Source: MNI – Market News / Bloomberg

NEW ZEALAND: Inflation, Rates, Floods Weigh On Consumer Confidence

The Westpac McDermott Miller Consumer Confidence Index rose 2.1points to 77.7 but remained close to Q4’s series low and well below average. Even though both present and expected conditions rose moderately, confidence is likely to weigh on expenditure going forward as higher rates, the housing market correction and cost of living pressures continue to weigh on households. Depressed consumer confidence is likely to be another reason why the RBNZ is likely to slow hikes further to 25bp at its April meeting.

- Confidence in regions hit severely by recent extreme weather was very low.

- Financial pressures are weighing on households with the “current financial situation” component deteriorating to -31.8 from -30.9. However, “expected financial situation” improved to -3.8 from -12.6. Expected flood-related increases in food prices are likely to weigh on consumers’ finances further.

- The impact on households from 450bp of cumulative tightening is yet to be fully felt with around half of mortgages due to be refinanced from pandemic-low rates in the next year.

- Confidence is at depressed levels across age and income groups. They are also very pessimistic around the economic outlook.

- A “good time to buy” improved but remained depressed at -24.2 from -27.1 last quarter, as purchasing power deteriorated.

FOREX: AUD Outperforms, USD Moderately Pressured

The AUD is the strongest performer in the G-10 at the margins, benefiting from improved risk sentiment as regional equities firm and US Treasury Yields tick lower today. The USD is moderately pressured, BBDXY is down ~0.1%.

- AUD/USD prints at $0.6690/95 ~0.4% firmer in todays dealing. The aussie has looked through weakness in Iron Ore prices, futures in Singapore fell ~2.5% to $120/tonne as Chinese steel demand has not picked up despite peak construction season approaching.

- AUD/NZD printed its highest level since 10 March and sits a touch below the $1.08 handle.

- Kiwi is marginally firmer, NZD/USD was pressured after Westpac lowered its 2022-23 NZ milk price forecast to $8.4/kg. However the improving risk sentiment saw the pair firm off session lows to sit ~0.1% higher at $0.6200/05.

- USD/JPY was offered after testing resistance at ¥132.65 the high from 20 March. The pair fell ~0.4% from peak to trough before marginally paring losses to deal at ¥132.45/50.

- GBP is marginally firmer up ~0.1% benefiting from the moderate USD pressure. EUR is little changed and has observed narrow ranges in Asia.

- Cross asset wise, Hang Seng is ~2% firmer and e-minis are up ~0.1%. US Treasury Yields are softer, the 10 Year Yield is down ~2bps.

- In Europe today UK CPI provides the headline. However, the Fed rate decision and Powell's post meeting press conference are today's highlight, our preview is here.

FX OPTIONS: Expiries for Mar22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E916mln), $1.0620-25(E612mln), $1.0660-80(E1.4bln), $1.0715-35(E1.2bln), $1.0775(E646mln), $1.0810(E564mln)

- USD/JPY: Y132.00($519mln), Y132.45-55($826mln), Y134.00($712mln), Y134.22-25($511mln)

ASIA FX: Cautious Tone, THB & PHP Unwind Some Recent Outperformance

Asian FX has been more cautious compared to the majors, where currencies (led by the A$) have firmed against the USD. The positive equity impulse and lower US Tsy yield backdrop hasn't done much to aid sentiment either (although yields are away from lows). Tomorrow, we have the BSP decision in the Philippines (+25bps expected), while the CBC in Taiwan is expected to keep rates unchanged. Singapore Feb inflation is also due.

- USD/CNH has spent most of the session drifting higher, albeit within recent ranges. We were last close to 6.8900, around 0.15% above NY closing levels. The CNY fixing was closer to neutral, while onshore equities are lagging the rest of the region. Northbound outflows have been seen so far today, the first after 7 straight sessions of inflows.

