-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: ISM Services Lower Than Expected, ADP Gains

MNI ASIA MARKETS ANALYSIS: Weak Data Underpins Treasuries

MNI US Payrolls Preview: Revisions And Seasonality In Focus

MNI EUROPEAN MARKETS ANALYSIS: RBA On Hold For An Extended Period

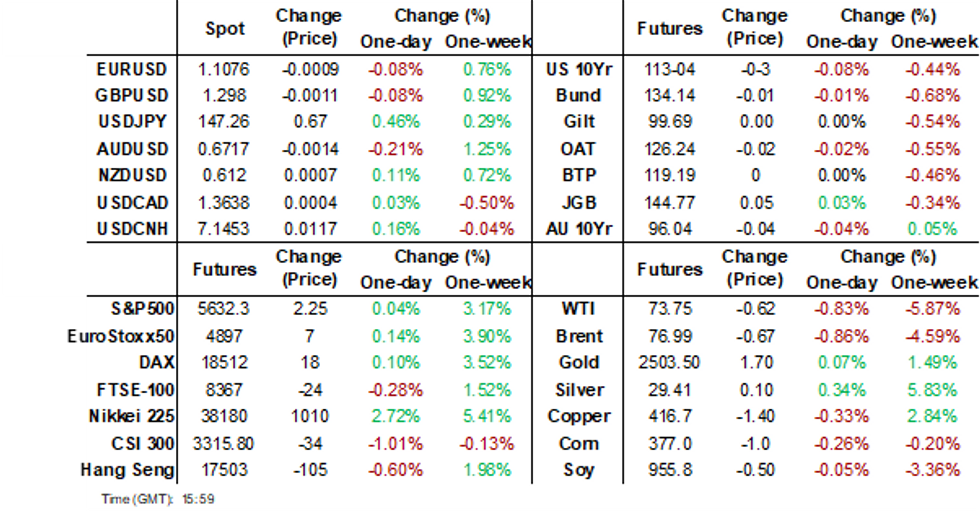

- The USD fell in early trade, but sentiment quickly stabilized, with USD/JPY more than 100pips up from earlier lows. US Treasury futures have been largely rangebound today, volumes have been slightly below average.

- The RBA reiterated that rates are likely to remain on hold for an extended period. AUD/USD has eased, weighed by weaker China equities. This has also taken some of the shine off Asian currencies.

- JGB futures are slightly stronger and in the middle of today’s range, +5 compared to the settlement levels.

- Later the Fed’s Bostic and Barr speak and the August Philly Fed non-manufacturing index is released. Final July euro area CPI and Q2 negotiated wages as well as Canada’s July CPI print.

MARKETS

US TSYS: Tsys Futures Little Changed, Curve Slightly Steeper

- Treasury futures have been largely rangebound today, volumes have been slightly below average. There has been little in the way of headlines today, investors as un the sideway as they await FOMC minutes, jobless claims, PMI & Jackson Hole later in the week.

- The Fed's Bostic will speak on payments later today, while Barr will speak on cybersecurity

- The front-end is out-performing a touch with TUU4 + 00⅛ at 103-04¼, while TYU4 is - 02 at 113-05.

- A bullish theme in tsys remains intact and price continues to trade above support. Moving average studies are in a bull-mode position and this highlights bullish sentiment. The recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend.

- Cash treasury curve has steepened today, yields have traded in a tight range are are +/- 1bp, with the 2yr yield -0.9bp to 4.057%, while the 10yr yield is +0.6bps at 3.794%.

- Fed Fund futures are fully pricing in at least one cut at the September meeting, with futures currently pricing in 32bps of cuts. The FX market could be leaning more towards a 50bps cut with the BBDXY now trading at 1,231.53 after falling 1.32% over the past week to the lowest level since mid March.

- Data and Fed speak remains limited Tuesday, with focus on July FOMC minutes on Wednesday. The KC Fed hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24, Fed Chairman Powell speaking 1000ET Friday Morning.

JGBS: Cash Bond Steeper After Lacklustre 20Y Auction

JGB futures are slightly stronger and in the middle of today’s range, +5 compared to the settlement levels.

- Today’s 20-year auction low price met dealer expectations, however, the cover ratio declined to 3.4223x from 3.8016x and the auction tail lengthened.

