-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA & RBNZ Expectations Diverge Post RBA Mins/Q3 NZ CPI

- NZ Q3 CPI came in below RBNZ and consensus forecasts but remains elevated. RBNZ dated OIS pricing shunted 5-9bps softer in post-CPI dealings, with terminal OCR expectations 7bps softer on the day at 5.65%.

- In contrast, RBA-dated OIS pricing is 4-15bps firmer across meetings, with terminal rate expectations 8bps firmer at 4.29%. The RBA Minutes showed that the Board had discussed both leaving rates unchanged and a 25bp hike but it felt that there hadn’t been “sufficient new information” to warrant tightening policy further. AUD outperformed NZD in the FX space today.

- Elsewhere, President Biden is due to visit Israel and Jordan on Wednesday to speak with not only Israeli PM Netanyahu but also Jordanian King Abdullah II, Egyptian President el-Sisi and President Abbas of the State of Palestine. Biden’s visit comes at a crucial time after Iranian foreign minister Amirabdollahian said yesterday that “time for political solutions is running out” and the expansion of the war is “approaching the inevitable stage”, Bloomberg is reporting.

- Looking ahead, the ECB’s de Guindos also appears and UK labour market data and Canadian September CPI print. Later the Fed’s Williams, Bowman, Barkin and Kashkari speak and US September retail sales, IP and NAHB housing index are released.

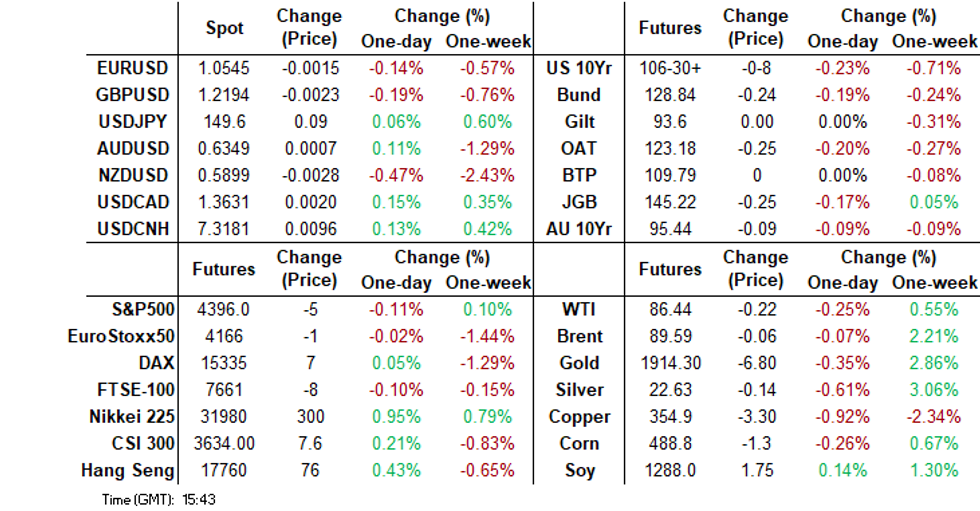

MARKETS

US TSYS: Pressured In Asia

TYZ3 deals at 107-00+, -0-06, a 0-10 range has been observed on volume of ~153k.

- Cash tsys sit 1-5bps cheaper across the major benchmarks, the curve has bear steepened.

- Tsys were pressured in the Asian session on spillover from ACGBs, in lieu of the minutes of the RBA October policy meeting.

- Losses extended through the session alongside US Equity futures ticking lower and the USD firming. TY broke support at 107-02+ and the next support level is 106-03+, low from Sep 4.

- Fedpseak from Harker crossed early in today's Asian session, he noted that the Fed shouldn't be thinking about rate increases as many small businesses are struggling with the tightening to date.

- The data docket is relatively light in Europe today, further out we have retail sales, business inventories and industrial production. Fedpeak from NY Fed President Williams, Gov Bowman and Richmond Fed President Barkin is due.

JGBS: Futures At Tokyo Session Cheaps & Curve Steepens After Poor Absorption Of 20Y Supply

JGB futures are cheaper, -28 compared to settlement levels, after pushing to Tokyo session lows following the results of today’s 20-year supply. 20-year supply saw poor digestion as the low-price printed below dealer expectations and the cover ratio at 2.973x declined sharply versus 3.942x at last month’s auction. The auction tail also lengthened dramatically.

- The local calendar was light today, with the Tertiary Industry Index (-0.1% m/m vs. +0.3% est. and +1.1% prior) as the sole release.

