-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: December CPI Housing & Core Goods in Focus

MNI ASIA MARKETS ANALYSIS: Post-PPI Highs Rejected

MNI EUROPEAN MARKETS ANALYSIS: PMIs Point To Slowing Global IP And Trade Flows

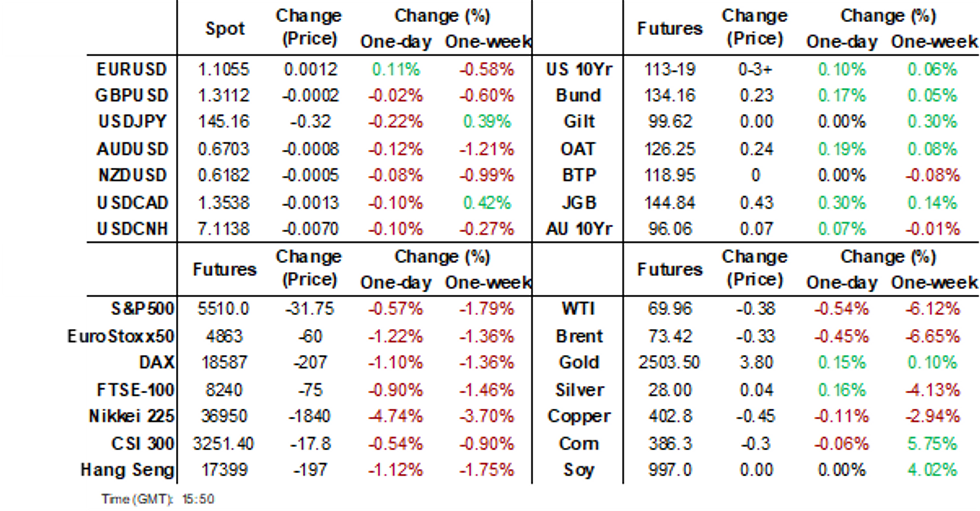

- Asian equity markets have seen significant selling pressure today, as US equity futures broke down through Tuesday lows. Tech related indices saw the largest sell-offs.

- In the FX space, yen and CHF gains were evident, although outperformance was limited against the likes of AUD. US Treasury futures have edged slightly higher today, although we remain within Tuesday's ranges. The 10yr yield is close to 3.80%.

- Oil prices fell sharply on Tuesday and have continued to sell off during APAC today. Global PMI trends point to slowing glboal IP and trade flows, see below for more details.

- Later the Fed’s Beige book is released and July JOLTS job openings, durable goods orders and trade balance print. The ECB’s Elderson speaks, European August services/composite PMIs are released and the BoC decision is announced. Friday’s US payrolls will be a focus for crude markets as they await Fed easing to support demand.

MARKETS

US TSYS: Tsys Futures Edge Higher, 10yr Yield Nears 3.80%

- Treasury futures have edged slightly higher today, although we remain within Tuesday's ranges. There was an earlier small jump after the VIX jumped and equities sold off. Japanese tech stocks were the worst performing, as the yen strengthened.

- TUZ4 is +0-01⅞+ at 103-28⅞ while TYZ4 is +0-05 at 114-05.

- Cash treasury curves have steepened today, although we remain in tight ranges with yields flat to 2bps lower. The 2yr is -0.8bps at 3.855%, while the 10yr is -0.6bps at 3.825%. The 2s10s is little changed today at -3.348.

- Projected rate cut pricing through year end has firmed 1bps vs. early Tuesday levels: Sep'24 cumulative -35.2bp (-34.4bp), Nov'24 cumulative -69.1bp (-67.6bp), Dec'24 -103bp (-102.5bp)

- The major focus this week is on Nonfarms on Friday, later today we will get Trade Balance, MBA Mortgage Applications & JOLTS job openings, while Bank Of Canada rate decision will also be watched.

US EQUITIES: Sell-Off In Equities Largely Focused In Tech

- The recent sell-off in equities has largely been confined to the tech sector, there was a rally into the close on Friday, leading to the S&P ex-Magnificent 7 to record highs.

- In contrast the Magnificent 7 was only able to recover 12% from the August 5 sell-off, before trending lower mid August and we now trade 5.65% off those levels.

- Much of the recent move lower has come from Nvidia falling 14.60% since releasing earnings, although the stock now trades flat m/m. While since August 2nd the worst performing stock has been Alphabet which is down about 5.5%.