- As highlighted in the auction preview, today’s auction presented an outright yield that was 20bps lower than July’s level. Additionally, the 10/20 yield curve was slightly flatter, and the 20-year JGB was significantly richer relative to the 10/20/30 butterfly than in July.

- Today, the local calendar will see Tokyo Condominiums for Sale data later.

- Cash US tsys are flat to 1bp cheaper in today’s Asia-Pac session. Attention seems focused on the KC Fed-hosted Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday morning.

- Cash JGBs are little changed out to the 20-year and ~2bp cheaper beyond. The benchmark 10-year yield is 0.8bp lower at 0.898% versus the cycle high of 1.108%.

- Swap rates are ~1bp lower out to the 30-year zone, and 4ps higher beyond. Swap spreads are mixed.

- Tomorrow, the local calendar will see Trade Balance data alongside BoJ Rinban Operations covering 1-10-year JGBs.

AUSSIE BONDS: Cheaper After RBA Minutes Suggest Rates ‘Steady For Longer’

ACGBs (YM -4.0 & XM -3.0) are cheaper, near Sydney session lows and 2-3bps weaker than pre-RBA Minutes levels.

- The August 6 meeting minutes showed that the RBA Board felt that it could achieve the same tightening of financial conditions as a rate hike by holding rates steady longer than the markets had assumed.

- It remains concerned about the slow return of inflation to target and possible upside risks and as a result “it was unlikely that the cash rate target would be reduced in the short term.”

- The Board remains “vigilant” and even more data-dependent given the uncertainty around its forecasts. Rates are likely to be on hold for some time.

- Cash US tsys are flat to 1bp cheaper in today’s Asia-Pac session.

- Cash ACGBs are 3bps cheaper on the day, with the AU-US 10-year yield differential at +6bps.

- Swap rates are 3bps higher.

- The bill strip is -2 to -4 beyond the first contract.

- RBA-dated OIS pricing is flat to 5bps firmer across meetings, with Jun-25 leading. A cumulative 19bps of easing is priced by year-end.

- The local calendar will see the Judo Bank PMI Composite and the Westpac Leading Index tomorrow.

- Tomorrow, the AOFM plans to sell A$800mn of the 3.00% 21 November 2033 bond.

RBA: Can Tighten Financial Conditions By Keeping Rates On Hold

The August 6 meeting minutes showed that the RBA Board felt that it could achieve the same tightening of financial conditions as a rate hike by holding rates steady longer than the markets had assumed. It remains concerned about the slow return of inflation to target and possible upside risks and as a result “it was unlikely that the cash rate target would be reduced in the short term.” The Board remains “vigilant” and even more data dependent given the uncertainty around its forecasts. Rates are likely to be on hold for some time.

- One of the key arguments for a rate hike was greater excess demand than originally believed. The minutes provide more details on this thinking. There had been a “reassessment of the economy’s current spare capacity” as well as an increase in demand expectations, which increased the gap between supply and demand, but estimates were “highly uncertain”. But this could have justified “an immediate increase” in rates.

- The risk of inflation not returning to target within a “reasonable timeframe” was also given as a reason for tightening, as the there was only limited “tolerance” of pushing the timing out further. Rates would have to be higher than market pricing used in the updated forecasts to “bring inflation sustainably back to target within a reasonable timeframe”. Policy appears to be on an extended pause.

- Other reasons for a hike were persistence of core inflation and cost pressures, and moderate easing in financial conditions.

- It opted to extend the pause as keeping rates unchanged would tighten financial conditions, balance the inflation/labour market risks, Q2 disinflation was broad based, inflation/labour market are expected to ease, uncertainties, market expectations & volatility, and insufficient data to warrant a change.

NZGBS: Cheaper, Post-RBNZ Rally Continues To Be Pared

NZGBs closed 1-6bps cheaper and well off the session’s best levels.

- With today’s domestic data drop 2nd tier, the drift away from the best levels in part reflects the digestion of today’s NZ$6bn issue of a new May 2036 bond via syndication. It was issued at a spread of 9bps over the May-35 bond for a yield-to-maturity of 4.365%. Total book size at final price guidance exceeded NZ$22.7bn.

