-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Q1 Aust CPI Beat Likely To Push Out RBA Easing

- AUD outperformed in the G10 space, following the Q1 CPI beat. Firmer regional equities also aided the trend. ACGBs (YM -18.0 & XM -13.0) are sharply cheaper, while RBA-dated OIS pricing is 9-14bps firmer for meetings beyond June after the data.

- In the Tokyo afternoon session, JGB futures are slightly weaker, -1 compared to the settlement levels. At this week’s meeting, we expect the BoJ to maintain its target range for the uncollateralized overnight call rate at 0-0.1%. This aligns with the BoJ's consistent messaging since the March rate hike, which emphasized a data-dependent, "wait and see" approach. A consecutive rate hike at this juncture would likely convey a conflicting signal.

- In China, the Government Bond Curve has bear-steepened, after a PBOC official’s comments suggest low yields have deviated from sound economic fundamentals.

- Later preliminary March US durable goods and April German Ifo survey print. The ECB’s Cipllone, Tuominen, McCaul, and Schnabel speak.

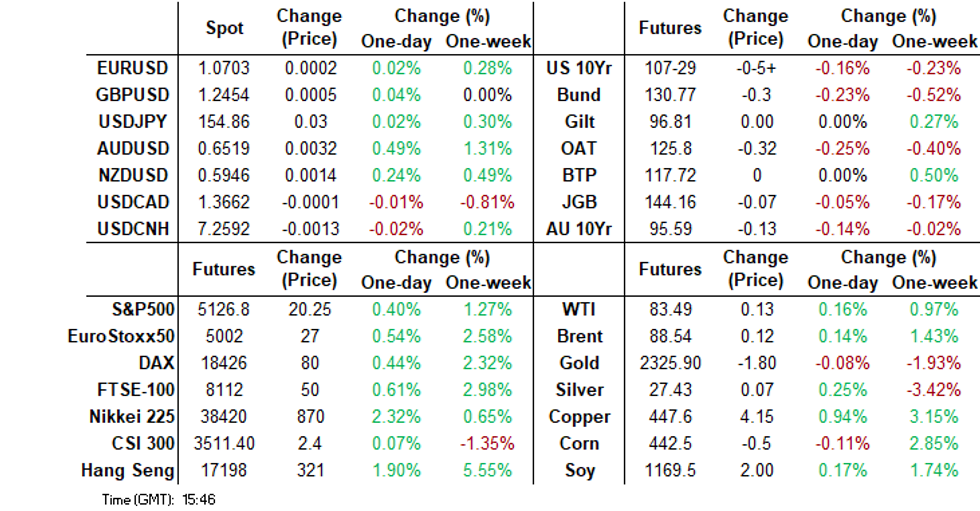

MARKETS

US TSYS: Treasury Futures Slip, Curve Flattens, Ukraine Aid Bill Passes

- Treasury futures have slipped as we head into the Asia break, weakness in the rates markets looks to have coincided with a strong AU CPI print, with the 10Y contract trading down (- 04) to 107-29, we are just off those levels now at 107-30, while the 2Y is slightly underperforming now trading down (-01 +) at intraday lows of 101-17.625.

- Cash Treasury curve has bear-flattened throughout the session with the 2Y yield +1.3bps to 4.944%, 10Y +1.2bps to 4.613%, while the 2y10y is +2.073 at -31.207

- Across local rate markets, NZGBs curve is steeper with yields 3-4bps higher, ACGBs curve is has bear-flattened with yields 11-16bps higher, while JGBs curve is little changed in the short and belly of the curve, while the long end is 1-3bps higher.

- DBS recommends going long 2Y UST, with the assumption short end yields are cap with the Fed doesn't tighten any further

- Earlier the US Senate passed the $95b emergency Aid package for Ukraine

- Looking ahead: Durable/Capital Goods, Tsy Auctions later today

JGBS: Little Changed, Light Local Calendar, Focus On Friday’s BoJ Policy Decision

In the Tokyo afternoon session, JGB futures are slightly weaker, -1 compared to the settlement levels, after today’s BoJ Rinban operations showed mixed results.

