-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Through First Support

MNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI EUROPEAN MARKETS ANALYSIS: Pre-BoJ Adjustments Dominate Overnight

- JGB futures were more contained than in recent sessions on Tuesday, consolidating the overnight session uptick after a pull back from best levels.

- The BBDXY has tracked recent ranges through today's session. We got above 1229 but found selling interest at this level, which is consistent with recent sessions. We are back at 1226.70 now, little changed for the session. Yen has underperformed slightly, particularly against AUD and NZD.

- Looking ahead, UK employment figures will cross before U.S. traders return and Canadian CPI will be published. We will also get Fedspeak from Williams.

MNI BoJ Preview - January 2023: Stick Or Twist

EXECUTIVE SUMMARY

- The recent round of well-documented press speculation, indicating that the BoJ will conduct a review of the side effects of its ultra-loose policy settings at the upcoming monetary policy meeting, coupled with the shrouding of trust in the Bank’s communication channels after last month’s surprise YCC tweak, has led to a meaningful market test of the BoJ’s will ahead of the meeting.

- We would suggest that the Bank will have a preference towards holding policy settings steady and lean into this as our baseline pre-meeting assumption.

- Expect a mark-up in underlying inflation forecasts, although the Bank will not suggest that its inflation goal has been met, given the cost-push nature of the move in inflation and the want to foster a meaningful wage growth.

- Click to view full preview: BOJ Preview - January 2023.pdf

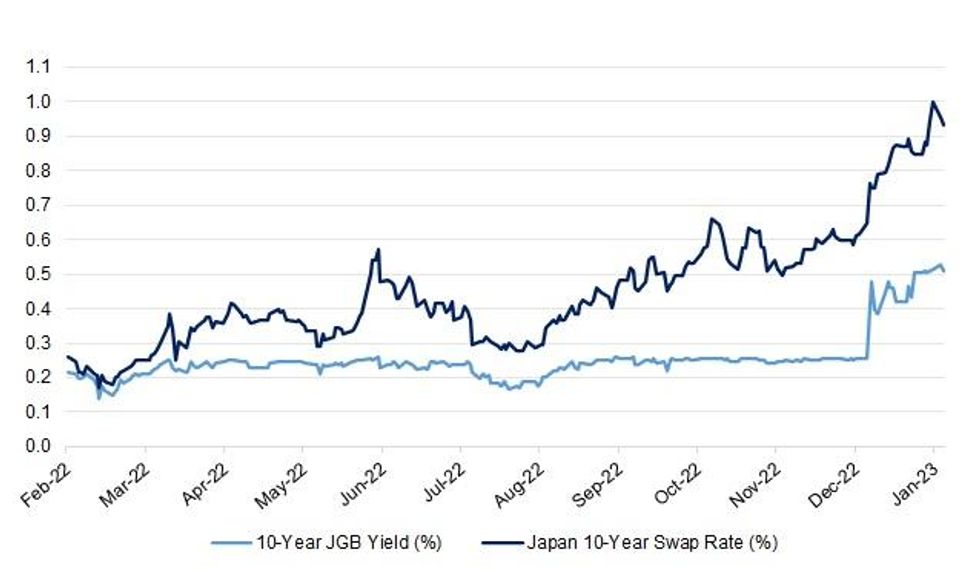

Fig. 1: 10-Year JGB Yield Vs. Japan 10-Year Swap Rate

Source: MNI - Market News/Bloomberg

US TSYS: Yields Firm As Curve Bear Steepens

TYH3 deals at 114-20, -0-04+, in the middle of its 0-08+ Asia-Pac range on volume of ~61K.

- Cash Tsys have bear steepened, running 1-5bps cheaper across the major benchmarks.

- Tsys were modestly richer in early trade as an offer in USD/JPY pressured the greenback in early dealing aiding the space, after an initial adjustment cheaper, catching up to futures moves after the elongated weekend.

- Later as Chinese cash markets opened, the USD was bid, U.S. equity futures reversed early gains and Tsys cheapened albeit without any overt headline driver.

- The cheapening marginally extended as Chinese Q4 GDP was firmer than expected, as were monthly economic activity readings.