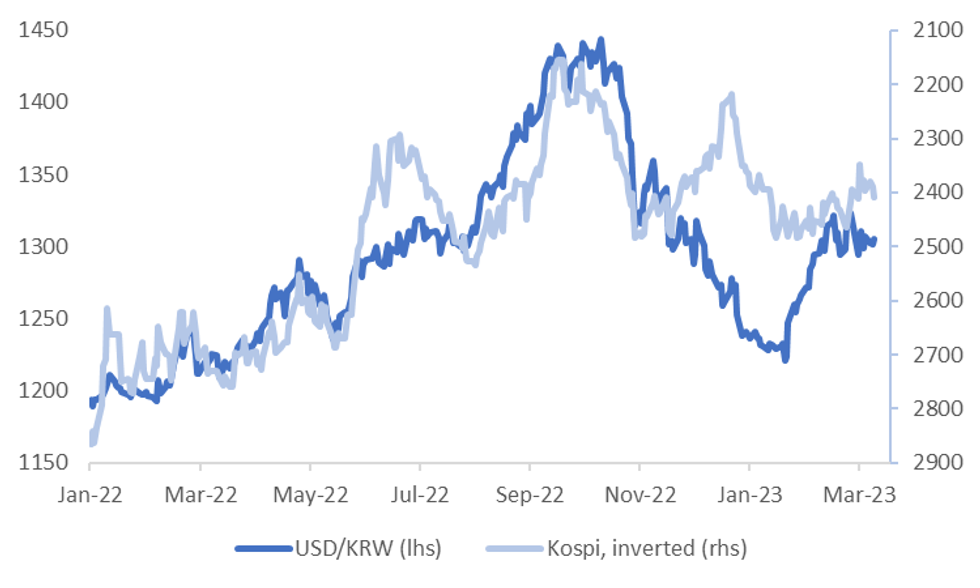

- 1 month USD/KRW has firmed, back near 1305/06, despite the better equity tone. Foreign investor flows have lagged the recent rebound in the Kospi, while USD/KRW and local equities correlation has been weaker in recent weeks compared to 2022.

- TWD has outperformed modestly, with spot USD/TWD back to the 30.50/55 level. The Taiex in +1.6% higher. The CBC is expected to keep rates steady at 1.75% tomorrow.

- The SGD NEER (per Goldman Sachs estimates) printed a fresh cycle yesterday before moderating gains, we are a touch firmer this morning. We currently sit ~0.6% below the top of the policy band. USD/SGD softened yesterday, printing its lowest level since mid-February. The pair broke below its 20-Day EMA on Monday and extended losses through Tuesday's session. This leaves USD/SGD at $1.3360/70, in line with yesterday's closing levels. Tomorrow's February CPI print headlines the week data-wise. The market expects headline and core pressures to remain elevated.

- USD/THB is down from earlier highs (34.56), last near 34.42, still around 0.25% weaker in baht terms for the session. A prominent sell-side name noted solid USD/THB buying throughout the NY session on Tuesday. This could reflect some nerves around the election (likely on the 14th of May), although outflows from Thai bonds were chunky at the start of the week. Equity outflows also continue, -$136.4mn week to date.

- USD/PHP has firmed in the latter part of trading, last near 54.69, back close to levels at the end of Monday. Recent support is evident sub 54.30. The BSP is expected to hike 25bps tomorrow.

KRW: Correlation With Equities Weaker In 2023, Equity Flows Lagging Kospi Rebound

1 month USD/KRW sits close to session highs currently, last near 1305 (highs were close to 1306.30), which is +0.30% on NY closing levels. This comes despite a weaker USD tone against the majors, albeit a modest one, while regional equities are higher (Kospi +0.96%).

- The relationship between KRW and the Kospi has not been as strong in recent months, see the first chart. The current rolling 1 month correlation (in levels) is close to flat. For much of 2022 we were consistently in the -60/-80% range (i.e. higher local equities coincided with lower USD/KRW levels).

- One possible driver of this weaker correlation has been the shift in the National Pension Service (NPS) FX hedging policy. The authority was asked to raise the ratio to 10% late last year to help curb USD demand.

- Also note corporate FX deposits fell sharply in Feb, down nearly $12bn, the sharpest drop since 2012, which also be impact local FX supply/demand dynamics.

- So, it remains to be seen when this correlation (between equities and the KRW) re-asserts itself.