- (MNI) At Friday's meeting, we expect the BoJ to maintain its target range for the uncollateralized overnight call rate at 0-0.1%. This aligns with the BoJ's consistent messaging since the March rate hike, which emphasised a data-dependent, "wait and see" approach. A consecutive rate hike at this juncture would likely convey a conflicting signal.

- Looking ahead, we anticipate the BoJ to follow a modest, gradual hiking trajectory. A growing number of economists foresee the possibility of another rate hike in October, with July also emerging as a potential earlier timeframe. Factors such as the prospect of a weaker yen are cited as potential accelerators for this timeline. (See MNI BoJ Preview here)

- Cash JGBs are dealing little changed. The benchmark 10-year yield is 0.3bp lower at 0.886%, just shy of the YTD high of 0.894%.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates -2bp to +1bp. Swap spreads are tighter out to the 10-year and wider beyond.

- Tomorrow, the local calendar will see Weekly International Investment Flow, Leading & Coincident Indices and Dept Sales data. Tokyo CPI data is due on Friday.

BOJ: MNI BoJ Preview - April 2024: ‘Wait & See’ Approach, Watch Messaging On JGB Buying & FX Weakness

EXECUTIVE SUMMARY

- At this week’s meeting, we expect the BoJ to maintain its target range for the uncollateralized overnight call rate at 0-0.1%.

- This aligns with the BoJ's consistent messaging since the March rate hike, which emphasised a data-dependent, "wait and see" approach. A consecutive rate hike at this juncture would likely convey a conflicting signal.

- Looking ahead, we anticipate the BoJ to follow a modest, gradual hiking trajectory. A growing number of economists foresee the possibility of another rate hike in October, with July also emerging as a potential earlier timeframe. Factors such as the prospect of a weaker yen are cited as potential accelerators for this timeline.

- In the Outlook Report, the BoJ is expected to present inflation forecasts that consistently exceed 2% across all projection periods. However, the BoJ is likely to underscore the downside risks associated with a scenario where 2% inflation extends into FY26.

- A potential downward adjustment to the growth outlook for FY2023 might serve as a rationale for implementing gradual policy tightening.

- Full preview here:

AUSSIE BONDS: Holding Sharply Cheaper After Q1 CPI Surprises On The Upside, ANZAC Holiday Tomorrow

ACGBs (YM -18.0 & XM -13.0) are sharply cheaper after Q1 CPI data surprised on the upside across all measures. Headline printed +1.0 q/q and +3.5% y/y versus expectations of +0.8% and +3.4% respectively. Trimmed Mean CPI printed +1.0% q/q and +4.0% y/y versus expectations of +0.8% and +3.8% respectively.

- Inflation is edging closer to the RBA's target range, but the robust quarterly increases and the uptick observed in March, if sustained, pose a threat to this progress. The likelihood of rate cuts being considered in 2024 appears remote, if not off the table.

- To meet the RBA’s Q2 forecasts a significant but not unlikely moderation is required in Q2 to around 0.5-0.6% q/q.

- Cash ACGBs are 9-13bps cheaper after the data and 13-18bps cheaper on the day. The AU-US 10-year yield differential is 11bps higher at -22bps.

- Swap rates are 8-13bps higher after the data and 12-18bps higher on the day. The 3s10s curve is 6bps flatter versus yesterday’s close.

- The bills strip has sharply bear-steepened, with pricing -9 to -20.

- RBA-dated OIS pricing is 9-14bps firmer for meetings beyond June after the data. A cumulative 8bps of easing is priced by year-end versus 17bps before the data.

- The Australian and NZ markets are closed tomorrow for the ANZAC Day holiday.

AUSTRALIAN DATA: Inflation Progress Patchy, Services Improving, RBA On Hold

Q1 CPI came in higher than expected rising 1.0% q/q and 3.6% y/y. While the quarterly rate was 0.4pp higher than in Q4, the annual rate eased 0.5pp. The trimmed mean was also 1% q/q higher bringing the annual rate to 4% from 4.2%. Inflation is moving closer towards the RBA’s target band but the strength in the quarterly rises and pick up in March if sustained threaten that progress and so rate cuts look off the table for most if not all of 2024 at this stage.