- In addition to domestic supply concerns, local participants have likely eyed US tsys in the Asia-Pac session after the bear-steepening observed during the NY session. Cash US tsys are flat to 5bps cheaper, with the curve steeper.

- The cash JGB curve has bear-steepened today, with yields 0.3bp to 5.2bps higher. The benchmark 10-year yield is 1.6bps higher at 0.777% versus the cycle high of 0.814%.

- The 20-year JGB is dealing 4-5bps cheaper at 1.598%, just shy of the cycle high of 1.606%, in post-auction dealings.

- The swaps curve has also bear-steepened, with rates 0.5bp lower to 6.6bps higher. Swap spreads are mixed across maturities.

- Tomorrow, the local calendar is light again, with Tokyo Condominiums for Sale data as the only release.

AUSSIE BONDS: Sharply Cheaper Post-RBA Minutes, US Tsys Extend Bear-Steepening In Asia-Pac Dealings

ACGBs (YM -14.0 & XM -9.5) sit sharply cheaper and at Sydney session lows. The weak performance can be attributed to both domestic and offshore factors.

- On the domestic front, the minutes from the October RBA meeting showed that the Board had discussed both leaving rates unchanged and a 25bp hike but it felt that there hadn’t been “sufficient new information” to warrant tightening policy further. But November is clearly live as there will be updated forecasts and more data (Q3 CPI on October 25).

- Abroad, US tsys have extended the bear-steepening observed in yesterday’s NY session into today’s Asia-Pac session. Cash US tsy yields are flat to 5bps higher in recent dealings, with the curve steeper.

- Cash ACGBs are 9-13bps cheaper, with the AU-US 10-year yield differential unchanged higher at -19bps.

- Swap rates are 10-13bps higher, with EFPs slightly wider.

- The bills strip has sharply bear-steepened, with pricing -6 to -16.

- RBA-dated OIS pricing is 4-15bps firmer across meetings, with terminal rate expectations 8bps firmer at 4.29%.

- Tomorrow, the local calendar sees a Fireside chat with RBA Governor Bullock at the AFSA Annual Summit Panel.

- The AOFM announced today that a new 4.75% Jun-54 bond had been issued via syndication and priced at a yield to maturity of 4.93%. The issue size was A$8bn.

RBA MINUTES: Inflation Risks Major Concern, Target Return Delay Could Drive Rates Higher

The minutes from the October RBA meeting showed that the Board had discussed both leaving rates unchanged and a 25bp hike but it felt that there hadn’t been “sufficient new information” to warrant tightening policy further. But November is clearly live as there will be updated forecasts and more data and it “acknowledged that upside risks” to inflation were a “significant concern”. Q3 CPI data out on October 25 and the RBA CPI forecast in Q2 2025, which currently stands at 3.1%, will be key to the meeting outcome.

- The RBA left rates unchanged because there had already been material tightening which was yet to be fully felt, inflation has moderated, consumption is “weak” with real disposable income still falling, the labour market “had reached a turning point” and because of risks to growth from China.

- The tightening discussion was centred on inflation risks with services remaining a concern, but also the impact of higher petrol prices on expectations and the easing in financial conditions from higher house prices and lower AUD.

- If these risks result in an upward revision to the RBA’s Q2 2025 CPI forecast, which is already above target at 3.1%, then there is a significant chance of another hike as the Board strengthened its language to remind us that it has a “low tolerance” to a delay in the return to target in a “reasonable timeframe”.

- The minutes pointed to the revised staff forecasts and new inflation, employment and activity data available at the November meeting.

- See RBA minutes here.

NZGBS: Post-CPI Rally Held Into The Close, Outperforms The $-Bloc

NZGBs closed with a twist-steepening of the curve. Yields closed 3bps lower to 3bps higher on the day and 1-4bps lower than pre-CPI levels after Q3 data printed on the downside of expectations. Headline CPI showed +1.8% q/q and +5.6% y/y versus estimates of +1.9% and +5.9% and prior +1.1% and +6.0%.

- Tradable and non-tradeable inflation also printed on the downside of expectations at +1.7% q/q and +1.8% q/q respectively versus estimates of +1.8% and +2.4% and prior +1.3% and +0.8%.

- NZ-US and NZ-AU 10-year yield differentials closed 5bps tighter on the day at +68bps and +87bps respectively.

- Non-Resident Bond Holdings dipped to 62.1% in September from 62.4% in August.

