-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Prospect Of Split U.S. Congress Does Little For Markets

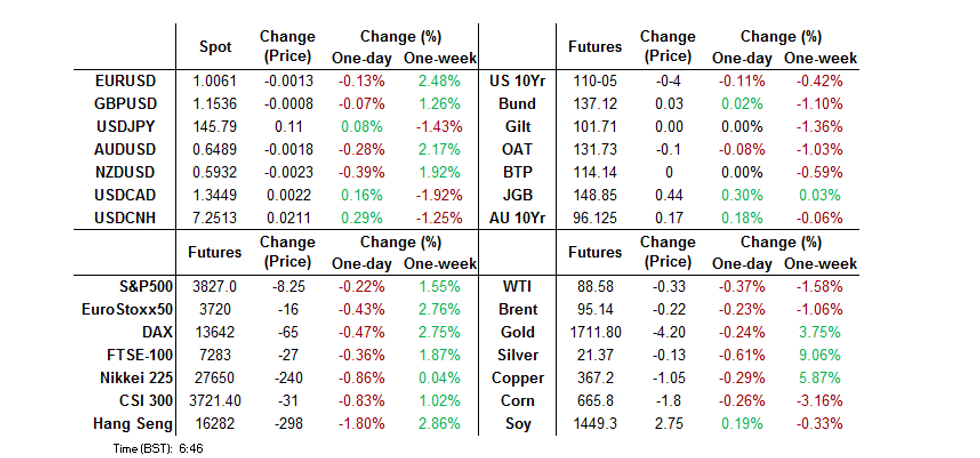

- Betting markets continuing to price in a split U.S. Congress with Democrat control of the Senate and Republican control of the House seen as the most likely outcome as of 2130PT/0030ET/0530GMT.

- Early indications of a strong Republican showing weren’t followed through on a national level, allowing the Tsy space to tick away from early session cheaps.

- The greenback oscillated and the yen capitalised on its safe haven status as participants monitored incoming updates on the midterm elections in the U.S

- Today's central bank speaker slate features Fed's Williams & Barkin, BoE's Haskel & Cunliffe, ECB's Elderson & RBA's Bullock. The U.S. midterm elections remain under the microscope as the results keep coming in.

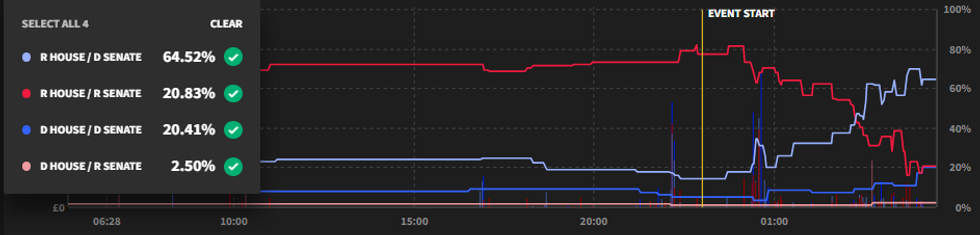

US MIDTERMS: Dems Flipping GOP House Seats Sees Betting Market Shift

Betting markets continuing to price in a split Congress with Democrat control of the Senate and Republican control of the House as the most likely outcome as of 2130PT/0030ET/0530GMT.

- Data from Smarkets shows a 64.5% implied probability of a split congress, with the prospect of a 'red wave' of the Republicans taking control of both chambers down to a 20.8% implied probability.

- There has been a jump in bettors moving towards the tail risk scenario of the Democrats retaining control of both chambers of Congress, now standing at a 20.4% implied probability, up from 3.3% at 1945ET.

- Democrats flipping Republican seats in Ohio, and notably NC-13 (see 0513GMT bullet) seen as significantly limiting the prospect of a sizeable (or in some scenarios any) GOP majority in the House.

Chart 1. Betting Market Implied Probability of Congressional Control, %

Source: Smarkets

Source: Smarkets

US TSYS: Likely Split Congress Does Little For Tsys

A contained round of Asia-Pac dealing leaves cash Tsys running little changed to 1.5bp cheaper across the curve into London trade, with intermediates leading the modest downtick observed across most of the curve. TYZ2 prints -0-03 at 110-06, around the middle of its 0-08+ overnight range, with volume running at a healthy ~98K.

- The latest indications point to a split Congress when all is said and done with the Midterms, with the most likely outcome seeing the Republican Party re-take the House, while the Democrats are expected to maintain control of the Senate.