- To meet the RBA’s Q2 forecasts a significant but not unlikely moderation is required in Q2 to around 0.5-0.6% q/q.

- Key domestically-driven components remained elevated but made further gradual progress posting their lowest annual growth in around two years. Services inflation eased 0.3pp to 4.3% y/y, core services 0.2pp to 4.3%, and non-tradeables 0.4pp to 5.0%. The series aren’t seasonally adjusted and usually show strong quarterly rises in Q1.

- Lower goods and tradeables inflation continued to be the main drivers of lower annual CPI rates.

Source: Market News/Refinitiv

- The monthly March outcome was in line with expectations at 3.5% y/y up from 3.4%. With the series sitting around this rate for the last four months, there are signs that disinflationary progress has stalled. The trimmed mean, CPI ex volatile items & travel and non-tradeables saw March annual rates pick up.

Source: MNI - Market News/ABS

- The ABS points out education (+5.9%), health (+2.8%), housing (0.7%) and food & beverages (+0.9%) as the main drivers of the quarterly increase. Low vacancies continued to boost rents with them rising a further 2.1% q/q and labour and material costs driving the 1.1% rise in new dwelling construction prices.

NZGBS: Cheaper, Spillover Selling From ACGBs & US Tsys, Local Market Closed Tomorrow

NZGBs closed cheaper but in the middle of today’s ranges, with yields 3-4bps higher across benchmarks. After opening weaker, the market cheapened further via spillover selling from ACGBs after Q1 CPI data printed higher than expected across all measures. ACGBs are currently dealing 9-13bps cheaper after the data.

- Cheaper US tsys in today’s Asia-Pacific session also likely weighed on the local market. Cash US tsys are dealing 1-2bps cheaper, with a slight flattening bias.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Trade Balance data.

- Solid demand metrics at today’s weekly supply, brought forward from its normal Thursday slot due to tomorrow's holiday, likely assisted the move away from session cheaps. The cover ratios for the Apr-29 and May-34 lines, 1.96x and 4.16x respectively, improved versus the previous outings.

- Swap rates closed 4-5bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-3bps firmer for meetings beyond May, with Nov-24 leading. A cumulative 51bps of easing is priced by year-end.

- Tomorrow, the NZ and Australian markets are closed for the ANZAC day holiday.

- Later today, the US calendar will see Durable/Capital Goods and Tsy Auctions. PCE Deflator data is due on Friday.

NEW ZEALAND DATA: Trade Deficit Continues Improving

March saw NZ post a trade surplus of $588mn after a deficit of $315mn as exports continue to recover while imports are weak. The YTD deficit narrowed to $9.87bn from $12.06bn in February. Exports rose 3.9% y/y while imports shrank 19.8% y/y, with both affected by large movements in volatile components.

- The YTD trade deficit has improved $7.26bn since its peak in May last year.

Source: MNI - Market News/Refinitiv

- Exports in March were boosted by crude oil (+266% y/y) which tends to be lumpy. There were also strong rises in fruit and wood shipments with dairy more subdued but still positive. The unit price of dairy exports fell while volumes rose for milk powder but fell for cheese.

- Exports to China fell 1.9% y/y and 3.7% to Australia but rose 8% to the US and 3.6% to Europe.

- Aircraft imports fell 92% and petroleum -31% driving the sharp fall in March imports but some more domestic demand related items, such as vehicles and art, were also weak.

Source: MNI - Market News/Refinitiv

FOREX: A$ Bounces Post CPI Beat, But Unable To Sustain 50-day EMA Break

The BBDXY sits marginally lower, last near 1258.75, slightly off end NY levels from Tuesday. The main theme today has been the A$ bounce, which followed the stronger than expected Q1/Mar CPI prints.

- AUD/USD was already on the front foot prior to the data, amid a positive equity backdrop. From around 0.6495 we got to 0.6530, but sit back slightly lower now (0.6515/20), which is still +0.45% higher, but sub the 50-day EMA (which sits just under today's highs).