- The flow side was highlighted by a block seller in UXY (901 lots).

- In Europe today national CPI data from Germany provides the highlight. Further out we have Empire Manufacturing as well as CPI data from Canada. Elsewhere, Fedspeak from NY President Williams is on the wires late in today's NY session.

JGBS: Mixed, Pre-BoJ Adjustments Dominate, Long End Firms Again

JGB futures were more contained than in recent sessions on Tuesday, consolidating the overnight session uptick after a pull back from best levels, heading into the bell +15, with pre-BoJ position adjustments front and centre.

- Yields are mixed across the curve, running 1bp cheaper to 4bp richer, with a flattening element apparent as the long end outperforms for a second consecutive session (albeit after last week’s dramatics).

- Swap rates are lower across the curve with 7s leading that move.

- Note that there are signs of JGB futures basis trades being deployed given the well-documented market dislocations.

- Unlike JPY FX implied vol., JGB implied vol. (as observed via the S&P-JPX JGB VIX metric), although elevated, has not breached its post-COVID peak in the run up to the BoJ’s monetary policy meeting,.

- The latest liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs was smoothly digested, likely aided by pre-BoJ short cover.

- Comments from Japanese Finance Minister Suzuki failed to move the needle as he went over old ground re: debt financing costs, purposefully steering clear of meaningful comments re: the BoJ.

- The aforementioned BoJ decision provides the major macro risk event on Wednesday (see our full preview of that event here). Elsewhere, final industrial production readings and core machine orders data round out Wednesday’s local docket.

AUSSIE BONDS: Light Twist Steepening

Aussie bonds failed to provide any meaningful movement on Tuesday, and were subjected to some light twist steepening pressure, leaving YM +1.0 & XM -1.0 at the close, while wider cash ACGBs ran 1.5bp cheaper, pivoting around the 7-Year zone.

- An early, light bid seemed to be aided by receiver side flow in swaps as EFPs tightened a little vs. yesterday’s closing levels, before a pre-Chinese data cheapening move in U.S. Tsys saw the space off best levels.

- The Chinese data deluge saw beats across the board, headlined by firmer than expected Q4 GDP data, then applied some modest pressure.

- ACGBs then edged off of cheaps ahead of the close.

- A$ denominated supply, from both offshore and onshore names continued to tick over, focused on the belly of the curve.

- Bills were -2 to +1 through the reds as the strip twist flattened, with RBA-dated OIS continued to show ~20bp of tightening for next month’s meeting, alongside a terminal OCR somewhere below 3.70-3.75%.

- Looking ahead, tomorrow’s local docket is empty, with the broader macro focus set to fall on the latest BoJ decision given the recent, well-documented challenge of the Bank’s YCC parameters (which were only tweaked last month, in a move that caught most off guard).

AUSTRALIA: No January RBA Meeting Boosts Consumer Sentiment

Westpac’s measure of consumer confidence rose 5% m/m, the second consecutive month increase, in January to 84.3, the highest level since September and highest monthly rise since April 2021. But according to Westpac, the index is still in the lowest 10% of observations since the mid-1970s. While it remains depressed, it appears to have reached a trough, which should ease some of the RBA’s concerns.

- The survey was conducted during the second week of January. The fact that there wasn’t a January RBA meeting and thus no further rate increases this month probably boosted consumer confidence. This improvement may prove temporary as a further 25bp hike is expected at the February 7 meeting.

- The share of those expecting rates to rise by at least another 1% fell to 48% in January from 60% in November. This is likely to fall further as the RBA approaches the end of its tightening cycle and inflation pressures ease through 2023, which is likely to help confidence recover, as reflected by the more forward looking components of the Westpac survey.

- Petrol prices fell 3.3% during the survey week, which may have also helped to drive the improvement. The release of higher than expected CPI inflation didn’t appear to impact confidence.

- Unemployment expectations have been volatile recently but fell 8.4% m/m in January and are 16.5% below their long-term average pointing to ongoing tight labour market conditions.