Fig 1: USD/KRW Versus Kospi (Inverted)

Source: MNI - Market News/Bloomberg

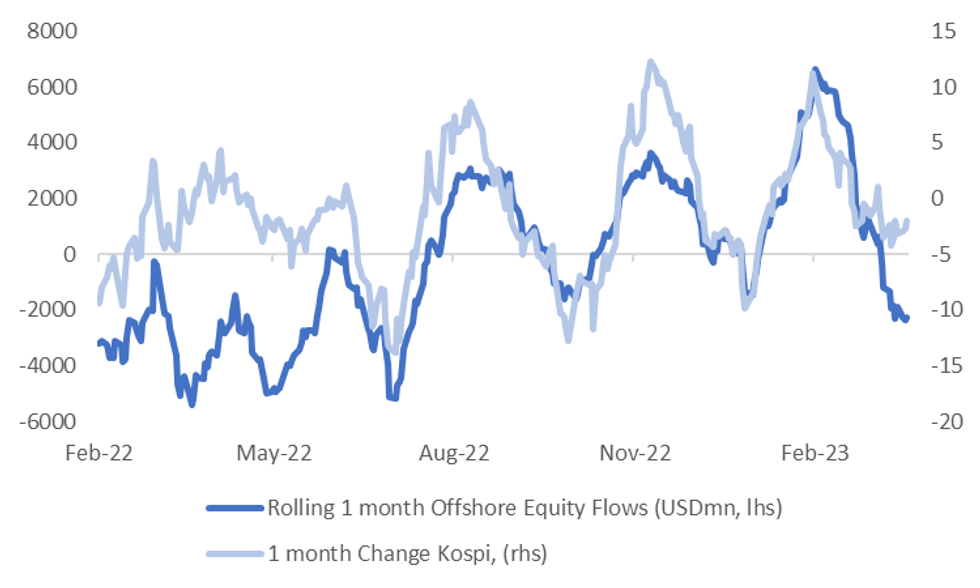

- It's also noteworthy that offshore equity flows have yet to return in a meaningful way, despite the Kospi being on a more stable footing in recent trading, see the second chart below.

- All else equal, this will provide less flow support for the won, than otherwise might be the case. An improved flow picture can aid the won and perhaps help drive a fresh test sub 1300, but the market will likely want to see how the Fed decision unfolds later before flows return in a meaningful fashion.

Fig 2: Kospi (1 month change) Versus Offshore Equity Flows (Rolling 1 month sum)

Source: MNI - Market News/Bloomberg

MNI BSP Preview - March 2023: +25bps Likely

EXECUTIVE SUMMARY

- Continued elevated inflation pressures point to an on-going need for a further tightening in policy conditions. Headline and core inflation pressures remain well above BSP’s 2-4% target band. Headline at 8.6% y/y is showing signs of a tentative peak and the Feb print came in below market expectations, which were at 8.9%. Still, the BSP is likely to be mindful of domestic inflation expectations becoming entrenched if the authorities don’t show a willingness/commitment to bring down inflation pressures.

- In the absence of a scaling back in Fed tightening expectations in recent weeks, we may have seen the consensus expecting a 50bps hike at tomorrow’s policy meeting. This is likely to give the BSP some comfort that it doesn’t need to be as aggressive in further policy adjustments that otherwise might have been the case. Recent comments by Governor Medalla stated though that the central bank’s primary focus remains on price stability, with local financial institutions relatively insulated from offshore developments.

- The other factor that may come into BSP thinking is signs of less positive growth momentum in the first parts of 2023, with the unemployment rate edging higher and export growth cooling sharply. This is unlikely to be enough to deliver an on hold outcome though, given still very elevated inflation pressures, as outlined above.

- Click to view the full preview here:

THAILAND: Elections On May 14, Opposition Well In The Lead

Thailand’s 52 million voters will go to the polls on Sunday May 14 after the House of Representatives was dissolved on Monday. The last election was held on 24 March 2019. Since mid-2021, there has been growing support for the main opposition Pheu Thai Party. In the latest Nida poll released on Sunday and reported in the Bangkok Post, it received the support of 49.75% of respondents and in second was the progressive Move Forward with 17.4%, while the incumbent PPRP had only just over 2%.

- The leader of Pheu Thai, Ms Paetongtarn, had 38.2% support as preferred PM followed by Mr Limjaroenrat from Move Forward on 15.75%. Incumbent PM Gen Prayut received 15.65%. Ms Paetongtarn is the youngest daughter of former PM Thaksin, who was ousted in the 2006 coup.

- The ruling PPRP split at the end of 2022 because of disagreements over interactions with the opposition.