- Early indications of a strong Republican showing weren’t followed through on a national level, allowing the Tsy space to tick away from early session cheaps.

- A downtick for e-minis has also provided support for the space.

- Note that a split Congress would likely bring worry surrounding fiscal impasse (read the debt ceiling and government shutdowns) to the fore, given the nature of the relatively hardline Republican House leadership.

- Looking ahead, Fedspeak from Williams and Barkin, in addition to 10-Year Tsy supply, will provide the highlights outside of the ongoing Midterm vote counts.

JGBS: Notable Flattening After 30-Year Supply Goes Well

Tuesday’s bid in core global FI markets, a recovery from the base of a limited Asia-Pac range for U.S. Tsys and a solid round of 30-Year JGB supply helped JGBS to firm on Wednesday.

- The major cash JGBs run flat to ~9bp richer into the bell with the long end outperforming. Meanwhile 7s are outstripping the bid in surrounding tenors owing to the bid in futures, with JGB futures 45 ticks firmer on the day, building on overnight gains. Cash JGBs are set to go out at richest levels of the day.

- In terms of the auction details, 30-Year JGB supply saw the low-price print above wider expectations, with the cover ratio nudging up to a more “normal” level after last month’s auction saw the lowest round of 30-Year JGB cover since early ’21. Elsewhere, the tail narrowed from a wide base.

- We would suggest there was some worry re: digestion of the auction, given the size of the reaction on the back of a fairly unremarkable round of internals.

- Local headline flow saw a wider than expected current account surplus and familiar tones from the government re: FX matters, which didn’t impact the space.

- Looking ahead, weekly international security flow data and the monthly money supply readings will cross on Thursday.

AUSSIE BONDS: Notably Firmer As The Day Wore On

Aussie bonds generally tracked the relatively limited U.S. midterm-driven gyrations in U.S. Tsys during the first half of the Sydney session, before extending higher and outperforming after a shallower bid came into Tsys.

- We didn’t see much in the way of overt domestic/idiosyncratic triggers to drive the outperformance, which extended as the major futures contracts made a meaningful break above their respective overnight highs, leaving cross-market moves and the breach of overnight session highs at the fore when it comes to explainers.

- Softer than expected Chinese CPI data may have helped the space find a base earlier in the session, with the passage of yesterday’s ACGB May-34 syndication also removing supply-related pressure.

- That left YM +11.0 & XM +17.0 at the close. Cash ACGBs sit 10-17bp richer across the curve, after 10s outperformed all day.

- EFPs were wider, with the 3-/10-Year box bull steepening.

- Bills print 2-9bp richer through the reds, bull flattening.

- Looking ahead, an address from RBA Deputy Governor Bullock, with the topic of “The Economic Outlook” in front of the ABE annual dinner headlines during the Sydney evening.

NZGBS: NZGBs Hold Firm

NZGBs held on to the bulk of their early gains, after playing catch up to Tuesday’s richening in core global FI markets, showing little reaction to the contained swings in U.S Tsys that surrounded the ongoing U.S. midterm election results.

- That left NZGBs 7-9bp richer across the curve at the close, with swap spreads marginally mixed across the curve.

- News from the Treasury that the new green NZGB May-34 will launch next week (sized at NZ$2-3bn) may have resulted in some underperformance for the longer end of the NZGB curve, alongside swap spread tightening in that zone.

- RBNZ dated OIS came in a touch on the day, with terminal OCR pricing printing just below 5.40% vs. 5.45% late on Tuesday. Pricing for this month’s meeting was a touch softer as well, with just under 70bp of tightening now priced.

- Looking ahead, Thursday will see the release of the RBNZ’s Review and Assessment of the Formulation and Implementation of Monetary Policy, with manufacturing PMI data and the weekly round of NZGB issuance also slated.

FOREX: Yen Takes Lead With U.S. Midterms In Spotlight, USD/JPY Shows Below 50-DMA

The greenback oscillated and the yen capitalised on its safe haven status as participants monitored incoming updates on the midterm elections in the U.S., where the Republicans moved closer to taking control of the House and the Senate race remained a toss-up. The prospect of a split Congress kept the BBDXY index in check.

- Spot USD/JPY probed the water below its 50-DMA for the first time since mid-August on two failed attempts to consolidate below that moving average. The rate fell to Y145.20 in early trade, but recovered over the Tokyo fix. Trader sources told Bloomberg that Tokyo-based leveraged accounts sold USD/JPY early on, which brought FX option strikes at Y145.00 into focus. The next round of sales sent the pair to Y145.18, but the bulk of those losses were quickly retraced. When this is being typed, USD/JPY trades ~15 pips shy of neutral levels.