- Local yields have surged in Australia, while the RBA's Q2 inflation forecasts will be difficult to achieve without a steep step down (unlikely). AUD option activity was busy post the print, but has now subsided somewhat (around 18% of total activity today).

- NZD/USD has been dragged higher by AUD, but at +0.20%, last in the 0.5940/45 region it has lagged the move. The AUD/NZD cross is to fresh highs back to June of last year, last near 1.0960/65. Earlier the NZ trade position moved back into surplus for March.

- USD/JPY has drifted a touch higher, lagging AUD noticeably. The pair last near 154.85. Regional equities and US futures are higher, while a firmer yield backdrop in the US has also been helpful for the pair.

- Later preliminary March US durable goods and April German Ifo survey print. The ECB’s Cipllone, Tuominen, McCaul, and Schnabel speak.

ASIA EQUITIES: Hong Kong Equities Continue To Outperform Post CSRC Announcement

Hong Kong and China equity are mostly higher today, with Hong Kong equities continuing their recent outperformance and the HSI now trades unchanged for the year and has now outperformed the CSI300 by 4.83% over the past month with all that move coming since Friday when the CSRC announced measures to support the Hong Kong market. Chinese companies have been increasingly bumping up their dividend payouts to investors in a sign recent stock market supervision is working, China Overseas Land report a revenue beat.

- Hong Kong equities are surging higher today with the HSTech Index up 2.62%, and has broken above the 100-day EMA, with eyes now on the 200-day EMA at 3,663, the 14-day RSI has ticked higher again to 57, the Mainland Property Index up 1.78% at 1,206.12, breaking above the 20-day EMA with eyes now on the 50-day at 1,216 and the wider HSI is up 1.67%, now eyeing a test of the 200-day EMA, something we have not traded above since July 2023. China Mainland equities are underperforming this morning, with the CSI300 unchanged and is trading at the bottom of recent ranges, the 50 & 100-day EMA are acting as key support, a break below here could signal further weakness and a test of the 3,400 level. Small-cap indices are performing better than large cap with the CSI1000 up 0.84%, the CSI2000 is up 1.60%.

- China Northbound had an outflow of 3b yuan on Tuesday, momentum has been decreasing over the past week with the 5-day average at -2.72billion, while the 20-day average sits at -1.37billion yuan.

- In the property space, China Overseas Land reported a revenue beat, while operating profit increase 0.2% y/y.

- Apple experienced a significant decline in iPhone sales in China, falling 19% in the March quarter, marking its worst performance in the country since the onset of the COVID-19 pandemic. The decline coincided with Huawei's resurgence in the premium segment, posing challenges for Apple's growth trajectory and raising concerns among investors about sustaining market share.

- Looking ahead, HK Trade Balance on Thursday, while the calendar for China remains quiet.

ASIA PAC EQUITIES: Regional Asian Equities Follow Global Markets Higher, AU CPI Beat

Regional Asian equities are higher today, following the US equity market higher after a second straight day of good corporate earnings. Tech is the top performing sector as stronger earnings from companies like Texas instruments, Tesla reported earnings miss however still traded higher on the back of an announcement they will accelerate the launch of more affordable model, while the Semiconductor index finished the session up over 2%. Earlier South Korean Consumer Confidence was in line with the previous month, New Zealand Trade Deficit continued to Improve and Japan's PPI Services beat estimates, while Australia's CPI ticked higher which saw yields on ACGBs push 12-17bps higher. The BI rate decision is next up where they are expected to hold rates at 6%.

- Japanese equities are higher today with tech names leading the way, the Nikkei 225 is up 2.20% and is testing the 20 & 50-day EMA at 38,500/38,600, while the Topix is up 1.50%. The yen is unchanged however just off the psychological 155.00, the former vice minister of finance for international affairs said the BoJ is on the brink of intervention if it weakens any further. Earlier Japan PPI Services were 2.3% y/y vs 2.1% y/y expected.

- South Korean equities are higher, with tech stocks leading the way. Earlier South Korean Consumer Confidence was unchanged at 100.7, while household inflation expectations for the next 12-months fell to 3.1% in April from 3.2% in March. the Kospi is up 1.96% breaking back above both the 20 & 50 Day EMAs, the 14-day RSI indictor has also just ticked back above 50, while the MACD is showing a decrease in red bars signaling buyers are back in control.