- Nevertheless, with the short-end underperforming, today's price action also reflects profit-taking after the strong post-RBNZ decision rally. Nevertheless, NZGBs remain 2-14bps richer, with the 2/10 curve 12bps steeper.

- NZ Treasury’s Fortnightly Economic Update stated that labour market data “revealed the impact of the reduced demand and production that occurred during the June quarter with an increase in the unemployment rate and a drop in hours worked and hours paid.”

- “Firms are reducing hours but there is a limit to their abilities to maintain employee levels with ongoing wage inflation, pointing to further market softening.” (per BBG)

- Swap rates closed 4-7bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 2-14bps firmer across meetings, with mid-2025 leading. A cumulative 69bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

NEW ZEALAND DATA: Trade Position Continues To Improve

The July merchandise trade balance shifted into deficit, a deterioration in July is not unusual. The trade deficit was $963mn after a surplus of $585mn in June but the YTD deficit improved to $9.29bn after $9.50bn. The peak deficit in May 2023 was $17.1bn. Seasonally adjusted exports and imports were higher on the month, but imports were a lot stronger thus driving the deterioration in the trade balance.

NZ merchandise trade balance YTD $bn

Source: MNI - Market News/Refinitiv

- Goods exports rose 14.3% y/y in July driven by dairy products, fruit and crude oil. There was an increase in dairy volumes too. Exports to key destinations are recovering with shipments to China up 8.5% y/y, Australia +19% y/y, Japan +5.3% y/y and Europe +33% y/y, while the US remains positive at 4.7% y/y.

- Merchandise imports are up 8.5% y/y driven by electrical equipment, petroleum and pharmaceuticals. There was a large drop in vehicles due to fewer EVs. Consumer goods imports were robust rising 8.3% y/y but capex goods were weak with plant equipment up only 0.7% y/y.

Source: MNI - Market News/Refinitiv

FOREX: USD Supported On Dips But Dollar Index Well Below Key EMAs

The USD index made fresh lows back to March of this year in the first part of trade (BBDXY USD index slipping under 1231) before sentiment stabilized. We were last 1233.5. Still, we are a long way from the 20-day EMA, back near 1247.5.

- We have key event risks later in the week in terms of Fed Chair Powell speaking at the Jackson Hole symposium. This may be reducing incentives to extend USD shorts, particularly in light of the recent sell-off.

- USD/JPY got to 145.85 in early dealings, but now sits more than 100pips higher, last near 147.00, close to 0.30% weaker in yen terms. US yields were down a touch in the first part of dealing but sit slightly higher now, so providing some support at the margins.

- A potentially cleaner position slate for USD/JPY (with investors turning more neutral last week per CFTC data) may also be aiding dips in the pair.

- Equity sentiment has mostly remained positive, except for China/HK losses, which were weighed by on-going property market concerns. This has likely weighed on the AUD, although we are down 0.20% for the session. The RBA minutes reiterated on extended hold for the central bank.

- NZD/USD is close to unchanged, last near 0.6115. We had second tier data earlier on trade and house sales, which didn't shift sentiment. The AUD/NZD cross sits off recent highs, last around 1.0980.

- We have Fed speak later (Bostic & Barr), and the August Philly Fed non-manufacturing index prints. The final July euro area CPI and Q2 negotiated wages as well as Canada’s July CPI print will also be in focus.

ASIA PAC STOCKS: Asian Equities Mostly Higher, Tech Stocks Outperform

Asian stocks are mostly higher today, with Japan's Nikkei 225 jumped over 2% after a previous decline, Hong Kong & China benchmarks slipped following the decision to keep lending rates unchanged. Australia's ASX 200 edged up 0.2% as the Reserve Bank of Australia emphasized its focus on controlling inflation, with no immediate rate cuts expected. Meanwhile, U.S. futures are slightly higher after the S&P 500 recorded its longest winning streak since November, nearing its all-time high, while Treasury yields remain steady ahead of Federal Reserve Chair Jerome Powell's upcoming speech at Jackson Hole.

- Japanese equities are higher today, tech is outperforming tracking US tech stocks. The yen's rally has ended for the moment with the USDJPY up 0.25% and is testing 147.00. The Nikkei is up 2.20%, while the Topix is up 1.30% with banks underperforming with the Topix Bank Index up just 0.05%.