- Spot USD/CNH turned bit on the back of China's inflation data. CPI printed at +2.1% Y/Y versus +2.4% expected, while PPI came in at -1.3% versus the median estimate of -1.5%. The impact of a miss in China's consumer inflation spilled over into the Antipodeans, applying some modest pressure to the space.

- Final U.S. wholesale inventories will take focus after hours. Today's central bank speaker slate features Fed's Williams & Barkin, BoE's Haskel & Cunliffe, ECB's Elderson & RBA's Bullock. The U.S. midterm elections remain under the microscope as the results keep coming in.

FX OPTIONS: Expiries for Nov09 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-09(E690mln)

- USD/JPY: Y147.00($543mln)

- USD/CAD: C$1.3520($780mln)

ASIA FX: Divergence With CNH Persists

Outside of the Chinese yuan, Asian FX has posted solid gains today, led by KRW and THB. A positive regional equity backdrop for the most part has aided risk appetite. Regional currencies have also outperformed an indifferent USD trend against the majors today. Tomorrow, Philippines Q3 GDP is due, along with Thailand consumer confidence. China aggregate credit figures are also due between the 15th of the month.

- USD/CNH has spent most of the session on the front foot, currently tracking near 7.2500, +0.25% on NY closing levels. Onshore equities are weaker amid further lockdown measures and rising Covid case numbers. Inflation data also argues for a further loosening in financial conditions to support growth. We still await October aggregate financing numbers.

- 1 month USD/KRW hit close to 1360, right on the simple 100-day MA. This is fresh lows in the pair back to early September. The currency continues to ride the firmer equity wave (Kospi +1% again today) and we continue to see outperformance against CNH. Sentiment has stabilized somewhat this afternoon, the pair back to 1365.

- Spot USD/IDR trades -48 figs at 15,650 in line with the broader regional trend. Bears look for losses towards Oct 28 low of 15,523, while a rebound towards Nov 4 high of 15,750 would please bulls. Indonesia's retail sales estimate rose 4.51%Y/Y last month against the revised +4.56% recorded in September.

- Losses in spot USD/PHP have resulted in a breach of the ascending 50-DMA, a notable layer of support. The pair last deals -0.35 at 587.935, with bears now setting their sights on Oct 28 low of 57.830. The Philippines' agricultural production rose 1.80% Y/Y in Q3 after a 0.60% contraction in Q2. Rice production was up 1.0% Y/Y. Thursday will see the release of Q3 GDP data. The local statistics authority revised the Q2 growth estimate to +7.5% Y/Y from +7.4%.

- At typing, spot USD/THB trades -0.47 at 36.833, after lodging new two-month lows at 36.78. The penetration of the 50-DMA yesterday shifts focus to the 100-DMA, which kicks in at 36.622. The baht has been one of the top performers in Asia EM space quarter-to-date, adding 3.34% versus the greenback, with only the Korean won faring better. Foreign investors were net buyers of $91.52mn in Thai stocks Tuesday, another decent round of inflows.

EM FX: Magnitude Of Tightening Cycles Drives Wedge In EM FX Performance

This monetary tightening cycle has been remarkably synchronised across both the OECD, excluding Japan, and emerging economies, even if there have been differences in the timing and pace. Both Hungary and Brazil have hiked around 12pp cumulatively, the US 3pp and Thailand only 0.5pp.

- The majority of central banks have moved in increments greater than the usual 25bp and so we have seen some slow their pace of tightening either back to 25bp or to smaller but still outsized moves. Australia was one of the first to pivot to 25bp at its October meeting followed by Norway this month, one of the early tighteners. Canada has gone from 100bp in July to 50bp at its last meeting and Poland has slowed to 25bp from 100bp. Brazil and Czech have now actually paused being some of the earliest tighteners.

- Given the amount of cumulative tightening this cycle and the darkening of the global growth outlook, more central banks are likely to pivot over the next few months.

- Asian central banks have been tightening not only to fight inflation pressures but also to support their currencies which have been under pressure forcing a rundown of FX reserves given the rapid Fed rate rises. Even Korea has hiked less than the Fed cumulatively and they began their cycle in August 2021. However, recent FX sentiment has been more encouraging, with broader USD conditions softening.

- In contrast, Latin American central banks not only started increasing rates in 2021 but have moved quite aggressively with Brazil and Chile hiking around 11pp and Mexico at the lower end with 5.25pp. As a result, Latin currencies have been a lot more stable against the USD than Asian ones have, see the chart below.