- Taiwan equities have followed global semiconductor prices higher, after the Philadelphia semiconductor Index closed up 2.2%. Foreign Investors purchased local equities for the first time since Apr 10th, helping boost the TWD after the currency slipped to the lowest levels since 2015. The Taiex is up 2.5% and now trading just below the 20-day EMA at 20,090.

- Australian equities have pared earlier gains and now trade up 0.14% after stronger than-expected CPI data showed an increase to 3.5% y/y from 3.4% y/y. The materials and industrials sectors are the worst performing, offsetting gains in Financials.

- Elsewhere in SEA, New Zealand Equities are up 0.73% after posting a trade surplus, Singapore equities are 0.68% higher, after CPI dropped to 2.7% in March from 3.4% April, Malaysian equities up 0.40%, Philippines equities are up 1.10%, Indonesian equities are 0.70 ahead of the BI rate decision later today.

ASIA EQUITY FLOWS: Asian Equity Flows Mixed, Trend Remains Negative

- China equities flows continue to see-saw, with a 3b yuan outflow on Tuesday, equity markets were lower with the CSI300 continuing its rangebound trading, with the 200-day acting as resistance, while we trade on the 50 & 100-day EMA at the moment. Flow momentum remains negative with the 5-day average now -2.72b, 20-day average at -1.37b and the longer term 100-day average now 0.32B yuan.

- Taiwan equities ended their run of 8 straight days of selling with a $143m inflow, as equity markets ticked higher, although still well below the levels prior to the Friday plummet. The local market maybe helped higher today after US semiconductor names rallied overnight and Texas Instruments gave a strong revenue forecast after the market closed, the Philadelphia Semiconductor Index finished up 2.21%. The 5-day average is now -$780m, vs the 20-day at -$432m, while the 100-day average is now just $58m.

- South Korea equities saw a small outflow compared to prior days; however, we have now marked seven of the past six trading days of net outflows. The Kospi closed 0.24% lower on Tuesday and now hovers just on the 100-day EMA, which looks to be acting as support for the moment, the market should be supported by strong performance in the semiconductor space during the US session overnight. The 5-day average is now -$139m, the 20-day average to $117m and the 100-day average to $171m.

- Philippines equities continue to see outflows with $8.85m leaving the market on Tuesday making it 13 straight days of outflows for a total of $141m. The PSEi was 0.97% higher on Tuesday, although this wasn't enough to test the 200-day EMA. The 5-day average is -$10.5m, the 20-day average is -$8.10m, while the 100-day average continues to edge lower now at $0.8m.

- Indonesia had a $7.9m outflow on Tuesday making it a 15-day streak of net selling by foreign investors for a total of $1.05b. The JCI was 0.52% higher on Tuesday, managing to trade back above the 200-day EMA and now sit 4.54% off recent highs. The 5-day average is now -$38m, the 20-day average is -$45m, while the longer term 100-day average is still positive at $14.2m.

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -3.0 | -13.6 | 44.6 |

| South Korea (USDmn) | -53 | -698 | 13112 |

| Taiwan (USDmn) | 144 | -3904 | -2058 |

| India (USDmn)** | -314 | -1498 | 228 |

| Indonesia (USDmn) | -8 | -190 | 760 |

| Thailand (USDmn) | 60 | -215 | -1881 |

| Malaysia (USDmn) ** | 24 | -198 | -645 |

| Philippines (USDmn) | -9 | -53.9 | 43 |

| Total (Ex China USDmn) | -156 | -6757 | 9559 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 19th |

OIL: Crude Range Trading, EIA US Data Out Later

Oil prices have been range trading during today’s APAC session to be little changed after rising strongly yesterday on increased hopes of a Fed cut. Brent is steady around $88.42/bbl, after a peak of $88.54 earlier, and WTI is at $83.40 after a high of $83.55. The USD index is down 0.1% but providing little support to crude.