- Through the volatility, house price expectations are resilient. They fell 10.3% in January after surging 27.6% last month and are still 7.7% above the August to November average.

Source: MNI - Market News/Refinitiv/Westpac

NZGBS: Little Changed Come The Bell After Chinese Data Unwound Early Richening

An early bid in NZGBs, which seemed to be linked to receiver side swap flows out to 5s, some gloomy details in the latest QSBO from the NZIER and some light richening in U.S. Tsys, has faded, with a firmer than expected round of Chinese data, headlined by the Q4 GDP reading, the reason for the pull back from best levels. NZGBs had been stickier when it came to the pre-data bid, with Tsys pulling away from best levels into the release.

- That left the major NZGB benchmarks running 0.5bp richer to 1.0bp cheaper at the bell, with the curve twist steepening as it pivoted around 5s.

- The twist steepening on the swap curve was a little more pronounced, with benchmark rates there running 2.5bp lower to 2bp higher, leading to mixed swap spread performance.

- Major near-dated RBNZ OIS pricing was little changed, leaving ~62bp of tightening showing for next month’s gathering, alongside a terminal OCR of just over 5.40%.

- Looking ahead, REINZ house price readings and card spending data headline the local docket on Wednesday.

FOREX: USD Sticks To Familiar Ranges, JPY Underperforms Against NZD & AUD

The BBDXY has tracked recent ranges through today's session. We got above 1229 but found selling interest at this level, which is consistent with recent sessions. We are back at 1226.70 now, little changed for the session. Yen has underperformed slightly, particularly against AUD and NZD.

- USD/JPY got to 129.15, which was above Monday's high, but we are now back to 128.60/65, slightly higher for the session. US cash Tsy yields are firmer, mostly at the back end, +2.9bps for the 10yr to 3.53%, as cash trading resumed following the US MLK holiday.

- US equity futures are weaker, but at this stage this hasn't weighed on AUD and NZD materially. AUD/USD is back to 0.6970, slightly down on session highs, which came after China data beat expectations. The better data hasn't inspired Asian FX though, while commodity prices are mixed. Iron ore is steady, close to $120/ton, but copper is off 2% from Friday closing levels to $413 (CMX basis).

- NZD/USD is back to 0.6400, +0.30% firmer, but has run out of momentum above this level in recent session.

- EUR/USD was supported towards 1.0800, now back at 1.0830. The ECB's Lane said in the FT that a policy rate around 2% is in the ballpark from a neutral standpoint.

- Looking ahead, UK employment figures will cross before US traders return and Canadian CPI will be published.

JPY: USD/JPY Correlations With Swap Rates Running High Ahead Of Tomorrow's BoJ Outcome

Much uncertainty rests on tomorrow's BoJ meeting. As this MNI piece highlighted, it is likely the BoJ is considering a number of options (see this link for more details). For USD/JPY, market reaction in the rates space is likely to be watched closely. At the moment, USD/JPY correlations with swap spreads are slightly higher than equivalent spreads in the government bond yield space, particularly at longer tenors.