Source: MNI - Market News/Refinitiv

Fig. 2: JP Morgan currency indices Latin America vs Asia

Source: MNI - Market News/JP Morgan/Bloomberg

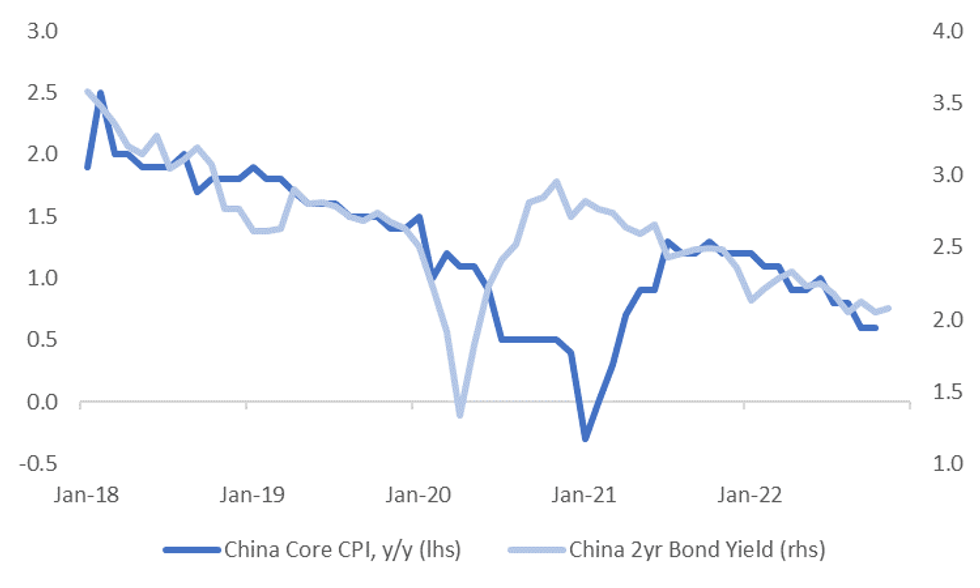

CHINA: CPI Slows More Than Expected, PPI Back Into Deflationary Territory

China headline CPI came in weaker than expected, rising 2.1% y/y, against a 2.4% y/y expectation. Last month was 2.8% y/y. PPI dipped back into deflationary territory, down -1.3% y/y from last month's +0.9% outcome, but this was slightly better than market estimates (-1.5%).

- The headline miss for CPI was helped by food price pressures, where the y/y pace eased to 7.0%, from 8.8% last month. Non-food inflation moderated further though, back to 1.1% y/y, from 1.5% in September.

- Only 1 sub category saw firmer y/y momentum in the month, while the housing sub component fell -0.2%. Core inflation was unchanged at 0.60% y/y.

- The data is still arguing for easier financial conditions, although there is some stability in onshore yields, with the 2yr continuing to hold above 2%, see the first chart below.

Fig 1: China Core CPI Versus 2yr Government Bond Yield

Source: MNI - Market News/Bloomberg

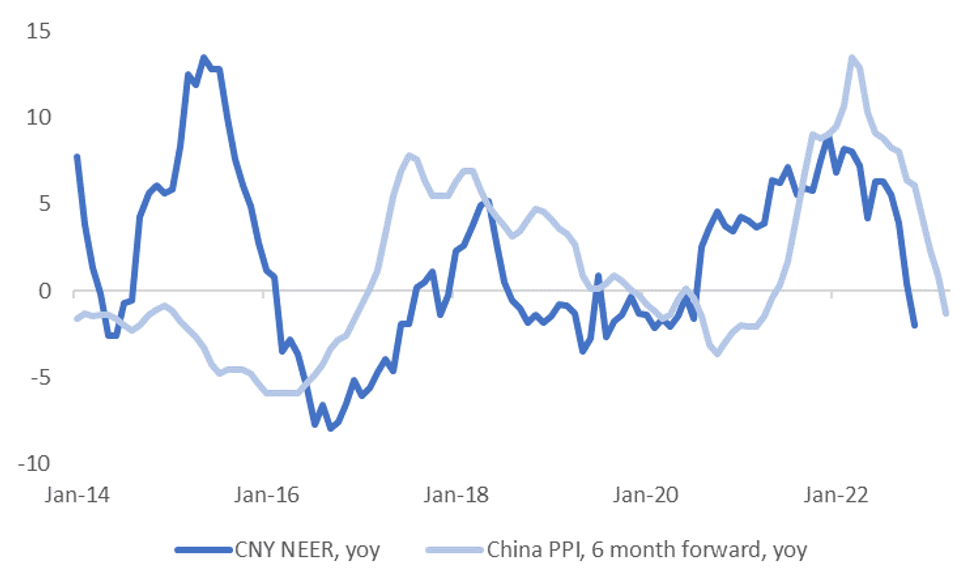

- The PPI dip was not as bad as feared. Recent trends were generally maintained though, with mining and raw materials showing steep y/y drops. Manufacturing also fell to a fresh cyclical low of -3.5% y/y. The picture was slightly better in the consumer goods space.