- The post-CPI rally defied the prevailing bearish mood in today's Asia-Pac session. US tsys are flat to 3bps cheaper compared to their NY closing levels.

- Swap rates closed 1-9bps lower than pre-CPI levels. The 2s10s curve twist-steepened on the day, with rates 5bps lower to 4bps higher.

- RBNZ dated OIS pricing shunted 5-9bps softer in post-CPI dealings, with terminal OCR expectations 7bps softer on the day at 5.65%.

- Tomorrow, the local calendar is empty. The next key release will be the September Trade Balance data on Friday.

NZ DATA: Q3 CPI Points To Unchanged RBNZ Stance

Q3 CPI came in below RBNZ and consensus forecasts but remains elevated. It rose 1.8% q/q to be up 5.6% y/y down from 6% in Q2 driven by transport, council rates and rents. The RBNZ had projected 2.1% q/q and 6% y/y. The central bank said that it is focussed on the medium-term and so an upside surprise was unlikely to shift them but given this more moderate outcome their on hold “high for longer” stance is unlikely to change.

- The domestically-driven non-tradeables CPI eased further rising a lower-than-expected 1.7% q/q with the annual rate moderating to 6.3% from 6.6% and a peak of 6.8% in Q1. It remains elevated but is moving in the right direction.

- Services prices rose a strong 2.2% q/q but still eased to 5.6% y/y from 6.1%. This series is usually robust in Q3 due to the increase in government charges at this time.

- Tradeables inflation came in a lot lower than expected at 1.8% q/q compared with Bloomberg consensus at 2.4%. It is now at 4.7% y/y down from 5.2% in Q2. Goods inflation rose 1.5% q/q to be 5.7% y/y and well off the Q2 2022 peak of 9%.

- Food price inflation rose only 0.9% q/q, the lowest quarterly rate since Q4 2021, and eased to 8.8% y/y from 12.3%. This meant that CPI ex food rose 2.1% y/y and 5% y/y up from 4.6% in Q2, but the series is well off its peak. The RBNZ’s measure of core inflation is out later today and has been at 5.8% for the last three quarters and the ex food CPI may be signalling little change in Q3 core again.

Source: MNI - Market News/Refinitiv

FOREX: Kiwi Pressured In Asia

The Kiwi has been pressured on Tuesday after Q3 CPI, NZD/USD is down ~0.4% and sits a touch above the $0.59 handle. Technically we remain in a downtrend, bears look to break the YTD low at $0.5860. AUD/NZD is ~0.6% firmer, bulls now target a move above the $1.08 handle and 200-Day EMA ($1.0822).

- Elsewhere in G-10; AUD/USD is up ~0.2% and sits at $0.6350/55. The pair firmed post the RBA minutes, the bank noted that it had considered two options at the October meeting hiking or staying on hold. The option to stay on hold provided the more compelling case with the updated forecasts and data available ahead of the November meeting.

- Yen is a touch softer however ranges have been narrow thus far. Resistance in USD/JPY remains at ¥150.16, Oct 3 high and bull trigger. Support is at the 20-Day EMA (¥148.74).

- EUR and GBP are marginally lower and BBDXY is up ~0.1%.

- US Tsy Yields are a touch firmer across the curve. US Equity Futures are lower, e-minis are down ~0.2%. Oil is a touch lower.

- In Europe today we have the UK Earnings Data and the latest ZEW Survey from Germany.

EQUITIES: Asia Pac Shares Tracking Higher

Regional equities are higher across the board, taking a positive cue from US market gains on Monday. Most markets are seeing gains of less than 1% (although the Kospi sits +1.15% higher). US equity futures are down a touch in the first part of Tuesday trade, but losses are modest and haven't impacted broader risk appetite. Eminis were last near 4396, down 0.11%, while Nasdaq futures are off by a similar amount.

- US President Biden will travel to Israel on Wednesday as part of a broader trip to the Middle East to show both support to Israel but also prevent the conflict from broadening (see this BBG link).

- Lack of escalation in the conflict over the past week has been a factor cited as aiding risk appetite in recent sessions. US yields continue to recover ground, but this isn't meaningfully impacting the equity space yet.

- At the break, the HSI is up 0.70%, while the CSI 300 has firmed 0.46%. China state owned companies have revealed plans to buy back shares late on Monday (see this link). This is a positive, although the CSI 300 is only modestly above recent cyclical lows. Tomorrow, we get Q3 GDP data and September activity figures.

- Japan's Topix is up 0.60%, while the Nikkei 225 has firmed 1.0%. The South Korean Kospi is outperforming, up 1.15%. Samsung shares have outperformed.