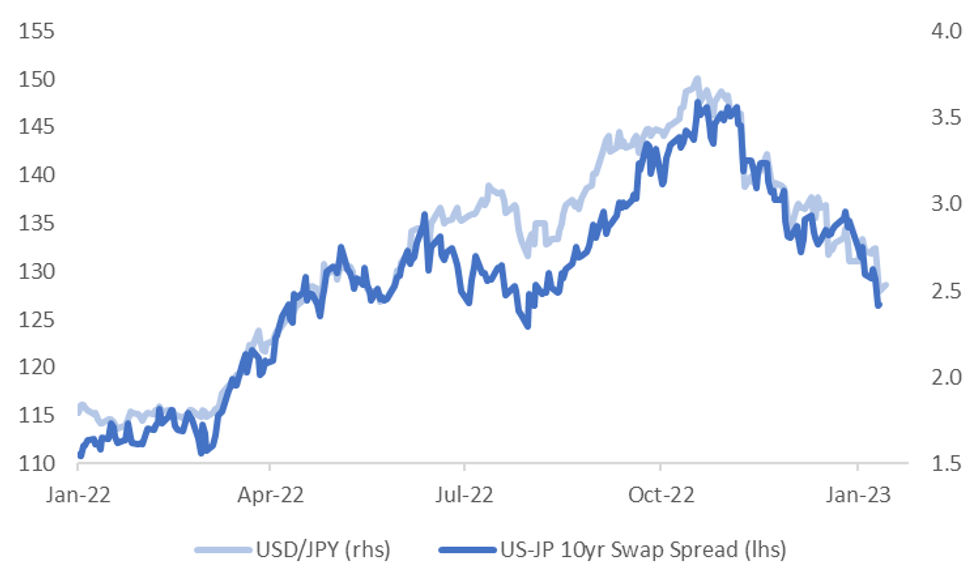

- This is perhaps not too surprising, given the 10yr JGB yield is being capped by BoJ actions. At present the US-JP 10yr swap spread correlation with USD/JPY sits at 66% for the past month. The first chart below plots USD/JPY versus this spread. The equivalent correlation with the 10yr government bond yield spread is slightly lower at 54%.

Fig 1: USD/JPY & US-JP 10yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

- At the 5yr tenor, the correlation with swap spreads is the same, at 66%, but slightly lower in the government bond yield space at 53%. At the 2yr tenor, correlations dip below 50% for the past month for both swaps and bond yield spreads.

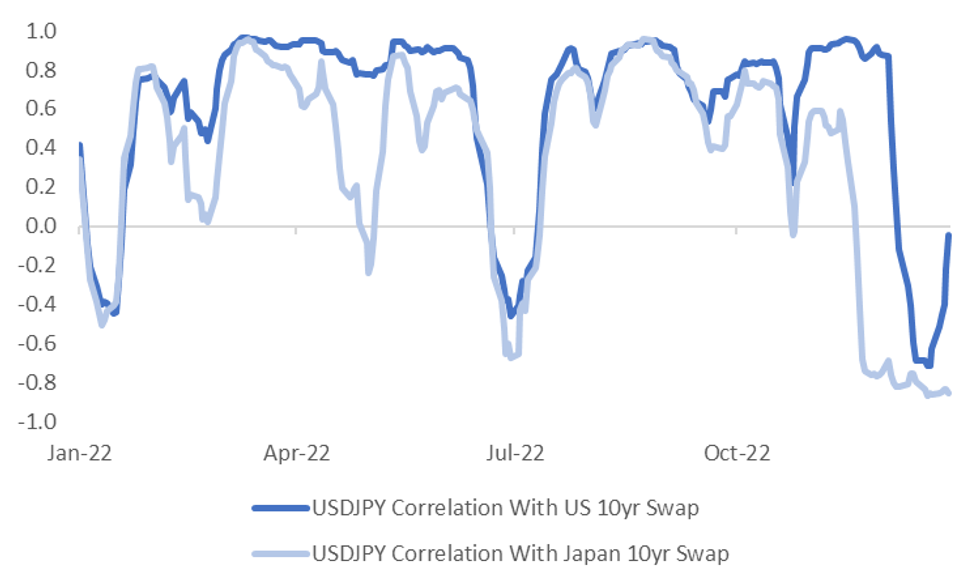

- Not surprisingly, USD/JPY moves have been increasingly correlated with JP 10yr swap moves over the past month, relative to US 10yr swap rates, see the second chart below. Higher 10yr swap rates in Japan are weighing noticeably on USD/JPY, while the correlation with US swap rates in close to flat.

- Given Japan 10yr swap rates are above 1.00%, more than double the BoJ's yield cap on 10yr JGBs, it is evident the swap space is already pricing further shifts from BoJ.

- Current swap spread differentials are still pointing to USD/JPY downside, as the chart above suggests. A dovish pushback from the BoJ tomorrow may induce a spike higher in USD/JPY, but it is likely the market will use this an opportunity to reload on shorts.