S&P ex-Magnificent 7 vs Magnificent 7

GLOBAL MACRO: PMI Points To Slowing Global IP And Trade Flows

Given how interconnected global supply chains are, it is not surprising that the ASEAN S&P Global manufacturing PMI showed a sharp drop in export orders since the global PMI showed the manufacturing sector contracted at a slightly faster pace in August. The JP Morgan global PMI fell to 49.5 from 49.7 in July, the second straight month below 50, signalling that the slowdown in global IP growth begun in Q2 likely continued into Q3.

- The US, Japan, and EU all posted PMIs showing that manufacturing is contracting, while China returned to positive territory and ASEAN and EM as a group showed moderate growth. Indian industry is growing strongly with the PMI at 57.5 in August.

- JP Morgan observed that the manufacturing slowdown was driven by contracting production, orders and employment. Export orders fell for a third straight month and at the fastest pace since December suggesting that global trade flows are likely slowing.

- Global input cost inflation picked up which JP Morgan believes is due to higher shipping costs, which have been boosted by rerouting around southern Africa and away from the Red Sea due to attacks. Some of this increase was passed onto customers.

- Manufacturers are pessimistic re the outlook with confidence in August weak and staying below its historical average, which is reflected in continued inventory drawdowns.

- The drop in production was driven by capex and intermediate goods, while consumer goods posted moderate growth. However, new orders fell in all three categories.

Global growth

JGBS: Cash Bonds Richer Across Curve, BoJ Takata Speech Tomorrow

JGB futures are stronger and near session highs, +41 compared to the settlement levels.

- Outside of the previously outlined Jibun Bank PMIs, there hasn't been much by way of domestic drivers to flag.

- Cash US tsys are slightly richer in today’s Asia-Pacific session after yesterday’s solid risk-off-induced gains. The major focus in the US this week is Nonfarm Payrolls on Friday. Later today we will get Trade Balance, MBA Mortgage Applications & JOLTS job openings, while the Bank Of Canada rate decision will also be watched.

- Cash JGBs are flat to 4bps richer across benchmarks, with the futures-linked 7-year leading. The benchmark 10-year yield is 3.9bps lower at 0.888% versus the cycle high of 1.108%.

- Swap rates are 1-2bps lower out to the 30-year and flat beyond. Swap spreads are mixed.

- Tomorrow, the local calendar will see Labor & Real Cash Earnings and Weekly International Investment Flow data alongside 30-year supply.

- BoJ Board Member Takata will also give a speech in Ishikawa.

AUSSIE BONDS: Richer & Near Highs, RBA Bullock Speech Tomorrow

ACGBs (YM +6.0 & XM +6.5) are holding stronger and near session highs.

- Q2 GDP was close to expectations rising 0.2% q/q to be up 1% y/y, the slowest since the Covid-impacted Q3 2020 and excluding that period Q4 1991. As expected, growth was driven by public demand and net exports, while private consumption, inventories and private capex were all drags. The headline result was in line with the RBA’s August forecast. Accordingly, it shouldn't impact the current ‘on hold’ stance.

- Cash US tsys are slightly richer in today’s Asia-Pacific session after yesterday’s solid risk-off-induced gains. The major focus in the US this week is Nonfarm Payrolls on Friday. Later today we will get Trade Balance, MBA Mortgage Applications & JOLTS job openings, while the Bank Of Canada rate decision will also be watched.

- Cash ACGBs are 5-6bps richer, with the AU-US 10-year yield differential at +11bps.

- Swap rates are 6-8bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing flat to +7.

- RBA-dated OIS pricing is 1-9bps softer across meetings. A cumulative 19bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Trade Balance data and a speech from RBA Governor Bullock at the Anika Foundation Lunch.

AUSTRALIA DATA: Public Demand Keeps Growth Positive

Q2 GDP was close to expectations rising 0.2% q/q to be up 1% y/y, the slowest since the Covid-impacted Q3 2020 and excluding that period Q4 1991. As expected growth was driven by public demand and net exports, while private consumption, inventories and private capex were all drags. The headline result was in line with the RBA’s August forecasts and so we don’t expect its on hold stance to change at this point.

Australia GDP %

- Private consumption detracted 0.1pp from growth falling 0.2% q/q to be up only 0.5% y/y, lower than the RBA’s 1.1% forecast. The weakness was concentrated in discretionary spending, especially air travel, following a strong quarter in Q1. The household savings ratio was unchanged at 0.6%.