- In SEA, most indices are higher, but Philippine shares are the standout, up a little over 1% at this stage.

OIL: Prices Tentatively Trend Lower As Monitoring Middle East Developments

Oil prices have been trending marginally lower during APAC trading today but are off intraday lows. WTI is down 0.2% to $86.50/bbl after falling to $86.11 earlier. Brent has traded below $90 today but is steady at $89.65 after a low of $89.22. The USD index is flat. Later US API crude and product inventory data are published.

- Oil has moderated in recent sessions driven by hopes that conflict in Israel/Gaza won’t spread on the back of US efforts to contain it. Secretary of State Blinken spoke to leaders in the region including Saudi Arabia and returned to Israel. In the interests of containment, President Biden is due to visit Israel and Jordan on Wednesday to speak with not only Israeli PM Netanyahu but also Jordanian King Abdullah II, Egyptian President el-Sisi and President Abbas of the State of Palestine.

- Biden’s visit comes at a crucial time after Iranian foreign minister Amirabdollahian said yesterday that “time for political solutions is running out” and the expansion of the war is “approaching the inevitable stage”, Bloomberg is reporting. There has also been unofficial communication between the US and Iran. The main risk to oil is if Iran directly joins the conflict or if it retaliates to a tightening of sanctions by blocking the Strait of Hormuz. Prices seem in “wait-and-see” mode.

- Talks continue to allow fair elections in Venezuela which would allow an easing of sanctions on its oil exports.

- Later the Fed’s Williams, Bowman, Barkin and Kashkari speak and US September retail sales, IP and NAHB housing index are released. The ECB’s de Guindos also appears and UK labour market data and Canadian September CPI print.

GOLD: Lower Despite A Weaker USD, Higher US Yields Weigh As Haven Demand Tapers

Gold is 0.2% lower in the Asia-Pac session, after closing 0.7% lower at $1920.20 on Monday. A softer USD provided little support for bullion after its strong push higher over recent days. Indeed, according to MNI’s technicals team, gold’s strong circa $60 increase on Friday has left it elevated compared to support at $1898.3 (50-day EMA).

- Higher US Treasury yields likely weighed on the yellow metal. US Treasury yields finished 5-11bps cheaper across the major benchmarks, with the curve steeper. Monday’s move reversed the bull flattening seen on Friday. Although geopolitical tensions remain high the reversal is attributed to no further escalation in the Israel/Hamas conflict as of yet.

- Moreover, President Joe Biden is set to travel to Israel on Wednesday. The visit is designed to signal US solidarity with its closest Middle East ally and prevent the conflict from widening.

CHINA DATA: Q3 GDP/September Activity Prints Out Tomorrow

MNI (Australia) A reminder that key China data prints are out tomorrow. Q3 GDP prints, along with September activity data.

- For GDP, base effects will impact the y/y print, as Q3 last year was inflated versus Q2 as Shanghai emerged from lockdown. The market expects 4.5% y/y growth, versus 6.3% in Q2 (forecast range 3.5%-5.2%). The q/q number should get more focus. The consensus is 0.9% (0.8% prior, with a forecast range 0.6%-1.5%).

- Sep IP is forecast at 4.4% y/y (prior 4.5%, forecast range is 3.2-4.9%).

- Sep retail sales is forecast at 4.9% y/y (prior 4.6%, forecast range is 4.3-6.5%)

- Both fixed asset investment (forecast 3.2% ytd y/y) and property investment (forecast -8.9% ytd y/y) are expected to print near August outcomes. We also get property sales. There is no consensus for this print, but the prior was -1.5% ytd y/y.

- The Sep jobless rate is expected to hold at 5.2%, unchanged from August levels.