- South Korean tech stocks are the top performers today, with SK Hynix (+4%) & Samsung (+1.30%). South Korea's Financial Services Commission will reduce the mortgage loan limit for homes in the greater Seoul area starting September 1, aiming to curb rising household debt amid a rebound in apartment prices. Additional measures under consideration include expanding debt service ratio rules and increasing mortgage loan risk weights for banks. The KOSPI is 0.83% higher, while the KOSDAQ is 0.90% higher.

- Hong Kong & China equities are lower today after the LPR were left unchanged and further weakness in the property market after headlines that local governments were reducing interventions. The Mainland Property Index is down 2%, HS Property is down 1.10%, CSI 300 RE Index is down 1.55%. The HSI is currently trading 0.36% lower, while the CSI 300 is 0.70% lower.

- Taiwan are underperforming today, with the TAIEX 0.10% higher, TSMC which is the largest company in the index trading down 0.10%

- Australian equities are slightly higher today, earlier the RBA released minutes and plans to keep interest rates at a 12-year high of 4.35% for an extended period to ensure inflation returns to its 2%-3% target. Despite global peers easing policies. The ASX200 is currently 0.15% higher. New Zealand equities are down 0.90% following a fall in Utility stocks.

- Asia EM equities continue to benefit from the view of a soft landing in the US, Indonesia's JCI is 0.70% higher, India's Nifty 50 0.45% higher, Singapore's Strait Times is 0.60% higher, Philippines PSEi is 0.90% higher, while Malaysia's KLCI is 0.20% lower,

ASIA EQUITY FLOWS: Asian Equities Flows Muted, Thailand Sees Large Outflow

- South Korea: South Korea recorded an outflow of $173m yesterday, leading to a net inflow of $1.056b over the past five trading days. The 5-day average inflow is $211m, contrasting with the 20-day average outflow of $52m, and a 100-day average inflow of $72m. Year-to-date, South Korea has seen substantial inflows totaling $17.855b.

- Taiwan: Taiwan saw an outflow of $90m yesterday, with a net inflow of $2.744b over the past five trading days. The 5-day average inflow is $549m, while the 20-day average shows an outflow of $362m, and the 100-day average reflects an outflow of $148m. Year-to-date, Taiwan has experienced outflows totaling $8.189b.

- India: India had an inflow of $143m Friday, resulting in a net outflow of $783m over the past five trading days. The 5-day average outflow is $157m, compared to a 20-day average outflow of $110m and a 100-day average near zero. Year-to-date, India has seen inflows totaling $1.653b.

- Indonesia: Indonesian equities registered an inflow of $39m yesterday, leading to a net inflow of $195m over the past five trading days. The 5-day average inflow is $39m, with a 20-day average inflow of $24m and a 100-day average outflow of $8m. Year-to-date, Indonesia has accumulated inflows totaling $364m.

- Thailand: Thailand saw an outflow of $305m yesterday the largest outflow since March, and the third largest outflow since April 2021, leading to a net outflow of $292m over the past five trading days. The 5-day average outflow is $58m, while the 20-day average shows an outflow of $14m, and the 100-day average reflects an outflow of $27m. Year-to-date, Thailand has experienced outflows amounting to $3.616b.

- Malaysia: Malaysia recorded an inflow of $131m yesterday, contributing to a net inflow of $216m over the past five trading days. The 5-day average inflow is $43m, while the 20-day average shows an inflow of $1m, and the 100-day average reflects a small inflow of $3m. Year-to-date, Malaysia has seen inflows totaling $160m.

- Philippines: The Philippines saw an inflow of $25m yesterday, leading to a net inflow of $46m over the past five trading days. The 5-day average inflow is $9m, in line with the 20-day average inflow of $1m, but there is a 100-day average outflow of $7m. Year-to-date, the Philippines has experienced outflows totaling $450m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -173 | 1056 | 17855 |

| Taiwan (USDmn) | -90 | 2744 | -8189 |

| India (USDmn)* | 143 | -783 | 1653 |

| Indonesia (USDmn) | 39 | 195 | 364 |

| Thailand (USDmn) | -305 | -292 | -3616 |

| Malaysia (USDmn) | 131 | 216 | 160 |

| Philippines (USDmn) | 25 | 46 | -450 |

| Total | -230 | 3182 | 7777 |

| * Up to Date 16-Aug-24 |

OIL: Crude Continues Decline As Pressure Builds For Hamas To Accept Proposal

After falling close to 2.5% on Monday, oil prices have continued to slide today with WTI down 0.8% to $73.06/bbl and Brent 0.8% lower at $77.04, close to their intraday lows. The Middle East risk premium is unwinding further after Israel accepted the US’ “bridging proposal” for a ceasefire in Gaza and pressure is building on Hamas to do the same. The USD index is 0.1% higher.