Fig 2: Japan Swap Rates A Bigger Driver Of JPY Shifts At The Moment

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jan17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0645-50(E608mln), $1.0675-80(E1.1bln), $1.0730-50(E771mln), $1.0800-05(E802mln), $1.0825(E825mln), $1.0850(E1.5bln), $1.0900(E798mln)

- GBP/USD: $1.2225-50(Gbp1.4bln)

- USD/JPY: Y127.85-00($665mln), Y129.00($612mln), Y130.00-22($1.0bln)

- AUD/USD: $0.6800(A$2.5bln), $0.7210(A$1.4bln)

- USD/CAD: C$1.3350($555mln), C$1.3400($1.0bln)

- USD/CNY: Cny6.8400-50($540mln)

ASIA FX: USD/CNH Back To Pre US-CPI Levels

higher US yields and a weaker equity backdrop haven't helped. Better than expected Q4 China GDP data and Dec activity prints didn't have a lasting positive impact on sentiment. The won and Taiwan dollar have outperformed slightly. SEA FX are all weaker but away from worst levels. Outside of Malaysia trade figures tomorrow, the data calendar is light in the region.

- USD/CNH continues to trade with a firmer bias. The pair just off fresh highs at the time of writing around the 6.7740/45 level, +0.45% for the session. This puts the pair above highs from last Thursday, wiping out CNH gains post the US print. Resistance should be evident ahead of the 6.8000 level. Some profit taking ahead of next week's LNY break may be also be a factor.

- The won has seemingly seen more benefit from the better than expected China data, with the 1 month NDF finding selling interest above 1240 (last at 1238). Onshore equities are weaker, while net outflows to local equities have also returned. 1 month USD/TWD is holding above 30.20, still sub NY closing levels. Taiwan equities have outperformed so far today, only down modestly.

- Singapore export data was weaker than expected, pushing the case for no further change in the MAS policy stance. Spot USD/SGD has pushed higher, last above 1.3220. The SGD NEER is higher for the session though, but remains below 2022 recent highs, per Goldman Sachs estimates.

- USD/IDR is back close to 15150, +0.70% higher for the session and back above the 200-day MA (15061.43). This follows a rapid round of IDR gains since mid last week. The country expects over $30bn in investment for EV batteries until 2026.

- USD/INR is back above the 100-day MA (81.66), last at 81.8550. Note the 50-day MA comes in at 82.115. USD/THB is back above 33.00, last at 33.085, -0.30% weaker in baht terms for the session.

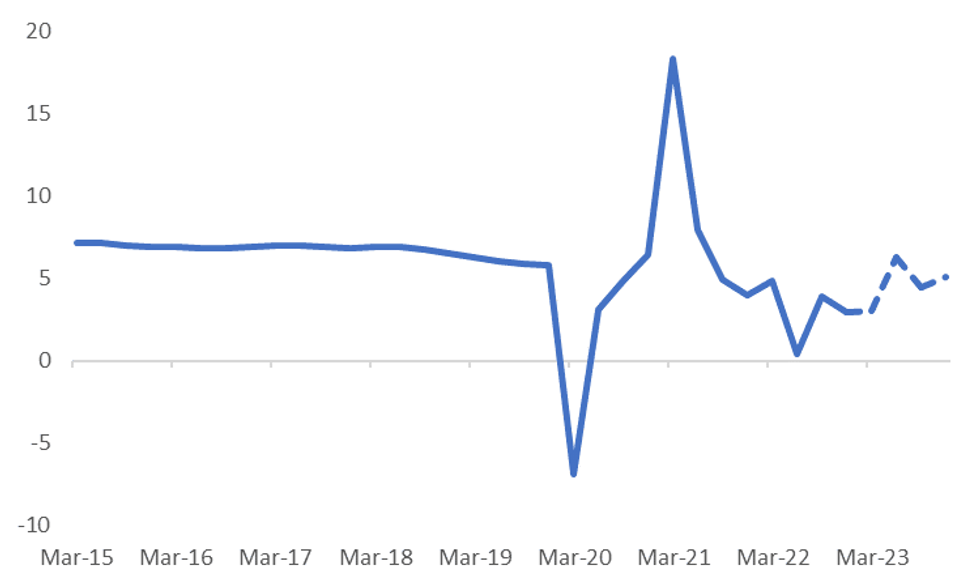

CHINA DATA: Growth Differential Expected To Peak In Q2 2023, FX Markets Pricing In Better Outlook

China data was uniformly better than expected, Q4 GDP was flat against a -1.1% forecast, which left y/y growth at 2.9%, also above expectations, but down from the 3.9% pace seen in Q3. IP (+1.3% y/y, versus 0.1% forecast) and retail sales (-1.8% y/y, -9.0% forecast) also comfortably beat expectations. Both measures are also above trough points in recent years (which coincided with previous Covid waves).