- Government spending rose 1.4% q/q to be up 4.7% y/y, the highest since Q2 2022, and contributed 0.3pp to growth. The strength was broad based across federal and state jurisdictions. This drove the 0.2% q/q rise in domestic demand, which slowed to 1.5% y/y from 2.4%.

- As expected, private capex was weak detracting 0.1pp from growth for the second consecutive quarter driven by non-dwelling construction and machinery & equipment. Private GFCF fell 0.6% q/q to only +1% y/y down from 2.5%, slightly below the RBA’s forecast. Inventories detracted 0.3pp concentrated in the industrial sector.

- While net exports contributed 0.2pp to growth, export growth was lacklustre rising only 0.5% q/q and 0.1% y/y, with the strength from education services, while imports fell 0.2% q/q but are still up 5.2% y/y.

- GDP per capita fell 0.4% q/q, sixth consecutive decline.

Australia domestic demand y/y%

Source: MNI - Market News/ABS

NZGBS: Closed Richer & Near Session Highs

NZGBs closed 7-9bps richer across benchmarks as global bond markets reacted to the current bout of risk-off sentiment.

- NZ July New Lending rose 19% m/m in July says RBNZ.

- NZ commodity export prices rose 2.1% from a month earlier in August, with dairy seeing the largest increase, according to the ANZ Commodity Price Index report.

- Cash US tsys are slightly richer in today’s Asia-Pacific session after yesterday’s solid risk-off-induced gains. The major focus in the US this week is Nonfarm Payrolls on Friday. Later today we will get Trade Balance, MBA Mortgage Applications & JOLTS job openings, while the Bank Of Canada rate decision will also be watched.

- Swap rates are 9-10bps lower, with the 2s10s curve little changed.

- RBNZ-dated OIS pricing is 1-8bps richer across 2025 meetings. A cumulative 73bps of easing is priced by year-end.

- Tomorrow, the local calendar will see CoreLogic Home Values alongside the NZ Treasury’s planned sale of NZ$225mn of the 4.50% May-30 bond, NZ$225mn of the 4.25% May-34 bond and NZ$50mn of the 1.75% May-41 bond.

FOREX: Safe Havens Outperformance Limited, Equity & Oil Trends Eyed

The USD BBDXY index sits down a touch from end Tuesday levels, last near 1235.5, off around 0.15%. In the G10 space, EUR and CHF are a touch higher, likewise for JPY. AUD and NZD are off slightly but up from session lows.

- Early focus was on USD/JPY downside, with the pair seeing a brief dip sub 145.00 but we quickly recovered (the pair last near 145.30). An option expiry for NY cut at 145.00 later may be influencing spot trends today.

- Still, FX options volumes has been dominated by USD/JPY downside, with a number of $100mn notional trades going through per DTCC (strikes between 140-145.00)

- We have seen weaker US equity futures, breaking below Tuesday lows, but after that sentiment stabilized somewhat. Eminis last -0.50%, Nasdaq futures off 0.63%. WTI prices slipped under $70/bbl, but follow through has been limited. US yields are relatively steady.

- This has likely helped curb risk off trends in the FX space. AUD/JPY got to lows near 97.00, but sits back near 97.50 in latest dealings.

- AUD/USD got to lows of 0.6686, but sits back above 0.6700 now. Q2 GDP headline figures for Australia were close to expectations, albeit with positive revisions. Still, the private domestic economy was quite weak. NZD/USD holds sub 0.6185 in latest dealings.

- Looking ahead we have ECB speak and the Bank of Canada decision (a 25bps cut is expected). In the US the focus will be on the JOLTS jobs data.

JPY: Little Changed, But FX Options Volumes Dominated By USD/JPY Downside

USD/JPY sits little changed versus end Tuesday levels in latest dealings. The pair was last 145.30/35. Earlier lows were at 144.89, but the dip sub the 145.00 figure level proved to be fleeting. There is a option expiry at 145.00 for NY cut later, which may be influencing spot.

- US equity futures are lower but away from session troughs, so that may be imparting some stability for yen. US yields are also off session lows.

- Still, FX options volumes for Wednesday to date has been dominated by JPY. USD/JPY has accounted for 41% of total trade volumes in the space per DTCC. We aren't outside of historical norms though from a volumes standpoint.

- Looking at the detail, the larger volume deals (notional of 100mn USD) have been skewed towards USD/JPY puts. Indeed there have been 5 deals with strikes between 140-145.00 done for this notional size.