- Benchmarks are now below 50-, 100- and 200-day moving averages.

- While concerns over China’s oil demand continue to weigh on prices, attention is also on the supply side ahead of OPEC’s plans to reduce output cuts from October, which the group has said are flexible. US industry data on inventories is released later today and will be watched for signs of weakness.

- Later the Fed’s Bostic and Barr speak and the August Philly Fed non-manufacturing index is released. Final July euro area CPI and Q2 negotiated wages as well as Canada’s July CPI print.

GOLD: Consolidating At Highs, Awaiting Jackson Hole Symposium

Gold is slightly lower in today’s Asia-Pacific session, following Monday’s fluctuation around the $2,500 mark as it consolidates near all-time highs.

- With little on the data/news flow front, the market’s attention has already turned to the KC Fed-hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday morning.

- Before then, the US calendar will see the FOMC minutes, jobless claims and PMI data.

- According to MNI’s technicals team, the technical break above $2483.7, the Jul 17 high and the bull trigger resumes the uptrend. The initial target of note is $2528.4, the 3.00 projection of the Oct 6 - 27 - Nov 13 price swing.

ASIA CENTRAL BANKS: Breathing Space for Central Banks

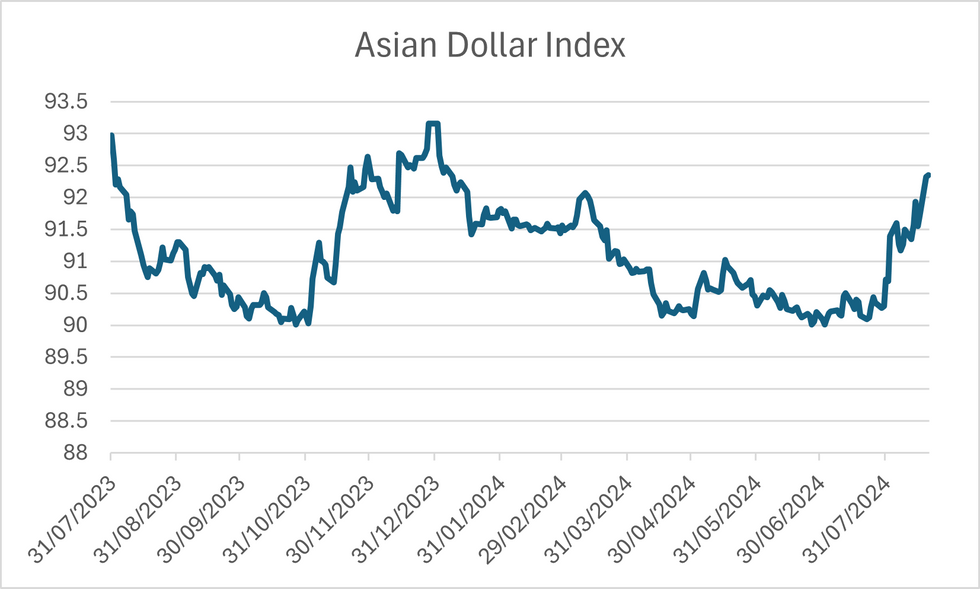

- Yesterday’s rally in Asian currencies reaffirms the position of Asia’s Central Banks ahead of the Federal Reserve decision next month.

- For many Asian economies, FX reserves are in a strong position and their economic data is stable.

- Yesterday saw the Bloomberg Asian Dollar Index rise to it’s highest level in several months as Asian currencies rallied. This trends has continued today, although we are away from best levels for most currencies in the region.

- The Won and Ringgit lead the move higher (both have growth outlooks that are favourable) and the Thai baht rose as political tensions eased in Thailand.

- With US recession fears fading (Goldman Sachs yesterday reduced their US recession probability from 25% to 20%) and Developed Market Central Banks looking to ease, there is a scenario where Asian currencies strengthen further.