- The US included an extension to sanctions on Iran’s oil sector in its foreign aid bill that the senate has now passed. It will extend measures to include ships and refineries that process and transport Iranian crude, and all financial transactions for the purchase of oil products between China’s financial institutions and Iranian banks facing sanctions. Analysts don’t expect the new measures to have a material impact on Iran’s crude exports, according to Bloomberg.

- After a number of large weekly inventory drops, Bloomberg is reporting that US crude stocks fell 3.23mn last week according to people familiar with the API data. Gasoline continued to fall at -595k but distillate rose 724k. The official EIA data is released later today and if it also falls would be the first decline in five weeks.

- Later preliminary March US durable goods and April German Ifo survey print. The ECB’s Cipllone, Tuominen, McCaul, and Schnabel speak.

GOLD: Extends Bounce Off Yesterday’s Low, Friday’s US PCE Deflator In Focus

Gold is 0.3% higher in the Asia-Pacific session, after closing 0.2% lower at $2322.02 on Tuesday. The recovery from the session low of $2292 was assisted by a pullback in the dollar.

- With Middle tensions cooling, the market’s focus has likely turned to key economic data later in the week that could shed more light on the Federal Reserve’s policy path.

- The US PCE deflator, the Fed’s preferred measure of inflation, is due on Friday and is forecast to show that price pressures remained elevated in March.

- According to MNI’s technicals team, the yellow metal breached the 20-day EMA, signalling the start of a corrective cycle. A continuation would signal the scope for an extension towards $2217.4, the 50-day EMA.

- Note that a short-term bear cycle would allow a significant overbought trend condition to unwind. Key resistance and the bull trigger have been defined at $2431.5, the recent Apr 12 high.

- Meanwhile, silver was up 0.6% on the day at $27.4/oz. By contrast, copper was down 0.9% to $443/lb, leaving the metal 2.5% off the near two-year high reached earlier in the week.

ASIA RATES: China Government Curve Bear-Steepens On PBoC Comments

The China Government Bond Curve has bear-steepened, with yields 1-5bps higher across benchmarks after a PBOC official’s comments suggest low yields have deviated from sound economic fundamentals. Currently, the 10-year yield stands at 2.243%, up from yesterday's cycle low of 2.215%.

- Today’s movement follows observations by Bloomberg indicating that local credit yields in China have reached their lowest levels ever, as investors seek higher returns by investing in corporate bonds amidst a liquidity-rich financial system. (See link)

- Moreover, it comes after the CH-US 10-year yield differential pushed to a fresh cycle high of 239bps, surpassing the previous high of 226bps set in October last year.

- The US tsy 10-year is currently 2bps cheaper at 4.62% in today’s Asia-Pac session after reaching a fresh YTD yield high of 4.69% last week.

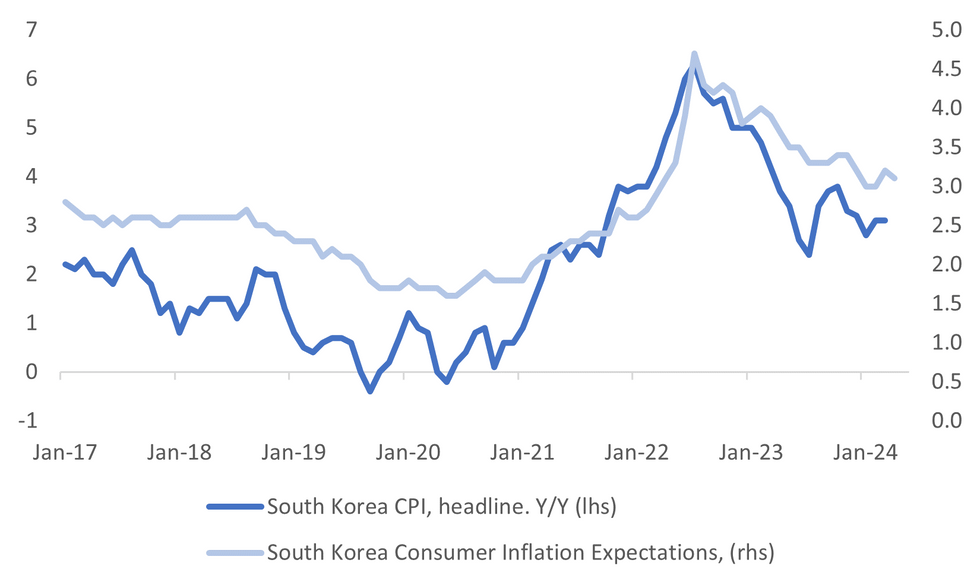

SOUTH KOREA DATA: Consumer Sentiment Index Steady, Inflation Expectations Down Modestly