- In terms of risk reversals, the 1 month has rolled back over, last near -1.90, against earlier September highs near -1.50. We are well above earlier August lows though close to -3.84. The one week risk reversal is back to -1.45, also off recent highs.

ASIA STOCKS: China & HK Equities Outperform Wider Asian Markets

China and Hong Kong equities are lower today, though they are faring better than other Asian markets. The CSI 300 is down less than 0.5%, making it a relative outperformer, while the HSI has dropped about 1.1%. The decline in these markets comes in the wake of a tech-led selloff on Wall Street, exacerbated by concerns over the US economy and weaker factory activity data. Earlier Caixin PMI missed estimates, while S&P Global Hong Kong PMI dropped slightly to 49.4 vs 49.5 prior.

- Major Indices in the region are holding up much better than the wider Asian markets in Hong Kong the Mainland Property Index is down just 0.62%, HS Property Index is down 1%, while in China the CSI 300 Real Estate Index is 1% lower, CSI 300 Tech is 0.90% lower, whiel the CSI EV Index is trading 1.30% higher.

- China's services sector grew less than expected in August, with the CAIXIN PMI Services falling to 51.6 from 52.1 in July, missing the forecast of 51.8. The IMF has pointed out that China's services sector is an "underutilized driver of growth" compared to peers. Despite policy efforts to support the slowing economy, the impact has been minimal, and concerns are growing, especially with the ongoing decline in the real estate sector negatively affecting consumer behavior.

- Some Chinese banks have experienced an increase in NPLs in their retail lending businesses during the first half of the year, though the overall asset quality remains stable, according to China Securities Journal. Competition for consumer and business loans has intensified, with nine banks reporting a rise in NPL ratios compared to the end of last year. Bank of Xi'an saw its NPL ratio increase by 0.37 percentage points to 1.72% by the end of June. Despite these rises, the risks in retail loans are considered manageable, per BBG.

- There is little else on the calendar for the region this week with China CPI expected on Monday.

ASIA PAC STOCKS: Equities Track US Peers Lower, Tech Hit Hardest

Asian equity markets are under significant pressure today, with major indices experiencing steep declines driven by a combination of Wall Street's sharp selloff and a stronger yen, which is dampening demand for Japanese exports. The Nikkei 225 and Topix are leading the downturn, dragged down by semiconductor stocks like Renesas and Socionext after Nvidia's extended losses following a US Justice Department subpoena. Broader concerns about the global economy, fueled by disappointing US manufacturing data and sliding oil prices, are exacerbating the risk-off sentiment across the region. Other major markets, including South Korea, Taiwan, and Australia, are also seeing substantial losses as investor focus shifts to potential economic slowdowns and higher borrowing costs.

- Japanese equities are lower across the board, consumer staples is the top performing sector with 22% of stocks trading higher, the TOPIX is down 2.75%, with banks contributing the most to the losses the TOPIX Banks Index is down 3.70%. The Nikkei 225 is trading down 3.30%, with tech stocks the largest contributors to the fall.

- Taiwan's Taiex is trading 3.60% lower today, with TSMC down 4.15% & Hon Hai down 2.70% contributing the most to the losses. Tomorrow we have Taiwan's CPI, which is expected to show a drop to 2.27% for August from 2.52% in July according to bbg consensus.

- South Korean equities are faring slightly better than Japan & Taiwan, although still struggling. Samsung is off 2.76%, SK Hynix is off 6.80%, while the KOSPI is down 2.60% and the KOSDAQ is down 3.15%. Tomorrow we have 2Q GDP with consensus at 2.3% in line with Q1.

- Australia's ASX 200 is down 2%, Mining and energy shares are among the hardest hit, reflecting worries about demand and oversupply in commodities, while Financials are tracking Asian peers lower. Earlier, Q2 GDP was close to expectations rising 0.2% q/q to be up 1% y/y, the slowest since the Covid-impacted Q3 2020 and excluding that period Q4 1991.

ASIA EQUITY FLOWS: Asian Equity Flows Muted, SK Continues To See Outflows

- South Korea: South Korea experienced an outflow of $258m on Tuesday, resulting in a net outflow of $906m over the past five trading days. The region has seen 11 of the past 12 days of outflows as investors continue to sell tech stocks. Year-to-date, the country has accumulated substantial inflows totaling $16.17b. The recent 5-day average shows an outflow of $181m, which is below the 20-day average of -$55m, while the 100-day average remains positive at $28m.