- There have been growing calls this year for volunteers to supervise the election and for the media to report unofficial results in real time, as the Election Commission has decided not to. Last year a government minister warned that protesting could result in elections being cancelled.

- Parties have to present a list of possible PM candidates ahead of the election. Following the election there will be a joint sitting of parliament to choose the next PM. This will include the 250-seat military-appointed senate and so they are likely to have a considerable say in who is the next PM. The House of Representatives has 500 seats and so a candidate needs 376 votes to be approved.

- All candidates need to be registered by April 7.

- The University of the Thai Chamber of Commerce estimates that the election could insert as much as THB120bn (0.7% of 2022 GDP) to the economy as competition is likely to be intense, according to the Bangkok Post.

- The economy is expected to grow 3-3.5% in 2023 helped by returning tourists but stability pre- and post-election will be important for Thailand’s economic outlook.

Source: MNI - Market News/Nida

EQUITIES: Rallying Ahead Of FOMC

Regional equity markets are all tracking higher ahead of the upcoming Fed decision. Gains have been led by HK and Japan markets, although all major bourses are firmer. US equity futures are a touch higher, with eminis remaining close to 2 week highs, last around ~4039. EU futures are modestly higher as well.

- Japan markets have played catch up after returning from yesterday's holiday. The Topix near a 2% gain, with the bank index up around 2.5% at this stage. Sell-side analysts have stated AT1 bond risks are low for the country's banks, which has aided sentiment at the margin.

- The HSI is also close to 2% higher. Gains have been broad based across the bank, property and tech spaces. The headline HSI index is getting close to erasing losses for March.

- China shares have lagged somewhat, the CSI 300 is +0.32% firmer at this stage. Some AI related companies have underperformed as shareholders stated they would offload shares given the recent rally. We have also seen modest northbound outflows in the session so far, after 7 straight sessions of inflows.

- The Kospi (+1%) and Taiex (+1.35%) are both tracking higher as well, although offshore investors in the Kospi have lagged the recent turnaround in the index.

- The ASX 200 is +0.90% higher, led by financial stocks. Higher oil prices have boosted energy related names, although lower iron ore prices has weighed on some part of the materials space.

GOLD: Bullion Stabilises Ahead Of Fed Decision

With the resurgence in risk appetite and reversal of flight-to-quality flows, gold prices have struggled. They fell 2% on Tuesday but have stabilised during APAC trading today and are down 0.1% to $1938.80/oz, close to the intraday low of $1937.98 and off the $1946.29 high earlier. The USD index is close to flat.

- Bullion faced resistance at $2000 and has moved down since reaching a high of $2009.73 on Monday, as markets have calmed following global moves to support the financial system and Treasury yields rose in response. It broke through $1959.70, which opened $1918.30, the March 17 low, as the next support level. Gold remains above key moving averages.

- The focus is on the Fed announcement later today. Economists expect a 25bp hike and the OIS market has about an 80% chance of 25bp priced in. Hawkish comments from the FOMC would be negative for gold prices. ECB President Lagarde speaks and UK CPI data for February prints.

OIL: Crude Down Ahead Of Expected Fed 25bp Hike

Oil prices have been range trading during the APAC session, ahead of the Fed’s decision today, after beginning to recover this week as risk appetite improved. WTI is down 0.6% today to $69.30/bbl, still below $70, after reaching a low of $68.97 and a high of $69.54 earlier. Brent is down 0.5% to $74.95, off the intraday low of $74.62. The USD index is flat.

- The oil market slumped as news of troubled banks hit the wires. But fundamentals seem more positive than recent price action would suggest with output likely to be reduced, possibly in Russia, and demand from China recovering. Uncertainty regarding the economic impact of recent bank problems may continue to cause volatility in the crude market. Price forecasts for H2 2023 are between $80 and $140, according to Bloomberg.

- The focus is on the Fed announcement later today. Economists expect a 25bp hike and the OIS market has just over an 80% chance of 25bp priced in. The EIA releases the official US inventory data today. ECB President Lagarde speaks and UK CPI data for February prints.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 22/03/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 22/03/2023 | 0845/0945 |  | EU | ECB Lagarde Address at ECB and its Watchers Conference | |

| 22/03/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/03/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 22/03/2023 | 0930/1030 |  | EU | ECB Lane in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/03/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2023 | 1345/1445 |  | EU | ECB Panetta in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/03/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 22/03/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.