- This simply provides breathing space for Asian Central Banks who are not forced into making decisions, rather (thanks to their good management) have the luxury to breath.

The upward trend move represents strengthening Asian CurrenciesSource: Bloomberg Asian Dollar Index

The upward trend move represents strengthening Asian CurrenciesSource: Bloomberg Asian Dollar Index

ASIA FX: South East Asia Currencies Hold Gains Better Than North Asia

USD/Asia pairs started the session off on a weaker note, before USD sentiment stabilized. USD/CNH is up from earlier lows, last near 7.1450. It has been a similar backdrop elsewhere, although South East Asia currencies have generally been able to hold onto some gains against the USD. We still have July Taiwan export orders to come. Tomorrow we have the BI and BOT decisions. No change is expected from either central bank.

- USD/CNH got to lows of 7.1200 in early trade before rebounding back towards 7.1500 and finding some selling interest. USD/JPY has been supported on dips so far today, a yuan headwind at the margins. Local equities are also weaker onshore, weighed by fresh property market concerns. The USD/CNY fixing fixing fell, but remain above the 7.1300 level.

- USD/KRW spot got to fresh lows of 1325.25, but now sits back near 1335, little changed for the session. Equity markets are higher, but the Kospi is sub the 2700 level at this stage. Spillover from weaker yen and yuan levels has been evident. On the data front, consumer sentiment fell, but households expectations for house prices surged further, which is a watch point for the authorities. Today it was announced that mortgage rules would be tightened from September 1.

- USD/TWD spot has weakened sub 32.00, but the 1 month NDF is little changed from end NY levels on Monday, last around 31.74. Taiwan equities have struggled for fresh gains today. Coming up later we have July export orders.

- USD/IDR is under 15500 in latest dealings, around 0.50% stronger in spot terms. Like elsewhere in South East Asia, we are closing in on earlier YTD lows (around the 15400 level). The pair is in oversold territory, a theme familiar in other parts of South East Asia FX. Still, IDR remains 0.50% weaker in YTD terms and is lagging SGD and MYR positive returns seen so far this year (in spot terms, with MYR the clear standout). Tomorrow we have the BI decision. Some in the market see risks of a cut, but our bias is for no change. As we noted in our preview: It is highly unlikely to want to risk recent rupiah gains by cutting ahead of the Fed, which is generally expected to begin easing on September 18.

- USD/THB is in the 34.30/35 region in latest dealings, +0.30% firmer in baht terms for the session so far. Earlier lows were at 34.205, which was close to lows from the start of the year near 34.10.• The pair is oversold, with the RSI (14) at 21.3 currently. The pair has been in oversold conditions for much of August though since we broke down through 35.00. The 20-day EMA based off yesterday's close is back at 35.45.• USD/THB has caught up with the sharp decline in US-TH 2yr government bond yield differentials (last +186bps). These trends have stabilized somewhat though and may not materially in the near term, given we have the BOT tomorrow (although no change is expected by the economic consensus) and then Fed Chair Powell speak later in the week.

CHINA: Bond Wrap

- Chinese Banks held their 1- and 5-year lending rates steady for August.

- The decisions reflect a balancing act for China, following PBOC Governor’s comments that authorities will avoid adopting “drastic” measures whilst still determined to achieve Beijing’s growth targets for 2024.

- Bonds saw modestly lower yields in intermediate maturities.

2yr 1.68% 5yr 1.88% (-2bp) 10yr 2.17% (-1bp) 30yr 2.36%

South Korea: Household Debt Up; Just like Seoul Property Prices.

- Household debt in Korea grew at a faster than expected pace in the last quarter.

- Total household credit rose to KRW1.896tn in the second quarter.

- This was a 1.9% year on year rise according to the Bank of Korea.

- Worrying for the BOK was the rise in mortgage loans at 5.9% year on year.

- The BOK has spoken of its concerns about property prices in Seoul and today’s data underscores those concerns.

- Additionally, today’s consumer confidence survey showed that (particularly in Seoul) consumers expect the housing market to continue to rise.

- This is likely see this week’s Bank of Korea’s meeting result in no change.