- Taiwan: Taiwan recorded a small inflow of $79m on Tuesday, ending 6 days of outflows although we have a net outflow of $1.34b over the past five trading days. Year-to-date, Taiwan has seen outflows totaling $9.69b. The 5-day average shows an outflow of $268m, which is below the 20-day average of $24m, and in line with the 100-day average of -$144m.

- India: India saw an inflow of $687m on Monday, leading to a net inflow of $3.1b over the past five trading days. The Nifty 50 has made new record highs over the past week. Year-to-date, India has accumulated inflows totaling $18.78b. The 5-day average is $633m, well above the 20-day average of $142m, and the 100-day average remains slightly positive at $47m.

- Indonesia: Indonesian equities recorded an inflow of $8m on Tuesday, contributing to a net inflow of $1.03b over the past five trading days.. Year-to-date, Indonesia has accumulated inflows totaling $1.92b. The 5-day average inflow is $207m, above the 20-day average of $94m, and well above the 100-day average of $2m.

- Thailand: Thailand experienced an outflow of $20m on Tuesday and has now seen three straight session of outflows resulting in a net outflow of $77m over the past five trading days. Year-to-date, Thailand has seen outflows amounting to $3.51b. The 5-day average shows an outflow of $15m, compared to the 20-day average of -$9m, and the 100-day average of -$16m.

- Malaysia: Malaysia continues to record inflows with a $45m on Tuesday, contributing to a net inflow of $366m over the past five trading days. Year-to-date, Malaysia has seen inflows totaling $754m. The 5-day average inflow is $73m, above both the 20-day average of $35m and the 100-day average of $10m.

- Philippines: The Philippines recorded no inflow on Tuesday, we have seen a net inflow of $30m over the past five trading days. Year-to-date, the Philippines has experienced outflows totaling $316m. The 5-day average inflow is $6m, below the 20-day average of $8m and above the 100-day average of -$5m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -258 | -906 | 16170 |

| Taiwan (USDmn) | 79 | -1342 | -9690 |

| India (USDmn)* | 687 | 3104 | 18776 |

| Indonesia (USDmn) | 8 | 1033 | 1916 |

| Thailand (USDmn) | -20 | -77 | -3512 |

| Malaysia (USDmn) | 45 | 366 | 754 |

| Philippines (USDmn) | 0 | 30 | -316 |

| Total | 540 | 2208 | 24099 |

| * Up to Date 02-Sep-24 |

OIL: Crude Continues To Fall With Little To Support Prices

Oil prices fell sharply on Tuesday and have continued to sell off during APAC today. WTI has been trading below $70 and is currently down 0.6% to $69.92/bbl, today’s low of $69.72 is only a touch above the 2024 trough in early January. Brent is down 0.5% to $73.38/bbl after a low of $73.14 – a new trough for 2024 and the lowest since mid-2023. The USD index is down 0.1%.

- Weak risk sentiment has weighed again on oil prices but so too have persistent concerns over excess supply if OPEC begins to gradually increase output from October. But if prices remain around these levels, then there will likely be pressure for the group to delay the unwinding of its output cuts. It has voiced flexibility around the plan.

- Libya’s central bank believes that an agreement can be reached soon that will allow the country’s oil output to resume to usual levels after a political dispute cut it sharply.

- Algorithmic selling has exacerbated the sharp move down in oil prices seen this month.

- With the market so focussed on supply/demand developments, the US industry inventory data out later today and the official EIA numbers on Thursday are likely to be watched closely. Recently they have been signalling robust US demand.

- Later the Fed’s Beige book is released and July JOLTS job openings, durable goods orders and trade balance print. The ECB’s Elderson speaks, European August services/composite PMIs are released and the BoC decision is announced. Friday’s US payrolls will be a focus for crude markets as they await Fed easing to support demand.

GOLD: Hovering Just Below $2500

Gold is slightly stronger in today’s Asia-Pac session, after closing 0.3% lower at $2492.91 on Tuesday.

- Bullion hovered just under the $2500 mark as the market succumbed to a broad-based sell-off in commodities on Tuesday stoked by growth concerns.

- US Treasury yields declined alongside lower US equities, with the 2-year yield reaching a low of 3.84%, before finishing 5bps lower at 3.86%. The yield curve flattened modestly with the 10-year yield down 7bps to 3.83%.

- Projected US rate cut pricing through year-end firmed 1-2bps vs. Friday close levels: Sep'24 cumulative -35bps (-33bps), Nov'24 cumulative -68bps (-66bps), Dec'24 -102bps (-100bps).