The South Korea April consumer confidence headline was unchanged at 100.7. We are comfortably above mid 2022 lows near 86, although the trend improvement in the headline index has stalled in recent months, which suggests a steady rather than accelerating GDP growth backdrop.

- In terms of the detail, we didn't see a lot of change to the sub-indices. Some slight improvement in terms of the domestic economy (81 from 80 prior) was offset by slightly lower spending intention plans (110 versus 111 in March).

- On the prices front, we saw house price expectations jump to 101 from 95 prior, while expected wages also rose a touch to 117, from 116. This measure remains within recent ranges though.

- Expected inflation eased modestly to 3.1% from 3.2% prior. The chart below overlays this expectations measure against headline CPI y/y.

- This is a modest improvement, but the trend towards 2% (BoK's inflation target) has stalled to a degree. The BoK is likely to want to be more confident of such trends before easing policy, which is its H2 bias. note the next CPI print, for April, is out on May 2.

Source: MNI - Market News/Bloomberg

INDONESIA: Domestic Growth "Still Solid"

Activity related data since Bank Indonesia's (BI) 20 March meeting have been consistent with its assessment that the domestic economy is "still solid". Thus given recent rupiah weakness, the central bank can maintain rates at 6% for some time as the economy doesn't need the additional stimulus and a rate cut would pressure the currency further. Over a quarter of analysts expect a rate hike today but given BI signalled the next move is likely to be down, we think this unlikely.

- We don’t expect BI's economic assessment to change this month on both the domestic and international fronts. Q1 GDP is released on May 6 and if it deviates materially from the 5% trend seen over the last year, then BI may change its view of the economy in its May 22 meeting statement.

- The S&P Global manufacturing PMI rose to 54.2 from 52.7 in March and is the highest in ASEAN. The pickup in activity was driven by domestic new orders but foreign orders were weak (see latest trade update). The April PMI prints on May 2.

- Consumer confidence rose 0.6% m/m to 123.8 in March and is signalling that consumption growth remained one of the drivers of “solid growth” in Q1. In Q4 it rose 4.5% y/y.

Source: MNI - Market News/Refinitiv

INDONESIA: BI Inflation Outlook Unlikely To Change In April

Bank Indonesia (BI) meets today and while consensus expects no change in rates over a quarter of analysts surveyed by Bloomberg expect at 25bp hike due to recent currency weakness. Apart from the rupiah, there has been some attention on inflation developments in March, but we believe that BI will look through the tick up in headline and its inflation assessment will be unchanged. See our BI Preview here.

- Headline inflation rose to 3.0% y/y in March from 2.8% due to the volatile food component which rose 10.3% y/y and was likely due to Ramadan-related demand. BI said in March that food inflation should ease with the “onset of the harvesting season”.

- Core inflation was steady at 1.7% y/y, well below the mid-point of the 2.5%±1% band which is important given the central bank’s focus on underlying price pressures. It stated in March that it is “confident that headline inflation in 2024 will remain under control” and within the target, we don’t expect this sentiment to change this month.

Source: MNI - Market News/Refinitiv

- With the rupiah weakening over the year though, BI will continue to monitor imported inflation, which remained negative in February. The S&P Global manufacturing PMI reported that the weak currency added to cost pressures March, which BI is likely to watch closely.

Source: MNI - Market News/Refinitiv

ASIA FX: USD/Asia Pairs Lower, CNH Steady Though, BI Still To Come

USD/Asia pairs are mostly lower, in line with continued improvement in equity sentiment, while higher beta plays have also outperformed in the G10 space. CNH hasn't rallied though, holding steady near 7.2600. KRW, THB and IDR have rallied, albeit sit slightly away from best levels. The BI decision comes later, it is expected to be a close call, but we sit in the no change camp. Tomorrow, we have South Korea business sentiment, along with Q1 GDP. The Malaysia CPI is also due.