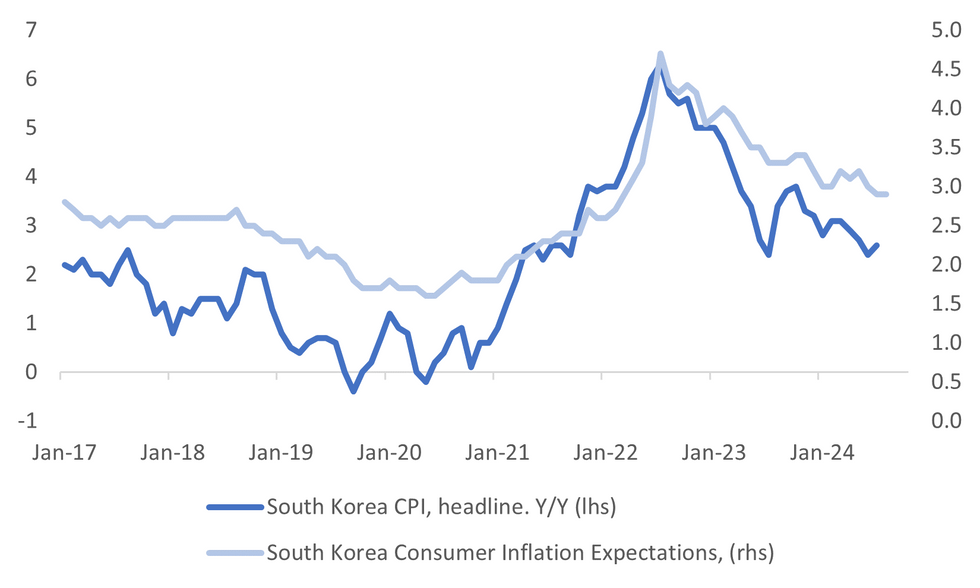

SOUTH KOREAN DATA: Headline Consumer Sentiment Softens, House Price Expectations Rise Further

South Korea consumer sentiment headline eased to 100.8 for August, versus 103.6 in July. It is the first headline fall since May of this year and puts the index back close to neutral levels. We are still above late 2023 lows for the index (97.3)

- GDP growth momentum eased in Q2 but current consumer sentiment levels aren't pointing to a further drastic slowing at this stage.

- In terms of the detail, spending plans all ticked down relative to July readings. Employment expectations also edged down but remain within recent ranges.

- On the price outlook, we saw a rise in expected house price changes. This reading is now at 118 versus 92 back in February. The index is now back to 2021 levels. This is a BoK and broader authority watch point, particularly ahead of an expected BoK easing cycle (although no change is expected at this Thursday's meeting).

- Today the Financial Services Commission head will meet with banking executives to discuss household debt levels (per BBG).

- In terms of inflation, expectations were steady at 2.9%, unchanged from July. This compares with the recent headline inflation read of 2.6%y/y, see the chart below.

Fig 1: South Korea Household Inflation Expectations Steady In August

Source: MNI - Market News/Bloomberg/BOK

INDONESIA: MNI Bank Indonesia Preview – August 2024: On Hold, Pieces Falling Into Place

- Bank Indonesia (BI) is widely expected to leave rates at 6.25% on August 21 as FX stability remains the focus. It is highly unlikely to want to risk recent rupiah gains by cutting ahead of the Fed, which is generally expected to begin easing on September 18.

- USDIDR appears to have peaked in mid-June around 16478 but the pair is now down 5.6% since then to 15553, below the lower end of BI’s 2024 range – it is now moving in the right direction as Fed easing expectations build. It is down 4.0% since the July 17 meeting and the August average is 2.4% below July and the first month below 16000 since March.

- With meetings every month, BI has the flexibility to watch and wait and may not necessarily feel the pressure to cut rates at its first meeting following Fed easing. The use of macroprudential policies to buoy the economy may mean that BI won’t be in a hurry to cut rates as it not only has other tools but growth has likely become less sensitive to rates.

- See full preview here.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/08/2024 | 0600/0800 | ** |  | DE | PPI |

| 20/08/2024 | 0730/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 20/08/2024 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/08/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 20/08/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 20/08/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 20/08/2024 | 1230/0830 | *** |  | CA | CPI |

| 20/08/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/08/2024 | 1845/1445 |  | US | Fed Governor Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.