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, trend conditions in gold remain bullish, with focus on a climb towards $2,536.4 next, a Fibonacci projection. Initial support to watch lies at $2,484.0, the 20-day EMA, which was pierced earlier in the session. A pullback would be considered corrective.

CHINA DATA: CAIXIN PMI Services down in August

- China’s services activity grew less than anticipated today’s CAIXIN PMI Services Release showed.

- CAIXIN China PMI Services Release declined to 51.6 in August, down from 52.1 in July and survey forecast of 51.8.

- The IMF has noted in research that China’s services sector relative to peers, is an ‘underutilized driver of growth’.

- Policy efforts this year to support the slowing economy have appeared yet to be making an impact and today’s data only adds to the concern.

- Weighing down on all parts of the economy has been a declining real estate sector which has continued to negatively impact consumer behavior over recent years.

ASIA: Manufacturing Activity Slows As Falling Export Orders Weigh On The Sector

The S&P Global ASEAN manufacturing PMI moderated to 51.1 in August from 51.6, the lowest since April. The slowdown in growth was driven by slower output, orders and job shedding. While four of the seven countries in the region had PMIs in expansionary territory, only Singapore saw a rise in August.

- While total orders continue to grow, they were at their slowest in 8 months and driven by domestic demand as the contraction in export orders persisted, which S&P Global said was “sharp”. This is weighing on output growth, which was its lowest in four months, resulting in job cuts and inventories rundown at a faster rate.

- Input cost inflation moderated and with softer demand so did selling inflation. Both are running below the series averages. Central banks in the region are expected to ease monetary policy by year end as inflation is contained.

- Despite subdued current conditions, optimism re the outlook for the year ahead improved to its highest in six months but remains below average.

- Singapore was the only country to see an increase in the PMI as it rose to 57.6 from 57.2. Manufacturing activity in Vietnam, Thailand and the Philippines grew but at slower rates, while Indonesia, Malaysia and Myanmar contracted.

ASEAN S&P Global manufacturing PMIs

MALAYSIA: MNI BNM Preview - September 2024: Firmly On Hold

- Bank Negara Malaysia (“BNM”) is likely to remain on hold at tomorrow’s policy meeting. The BNM is in a fortuitous position whereby there is limited need to cut rates given the trajectory of the economy. The data following the last BNM meeting has surprised to the upside.

- There remains some upside potential for CPI given the shift in diesel subsidies, though, this risk now appears manageable given we are at the lower end of the BNM’s target for the year. For now, given the slowing growth outlook for many of Malaysia’s neighbours (particularly China), the upside risks to CPI appear manageable, especially with the strength of the currency against the dollar.

- Full preview is here:

ASIA FX: NEA FX Resilient To Equity Losses

North East Asia FX trends are similar to last risk off period in early August, with the majority of the negative spill over seen in equities rather than FX. Tech sensitive markets like Taiwan and South Korea are seeing sharp losses, off nearly 4% for the Taiex and nearly 3% for the Kospi. We are away from session lows for both indices though.

- Spot KRW and TWD are only modestly weaker though. USD/KRW sits little changed, last near 1342, with intra-session Tuesday highs just above 1345 remaining intact. We haven't been able to breach 1340 on the downside.

- USD/TWD is up more, the pair last near 32.16, off 0.25% in TWD terms. The prospect of more equity outflows from Taiwan a potential near term headwind. USD/TWD spot is now back above its 20 and 200-day EMAs.

- USD/CNH is back sub 7.1100, outperforming the USD/JPY weakness at the margins for Wednesday trade so far. The USD/CNY fixing was close to neutral. The Caixin services PMI for August was 51.6 versus 51.8 forecast, but didn't impact sentiment. Onshore equities are down but only modestly at this stage (CSI 300 off 0.40% at the lunch break).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/09/2024 | 0700/0900 |  | EU | ECB's Elderson at Joint European Banking Authority and ECB conference | |

| 04/09/2024 | 0900/1100 | ** |  | EU | PPI |

| 04/09/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/09/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 04/09/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 04/09/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/09/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/09/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 04/09/2024 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/09/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 04/09/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 04/09/2024 | 1400/1000 |  | US | MNI Connect Video Conference on the U.S. Fiscal Policy Outlook | |

| 04/09/2024 | 1430/1030 |  | CA | BOC Governor Press Conference | |

| 04/09/2024 | 1800/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.