- FAI and property investment were both a touch better than expected, but property sales remained very depressed at -28.3%, little changed from November.

- The consensus expectation is growth momentum will improve from here, see the chart below, with the dashed lines the consensus y/y projections for 2023. We are expected to be back above 6% by Q2, although part of this reflects base effects versus 2022.

- This is well above projected pace for other major economies/regions. EU y/y GDP growth is expected to be negative in Q2 (-0.3%) and modestly positive for the US (+0.8%).

Fig 1: China GDP Momentum Projected To Improve Through 2023

Source: MNI - Market News/Bloomberg

- Still, the overall projection for 2023 growth is unchanged at 4.8% for the consensus. This is also consistent with a steady J.P. Morgan Growth Forecast Revision Index (FRI) over recent weeks.

- Forecasters may want to see how the economy unfolds post the recent Covid waves and see genuine improvement in underlying activity before upgrading 2023 aggregate forecasts.

- This factor, coupled with the fact the market has been trading off the re-opening theme for some time may explain today's muted reaction in the Asian FX space to the better than expected data outcomes.

- The second chart below shows the J.P. Morgan ADXY Y/Y momentum is already on the improve at this stage, so some of the re-opening story is already priced to a degree.

Fig 2: ADXY Y/Y & China Industrial Production Growth

MNI: J.P. Morgan/MNI - Market News/Bloomberg

SGD: Export Growth Below Expectations, Next Focus Point CPI Next Week

On the wires this morning we had Dec export data. Non-oil Domestic Exports printed at -20.6%, below the Bloomberg survey median of -16.0%, with prior reading revised higher to -14.7%. MoM growth fell 3.3%, this was significantly below the Bloomberg survey median of 0.2% growth. Electronic Exports fell -17.9%, the prior reading was -20.2%.

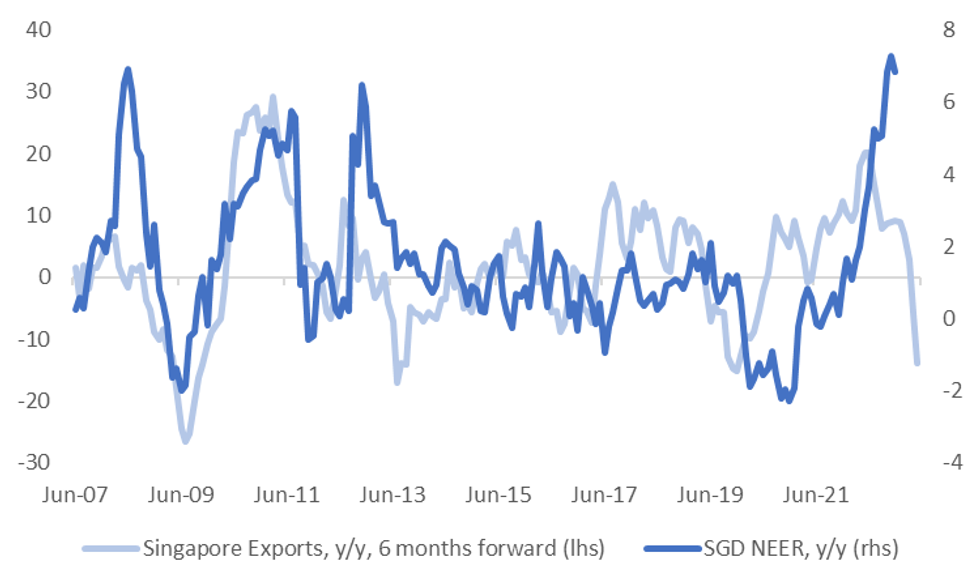

- Base effects and weakness from China, which should partially reverse as we progress through 2023, were factors in the weaker export figures, but there is no doubting the slowing trends. As we highlighted late last year, the weaker export growth backdrop suggests the best of SGD NEER gains is behind, see the chart below.