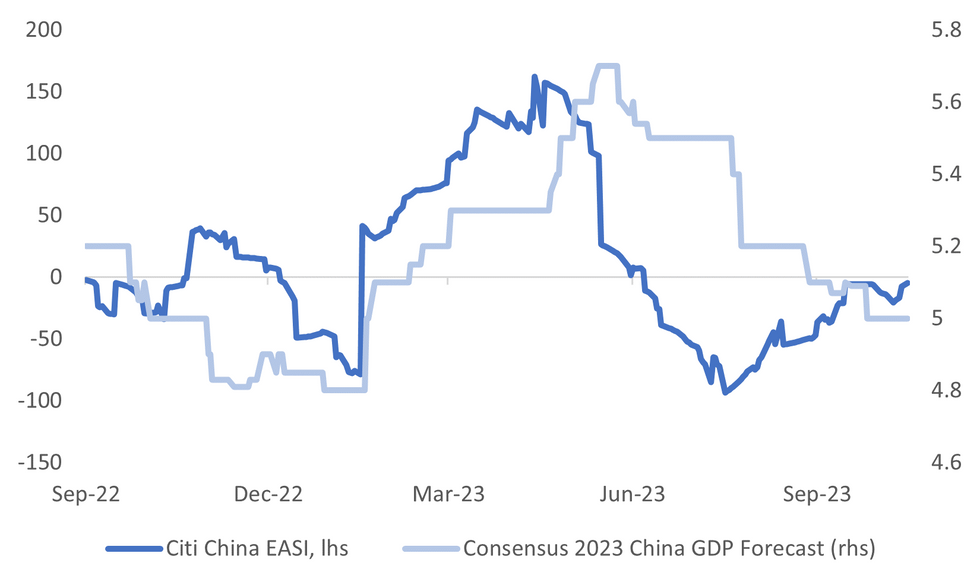

- Recent China data outcomes have, on balance, shown some modest upside momentum relative to expectations. The chart below overlays the Citi China EASI against consensus 2023 GDP growth expectations (BBG).

- Arguably we will need to see further positive surprises to see fresh upside momentum in growth expectations. Still, such upside surprises may need to be meaningful to put local assets (equities/FX) on a firmer footing.

- Markets have generally been left underwhelmed by efforts to boost the growth backdrop/outlook in recent months.

Fig 1: Citi China EASI Versus Consensus 2023 GDP Growth Expectations

Source: Citi/MNI - Market News/Bloomberg

SINGAPORE DATA: Better September Export Growth, In Line With Other Asian Economies

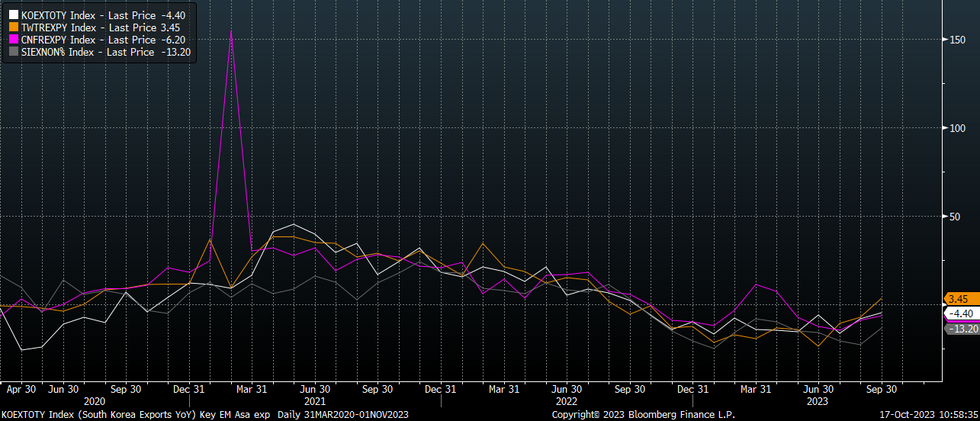

Singapore exports for September have continued the trend of better than expected outcomes for export orientated economies in Asia (see the chart below, Singapore's line is in grey). In m/m terms exports were +1.1%, versus +3.3% forecast, although the August fall was revised down to -6.6% (originally reported as -3.8%). For Y/Y we saw -13.2%, against -15.0% forecast and -22.5% prior. Electronic exports were -11.6% y/y in September versus -21.1% prior.

- The detail showed a modest rise in electronic exports in m/m terms, while y/y momentum looks to on the improve.

- The improvement in non-electronic exports looks to be fairly broad based, with the volatile pharmaceuticals and petrochemicals sub-categories not accounting for the rise in September.

- By country exports to China rebounded strongly in September, up 26.2% from -19.3% in August. Exports to the US were also higher +9.7% y/y from -32.4%. Other countries still saw negative export momentum in y/y terms.

Fig 1: Key Asia Economy Exports Y/Y - Better Trends In September

Source: MNI - Market News/Bloomberg

ASIA FX: Most USD/Asia Pairs Higher, China Data Prints Out Tomorrow

USD/Asia pairs are mostly higher today, in line with a modest recovery in the USD against the majors. Firmer US yields have aided the USD, while the stronger regional equity tone hasn't impacted sentiment. Tomorrow, we have China Q3 GDP and September activity prints. The market looks for similar outcomes to recent prints Q3 GDP and key acivity prints.