- The second chart below is an update of this morning's one, highlighting the decelerating trends in the PPI and CNY NEER (J.P. Morgan Index).

Fig 2: China PPI Versus CNY NEER Y/Y

Source: J.P. Morgan/MNI - Market News/Bloomberg

EQUITIES: China Stocks Still Down Despite Fresh Developer Support

Aggregate China/HK indices are struggling again, despite fresh support measures for the real estate developer segment. US futures are slightly up at this stage, but have been range bound for much of the session as the market processes the mid-term election results. A Republican controlled House, but Democrat controlled Senate is now a potential outcome (see this link for more details).

- The CSI 300 is off 0.75% at this stage, the Shanghai Composite -0.35%. China headline inflation data came in softer than expected, underscoring a weak domestic demand backdrop. Coupled with a further lockdown for part of Guangzhou and rising covid case numbers, has dented sentiment.

- Property related stocks have done better, the Shanghai composite sub-index up 2.3%. Onshore media stated that the financing backdrop for developers is improving, while a funding program, available to developers, along with other private firms, was boosted to 250bn yuan.

- The HSI is down around 1.5% at this stage, with the underlying tech sub-index off 2.26%.

- The Kospi (+1%) and Taiex (+1.75%) are faring better, aided by Samsung and TSMC gains. Offshore tech gains have continued to impress in the first part of this week. The Nikkei 225 has been a laggard though, -0.50%.

- The ASX 200 is +0.60% at this stage, with mining names the main drivers.

GOLD: Edges Down From Multi Week Highs

As has been the case this week, gold is giving back some gains from the overnight session during Asian trading hours, but only modestly. The precious metal last sits close to $1708.5, down from overnight highs around $1717, and -0.20% below NY closing levels.

- To recap, gold surged 2.2% for yesterday's session, continuing to benefit from lower USD levels. Gold may have also benefited from safe haven flows related to weakness in the crypto space, although gold was already pushing higher before these trends emerged.

- US yields also moved lower, the real 10yr yield back to 1.64% overnight (-5bps). This was also reflected in the nominal space, although the 2yr and 10yr have been relatively steady today.

- The market may still be eyeing a test of the 100-day EMA ($1716.95), which cap gains overnight. On the downside the 50-day comes in at $1681.43.

OIL: Prices Range Bound As News Impacts Both Supply And Demand Outlook

Oil prices have been range bound and are in line with their New York close at around $95/bbl for Brent and $88.50 for WTI, as tight supply balances demand fears. WTI has been trading between $88.50-$89.50.

- The market is watching the results of the US mid-term elections closely for any impact they may have on the USD. So far the outcome is unclear. A weaker USD would be positive for oil prices as it makes it cheaper for foreign buyers.

- Beijing reported the highest number of Covid cases in more than 5 months, which raised concerns that any reopening would be delayed, but the lockdown in the area around the iPhone plant was lifted. The market still hopes that there will be some easing of restrictions in China but currently there is little to suggest anything is planned.

- On the supply front, the US revised down its 2023 oil production forecast to 12.31 mbd signalling that its shale oil is unlikely to be able to boost global supply in a tight market. The latest US API data showed a build in crude inventories of 5.618 mn barrels not completely unwinding last week’s 6.53 mn drawdown. Already low stocks of distillate fell a further 1.8 mn barrels but gasoline rose 2.6 mn. The EIA data will be out overnight.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/11/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/11/2022 | 0800/0300 |  | US | New York Fed's John Williams | |

| 09/11/2022 | 1000/1100 |  | EU | ECB Elderson Panels EMEA Event at COP27 | |

| 09/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/11/2022 | 1300/1300 |  | UK | BOE Haskel Speech at Digital Futures at Work | |

| 09/11/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/11/2022 | 1600/1100 |  | US | Richmond Fed's Tom Barkin | |

| 09/11/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.