- An on-hold MAS bias/view can still be challenged by the inflation backdrop though. Note Dec CPI is released next Wednesday. The SGD NEER (per Goldman Sachs estimates) has drifted a touch lower, last at 135.60/65. We are -0.82% below the top end of the MAS policy band.

- For USD/SGD, we last sit just above $1.32, after breaching the 2021 low on Friday. The technical trend remains bearish for the pair, as we sit comfortably below the 20,50,100,200 EMAs and the 100-Day EMA has crossed the 200-Day EMA in early January. The next target for bears is the 2018 low at $1.3009, bulls first look to break $1.3369 to halt the bear's momentum.

Fig 1: SGD NEER Y/Y & Smoothed Export Growth (6mths Forward)

Source: MNI - Market News/Bloomberg

EQUITIES: Lower US Futures Weigh, Better China Data Fails To Inspire

Asia Pac equities have traded mixed through Tuesday's session. A negative US futures backdrop hasn't helped sentiment, with major indices off by -0.30 to -0.50% at this stage, with the Nasdaq underperforming. Better than expected China data didn't have a lasting positive impact on sentiment.

- The CSI 300 is down slightly, -0.16% at this stage, while the Shanghai Composite is off by -0.25%. Of course, this follows strong gains yesterday (CSI 300 +1.56%), while northbound inflows have slowed back to +4.82bn yuan, from yesterday’s heady +15.84bn yuan pace.

- The HSI is tracking weaker, down 1% at this stage, with the Tech sub index down by 0.64%.

- Japan stocks are firmer, with the Nikkei 225 up close to 1.30% at this stage, with Toyota gaining after the company stated 2023 production will exceed pre-pandemic levels.

- The Kospi is off 0.70%, moving away from a test of the 2400 level. Offshore investors have sold -$88.3mn of local equities so far today, trimming week to date net inflows. The Taiex is up slightly, +0.05%.

- In SEA we are seeing contrasting fortunes, with the JCI outperforming, +1.28% at this stage, while Philippines' stocks are off by 1.20%.

GOLD: Gold Prices Lower But Not Too Far Off Recent Highs

MNI (Australia) - Gold prices are off slightly (-0.3%) on higher UST yields, despite the USD being softer during the APAC session. Bullion range traded during Monday’s northern hemisphere session. Gold is currently around $1910.20/oz, close to the intraday low, after reaching an intraday high of $1919.11 earlier.

- Conditions for gold remain in a bullish uptrend with higher highs and higher lows. The reopening of China’s economy should mean increased physical demand for the yellow metal.

- There is no data scheduled in the US today but the Canadian December CPI is released. Later there is also UK labour market data. On Wednesday, the BoJ meets and US December retail sales & PPI print.

OIL: Oil Prices Trend Higher On Positive Economic News From China

MNI (Australia) - China optimism and global pessimism continue to pull oil prices in opposite directions. During the the APAC session, they have been trending up, as the USD softened and Chinese economic data exceeded expectations. WTI is currently up 0.7% to around $79.30/bbl, close to its intraday high of $79.39. Brent is up only 0.2% to about $84.60, also close to its intraday high of $84.81.

- The short-term bull trend remains in place for WTI. If it continues, then $81.50 could open up, the January 3 high and bull trigger. The key level for Brent is $87.00.

- Today OPEC publishes its monthly oil market report, which should help to quantify the demand and supply outlook. Last week Russian exports rose 30%, its highest since April 2022, with India the biggest customer. However, on February 5 the G7, including the EU, plans to cap the price of Russian fuel exports.(ANZ)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/01/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 17/01/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 17/01/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/01/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/01/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 17/01/2023 | 1330/0830 | *** |  | CA | CPI |

| 17/01/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/01/2023 | 2000/1500 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.