- USD/CNH sits little changed, last near 7.2600. It is a similar backdrop for spot USD/CNY onshore, which is unchanged at 7.2455. Onshore and offshore levels continue to exhibit low volatility/correlation with respect to broader USD trend shifts at this stage. The firmer yield backdrop has helped US-CH yield differentials edge down, but we are only a touch off recent highs (2yr spread at +309bps, 10yr around 237bps), with the little positive follow through to CNH, as there remains a decent wedge between current spot levels and the spreads. CNH implied forward yields have fallen further.

- 1 month USD/KRW sits up from earlier lows, last near 1368. Earlier we got close to 1365, which is near the 20-day EMA. Regional and local equity (+2% for the Kospi) sentiment has been buoyed by tech earnings optimism and recent US yield softness. Earlier we had steady South Korean consumer sentiment for April, while inflation expectations fell a touch.

- USD/THB has fallen back sub 37.00, the pair last near 36.90, slightly above earlier lows. BoT minute headlines have crossed from the last policy meeting. The central bank voted in favor of keeping rates steady by 5-2 at the Apr. It appears the central bank wants to keep optionality (for broader risks and the baht outlook) around the policy outlook given considerable uncertainties facing the outlook. We have also heard from BoT Assistant Governor Piti, who stated that the authorities have intervened in THB to smooth moves, but don't have a specific baht level in mind. Piti also noted that the BOT may need to recalibrate the policy rate if oil prices keep rising, a hawkish development.

- USD/IDR spot has fallen back to 16150/55, around 0.40% stronger in IDR terms. The better tone to regional/global equity sentiment has clearly aided risk appetite for the rupiah. Bank Indonesia (BI) meets today and while consensus expects no change in rates over a quarter of analysts surveyed by Bloomberg expect at 25bp hike due to recent currency weakness.

- Elsewhere, USD losses have been more modest. Spot USD/PHP sits near 57.42, around 0.15% stronger in PHP terms. The rebound in oil prices likely weighing on the PHP rebound. USD/SGD sits under 1.3600, while USD/MYR is near 4.7750.

PHILIPPINES: PHILIP Curve Flatter, Budget Deficit Narrows

- The PHILIP curve is slightly flatter today, front-end yields have ticked a touch higher, with the 2Y yield up 1.5bps at 5.20%, 5Y yield is 1bps lower at 5.33%, 10Y yield is 1bps lower 5.44%, while 5yr CDS is down unchanged at 66.5bps.

- The Philip to US Treasury spread difference has widen in the front-end overnight as the treasury curve bear-steepened, with the 2y is 26bps (+6bps), the 5yr is 68.5bps (-0.5bp), while the 10yr is 82.5bps (-1.5bp).

- Cross-asset moves: The USD/PHP is down 0.16% at 57.42, the PHP trades just off mulit-year lows, PSEi Index is up 1.20%, while US Tsys yields are 1-2bps higher.

- In March, the Philippines recorded a budget deficit of 195.9 billion pesos ($3.42 billion), slightly lower than the deficit of 210.3 billion pesos in the same period last year. Despite a year-on-year increase in revenue by 11.32%, reaching 287.9 billion pesos, spending also rose by 3.18% to 483.8 billion pesos. Overall, the budget deficit for January to March amounted to 272.6 billion pesos ($4.75 billion), with revenue up by 14.05% and spending up by 10.72% compared to the same period last year.

- Looking Ahead, this is little on the calendar for the remainder of the month.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 24/04/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 24/04/2024 | 0735/0935 |  | EU | ECB's Cipollone speech at ECB retail payments conference | |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/04/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2024 | 0910/1110 |  | EU | ECB's Cipollone panel at ECB Retail Payments Conference | |

| 24/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/04/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/04/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/04/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2024 | 1400/1600 |  | EU | ECB's Schnabel remarks at '"Frankfurt liest ein Buch" | |

| 24/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/04/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.