- USD/CNH is close to Monday session highs, the pair last around 7.3180 (Monday highs near 7.3195). A break above 7.3200 could see early October highs targeted. Onshore spot sits lower, last near 7.3130, note that the topside cap in spot (+2% above the fixing level) is 7.3232 today. Broader USD sentiment is firmer, with the BBDXY up 0.10%. Higher US yields providing some support. US-CH yield differentials have ticked higher, with the US leg of this spread continuing to dominate trends.

- 1 month USD/KRW has seen little further downside in the first part of Tuesday trade. The pair was last near 1350.5, around +0.30% above Monday NY closing levels. This comes despite a better onshore equity backdrop, with the Kospi up nearly 1% in the first part of trade today. Broader USD sentiment (ex AUD) has stabilized, which is likely working against the won, while USD/CNH also remains close to recent highs. There also remains little foreign sponsorship of a modestly firmer equity backdrop, see the chart below. Rolling 1 month changes in Kospi and MSCI IT index are comfortably off recent lows, but net equity outflows are nearly $3.4bn for the past month, which is back to mid 2022 lows.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing on Tuesday and remains well within recent ranges. The measure sits ~0.6% below the top of the band. USD/SGD is holding in a narrow range above the 20-Day EMA ($1.3666) as of yet the pair has been unable to sustain a rally above the $1.37 handle. We sit at $1.3690/95. Early into session September Exports crossed, Non-Oil Domestic Exports were stronger than forecast whilst the momentum in Electronic Exports looks to be improving. Looking ahead the local docket is empty for the remainder of the week.

- The Rupee has opened dealing a touch firmer on Tuesday, USD/INR remains well within recent ranges as moves have had little follow through. USD/INR is ~0.1% below Monday's closing level and last prints at 83.2150/2250. A reminder that the local data docket is empty until 31 October when September Fiscal Deficit and Sep Eight Infrastructure Industries cross.

- The Ringgit strengthened as much as 0.5% in early trade before paring gains as higher US Tsy Yields and risk off flows weigh. USD/MYR sits at 4.7325/50, ~0.1% below yesterday's closing levels. Support was seen at the 20-Day EMA (4.7120) in early trade. Malaysia has kept its November Export Tax for Crude Palm Oil at 8% and lowered the reference price to MYR3556.08/tonne. The tax has been steady at 8% since January 2021. The export duty structure starts at 3% when prices are in the MYR2,250-2400/tonne range, with the 8% rate kicking in at MYR3,450.

- USD/PHP remains comfortably within recent ranges. The pair tracked at 56.76 in recent dealings, a touch firmer in PHP terms for the session. This leaves us wedged close to the mid-point of the recent 56.50/57.00 range. The local data calendar remains quiet, with yesterday's August remittances data printing close to expectations (+2.7% y/y, a slight uptick on the prior 2.6% outcome). We get BoP figures on Thursday, but these are not typically a market mover. Note the next key release from a BSP standpoint, October CPI, is due on Nov 7th.

- USD/THB has remained mostly on the front foot in the first part of today's session. The pair is tracking near 36.45 in recent dealings, around 0.40% weaker in baht terms versus Monday closing levels. This is underperforming some USD weakness seen over the past 24hours or so. The baht has lost 0.75% so far this week, unwinding part of last week's +2.28% gain. Yesterday's sharp local equity pull back (-1.63%), has seen fresh offshore investors outflows (-$80mn for Monday's session), which has likely been a baht headwind. Local equities are tracking higher in early trade today though (SET +0.60%).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 17/10/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/10/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/10/2023 | 1200/0800 |  | US | New York Fed's John Williams | |

| 17/10/2023 | - |  | EU | ECB's de Guindos attends Luxembourg Ecofin meeting | |

| 17/10/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/10/2023 | 1230/0830 | *** |  | CA | CPI |

| 17/10/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 17/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/10/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/10/2023 | 1320/0920 |  | US | Fed Governor Michelle Bowman | |

| 17/10/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/10/2023 | 1400/1000 | * |  | US | Business Inventories |

| 17/10/2023 | 1445/1045 |  | US | Richmond Fed's Tom Barkin | |

| 17/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/10/2023 | 1700/1900 |  | EU | ECB's De Guindos Speech at Conference | |

| 17/10/2023 | 2000/1600 | ** |  | US | TICS |

| 17/10/2023 | 2100/1700 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.